2025 Wire Cage Pallet Collar Market: Unlocking $136.5 Million Global Growth, Led by Innovations in United States, China, Germany

Discover how wire cage pallet collars revolutionize logistics and warehousing efficiency. From enhanced inventory management to sustainable storage solutions, explore the key markets, trends, and innovations shaping this essential industry sector. Learn why the US, China, and Germany lead global adoption of these versatile storage solutions.

- Last Updated:

Projected Market Trends for Wire Cage Pallet Collar in Q1 & Q2 of 2025

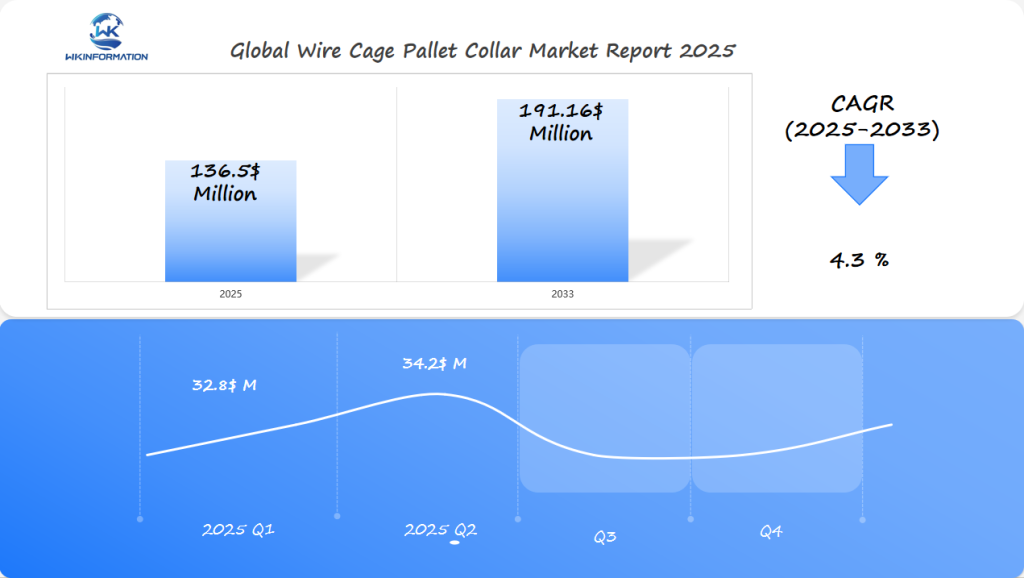

The global wire cage pallet collar market was valued at approximately US$136.5 million in 2025, with a projected CAGR of 4.3% from 2025 to 2033. Based on market dynamics and demand fluctuations, the estimated market size for Q1 2025 is US$32.8 million, while Q2 2025 is expected to reach US$34.2 million. This growth is driven by increasing adoption in logistics, warehousing, and industrial storage applications.

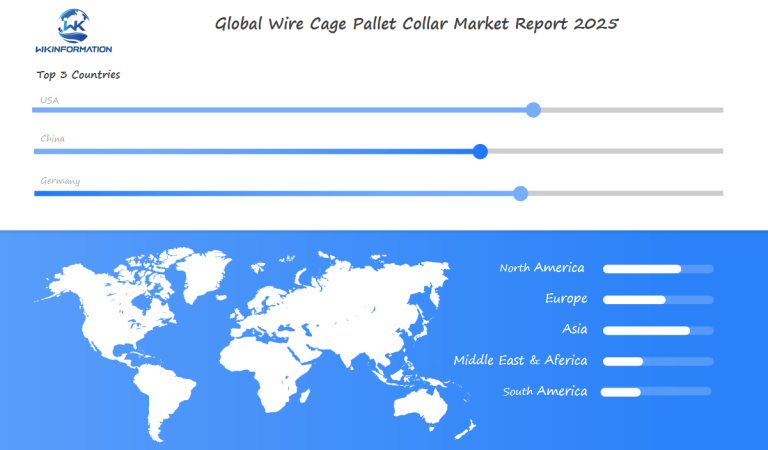

Among the key regions, the United States, China, and Germany stand out as the most critical markets due to their robust industrial infrastructure and expanding supply chain networks. These countries present significant opportunities for investment and strategic expansion, making them essential areas of study for stakeholders in the wire cage pallet collar industry.

