Reclaimed Rubber Market Set to Hit $1.54 Billion by 2025: Key Developments in the U.S., China, and Brazil

Comprehensive analysis of the reclaimed rubber market’s growth trajectory, exploring key factors driving market expansion to $1.54 billion by 2025. Examines upstream and downstream influences, technological innovations, and regional market dynamics across the U.S., China, and Brazil. Details emerging applications, quality control measures, and future market trends while highlighting sustainability initiatives and competitive forces shaping industry development.

- Last Updated:

Reclaimed Rubber Market Forecast for Q1 and Q2 2025

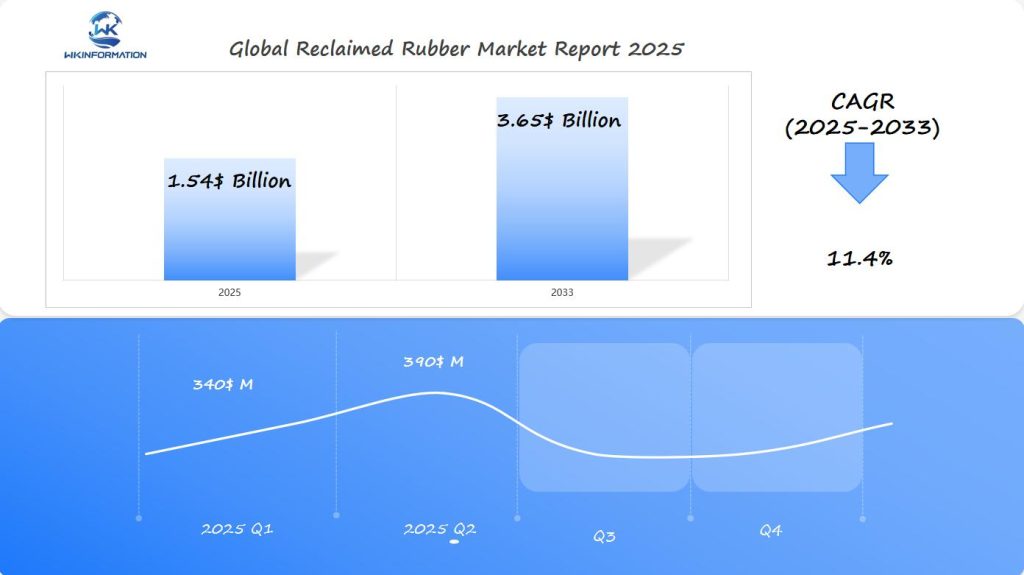

The global reclaimed rubber market is expected to reach $1.54 billion in 2025, with a CAGR of 11.4% projected through 2033. The market in the first half of 2025 is expected to experience strong growth, with Q1 projected at $340 million and Q2 reaching approximately $390 million, driven by increasing demand for sustainable materials and cost-effective alternatives in the automotive and manufacturing industries.

The U.S., China, and Brazil are identified as the most important regions for reclaimed rubber. The U.S. is expected to lead in demand for environmentally friendly materials, while China remains a major producer and consumer of reclaimed rubber, particularly in tire manufacturing. Brazil’s growing automotive sector and focus on sustainability will also contribute to market expansion in South America. These countries are key for a detailed understanding of the market trends and the role of reclaimed rubber in the global supply chain.

Key Upstream and Downstream Factors Impacting the Reclaimed Rubber Industry

The reclaimed rubber industry’s success hinges on a complex interplay of upstream and downstream factors that shape market dynamics. Raw material availability stands as a critical upstream determinant, directly influencing production capabilities and market stability.

Key Supply-Side Factors:

- End-of-life tire availability

- Collection and sorting infrastructure

- Transportation networks

- Storage facilities

- Processing equipment capacity

The industry’s upstream operations face significant challenges in maintaining consistent raw material supply. Tire collection systems vary widely across regions, creating supply fluctuations that impact production schedules. Advanced tracking systems and partnerships with tire retailers have emerged as solutions to stabilize supply chains.

