2025 Deep Processing Raspberry Market: Seizing $3.6 Billion Global Opportunities, Boosted by Demand in China, Poland and the United States

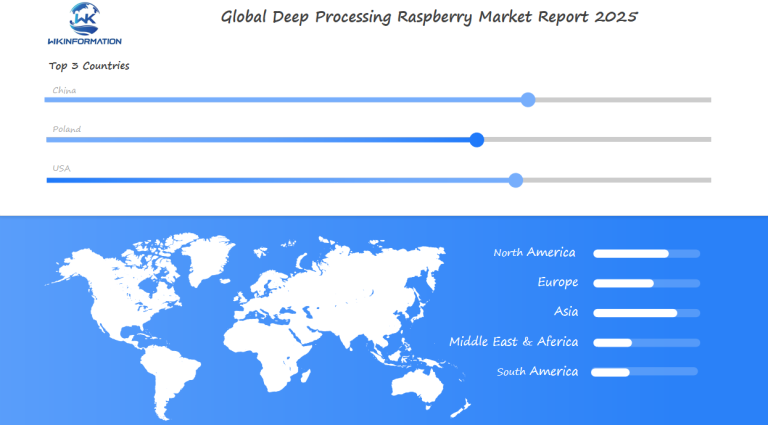

Discover strategic insights into the booming global Deep Processing Raspberry Market, focusing on three major growth poles: China, Poland, and the United States. Learn about market trends, key players, and future projections through 2033 in this comprehensive analysis of the industry’s expansion and opportunities.

- Last Updated:

Deep Processing Raspberry Market Forecast for Q1 and Q2 of 2025

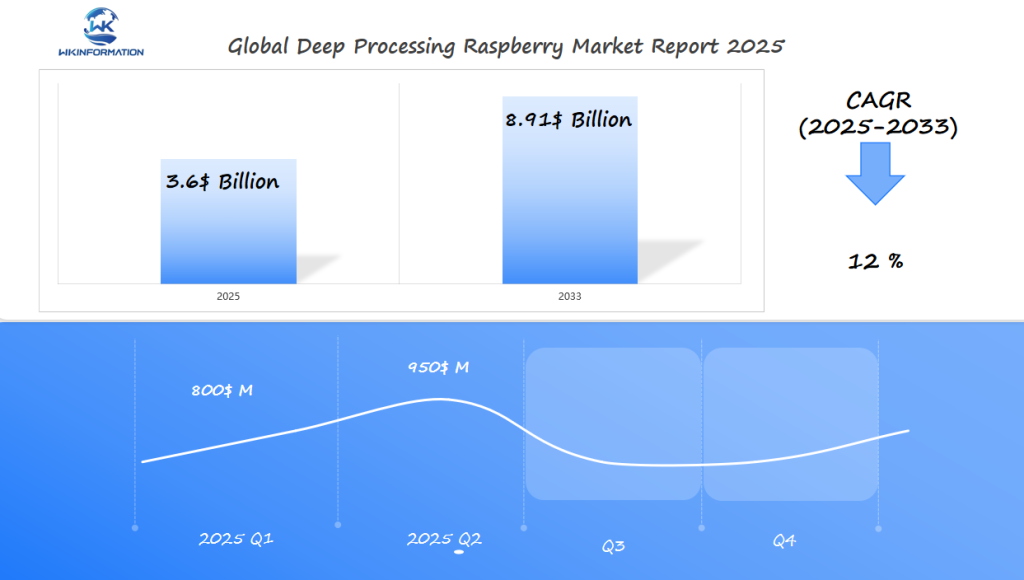

The global Deep Processing Raspberry market is expected to reach approximately $3.6 billion by the end of 2025, driven by increasing consumer demand for nutritious, functional foods and beverages.

For Q1 2025, the market is projected to be valued around $800 million, with significant growth observed in key regions like China, Poland, and the U.S. As these countries continue to invest in advanced agricultural practices and health-conscious food products, the demand for deep-processed raspberries remains robust.

