$741.2 Million Surging Demand for Sorghum Seed Market in the U.S., India, and Argentina by 2025

Explore the sorghum seed market’s growth to $741.2M by 2025, driven by technological innovations, sustainable practices, and rising demand across the U.S., India, and Argentina. Learn about supply chain dynamics, market trends, and key applications in agriculture, biofuels, and food industries.

- Last Updated:

Sorghum Seed Market Q1 and Q2 2025 Forecast

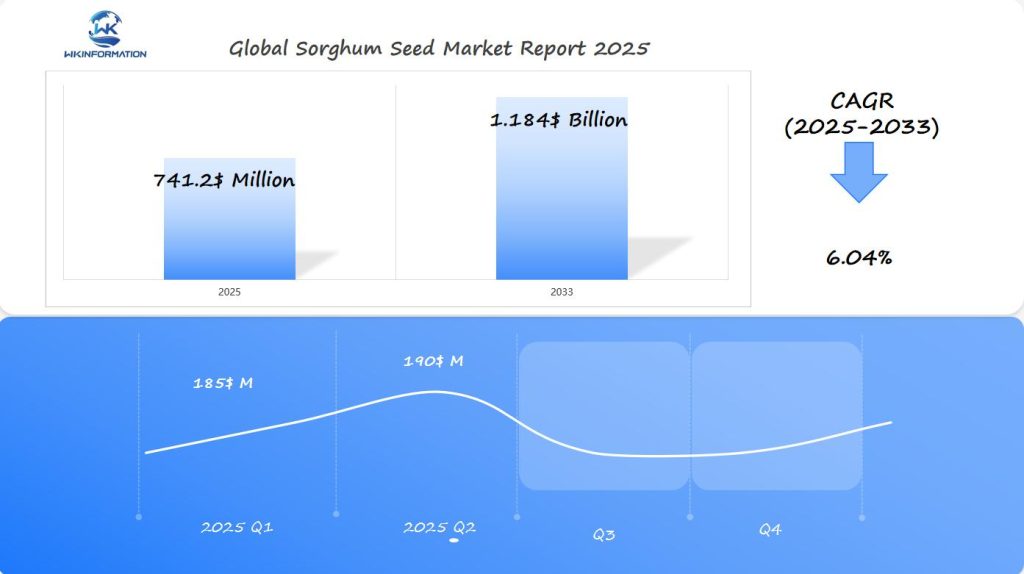

The Sorghum Seed market is projected to reach $741.2 million in 2025, with a CAGR of 6.04% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $185 million, driven by the increasing demand for drought-resistant crops and sustainable farming practices in the U.S., India, and Argentina. Sorghum’s versatility in biofuel production, animal feed, and food products continues to make it a popular choice for farmers in these regions.

By Q2 2025, the market is forecasted to grow to $190 million, supported by continued adoption in India and Argentina for both food and livestock production. The market benefits from sorghum’s resilience in challenging environmental conditions, driving further expansion in agriculture sectors globally.

Exploring the Sorghum Seed Supply Chain and Industry Growth

The sorghum seed supply chain involves a network of stakeholders who play important roles in getting seeds from development to harvest. Here’s a breakdown of the key players in this chain:

- Research Institutions: These organizations are responsible for developing new varieties of sorghum and improving existing strains through scientific research and innovation.

- Seed Companies: These businesses focus on mass-producing certified seeds and ensuring their availability to farmers through effective distribution channels.

- Agricultural Suppliers: They provide the necessary inputs such as fertilizers, pesticides, and equipment that farmers need to grow healthy sorghum crops.

- Farmers: The backbone of the supply chain, farmers are responsible for cultivating and harvesting the sorghum crops.

- Processors: Once harvested, the raw sorghum is processed into various products such as flour, syrup, or animal feed by specialized facilities.

- Distributors: These entities play a crucial role in moving the processed products through regional and international markets, ensuring they reach consumers.

Factors Driving Industry Growth

The growth of the sorghum seed industry is projected to reach an impressive market value of $741.2 million by 2025. Several key factors are driving this growth:

- Increasing demand for climate-resilient crops in areas prone to drought

- Expanding applications of sorghum in biofuel production

- Growing adoption of sorghum in the food processing industry

- Rising use of sorghum in animal feed formulations

Technological Advancements Improving Supply Chain Efficiency

The efficiency of the supply chain has been enhanced through various technological advancements, including:

- Implementation of digital tracking systems for seed quality control

- Automation in processing facilities to streamline operations

- Adoption of smart logistics solutions for efficient distribution

- Integration of blockchain technology for transparency in the supply chain

These improvements have bolstered the industry’s ability to meet increasing global demand while ensuring product quality and traceability.