Technological Advancements in Processing:

- Improved devulcanization techniques

- Automated sorting systems

- Enhanced quality control mechanisms

- Precision grinding equipment

- Advanced material testing capabilities

Recent technological breakthroughs have revolutionized production processes, enabling manufacturers to achieve higher quality standards. Modern recycling facilities now employ AI-powered sorting systems, reducing contamination rates by up to 40%. These innovations have strengthened downstream market confidence in reclaimed rubber products.

Quality Control Measures:

- Particle size consistency

- Chemical composition analysis

- Physical property testing

- Performance validation

- Batch uniformity checks

The implementation of stringent quality control protocols has expanded market opportunities. Manufacturers now produce reclaimed rubber that meets specific industry requirements, opening doors to high-value applications in automotive components and construction materials.

Supply chain integration plays a vital role in market success. Companies that establish strong relationships with both tire suppliers and end-users gain competitive advantages. This vertical integration helps maintain steady material flow and ensures product specifications align with customer needs.

The market’s growth trajectory depends on continuous improvement in both upstream collection systems and downstream processing capabilities. Investment in advanced recycling technologies remains essential for meeting increasing quality demands and expanding market applications.

How Emerging Trends Are Shaping the Future of Reclaimed Rubber

The reclaimed rubber industry is undergoing a significant change due to shifting market demands and increased environmental awareness. Consumer preferences have opened up new opportunities in various sectors:

1. Automotive Industry Transformation

- Electric vehicle manufacturers prioritize sustainable materials for interior components

- Tire manufacturers integrate higher percentages of reclaimed rubber in new products

- Auto parts suppliers develop innovative applications for dashboard components and seals

2. Construction Sector Adoption

- Rubber-modified asphalt gaining popularity in road construction

- Sustainable building materials incorporating reclaimed rubber

- Noise reduction panels and vibration dampening solutions

3. Footwear Market Evolution

- Athletic shoe brands launching eco-friendly product lines

- Sustainable fashion movement driving demand for recycled materials

- Development of premium-grade reclaimed rubber for high-end footwear

The increase in environmental awareness has had a wide-ranging impact on supply chains. Companies are facing growing pressure from consumers who want transparency regarding how materials are sourced and what effect they have on the environment. As a result, manufacturers are taking action by:

- Implementing advanced tracking systems for rubber recycling

- Developing clearer labeling for recycled content

- Creating marketing campaigns that highlight their sustainability efforts

Market Response to Consumer Awareness

- 73% of consumers are willing to pay more for sustainable products

- There is a rising demand for products with verified recycled content

- Eco-friendly manufacturing processes are seeing increased investment

These trends have sparked innovation in product development, with manufacturers exploring new applications for reclaimed rubber. The material now appears in:

- Playground surfaces and sports facilities

- Garden and landscaping products

- Industrial flooring solutions

- Consumer goods and accessories

The combination of sustainability demands and technological advancement continues to broaden the potential uses of reclaimed rubber, creating new market opportunities and driving growth within the industry.

Overcoming Barriers to Growth in the Reclaimed Rubber Market

The reclaimed rubber market faces significant technical hurdles that manufacturers must address to ensure widespread adoption. Quality consistency remains a primary challenge, with manufacturers struggling to maintain uniform properties across different batches of recycled materials.

Key Quality Control Challenges:

- Variable composition of input materials

- Inconsistent particle size distribution

- Fluctuating mechanical properties

- Unpredictable aging characteristics

The performance gap between virgin and reclaimed rubber creates limitations in high-demand applications. Industrial seals, critical automotive components, and high-performance tires require specific material properties that current reclaimed rubber formulations struggle to achieve.

Performance Limitations in Key Areas:

- Reduced tensile strength compared to virgin rubber

- Lower elasticity and resilience

- Decreased heat resistance

- Limited durability under extreme conditions

Manufacturers have implemented advanced testing protocols to address these challenges:

- Real-time monitoring systems

- Automated sorting technologies

- Enhanced processing controls

- Standardized quality metrics

Research facilities are developing innovative solutions to bridge the performance gap. Recent technological breakthroughs include:

- Advanced devulcanization processes

- Nano-reinforcement techniques

- Surface modification treatments

- Hybrid compound formulations

The integration of artificial intelligence and machine learning in quality control processes shows promising results. These systems can predict material behavior, optimize processing parameters, and ensure consistent output quality.

