Softwood Lumber Market Set to Reach $712.8 Billion by 2025: Key Insights from the U.S., Canada, and Russia

Comprehensive analysis of the global softwood lumber market dynamics, examining market growth projections of $712.8 billion by 2025, with insights into key production regions including the U.S., Canada, and Russia. Explores upstream and downstream forces, market trends, challenges, and opportunities while highlighting sustainable practices and technological innovations shaping the industry’s future.

- Last Updated:

Softwood Lumber Market Forecast for Q1 and Q2 2025

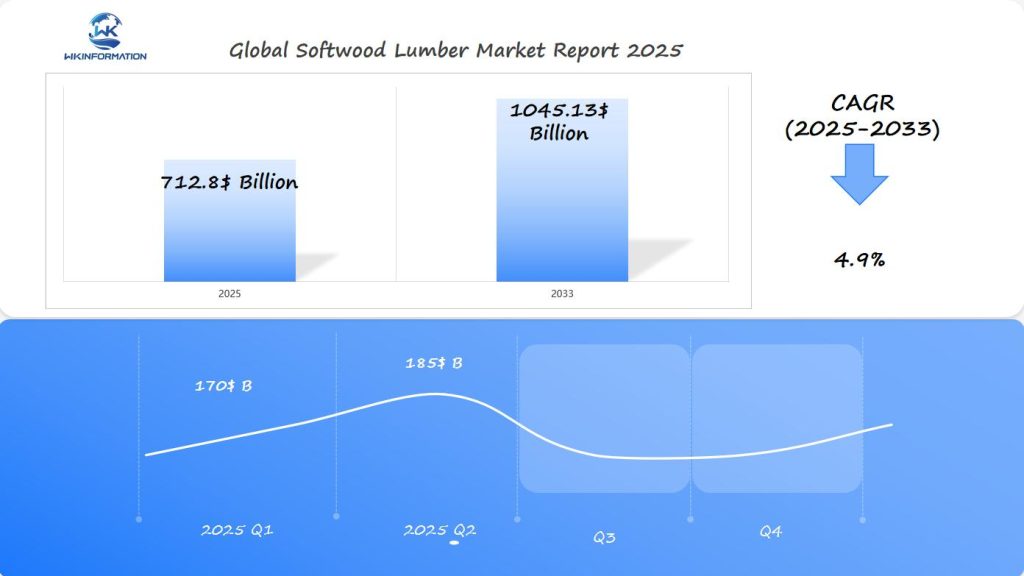

The global softwood lumber market is projected to reach $712.8 billion in 2025, with a CAGR of 4.9% expected through 2033. The market in the first half of 2025 will likely show a steady growth trend, with Q1 forecasted to generate approximately $170 billion, while Q2 is expected to see a rise to $185 billion as construction and manufacturing activities increase during the warmer months.

The U.S., Canada, and Russia are identified as key regions for softwood lumber. The U.S. leads in consumption, driven by the ongoing demand in the housing and construction sectors, while Canada remains a major exporter, particularly to North America and Asia. Russia, with its vast forest resources, is expected to contribute significantly to global supply, especially in Europe and emerging markets. These regions are vital for a more detailed analysis, reflecting their diverse roles in both production and consumption dynamics.

How Upstream and Downstream Forces Are Shaping the Softwood Lumber Market

The softwood lumber market operates through a complex interplay of upstream and downstream forces that significantly impact its $712.8 billion projected value by 2025. Understanding these forces helps stakeholders navigate market dynamics effectively.

Upstream Forces: Supply-Side Dynamics

The upstream segment includes various activities involved in the production of softwood lumber. These activities play a crucial role in determining the supply of lumber available in the market.

- Raw material sourcing from forests

- Logging operations and transportation

- Primary processing at sawmills

- Secondary manufacturing facilities

However, the upstream segment is facing significant challenges in 2024. Log shortages have become widespread across North America, with several regions reporting 15-20% decreases in available timber. Additionally, mill closures, particularly in British Columbia, have resulted in a reduction of approximately 2 billion board feet annually in production capacity.