Opportunities Created by Sustainable Practices

The integration of sustainable practices throughout the supply chain has opened up new opportunities for stakeholders involved in sorghum production and distribution. This is particularly significant in emerging markets where there is a growing recognition of the importance of sustainable agriculture.

By embracing environmentally friendly practices such as organic farming methods or water conservation techniques, stakeholders can tap into niche markets that prioritize sustainability. This not only benefits the environment but also enhances their competitive advantage in an increasingly conscious consumer landscape.

Key Trends in the Sorghum Seed Market: Climate Adaptability and Crop Diversification

Climate adaptability is currently one of the most important trends in the sorghum seed market. Sorghum’s natural ability to withstand harsh weather conditions makes it an ideal crop choice in areas facing uncertain climate conditions. With its deep root system and efficient use of water, sorghum can thrive in temperatures ranging from 85°F to 100°F, making it well-suited for regions prone to drought and heat stress.

Hybrid Sorghum Innovations

Recent advancements in hybrid sorghum breeding have resulted in several innovations that address the challenges posed by climate change:

- Drought-resistant varieties capable of producing yields with 30% less water

- Enhanced disease resistance against common pathogens like anthracnose

- High-yielding hybrids producing up to 40% more grain per acre

- Improved nutritional profiles with increased protein content

Sorghum Integration for Sustainable Agriculture

Crop diversification through the integration of sorghum into existing farming systems offers multiple benefits for agricultural sustainability. Farmers who have adopted sorghum rotation systems report:

- 25% reduction in soil erosion

- Improved nitrogen fixation

- Decreased dependency on chemical fertilizers

- Natural pest suppression

These advantages not only contribute to the long-term health of the ecosystem but also enhance the resilience of farming communities in the face of climate change.

Meeting Market Demands with Specialized Varieties

The development of specialized sorghum varieties is another key trend driven by specific market demands:

- BMR (Brown Mid-Rib) varieties for superior digestibility in livestock feed

- Sweet sorghum hybrids optimized for biofuel production

- Grain sorghum types with enhanced food-grade qualities

By tailoring sorghum varieties to meet these requirements, researchers and seed companies are opening up new avenues for economic opportunities within agricultural value chains.

Towards Climate-Smart Agriculture: Ongoing Research and Development

Research institutions and seed companies are actively working towards developing climate-smart sorghum varieties that can withstand the impacts of climate change. These innovations focus on traits such as heat tolerance, pest resistance, and improved grain quality—attributes that will be crucial in ensuring food security while minimizing environmental footprints.

Through collaborative efforts between scientists, farmers, and industry stakeholders, there is potential for further scaling up sustainable practices associated with sorghum cultivation. This aligns with global goals aimed at mitigating greenhouse gas emissions from agriculture while promoting biodiversity conservation.

Challenges in Sorghum Seed Production: Pest Control and Water Efficiency

Sorghum seed production faces significant challenges from persistent pest infestations and water management issues. The crop attracts several destructive pests that can devastate entire harvests:

Primary Pest Threats:

- Sorghum midge – tiny flies that damage developing seeds

- Fall armyworm – leaf-eating caterpillars that attack young plants

- Bird damage – particularly during the grain-filling stage

- Aphids – vectors for viral diseases affecting plant health

Effective pest management requires an integrated approach combining biological controls, resistant varieties, and targeted pesticide applications. Many farmers implement crop rotation strategies and adjust planting dates to disrupt pest life cycles.

Water Management Solutions:

- Deficit irrigation techniques

- Soil moisture monitoring systems

- Drought-resistant variety selection

- Strategic planting schedules

Sorghum’s natural drought tolerance makes it suitable for water-scarce regions, yet optimal yields still depend on efficient water management. Advanced irrigation systems help farmers maintain crucial moisture levels during critical growth stages. In regions facing severe water constraints, producers adopt precision agriculture techniques to maximize water use efficiency.

The implementation of smart farming technologies, including soil moisture sensors and weather monitoring systems, enables farmers to make data-driven decisions about irrigation timing and volume. These technologies help reduce water waste while maintaining crop productivity.

