$852.1 Million Expanding Sulphur Market in the U.S., China, and Saudi Arabia by 2025

Explore the complex sulphur supply chain network, from extraction to end-use applications across industries. Learn about sulphur market dynamics, key players, environmental regulations, and future trends in this comprehensive guide to global sulphur markets, including insights from major producing regions like the U.S., China, and Saudi Arabia.

- Last Updated:

Sulphur Market Q1 and Q2 2025 Forecast

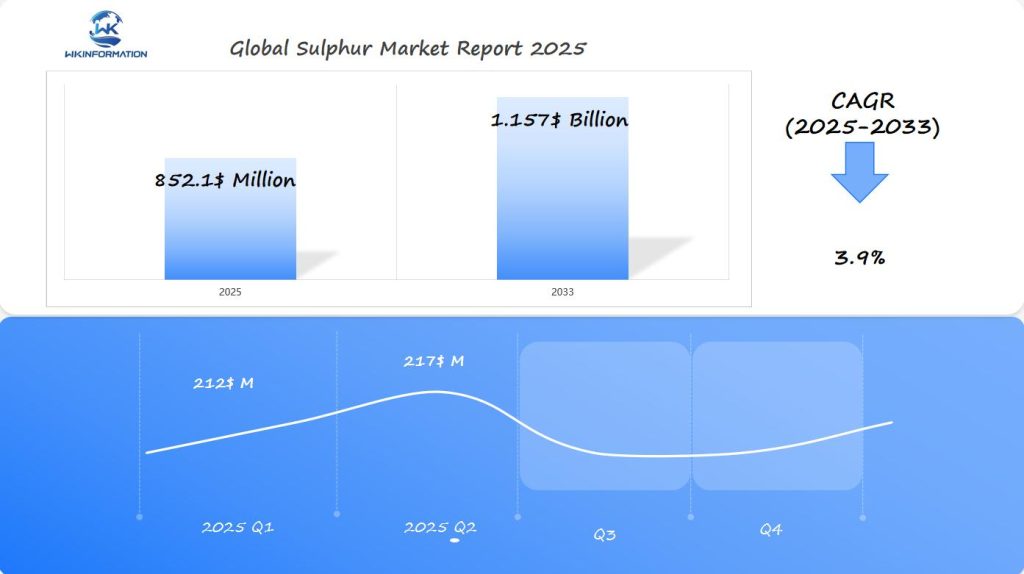

The Sulphur market, projected to reach $852.1 million in 2025, is expected to grow at a CAGR of 3.9% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $212 million, driven by the increasing demand for fertilizers and petrochemical applications in the U.S., China, and Saudi Arabia. Sulphur plays a key role in agricultural and industrial sectors, primarily as a soil amendment and raw material for various chemicals.

By Q2 2025, the market is forecasted to reach $217 million, supported by growth in the chemical industry and continued sulphur recovery processes in oil refineries. This demand will be particularly significant in Saudi Arabia, where the chemical industry is expanding rapidly.

The sulphur market is expected to maintain steady growth due to its critical role in agriculture and the energy sector, with increasing applications in industrial processes.

Exploring the Sulphur Supply Chain and Industry Impact

The sulphur supply chain is a complex network involving production facilities, transportation systems, and end-users across various industries. Here’s a breakdown of how it works:

1. Extraction Methods

The process starts with extracting sulphur using two main methods:

- The Claus Process: This method removes sulphur from natural gas and petroleum.

- The Frasch Process: This technique extracts native sulphur from underground deposits.

2. Transportation Networks

Once extracted, raw sulphur needs to be transported to different locations. Specialized transportation networks are used for this purpose, which include:

- Heated storage facilities

- Dedicated rail cars

- Marine vessels with temperature-controlled tanks

- Pipeline systems for liquid sulphur

3. Key Players in the Market

The global sulphur market is primarily dominated by a few industry giants who have significant control over production capacity and technological innovations. Some of these key market players include:

- China National Petroleum Corporation

- Saudi Aramco

- Gazprom

- Shell

- ExxonMobil

4. Impact on Various Industries

Sulphur plays a crucial role in multiple sectors, influencing their operations and growth:

- Agriculture: It is an essential component in phosphate fertilizers, which helps boost crop yields.

- Chemical Manufacturing: Sulphur is the primary ingredient used in producing sulphuric acid.

- Petroleum Refining: It plays a critical role in fuel processing and reducing emissions.

- Mining: Sulphur is utilized in mineral processing and metal extraction processes.

- Construction: Specialized concrete and asphalt formulations rely on sulphur as one of their components.