Downstream Forces: Demand-Side Elements

The downstream segment consists of various entities involved in the consumption of softwood lumber. These entities directly influence the demand for lumber in the market.

- Construction companies

- Wholesale distributors

- Retail outlets

- End consumers

One key indicator of downstream demand is housing starts, which refer to the number of new residential construction projects initiated during a specific period. This figure holds significant importance as residential construction accounts for roughly 65% of softwood lumber consumption.

Supply Chain Disruptions

Recent market data has revealed several critical areas within the supply chain that are experiencing pressure:

Transportation Bottlenecks

- Rail capacity limitations

- Trucking shortages

- Port congestion issues

Production Constraints

- Labor shortages at mills

- Equipment maintenance delays

- Weather-related disruptions

These supply chain challenges have a cascading effect throughout the market. When mills are unable to sustain consistent production levels due to these issues, prices typically surge by 25-30% above normal ranges. Consequently, the construction industry bears the brunt of these cost increases, resulting in project delays and budget overruns.

Current stability in the softwood lumber market heavily relies on finding a balance between these upstream and downstream forces. As housing demand fluctuates and production challenges persist, industry participants must adapt their strategies to maintain competitive positions in this ever-changing market landscape.

Key Trends Driving the Growth of the Softwood Lumber Industry

Recent data reveals significant shifts in U.S. housing starts, directly impacting softwood lumber demand patterns.

Housing Market Dynamics

- Single-family home construction increased by 18% in 2023

- Multi-family projects decreased by 11.3%

- Custom home building sector maintained steady growth at 7.2%

The residential construction sector remains the primary driver of softwood lumber consumption, accounting for 65% of total demand. This dominance stems from lumber’s essential role in:

- Structural framing

- Interior finishing

- Exterior siding

- Decking and outdoor projects

Commercial Construction Impact

Commercial construction presents a different demand pattern, with specific requirements affecting lumber consumption:

- Mid-rise buildings utilizing mass timber technology

- Retail space renovations

- Industrial warehouse construction

- Office building retrofits

The sector’s lumber usage varies significantly by project type:

- Large-scale commercial: 35-40% of project materials

- Light commercial: 20-25% of materials

- Industrial: 15-20% of materials

Regional Variations

Market data indicates distinct regional patterns in lumber consumption:

- Southeast: 28% increase in residential construction

- West Coast: 15% growth in commercial projects

- Northeast: 12% rise in renovation activities

- Midwest: 22% expansion in industrial construction

These consumption patterns reflect broader economic trends, with construction activity serving as a reliable barometer for lumber demand. The varying requirements across different construction sectors create distinct market segments, each responding to specific economic and demographic factors.

Barriers to Growth in the Softwood Lumber Market: What You Need to Know

The softwood lumber market faces significant challenges that impact its growth trajectory.

Tariff Barriers

Canadian producers grapple with substantial tariff barriers, currently ranging from 8.99% to 20.23% on exports to the U.S. These tariffs have resulted in:

- Reduced market accessibility for Canadian suppliers

- Increased costs passed down to U.S. consumers

- Shifted market share to alternative suppliers from Europe and Russia

The tariff situation has created a ripple effect across the North American market, with Canadian producers experiencing a 15% decline in their U.S. market share since 2016.

Pricing Volatility

Pricing volatility presents another critical barrier to market growth. Recent data shows lumber prices fluctuating between $300 and $1,000 per thousand board feet in 2023. These dramatic price swings stem from:

- Currency exchange rate fluctuations

- Transportation cost variations

- Supply chain disruptions

- Weather-related production delays

The unstable pricing environment has triggered significant changes in consumer behavior:

Domestic Markets:

- Delayed construction projects

- Increased use of alternative materials

- Stockpiling during price dips

- Shorter-term purchasing contracts

International Markets:

- Shift toward local suppliers

- Rise in substitute product adoption

- Modified inventory management strategies

Geopolitical Events

Geopolitical events have intensified these market challenges. The Russia-Ukraine conflict has disrupted traditional trade routes, while tensions in the Middle East have affected shipping costs and availability. These factors have led to a 23% increase in transportation costs for softwood lumber in 2023.

