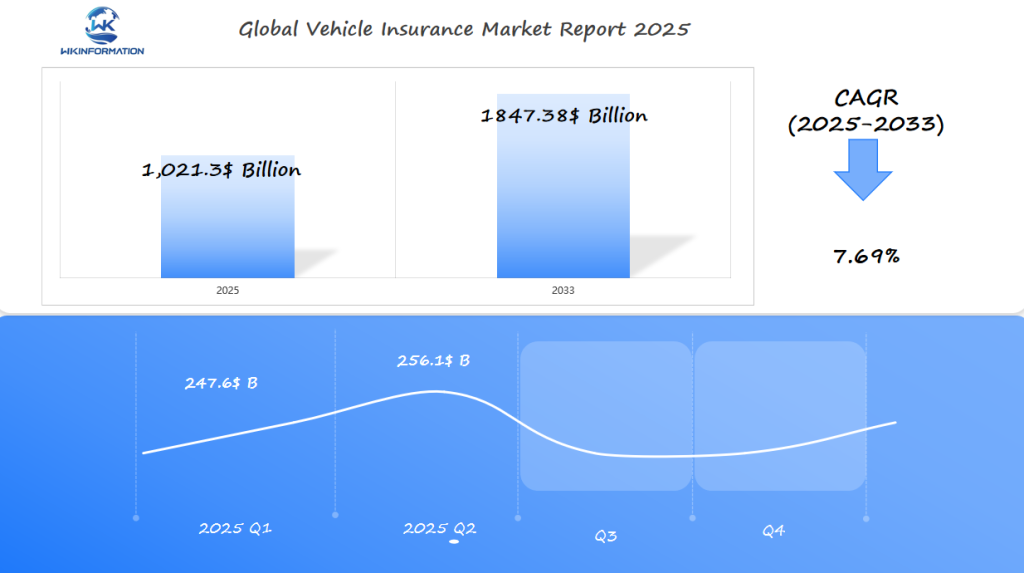

Vehicle Insurance Market Set to Surpass $1,021.3 Billion by 2025: Demand Growth in the U.S., China, and Germany

Explore the growing Vehicle Insurance Market, projected to surpass $1,021.3 billion by 2025, with rising demand in the U.S., China, and Germany.

- Last Updated:

Vehicle Insurance Market in Q1 and Q2 of 2025

The Vehicle Insurance market is projected to be valued at $1,021.3 billion in 2025, expanding steadily at a CAGR of 7.69% over the 2025–2033 period. In Q1, the market is forecasted to reach $247.6 billion, with Q2 expected to rise to $256.1 billion.

Key Drivers by Region

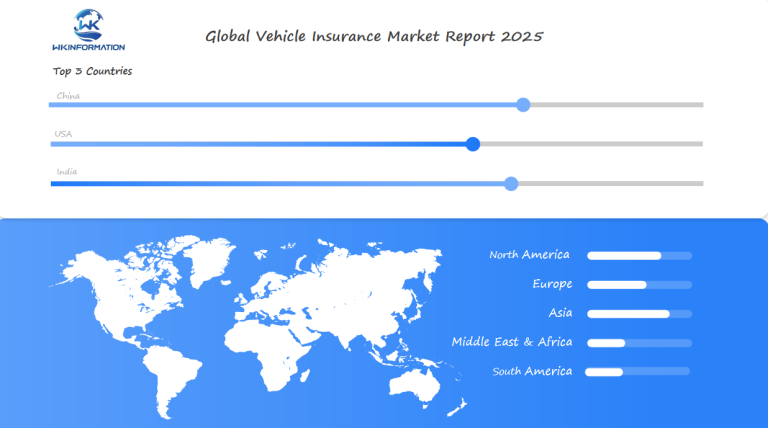

- The U.S. market remains dominant due to a high penetration of commercial and personal auto policies, along with adoption of telematics-based premiums.

- China’s growth is driven by a booming EV segment and regulatory mandates for motor coverage.