5. Importance of Supply Chain Efficiency

The efficiency of the sulphur supply chain has far-reaching implications:

- It directly impacts global food security by affecting agricultural productivity.

- Industrial production relies on a smooth flow of raw materials like sulphur for manufacturing processes.

- Environmental protection efforts are influenced by how effectively emissions are reduced through petroleum refining practices.

6. Price Fluctuations and Interconnected Industries

Price changes in sulphur markets can create ripple effects throughout these interconnected industries:

- Production costs may increase or decrease depending on the price of sulphur.

- End-product pricing can also be influenced as manufacturers pass on their cost changes to consumers.

Understanding this complex web of relationships helps us grasp the significance of the sulphur supply chain and its impact on various sectors.

Key Trends in the Sulphur Market: Demand for Fertilizers and Industrial Uses

The global sulphur market is experiencing significant growth driven by increasing demand for fertilizers. The agricultural sector requires large amounts of sulphuric acid-based fertilizers to improve crop yields and maintain soil health. Current market data shows a 15% increase in fertilizer-grade sulphur consumption in major agricultural regions.

Key market trends include:

1. Rising Phosphate Fertilizer Production

- Enhanced crop nutrition requirements

- Increased food production demands

- Expansion of agricultural land use

2. Growth in Industrial Applications

- Metal leaching processes

- Wastewater treatment systems

- Paper and pulp manufacturing

The chemical manufacturing sector shows strong demand for sulphur-based products. Industries use sulphur compounds in:

- Petroleum refining processes

- Battery production

- Rubber vulcanization

- Mining operations

Market analysts expect a steady 3.9% annual growth rate in industrial sulphur applications through 2025. This growth is driven by expanding manufacturing activities in emerging economies and technological advancements in chemical processing methods.

The textile industry is also becoming a significant consumer of sulphur-based chemicals, especially in fabric treatment processes. Recent innovations in sustainable manufacturing practices are creating additional demand for specialized sulphur compounds in eco-friendly industrial applications.

Challenges in Sulphur Production: Environmental Regulations and Emissions

Sulphur production faces significant hurdles due to strict environmental regulations across global markets. The Clean Air Act and similar international policies have established rigid guidelines for emissions control, requiring producers to invest heavily in advanced pollution control technologies.

Key regulatory challenges include:

- SO2 Emissions Limits: Production facilities must maintain sulphur dioxide emissions below specified thresholds

- Monitoring Requirements: Continuous emission monitoring systems (CEMS) installation and maintenance

- Reporting Obligations: Regular submission of environmental compliance reports to regulatory authorities

The implementation of emissions control measures creates substantial operational complexities:

- Installation of scrubber systems costs $5-10 million per facility

- Regular maintenance and upgrades of pollution control equipment

- Additional staffing requirements for environmental compliance management

- Reduced production capacity due to emissions restrictions

Recent government initiatives have introduced:

- Carbon pricing mechanisms affecting sulphur recovery units

- Mandatory use of best available technologies (BAT)

- Stricter workplace safety protocols for handling sulphur compounds

These regulations particularly impact smaller producers who struggle with compliance costs. Large-scale facilities adapt by integrating advanced recovery systems and automated monitoring solutions, though this raises production costs by 15-20%.

The push for cleaner production methods has sparked innovation in sulphur recovery technologies. Industry leaders now explore catalytic reduction processes and closed-loop systems to minimize environmental impact while maintaining production efficiency.

Geopolitical Factors Affecting Sulphur Trade and Pricing

The global sulphur market operates within a complex web of international relationships, trade agreements, and regional dynamics. Political tensions between major producing countries can trigger significant price fluctuations and disrupt established trade routes.

Key Trade Relationships:

- U.S.-China trade relations impact sulphur prices across the Pacific

- Middle Eastern exports depend heavily on diplomatic ties with Asian markets

- Russian sanctions affect European supply chains

Regional price variations reflect these geopolitical dynamics:

- North American prices: $120-150 per ton

- Asian markets: $180-220 per ton

- Middle Eastern exports: $140-170 per ton

Supply chain disruptions caused by political events create immediate market responses. The 2022 Russia-Ukraine conflict demonstrated this sensitivity, causing a 25% price spike in European markets.

Market Control Mechanisms:

- Strategic stockpiling by major importers

- Export quotas from dominant producers

- Bilateral trade agreements affecting preferential pricing

The pricing landscape responds to:

- Regional production capacity shifts

- Transportation route availability

- Import/export regulations

- Currency exchange fluctuations

China’s Belt and Road Initiative has created new trade corridors, influencing traditional pricing models and market access. Saudi Arabia’s position as a key producer allows strategic pricing control in Middle Eastern markets, while U.S. producers adjust their strategies based on domestic energy policies and international trade agreements.

