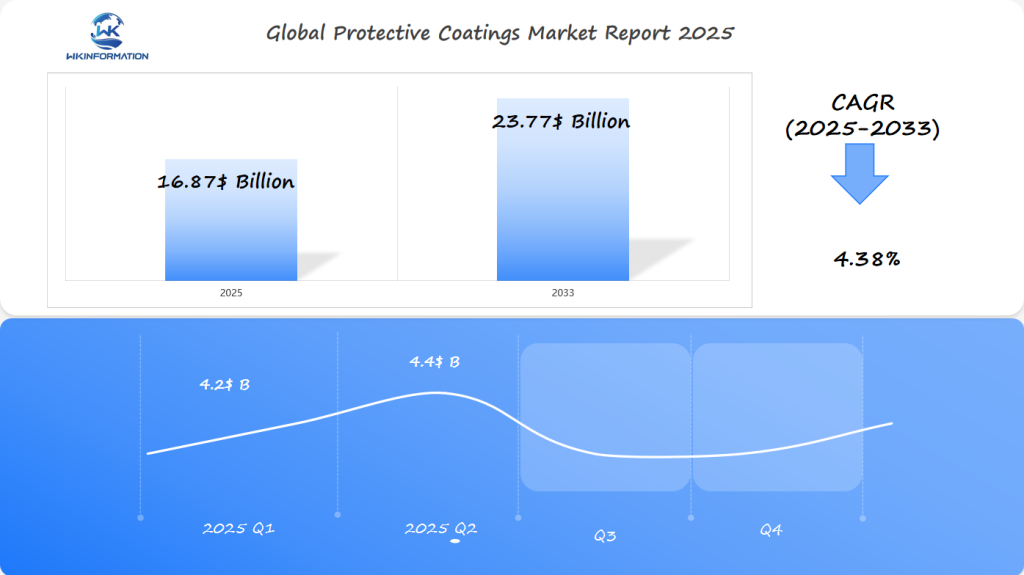

Protective Coatings Market Set to Reach $16.87 Billion by 2025: Key Drivers of Growth in the U.S., Japan, and Germany

Explore the comprehensive analysis of the Global Protective Coatings Market from 2025-2033. This detailed report examines market trends, growth projections, regional insights, and competitive landscapes. Learn about key drivers fueling market expansion, emerging technologies, and investment opportunities in this dynamic sector. The analysis covers product segmentation, geographical distribution, and future market developments, making it essential reading for industry stakeholders and decision-makers.

- Last Updated:

Protective Coatings Market Q1 and Q2 2025 Forecast

The Protective Coatings market is projected to reach $16.87 billion in 2025, with a CAGR of 4.38% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $4.2 billion, as industries such as automotive, construction, and marine continue to invest in coating solutions that improve durability and corrosion resistance. The U.S. will remain a key player, with aerospace and defense sectors driving demand for high-performance coatings.

By Q2 2025, the market will likely grow to around $4.4 billion, with Japan increasing its focus on environmentally friendly coatings and Germany driving innovation in automotive coatings that enhance fuel efficiency and reduce carbon emissions. Additionally, the construction sector in Germany will continue to rely on protective coatings to ensure longevity and safety of infrastructure in challenging environments.

Understanding the Protective Coatings Market: Upstream and Downstream Dynamics

The protective coatings industry operates through a complex network of raw material suppliers, manufacturers, and end-users. To better understand this market, let’s explore the upstream and downstream segments of the industry chain.

Upstream Segment: Essential Raw Materials

The upstream segment focuses on the crucial raw materials used in the production of protective coatings. These materials include:

- Resins: Epoxy, polyurethane, and acrylic resins are the primary binders that provide durability and adhesion to the coatings.

- Pigments: Pigments are responsible for imparting color and hiding power to the coatings.

- Solvents: Solvents are used to dissolve resins and adjust the viscosity of the coatings for application.

- Additives: Additives are added to enhance specific properties such as UV resistance, anti-corrosion, or anti-fungal characteristics.

Manufacturers rely on these raw materials to create high-quality protective coatings that meet industry standards.

Manufacturing Processes: Transforming Raw Materials into Finished Products

The manufacturing processes involved in producing protective coatings are critical in ensuring consistent quality and performance. These processes include:

- Raw material preparation and testing: Before production, raw materials undergo thorough testing to ensure they meet specified requirements.

