Plant-Based Ingredients Market Expansion: $103.6 Billion Global Growth by 2025 with Key Insights from the U.S., Germany, and India

Discover comprehensive insights into the evolving global plant-based ingredients market from 2025-2033. This in-depth analysis explores market trends, regional dynamics, and industry growth factors shaping the future of sustainable food alternatives. Learn about technological innovations, consumer preferences, and investment opportunities driving this rapidly expanding sector. Perfect for stakeholders seeking to understand market share analysis and future projections in the plant-based ingredients industry.

- Last Updated:

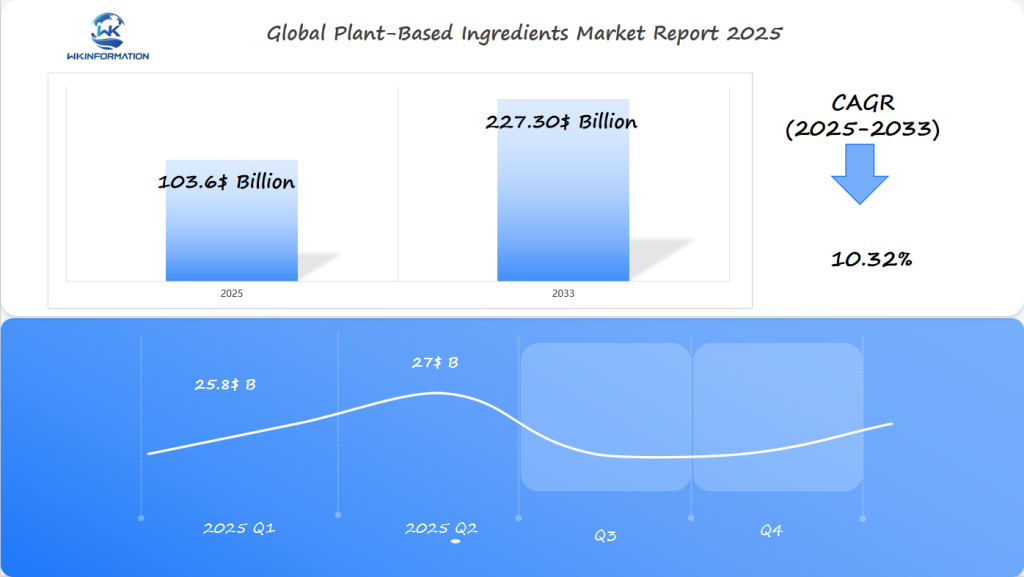

Plant-Based Ingredients Market Q1 and Q2 2025 Forecast

The Plant-Based Ingredients market is projected to reach $103.6 billion in 2025, with a CAGR of 10.32% from 2025 to 2033. In Q1 2025, the market will likely generate around $25.8 billion, as demand for plant-based food products and ingredients rises in the U.S., Germany, and India. This surge is driven by growing consumer interest in vegan and flexitarian diets, along with the increasing popularity of plant-based meat alternatives, dairy substitutes, and healthier food options.

By Q2 2025, the market is expected to reach $27 billion, supported by expanding product portfolios from plant-based food companies and the increasing availability of plant-based protein options. The U.S. and Germany will continue to lead in market demand due to their strong focus on health-conscious eating and environmental concerns. Meanwhile, India will see increased adoption of plant-based ingredients due to growing vegetarian and vegan populations.

The plant-based ingredients market will grow robustly, propelled by innovations in food processing and greater availability of plant-based alternatives across various sectors, including meat, dairy, and beverages. Consumer preferences for health, sustainability, and ethical food sources will drive demand in all three key markets.

Upstream and Downstream Industry Chain Analysis of Plant-Based Ingredients

The plant-based ingredients supply chain includes several stages, starting from farming to delivering products to consumers. By understanding how these processes are connected, we can find important challenges and opportunities in the industry.

