$1.43 Billion Photodiode Arrays Market Set for Exceptional Growth in the U.S., Germany, and China by 2025

Uncover the surging $1.43 Billion Photodiode Arrays Market in the U.S., Germany, and China.

- Last Updated:

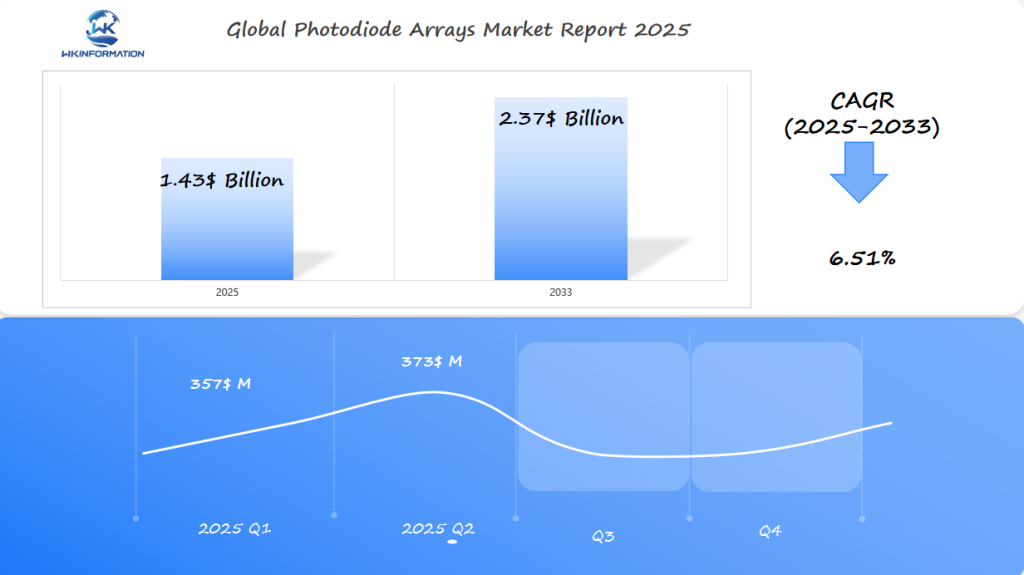

Projected Market Insights for Photodiode Arrays in Q1 and Q2 of 2025

The Photodiode Arrays market is projected to reach $1.43 billion in 2025, with a CAGR of 6.51% from 2025 to 2033. In Q1, the market is expected to generate approximately $357 million, driven by their increasing use in telecommunications, medical imaging, and industrial applications. By Q2, the market is expected to grow to about $373 million, continuing its steady expansion. The U.S., Germany, and China will be the key players in this market.

The U.S. is leading in the telecom and medical imaging sectors, Germany contributes significantly through its industrial automation and laser technologies, and China’s demand is fueled by its electronics and manufacturing industries. As technologies such as 5G and AI continue to advance, the demand for photodiode arrays is expected to rise significantly in these regions.

Upstream and Downstream Industry Chain for Photodiode Arrays

The photodiode supply chain begins with raw materials and ends with finished products. It shows how each step affects the market’s growth.

Raw Materials and Component Suppliers in the Photodiode Supply Chain

Silicon and germanium are key semiconductor materials in photodiode manufacturing. Companies like Infineon Technologies and Sumitomo Electric provide these materials. Important parts come from firms like Hamamatsu Photonics, which make light-sensitive devices.

The quality of these raw materials is crucial for the performance of the final products.

- Silicon: Widely used for cost-effective devices

- Germanium: Critical for high-sensitivity applications

- Compound semiconductors: Enable advanced optoelectronic components

End-Product Integration and Downstream Applications

| Industry Applications Healthcare | Medical imaging systems |

| Telecom | Optical communication devices |

| Consumer Electronics | Sensors in smartphones and cameras |

For photodiode integration to succeed, manufacturers and users must work together. For instance, car companies team up with photodiode makers for sensors in self-driving cars. This teamwork boosts innovation in optoelectronic components for new tech like LiDAR systems.

Trends and Innovations Driving the Photodiode Arrays Market

Photodiode innovation is changing many fields, with miniaturized photodiodes at the forefront. These small devices fit into wearables and medical tools without losing quality. High-sensitivity photodiodes can pick up weak signals in dark places or in medical imaging.

Miniaturization and Increased Sensitivity in Modern Photodiodes

Hamamatsu Photonics has made significant progress in photodiode technology. They have developed miniaturized photodiodes that are compact yet highly efficient. These small-sized photodiodes are now being utilized in various applications such as glucose monitors and car sensors.

Additionally, these advancements in photodiode technology have also benefited high-sensitivity photodiodes used in fields like astronomy and security.

Integration with AI and Machine Learning Technologies

AI is teaming up with photodiode arrays to make things more automated. IBM is working on systems where AI looks at data from miniaturized photodiodes right away. This combo makes quality control in factories better and helps create smart lighting.