Moving into Q2 2025, the market is anticipated to rise to about $950 million, as seasonal shifts and consumer interest in plant-based and functional food products result in higher consumption, particularly in the U.S. and Poland, which are expanding their raspberry-based product lines. China, with its growing preference for natural and organic products, remains a crucial market, driving further expansion in the sector.

The market is projected to grow at a Compound Annual Growth Rate (CAGR) of 12% by 2033, underscoring its strong long-term growth potential. For a comprehensive analysis of market trends, regional dynamics, and strategic insights, we encourage you to explore the full Wkinformation Research report.

Key Takeaways

- China, Poland, and the U.S. dominate the Deep Processing Raspberry Market through infrastructure and innovation.

- Global raspberry market growth is driven by rising demand for health-focused products.

- Technological advancements in automation and sustainability are key trends in 2025.

- China’s production capacity and Poland’s EU access boost international raspberry market trends.

- Consumer focus on functional foods is reshaping the raspberry processing industry 2025 landscape.

Upstream and Downstream Industry Chain Analysis: The Deep Processing Raspberry Supply Chain Explained

To understand the raspberry supply chain analysis, we must follow the journey from berry to bottle. This deep processing value chain connects farmers, manufacturers, and retailers. Together, they ensure processed raspberries reach markets worldwide.

From Farm to Factory: Mapping the Raspberry Value Chain

Raspberries grow in fields where farmers carefully plan harvest times. Once picked, they move to processing plants. There, they are transformed into juices, powders, or purees for global shipping.

Critical Dependencies in Raspberry Processing Infrastructure

- Cold storage facilities: Keep berries fresh during storage and transport

- Automation tools: Fast sorters and packagers cut down on waste

- Regulatory compliance: EU and USDA rules ensure product safety

Distribution Channels and Market Access Points

| Channel Type | Key Players | Market Impact |

|---|---|---|

| Export hubs | Polish and Chinese processing hubs | Streamline upstream downstream raspberry market flows |

| Retail networks | Supermarkets, health stores | Direct consumer access |

| Contract farming | Grower-manufacturer partnerships | Secure raw material supply |

Each part of this chain affects how raspberries are available globally. Issues in raspberry processing logistics can cause delays. But, strong partnerships help the market stay strong.

Trend Analysis: Innovations and Trends in Deep Processing Raspberry Technology

Raspberry processing technology is changing fast. New ways of making raspberries into premium products are emerging. Three key areas are leading this change: innovative raspberry extraction methods, automated raspberry production, and sustainable raspberry processing.

Advanced Extraction Techniques Revolutionizing Processing

New innovative raspberry extraction methods like cold-press juicing and supercritical CO₂ extraction are better than old ways. They keep more nutrients in the raspberries. This meets the growing need for products with clean labels.

Automation and AI Integration in Raspberry Processing

- Automated sorting systems reduce waste by 40% using machine vision

- AI-driven drying systems optimize temperature controls for better texture retention

- Leading facilities now use robotics for 24/7 production cycles

Sustainability Innovations Driving Industry Evolution

| Technology | Application | Outcome |

|---|---|---|

| Waste-upcycling | Raspberry seed oil production | Cuts waste by 30% |

| Solar-powered facilities | Energy-efficient processing | 30% lower carbon footprint |

Companies using sustainable raspberry processing now use 90% of byproducts. They make biofuel or cosmetics from it. This greatly reduces environmental harm.

These changes make automated raspberry production systems key for meeting global demand. They also help meet ESG goals. Innovations focus on being efficient and good for the planet.

Restriction Analysis: Challenges Facing the Deep Processing Raspberry Industry

Global raspberry processors face big raspberry industry challenges that test their strength. Rules vary by country, making raspberry processing regulations hard to follow. For instance, U.S. and EU rules are very different, forcing companies to change their products for each market.