Types of Sulphur: Elemental Sulphur, Sulphuric Acid, and By-Products

The sulphur market features three primary forms, each serving distinct industrial applications:

1. Elemental Sulphur

- Bright yellow crystalline solid

- Extracted through Claus and Frasch processes

- Used in vulcanization of rubber

- Key component in black gunpowder production

- Essential for manufacturing phosphate fertilizers

2. Sulphuric Acid

- Most widely used form in industrial applications

- Concentration levels range from 93% to 98%

- Primary uses:

- Phosphoric acid production

- Metal processing

- Chemical synthesis

- Industrial cleaning

- Battery manufacturing

3. By-Products

- Sulphur dioxide

- Generated during metal smelting

- Used in food preservation

- Paper bleaching agent

- Hydrogen sulphide

- Produced during oil refining

- Raw material for sulphuric acid production

- Sulphates

- Created through chemical processing

- Applied in detergent manufacturing

- Used in water treatment systems

The agricultural sector heavily relies on sulphur-based fertilizers to enhance crop yields. These products supply essential nutrients to soil, particularly beneficial for crops like canola, corn, and wheat. In petrochemical applications, sulphuric acid acts as a catalyst in alkylation processes, producing high-octane gasoline components.

Applications of Sulphur in Agriculture, Petrochemicals, and Manufacturing

Sulphur serves as a vital component across multiple industries, with significant applications in agriculture and petrochemical sectors.

Agricultural Applications:

- Sulphur-enriched fertilizers boost crop yields by up to 30%

- Essential for protein synthesis in plants

- Enhances nitrogen uptake efficiency

- Improves resistance to plant diseases

- Activates crucial enzymes for chlorophyll formation

Petrochemical Industry Uses:

- Catalyst in hydrodesulfurization processes

- Raw material for sulfuric acid production

- Key component in rubber vulcanization

- Essential in petroleum refining operations

The manufacturing sector harnesses sulphur’s unique properties through diverse applications:

1. Metallurgical Processing:

- Metal ore extraction

- Steel production enhancement

- Copper and zinc processing

2. Chemical Manufacturing:

- Production of phosphoric acid

- Creation of detergents and surfactants

- Manufacturing of pigments and dyes

Modern agricultural practices rely heavily on sulphur-based fertilizers to maintain soil health. Farmers apply these fertilizers to address sulphur deficiencies in crops like canola, corn, and wheat. The recommended application rates range from 10-40 kg/ha, depending on soil conditions and crop requirements.

The petrochemical industry utilizes sulphur as a crucial catalyst in various production processes. Refineries incorporate sulphur compounds to enhance fuel quality and remove impurities from petroleum products. This process helps meet strict environmental regulations while improving the final product quality.

Global Insights into the Sulphur Market

The global sulphur market has different characteristics in different regions, with the U.S., China, and Saudi Arabia playing important roles in shaping international trade. According to current market projections, there is expected to be significant growth in the industry, reaching $852.1 million by 2025.

Market Position Analysis

United States

- Strong domestic production infrastructure

- Advanced technological capabilities

- Established regulatory framework

- High-quality control standards

- Extensive distribution networks

China

- Largest consumer market globally

- Rapid industrial expansion

- Growing agricultural sector

- Strategic import partnerships

- Increasing domestic production capacity

Saudi Arabia

- Abundant natural resources

- Cost-effective production methods

- Strategic geographic location

- Strong export capabilities

- Integrated petrochemical facilities

Regional Strengths and Market Dynamics

The U.S. market benefits from its advanced technological infrastructure and robust agricultural sector. American producers maintain strict quality standards, positioning themselves as reliable suppliers in the international market. Their production methods align with stringent environmental regulations, setting industry benchmarks for sustainable practices.

China’s market dominance stems from its massive industrial base and expanding agricultural needs. The country’s strategic focus on domestic production capacity enhancement has reduced import dependencies. Chinese manufacturers have invested heavily in modernizing production facilities, improving efficiency and output quality.

Saudi Arabian producers leverage their natural resource advantages and strategic location. The kingdom’s integrated petrochemical complexes enable cost-effective production, while its geographic position facilitates efficient distribution to Asian and European markets.