- Germany leads in digital insurance adoption, with insurtech firms offering app-based policy management and claims services.

Global Trends Shaping the Industry

Usage-based insurance (UBI), AI-powered risk assessment, and climate-resilient policy models are reshaping industry standards globally.

Upstream and Downstream Market Analysis of Vehicle Insurance

As the vehicle insurance market continues to evolve, it’s essential to examine the upstream and downstream elements that drive its growth. The industry is witnessing a significant shift due to technological advancements and changing consumer preferences.

The supply chain of vehicle insurance involves various stakeholders, including insurers, reinsurers, and third-party administrators. Understanding the dynamics of this supply chain is crucial for analyzing the industry’s current state and future prospects.

Understanding the Supply Chain and Market Dynamics

The vehicle insurance industry is influenced by insurance trends such as telematics and usage-based insurance. These trends are driven by technological innovations and changing consumer behaviors.

The Role of Telematics

Telematics, for instance, allows insurers to collect data on driving habits, enabling them to offer usage-based insurance policies that are more personalized and fair. This shift towards data-driven underwriting is transforming the industry, making it more efficient and customer-centric.

Downstream Market Analysis

The downstream market analysis involves understanding the end-users’ needs and preferences. With the rise of AI-driven underwriting, insurers can now assess risks more accurately and provide policies that are tailored to individual needs.

| Market Element | Description | Impact on Industry |

| Telematics | Technology used to collect data on driving habits | Enables usage-based insurance and personalized pricing |

| AI-driven Underwriting | Use of AI to assess risks and determine policy prices | More accurate risk assessment and tailored policies |

| Usage-Based Insurance | Insurance policies based on actual driving habits | More fair and personalized insurance pricing |

The interplay between upstream and downstream elements of the vehicle insurance market is complex. As the industry continues to evolve, understanding these dynamics will be crucial for insurers, policymakers, and consumers alike.

Trends in telematics, usage-based insurance, and AI-driven underwriting

Telematics and AI-driven underwriting are transforming the insurance landscape, offering more personalized and accurate risk assessments. The insurance industry is rapidly evolving, driven by technological advancements that enable insurers to better understand and manage risk.

The impact of technology on the insurance industry is profound. Telematics, which involves the use of devices to track and monitor vehicle behavior, is becoming increasingly popular. This technology allows insurers to gather detailed data on driving habits, enabling them to offer usage-based insurance policies that are tailored to individual drivers.

Impact of technology on the insurance industry

The integration of technology in insurance underwriting has led to more accurate risk assessments. AI-driven underwriting enables insurers to analyze vast amounts of data, including telematics information, to make informed decisions about policyholders.

Telematics and usage-based insurance: a growing trend

The benefits of telematics and usage-based insurance include:

- More accurate risk assessment

- Personalized insurance policies

- Improved customer engagement

As the insurance industry continues to evolve, it’s clear that telematics and AI-driven underwriting will play a crucial role in shaping the future of vehicle insurance.

Regulatory challenges and regional compliance in the insurance sector

The insurance industry operates under a complex regulatory environment that varies significantly across different regions. Insurers must deal with numerous regulatory challenges that affect their operations worldwide. This includes following various rules regarding insurance agreements, preventing fraud, and protecting data.

Navigating Complex Regulatory Landscapes

The regulatory landscape for insurers is multifaceted, involving various national and international regulations. For instance, regulations regarding insurance contracts can differ substantially between countries, affecting how insurers draft and execute contracts.

| Region | Regulatory Requirement | Impact on Insurers |

| United States | Strict regulations on policy disclosures | Increased transparency and consumer trust |

| European Union | GDPR compliance for customer data | Enhanced data protection measures |

| China | Mandatory insurance coverage for certain risks | Increased demand for specific insurance products |

Another critical aspect of regulatory compliance is fraud prevention. Insurers must implement robust systems to detect and prevent fraudulent activities, which can vary significantly in nature and complexity across different regions.