- Regulatory barriers: Export rules and delays in getting certifications slow down trade

- Climate pressures: Unpredictable weather harms harvests, making climate change impact on raspberries a big worry

- Cost challenges: Shortages of workers in key areas increase raspberry production constraints like higher wages and energy costs

Regulatory Hurdles and Compliance Requirements

Companies must follow strict raspberry processing regulations from start to finish. Poland and China have new rules that add costs. Driscoll’s and Naturipe spend on compliance teams to keep their products on the market while keeping quality high.

Climate Change Impacts on Raspberry Production

Warmer winters mess up the sleep cycles of U.S. Northwest orchards. European growers see less fruit because of extreme heat. Oregon State University found that berries are 15% smaller since 2015, thanks to warmer weather.

Labor Shortages and Rising Costs

Companies try to use machines to solve the labor problem, but it costs a lot at first. Higher energy prices in the EU and U.S. and problems with getting goods to market make things harder. This tightens profit margins.

Geopolitical Analysis: The Impact of Global Politics on Deep Processing Raspberry Production and Trade

Global raspberry trade is more than just growing crops. It’s a complex game of geopolitical impact on raspberry trade. Countries like China, Poland, and the U.S. are fighting for market share. Political decisions now control supply chains and prices.

Raspberry market trade agreements and diplomatic ties decide who gets into key markets. This is crucial for success.

| Region | Trade Agreement | Trade Impact |

|---|---|---|

| China | RCEP | Boosts Southeast Asia exports with zero tariffs by 2025 |

| Poland | EU-MERCOSUR | Delayed ratification risks disrupting South American market entry |

| U.S. | USMCA | Reduces paperwork but doesn’t resolve quota disputes |

These deals show how global raspberry trade relations depend on politics. Poland’s stalled EU-MERCOSUR deal is a clear example. It shows how unresolved issues can block growth.

Political Tensions and Market Access Challenges

- US-China tariffs: 25% levies on frozen raspberries add $0.15/lb to US imports from China

- EU-UK post-Brexit checks: 40% of EU raspberry exports to UK face new inspections

- Argentina’s export caps: Limits on shipments to EU disrupt supply chains

Regional Cooperation Initiatives in the Raspberry Sector

- EU-China Food Safety Accord: Aligns pesticide standards to ease inspections

- North American Raspberry Council: US-Poland joint venture to share AI-driven logistics

- Asia-Pacific Forum: Annual talks to counter non-tariff barriers like labeling disputes

These efforts show how international raspberry politics can turn rivals into partners. Finding a balance between diplomacy and profit is crucial for success in a changing world.

Segmentation Type Market Analysis: Deep Processing Raspberry Market Segmentation by Product Type

Looking into the raspberry market segmentation shows how different types meet various needs. From frozen berries to powders, each segment serves a purpose. These categories are key to the industry’s growth.

Frozen Raspberry Products Market Segment

The frozen raspberry market is big, with IQF (individually quick-frozen) berries and bulk frozen blocks leading. These are perfect for bakeries, smoothie chains, and retail. Trends include:

- IQF raspberries keep their texture for top desserts

- Frozen blocks make bulk production easy for juice makers

- North American makers like Oregon Raspberry Co. see 8% growth each year

Raspberry Concentrate and Purée Market Dynamics

In the raspberry concentrate market, purified concentrates and smooth purées drive new drinks. Companies like Raspberri Puree Industries focus on:

- Strong concentrates for energy drinks

- Purées for yogurt toppings

- Health trends boost demand in Europe

Dried and Powdered Raspberry Product Trends

Dried raspberry products are growing in functional foods, like freeze-dried snacks and powders. Key trends include:

- Freeze-dried raspberries in trail mixes (US market up 15% in 2023)

- Powders in protein bars and supplements

- Asia-Pacific growth thanks to Japanese nutraceutical brands

Europe likes concentrates for juices, while North America prefers frozen options. These differences show how diverse products help the $2.3B global market grow.