Competitive Landscape Challenges

Each region faces distinct challenges:

Environmental Considerations

- U.S.: Strict emissions controls impact production costs

- China: Growing pressure to reduce industrial pollution

- Saudi Arabia: Water scarcity affects processing capabilities

Market Access

- U.S.: Trade tensions affect export opportunities

- China: Dependency on specific import sources

- Saudi Arabia: Regional political dynamics influence trade routes

Production Efficiency

- U.S.: High operational costs

- China: Technology gaps in certain processes

- Saudi Arabia: Resource-intensive production methods

The market demonstrates strong growth potential across these regions, driven by increasing industrial applications and agricultural demands. Each player brings unique advantages and challenges that will shape the future of the sulphur industry.

U.S. Sulphur Market: Demand for Fertilizers and Environmental Considerations

The U.S. sulphur market is experiencing strong growth due to the needs of agriculture and various industries. Farmers in the United States require large amounts of sulphur-based fertilizers to keep their soil fertile, especially in the Midwest region.

Key Factors Driving the Market:

- Increased use of precision farming methods

- Growing understanding of sulphur deficiency in crops

- Higher demand for high-yield crop varieties

The U.S. Environmental Protection Agency (EPA) has strict rules regarding sulphur emissions and production processes. These regulations have led to the development of cleaner production techniques and more efficient recovery systems in refineries.

Managing Environmental Impact:

- Use of advanced scrubbing technologies

- Creation of closed-loop recovery systems

- Installation of real-time monitoring equipment

The domestic market has an advantage when it comes to transportation infrastructure. There is a wide network of railways and pipelines that allows for smooth distribution from production sites to end-users. This infrastructure supports both local consumption and export capabilities, especially to nearby markets in Canada and Mexico.

Production Hubs:

- Refineries along the Gulf Coast

- Mining operations in Wyoming

- Processing facilities in North Dakota

The market shows particular strength in recovered sulphur production, with U.S. refineries operating at high efficiency levels. These facilities produce high-purity sulphur products that meet stringent quality standards for both agricultural and industrial applications.

China’s Sulphur Market: Growth in Industrial and Chemical Sectors

China’s sulphur market is experiencing significant growth, driven by rapid industrialization and a growing chemical manufacturing sector. As both a major producer and consumer of sulphur, China has a unique and dynamic market.

Key Market Drivers:

- Rising demand from phosphate fertilizer production

- Expansion of chemical manufacturing facilities

- Growth in metal processing industries

- Increased rubber vulcanization requirements

The country’s industrial sector uses large amounts of sulphuric acid for various purposes, such as making semiconductors and batteries. Chinese manufacturers have invested heavily in advanced processing facilities to increase their ability to turn raw sulphur into valuable products.

Trade Dynamics:

- Import partnerships with UAE, Canada, and South Korea

- Strategic stockpiling practices

- Price fluctuations based on regional demand

- Domestic production capacity expansion

China’s chemical sector shows particular strength in developing sulphur-based products for specific industries such as electronics, pharmaceuticals, textiles, and wastewater treatment.

The market has good potential for continued growth, supported by government initiatives that promote industrial development and technological advancement. Chinese companies are also investing in research and development to find more efficient ways to recover sulphur and discover new uses for it in various industrial processes.

Saudi Arabia’s Sulphur Market: Role in Oil and Gas Industry

Saudi Arabia’s position as a global sulphur powerhouse stems directly from its vast oil and gas operations. The country’s sulphur production capacity reaches 8 million metric tons annually, primarily extracted through the Claus process during petroleum refining.

Key Market Characteristics

- Integrated Production Systems: Saudi Aramco’s refineries incorporate advanced sulphur recovery units, achieving recovery rates of 99.9%

- Strategic Export Infrastructure: Dedicated sulphur handling facilities at ports like Jubail Industrial City support the country’s export capabilities

- Value Chain Integration: Direct pipeline connections between production facilities and storage terminals reduce transportation costs

Benefits of the Saudi Market

- Low Production Costs: Integration with existing oil and gas operations

- Geographic Advantage: Strategic location for exports to Asian markets

- Modern Technology: State-of-the-art sulphur recovery and handling systems

Saudi Arabia’s sulphur industry plays a crucial role in the country’s Vision 2030 economic diversification plan. The petrochemical sector’s expansion drives increased sulphur demand for industrial applications, while domestic fertilizer production consumes significant quantities for agricultural needs.

Recent investments in sulphur processing facilities demonstrate Saudi Arabia’s commitment to maintaining its market position. Projects like the Waad Al-Shamal phosphate mining complex highlight the growing domestic utilization of sulphur resources.

The Future of Sulphur: Sustainability and Green Technologies

The sulphur industry is at a point where technology can change things for the better. New and creative solutions are changing the way sulphur has been made for years. With advanced catalytic processes, we can now recover sulphur in a cleaner way, cutting down emissions by up to 40% compared to older methods.

