Treasury Management Software Market to Surpass $15.12 Billion by 2025 with Fintech Advancements Driving Growth in the U.S., Singapore, and Germany

Treasury Management Software market analysis and FAQ guide covering key benefits, fintech influences, market challenges, regional growth drivers, and projected market value of $15.12B by 2025. Includes detailed insights on financial operations management tools and digital transformation trends.

- Last Updated:

Treasury Management Software Market Outlook for Q1 and Q2 2025

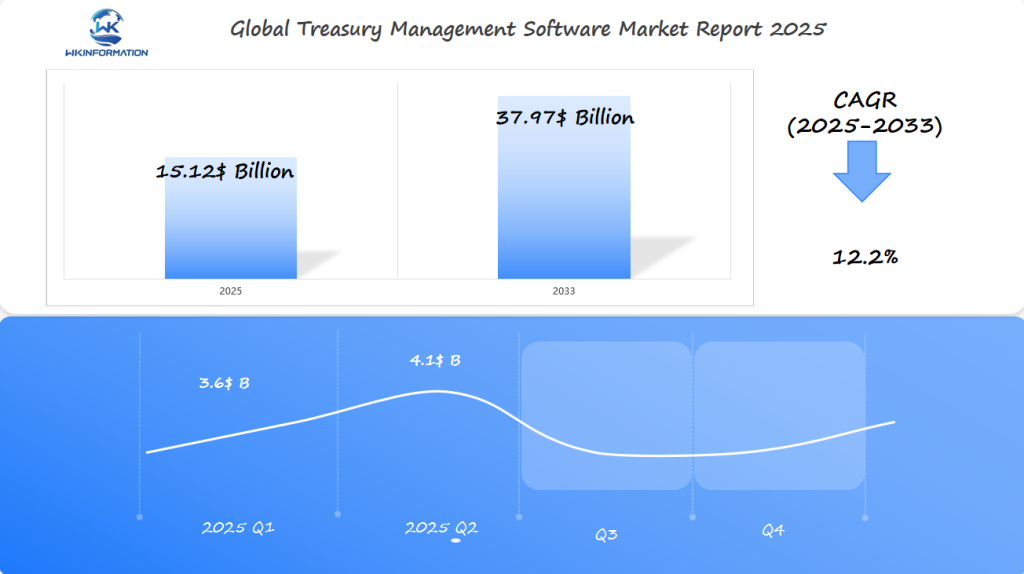

The Treasury Management Software market is projected to reach $15.12 billion in 2025, with a CAGR of 12.2% from 2025 to 2033.

Q1 2025: Early Growth

In Q1 2025, the market will likely see early growth, reaching around $3.6 billion as businesses begin to adopt advanced treasury solutions for financial optimization. The U.S., Singapore, and Germany will be key players in this market, as the need for automation, security, and cash flow management in large enterprises continues to rise.

Q2 2025: Increased Demand for Integrated Platforms

By Q2 2025, the market is expected to grow to approximately $4.1 billion, driven by increased demand for integrated treasury platforms that streamline cash management, risk mitigation, and regulatory compliance. The U.S. will maintain its position as the largest market, but Singapore and Germany will also experience significant adoption as businesses look to digital solutions to manage financial operations more efficiently and accurately. The ongoing digital transformation in the finance sector will contribute to this expansion.

Treasury Management Software market ecosystem from upstream to downstream

The Treasury Management Software market ecosystem is complex, involving various stakeholders from upstream to downstream.

The ecosystem includes several key components that work together to enable the development, implementation, and maintenance of treasury management solutions.

Understanding the Treasury Management Software Market Ecosystem

The treasury management software market has a variety of participants, such as software vendors, financial institutions, and regulatory bodies.

Key components of the ecosystem include:

- Software development companies that design and develop treasury management solutions.

- Financial institutions that implement these solutions to manage their treasury operations.

- Regulatory bodies that oversee the industry and ensure compliance with relevant regulations.

Key Players and Their Roles in the Ecosystem

The key players in the treasury management software market ecosystem have important responsibilities in shaping the industry.

Software development companies, such as SAP and Oracle, create innovative treasury management solutions to meet the changing needs of financial institutions.

Financial institutions, including banks and corporations, use these solutions to make their treasury operations more efficient.

Regulatory bodies, like the Federal Reserve and the European Central Bank, establish rules and guidelines for the industry.

