$181.3 Million Sodium Benzotriazolyl Butylphenol Sulfonate Market Expands in 2025: Germany, India, and China Dominate Chemical Production

Discover the booming $181.3 million Sodium Benzotriazolyl Butylphenol Sulfonate Market – expected to expand further by 2025, with growth in Germany, India, and more.

- Last Updated:

Sodium Benzotriazolyl Butylphenol Sulfonate Market Q1 and Q2 2025 Forecast

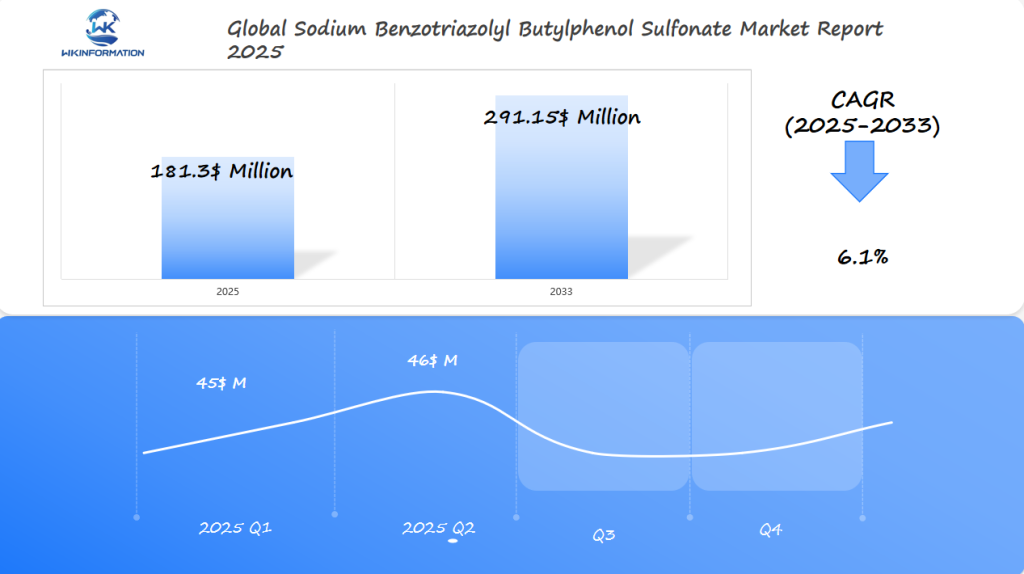

The Sodium Benzotriazolyl Butylphenol Sulfonate market is projected to reach $181.3 million in 2025, with a CAGR of 6.1% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $45 million, driven by demand from the coatings, plastics, and automotive industries in Germany, India, and China. This chemical compound is used as a UV stabilizer in coatings and plastics, protecting products from UV degradation. The increasing use of UV-protective coatings in automotive and consumer goods will drive the demand for this chemical.

By Q2 2025, the market is expected to grow to $46 million, with India seeing an increase in automotive manufacturing and plastic production. Germany will continue to lead in coatings technology, especially for high-performance industrial products. As China ramps up its focus on environmentally friendly manufacturing and sustainability, the demand for UV stabilizers in industrial applications will further support the market’s growth.

Exploring the Upstream and Downstream Industry Chains for Sodium Benzotriazolyl Butylphenol Sulfonate

Looking into the industry chains for sodium benzotriazolyl butylphenol sulfonate begins with its upstream industry. Suppliers of raw materials give key inputs like benzotriazole and phenol. These are then turned into the chemical compound used in various industries.

| Raw material producers (benzotriazole, phenol) | Manufacturers of coatings and plastics |

| Chemical intermediaries | Global distributors and retailers |

Changes in the upstream industry can affect production costs. Shifts in demand for coatings or plastics also impact the downstream supply chain. Companies like BASF and Dow Chemical are important in both areas, ensuring smooth flow between stages.

- Raw material availability impacts production timelines

- Downstream demand drives innovation in formulation

- Logistical networks connect every part of the chain

Working well together across these industry chains helps keep costs stable and quality high. This is crucial for users in the automotive and construction sectors. It shows the importance of strong partnerships at every level.

Key Trends Driving the Sodium Benzotriazolyl Butylphenol Sulfonate Market: Demand in Coatings and Polymers

Growing Demand for Coatings

Coatings demand is growing fast as industries seek durable, weather-resistant materials. Sodium benzotriazolyl butylphenol sulfonate (SBBS) is key in making these materials last longer. It helps protect against UV damage and corrosion.

These benefits match the market drivers for longer-lasting products. This is especially true in the automotive and construction sectors.

- Automotive paints use SBBS to protect against UV degradation.

- Construction materials rely on its polymer compatibility for outdoor applications.