Industry Response:

- Investment in R&D facilities

- Collaboration with research institutions

- Development of specialized testing equipment

- Implementation of strict quality management systems

The market demands continuous innovation to overcome these technical barriers. Manufacturers who successfully address these challenges position themselves as industry leaders, driving the market toward its projected growth potential.

The Role of Geopolitics in Reclaimed Rubber Production and Distribution

Government policies shape the reclaimed rubber market landscape through complex regulatory frameworks that vary significantly across regions. These policies create distinct market dynamics in key economies:

United States

- Implementation of the Resource Conservation and Recovery Act (RCRA)

- Tax incentives for manufacturers using recycled materials

- State-level regulations mandating minimum recycled content

- EPA guidelines influencing production standards

China

- Five-Year Plan initiatives promoting circular economy

- Import restrictions on waste materials affecting supply chains

- Subsidies for recycling facilities

- Mandatory recycling quotas for manufacturers

Brazil

- National Solid Waste Policy (PNRS) guidelines

- Regional incentives for sustainable manufacturing

- Environmental licensing requirements

- Tax benefits for recycled material usage

International trade agreements significantly impact cross-border material flows. The recent changes in trade policies have created new patterns:

Trade Agreement Effects

- Tariff structures affecting raw material costs

- Quality certification requirements

- Cross-border transportation regulations

- Supply chain documentation standards

Regional production hubs face varying challenges based on local regulatory environments. Key factors include:

Production Dynamics

- Local content requirements

- Environmental compliance costs

- Labor regulations

- Energy efficiency standards

Distribution channels adapt to these geopolitical pressures through:

Strategic Responses

- Alternative sourcing routes

- Regional processing centers

- Strategic stockpiling

- Digital tracking systems

The interaction between national policies creates market opportunities and barriers. Countries with stringent environmental regulations often drive innovation in recycling technologies, while those with fewer restrictions may focus on cost-competitive production methods.

Reclaimed Rubber Market Segmentation: Understanding Types and Applications

The reclaimed rubber market features distinct product categories, each serving specific industrial needs and applications. Let’s dive into the main types and their primary uses:

Types of Reclaimed Rubber

1. Whole Tire Reclaim (WTR)

- High-quality rubber derived from complete tire processing

- Retains superior mechanical properties

- Ideal for manufacturing new tires and heavy-duty products

2. Butyl Reclaim

- Extracted from inner tubes and bladders

- Excellent air retention properties

- Used in tire inner liners and sealing applications

3. Crumb Rubber

- Ground rubber particles from end-of-life tires

- Available in various mesh sizes

- Perfect for asphalt modification and sports surfaces

4. High-Quality Reclaim

- Processed under controlled conditions

- Enhanced physical properties

- Suitable for premium rubber products

Key Applications

1. Automotive Sector

- Tire manufacturing and retreading

- Automotive belts and hoses

- Vehicle floor mats and gaskets

- Noise reduction components

2. Construction Industry

- Roofing materials

- Waterproofing membranes

- Sound insulation panels

- Sports surfaces and playground materials

3. Industrial Applications

- Conveyor belts

- Industrial rubber sheets

- Adhesives and sealants

- Rubber molded products

The market segmentation reflects growing demand across these sectors, with automotive applications leading the consumption patterns. Each type of reclaimed rubber brings unique properties to specific applications, enabling manufacturers to optimize cost and performance based on end-use requirements.

Recent technological advancements have expanded the application scope of reclaimed rubber products, particularly in high-performance sectors where quality standards are crucial. The ability to customize reclaimed rubber properties through advanced processing techniques has opened new market opportunities across various industries.

How Applications Are Driving the Demand for Reclaimed Rubber Globally

The automotive sector stands as the primary force behind reclaimed rubber demand, consuming 65% of global production. Electric vehicle manufacturers have embraced reclaimed rubber for non-structural components, creating a new growth avenue in this segment.