Fintech Trends Impacting Treasury Management Software Development

The financial technology (fintech) sector is undergoing rapid transformation, driven by technological advancements and changing consumer demands. As fintech continues to advance, its impact on Treasury Management Software development is becoming increasingly pronounced.

Emerging Trends in Fintech and Their Impact

Several emerging trends in fintech are significantly influencing the development of Treasury Management Software. These include the integration of artificial intelligence (AI) and machine learning (ML) to enhance predictive analytics and automate treasury operations.

The adoption of blockchain technology is another critical trend, offering enhanced security, transparency, and efficiency in treasury management. Furthermore, the rise of cloud-based solutions is facilitating greater flexibility and scalability for businesses.

The impact of these trends on Treasury Management Software development is multifaceted. For instance, the incorporation of AI and ML is enabling more sophisticated cash forecasting and risk management. Blockchain technology is improving the security and transparency of transactions.

| Artificial Intelligence (AI) and Machine Learning (ML) | Enhanced predictive analytics and automation of treasury operations |

| Blockchain Technology | Improved security, transparency, and efficiency in treasury management |

| Cloud-Based Solutions | Greater flexibility and scalability for businesses |

These emerging trends are not only shaping the current landscape of Treasury Management Software but are also paving the way for future innovations. As fintech continues to evolve, it is likely that we will see even more sophisticated and integrated treasury management solutions.

Limitations and compliance challenges in the treasury tech space

Treasury tech, a sector on the brink of significant growth, has its own set of challenges. As the industry continues to develop, it faces various limitations and compliance challenges that can slow down its progress.

The treasury tech space is known for its complex regulatory requirements, high security standards, and the need to smoothly integrate with existing financial systems. Compliance challenges are crucial, as failing to comply can lead to hefty financial penalties and damage to reputation.

Navigating Compliance Challenges

Navigating the complex world of compliance requires a deep understanding of regulatory requirements and the ability to adapt to changing laws and regulations. Treasury tech companies must invest in strong compliance systems that include regular audits, risk assessments, and training for employees.

The Role of RegTech Solutions

Regulatory Technology (RegTech) solutions can play a crucial role in helping treasury tech companies navigate compliance challenges. RegTech solutions use technology to make compliance processes more efficient, improve risk management, and enhance regulatory reporting.

Overcoming Limitations in Treasury Tech

To overcome the limitations in treasury tech, companies are turning to innovative solutions such as:

- Cloud-based services: These services offer flexible and scalable solutions for handling increased transaction volumes.

- Artificial intelligence (AI): AI technologies can help detect and prevent potential data breaches and cyber attacks.

- Blockchain technology: Blockchain can enhance security measures and provide transparent audit trails for transactions.

Treasury tech, a sector on the brink of significant growth, has its own set of challenges. As the industry continues to develop, it faces various limitations and compliance challenges that can slow down its progress.

The treasury tech space is known for its complex regulatory requirements, high security standards, and the need to smoothly integrate with existing financial systems. Compliance challenges are crucial, as failing to comply can lead to hefty financial penalties and damage to reputation.

Navigating Compliance Challenges

Navigating the complex world of compliance requires a deep understanding of regulatory requirements and the ability to adapt to changing laws and regulations. Treasury tech companies must invest in strong compliance systems that include regular audits, risk assessments, and training for employees.

The Role of RegTech Solutions

Regulatory Technology (RegTech) solutions can play a crucial role in helping treasury tech companies navigate compliance challenges. RegTech solutions use technology to make compliance processes more efficient, improve risk management, and enhance regulatory reporting.

Overcoming Limitations in Treasury Tech

To overcome the limitations in treasury tech, companies are turning to innovative solutions such as:

- Cloud-based services: These services offer flexible and scalable solutions for handling increased transaction volumes.

- Artificial intelligence (AI): AI technologies can help detect and prevent potential data breaches and cyber attacks.

- Blockchain technology: Blockchain can enhance security measures and provide transparent audit trails for transactions.

| Limitation | Impact | Solution |

| Scalability Issues | Limited ability to handle increased transaction volumes | Cloud-based services |

| Security Risks | Potential for data breaches and cyber attacks | Artificial Intelligence (AI) and enhanced security protocols |

| Regulatory Compliance | Difficulty in keeping up with changing regulations | Regulatory Technology (RegTech) solutions |

By understanding the limitations and compliance challenges in the treasury tech space, companies can develop effective strategies to overcome these obstacles. This involves using innovative technologies, investing in compliance systems, and staying updated on regulatory changes.

