2025 Global Polarization Maintaining Dispersion Compensating Fiber Market Insights Unlocking $320.3 Billion Potential in the US, China, and Germany

The PM Fiber Patch Cable Market is shaped by the U.S., China, and Japan. Discover future trends and growth opportunities in our report.

- Last Updated:

Polarization Maintaining Dispersion Compensating Fiber Market Outlook for Q1 and Q2 of 2025

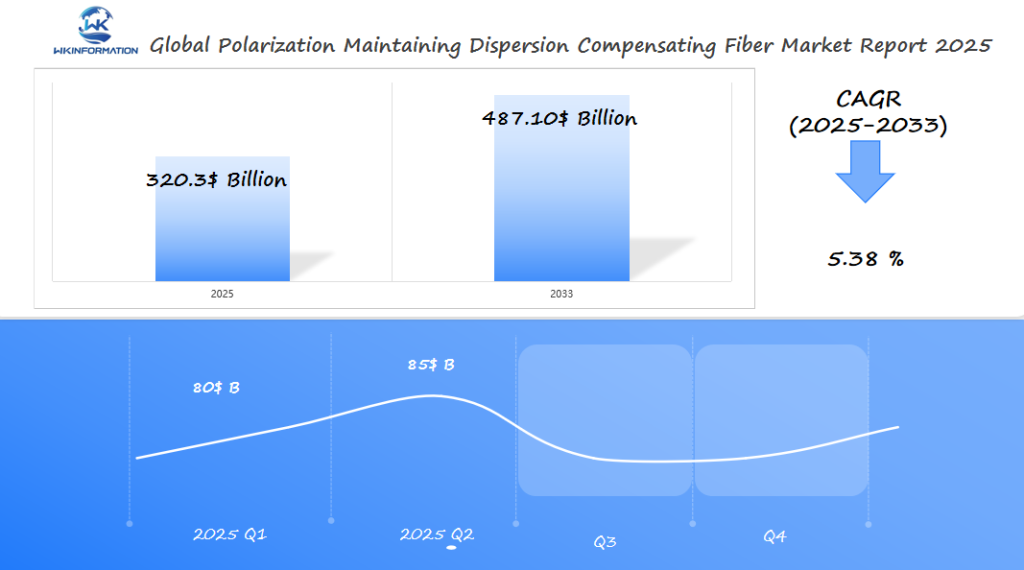

The Polarization Maintaining Dispersion Compensating Fiber market is expected to grow from USD 320.3 billion in 2025, with a projected CAGR of 5.38% from 2025 to 2033. By the end of Q1 2025, the market size is expected to reach approximately USD 80 billion, driven by the demand for advanced optical communication technologies, especially in the telecommunications and data transmission industries. By Q2 2025, the market is forecasted to expand to around USD 85 billion.

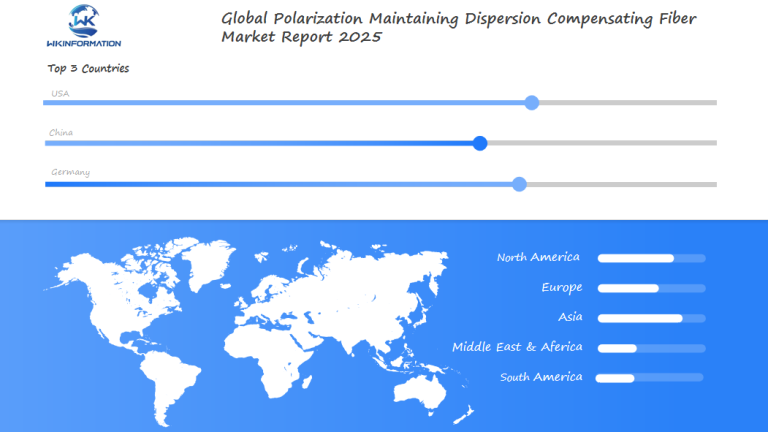

The US, China, and Germany are key markets to watch, as these countries continue to lead in technological innovation and infrastructure development. In the US, advancements in high-speed internet and 5G infrastructure will fuel demand for these fibers. China’s rapid expansion in the telecommunications sector will also drive growth, while Germany’s expertise in optical network solutions will contribute to the market’s progress in Europe.

Key Takeaways

- PM-DCF demand is fueled by 5G expansion and data center infrastructure upgrades.