- Pigment dispersion: Pigments are dispersed evenly in the resin matrix to achieve uniform color distribution.

- Base formation: The resin, along with other components like solvents and additives, is mixed together to form the coating base.

- Quality control: Throughout the manufacturing process, quality control measures are implemented to detect any defects or deviations from standards.

- Packaging: Once the coatings are produced, they are packaged appropriately for storage and transportation.

Downstream Segment: Distribution Channels and End-User Industries

The downstream segment involves the distribution of protective coatings to various sectors through different channels:

- Direct Sales: Large-scale industrial clients often purchase coatings directly from manufacturers for their specific projects.

- Distributors: Regional markets and smaller customers rely on distributors who stock a variety of coatings from different manufacturers.

- Retail Networks: Commercial and residential users can find protective coatings in retail stores or online platforms.

Key industries that utilize protective coatings include:

- Heavy Industry: Sectors such as oil and gas, power generation, and chemical processing require robust coatings to protect equipment and structures from harsh environments.

- Infrastructure: Bridges, roads, and public facilities need regular maintenance to prevent deterioration caused by weathering or corrosion.

Supply Chain Optimization: Key to Success

Optimizing the supply chain is crucial for companies operating in the protective coatings market. By implementing vertical integration strategies, businesses can gain better control over raw material costs and quality standards.

Furthermore, fostering strong relationships between suppliers and manufacturers can lead to strategic partnerships that drive innovation and cost-effective solutions throughout the industry chain.

Emerging Trends Revolutionizing the Protective Coatings Industry

The protective coatings industry is experiencing a significant shift toward sustainable practices and advanced formulations. Manufacturers now prioritize water-based coatings that reduce volatile organic compound (VOC) emissions by up to 80% compared to traditional solvent-based alternatives.

Key Sustainable Innovations:

- Nano-engineered coatings with self-healing properties

- Bio-based raw materials derived from renewable resources

- Zero-VOC formulations meeting strict environmental standards

Advanced technologies have dramatically enhanced coating performance metrics. Smart coatings equipped with sensors can now detect and report corrosion before visible damage occurs. These intelligent systems provide real-time monitoring capabilities, extending asset lifespans by up to 40%.

Performance Enhancements Through Technology:

- Anti-microbial properties for healthcare applications

- Enhanced UV resistance for outdoor installations

- Improved adhesion through surface modification techniques

The push for eco-friendly products has sparked development in:

- Powder coatings with zero waste application

- Water-based epoxy systems

- Recyclable packaging solutions

Research indicates a 35% increase in demand for green coating solutions since 2020. Industry leaders are investing heavily in R&D to develop formulations that combine environmental responsibility with superior protection capabilities. These innovations align with global sustainability goals while meeting stringent performance requirements across various sectors.

Key Challenges Facing Protective Coatings Manufacturers

Supply chain disruptions have created significant hurdles for protective coating manufacturers in recent years. Raw material shortages, particularly in epoxy resins and specialized additives, have led to production delays and increased costs. These disruptions force manufacturers to maintain larger inventory levels, impacting their working capital requirements.

Environmental Compliance Pressures

- Strict VOC emission limits require extensive reformulation efforts

- Complex documentation and testing requirements for new formulations

- Additional investment in emission control equipment

- Regular audits and compliance monitoring costs

Financial Strain Points

- Rising energy costs affecting production expenses

- Increased raw material prices cutting into profit margins

- Higher transportation and logistics expenses

- Investment requirements for sustainable technology adoption

The implementation of REACH regulations in Europe and similar frameworks worldwide has created additional complexity in manufacturing processes. Manufacturers must now invest heavily in research and development to create compliant formulations while maintaining coating performance standards.

Labor shortages have emerged as another critical challenge, particularly in specialized roles requiring expertise in advanced coating technologies. This skills gap has led to increased operational costs and potential production bottlenecks.

Price volatility in key raw materials, such as titanium dioxide and specialty resins, forces manufacturers to adjust their pricing strategies frequently, potentially affecting their market competitiveness and customer relationships.

The Impact of Geopolitical Events on Protective Coatings Production

Recent geopolitical tensions have created significant ripples across the protective coatings industry. Trade disputes between major economies have triggered price volatility in essential raw materials, particularly affecting epoxy resins and specialty additives.