In conclusion, navigating the complex regulatory landscape is crucial for insurers to ensure compliance and maintain operational integrity. By understanding and adapting to these regulatory challenges, insurers can better serve their customers and maintain a competitive edge in the market.

Geopolitical factors impacting cross-border insurance policies and claims

Geopolitical tensions are reshaping the global insurance landscape, particularly in the context of cross-border policies and claims. Insurers must navigate a complex web of regulations, trade policies, and geopolitical risks that can significantly impact their business operations.

The impact of geopolitical factors on insurance is multifaceted. For instance, changes in trade policies can affect the cost of importing and exporting goods, which in turn can influence insurance premiums. Similarly, geopolitical tensions can lead to increased risks of conflicts, terrorism, and cyberattacks, making it essential for insurers to reassess their risk management strategies.

Understanding the impact of geopolitical factors on insurance

To effectively manage the risks associated with geopolitical factors, insurers need to stay informed about the latest developments in the global geopolitical landscape. This includes monitoring changes in government policies, trade agreements, and other factors that could impact the insurance industry.

Some key geopolitical factors that insurers should be aware of include:

- Trade tensions and protectionism: The rise of protectionism and trade tensions between countries can lead to increased costs and uncertainty for insurers operating in multiple markets.

- Regional conflicts and terrorism: Geopolitical conflicts and terrorism can result in significant losses for insurers, particularly in regions with high-risk profiles.

- Cyber threats: Geopolitical tensions can also lead to an increased risk of cyberattacks, which can have a devastating impact on insurers and their policyholders.

By understanding these geopolitical factors and their potential impact on the insurance industry, insurers can develop more effective risk management strategies and improve their ability to respond to emerging challenges.

Geopolitical factors play a significant role in shaping the global insurance landscape, particularly in the context of cross-border policies and claims. Insurers must remain vigilant and adapt to the changing geopolitical landscape to remain competitive and manage risks effectively.

Type segmentation: comprehensive, third-party, and pay-per-mile vehicle insurance

As the vehicle insurance industry changes, insurers are providing various products such as comprehensive, third-party, and pay-per-mile insurance to appeal to different customer groups. It is essential for insurers to understand these various types of vehicle insurance in order to effectively meet the needs of different customers.

Different Types of Vehicle Insurance

Vehicle insurance can be broadly categorized into three main types: comprehensive, third-party, and pay-per-mile insurance. Each type has its unique characteristics and benefits.

1. Comprehensive Insurance

Comprehensive Insurance covers damages to the insured vehicle, as well as third-party liabilities. It is the most extensive form of vehicle insurance and provides maximum protection.

2. Third-Party Insurance

Third-party insurance, on the other hand, only covers damages to third-party vehicles or property. It is mandatory in many countries and is often considered a basic level of insurance coverage.

3. Pay-Per-Mile Insurance

Pay-per-mile insurance is a usage-based insurance model where premiums are calculated based on the distance traveled by the vehicle. This type of insurance is gaining popularity, especially among low-mileage drivers.

| Insurance Type | Coverage | Premium Calculation |

| Comprehensive | Damages to insured vehicle and third-party liabilities | Based on various factors, including vehicle value and driver history |

| Third-Party | Damages to third-party vehicles or property | Typically a fixed premium or based on vehicle type |

| Pay-Per-Mile | Varies, often similar to comprehensive or third-party | Based on distance traveled |

Insurers must understand the different types of vehicle insurance and their appeal to various customer segments to remain competitive in the market. By offering a range of insurance products, insurers can cater to diverse customer needs and preferences.

Application segmentation: private vehicles, commercial fleets, and electric vehicles

Vehicle insurance providers are now focusing on different application segments, including , , and the growing . This shift towards application segmentation is driven by the unique needs and requirements of each segment.