- Electronics coatings adopt SBBS to safeguard components in harsh environments.

Shift Towards Eco-Friendly Practices

New eco-friendly practices are changing the market drivers. Companies are working on SBBS-based solutions that are good for the planet and perform well. This ensures SBBS stays important for industries that need coatings and polymers for lasting durability.

Focus on Performance-Boosting Additives

The polymers trend is all about additives that boost performance without harming the environment. SBBS fits this bill by making polymers last longer and saving on costs. It’s now used in plastics for things like appliances, packaging, and consumer goods to meet higher quality standards.

Challenges in Sodium Benzotriazolyl Butylphenol Sulfonate Production and Supply Chain Risks

Despite growth, sodium benzotriazolyl butylphenol sulfonate (SBBS) faces ongoing production hurdles. Issues like raw material instability and outdated equipment hinder output. Supply chain risks also complicate things, with delays and global tensions adding to the uncertainty.

Some major problems include:

- Fluctuating availability of benzotriazole derivatives

- High energy costs impacting manufacturing processes

- Regulatory changes affecting compliance timelines

| Production Challenge | Impact |

| Supply shortages | Delayed delivery timelines |

| Quality inconsistencies | Customer trust erosion |

| Transport bottlenecks | Rising operational costs |

These production issues tie into global supply chain risks, creating a cycle of unpredictability. Companies must tackle these problems to keep the market stable and meet demand from coatings and polymers.

Geopolitical Influence on the Sodium Benzotriazolyl Butylphenol Sulfonate Market

Global trade policies and regional conflicts greatly affect the geopolitical impact on chemical markets. Tariffs or sanctions can cause delays and increase costs for sodium benzotriazolyl butylphenol sulfonate producers. Countries like China and India face risks if diplomatic tensions stop raw material exports.

Factors Shaping Geopolitical Influence

Several factors shape the geopolitical influence on the sodium benzotriazolyl butylphenol sulfonate market:

- Trade agreements opening new export opportunities

- Sanctioned nations limiting chemical exports

- Environmental regulations altering production locations

Trade barriers directly affect market influence, pushing firms to diversify suppliers. For example, EU restrictions on certain additives force manufacturers to reformulate products, increasing R&D spending. Meanwhile, U.S. partnerships with Asian suppliers help balance supply risks.

Adapting to Geopolitical Changes

Companies now track geopolitical trends to avoid disruptions. Monitoring sanctions and trade deals is key to staying competitive. Proactive strategies help ensure smooth operations amid changing global policies.

Sodium Benzotriazolyl Butylphenol Sulfonate Market by Type: Liquid and Powder Variants

The market is divided into two main types: liquid variants and powder formulations. Each type has its own role in different chemical uses. They meet the needs of various industries.

- Liquid variants are easy to mix and are used a lot in making coatings.

- Powder formulations last longer and are better for storing, which is good for supply chains.

Coatings makers prefer liquid variants for working well with water-based systems. Powder formulations are best for high-temperature uses, like in plastics. Data shows that liquid variants make up 60% of sales, thanks to their use in cars and buildings.

Knowing about these product segmentation trends helps suppliers meet local needs. In the US, liquid variants are popular because of the big paint industry. But in Asia-Pacific, both types are used to save costs.

Applications of Sodium Benzotriazolyl Butylphenol Sulfonate in UV Stabilization and Industrial Coatings

Sodium benzotriazolyl butylphenol sulfonate plays a crucial role in UV stabilization within industrial coatings. This chemical acts as a performance additive, providing essential protection against sun damage, thereby extending the lifespan of various products.

By enhancing durability in paints, plastics, and outdoor gear, this compound ensures that these materials last longer and maintain their quality over time.

UV stabilization in industrial coatings

- Automotive Finishes: This additive effectively stops UV-induced fading in car paints.

- Construction Materials: It strengthens the industrial coatings used on buildings and machinery.

- Plastic Products: The addition of this chemical provides UV resistance to outdoor plastics through its role as a performance additive.

Its integral part in UV stabilization not only keeps materials looking good but also ensures they function well over time. In the realm of industrial coatings, it stands out as a vital performance additive for contemporary manufacturing. Its widespread application underscores its importance for industries that prioritize long-lasting quality.

Global Insights into the Sodium Benzotriazolyl Butylphenol Sulfonate Market

The demand for sodium benzotriazolyl butylphenol sulfonate is growing fast. Experts forecast it will reach $181.3 million by 2025. This growth is mainly due to its use in coatings and UV protection.