1. Raw Material Sourcing and Production

This stage involves obtaining the necessary ingredients from various sources and ensuring their quality for production. Key activities include:

- Building partnerships with farmers who grow specific crops

- Implementing quality control measures to maintain consistent ingredient standards

- Setting up storage facilities that meet specific temperature and humidity requirements

- Establishing processing centers that are capable of extracting plant proteins

However, manufacturers face several challenges when it comes to sourcing raw materials:

- Limited availability of certain crop varieties

- Seasonal fluctuations that impact the consistency of supply

- Price volatility caused by weather conditions

- Competition for high-quality ingredients

2. Distribution Network Development

Once the raw materials are sourced and produced, they need to be distributed effectively to reach the end consumers. This involves developing a robust distribution network with the following components:

- Setting up regional distribution centers strategically located near production facilities

- Implementing cold chain logistics for ingredients that require specific temperature conditions

- Using specialized transportation equipment for bulk ingredients

- Establishing quality assurance checkpoints throughout the supply chain

As the demand for plant-based products continues to rise, distribution strategies are also evolving:

Retail Channel Expansion

- Creating dedicated sections for plant-based products in mainstream supermarkets

- Increasing shelf space for specialty health food stores

- Offering direct-to-consumer shipping options

- Forming partnerships with restaurants and institutions in the food service industry

Supply Chain Innovation

- Implementing digital tracking systems to ensure ingredient traceability

- Utilizing blockchain technology for transparency in the supply chain

- Adopting automated inventory management systems

- Optimizing delivery schedules through just-in-time practices

The plant-based supply chain is constantly evolving due to advancements in technology and changing consumer preferences. Manufacturers are investing in vertical integration strategies to secure reliable sources of ingredients while also expanding their distribution networks to meet the growing demands of the market.

Key Trends Shaping the Plant-Based Ingredients Market

The plant-based ingredients market is undergoing significant changes due to shifting consumer preferences and market dynamics. Three key trends are playing a major role in shaping the industry’s direction:

1. Clean-Label Products and Ingredient Transparency

- Consumers now scrutinize product labels with unprecedented attention

- 73% of consumers read ingredient lists before making purchase decisions

- Growing demand for products free from artificial preservatives, colors, and flavors

- Manufacturers respond by simplifying ingredient lists and using recognizable components

2. Global Shift Towards Plant-Based Diets

- Environmental impact awareness drives dietary changes

- 40% reduction in carbon footprint possible through plant-based diet adoption

- Ethical considerations regarding animal welfare influence consumer choices

- Health benefits, including lower risks of heart disease and diabetes

- Rise of flexitarian lifestyles among younger demographics

3. Sustainable Sourcing and Health-Focused Innovation

- Regenerative agriculture practices gain traction

- Soil health improvement

- Biodiversity preservation

- Carbon sequestration benefits

- Integration of functional ingredients

- Protein-rich alternatives from pea and chickpea sources

- Omega-3 fatty acids from algae

- Antioxidant-rich botanical extracts

- Supply chain transparency through blockchain technology

- Local sourcing initiatives reducing transportation emissions

These trends reflect a broader shift in consumer consciousness, where health, sustainability, and ethical considerations intersect. The industry responds through innovation in ingredient sourcing, processing methods, and product development, creating new opportunities for market expansion and technological advancement.

Understanding the Restrictions Impacting the Plant-Based Ingredients Industry

The plant-based ingredients industry faces complex regulatory challenges across different markets. In the United States, the FDA enforces strict labeling requirements for plant-based alternatives, particularly regarding protein content claims and nutritional equivalency statements. Manufacturers must navigate these requirements while ensuring their products meet established food safety protocols.

Key Regulatory Considerations:

- Product naming conventions and standards of identity

- Allergen declarations and cross-contamination prevention

- Nutritional content verification

- Health claim substantiation

- GMO status disclosure

European markets present additional complexities with the EU’s Novel Food Regulation. New plant-based ingredients must undergo extensive safety assessments before market approval, a process that can take 18-24 months and cost up to €500,000.

Compliance Challenges for Manufacturers:

- Managing varying international regulatory frameworks

- Maintaining consistent product formulations across regions

- Implementing robust quality control systems

- Securing necessary certifications (organic, kosher, halal)

- Documenting supply chain traceability

Market entry barriers create significant hurdles for new companies. Established brands control substantial market share through existing distribution networks and economies of scale. New entrants must overcome:

- High initial capital requirements for R&D and production facilities

- Limited access to specialized ingredients and suppliers

- Intense competition for retail shelf space

- Patent restrictions on processing technologies

- Brand recognition challenges

The regulatory landscape continues to evolve as governments develop specific frameworks for plant-based products. Companies must stay informed about changing requirements while balancing innovation with compliance demands.