Upstream and Downstream Industry Chain Analysis: Understanding the Wire Cage Pallet Collar Supply Chain

The wire cage pallet collar market is a crucial part of modern logistics and warehousing. It offers strong solutions for storage and transportation. These collars improve efficiency by allowing flexible stacking and protecting goods during shipping. In a time when maximizing space is crucial, their importance grows even more.

Factors Driving Growth

Key factors driving this growth include:

- The shift towards automated warehouses

- A growing preference for sustainable packaging

- The expansion of e-commerce requiring adaptable logistics solutions

Importance of Understanding the Industry Chain

Understanding the industry chain helps us see how these factors interact within the wire cage pallet collar market. This understanding lays the groundwork for future developments and competitive dynamics. It’s vital knowledge for stakeholders who want to navigate this changing landscape successfully.

Trend Analysis: Emerging Trends in Wire Cage Pallet Collars

Understanding the supply chain analysis is crucial for grasping the emerging trends in the wire cage pallet collar market. At the core of this analysis lies the examination of raw material sourcing. Steel and wire mesh are primary components, sourced from global suppliers. The quality of these materials directly influences the durability and effectiveness of the final product.

The production processes involved in manufacturing wire cage pallet collars are becoming more sophisticated. Automation has been a game-changer, enabling manufacturers to enhance precision and efficiency. Key players are leveraging advanced machinery that reduces production time while maintaining high standards.

Distribution channels are evolving to meet the demands of both upstream suppliers and downstream consumers. Manufacturers are forming strategic partnerships with logistics companies to ensure timely delivery and efficient distribution. This seamless coordination is essential for meeting consumer expectations and reducing lead times.

Key stakeholders, including warehousing facilities, e-commerce businesses, and industrial sectors, rely heavily on these products to optimize storage solutions. As demand grows, so does the need for effective distribution networks that can cater to diverse geographical markets. This interconnectedness within the supply chain highlights the importance of continual innovation and adaptation in the industry.

Restriction Analysis: Challenges in the Wire Cage Pallet Collar Market

The wire cage pallet collar market is witnessing significant growth, yet several challenges persist. With the rising demand for efficient storage solutions, industrial automation plays a crucial role in shaping market trends. Automated warehouses require adaptable and customizable storage options; however, integrating these systems with existing infrastructure can be costly and complex.

1. Impact of Industrial Automation on Market Growth

- Automation demands precision and reliability, necessitating advanced engineering and innovative design in wire cage pallet collars.

- High initial investment costs associated with automation equipment can deter small to medium enterprises (SMEs) from adopting these solutions.

2. Preference for Sustainable Packaging Options

- There’s an increasing inclination towards sustainable solutions within the industry. Wire cage pallet collars, often constructed from durable materials, align with this trend by offering reusability and reduced environmental impact.

- Innovations enhancing product features include foldable designs and customizable elements that cater to diverse logistics needs.

Despite the appeal of sustainable packaging, the challenge lies in balancing cost-effectiveness with ecological benefits. Companies must navigate these hurdles to leverage emerging opportunities in the wire cage pallet collar market effectively.

Geopolitical Analysis: How Global Politics Influence Wire Cage Pallet Collar Production and Trade

The Wire Cage Pallet Collar Market faces several geopolitical challenges that affect production and trade dynamics. One major factor is the high initial investment costs. This financial hurdle can discourage adoption as businesses weigh the cost-effectiveness of wire cage pallet collars against other storage options like plastic bins and wooden pallets.

Supply Chain Disruptions

Supply chain disruptions also play a crucial role in shaping the market landscape. Changes in the availability and pricing of raw materials, often worsened by global political tensions, lead to higher manufacturing costs. These disruptions force companies to adjust their pricing strategies, which could impact their competitive position.

Competition from Alternative Solutions

Competition from alternative solutions remains fierce. Plastic bins and wooden pallets often present a more economically viable option for businesses cautious about the high upfront investments associated with wire cage pallet collars. This competition requires manufacturers to come up with innovative ways to emphasize the long-term benefits of durability and sustainability inherent to wire cage designs.