Key Market Disruptions:

- Political instability in titanium dioxide-producing regions has led to a 15-20% surge in coating pigment costs

- Economic sanctions against certain countries have restricted access to specialized chemical compounds

- Trade tariffs have increased manufacturing costs by an average of 12% in affected regions

The Russia-Ukraine conflict has severely impacted the supply of specific metal-based additives, forcing manufacturers to seek alternative sourcing options at premium prices. Chinese market dynamics have added another layer of complexity, with export restrictions on certain chemical components creating bottlenecks in global supply chains.

Regional Production Shifts:

- North American manufacturers have increased local production capacity by 25%

- European producers have diversified their supplier networks across multiple countries

- Asian markets have developed new regional partnerships to maintain stability

These geopolitical pressures have prompted protective coating manufacturers to adopt strategic stockpiling practices and invest in research for alternative raw materials. Companies are now establishing multiple production facilities across different regions to minimize dependency on single-source markets and maintain consistent supply capabilities.

Understanding the Different Types and Materials in the Protective Coatings Market

The protective coatings market is divided into different categories based on formulation types and material compositions. Here’s a detailed breakdown of the main segments:

1. Solvent-Borne Coatings

- High solid content offering superior protection

- Excellent chemical resistance properties

- Fast-drying characteristics

- Enhanced durability in extreme conditions

- Ideal for industrial applications

2. Water-Borne Technologies

- Environmentally friendly alternatives

- Lower VOC emissions

- Reduced fire hazards during application

- Cost-effective solutions

- Growing popularity in residential applications

3. Emerging Coating Types

- Powder coatings with zero VOC emissions

- UV-curable systems for rapid curing

- High-performance fluoropolymer coatings

- Nano-engineered protective solutions

The market segmentation also includes specialized materials:

- Epoxy-based coatings: Offering superior adhesion

- Polyurethane variants: Providing excellent UV resistance

- Acrylic formulations: Delivering cost-effective protection

- Alkyd-based solutions: Suitable for metal substrates

Recent market data shows solvent-borne coatings maintaining a 45% market share. This shift reflects increasing environmental awareness and stricter regulations across industries.

How Applications Are Fueling the Demand for Protective Coatings in Construction, Aerospace, and Industrial Projects

The construction sector dominates the protective coatings market. This substantial presence stems from:

- Infrastructure Protection Requirements

- Bridge coatings for corrosion resistance

- Building facade protection against weathering

- Underground structure waterproofing

- Residential Construction Applications

- Roof coating systems

- Foundation waterproofing

- Interior wall protection

The aerospace industry represents a high-value segment with specialized coating needs:

- Heat-resistant coatings for engine components

- Anti-corrosive treatments for aircraft exteriors

- Ice-resistant formulations for critical flight surfaces

Industrial projects drive significant coating demand through:

- Heavy Equipment Protection

- Mining machinery coatings

- Agricultural equipment preservation

- Construction vehicle protection

- Manufacturing Facility Requirements

- Chemical processing plant protection

- Power generation facility coatings

- Storage tank preservation

These diverse applications share common requirements for durability, chemical resistance, and long-term performance. The protective coatings market responds with specialized formulations designed for each sector’s unique challenges, from extreme temperature variations in aerospace to constant chemical exposure in industrial settings.

Regional Trends Shaping the Protective Coatings Market Globally with a Focus on North America and Asia-Pacific's Infrastructure Spending

North America: The Powerhouse of Protective Coatings

North America is a major player in the protective coatings market, primarily due to its strong automotive manufacturing industry. The automotive sector in this region requires high-quality coatings that can withstand various challenges such as:

- Rust

- Sun damage

- Exposure to chemicals

- Wear and tear

Asia-Pacific: Emerging Market with Great Potential

The Asia-Pacific region shows significant potential for growth, thanks to large-scale investments in infrastructure. China is at the forefront of this development, leading the way with projects like:

“The Belt and Road Initiative has created unprecedented demand for protective coatings across transportation and building sectors”

Key Factors Contributing to Growth in North America and Asia-Pacific

North America:

- Increase in automotive production by 12% each year

- Strict environmental regulations encouraging the use of eco-friendly coatings

- Growing demands from the aerospace industry

Asia-Pacific:

- Annual infrastructure spending reaching $1.7 trillion

- Rapid urbanization creating new opportunities for coating applications

- Expanding requirements of the marine industry

Understanding Market Differences

It’s important to note that market dynamics differ significantly between developed economies like North America and emerging economies such as those in Asia-Pacific. While North American markets focus on technological advancements and sustainability efforts, Asia-Pacific regions prioritize cost-effectiveness and high-volume production capabilities.