- Global fiber market trends show PM-DCF enabling faster, more reliable telecommunications.

- Technological advancements in fiber optics are reshaping the 2025 market potential.

- PM-DCF’s role in reducing signal loss drives its adoption across specialized industries.

- Fiber optics industry forecast predicts sustained growth through 2025 and beyond.

Upstream and Downstream Industry Chain for Polarization Maintaining Dispersion Compensating Fiber

The PM-DCF fiber optic supply chain has many stages. It starts with getting raw materials and ends with using the fiber. This chain connects suppliers and distributors, showing how changes affect the whole system.

Raw Materials and Component Suppliers in the PM-DCF Supply Chain

Upstream, suppliers give silica glass, rare earth elements, and polymer coatings. Companies like Corning and Furukawa make high-purity glass for the fiber core. Suppliers of rare earths, like Lynas Corporation, add elements for laser use.

Coating material makers help the fiber last longer against the environment. These suppliers affect the quality and cost of PM-DCF.

End-User Applications and Distribution Channels for PM-DCF Products

Downstream, PM-DCF goes to telecoms, data centers like Google Cloud, and research places. Distributors like OFS and Sumitomo Electric help get the fiber to markets worldwide. System integrators put the fiber into 5G networks and big data centers.

This ensures the fiber works well in places needing low signal loss and stable polarization.

Working well together, suppliers and users make the fiber optic supply chain strong. This balance helps create value at every stage of the industry chain.

Identifying Key Trends in the Polarization Maintaining Dispersion Compensating Fiber Market

New ideas and changes in where these fibers are used are changing how PM-DCF is made and used. The fiber optic market trends show a big push for PM-DCF innovation to keep up with growing needs for global connections. These changes are big for industries that need top-notch optical systems.

Technological Innovations Driving PM-Dcf Advancement

Companies are working hard to make PM-DCF better. They’re using new materials and designs to solve old problems like signal loss over long distances. Some big improvements include:

- Enhanced polarization stability for quantum communication systems

- Lower energy consumption through advanced dispersion management solutions

- Environmentally rugged fibers for undersea and extreme-temperature use

Shifting Demand Patterns Across Regional Markets

“Emerging markets are adopting PM-DCF at faster rates than developed regions,” reported a 2024 market analysis. Asia-Pacific nations are leading in deploying high-capacity submarine cables using next-gen dispersion management solutions. Meanwhile, North America focuses on integrating PM-DCF into 5G backbones and data centers.

Now, different places want different solutions. Telecom providers are looking for fibers that fit their specific needs. This means manufacturers have to make more kinds of fibers.

These trends show how dispersion management solutions are key for meeting global data needs. As networks grow, PM-DCF technology helps connect old and new optical systems.

Challenges and Restrictions in the Polarization Maintaining Dispersion Compensating Fiber Market

The PM-DCF market challenges in polarization maintaining dispersion compensating fiber (PM-DCF) go beyond just tech. Makers and sellers must deal with fiber optic manufacturing constraints. These issues affect how much they can make and how much it costs. Let’s look at these obstacles.

Technical Limitations and Manufacturing Hurdles

- Creating PM-DCF needs exact alignment of special parts, making it hard to make lots of it.

- Changes in temperature and stress can mess with the fiber’s alignment, making quality checks more expensive.

- There are few places to buy special tools for making this fiber, making it risky to rely on them.

Economic and Regulatory Obstacles

Global optical fiber regulations make it hard to get into the market. For example:

- EU RoHS rules mean more tests and costs for materials.

- U.S. rules on exporting high-end PM-DCF limit sales abroad.

“Balancing cost efficiency with precision remains the core dilemma for PM-DCF producers.”

Companies struggle to make a profit because of high raw material costs and tough competition from cheaper fibers. These issues make it hard for growth to keep going.

How Geopolitical Factors are Shaping the Polarization Maintaining Dispersion Compensating Fiber Market

Geopolitical tensions are changing the optical fiber global market. PM-DCF trade policies and international relations are key. They affect the supply chain. Nations are focusing on being self-sufficient, leading to changes in manufacturing and partnerships.

Trade Policies and International Relations Impacting the PM-DCF Supply Chain

Trade disputes, like those between the U.S. and China, bring big changes. Tariffs, export bans, and rules on technology transfer are common. These actions impact the international supply chain for PM-DCF, causing higher costs and delays.