Industry Consolidation

The combination of tariff barriers and price instability has pushed many smaller producers out of the market, leading to industry consolidation. Large producers now control approximately 65% of North American production capacity, creating additional market access challenges for new entrants.

Geopolitical Factors Impacting Softwood Lumber Production and Supply

Global geopolitical events have created significant ripples across the softwood lumber industry, reshaping traditional supply chains and market dynamics. The Ukraine war has disrupted European timber markets, leading to:

- Reduced timber harvesting in conflict zones

- Disrupted transportation routes

- Shifted trade patterns among major exporters

Russia’s role as a key softwood lumber supplier has faced challenges due to international sanctions, creating supply gaps in several markets. These disruptions have pushed European buyers to seek alternative sources, particularly from Nordic countries and North America.

The Middle Eastern conflicts have affected shipping routes through the Red Sea, increasing transportation costs and delivery times for lumber shipments. This situation has created:

- Higher freight rates

- Extended delivery schedules

- Supply chain uncertainties

Impact on Economic Recovery

North American markets have experienced mixed effects from these global disruptions:

- U.S. domestic production has increased to fill supply gaps

- Canadian producers have found new export opportunities

- Price volatility has affected construction projects

European markets face distinct challenges:

- Reduced availability of Eastern European timber

- Increased reliance on Scandinavian suppliers

- Rising energy costs affecting production

The construction sector’s recovery in both regions shows varying patterns:

- North America: Residential construction adapts to material availability

- Europe: Infrastructure projects face delays due to supply constraints

- Both regions: Increased focus on domestic production capacity

These geopolitical tensions have accelerated changes in regional lumber trade patterns. Baltic states have emerged as alternative suppliers, while Asian markets have diversified their sourcing strategies to maintain stable supply chains.

The shift in global trade routes has prompted investments in new production facilities and transportation infrastructure, particularly in regions less affected by current conflicts. These adaptations reflect the industry’s response to ongoing geopolitical challenges and its efforts to maintain supply stability.

Breaking Down Softwood Lumber Market Segmentation

The softwood lumber market divides into distinct segments based on product types and end-user applications, each serving specific industry needs.

Product Types:

- Pine Sawtimber: The most widely used variety, known for its versatility and cost-effectiveness

- Spruce-Pine-Fir (SPF): Popular in North American construction, valued for strength-to-weight ratio

- Douglas Fir: Premium choice for heavy construction and structural applications

- Cedar: Preferred for outdoor applications due to natural resistance to decay

- Hemlock: Common in general construction and industrial applications

End-User Industries:

- Construction SectorResidential building (framing, roofing, flooring)

- Commercial construction

- Industrial facilities

- Infrastructure projects

- ManufacturingFurniture production

- Cabinet making

- Packaging materials

- Wooden pallets

- DIY and Home ImprovementDecking

- Fencing

- Interior finishing

- Renovation projects

The construction sector claims the largest market share, consuming approximately 70% of softwood lumber production. Manufacturing industries utilize about 20% of the supply, with DIY and home improvement accounting for the remaining 10%.

Market dynamics vary by segment, with residential construction driving demand for SPF and pine sawtimber, while specialty applications like outdoor furniture boost cedar consumption. Price sensitivity differs across segments – construction buyers focus on bulk pricing, while furniture manufacturers prioritize quality and specific grade requirements.

Recent market data shows growing demand in the DIY segment, attributed to increased home improvement activities. The manufacturing sector demonstrates steady growth, particularly in sustainable furniture production using certified softwood materials.