This diversity presents unique opportunities for coating manufacturers to tailor their solutions according to specific regional needs.

The Role of Automotive Sector in North America’s Growth

The automotive industry in North America continues to be a key driver of growth for protective coatings. Applications of these coatings are expanding beyond traditional vehicle manufacturing processes to include facilities producing electric vehicles (EVs) and charging infrastructure as well.

Opportunities for Growth in the U.S. Protective Coatings Market Driven by Automotive Industry Expansion and Infrastructure Development Projects

The U.S. protective coatings market has significant growth potential through two main sectors: automotive manufacturing and infrastructure development. The expansion of the automotive industry creates a high demand for specialized coatings, especially in:

- Electric vehicle manufacturing facilities

- Auto parts production centers

- Assembly line protective systems

- Maintenance and repair operations

The U.S. infrastructure development initiative, valued at $1.2 trillion, presents extensive opportunities for protective coating applications across:

- Bridge rehabilitation projects

- Highway system upgrades

- Public transportation networks

- Airport facility improvements

Key Market Drivers:

- Rising domestic automotive production rates

- Implementation of stricter corrosion protection standards

- Growing demand for sustainable coating solutions

- Increased federal funding for infrastructure projects

The U.S. market benefits from advanced research and development capabilities, with coating manufacturers investing heavily in innovative solutions. These investments focus on developing high-performance products that meet specific requirements for both automotive and infrastructure applications. The market shows particular strength in powder coatings, which offer superior durability and environmental benefits compared to traditional liquid coatings.

Recent developments in nano-coating technologies have opened new opportunities for protective coating applications in extreme environments, particularly benefiting the automotive sector’s demanding specifications for wear resistance and longevity.

Japan's Role in Driving Innovation and Technology Adoption within the Protective Coatings Market

Japan is a leader in protective coating innovations, with its market experiencing significant growth due to infrastructure development and technological advancements.

Groundbreaking Technologies by Japanese Manufacturers

Japanese manufacturers have introduced several innovative technologies:

- Smart Coatings: Self-healing protective layers that automatically repair minor damage

- Nano-engineered Solutions: Ultra-thin coatings providing superior protection while reducing material usage

- Bio-based Formulations: Environmentally conscious coating alternatives derived from renewable resources

Demand for Specialized Protective Coatings

The country’s infrastructure development initiatives have created substantial demand for specialized protective coatings:

- Railway system expansions requiring corrosion-resistant coatings

- Seismic-resistant building materials with enhanced protective properties

- Marine structure protection against harsh coastal conditions

Leading the Way in High-Performance Coatings

Japanese companies are at the forefront of developing high-performance ceramic coatings for industrial applications, particularly in automotive and electronics manufacturing. These innovations have resulted in coatings that offer:

- Extended durability under extreme conditions

- Reduced maintenance requirements

- Lower environmental impact

- Enhanced resistance to chemical exposure

Setting Industry Standards through Quality Control

The Japanese market’s focus on quality control and precision manufacturing has established new industry standards for protective coating applications. This has had an impact on global manufacturing practices and product development strategies.

Germany's Leadership Position in the Protective Coatings Landscape: Exploring Trends, Innovations, and Sustainability Initiatives

Germany is a leader in protective coatings innovation, thanks to its strong industrial sector and focus on environmental sustainability. The German market has introduced several groundbreaking developments in coating technologies:

Key Industrial Applications

- Advanced automotive coating systems with self-healing properties

- High-performance marine coatings for shipbuilding

- Specialized protective solutions for renewable energy infrastructure

German manufacturers have responded to strict environmental regulations by creating:

- Water-based coating formulations with reduced VOC emissions

- Bio-based raw materials integration

- Energy-efficient application processes

The country’s leadership in sustainable practices has led to significant innovations:

“German coating manufacturers have reduced their carbon footprint by 45% since 2015 through green chemistry initiatives and renewable energy adoption in production facilities”

Market Dynamics

German research institutions work closely with industry leaders, forming a powerful innovation ecosystem. This collaboration has resulted in breakthrough technologies in:

- Nano-engineered coating materials

- Smart coating systems with integrated sensors

- Anti-microbial surface treatments for medical applications

The German protective coatings sector continues to set global standards through its commitment to quality, innovation, and sustainability.