Construction Applications

Construction applications have seen a 12% increase in reclaimed rubber usage since 2023, particularly in:

- Roofing materials

- Sound dampening panels

- Playground surfaces

- Athletic tracks

The use of reclaimed rubber in construction has also extended to industrial sealants, further enhancing its application scope.

Footwear Industry

The footwear industry represents another significant demand driver, with major brands incorporating reclaimed rubber into their sustainable product lines. Nike’s “Move to Zero” initiative uses 20% reclaimed rubber content in select shoe models.

Industrial Uses

Industrial applications showcase diverse uses:

- Conveyor belt manufacturing

- Anti-vibration pads

- Industrial flooring

- Rubber sheets for machinery

Agricultural and Marine Sectors

Agricultural sector adoption has grown 8% year-over-year, with reclaimed rubber used in irrigation systems and equipment components. The marine industry utilizes reclaimed rubber in dock bumpers and marine fenders, creating a specialized market segment.

Emerging Opportunities

The packaging industry has started incorporating reclaimed rubber into protective materials, while the aerospace sector explores its potential in non-critical components. These emerging applications signal expanding market opportunities beyond traditional uses.

Regional Insights: Reclaimed Rubber Market Trends Worldwide

The reclaimed rubber market displays distinct regional characteristics across major global territories, each shaped by unique industrial demands and regulatory frameworks.

North America

- Strong emphasis on sustainable manufacturing practices

- Established tire recycling infrastructure

- Growing adoption in construction and automotive sectors

- Strict environmental regulations driving market growth

Europe

- Advanced recycling technologies

- High focus on circular economy initiatives

- Premium pricing for high-quality reclaimed products

- Stringent waste management policies

Asia Pacific

- Largest market share at 45% of global revenue

- Rapid industrial expansion driving demand

- Cost-effective manufacturing capabilities

- Key manufacturing hubs:

- China

- India

- Malaysia

- Indonesia

Latin America

- Emerging automotive manufacturing sector

- Growing construction industry applications

- Developing recycling infrastructure

- Rising environmental awareness

The Asia Pacific region stands out with its remarkable market dominance, attributed to:

- High concentration of rubber processing facilities

- Lower operational costs

- Abundant raw material availability

- Government-backed recycling programs

- Extensive manufacturing base

Regional market dynamics are influenced by:

- Local manufacturing capabilities

- Raw material availability

- Environmental regulations

- Industrial development levels

- Technology adoption rates

The distribution of reclaimed rubber production facilities shows a clear concentration in Asian countries, where established supply chains and technical expertise create favorable market conditions. These regions benefit from robust transportation networks and proximity to major end-users in the automotive and industrial sectors.

U.S. Market: Key Insights and Opportunities in Reclaimed Rubber

The U.S. reclaimed rubber market has significant growth potential, thanks to its established tire retreading system and strict environmental laws.

Opportunities for American Manufacturers

American manufacturers have positioned themselves at the forefront of sustainable rubber production through:

- Advanced Tire Retreading FacilitiesState-of-the-art equipment for precise rubber reclamation

- Automated sorting and processing systems

- Quality control measures exceeding industry standards

The U.S. Environmental Protection Agency’s guidelines have created new opportunities for manufacturers:

- Mandatory recycling quotas

- Tax incentives for sustainable production

- Grants for facility upgrades

Key Market Drivers:

- Rising demand for pickup trucks and commercial vehicles

- Growing adoption of green manufacturing practices

- Increased focus on circular economy initiatives

U.S. manufacturers are capitalizing on these opportunities through:

- Investment in research and development

- Implementation of advanced devulcanization processes

- Development of specialized reclaimed rubber compounds

- Integration of IoT and automation in recycling facilities

The presence of major tire manufacturers and automotive companies in the U.S. creates a steady demand stream for reclaimed rubber products. Local producers benefit from reduced transportation costs and faster delivery times compared to international competitors.

China’s Role in Reclaimed Rubber Market Expansion

China’s dominance in the reclaimed rubber market comes from its strong government-led initiatives and strategic policies. The country’s 14th Five-Year Plan specifically targets rubber recycling as a key environmental priority, allocating substantial resources to modernize recycling facilities.