How the Geopolitical Climate is Shaping the Financial Technology Sector

The financial technology (fintech) sector is undergoing a significant transformation due to the changing geopolitical climate. Geopolitical factors have a major influence on the financial technology landscape, affecting innovation and market dynamics. As global economic conditions shift, fintech companies need to adjust to new regulatory environments and geopolitical tensions that could impact their operations and growth.

The Various Ways Geopolitical Climate Affects Fintech

The effect of the geopolitical climate on fintech is complex. It impacts:

- The regulatory frameworks that govern the industry

- The flow of investments

- The technological advancements that drive innovation

For example, trade tensions between major economies can result in increased regulatory scrutiny, which in turn affects how fintech companies conduct business across borders.

Impact of Geopolitical Climate on Fintech

The geopolitical climate affects fintech in several key areas:

- Regulatory Compliance: Fintech companies must navigate complex and changing regulatory landscapes, which can vary significantly across different jurisdictions.

- Investment Flows: Geopolitical tensions can impact investment decisions, with some regions or countries being viewed as more risky than others.

- Innovation: The geopolitical climate can drive innovation as fintech companies seek to develop solutions that address emerging challenges and opportunities.

Understanding these dynamics is crucial for fintech companies looking to expand their operations or develop new products and services. By staying informed about geopolitical developments, these companies can better navigate the challenges and opportunities that arise in this rapidly evolving sector.

Segmentation by solution types in Treasury Management Software

The growing demand for tailored financial solutions is driving the segmentation of Treasury Management Software by solution types. This segmentation is crucial as it allows financial institutions to select solutions that best fit their operational needs, enhancing their ability to manage cash, liquidity, and risk.

Types of Treasury Management Solutions

Treasury Management Software includes various solution types, such as cash management, liquidity management, risk management, and investment management solutions. Each of these solution types focuses on specific areas of financial management, offering comprehensive support to financial institutions.

The market share of different solution types within the Treasury Management Software market varies, with cash management solutions often being the most adopted due to their critical role in financial operations. However, other solution types like risk management are gaining traction due to their importance in mitigating financial risks.

The adoption of these solution types is influenced by factors such as the size of the financial institution, the complexity of their financial operations, and their specific regulatory requirements. Larger financial institutions, for instance, may require more comprehensive and integrated treasury management solutions.

Key factors driving the adoption of different solution types include:

- The need for enhanced financial control and visibility

- The requirement for regulatory compliance

- The desire to optimize financial performance through better cash and liquidity management

As the Treasury Management Software market continues to evolve, understanding the segmentation by solution types will be crucial for financial institutions looking to invest in treasury management solutions that meet their specific needs.

Use-case expansion across industries for treasury solutions

The adoption of treasury solutions is on the rise across various industries, driven by the need for efficient financial management and compliance. As companies expand their operations, the complexity of their financial transactions increases, necessitating the use of advanced treasury management solutions.

The trend of diversifying treasury solutions across industries is gaining momentum. Treasury management software is being increasingly adopted to streamline financial operations, improve cash visibility, and mitigate financial risks.

Diversification Across Industries

Several factors are facilitating the adoption of treasury solutions across industries. These include the need for improved financial efficiency, enhanced compliance with regulatory requirements, and better risk management. As noted by a financial expert,

Industries Adopting Treasury Solutions

Treasury solutions are being adopted across various industries, including:

- Manufacturing

- Healthcare

- Retail

Each industry has its unique requirements, and treasury management solutions are being tailored to meet these specific needs.

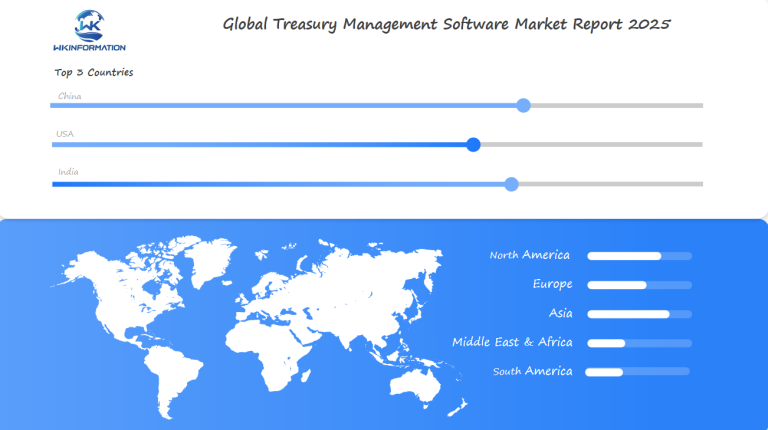

Regional distribution trends in the Treasury Management Software market

As the Treasury Management Software market evolves, distinct regional trends are emerging. The adoption and implementation of treasury management solutions vary significantly across different geographical regions due to factors like regulatory requirements, technological infrastructure, and economic conditions.