Understanding different applications of vehicle insurance

1. Private Vehicles

Private vehicles, being the most common application, require insurance policies that cover personal use, family protection, and sometimes, additional coverage for specific drivers. Tailored insurance products for private vehicles often include comprehensive coverage, collision coverage, and personal injury protection.

2. Commercial Fleets

Commercial fleets, on the other hand, demand more complex insurance solutions due to their varied uses, from logistics and transportation to service vehicles. Insurance for commercial fleets must account for factors like vehicle type, usage patterns, and driver history, making it a challenging yet critical segment.

3. Electric Vehicles (EVs)

The rise of electric vehicles (EVs) is also influencing the auto insurance landscape. EVs have different insurance requirements compared to traditional gasoline-powered vehicles, partly due to their higher value, specific charging infrastructure needs, and the potential for different types of risks. Insurance policies for EVs are evolving to address these unique aspects, including coverage for charging equipment and battery damage.

Understanding these different applications of vehicle insurance is crucial for insurers to develop competitive and relevant products. By segmenting their offerings, insurers can better meet the needs of their diverse customer base, from individual vehicle owners to large commercial fleet operators and EV owners.

Global push for personalized vehicle insurance and risk-based pricing

The global vehicle insurance market is shifting towards personalized policies, driven by advancements in technology and changing consumer preferences. Insurers are now leveraging AI-driven underwriting to offer more tailored policies and assess risks more accurately.

The Shift Towards Personalized Insurance and Risk-Based Pricing

The trend towards personalized insurance is not just a response to consumer demand but also a strategic move to differentiate insurers in a competitive market. By adopting risk-based pricing, insurers can more accurately reflect the risk profile of individual drivers, leading to more equitable premiums.

Several factors are driving this shift:

- Increased use of telematics and IoT devices to gather detailed driver data

- Advancements in AI and machine learning for more sophisticated risk assessment

- Changing consumer expectations towards more personalized services

- Regulatory support for innovation in insurance products

The adoption of AI-driven underwriting is central to this transformation. It enables insurers to analyze vast amounts of data, including driving behavior, to determine premiums that are both competitive and profitable.

Benefits of Personalized Insurance

Personalized insurance offers several benefits, including:

- More Accurate Pricing: Premiums are based on actual driving behavior

- Increased Fairness: Drivers are not penalized for factors outside their control

- Improved Customer Satisfaction: Policies are tailored to individual needs

As the industry continues to evolve, we can expect to see further innovations in personalized insurance and risk-based pricing, driven by technological advancements and changing consumer needs.

U.S. market shift towards AI-driven risk assessment and pricing models

The U.S. insurance market is about to undergo a significant change with the introduction of AI-driven risk assessment and pricing models. Insurers are increasingly using advanced technologies to enhance their ability to evaluate risks and provide more competitive pricing options to their customers.

Impact on the Insurance Industry

The adoption of AI-driven risk assessment is transforming the insurance industry in several ways. Insurers can now analyze vast amounts of data to make more informed decisions about policyholders and potential risks.

- Improved risk assessment accuracy

- Enhanced customer segmentation

- More competitive pricing models

By leveraging machine learning algorithms and data analytics, insurers can better understand their customers’ needs and tailor their policies accordingly. This shift is expected to drive growth and innovation in the U.S. insurance market.

Key Benefits of AI-Driven Risk Assessment

- Enhanced accuracy: AI-driven models can analyze complex data sets to provide more accurate risk assessments.

- Personalized pricing: Insurers can offer personalized pricing models based on individual risk profiles.

- Competitive advantage: Companies that adopt AI-driven risk assessment can gain a competitive edge in the market.

As the U.S. insurance market continues to evolve, the integration of AI-driven risk assessment and pricing models is expected to play a crucial role in shaping the industry’s future.

China's Growing Automotive Insurance Market in Line with Vehicle Electrification

As China continues to lead in vehicle electrification, its automotive insurance market is experiencing substantial growth. The increasing adoption of electric vehicles (EVs) is not only transforming the automotive industry but also presenting new opportunities and challenges for insurers.