Geopolitical Factors Affecting Sorghum Seed Demand and Export Markets

Trade policies shape the global sorghum seed market dynamics, creating ripple effects across major exporting nations. The U.S. dominates the export landscape, controlling approximately 75% of global sorghum trade. Recent shifts in U.S.-China trade relations have significantly impacted market patterns:

1. U.S. Market Position

- Implementation of tariffs affects export volumes

- Strategic partnerships with emerging markets

- Price competitiveness in global trade

2. India’s Trade Dynamics

- Domestic consumption prioritization

- Export restrictions during food security concerns

- Regional trade agreements with Asian partners

3. Argentina’s Market Strategy

- Competitive pricing in Latin American markets

- Currency fluctuations impact export earnings

- Agricultural export taxes influence trade decisions

Trade barriers, including phytosanitary requirements and import quotas, create market access challenges for exporters. Changes in bilateral agreements between major trading partners directly affect market prices and supply chain decisions.

The shifting geopolitical landscape has prompted diversification strategies among importing nations. Countries traditionally dependent on specific suppliers now seek multiple sourcing options to ensure supply stability. This market adaptation has created new opportunities for emerging sorghum-producing regions to establish their presence in international trade.

Types of Sorghum Seeds: Grain Sorghum, Forage Sorghum, and Sweet Sorghum

Sorghum seeds come in three distinct varieties, each serving unique agricultural purposes:

1. Grain Sorghum

Grain sorghum is primarily used in human food production. It is rich in protein, minerals, and antioxidants, making it an ideal choice for gluten-free products. This variety of sorghum is commonly found in breakfast cereals and flour alternatives.

2. Forage Sorghum

Forage sorghum is specifically bred for animal feed. It has higher biomass production and exhibits rapid growth with the potential for multiple harvests. This variety also boasts superior drought resistance and excellent silage quality for livestock.

3. Sweet Sorghum

Sweet sorghum is distinguished by its high sugar content in the stalks. It is primarily used in syrup production and serves as a valuable feedstock for biofuel. Additionally, sweet sorghum can be cultivated as a dual-purpose crop, allowing for both sugar extraction and grain harvest.

The selection of sorghum type depends on your specific agricultural goals. Grain sorghum thrives in dryland farming conditions, making it a reliable food security crop. Forage sorghum’s quick regrowth capabilities provide a consistent feed supply for livestock operations. Sweet sorghum’s versatility creates additional revenue streams through both food and energy markets.

These varieties demonstrate different growth patterns and management requirements. Grain sorghum typically reaches heights of 2-4 feet, while forage and sweet sorghum can grow up to 12 feet tall. Your choice of sorghum type will impact factors such as planting density, harvest timing, and equipment needs.

Applications of Sorghum Seeds in Agriculture, Biofuels, and Food Industries

Sorghum seeds drive innovation across multiple industries, with each sector unlocking unique potential from this versatile crop. In agriculture, farmers utilize sorghum as a rotational crop to enhance soil health and maintain sustainable farming practices.

Agriculture

Farmers use sorghum as a rotational crop to improve soil health and promote sustainable farming methods.

Biofuels

The biofuel industry leverages sorghum’s high sugar content to produce ethanol, providing a renewable energy alternative. Sweet sorghum varieties can yield up to 500 gallons of ethanol per acre, making it an economical choice for biofuel production. Several ethanol plants in the U.S. have started using sorghum in their processing operations.

Food Industry

The food industry embraces sorghum in various forms:

- Gluten-free products: Sorghum flour serves as a primary ingredient in breads, cereals, and snacks

- Health foods: Rich in antioxidants and minerals, sorghum appears in nutrition bars and supplements

- Traditional cuisine: Popular in African and Asian dishes, from porridge to alcoholic beverages

- Pet food: Natural ingredient in premium pet food formulations

Industrial Applications

Sorghum seeds find applications in various industries:

- Biodegradable packaging materials

- Natural dyes and colorants

- Adhesives manufacturing

- Construction materials

Research and Development

Research institutions continue to discover new applications for sorghum seeds, with recent developments in pharmaceutical compounds and sustainable textile production. The U.S. Department of Energy recognizes sorghum as a key biomass crop for future energy security.