Challenges Impacting the Photodiode Arrays Market

Photodiode arrays are driving innovation, but the industry faces big challenges. Photodiode manufacturing challenges and semiconductor production issues slow progress. These problems need quick solutions to keep growth going.

Technical Limitations and Manufacturing Hurdles

There are several technical and economic challenges that affect the development and production of photodiodes.

Technical Challenges

- Noise reduction is a top technical goal

- Temperature sensitivity affects reliable use

- Low yield rates raise production costs

- Dark current instability poses a risk

- Material defects can lead to quality issues

Economic Challenges

- Rising costs of photodiode components

- Pressure from the global competitive market for photodiodes

Engineers are actively working to overcome these challenges by implementing various strategies such as:

- Conducting extensive research and development to find innovative solutions

- Collaborating with industry experts and partners to share knowledge and resources

- Investing in advanced manufacturing techniques to improve efficiency and reduce costs

Pricing Pressures and Market Competition

Manufacturers face photodiode market barriers from higher material and labor costs. The intense competition leads to lower prices, making profits thin. New players and patent disputes add to the market’s complexity.

- Rising silicon and substrate costs

- IP disputes delay product launches

- Shortages of skilled semiconductor engineers

To tackle these issues, researchers and suppliers must work together. Finding a balance between quality and cost is crucial to overcome photodiode manufacturing challenges.

Geopolitical Factors Affecting Photodiode Arrays Demand

Global changes in semiconductor trade policies are changing the photodiode global market. Trade wars between big countries have made competition fierce over regional photodiode production. This has changed how goods are made and moved around.

Now, governments see semiconductor geopolitics as key to national safety. They’re making rules to help electronics manufacturing regions at home.

Trade Policies and International Relations Impact

Trade barriers like tariffs and export controls have messed up global semiconductor flows. The U.S. put limits on chip exports to China, making companies think twice about where to make things. These semiconductor trade policies affect photodiode supply chains a lot.

Asia-Pacific makers are setting up factories in new places to dodge trade problems.

- U.S. export controls on semiconductor equipment impact Taiwan’s foundries

- EU’s technology sanctions on Russia disrupted European photodiode imports

- Japan’s revised export rules affect global photodiode component sourcing

Regional Investment and Development Initiatives

Countries are pushing for more regional photodiode production with big investments. The U.S. CHIPS Act gives $52 billion to boost home chip making, including photodiodes. China’s “Made in China 2025” aims for tech self-sufficiency, and the EU wants 20% of global chip making by 2030.

These plans are moving electronics manufacturing regions to places like Mexico, Southeast Asia, and Eastern Europe. It’s creating new chances for growth.

Big companies like Texas Instruments and Infineon are growing their R&D in safe places. The semiconductor geopolitics now shapes where the latest photodiode arrays are made and used around the world.

Market Segmentation of Photodiode Arrays: Types and Applications

Photodiode arrays are made in different types to meet various needs. Each type is designed and made from specific materials. This makes them useful in many fields, from healthcare to telecommunications.

Linear vs. Area Photodiode Arrays: Technical Differences and Use Cases

Linear photodiode arrays capture data in one dimension. They are great for barcode scanners and spectroscopy because they analyze line by line. On the other hand, area photodiode arrays are 2D grids. They are perfect for cameras and industrial imaging.

| Type | Structure | Applications |

| Linear | One-dimensional pixel rows | Barcode readers, spectrometers |

| Area | 2D pixel matrix | Cameras, machine vision systems |

Segmentation by Material Type and Spectral Response

The material used affects how well a photodiode works and its price. Silicon photodiodes are good for visible to near-infrared light. They are cheap and used a lot in gadgets. InGaAs photodiodes can see infrared light better. They are more expensive but needed for high-speed data in telecom and science.

1. Silicon Photodiodes

- Wavelength Range: 200-1100 nm

- Advantages: Cost-effective, widely used

- Applications: Common in smartphones, cameras, and various sensors

2. InGaAs Photodiodes

- Wavelength Range: 900-1700 nm

- Advantages: Superior sensitivity to infrared light, suitable for high-speed applications

- Applications: Used in LiDAR systems, fiber optic communication, and other industries requiring fast data transmission

Companies like Hamamatsu and Thorlabs use these materials to make products for specific markets. They aim to offer good value and performance to their customers.

Applications of Photodiode Arrays Across Key Industries

Photodiode arrays are changing the game in many fields. They power life-saving medical tools and everyday gadgets. These small parts help with photodiode medical applications and industrial photodiodes that improve manufacturing.

Medical and Biomedical Imaging Applications

Medical progress depends on accurate light detection. Hospitals use photodiode imaging systems in many ways:

- CT and MRI scanners for real-time imaging

- Pulse oximeters for non-invasive patient monitoring

- Endoscopes for minimally invasive surgeries

Industrial Automation and Quality Control Systems

Factories rely on industrial photodiodes for accuracy. They are used in several important ways.