The Growth Drivers

The growth of China’s automotive insurance market is driven by several key factors, including government incentives for EVs, declining battery costs, and the expansion of charging infrastructure. Insurers must understand these dynamics to develop products that meet the evolving needs of EV owners.

- Increasing EV adoption rates

- Government policies supporting electrification

- Advancements in battery technology

The unique characteristics of EVs, such as their lower environmental impact and potentially lower maintenance costs, are also influencing insurance product design. Insurers are beginning to offer specialized EV insurance policies that take into account the specific risks and benefits associated with electric vehicles.

Key Trends in China’s Automotive Insurance Market

- Personalization: Insurers are leveraging data analytics to offer personalized insurance products tailored to individual driving habits and vehicle characteristics.

- Technology Integration: The use of telematics and IoT devices is becoming more prevalent, enabling insurers to monitor vehicle usage and driving behavior in real-time.

- Sustainability: There is a growing focus on sustainable insurance practices, including incentives for eco-friendly driving behaviors.

As China’s automotive insurance market continues to evolve, insurers will need to stay abreast of these trends to remain competitive. By understanding the impact of vehicle electrification on insurance products and services, insurers can capitalize on the opportunities presented by this growing market.

Germany’s focus on regulatory alignment and comprehensive insurance offerings

With a strong emphasis on regulatory compliance, Germany’s insurance market is evolving to meet the changing needs of its consumers. The country’s insurers are focusing on regulatory alignment to ensure that their offerings are both compliant with existing laws and competitive in the market.

Regulatory Compliance in Germany’s Insurance Sector

Germany’s insurance industry is subject to a complex regulatory landscape. Insurers must comply with both national and European Union (EU) regulations. The European Insurance and Occupational Pensions Authority (EIOPA) plays a crucial role in shaping the regulatory framework across EU member states, including Germany.

Key Regulatory Requirements

Key Regulatory Requirements include solvency regulations, consumer protection laws, and data protection standards. Insurers must ensure that they meet these requirements to operate effectively in Germany.

| Regulatory Aspect | Description | Impact on Insurers |

| Solvency Regulations | Requirements for capital adequacy | Increased capital reserves |

| Consumer Protection Laws | Laws to protect consumer rights | Enhanced transparency and fairness |

| Data Protection Standards | Regulations for data privacy and security | Stricter data handling practices |

Comprehensive Insurance Offerings

Comprehensive insurance offerings are also a key aspect of Germany’s insurance market. Consumers are looking for policies that provide broad coverage and additional benefits. Insurers are responding by developing more comprehensive products that meet these needs.

These products typically include a range of benefits such as liability coverage, collision damage, and personal accident insurance. They are designed to provide policyholders with peace of mind and financial protection against various risks.

By focusing on regulatory alignment and comprehensive insurance offerings, Germany’s insurance market is poised for continued growth and development. Insurers that adapt to these changes are likely to succeed in this evolving landscape.

Future trends in blockchain for insurance contracts and fraud prevention

The insurance industry is on the verge of a revolution with blockchain technology. As insurers seek to enhance efficiency, transparency, and security, blockchain is emerging as a key solution.

Blockchain technology has the potential to transform insurance contracts by making them more secure, transparent, and efficient. It enables the creation of smart contracts that automatically execute when certain conditions are met, reducing the need for intermediaries and increasing the speed of claims processing.

Enhancing Security and Transparency

One of the significant benefits of blockchain in insurance is its ability to enhance security and transparency. By using a decentralized ledger, blockchain technology ensures that data is not controlled by a single entity, making it more difficult for fraudsters to manipulate.

The use of blockchain in insurance contracts also improves transparency by providing a clear and immutable record of all transactions. This transparency can help build trust between insurers and policyholders, leading to stronger relationships and increased customer satisfaction.