Key Sustainable Technologies:

- Bio-based sulphur extraction using specialized bacteria

- Carbon capture integration in sulphur recovery units

- Smart monitoring systems for emissions control

- Waste heat recovery systems in production facilities

The concept of a circular economy is also making waves in the industry, turning sulphur waste into something valuable. Companies are adopting closed-loop systems, where they recycle sulphur-containing compounds from their industrial activities back into their production processes.

Green Technology Initiatives:

- Development of zero-waste sulphur recovery processes

- Implementation of renewable energy in production facilities

- Advanced filtration systems for reduced environmental impact

- Integration of AI-driven optimization tools

Research institutions are working on new ways to use sulphur in sustainable materials. This includes creating concrete with added sulphur that lasts longer and special polymers that can store energy.

The industry’s move towards being more eco-friendly isn’t just good for the planet; it also brings economic advantages:

- Lower costs of running operations

- Better use of resources

- Meeting regulations more effectively

- Opening doors to new markets in green technologies

New digital solutions are coming up that allow us to keep an eye on production processes in real-time. This helps us work more efficiently and reduce harm to the environment. With these technologies, we can precisely manage emissions and resource usage, setting higher standards for sustainable sulphur production.

Competitive Landscape in the Sulphur Market

The global sulphur market has several key players who are influencing the industry through strategic actions and their presence in the market. The main leaders in this industry are:

-

Saudi Aramco – Saudi Arabia

-

Gazprom – Russia

-

Abu Dhabi National Oil Company (ADNOC) – United Arab Emirates

-

Canadian Natural Resources – Canada

-

Shell – Netherlands / United Kingdom

-

Qatar Petrochemical Company (QAPCO) – Qatar

-

Kuwait Petroleum Corporation – Kuwait

-

NPC (National Petrochemical Company) – Iran

-

Suncor Energy – Canada

-

Tengizchevroil – Kazakhstan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Sulphur Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Sulphur Market is expected to reach $852.1 million by 2025, showing its importance in global industries and agriculture. Those involved in the industry have two main challenges: meeting the increasing demand and addressing environmental issues.

Here are some key findings:

- The shift toward sustainable production methods creates opportunities for technological innovation

- Digital transformation in supply chain management enhances operational efficiency

- Growing demand from emerging economies drives market expansion

- Integration of circular economy principles reshapes traditional business models

The future success of the industry depends on:

“Balancing economic growth with environmental stewardship through strategic investments in clean technologies and sustainable practices”

Technological advancements in sulfur recovery and processing present promising solutions to current challenges. Research gaps in sustainable extraction methods and eco-friendly applications signal areas for future development. The market’s evolution will be shaped by companies that successfully adapt to stricter environmental regulations while maintaining competitive advantages through innovation and strategic partnerships.

Global Sulphur Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Sulphur Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Sulphur Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalSulphur Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Sulphur Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Sulphur Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Sulphur Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Sulphur Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the sulphur supply chain and its significance in various industries?

The sulphur supply chain encompasses the entire process from production to end-use applications. It plays a crucial role in driving industry growth, particularly in sectors such as agriculture and petrochemicals, where sulphur is essential for fertilizers and chemical manufacturing.

How is sulphur used in fertilizers and what drives its demand?

Rising demand for sulphuric acid in fertilizers is primarily driven by the need to enhance crop yields. Sulphur serves as a vital nutrient component that improves soil fertility, thus increasing its application in agricultural practices globally.

What challenges does the sulphur industry face regarding environmental regulations?

The sulphur production industry faces stringent environmental regulations that impact production activities worldwide. Additionally, emissions control measures implemented by governments pose significant challenges, as they aim to mitigate pollution levels associated with sulphur production.

How do geopolitical factors influence the trade and pricing of sulphur?

Geopolitical relationships between countries significantly affect trade flows of sulphur products. Pricing dynamics are influenced by shifts in supply and demand patterns across different regions, which can lead to fluctuations in market prices.

What are the different types of sulphur available in the market?

The market offers various forms of sulphur including elemental sulphur, sulphuric acid, and several by-products generated during its production. Each type has specific uses and applications, particularly within industries like agriculture for fertilizers and petrochemicals for chemical processes.

What future trends are expected in the sulphur market regarding sustainability?

Future trends indicate a shift towards sustainable practices within the sulphur industry, driven by innovations aimed at reducing environmental impact. This includes the adoption of green technologies and circular economy principles among industry stakeholders to address sustainability challenges while capitalizing on emerging opportunities.