Geopolitical Factors Affecting Plant-Based Ingredients Production and Distribution

Geopolitical dynamics shape the landscape of plant-based ingredient production and distribution through complex international relationships and trade policies. The strategic location of production facilities depends on several critical factors:

- Agricultural Land Availability: Countries with extensive arable land like Brazil, the United States, and Canada maintain significant advantages in soybean and pea production

- Cost Competitiveness: Labor costs and agricultural subsidies in different regions create varying production economics

- Political Stability: Investment decisions factor in long-term political stability of potential production locations

Recent Trade Tensions and Their Impacts

Recent trade tensions between major economies have disrupted traditional supply chains for plant-based ingredients. Key impacts include:

- Price volatility in soybean markets due to U.S.-China trade disputes

- Shifting production patterns as manufacturers seek alternative sourcing locations

- Development of regional processing capabilities to reduce dependency on international suppliers

Supply Chain Vulnerabilities

Supply chain vulnerabilities have emerged through:

“Political instability in key growing regions can trigger immediate shortages and price spikes in plant-based commodities, affecting manufacturers’ ability to maintain consistent production schedules.”

Geopolitical Risks Highlighted by COVID-19

The COVID-19 pandemic highlighted additional geopolitical risks:

- Border closures affecting ingredient transportation

- Export restrictions on agricultural commodities

- Disrupted labor availability for harvesting and processing

Influence of Regional Trade Agreements

Regional trade agreements continue to influence market access and competitive dynamics:

- EU-Mercosur trade agreement impacts on South American soy exports

- USMCA provisions affecting North American agricultural trade

- RCEP’s influence on Asian market access for plant-based ingredients

These geopolitical factors create a complex web of challenges and opportunities for manufacturers in the plant-based ingredient sector, requiring adaptive strategies and diverse sourcing options.

Exploring Plant-Based Ingredients Market Segmentation by Type

The plant-based ingredients market includes various product categories, each catering to specific consumer needs and preferences. Here’s a detailed breakdown of key segments:

1. Protein-Based Ingredients

- Soy protein isolates and concentrates

- Pea protein derivatives

- Wheat protein (vital wheat gluten)

- Rice protein

- Hemp protein

2. Dairy Alternatives

- Nut-based ingredients (almonds, cashews)

- Oat derivatives

- Coconut-based products

- Soy milk components

3. Specialty Ingredients

- Plant-based emulsifiers

- Natural colorants

- Texturizing agents

- Binding compounds

The meat alternatives segment dominates the market, with soy and pea proteins leading the charge. These ingredients offer versatile applications in creating products that mimic the texture and taste of traditional meat products. Innovative processing techniques enhance their functionality, enabling manufacturers to develop convincing alternatives to burgers, sausages, and other meat products.

Dairy substitutes represent another rapidly growing segment. Almond and oat-based ingredients have gained significant traction, particularly in milk alternatives and plant-based yogurts. The rising lactose intolerance rates and increased focus on sustainability drive this segment’s expansion.

Specialty ingredients play a crucial role in improving product texture and appearance. Plant-based emulsifiers and texturizing agents help achieve desired mouthfeel and stability in finished products, addressing common challenges in plant-based food formulation.

The Role of Applications in Shaping Plant-Based Ingredients Demand

Plant-based ingredients are used in many ways in the food industry, not just as replacements for meat and dairy products. These flexible ingredients offer creative solutions for manufacturers looking to improve their product lines.

Key Applications in Food Manufacturing:

1. Texture Enhancement

- Natural thickeners from plant sources

- Stabilizers for frozen desserts

- Binding agents in baked goods

2. Nutritional Fortification

- Protein enrichment in snack foods

- Fiber addition to beverages

- Vitamin and mineral supplementation

3. Functional Benefits

- Natural preservatives

- Color enhancement

- Emulsification properties

Advancements in food processing technology have opened up new opportunities for using plant-based ingredients. Manufacturers are now incorporating pea protein isolates to enhance the mouthfeel of beverages, while chickpea flour is being utilized as an effective egg substitute in baked goods. These examples highlight how adaptable plant-based ingredients can be in contemporary food formulation.

Research suggests that plant-based ingredients have the potential to improve the shelf-life stability of processed foods. Manufacturers are capitalizing on these qualities to develop clean-label products that align with consumer preferences for natural preservation techniques. By integrating plant-based ingredients into traditional food applications, there has been a notable enhancement in nutritional profiles without sacrificing taste or texture.

Regional Insights into the Global Plant-Based Ingredients Market

The global plant-based ingredients market reveals distinct regional patterns and growth trajectories across different geographical zones.