In this complicated geopolitical situation, understanding these market challenges is crucial for effectively navigating the wire cage pallet collar industry, especially as businesses strive to balance cost concerns with the need for efficient and resilient storage solutions.

Wire Cage Pallet Collar Market Segmentation by Type and Application

The wire cage pallet collar market is closely connected to geopolitical factors, which affect the availability and pricing of raw materials. International trade agreements are crucial in this situation, as they determine the movement of materials needed to produce these storage solutions. Countries with favorable trade agreements usually have smoother supply chains, ensuring a consistent supply of raw materials at competitive prices.

Trade policies such as tariffs have a significant impact on the importing and exporting dynamics of wire cage pallet collars. Higher tariffs can lead to increased costs for manufacturers, which may be passed on to end-users, affecting overall market competitiveness. The geopolitical landscape also influences where manufacturing takes place; regions with political stability often become preferred locations for production facilities.

Geopolitical tensions can disrupt traditional supply routes, forcing companies to find alternative sourcing strategies or even move their manufacturing operations. In response to these challenges, industry stakeholders might consider implementing three strategies to de-risk supply chains amid soaring geopolitical tensions. These strategies require flexibility within the industry, as companies work hard to maintain efficiency and cost-effectiveness despite changing international relations. Understanding these complexities is crucial for stakeholders who want to successfully navigate the global wire cage pallet collar market.

Application Market Analysis: The Role of Wire Cage Pallet Collars in Logistics and Storage

Wire Cage Pallet Collars are essential components in the logistics and storage sectors due to their versatility and efficiency. Understanding the market segmentation by product types can help businesses choose the solution that best fits their needs:

1. Wooden Bottom Wire Cage Pallet Collar

Known for their durability, these collars are ideal for handling heavy loads. They provide a stable base for transportation within warehouses, reducing the risk of damage during movement.

2. Plastic Bottom Wire Cage Pallet Collar

Lightweight and resistant to moisture, these collars are perfect for storing goods in environments where humidity is a concern. Their stackable design makes them particularly useful in optimizing vertical space.

3. Iron Bottom Wire Cage Pallet Collar

Offering robust protection, these collars are tailored for industrial applications where strength is paramount. They withstand tough conditions and ensure the safety of stored materials.

These product types find extensive applications across warehouse transportation and storage. Their modular nature allows for easy assembly and disassembly, facilitating quick adaptation to varying storage requirements. As logistics operations become more complex, the demand for customizable and efficient storage solutions like wire cage pallet collars continues to rise, supporting streamlined inventory management and enhanced space utilization.

Regional Market Trends: Global Wire Cage Pallet Collar Market Analysis

Wire cage pallet collars are playing a crucial role in enhancing logistics applications, significantly impacting the efficiency of e-commerce businesses across different regions. Their stackable design and durability are particularly beneficial for optimizing storage efficiency, allowing for seamless integration within automated warehouse systems.

1. Logistics Operations for E-Commerce

The rapid expansion of e-commerce has necessitated innovative storage solutions. Wire cage pallet collars offer flexibility and robustness, catering to the dynamic needs of online retail operations. By enabling modular storage setups, these collars help streamline inventory management, resulting in faster order fulfillment and reduced operational costs.

2. Case Studies Highlighting Implementation

Various enterprises have successfully adopted wire cage pallet collars to improve their logistics processes. For instance, a leading e-commerce company in Europe integrated these collars into their distribution centers, which enhanced their storage capacity by 30%, while reducing product damage incidents by 15%. Similarly, a North American retailer reported a significant decrease in labor costs due to the ease of handling provided by wire cage pallet collars.

This increasing adoption across regions underscores the importance of wire cage pallet collars as a pivotal tool in modernizing supply chain operations. Their impact is evident not just in cost savings but also in elevating service levels, demonstrating their indispensable role in today’s fast-evolving market landscape.