Key government initiatives driving market growth:

- Implementation of strict recycling quotas for manufacturing facilities

- Tax incentives for companies utilizing reclaimed rubber

- Establishment of dedicated rubber recycling zones in industrial parks

- Financial support for upgrading recycling technology

The Chinese market shows impressive innovation in rubber reclamation processes:

Advanced Processing Centers

- Automated sorting systems

- High-precision grinding technology

- Quality control laboratories

- Integrated waste management solutions

Chinese manufacturers have developed specialized techniques for processing various rubber types:

“Our facilities can now process up to 500,000 tons of waste rubber annually, with quality levels matching virgin rubber in many applications” – Leading Chinese recycling facility operator

The market expansion is supported by China’s massive manufacturing base, particularly in:

- Automotive components

- Industrial machinery

- Construction materials

- Consumer goods

Recent technological investments have enabled Chinese processors to achieve higher quality standards, meeting international specifications for exported reclaimed rubber products. These advancements position China as a primary supplier in the global reclaimed rubber supply chain.

Brazil’s Impact on the Global Reclaimed Rubber Market

Brazil’s automotive sector has become a major player in the global reclaimed rubber market. The country produces around 2.5 million vehicles each year, leading to a significant demand for recycled rubber parts.

Key Factors Driving Brazil’s Influence in the Market

Several factors are contributing to Brazil’s growing impact on the reclaimed rubber market:

1. Sustainable Manufacturing Practices

Brazilian manufacturers are adopting sustainable practices to reduce their environmental footprint. This includes:

- Implementing strict waste management protocols

- Integrating recycled materials into their production processes

- Following eco-friendly manufacturing standards

2. Strategic Industry Partnerships

Collaboration within the industry is also driving Brazil’s market influence. Key partnerships include:

- Collaboration between tire manufacturers and recycling facilities

- Joint ventures with international automotive companies

- Development of specialized rubber reclamation centers

Impressive Growth Metrics in Brazil’s Reclaimed Rubber Market

The Brazilian market is showing impressive growth numbers:

- 15% annual increase in reclaimed rubber usage

- 30% reduction in reliance on virgin rubber

- 40% cost savings for manufacturers using recycled materials

Innovative Applications of Reclaimed Rubber by Local Manufacturers

Local automotive manufacturers in Brazil have found creative ways to use reclaimed rubber:

- Vehicle floor mats

- Noise reduction components

- Vibration dampening systems

- Non-structural automotive parts

Regional Impact and Expansion Beyond Automotive Applications

Brazilian companies are not only meeting domestic demand but also exporting reclaimed rubber products to neighboring Latin American countries. This creates regional supply chains and opens up new market opportunities.

Furthermore, the influence of reclaimed rubber extends beyond the automotive industry. It is increasingly being used in construction materials and industrial equipment manufacturing.

Recent Investments and Future Prospects

Recent investments in advanced recycling technologies have positioned Brazil as a key player in producing high-quality reclaimed rubber. This attracts international buyers looking for sustainable material alternatives.

With its growing influence and commitment to sustainability, Brazil is set to play an important role in shaping the future of the global reclaimed rubber market.

What’s Next for the Reclaimed Rubber Market? Future Trends to Consider

The reclaimed rubber market is expected to continue growing after 2025, thanks to new technologies and changing industry needs. One of the key areas of innovation is advanced devulcanization processes, which make it possible to create recycled rubber products that are just as good as new ones.

Emerging Technologies Reshaping the Industry:

- AI-powered sorting systems for improved rubber waste classification

- Smart recycling plants with automated quality control

- Enhanced chemical devulcanization methods for superior end products

- Bio-based additives integration for improved material properties

The market expects significant developments in specialized applications:

- High-performance automotive components

- Advanced construction materials

- Eco-friendly consumer products

- Sustainable infrastructure solutions

Research institutions and industry leaders are working on developing nano-engineered additives to enhance the mechanical properties of reclaimed rubber. These innovations aim to expand applications into sectors that require higher performance standards but have not yet been explored.

The use of Internet of Things (IoT) technology in recycling facilities is expected to lead to better production efficiency and quality control. With the help of smart sensors and real-time monitoring systems, it will be possible to have precise control over devulcanization processes, resulting in consistent product quality.