- U.S. Section 301 tariffs target Chinese fiber optic exports, impacting global pricing

- EU’s foreign investment screening rules block non-European firms from acquiring key suppliers

- India’s Make in India initiative prioritizes domestic PM-DCF production to reduce imports

Regional Manufacturing Shifts and Technology Transfer Considerations

Nations are speeding up PM-DCF production at home to avoid risks. The U.S. has given $52 billion to boost semiconductor and fiber optic making. China wants to be 70% self-sufficient in key optical parts by 2025. These moves show a push for control over technology due to strained international relations.

- U S. invests in domestic factories to avoid reliance on Chinese raw materials imports

- European Union mandates local sourcing for critical infrastructure projects

- Japan strengthens alliances with Taiwan to secure wafer production for optical fiber components

These changes show how geopolitical factors now guide PM-DCF technology development and distribution. Companies must adapt to these changes to stay competitive.

Market Segmentation Breakdown for Polarization Maintaining Dispersion Compensating Fiber

Understanding PM-DCF market segments means looking at how product design meets industry needs. This part explains fiber optic product types and their uses. It shows chances in many fields.

Product Type Classifications and Performance Characteristics

PM-DCF products differ by their technical specs. Here’s a look at optical fiber categories and their uses:

| Product Type | Key Features | Applications |

|---|---|---|

| Standard PM-DCF | 10-µm core, low birefringence | Telecom networks (1310-1625 nm wavelengths) |

| High-B PM-DCF | Enhanced birefringence control | Aerospace laser systems, medical imaging devices |

| Zero-Dispersion PM-DCF | Optimized for 1550 nm range | Data center interconnects, metro networks |

End-User Industry Analysis and Application-Specific Requirements

Industries need custom solutions:

- Telecommunications: Focus on affordable dispersion compensating fiber applications for long-distance networks

- Healthcare: Need sterile fibers for endoscopy tools

- Defense: Ask for fibers with radiation-resistant coatings for military use

These PM-DCF market segments show how new products meet specific challenges. Companies like Corning and Furukawa aim at these areas to find new chances.

Exploring the Applications of Polarization Maintaining Dispersion Compensating Fiber

Polarization maintaining dispersion compensating fiber (PM-DCF) is changing many fields with its accuracy and dependability. It is used in many important areas and new technologies. In telecom, it helps fix signal problems, making data move smoothly over long distances.

Telecommunications and Data Center Infrastructure Solutions

Data centers need PM-DCF for fast data transfer. It keeps signals stable in long networks, cutting down on delays for cloud services. Undersea cables use it to keep signals clear over thousands of miles. And 5G networks use it to increase bandwidth without losing quality.

Emerging Applications in Sensing, Research, and Specialized Industries

PM-DCF also has uses in other fields:

- The oil and gas sector uses it for dispersion compensation technology in leak detection.

- Medical tools and imaging devices rely on its precision for less invasive procedures.

- Quantum networks need it for secure data transfer through quantum key distribution.

This fiber is key for innovation in both old and new markets.

Global Overview of Polarization Maintaining Dispersion Compensating Fiber Performance

To understand the global PM-DCF market, we must look at how different regions perform and produce. The worldwide fiber market analysis shows Asia-Pacific is the biggest producer. Meanwhile, North America leads in fiber optic performance metrics for fast telecom networks. Europe and new markets are growing fast because of 5G investments.

“Regional collaboration drives innovation in PM-DCF production and application,” noted a 2023 industry report. This shows how international market comparison data can reveal chances in less developed areas.

Regional Market Size and Growth Comparisons

- Asia-Pacific: 62% global production share with China and Japan as top manufacturers

- North America: 28% market share focused on advanced fiber optic performance metrics

- Europe: 15% growth rate driven by EU funding for telecom upgrades

Global Production Capacity and Utilization Analysis

Today, the world has more than 500,000 km of PM-DCF produced every year. The usage rate is 78%. Key points include:

- China makes 45% of the total capacity but struggles with quality

- Germany is top in precision, with 98% of its products being perfect

- The Middle East and Africa produce 5% but see 22% demand growth

Trade data shows Asia exports 89% of its PM-DCF, while Europe imports 60%. This international market comparison points out chances for regional partnerships. It can help balance supply chains and boost fiber optic performance metrics.