Application Market Analysis: The Role of Deep Processing Raspberries in Food and Beverage Industries

Raspberry ingredients are changing kitchens and factories around the world. The raspberry ingredient market is growing fast. This is because people are finding new uses for processed raspberries.

These new uses appeal to those who want natural flavors and nutrients. It’s a big hit with health-conscious consumers.

Dairy Industry Applications for Processed Raspberries

Processed raspberries add color and vitamin C to dairy products. Brands like Chobani mix raspberry puree into Greek yogurt. Häagen-Dazs uses concentrated raspberry flavors in their ice cream.

Processed raspberry uses are also seen in cheese spreads and probiotic milks. These are becoming more popular.

Bakery and Confectionery Sector Usage Patterns

Bakers add dried raspberries to granola bars and muffins. Candy makers, like Jelly Belly, create gummy snacks with raspberry extracts. They focus on clean-label raspberry food applications without artificial additives.

Emerging Applications in Functional Foods and Nutraceuticals

The raspberry beverage industry is expanding. It now includes vitamin-enhanced smoothie packs and kombucha with raspberry extracts. Brands like Nature’s Way offer raspberry leaf teas for wellness.

Even meat alternatives use raspberry powders for a unique taste. This adds umami notes to their products.

“Raspberry’s natural acidity pairs perfectly with fermented foods,” says Emma Lopez, a food tech innovator. “It’s not just flavor—it’s a functional ingredient.”

Global Deep Processing Raspberry Market Region Analysis: Regional Market Dynamics

Looking beyond the top raspberry producers opens up new opportunities. The global raspberry distribution network is changing as new centers come online. This change shows how raspberry market geography sparks innovation.

European Market Landscape Beyond Poland

Serbia and Ukraine are building cold storage to meet EU standards. France is leading in tech for Mediterranean markets. These countries are growing in international raspberry trade through certifications and partnerships.

- Serbia: 20% export growth to Middle East via new logistics hubs

- Ukraine: Organic certifications unlocking premium EU markets

- France: High-tech drying facilities for Middle Eastern confectionery

Asian Market Growth Centers Outside China

In South Korea, automated factories make premium purées for Japan. Vietnam’s climate allows for year-round harvests. Both countries use global raspberry distribution to reach more markets.

- Vietnam: 30% annual export growth to Singapore and Hong Kong

- South Korea: EU FTA agreements reduce tariffs on processed goods

Emerging Markets in Latin America and Africa

Chile’s valleys now send premium frozen raspberries to US stores. Mexico’s close ties with the US boost exports. Kenya and Morocco are testing drought-resistant raspberries for African markets.

| Region | Key Drivers | Trade Partners |

|---|---|---|

| Europe | EU subsidies, climate resilience | Mediterranean & Middle East |

| Asia | Automation, labor cost advantages | Japan, EU, ASEAN |

| Latin America | Climate diversity, NAFTA access | U.S., EU |

| Africa | Untapped arable land, AU initiatives | Regional trade blocs |

China Deep Processing Raspberry Market Analysis

China has become a top player in the Asian raspberry market. This is thanks to big investments in China raspberry production and new processing tech. Places like Shandong and Liaoning provinces now handle over 40% of the country’s raspberries. This has boosted the Chinese raspberry processing industry by 15% each year.

Domestic demand is pushing for new ideas. People in cities want healthier foods, leading to more ready-to-drink beverages and frozen snacks. Big names like Bright Foods and Hengyuan have grown their cold storage to meet this demand. The China raspberry market analysis shows a 28% jump in sales of premium products since 2022.

- Automated sorting systems reduce waste by 30% in major processing hubs

- Government subsidies support solar-powered drying facilities in northern provinces

- Export partnerships with Southeast Asia increased by 20% in 2023

Innovation is all about being green. Companies like BerryTech work with tech companies to use blockchain for tracking. These Chinese raspberry processing industry steps are making China a big player in Asia’s raspberry market by 2026.