North America

- Leading market position with 35% global share

- Strong consumer awareness and early adoption of plant-based alternatives

- Robust retail distribution networks

- High investment in R&D for innovative ingredients

Europe

- Stringent sustainability certification requirements

- Germany leads with advanced food technology infrastructure

- Nordic countries show highest per capita consumption

- Strong focus on organic and non-GMO ingredients

Asia-Pacific

- Fastest-growing region at 8.3% CAGR

- Traditional plant-based diet cultures driving acceptance

- India emerges as key production hub for pulse proteins

- Rising middle-class population increasing demand

Regional Market Characteristics

- North American companies prioritize convenience and taste

- European manufacturers focus on clean-label certifications

- Asian markets emphasize traditional ingredients and applications

The regional dynamics reflect local consumer preferences, regulatory environments, and existing food industry infrastructure. North American markets demonstrate strong demand for ready-to-eat plant-based products, while European consumers show heightened interest in sustainable sourcing practices. Asian markets leverage traditional plant-based ingredients while adapting to modern processing technologies.

In-Depth Analysis of the U.S. Plant-Based Ingredients Market

The U.S. market stands as a powerhouse in plant-based ingredients innovation. American consumers demonstrate a strong preference for:

- Plant-based milk alternatives (almond, oat, soy)

- Meat substitutes using pea protein

- Novel ingredients like chickpea flour and aquafaba

Key Market Drivers

- Health-conscious millennials leading consumption trends

- Retail partnerships expanding product accessibility

- Investment in R&D by major food manufacturers

The U.S. regulatory landscape has adapted to support this growth, with the FDA providing clearer guidelines for plant-based ingredient labeling. This regulatory clarity has encouraged new product development and market entry.

Regional Distribution Patterns

- Coastal urban centers showing highest adoption rates

- Midwest emerging as a hub for ingredient processing

- Southern states experiencing rapid growth in retail availability

U.S. manufacturers have pioneered technological advancements in ingredient processing, particularly in:

- Protein extraction methods

- Texture optimization

- Flavor enhancement techniques

Private equity investments in U.S. plant-based startups, highlighting strong market confidence. This capital injection has accelerated innovation in ingredient development and processing capabilities.

Trends and Growth in Germany's Plant-Based Ingredients Industry

Germany is the leading country in Europe for plant-based ingredients. The German market has some unique features that make it different from other areas:

Market Dynamics

- 42% of German consumers identify as flexitarians

- Plant-based milk alternatives account for 20% of total milk sales

- Local manufacturers are focusing on clean-label products with minimal processing

Innovation Drivers

- Research institutions are partnering with food companies to develop new protein sources

- There is a focus on regional ingredients such as lupine and fava beans

- The government is providing strong support for sustainable food production initiatives

The success of the German market can be attributed to a combination of consumer awareness and industrial capabilities:

“German consumers prioritize environmental sustainability and health benefits, driving demand for locally-sourced plant-based ingredients” – German Plant-Based Association

Distribution Channels

- Specialized vegan supermarket chains

- Traditional retailers expanding their plant-based sections

- Direct-to-consumer platforms for innovative products

German manufacturers have been at the forefront of developing new processing technologies, especially in protein extraction and fermentation. These advancements have resulted in better texture and taste profiles in plant-based products, setting new industry standards throughout Europe.

The market exhibits significant regional differences, with urban centers like Berlin and Hamburg leading the way in consumption patterns. Rural areas are showing increasing acceptance through greater availability in discount supermarket chains.

An Overview of India's Plant-Based Ingredients Market

India’s plant-based ingredients market presents unique opportunities shaped by its cultural and dietary traditions. The country’s large vegetarian population creates a natural foundation for plant-based innovation, with traditional ingredients like chickpeas, lentils, and mung beans leading the market growth.

Key Features of the Market

Here are some key characteristics of the market:

- Strong domestic production: India has a robust production of pulses, legumes, and grains, which serve as cost-effective raw materials for plant-based products.

- Rising urban middle class: The demand for convenient, protein-rich plant-based alternatives is being driven by the growing urban middle class in India.

- Local startups: Innovative products using indigenous ingredients are being developed by local startups.

Regional Variations in the Market

The plant-based ingredients market in India exhibits significant regional differences:

- Northern regions: Dairy alternatives made from almonds and cashews are popular in this area.

- Southern states: Coconut-based ingredients have high consumption rates in southern states.

- Western India: Pulse-based protein development is leading in western India.

Recent Developments in the Market

The integration of traditional Indian ingredients with modern food technology creates distinctive product offerings. Local companies leverage ancient grain varieties like millets and amaranth to develop nutrient-rich plant-based ingredients, setting Indian products apart in the global market.

Future Development Prospects for Plant-Based Ingredients

The plant-based ingredients sector is on the verge of significant growth, fueled by technological advancements and changing consumer preferences.