United States Wire Cage Pallet Collar Market Analysis

The wire cage pallet collar market displays varying dynamics across different regions. In North America, the demand is primarily driven by the increasing adoption of industrial automation and the robust growth of e-commerce sectors. The United States stands at the forefront within this region, where companies seek efficient storage systems that cater to large-scale operations.

Europe, on the other hand, emphasizes sustainability. The market here is characterized by a preference for eco-friendly and reusable packaging solutions, with countries like Germany leading initiatives in sustainable logistics practices.

Asia-Pacific emerges as a rapidly growing market. The surge in manufacturing activities and the expansion of modern retailing infrastructures are key factors propelling demand in countries such as China and India. These nations focus on scalable solutions that enhance supply chain efficiency.

The global comparison highlights potential growth markets in emerging economies where industrialization is accelerating. As businesses worldwide strive for optimization, wire cage pallet collars play an essential role in streamlining logistics and warehousing processes across these diverse regions.

Understanding these regional variations helps stakeholders identify strategic opportunities tailored to specific market needs, ensuring a competitive edge in the evolving landscape of global logistics solutions.

China Wire Cage Pallet Collar Market Analysis

The wire cage pallet collar market in China is experiencing significant growth, driven by several key factors. Rapid industrialization and the expansion of e-commerce are crucial in increasing demand. China’s manufacturing sector benefits from the integration of industrial automation, enhancing production efficiency and reducing costs, which aligns with global trends observed in the US market.

Key players in the Chinese market include prominent figures similar to those in the United States, such as Rotom and Titan Load Restraints, who leverage their expertise to meet local and international demand. The influence of industry leaders extends into China, promoting advanced storage solutions that cater to both domestic needs and export opportunities.

Factors Driving Growth

1. E-commerce Growth

As online retail continues to flourish, so does the need for efficient logistics and storage solutions like wire cage pallet collars. This trend mirrors observations in US market trends where e-commerce plays a critical role.

2. Industrial Automation

Embracing cutting-edge technology enhances operational capabilities, allowing businesses to respond swiftly to market changes.

China’s role as a manufacturing hub positions it strategically within the global wire cage pallet collar landscape, setting a stage for future innovations and expansions. The country’s approach reflects a blend of traditional practices with modern advancements, fostering a dynamic environment for growth.

Germany Wire Cage Pallet Collar Market Analysis

Germany plays a significant role in the European wire cage pallet collar market, mainly due to its focus on sustainability and innovation. German companies are increasingly using wire cage pallet collars in their logistics solutions as part of their efforts to adopt environmentally friendly practices. This trend is in line with the global shift towards reusable and long-lasting materials in storage and transportation.

Strengths of Germany’s Manufacturing Sector

Germany’s manufacturing industry benefits from advanced industrial capabilities, which enable efficient production of wire cage pallet collars. This gives local manufacturers an advantage in meeting the growing demand for these products.

Challenges Faced by Local Manufacturers

However, local manufacturers also face challenges that could impact their growth:

- Fluctuating prices of raw materials

- Competition from alternative storage solutions such as plastic bins

These factors may pose obstacles for local manufacturers in maintaining their market position.

Potential for Future Growth

Despite these challenges, there is significant potential for future growth in the wire cage pallet collar market in Germany. The country’s strong commitment to environmental sustainability creates opportunities for businesses offering eco-friendly storage solutions.

The integration of technological advancements in designs—such as foldable and stackable features—caters to the evolving needs of industries seeking customizable storage options. The emphasis on enhancing warehouse space utilization is shaping the demand landscape positively.

China’s influence on the global wire cage pallet collar market cannot be overlooked. Rapid industrialization has positioned it as a formidable player, contributing to production scalability and competitive pricing. Nevertheless, Chinese manufacturers encounter hurdles like regulatory compliance and supply chain disruptions, impacting their market dynamics.

Future Development Analysis: The Future of Wire Cage Pallet Collars in Efficient Supply Chains

Germany’s industrial sector plays a crucial role in the European wire cage pallet collar market, both as a major consumer and innovator. The country’s strategy prioritizes sustainability initiatives, which aligns with its overall commitment to environmentally friendly practices. This emphasis on sustainability is driving the adoption of wire cage pallet collars due to their long-lasting nature and ability to be reused.