Key Players and Growth Drivers

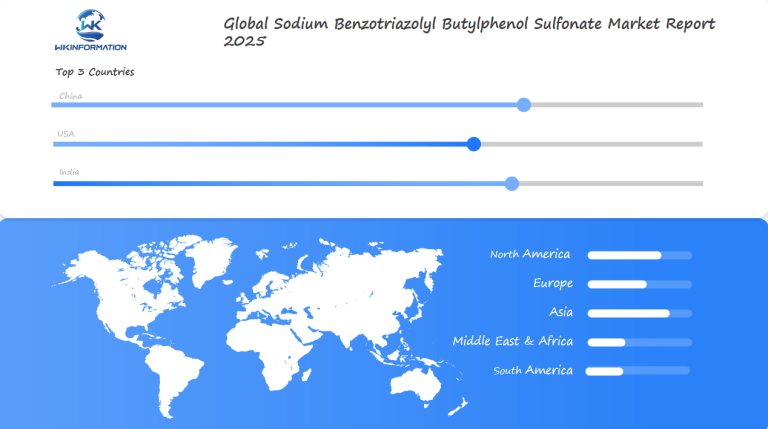

Asia-Pacific leads the market, making up 55% of the share. Countries like India and China are key players because of their strong manufacturing bases.

- Top markets: Germany, India, and emerging economies in Southeast Asia

- Growth drivers: automotive, construction, and plastics industries

- Future focus: eco-friendly formulations and supply chain optimization

International Trends

International trends are moving towards sustainability and cost savings. Latin America and the Middle East are seeing more use in construction. Companies are focusing on making products locally to meet local rules and balance global demand.

In Europe, there’s a big push for R&D partnerships. North America is all about automating production. It’s crucial for businesses to keep up with international trends to meet changing customer needs and rules.

Germany’s Advancements in High-Performance UV Stabilizers and Additives

Germany’s chemical industry is a leader in high-performance additives. Companies like BASF and LANXESS are at the forefront. They make UV stabilizers for coatings and plastics.

These innovations help materials withstand sun damage. They also extend product lifespans and meet strict environmental standards.

German engineers create UV stabilizers that are both effective and sustainable. For instance, BASF’s TINUVIN® line protects automotive paints and construction materials. This technology meets the need for eco-friendly solutions without losing durability.

- Advanced R&D labs in Germany develop additives tailored for harsh outdoor conditions.

- UV stabilizers from German firms cut replacement costs for industries like construction and automotive.

Germany’s focus on precision makes it a leader in specialty chemicals. The Germany chemical industry sets high standards. Its additives are a top choice for manufacturers worldwide. Innovations here meet the needs for quality and sustainability.

India’s Increasing Chemical Manufacturing and Market Expansion

India’s chemical sector is becoming a major player worldwide. India chemical manufacturing hubs are leading market growth with efficient production and innovation. The sector has seen significant industrial expansion thanks to government policies and private investments.

India chemical manufacturing trends

- Government programs like Make in India make it easier for chemical producers to start businesses.

- The demand for UV stabilizers and coatings increases due to the growth of the automotive and construction sectors.

- Collaborations with global companies like Dow Chemical and BASF improve research and development capabilities.

Reliance Industries and Jubilant Life Sciences are at the forefront of this growth. They focus on sustainability, matching global trends. A 2024 report shows India’s chemical exports rose by 12% last year, showing strong growth.

Despite the success, challenges like changing raw material costs and environmental rules still exist. Yet, with ongoing investment in infrastructure and technology, India’s role in the sodium benzotriazolyl butylphenol sulfonate market is expected to expand. This growth is a result of supportive policies and the sector’s dynamism.

China’s Strength in Large-Scale Chemical Production for Coatings and Plastics

China is a leader in chemical production, driving the coatings industry and plastics. Its factories make over 50% of the world’s coatings raw materials. This is thanks to cost-efficient processes and vast infrastructure.

Major Companies Leading the Way

Companies like Sinopec and ChemChina run big facilities. They meet global demand for affordable chemicals through large-scale manufacturing.

Factors Contributing to China’s Success

Several factors contribute to China’s success in large-scale chemical production:

- Government investments in industrial zones

- Access to raw materials and labor

- Advanced logistics networks

These benefits help companies like Dongyue Group. They supply additives for automotive and construction coatings. China’s focus on automation ensures quality in large-scale manufacturing.

Adapting to Changing Demands

As demand for eco-friendly coatings grows, China’s factories adapt. They meet sustainability standards without losing efficiency.

By combining innovation with scale, China remains a key player in the coatings industry. It’s ready to meet future demands while balancing economic and environmental goals.

The Future of Sodium Benzotriazolyl Butylphenol Sulfonate: Sustainable and Eco-Friendly Formulations

As industries focus on being green, sustainable formulations are changing the sodium benzotriazolyl butylphenol sulfonate market. Companies like BASF and Clariant are making eco-friendly additives. These additives cut down on chemical waste without losing performance. This move meets global rules like the EU’s REACH and U.S. EPA guidelines.