Applications and How They’re Influencing the Softwood Lumber Market Demand

Softwood lumber is in high demand across various industries due to its versatility. The construction sector is the largest consumer, with Cross-Laminated Timber (CLT) panels emerging as a groundbreaking innovation. These engineered wood products offer several advantages:

- Superior structural strength

- Enhanced fire resistance

- Improved thermal insulation

- Reduced carbon footprint

Residential Construction Applications

The residential construction industry extensively uses softwood lumber in various applications, including:

- Floor joists and roof trusses

- Wall framing and structural support

- Decorative elements and trim work

- Outdoor decking and fencing

Expanded Manufacturing Applications

Manufacturing uses for softwood lumber have gone beyond traditional furniture making. Some modern applications include:

Industrial Uses

- Packaging materials

- Shipping containers

- Railroad ties

- Utility poles

Specialty Products

- Musical instruments

- Craft supplies

- Custom millwork

- Architectural details

Sustainable Practices Shaping Market Demands

Current market demands are being shaped by sustainable practices. The increasing popularity of green building certifications has created new requirements for softwood products:

Key Certifications

- Forest Stewardship Council (FSC)

- Programme for the Endorsement of Forest Certification (PEFC)

- Sustainable Forestry Initiative (SFI)

These certifications have an impact on purchasing decisions in both commercial and residential sectors. Builders are increasingly specifying certified softwood products to meet LEED requirements and other environmental standards. This shift towards sustainability has led to innovation in engineered wood products, creating new market opportunities while reducing environmental impact.

New Opportunities in Construction with Mass Timber Techniques

The growing adoption of mass timber construction techniques has opened up new applications for softwood lumber in mid-rise and high-rise buildings. These projects showcase the potential of softwood to replace traditional construction materials while offering superior environmental benefits.

Regional Market Insights: Softwood Lumber Market Developments Worldwide

The global softwood lumber market showcases distinct regional patterns shaped by local economic conditions, trade policies, and resource availability. Each major region contributes uniquely to the market’s dynamics:

North American Market

- U.S. production capacity remains concentrated in the Pacific Northwest and Southern regions

- Canadian mills face operational adjustments due to beetle-killed timber and reduced harvesting quotas

- Cross-border trade tensions continue to influence regional pricing structures

European Landscape

- Nordic countries lead production with advanced processing technologies

- German producers adapt to bark beetle outbreaks affecting timber quality

- UK market shows increased demand for sustainably sourced materials

Asia-Pacific Dynamics

- Chinese imports surge as domestic construction sector expands

- Japanese market maintains steady demand for high-grade softwood

- South Korean buyers diversify supply sources beyond traditional partners

Russian Territory

- Siberian producers increase export capacity through infrastructure improvements

- Far East operations target Asian markets with competitive pricing

- New processing facilities enhance value-added product capabilities

Supply chain disruptions have created regional shifts in traditional trade patterns. U.S. buyers now source more material from European suppliers, while Asian markets increase their reliance on Russian exports. These changes reflect a broader transformation in global market relationships, with price competitiveness and reliability becoming key factors in sourcing decisions.

Recent developments point to emerging regional hubs:

- Baltic states expanding processing capabilities

- Brazilian producers entering traditional North American markets

- New Zealand strengthening its position in Asian supply chains

The U.S. Softwood Lumber Market: Key Trends and Opportunities

The U.S. softwood lumber market is influenced by both domestic construction activities and economic factors. According to housing starts data, with single-family construction showing strength despite challenges in the market.

Key Market Indicators:

- Single-family home construction maintains steady growth

- Multifamily sector experiences strategic contraction

- Renovation projects drive sustained demand

- Industrial construction creates new market opportunities

Recent analysis of prices shows that there are differences in the cost of softwood lumber across different regions. In the fourth quarter of 2023, prices for southern yellow pine markets are expected to be quite unstable, ranging from $420 to $580 per thousand board feet.

Growth Opportunities:

- Green Building Initiatives: LEED certification requirements boost demand for sustainably sourced lumber

- DIY Market: Home improvement projects create steady retail sales channels

- Mass Timber Construction: Commercial buildings adopt innovative wood technologies

- Custom Home Building: High-end residential projects require premium lumber grades

As a result of changes in the supply chain, U.S. producers are now expanding their ability to produce lumber domestically. Mills located in states such as Georgia and Alabama are reporting increased investments in automation and efficiency improvements, positioning themselves to capture market share from traditional sources of imported lumber.