Future Developments and Emerging Technologies Shaping the Future Outlook of the Protective Coatings Industry

The protective coatings industry is on the verge of significant technological breakthroughs. Smart coatings with self-healing properties are emerging as game-changers, capable of automatically repairing surface damage without human intervention. These innovations integrate nanotechnology and advanced polymers to create responsive coating systems.

Key technological advancements shaping the future:

- Artificial Intelligence Integration: AI-powered coating formulation processes optimize product performance and reduce development time

- Internet of Things (IoT) Sensors: Real-time monitoring systems track coating performance and predict maintenance needs

- Graphene-Enhanced Coatings: Ultra-thin protective layers offering superior strength and conductivity

- Bio-based Solutions: Plant-derived raw materials replacing traditional petroleum-based ingredients

The market’s future outlook points toward increased automation in manufacturing processes. Robotics and advanced spray technologies are revolutionizing application methods, ensuring precise coating thickness and reducing material waste.

Research indicates a shift toward multi-functional coatings that combine protective properties with additional benefits:

- Anti-microbial protection

- Energy-efficient thermal regulation

- Enhanced UV resistance

- Zero-VOC formulations

Industry leaders are investing heavily in R&D to develop coatings that meet stricter environmental regulations while maintaining high performance standards. The push toward carbon-neutral manufacturing processes signals a fundamental transformation in production methods, with companies adopting renewable energy sources and circular economy principles.

Navigating Competitive Strategies Amidst Growing Demand: A Competitive Analysis Of Major Players In The Protective Coatings Market

The protective coatings market has several dominant players who are using strategic initiatives to maintain their positions.

Major players:

1. Sika AG —— Switzerland

2. PPG Industries, Inc. —— United States

3. Akzo Nobel N.V. —— Netherlands

4. Arkema —— France

5. Sherwin-Williams Company —— United States

6. Wacker Chemie AG —— Germany

7. RPM International Inc. —— United States

8. Hempel A/S —— Denmark

9. Axalta Coating Systems —— United States

10. Kansai Nerolac Paints Limited —— India

Overall

| Report Metric | Details |

|---|---|

| Report Name |

Global Protective Coatings Market Report |

| Base Year |

2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units |

USD million in value |

| Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The protective coatings market is at a crucial point of change, expected to reach $16.87 billion by 2025. This growth is driven by several key factors:

- Technological Innovation: Advanced coating formulations continue to push boundaries in durability and environmental sustainability

- Regional Market Strength: North America, Japan, and Germany lead market development through distinct competitive advantages

- Industry Applications: Construction remains the dominant sector, with aerospace and automotive sectors showing robust growth

The future success of the market depends on three critical factors:

- Sustainability Integration

- Development of eco-friendly coating solutions

- Reduction in VOC emissions

- Implementation of circular economy practices

- Digital Transformation

- Smart coating technologies

- Automated application systems

- Data-driven quality control

- Market Adaptation

- Response to changing regulatory landscapes

- Supply chain resilience

- Strategic partnerships across regions

Companies that effectively manage these factors while continuing to innovate in product development will gain significant market share. The growth story of the protective coatings industry combines technological progress, environmental responsibility, and market adaptability – laying a strong foundation for ongoing expansion through 2025 and beyond.

Global Protective Coatings Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Protective Coatings Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Protective CoatingsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Protective Coatingsplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Protective Coatings Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Protective Coatings Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Protective Coatings Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofProtective Coatings Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the protective coatings market by 2025?

The protective coatings market is projected to grow to $16.87 billion by 2025, driven by increasing demand across various sectors.

What are the key drivers of demand in the protective coatings market?

Key factors driving global demand for protective coatings include advancements in technology, sustainability initiatives, and increasing applications in construction, aerospace, and industrial projects.

How do geopolitical events impact the production of protective coatings?

Geopolitical events can significantly affect the availability and pricing of raw materials for protective coatings, as well as production capabilities in key regions due to trade policies and economic sanctions.

What are the main types of protective coatings available in the market?

The main types of protective coatings include solvent-borne and water-borne technologies, each catering to specific applications and performance requirements.

Which regions are currently shaping the protective coatings market?

North America and Asia-Pacific are significant regions shaping the protective coatings market, with North America’s automotive sector and Asia-Pacific’s infrastructure spending driving growth.

What challenges do manufacturers face in the protective coatings industry?

Manufacturers face several challenges including supply chain disruptions, stringent regulatory compliance regarding environmental standards, and financial pressures impacting production costs.