Market projections suggest a shift towards customized reclaimed rubber formulations that are specifically designed for certain end-use applications. This trend of specialization is a response to the increasing demand from industries that are looking for sustainable materials with specific performance characteristics.

Competitive Forces in the Reclaimed Rubber Market

The reclaimed rubber market is highly competitive, with both established companies and new entrants vying for market share. Here are some of the key players in the industry:

-

Bolder Industries – United States

-

Lehigh Technologies (Michelin) – United States

-

Liberty Tire Recycling LLC – United States

-

Marangoni Tread North America Inc. – United States

-

Eldan Recycling A/S – Denmark

-

Scandinavian Enviro Systems AB – Sweden

-

Global Rubber Industries Pvt. Ltd. – Sri Lanka

-

GTR Recycled Rubber LLC – United States

-

Kraton Polymers LLC – United States

-

Redox Rubber Products – India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Reclaimed Rubber Market Report |

| Base Year | 2024 |

| Segment by Type | · Whole Tire Reclaimed Rubber

· Crumb Rubber · Reclaimed Rubber from Devulcanization |

| Segment by Application | · Automotive Industry

· Footwear · Construction and Civil Engineering · Industrial Products |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The reclaimed rubber market’s trajectory toward $1.54 billion by 2025 signals a transformative shift in sustainable materials adoption. This growth reflects three key market dynamics:

- Industry Evolution: The market has moved from basic recycling to sophisticated processing technologies, enabling higher quality outputs and broader applications

- Regional Leadership: China, the U.S., and Brazil have emerged as pivotal players, each contributing unique strengths to market development

- Sustainability Drive: Environmental regulations and consumer preferences continue to push manufacturers toward eco-friendly alternatives

The market’s future success hinges on:

- Technological advancements in rubber reclamation processes

- Strengthening international trade relationships

- Expanding applications beyond traditional sectors

- Quality improvements to match virgin rubber performance

The 7.72% CAGR projection through 2030 highlights the market’s resilience and potential. As manufacturers invest in R&D and governments implement supportive policies, the reclaimed rubber industry stands ready to meet growing global demand for sustainable materials.

The convergence of environmental consciousness, technological innovation, and market demand positions reclaimed rubber as a critical component in the circular economy. This market’s growth represents a significant step toward sustainable industrial practices and reduced environmental impact.

Global Reclaimed Rubber Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Reclaimed Rubber Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Reclaimed Rubber Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalReclaimed Rubber Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Reclaimed Rubber Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Reclaimed Rubber Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Reclaimed Rubber Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Reclaimed Rubber Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key upstream factors affecting the reclaimed rubber industry?

The key upstream factors impacting the reclaimed rubber industry include the availability of raw materials and advancements in recycling technology. The supply side is significantly influenced by how readily accessible these materials are, while technological improvements enhance production capacity and quality control.

How are emerging trends shaping the demand for reclaimed rubber?

Emerging trends such as increasing demand for sustainable materials and rising consumer awareness about environmental issues are significantly shaping the reclaimed rubber market. Industries like automotive, construction, and footwear are particularly influenced by a shift towards eco-friendly alternatives.

What barriers do manufacturers face in the reclaimed rubber market?

Manufacturers in the reclaimed rubber market encounter challenges such as maintaining consistent quality standards compared to virgin rubber products and addressing performance limitations in high-performance applications like tires or industrial seals.

How does geopolitics influence reclaimed rubber production and distribution?

Geopolitical factors play a crucial role in the reclaimed rubber market, with government policies promoting or restricting recycled material usage affecting production dynamics. Additionally, international trade agreements can impact the flow of reclaimed rubber across borders.

What types of reclaimed rubber are available in the market?

The market features various types of reclaimed rubber, including whole tire reclaim and crumb rubber. These types serve multiple applications, especially in automotive components such as tires and belts.

What future trends should we expect in the reclaimed rubber market beyond 2025?

Future trends expected beyond 2025 include continued growth driven by innovations such as devulcanization processes and bio-based additives. These technologies may reshape the landscape of the reclaimed rubber industry, enhancing its sustainability and performance.