Global Insights into the Sorghum Seed Market

The global sorghum seed market has different trends and growth patterns in different regions. North America has the largest market share, with the United States leading in production and technological advancements. The success of this region can be attributed to:

- Advanced agricultural infrastructure

- High adoption of hybrid varieties

- Strong research and development capabilities

- Established export channels

On the other hand, Asia-Pacific is the fastest-growing region due to factors such as:

- Rapid agricultural modernization

- Population growth

- Increasing meat consumption

- Rising demand for animal feed

In Europe, the market is steadily growing with a focus on:

- Sustainable farming practices

- Organic sorghum production

- Biofuel applications

- Premium food products

Regional Differences in Market Dynamics

The dynamics of the market vary significantly across regions:

North America

- Premium pricing for high-quality seeds

- Dominant hybrid seed segment

- Strong institutional support

Asia-Pacific

- Price-sensitive market

- Growing adoption of improved varieties

- Government-backed agricultural initiatives

Africa

- Traditional farming practices

- Rising commercial farming

- Emphasis on drought-resistant varieties

Regional Market Shares

These regional differences also reflect in the market shares. North America holds 35% of the global market, Asia-Pacific has 28%, and other regions make up the remaining 37%. These patterns influence investment strategies, research priorities, and market development in the global sorghum seed industry.

U.S. Sorghum Seed Market: Technological Advancements and Crop Yield

The U.S. leads global sorghum production through cutting-edge agricultural technologies and research innovations. American farmers have embraced precision agriculture tools to optimize sorghum cultivation:

- Smart Irrigation Systems: GPS-guided equipment delivers precise water amounts based on real-time soil moisture data

- Drone Technology: Aerial monitoring identifies crop stress, disease outbreaks, and nutrient deficiencies

- AI-Powered Analytics: Predictive modeling helps farmers make data-driven decisions about planting and harvesting

Research institutions across Kansas, Texas, and Oklahoma have developed high-performing sorghum varieties yielding 15-20% more than traditional seeds. These enhanced varieties demonstrate:

- Improved drought tolerance

- Better disease resistance

- Enhanced nutrient absorption

- Increased biomass production

U.S. farmers achieve average yields of 4,500-5,000 pounds per acre through these technological implementations. Key growing regions include:

- Kansas (Leading producer – 2.5 million acres)

- Texas (Second largest – 1.8 million acres)

- Colorado (Emerging region – 0.4 million acres)

The USDA’s Agricultural Research Service continues investing in genetic research to develop sorghum varieties with improved stress tolerance and nutritional profiles. These advancements position U.S. sorghum producers at the forefront of global agricultural innovation.

India’s Sorghum Seed Market: Growth in Agricultural Sector

India’s sorghum seed market has great potential for growth, thanks to the country’s efforts to modernize agriculture and the increasing demand for crops that can withstand drought.

Key growth factors in India’s sorghum seed market:

- Rising adoption of hybrid varieties engineered for local climate conditions

- Government-backed agricultural initiatives supporting sustainable farming practices

- Integration of digital farming technologies in sorghum cultivation

- Increased private sector investment in seed research and development

The transformation of the agricultural sector has led to innovation in the production of sorghum seeds. Research institutions are developing varieties that are specifically suited to India’s different agro-climatic regions. These new varieties offer:

- Enhanced resistance to local pests

- Improved nutritional content

- Higher yield potential

- Better adaptation to monsoon patterns

Small-scale farmers in states such as Maharashtra, Karnataka, and Andhra Pradesh are transitioning to these improved sorghum varieties. They recognize the crop’s potential as a dependable source of food and income. Additionally, the establishment of seed production clusters has strengthened the local supply chain, ensuring consistent seed quality and availability for farmers.

Private-public partnerships are crucial for advancing India’s sorghum seed sector. Organizations like the Indian Council of Agricultural Research (ICAR) are working together with seed companies to develop varieties that are specific to different regions.

Argentina’s Sorghum Seed Market: Export and Trade Dynamics

Argentina’s position in the global sorghum seed market showcases remarkable strength through its strategic export capabilities and advanced agricultural infrastructure. The country’s sorghum seed production benefits from:

- Favorable Climate Conditions: Argentina’s diverse agricultural zones provide ideal growing conditions for sorghum cultivation

- Advanced Farming Technologies: Implementation of precision agriculture and modern irrigation systems

- Strong Export Infrastructure: Well-developed port facilities and transportation networks

The country’s trade dynamics reveal significant export relationships with key markets:

- China: Primary destination for Argentine sorghum exports

- European Union: Growing demand for non-GMO sorghum varieties

- Southeast Asian Markets: Emerging opportunities in livestock feed sector

Argentina’s competitive advantage stems from its cost-effective production methods and quality control measures. Local farmers maintain high production standards through:

- Rigorous seed certification programs

- Implementation of sustainable farming practices

- Investment in storage and handling facilities

Recent trade agreements have expanded market access for Argentine sorghum seeds, with bilateral partnerships strengthening the country’s position as a reliable supplier. The domestic market demonstrates steady growth, driven by increasing demand from local livestock producers and biofuel manufacturers.