Key Benefits of Blockchain in Insurance

- Smart contracts that automate claims processing

- Enhanced security through decentralized ledgers

- Improved transparency in insurance contracts

- Reduced fraud through tamper-proof records

As the insurance industry continues to evolve, the adoption of blockchain technology is expected to grow. Insurers who embrace this technology will be better positioned to meet the changing needs of their customers and stay ahead of the competition.

Key competitors in the global vehicle insurance market

- State Farm – United States

- Progressive – United States

- Geico – United States

- Allstate – United States

- USAA – United States

- Liberty Mutual – United States

- Farmers – United States

- American Family – United States

- Travelers – United States

- Nationwide – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Vehicle Insurance Report |

| Base Year | 2024 |

| Segment by Type |

· Comprehensive Insurance · Third-Party Insurance · Pay-Per-Mile Vehicle Insurance |

| Segment by Application |

· Private Vehicles · Commercial Fleets · Electric Vehicles |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The vehicle insurance market is set for significant growth and transformation, driven by technological advancements, changing consumer preferences, and evolving regulations. As insurers navigate these changes, understanding the trends, challenges, and opportunities shaping the industry will be crucial to staying competitive.

Emerging Trends and Future Directions

The future of vehicle insurance will be characterized by increased personalization, risk-based pricing, and the adoption of emerging technologies such as AI, blockchain, and telematics. These developments will enable insurers to better assess risk, improve customer experiences, and reduce fraud. As the industry continues to evolve, companies that adapt to these changes will be well-positioned to capitalize on the growing demand for vehicle insurance.

With the global vehicle insurance market expected to surpass $1,021.3 billion by 2025, driven by growth in regions such as the U.S. and China, insurers must be prepared to respond to emerging trends and future trends in the insurance market.

Global Vehicle Insurance Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Vehicle Insurance Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vehicle InsuranceMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Vehicle Insuranceplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Vehicle Insurance Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Vehicle Insurance Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Vehicle Insurance Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofVehicle InsuranceMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the vehicle insurance market?

The vehicle insurance market is driven by increasing demand in the U.S. and China, as well as the rising adoption of telematics and usage-based insurance.

How is technology impacting the insurance industry?

Technology is transforming the insurance industry. Advancements in telematics, usage-based insurance, and AI-driven underwriting are enabling insurers to:

- Offer more personalized policies

- Assess risks more accurately

What are the different types of vehicle insurance?

Vehicle insurance can be segmented into comprehensive, third-party, and pay-per-mile insurance, each with its unique characteristics and benefits.

How is AI being used in the U.S. insurance market?

The U.S. insurance market is using AI and machine learning algorithms to analyze large amounts of data and make informed decisions. This helps improve risk assessment abilities and offer more competitive pricing.

What is the impact of vehicle electrification on the insurance market?

Vehicle electrification is driving growth in the automotive insurance market, particularly in China, and insurers must understand the unique needs and requirements of this growing market.

How is blockchain technology expected to impact the insurance industry?

Blockchain technology is expected to play a significant role in the insurance industry, particularly in the areas of insurance contracts and fraud prevention, improving transparency and security.

What are the regulatory challenges facing the insurance sector?

The insurance sector faces several regulatory challenges and regional compliance requirements, such as:

- Regulations governing insurance contracts

- Fraud prevention measures

- Data protection laws

How are insurers responding to changing consumer preferences?

Insurers are responding to changing consumer preferences by offering more personalized policies and leveraging technology, including AI-driven underwriting, to improve their risk assessment capabilities.

Why is regulatory alignment important in Germany’s insurance market?

Germany’s insurance market places a strong emphasis on regulatory alignment. Insurers need to have a clear understanding of the regulatory environment in order to operate successfully in this market.

How is the global push for personalized vehicle insurance and risk-based pricing impacting the industry?

The global push for personalized vehicle insurance and risk-based pricing is driving insurers to leverage technology and offer more tailored policies, improving their competitiveness in a rapidly changing market.