1. Technological Innovations

- AI-powered ingredient discovery platforms enabling rapid identification of novel plant proteins

- Advanced fermentation techniques creating more authentic meat-like textures

- Precision breeding technologies improving crop yields and nutritional profiles

2. Emerging Processing Methods

- High-moisture extrusion technology for enhanced protein texturization

- Ultrasound-assisted extraction maximizing ingredient yield

- Cold plasma treatment preserving nutritional value while extending shelf life

The integration of smart manufacturing systems promises to revolutionize production efficiency:

- Automated quality control systems

- Real-time process optimization

- Reduced water and energy consumption

Research institutions and food tech companies are developing next-generation ingredients with improved functionality:

- Protein isolates with superior gelation properties

- Clean-label stabilizers from upcycled agricultural byproducts

- Bioactive compounds with enhanced bioavailability

The market anticipates significant breakthroughs in:

- Cell-cultured hybrid products combining plant proteins with cultivated meat

- Biodegradable packaging solutions from plant-based materials

- Personalized nutrition formulations using plant-based bioactives

These advancements indicate a strong growth trajectory for the plant-based ingredients industry, with innovation driving both product quality and market expansion.

Competitive Landscape of the Plant-Based Ingredients Industry

The plant-based ingredients market is highly competitive, with established food giants and innovative startups vying for dominance.

Major players:

1. Puris Proteins, LLC —— United States

2. Ingredion Inc. —— United States

3. Cargill —— United States

4. Döhler Group —— Germany

5. Health Warrior, Inc. —— United States

6. Avebe U.A. —— Netherlands

7. Atlantic Food Naturals, LLC —— United States

8. Renmatix Inc. —— United States

9. DuPont —— United States

10. Farbest Brands —— United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Plant-Based Ingredients Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The plant-based ingredients market is at a crucial point of change, with expected growth reaching $103.6 billion by 2025. This significant increase reflects fundamental shifts in consumer behavior and industry dynamics.

Key Growth Factors

Several factors are driving this growth:

- Rising Consumer Awareness: Health-conscious consumers are driving demand for clean-label products

- Technological Advancements: Improved processing methods enhance taste and texture profiles

- Supply Chain Innovation: Streamlined distribution networks reduce costs and increase accessibility

Regional Growth Potential

The market’s trajectory suggests significant opportunities across regions:

“The U.S., Germany, and India represent distinct yet complementary growth patterns in the plant-based sector” – Industry Analysis Report 2023

- North America: Focus on meat alternatives and dairy substitutes

- Europe: Leadership in ingredient innovation and sustainable practices

- Asia-Pacific: Rapid expansion in traditional plant-based products

Investment Opportunities

Investment opportunities continue to emerge as established players and startups compete to capture market share. The industry’s future success depends on:

- Sustained innovation in ingredient development

- Strategic partnerships across supply chains

- Adaptation to evolving regulatory frameworks

The plant-based ingredients sector demonstrates resilience and adaptability, positioning itself as a cornerstone of the future food industry landscape.

Global Plant-Based Ingredients Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Plant-Based Ingredients Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Plant-Based IngredientsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Plant-Based Ingredients players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Plant-Based Ingredients Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Plant-Based Ingredients Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Plant-Based Ingredients Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPlant-Based Ingredients Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the plant-based ingredients market by 2025?

The plant-based ingredients market is projected to experience substantial growth, reaching $103.6 billion globally by 2025, driven by increasing consumer demand for sustainable and healthier food options.

What are the key regions contributing to the expansion of the plant-based ingredients market?

Key insights from major regions contributing to the expansion of the plant-based ingredients market include the U.S., Germany, and India, each showcasing unique trends and consumer preferences.

What challenges do manufacturers face in sourcing plant-based raw materials?

Manufacturers encounter challenges in obtaining high-quality plant-based raw materials, ensuring consistent supply, and adhering to regulatory compliance while maintaining product quality.

How are consumer preferences influencing the plant-based ingredients market?

There is an increasing demand for clean-label products as consumers become more conscious about ingredient transparency and seek minimally processed items without artificial additives.

What geopolitical factors affect the production and distribution of plant-based ingredients?

Geopolitical dynamics influence production locations and international trade flows for plant-based commodities, affecting cost competitiveness and leading to potential supply chain disruptions due to political instability.

How does the segmentation of the plant-based ingredients market look?

The plant-based ingredients market is segmented into various categories such as meat alternatives made from soy or pea protein and dairy substitutes derived from nuts or oats, catering to diverse culinary applications.