Poland Deep Processing Raspberry Market Analysis

Poland has become a top player in Polish raspberry production and European raspberry processing. This success comes from years of careful planning. Today, the Poland raspberry market analysis shows strong infrastructure and partnerships that help reach the world.

Poland’s Historical Raspberry Industry Development

Poland’s raspberry sector combines old farming ways with new technology. Important factors include:

- Climate ideal for high-yield crops

- Cooperative farming models boosting efficiency

- Government grants for processing tech upgrades

European Union Integration Benefits for Producers

Joining the EU opened up new opportunities for:

- Subsidized agricultural funding programs

- Streamlined exports to 27 EU member states

- Standardized safety protocols for Poland raspberry export streams

Quality Standards and Certification Advantages

Poland’s high Polish raspberry production standards mean top-quality raspberries. Certifications like EU Organic and GlobalGAP:

- Secure premium pricing in health-focused markets

- Enable traceability systems for export partners

- Support sustainability claims verified by third parties

United States Deep Processing Raspberry Market Analysis

Northwest states like Washington and Oregon are key in the US raspberry market analysis. They lead in American raspberry processing thanks to their climate and tech. This makes them a big part of the United States raspberry production growth.

Northwest Growing Region Industrial Ecosystem

Washington and Oregon are leaders with their high-yield farms. They use precision agriculture. Big names like Driscoll’s and Naturipe Farms focus on sustainable farming.

- Climate-controlled storage cuts down on waste by 40%.

- Working with Washington State University helps grow pest-resistant crops.

US Consumer Demand Patterns

More people want organic and functional foods. This is changing the North American raspberry industry.

| Consumer Preference | Growth Rate (2023) |

|---|---|

| Organic products | 18% |

| Functional food additives | 25% |

| Convenience formats | 14% |

Technological Leadership in Processing Methods

Automation is making American raspberry processing more efficient. Oregon Raspberry Technologies uses AI to sort raspberries with 99.5% accuracy. Sustainability is now a big focus.

“Innovative processing cuts energy use by 30% while tripling shelf life,” said a 2024 USDA report.

Exports to the EU went up 12% in 2023. This is thanks to FDA rules. The US is now a top player in raspberry products worldwide.

Future Development Analysis: The Future of Deep Processing Raspberries in Sustainable Food Production

The global raspberry industry is changing fast. Sustainable raspberry processing and eco-friendly raspberry production are key to this change. Companies are now focusing on ways to reduce harm to the environment while staying profitable.

The future raspberry industry trends show a move towards growth that respects the planet. This means finding a balance between increasing production and protecting the environment.

Circular Economy Applications in Raspberry Processing

Top companies are using new strategies to be more sustainable. They’re turning pruning waste into compost or using seed extracts for beauty products. This reduces waste and helps the environment.

They’re also using new technologies like enzymatic separation systems. These systems help recover nutrients from waste, reducing landfill use. Plus, they’re exploring biodegradable packaging made from raspberry plant fibers to cut down on plastic.

Carbon Footprint Reduction in the Raspberry Value Chain

In Poland, producers are installing solar panels to power their facilities. In the US, farms are using drip irrigation to save 30% of water. China’s factories are testing AI to use less energy during freezing and drying.

These efforts are in line with global goals to reduce emissions in the sustainable raspberry processing lifecycle.

Ethical Sourcing and Social Responsibility Trends

Blockchain systems are now tracking eco-friendly raspberry production from farm to store. This ensures fair labor practices. Fair Trade and B Corp certifications are becoming more common in the industry.

Companies are also working with local communities for berry farming. This builds trust and increases market appeal. It shows future raspberry industry trends that value transparency and fairness.

Competitor Analysis: Major Players in the Deep Processing Raspberry Market

- Driscoll’s, Inc.

- Sun Belle Inc.