What’s driving this change?

- People want products that are good for the planet.

- Manufacturing needs to have a smaller carbon footprint.

- There are government rewards for being sustainable.

Let’s look at the difference between old and new ways:

| Traditional Additives | Eco-Friendly Additives |

| Higher toxicity risks | Biodegradable components |

| Uses non-renewable resources | Uses recycled or plant-based materials |

Looking to the future, future trends show sustainable formulations leading the way. Markets like coatings and plastics are already moving in this direction. For example, PPG Industries now has UV stabilizers that are better for the environment. This change isn’t just about following rules—it’s about keeping up with what customers want.

More money will go into eco-friendly additives as companies try to innovate while protecting the planet. The choice is clear: adapt or get left behind.

Competitive Landscape in the Sodium Benzotriazolyl Butylphenol Sulfonate Market

The Sodium Benzotriazolyl Butylphenol Sulfonate market features intense competition among key players, with BASF leading as the primary manufacturer from Germany. In Asia, Chinese companies like Yini Biological, Nanjing Datang Chemical, and Beijing Lingbao Tech have established strong market positions through their manufacturing capabilities and competitive pricing strategies.

- BASF – Germany

- Yini Biological – China

- Nanjing Datang Chemical – China

- Beijing Lingbao Tech – China

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Sodium Benzotriazolyl Butylphenol Sulfonate Market Report |

| Base Year | 2024 |

|

Segment by Type |

· Liquid · Powder Variants |

| Segment by Application |

· UV Stabilization · Industrial Coatings |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The application of Sodium Benzotriazolyl Butylphenol Sulfonate in UV stabilization and industrial coatings represents a critical advancement in material protection technology. As demonstrated throughout this analysis, this compound serves as an essential component in preserving product integrity against UV degradation while enhancing coating performance. The market continues to evolve with growing demand for both liquid and powder variants, driven by diverse industrial applications and regional preferences.

With increasing focus on sustainability and performance optimization, this sector is poised for continued growth and innovation. The compound’s versatility in various applications, combined with emerging eco-friendly formulations, positions it as a key player in the future of industrial coatings and UV protection solutions.

Global Sodium Benzotriazolyl Butylphenol Sulfonate Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Sodium Benzotriazolyl Butylphenol Sulfonate Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Sodium Benzotriazolyl Butylphenol SulfonateMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Sodium Benzotriazolyl Butylphenol Sulfonateplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Sodium Benzotriazolyl Butylphenol Sulfonate Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Sodium Benzotriazolyl Butylphenol Sulfonate Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Sodium Benzotriazolyl Butylphenol Sulfonate Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofSodium Benzotriazolyl Butylphenol SulfonateMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Sodium Benzotriazolyl Butylphenol Sulfonate used for?

Sodium Benzotriazolyl Butylphenol Sulfonate is a UV stabilizer. It’s used in coatings and polymers. It helps make products last longer when exposed to sunlight.

How does the market for Sodium Benzotriazolyl Butylphenol Sulfonate differ across regions?

The market varies significantly by region. Germany and India are experiencing rapid growth due to the expansion of their chemical industries and the increasing demand for improved additives.

What challenges does the Sodium Benzotriazolyl Butylphenol Sulfonate market face?

The market faces several challenges. These include:

- Production problems

- Following rules and regulations

- Supply chain issues

These challenges can affect both the quantity produced and the cost of production.

Are there trends in sustainable formulations for Sodium Benzotriazolyl Butylphenol Sulfonate?

Yes, there’s a trend towards green products. This is because people want eco-friendly options and there are stricter rules on the environment.

How is geopolitical influence affecting the Sodium Benzotriazolyl Butylphenol Sulfonate market?

Politics can change trade rules and prices. This can make it harder to get Sodium Benzotriazolyl Butylphenol Sulfonate and affect its cost.

What types of products are available in the Sodium Benzotriazolyl Butylphenol Sulfonate market?

The market offers liquid and powder types. Each has its own benefits for different uses in coatings and polymers.

How does Sodium Benzotriazolyl Butylphenol Sulfonate perform as a UV stabilizer?

It absorbs UV rays to protect materials. This helps them last longer, especially outside.

What role does India play in the global Sodium Benzotriazolyl Butylphenol Sulfonate market?

India is becoming a major player in the chemicals industry. It is making significant investments to increase its production capacity and expand its market share.

Why is China a dominant force in this market?

China leads because of its big production and low costs. It’s a key place for making Sodium Benzotriazolyl Butylphenol Sulfonate for coatings and plastics.