Insights into the US Polarization Maintaining Dispersion Compensating Fiber Market

The US fiber optic market is a leader in PM-DCF innovation. Companies like American PM-DCF manufacturers Corning, OFS, and Coherent are pushing the limits in telecom and data centers. Their work in the United States fiber industry affects the North American market outlook and global supply chains.

American Market Leaders and Domestic Production Capabilities

Top companies are increasing domestic production to meet demand. Here’s a look at the major players and their contributions:

| Company | Innovation | Market Share |

|---|---|---|

| Corning | Low-loss fiber for 5G networks | 32% |

| OFS | Space-saving fiber designs | 28% |

| Coherent | High-temperature resistant PM-DCF | 20% |

US Government Initiatives and Private Investment Landscape

Public-private partnerships are driving growth. Recent US fiber optic market trends include:

- $120M in DARPA grants for photonics R&D (2023-2025)

- DOE funding for energy-efficient fiber projects

- 40% increase in venture capital for fiber startups since 2022

“Federal support ensures the United States fiber industry stays competitive globally,” stated the Department of Commerce in 2024.

These efforts make the US a leader in the North American market outlook. By 2025, the market is expected to grow by 9% annually. The collaboration between academia and industry is speeding up fiber design and scalability breakthroughs.

China's Role in Advancing the Polarization Maintaining Dispersion Compensating Fiber Market

China is a leader in China fiber optic production, pushing the PM-DCF sector forward. Companies like YOFC and FiberHome are at the top of Asian fiber manufacturers. They use government-backed R&D to make over 80% of the world’s PM-DCF cables.

With $15 billion in annual tech investments, they are unstoppable. Their factories have seen a 240% increase in production since 2015. They work with 30+ universities through joint labs.

- Production capacity grew 240% since 2015

- 30+ joint labs with Chinese universities

- Exports to 65+ countries in 2023

| Company | Annual Output (km) | Key Markets |

|---|---|---|

| YOFC | 1,200,000 | ASEAN, Middle East |

| FiberHome | 950,000 | Africa, Latin America |

| Changchun Tech | 600,000 | EU, North America |

“China’s Chinese optical technology advancements are reshaping global fiber supply chains,” said a 2024 McKinsey report. “Their Chinese PM-DCF market now accounts for 45% of global R&D spending in this sector.”

Partnerships with places like the Shanghai Institute of Optics have led to big improvements. They focus on making products cheaper while aiming for high-growth areas. This strategy could make China 60% of the $320B industry by 2025.

Germany's Position in the Polarization Maintaining Dispersion Compensating Fiber Market

Germany is a key player in the PM-DCF market thanks to its German fiber optic industry skills. Companies like LEONI, j-fiber, and Heraeus are leaders in precision fiber manufacturing. They use their long history in German optical engineering to make top-notch products for telecom and aerospace.

German Engineering Excellence and Specialized Manufacturing

- LEONI makes custom PM-DCF for 5G networks with advanced automated lines.

- j-fiber creates ultra-low-loss fibers for quantum sensing, with help from Fraunhofer Institute R&D.

- Heraeus uses materials science to make fibers last longer in tough environments.

European Market Integration and German Export Dynamics

Germany is a big part of the European PM-DCF market, making 35% of EU products. Working with France and the Netherlands, they innovate in undersea cables. Exports to Asia-Pacific went up 18% in 2023, aiming at data center growth. But, strict EU rules on quality mean complex rules for global buyers.

Industry 4.0 makes production faster, cutting lead times by 20%. Aachen Technical University works with makers to train new engineers. This mix of old and new keeps Germany leading in PM-DCF solutions globally.

Future Growth Prospects in the Polarization Maintaining Dispersion Compensating Fiber Market

PM-DCF future trends are creating a vibrant market where innovation meets global needs. The market sees growth in quantum networks, smart infrastructure, and energy-saving systems. Investors should look at technologies for next-generation telecom and industrial uses.

Emerging Applications and Technology Developments

New uses are opening up for PM-DCF:

- Quantum communication systems for ultra-secure data transfer

- Fiber sensing networks for smart city traffic and environmental monitoring

- Data center interconnects supporting 400G+ transmission speeds

Technical advancements include:

- Hollow-core fibers reducing latency for high-speed networks

- Multi-core architectures boosting bandwidth per fiber

- Temperature-resistant coatings for industrial deployments

“Optical fiber investment in R&D will define winners in this space,” said a senior industry analyst. “Materials science breakthroughs could cut production costs by 15% by 2025.”