The shift towards producing lumber domestically aligns with the rise in mortgage rates, creating a complex market environment where being efficient in operations becomes crucial for maintaining competitive advantages.

Canada’s Role in Softwood Lumber Growth and Market Dynamics

Canada’s softwood lumber industry is facing significant challenges as market dynamics change. The introduction of U.S. tariffs, has forced Canadian exporters to rethink their strategies and find new ways to compete.

Market Adaptation Strategies

- Diversification into Asian markets, particularly China and Japan

- Investment in value-added processing facilities

- Development of sustainable forestry practices

Canadian producers have shifted focus to domestic market opportunities, with investments in mass timber projects and sustainable building initiatives. The industry’s adaptation includes modernizing mill operations and implementing advanced technologies for improved efficiency.

Regional Impact Distribution

- British Columbia: 50% reduction in available timber supply

- Quebec: Increased focus on value-added products

- Ontario: Expansion into engineered wood products

The Canadian softwood lumber sector maintains its competitive edge through strategic partnerships with Indigenous communities and implementation of innovative forestry management practices. These initiatives strengthen the industry’s resilience against market pressures while maintaining Canada’s position as a leading global supplier.

Russia’s Influence on the Global Softwood Lumber Market

Russia’s position as a dominant force in the global softwood lumber market stems from its vast forest resources, accounting for 20% of the world’s timber reserves. The country’s production capabilities have shaped international trade dynamics through several key factors:

1. Export Market Dominance

- Annual softwood lumber exports exceed 30 million cubic meters

- Primary export destinations include China, Europe, and Central Asia

- Competitive pricing advantages due to lower production costs

2. Strategic Market Positioning

- Russia’s geographical location enables efficient distribution to both Asian and European markets

- The country’s extensive railway network facilitates cost-effective timber transportation

- Processing facilities concentrated in regions with abundant forest resources

3. Trade Policy Impact

- Recent export restrictions on raw logs have pushed domestic processing capacity

- Implementation of digital tracking systems for timber origin verification

- Strict enforcement of forest management regulations affecting harvest volumes

4. Production Advantages

- Lower labor costs compared to North American and European competitors

- Abundant natural resources reducing raw material costs

- Modern processing facilities in key production regions

The Russian lumber industry’s influence extends beyond mere production numbers. The country’s ability to maintain steady supply chains during global disruptions has strengthened its position as a reliable supplier in international markets. Russian producers have capitalized on market gaps created by North American supply constraints, particularly in the Chinese market where demand for construction materials remains strong.

Future Outlook: What Lies Ahead for the Softwood Lumber Industry

The softwood lumber industry is at a crucial point, with market forecasts showing significant growth potential until 2033. Industry experts expect a compound annual growth rate of 4.9% from 2025 to 2033, driven by several key factors:

Post-Pandemic Construction Surge

- Residential construction recovery expected to gain momentum by mid-2024

- Commercial construction projects showing signs of increased activity

- Infrastructure development initiatives creating new demand channels

Market Challenges Through 2025

- Rising interest rates affecting housing affordability

- Supply chain disruptions requiring new logistics solutions

- Labor shortages impacting production capacity

- Environmental regulations reshaping industry practices

The integration of digital technologies presents transformative opportunities for the industry:

- AI-powered inventory management systems

- Automated grading and sorting processes

- Digital marketplace platforms connecting buyers and sellers

- Smart manufacturing solutions reducing waste

Price Stabilization Indicators

- Gradual normalization of supply-demand dynamics

- Enhanced production efficiency reducing costs

- New supplier markets emerging to balance trade dependencies

The shift toward sustainable construction practices creates additional market opportunities:

- Growing demand for certified sustainable lumber

- Increased adoption of mass timber construction

- Development of innovative wood-based building materials

- Carbon credit potential for sustainable forestry practices

These market factors indicate a strong future for the softwood lumber industry, despite short-term fluctuations. The sector’s ability to adapt to technological advancements and sustainability requirements puts it in a good position for continued growth through 2025 and beyond.