Regional Market Trends

The global Treasury Management Software market is not uniform; it is shaped by regional characteristics. For instance, North America is a mature market with a high adoption rate of advanced treasury solutions, while the Asia-Pacific region is emerging as a significant growth area due to rapid economic expansion and increasing financial complexity.

Emerging Markets in Treasury Management Software

Emerging markets, particularly in the Asia-Pacific and Latin America regions, are witnessing a surge in the adoption of Treasury Management Software. Countries like China, India, and Brazil are driving this growth due to their expanding economies and the need for sophisticated financial management tools.

The Treasury Management Software market exhibits diverse regional distribution trends, with emerging markets in Asia-Pacific and Latin America showing significant growth potential. Understanding these trends is crucial for vendors and businesses looking to expand their presence in the global treasury management solutions market.

U.S. market updates for Treasury Management Software adoption

The adoption of Treasury Management Software in the U.S. is on the rise, driven by the need for efficient financial management. As companies expand their operations, the demand for sophisticated treasury solutions is increasing.

The U.S. market is witnessing a significant shift towards digital transformation, with fintech advancements playing a crucial role. The integration of technologies like artificial intelligence and blockchain is enhancing the capabilities of Treasury Management Software, making it more appealing to businesses.

Adoption Trends in the U.S. Market

Several factors are driving the adoption of Treasury Management Software in the U.S. market. These include the need for improved cash visibility, enhanced risk management, and streamlined financial operations.

Despite the positive trends, the industry faces challenges such as regulatory compliance and cybersecurity threats. Companies are adopting Treasury Management Software that not only meets their operational needs but also ensures compliance with regulatory requirements.

The market updates indicate a growing preference for cloud-based Treasury Management Software solutions, driven by their scalability and cost-effectiveness.

- Increased adoption of digital payment solutions

- Growing demand for real-time cash management

- Integration of advanced technologies like AI and machine learning

As the U.S. market continues to evolve, it is expected that the adoption of Treasury Management Software will become more widespread, driven by the need for efficient and secure financial management solutions.

Singapore’s fintech ecosystem and treasury integration

Singapore’s fintech ecosystem is undergoing a major change with the introduction of treasury integration. The city-state has always been a leader in financial innovation, and its efforts to incorporate treasury solutions into the fintech ecosystem are showing great results.

The fintech ecosystem in Singapore is known for its strong infrastructure that supports innovation and the use of new technologies. With a solid regulatory framework and a cooperative environment, Singapore is drawing in significant investments in fintech.

Singapore’s Fintech Ecosystem

The fintech ecosystem in Singapore is complex, involving various stakeholders including financial institutions, technology providers, and regulatory bodies. Key initiatives such as the Singapore FinTech Festival and the Monetary Authority of Singapore’s (MAS) Fintech Funding Scheme are driving the growth of this ecosystem.

Treasury Integration in Singapore’s Fintech Landscape

Treasury integration is becoming increasingly important in Singapore’s fintech landscape. This involves the incorporation of treasury management solutions into the fintech ecosystem, enabling more efficient financial management for businesses.

The integration of treasury solutions is expected to bring about several benefits, including:

- Enhanced financial management capabilities

- Improved liquidity management

- Reduced operational costs

| Benefits | Description |

| Enhanced Financial Management | Improved financial oversight and control |

| Improved Liquidity Management | Better management of cash flows |

| Reduced Operational Costs | Streamlined processes reducing costs |

As Singapore continues to evolve as a fintech hub, the integration of treasury solutions will play a crucial role in shaping the future of financial management in the region.

Germany’s Banking Sector Transformation and Market Role

Germany’s banking sector is evolving as part of the broader fintech landscape. This transformation is driven by technological advancements and changing regulatory requirements.

Transformation in Germany’s Banking Sector

The German banking sector is undergoing significant changes, with a focus on digitalization and improved customer experience. This transformation is expected to have a profound impact on the Treasury Management Software Market.