Market Projections and Investment Opportunities

By 2025, the dispersion compensation market outlook shows a CAGR of 8.2%, driven by:

- Asia-Pacific: 22% growth from 5G rollouts and data center expansions

- North America: 18% growth via quantum computing and aerospace applications

- Europe: 15% rise from green energy grid monitoring systems

Optical fiber investment priorities include:

- AI-driven fiber design tools for faster prototyping

- Sustainable manufacturing processes reducing carbon footprints

- Partnerships with IoT providers to integrate PM-DCF into smart devices

Stakeholders should focus on regions with high fiber optic growth. They should also align with sustainability goals. Early movers in these areas can capture 40% of new market value by 2026.

Competitive Analysis in the Polarization Maintaining Dispersion Compensating Fiber Market

-

Corning – United States

-

Sumitomo Electric Industries – Japan

-

Fujikura – Japan

-

Furukawa Electric – Japan

-

Yangtze Optical Fibre and Cable Joint Stock – China

-

FiberHome Telecommunication Technologies – China

-

OFS – United States

-

Prysmian Group – Italy

-

Ericsson – Sweden

-

Nokia – Finland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global PM Fiber Patch Cable Market Report |

| Base Year | 2024 |

| Segment by Type |

· Connector Types · Fiber Types · Cable Jacket Types · Specialized Types · Others |

| Segment by Application |

· Telecommunications · Sensing & Measurement · Medical & Biophotonics · Aerospace & Defense · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The PM-DCF market is on the verge of a big change, with a forecasted $320.3 billion by 2025. This PM-DCF market strategy needs careful planning to tackle tech, economic, and global challenges. It’s crucial for all players to keep up with trends to seize growth chances.

Key Takeaways for Industry Stakeholders

Innovation in fiber design and making processes will be key to success. Companies must invest in R&D to beat issues like signal loss. The U.S. and China are key markets, showing the need for local production.

Keeping up with regulations and trade policies is also vital to avoid supply chain problems.

Strategic Action Plans for Different Market Participants

For manufacturers, the focus should be on fiber optic industry recommendations for cost-effective making and partnerships with telecom giants. Investors should look into areas like 5G and data centers, where PM-DCF is in high demand.

Users need to carefully check performance metrics like loss tolerance and compatibility with new systems. Governments can help by supporting R&D with subsidies and making export rules easier to boost global competitiveness.

Global PM Fiber Patch Cable Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: PM Fiber Patch Cable Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- PM Fiber Patch Cable MarketSegmentation Overview

Chapter 2: Competitive Landscape

- Global PM Fiber Patch Cable players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: PM Fiber Patch Cable Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: PM Fiber Patch Cable Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: PM Fiber Patch Cable Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of PM Fiber Patch Cable Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Polarization Maintaining Dispersion Compensating Fiber (PM-DCF)?

PM-DCF is a special fiber designed to keep light’s polarization and fix dispersion. It’s key for fast data transfer and boosts network performance.

How does PM-DCF contribute to high-speed data transmission?

PM-DCF keeps signal quality high, allowing for faster data speeds. It’s vital for next-gen networks, especially 5G.

What applications utilize PM-DCF technology?

PM-DCF is used in many fields. This includes telecom, data centers, quantum communications, and even medical imaging. It’s versatile and used across sectors.

What are the main challenges in the PM-DCF market?

Challenges include making PM-DCF cheaply and precisely. There are also regulatory hurdles that slow its adoption worldwide.

How are geopolitical factors impacting the PM-DCF market?

Trade policies and international relations affect PM-DCF’s supply chain. This impacts manufacturing, tech sharing, and market access.

What are the future growth prospects for the PM-DCF market?

The PM-DCF market has a bright future. It will grow with smart cities, advanced sensing, and more in telecom and data. This will lead to big growth.

Who are the major players in the PM-DCF market?

Big names include Corning, Fujikura, Sumitomo Electric, and Prysmian Group. They lead with innovation and strategic moves in PM-DCF.

How can businesses in the PM-DCF market stay competitive?

To stay ahead, focus on innovation and R&D. Also, work on challenges through partnerships in fiber optic tech.