Competitive Landscape in the Softwood Lumber Market

The softwood lumber market has several major players competing for market share in different regions. Some of the key industry leaders include:

-

West Fraser Timber Co. Ltd. – Canada

-

Canfor Corporation – Canada

-

Weyerhaeuser Company – United States

-

Interfor Corporation – Canada

-

Resolute Forest Products Inc. – Canada

-

Georgia-Pacific LLC – United States

-

Sierra Pacific Industries Inc. – United States

-

Hampton Lumber Sales Company Inc. – United States

-

Tolko Industries Ltd. – Canada

-

Rayonier Advanced Materials Inc. – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Softwood Lumber Market Report |

| Base Year | 2024 |

| Segment by Type | · Common Softwood Species

· Dimension Lumber · Engineered Wood Products |

| Segment by Application | · Construction

· Furniture Production · Packaging · Paper and Pulp Industry · Interior Design |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The softwood lumber market’s trajectory toward $712.8 billion by 2025 presents both opportunities and challenges for industry stakeholders. Market participants must adopt strategic approaches to navigate the complex landscape:

- Price Volatility Management: Implementing robust hedging strategies and maintaining flexible inventory levels can help buffer against market fluctuations.

- Supply Chain Resilience: Building diverse supplier networks and investing in digital tracking systems strengthens operational stability.

- Sustainable Practices: Embracing eco-friendly production methods and certification programs positions companies for long-term success.

The market’s future hinges on several critical factors:

- Housing market recovery in key regions

- Resolution of trade disputes

- Adaptation to climate-related challenges

- Innovation in wood processing technology

Industry players should focus on:

- Data-Driven Decision Making: Regular market analysis and trend monitoring

- Technology Integration: Adoption of smart manufacturing and inventory management systems

- Strategic Partnerships: Building strong relationships across the supply chain

The path to 2025 requires careful navigation of geopolitical tensions, environmental considerations, and evolving consumer demands. Companies that prioritize adaptability and sustainable practices will be best positioned to capture growth opportunities in this dynamic market landscape.

Global Softwood Lumber Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Softwood Lumber Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Softwood Lumber Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalSoftwood Lumber Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Softwood Lumber Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Softwood Lumber Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Softwood Lumber Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Softwood Lumber Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are upstream and downstream forces in the softwood lumber market?

Upstream forces refer to factors affecting the supply side, such as production challenges and raw material availability, while downstream forces pertain to demand trends influenced by construction activities and housing starts. Both play a crucial role in shaping the pricing and stability of the softwood lumber market.

How do production challenges impact the softwood lumber supply chain?

Production challenges, including log shortages and mill closures, create significant disruptions in the supply chain, leading to reduced availability of softwood lumber. These issues can further exacerbate pricing volatility and affect market stability.

What trends are currently driving demand for softwood lumber?

Recent data indicates that rising housing starts in the U.S. correlate strongly with increased demand for softwood lumber. Additionally, different sectors within the construction industry, such as residential versus commercial projects, significantly influence overall consumption levels.

What barriers are hindering growth in the softwood lumber market?

Key barriers include tariffs imposed on Canadian producers that limit market availability, along with pricing volatility driven by currency fluctuations and geopolitical events. These factors can alter consumer behavior both domestically and internationally.

How do geopolitical events affect the global softwood lumber market?

Geopolitical events like the Ukraine war and conflicts in the Middle East have far-reaching implications for softwood lumber production and supply chains worldwide. Such events can disrupt trade routes and impact economic recovery in major markets like North America and Europe.

What is the future outlook for the softwood lumber industry post-pandemic?

As construction activities rebound post-pandemic, future demand trends for softwood lumber are expected to rise. However, challenges such as ongoing geopolitical tensions and potential supply chain disruptions may affect growth leading into 2025.