The key drivers of this transformation include the adoption of fintech solutions, increased focus on cybersecurity, and the need for compliance with evolving regulatory standards.

The transformation in Germany’s banking sector is also influenced by the geopolitical climate and the need for robust treasury management solutions. As the sector continues to evolve, it is expected that the demand for sophisticated treasury management software will increase.

Key Trends in Germany’s Banking Sector Transformation

- Digital transformation and innovation

- Increased adoption of fintech solutions

- Enhanced focus on cybersecurity and compliance

As Germany’s banking sector continues to transform, it is likely to play a significant role in shaping the Treasury Management Software Market. The market is expected to benefit from the increased adoption of digital treasury management solutions.

Future Opportunities in Treasury Management Software Innovation

The Treasury Management Software market is about to undergo a significant change, fueled by technological advancements and changing business requirements. As financial institutions increasingly embrace digital solutions, the need for innovative treasury management systems is anticipated to grow.

Emerging Opportunities in Treasury Management Software

The integration of emerging technologies such as AI, blockchain, and cloud computing is creating new opportunities in the Treasury Management Software market. These technologies are enhancing the capabilities of treasury management systems, making them more efficient, effective, and secure.

Innovation Drivers

There are several drivers of innovation in the Treasury Management Software market. Some of the key factors include:

- Technological Advancements: Advances in technologies such as AI and blockchain are driving innovation in treasury management software.

- Changing Business Needs: Evolving business needs, such as the need for real-time payment processing and enhanced security, are driving the demand for more sophisticated treasury management solutions.

- Regulatory Compliance: The need to comply with changing regulatory requirements is also driving innovation in the treasury management software market.

Opportunities in Treasury Management Software

Here are some emerging opportunities in the Treasury Management Software market:

| AI Integration | Use of AI for predictive analytics and automated decision-making | Enhanced efficiency and accuracy |

| Blockchain Adoption | Use of blockchain for secure and transparent transactions | Increased security and reduced risk |

| Cloud Computing | Migration to cloud-based treasury management solutions | Improved scalability and reduced costs |

Competitive analysis in the Treasury Management Software sector

Here are some of the key players in the Treasury Management Software industry:

- Oracle – United States

- Finastra – United Kingdom

- Kyriba – United States

- SAP – Germany

- Salmon Software Limited – Ireland

- ACI Worldwide – United States

Overall

| Report Metric | Details |

|---|---|

|

Report Name |

Global Treasury Management Softwareg Market Report |

| Base Year | 2024 |

| Segment by Type |

· Cash management · Liquidity management · Risk management · Investment management solutions |

| Segment by Application |

· Manufacturing · Healthcare · Retail |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units |

USD million in value |

| Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Treasury Management Software Market is set for significant growth, driven by advancements in fintech and increasing demand for efficient treasury solutions. As discussed, the market ecosystem is complex, with various stakeholders influencing its development.

The integration of emerging trends in fintech, such as artificial intelligence and blockchain, is expected to shape the future of treasury management. Regional trends, including the growth of fintech hubs in Singapore and the transformation of Germany’s banking sector, will also play a crucial role.

Global Treasury Management Software Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Treasury Management Software Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Treasury Management SoftwareMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Treasury Management Softwareplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Treasury Management Software Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Treasury Management Software Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Treasury Management Software Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofTreasury Management Software Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Treasury Management Software?

Treasury Management Software is a financial management tool used by organizations to manage their financial operations, including cash management, liquidity management, and risk management.

What are the key benefits of using Treasury Management Software?

The key benefits of using Treasury Management Software include:

- Improved financial visibility

- Enhanced cash management

- Reduced financial risk

- Increased operational efficiency

How is fintech influencing the development of Treasury Management Software?

Fintech advancements are driving innovation in Treasury Management Software, enabling the development of more sophisticated and user-friendly solutions that cater to the evolving needs of financial institutions.

What are the major challenges faced by the Treasury Management Software market?

The Treasury Management Software market faces challenges such as compliance with regulatory requirements, cybersecurity threats, and the need to adapt to changing market trends and customer needs.

Which regions are expected to drive growth in the Treasury Management Software market?

The Treasury Management Software market is expected to witness significant growth in regions such as North America, Europe, and Asia-Pacific, driven by the increasing adoption of digital financial management solutions.

What is the projected value of the Treasury Management Software market by 2025?

The Treasury Management Software market is projected to surpass $15.12 Billion by 2025, driven by the increasing demand for digital financial management solutions and advancements in fintech technology.