Price competitiveness remains a key factor in Argentina’s export success, with producers leveraging economies of scale and efficient supply chain management to maintain market share in international markets.

The Future of Sorghum Seeds: Biotechnology and Sustainability

Biotechnology innovations are reshaping sorghum seed development through advanced genetic engineering techniques. Scientists now utilize CRISPR gene editing to enhance:

- Drought tolerance mechanisms

- Disease resistance capabilities

- Nutrient content optimization

- Biomass production efficiency

Research laboratories are developing smart sorghum varieties with built-in pest resistance, reducing the need for chemical pesticides. These genetically optimized seeds demonstrate up to 40% higher yield potential compared to traditional varieties.

Sustainable practices in sorghum cultivation integrate cutting-edge technology with environmental stewardship:

- Precision Agriculture IntegrationGPS-guided planting systems

- Smart irrigation technologies

- Soil health monitoring sensors

- Resource Conservation MethodsWater-efficient irrigation systems

- Organic pest management solutions

- Crop rotation strategies

Biotechnology companies are investing in carbon-neutral production methods to align with global sustainability goals. The implementation of AI-driven breeding programs accelerates the development of climate-resilient sorghum varieties, reducing the traditional breeding cycle from 12 years to 5 years.

Research initiatives focus on developing sorghum varieties with enhanced carbon sequestration capabilities, positioning sorghum as a key player in agricultural carbon credits markets. These advancements create new revenue streams for farmers while contributing to climate change mitigation efforts.

Competitive Landscape in the Sorghum Seed Market

The sorghum seed market has several key players who are influencing the industry through strategic actions and technological advancements.

-

Corteva Agriscience – United States

-

KWS SAAT SE & Co. KGaA – Germany

-

Bayer CropScience – Germany

-

Advanta Seeds – UPL Limited – India

-

RAGT Group – France

-

Land O’Lakes Inc. – United States

-

LongPing High-Tech – China

-

GW Sorghum Seed Co. Inc. – United States

-

Pioneer Hi-Bred International Inc. – United States

-

Allied Seed LLC – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Sorghum Seed Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The sorghum seed market is expected to grow to $741.2 million by 2025, showing its increasing importance in global agriculture. This growth is driven by several key factors:

- Rising demand for sustainable, climate-resilient crops

- Expanding applications in biofuels and food industries

- Technological advancements in seed development

- Growing focus on food security

This growth presents significant opportunities in different regions:

North America

- Advanced agricultural practices

- Strong research and development infrastructure

- Leading position in seed technology

Asia-Pacific

- Rapid agricultural modernization

- Increasing adoption of hybrid varieties

- Growing livestock sector demands

Latin America

- Export market expansion

- Favorable climate conditions

- Agricultural technology integration

The combination of innovative breeding techniques, sustainable farming practices, and increasing global demand positions sorghum as a crucial crop for future food security. Industry leaders’ continued investment in research and development, coupled with supportive government policies, creates a strong foundation for sustained market growth through 2025 and beyond.

The success of the market depends on finding a balance between improving productivity and maintaining environmental sustainability, making sorghum an essential part of global agricultural systems.

Global Sorghum Seed Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Sorghum Seed Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Sorghum Seed Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalSorghum Seed Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Sorghum Seed Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Sorghum Seed Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Sorghum Seed Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Sorghum Seed Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market value of the sorghum seed industry by 2025?

The sorghum seed market is expected to reach a value of $741.2 million in the U.S., India, and Argentina by 2025.

Who are the key players in the sorghum seed supply chain?

Key players in the sorghum seed supply chain include research institutions, seed companies, agricultural suppliers, farmers, processors, and distributors.

What factors are driving growth in the sorghum seed market?

Growth in the sorghum seed market is driven by demand for climate-resilient crops, increased biofuel use, adoption of food processing technologies, and formulation of animal feed.

What technological advancements are impacting sorghum seed production?

Technological advancements such as digital tracking systems for seed quality control, automation in processing facilities, smart logistics solutions, and blockchain integration for supply chain transparency are significantly impacting sorghum seed production.

What challenges does the sorghum seed industry face?

Challenges in sorghum seed production include pest control issues (such as sorghum midge and fall armyworm), water efficiency concerns (including deficit irrigation techniques), and damage from birds during the grain-filling stage.

How does sorghum contribute to sustainable agriculture?

Sorghum contributes to sustainable agriculture through practices like organic farming methods and water conservation techniques. It also plays a role in soil health improvement as a rotational crop and aids in biofuel production due to its high sugar content.