- BerryWorld

- Wish Farms

- Watsonville Coast Produce

- California Giant Berry Farms

- Mountain View Fruit Sales

- Rainier Fruit Company

- Naturipe Farms

- Planasa

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Deep Processing Raspberry Market Report |

| Base Year | 2024 |

| Segment by Type |

·Raspberry Concentrate · Raspberry Jam · Raspberry Powder · Raspberry Extracts and Flavorings · Dried Raspberry |

| Segment by Application |

· Online Sales · Offline Sales |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global deep processing raspberry market is growing fast. Experts predict it will keep expanding over the next five years. This growth is thanks to more people wanting healthy foods and eco-friendly ingredients.

Places like China, Poland, and the U.S. will play big roles in this growth. Each country has its own strengths that will help the raspberry market.

Five-Year Growth Projections by Region and Segment

In Europe, especially Poland, the raspberry market will focus on high-end products like concentrates and powders. Asia-Pacific, especially China, is expected to see a lot of raspberry exports. Meanwhile, North America will lead in creating new, healthy food products.

Frozen raspberries and special raspberry products like extracts will see the biggest increase in demand. This is because more people are becoming health-conscious.

Investment Opportunity Identification

There are great opportunities for investment in raspberry processing. Eastern Europe needs better automation, while North America is looking for new packaging ideas. Big companies like Pepsico and Nestlé are teaming up with processors to meet the demand for healthy foods.

Latin America is also a promising market for small raspberry producers. They can join global supply chains and grow their businesses.

Strategic Positioning Recommendations for Market Participants

Big companies should focus on being more sustainable. This means reducing waste and following EU green rules. New companies can focus on organic products or use AI to check quality.

Working with local farming groups in Africa and Southeast Asia can help get fresh berries. It also helps deal with climate change. Getting certifications like Fair Trade and B Corp can make a company look better in the market.

Global Deep Processing Raspberry Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Deep Processing Raspberry Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Deep Processing RaspberryMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Deep Processing Raspberryplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Deep Processing Raspberry Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Deep Processing Raspberry Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Deep Processing Raspberry Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofDeep Processing RaspberryMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current market size of the global raspberry deep processing industry?

The global raspberry deep processing market is growing fast. By 2025, it’s expected to see big increases. This growth is driven by more people wanting processed raspberry products and better processing technology.

Who are the major players in the raspberry processing market?

Big names in raspberry deep processing include well-known companies and local experts. They use their strengths, big production, and new ideas to stay ahead.

Why are China, Poland, and the United States considered major growth poles in Raspberry processing?

These countries lead because of their advanced farming, strong processing setups, and supportive government policies. These factors help them grow raspberries and process them well.

How do climate change and environmental factors impact raspberry production?

Climate change is a big problem for raspberries. It affects how they grow and when they can be picked. To deal with this, using green practices is key.

What are the latest technological innovations in raspberry processing?

New tech includes better ways to extract raspberry goodness, using AI and automation, and green processing. These advancements aim to boost yield, efficiency, and product quality.

How is the raspberry deep processing supply chain structured?

The supply chain starts with farming and harvesting raspberries. Then, it moves to processing, packaging, and getting the products to stores. This chain is crucial for getting raspberries to consumers.

What trends are shaping consumer demand for raspberry products?

Today, people want natural, sustainable, and healthy foods. This means more demand for clean label and functional foods with raspberries.

What challenges do companies face within the raspberry deep processing sector?

Companies deal with rules, labor shortages, higher costs, and adapting to climate changes. They also need to follow food safety rules.

What are the key applications for deep processed raspberries across industries?

Deep processed raspberries are used in many areas. They’re in dairy, baked goods, sweets, and even in health foods and supplements. They meet different consumer needs and tastes.

How do different regions approach raspberry processing sustainability?

Places like China, Poland, and the United States have their own ways to be green. They focus on cutting carbon, sourcing ethically, and using new green practices. This shows their commitment to the environment.