Key trends shaping the German market include:

- Technological Integration: German companies are increasingly integrating advanced technologies such as automation and smart warehousing systems. This trend supports the use of wire cage pallet collars which are compatible with these technologies, offering flexibility and safety.

- Customization Demand: Businesses in Germany are seeking storage solutions that can be customized to fit specific needs, an area where wire cage pallet collars excel with their modular design.

- E-commerce Growth: The expansion of e-commerce in Germany is creating a surge in demand for efficient logistics solutions. Wire cage pallet collars, being stackable and space-efficient, cater effectively to this need.

As these trends continue, Germany’s role in the wire cage pallet collar market is set to expand further, reinforcing its position as a leader in sustainable and efficient supply chain solutions.

Competitor Analysis: Key Players in the Wire Cage Pallet Collar Market

- Daywalk

- Loscam

- Huameilong metal products

- Kronus

- Chep

- Rehrig Pacific Company

- Pallet Market Inc.

- Dajano

- Rotom

- Palletower

Overall

| Report Metric | Details |

| Report Name | Global Wire Cage Pallet Collar Market Report |

| Base Year | 2024 |

| Segment by Type |

·Wooden Bottom Wire Cage Pallet Collar ·Plastic Bottom Wire Cage Pallet Collar ·Iron Bottom Wire Cage Pallet Collar |

| Segment by Application |

·Warehouse Transportation ·Warehouse Storage |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

In the competitive landscape of the Wire Cage Pallet Collar Market, leading companies such as Arcawa GmbH and Fletcher European Containers play crucial roles. These industry giants have carved out significant market shares by leveraging their strengths in innovation, quality, and customer service.

Arcawa GmbH excels in sustainable product offerings, aligning with the increasing demand for eco-friendly solutions. Their emphasis on durability and reusability gives them a competitive edge. However, the challenge lies in adapting to rapidly changing technological advancements, which emerging competitors are quick to adopt.

Fletcher European Containers focuses on providing customizable storage solutions tailored to specific client needs. This strategy enhances their market position, particularly among niche segments seeking bespoke solutions. The downside is that their customization approach may lead to higher production costs compared to standardized options offered by newer market entrants.

Emerging competitors often capitalize on agility and price competitiveness, challenging established players to continuously innovate. The dynamic nature of global trade agreements and geopolitical influences further complicates the competitive environment, pushing these companies to refine their strategies for sustained growth.

The balance between maintaining traditional strengths and embracing future trends remains crucial for both Arcawa GmbH and Fletcher European Containers as they navigate this evolving market landscape.

Global Wire Cage Pallet Collar Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Wire Cage Pallet Collar Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Wire Cage Pallet CollarMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Wire Cage Pallet Collar players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Wire Cage Pallet Collar Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Wire Cage Pallet Collar Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Wire Cage Pallet Collar Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWire Cage Pallet Collar Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the significance of wire cage pallet collars in logistics and warehousing?

Wire cage pallet collars play a crucial role in logistics and warehousing by providing efficient storage solutions that enhance organization and accessibility. They allow for flexible stacking and secure containment of goods, making them essential for optimizing space in warehouses.

What are the current trends influencing the wire cage pallet collar market?

Emerging trends in the wire cage pallet collar market include a rising demand for automation in industrial settings, increased preference for sustainable packaging solutions, and innovations that enhance product features to meet consumer needs.

How do geopolitical factors affect the production and trade of wire cage pallet collars?

Geopolitical factors significantly influence the wire cage pallet collar market by impacting raw material availability, pricing due to tariffs, and manufacturing locations. Trade agreements and international relations can either facilitate or hinder market access for manufacturers.

What types of wire cage pallet collars are available and what are their applications?

Wire cage pallet collars come in various types, including Wooden Bottom, Plastic Bottom, and Iron Bottom options. They are widely used in applications such as warehouse transportation and storage to improve efficiency and organization.

What challenges does the wire cage pallet collar market face today?

The wire cage pallet collar market faces challenges such as high initial investment costs for manufacturers, supply chain disruptions that affect pricing strategies, and competition from alternative storage solutions like plastic bins and wooden pallets.