- Automated defect detection in production lines

- Light-based sorting systems for quality checks

- Environmental sensors for process optimization

Photodiodes also help in car tech, like LiDAR systems in self-driving cars. And in gadgets, like smartphone cameras and wearables. These arrays are key to modern technology, working behind the scenes.

Understanding the Global Photodiode Arrays Market

To understand the size of the global photodiode market and its future prospects, we need to look at regional trends and industry data. Currently, the market is valued at $1.43 billion. The analysis of the photodiode market indicates steady growth, driven by technological advancements and changing demand patterns.

Current Market Size and Growth Projections

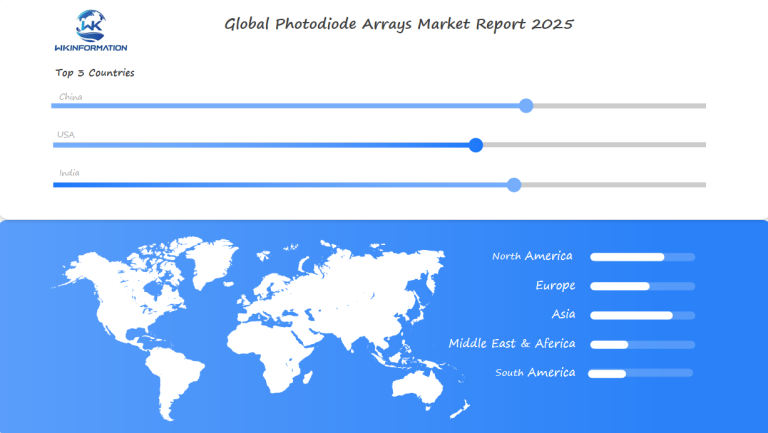

Experts predict a 6.3% annual growth rate for the photodiode market forecast until 2030. This growth is driven by increased industrial automation and healthcare imaging needs. Today, North America and Europe lead the photodiode market share. But Asia-Pacific is quickly catching up, thanks to China and India’s manufacturing bases.

Regional Market Distribution and Dynamics

Regional photodiode markets differ significantly:

- North America focuses on high-end uses like aerospace.

- Asia-Pacific, on the other hand, focuses on cost-effective production.

- Europe emphasizes research and development, boosting its photodiode market share.

- Latin America and the Middle East are growing markets with great potential.

Market dynamics also depend on pricing trends and regulatory policies. Asia-Pacific leads in production volume, but North America has higher profit margins due to advanced tech. This photodiode market analysis shows how regional strengths influence global supply chains and future opportunities.

Growth Drivers in the U.S. Photodiode Arrays Market

The American semiconductor industry is growing fast. This is thanks to the CHIPS Act, which supports making things in the U.S. It’s making US photodiode manufacturers invest in new tech. This is building a strong American optoelectronics scene.

Places like Silicon Valley are becoming key. Here, big tech companies and universities work together. They’re making new things happen.

U.S. Technology Innovation Hubs and Research Initiatives

- Silicon Valley startups and big names like IBM and Honeywell are leading in R&D. They’re working on US photodiode applications for AI and sensors.

- Government grants are helping projects that mix photodiodes with quantum computing and self-driving cars.

Defense and Aerospace Applications Boosting Demand

| Manufacturer Key Focus Teledyne Technologies | High-speed aerospace sensors |

| Hamamatsu Photonics (U.S. branch) | Medical imaging solutions |

Defense spending and private equity are helping the market grow. As American optoelectronics companies get better at making things, the US photodiode market is key for leading in tech.

China's Role in the Growth of Photodiode Arrays

China is a key player in the global Asian photodiode industry. It has made significant investments in the Chinese semiconductor market, which has positioned the country as a leader, thanks to its robust domestic manufacturers. The growth of photodiode arrays, a crucial component in various electronic devices, has been substantially influenced by these developments.

The advancements in technology and manufacturing capabilities within China have led to an increase in the production and supply of photodiode arrays. This is evident in the growing demand for these components across various sectors, including telecommunications, automotive, and consumer electronics.

With its strategic investments and focus on innovation, China is set to continue its dominance in the photodiode array market, shaping the future of this essential technology.

Manufacturing Capabilities and Supply Chain Strengths

China’s photodiode makers get support from the government. Programs like Made in China 2025 focus on improving semiconductors. They have:

- Advanced factories that cut costs

- Partnerships with big tech companies for research

- A huge China technology market for testing and growing

Domestic Demand Drives Innovation

Fast growth in key areas is boosting the industry. Here’s a look at what’s driving demand:

| Sector | Annual Growth Rate |

| Telecommunications | 15% |

| Consumer Electronics | 11% |

| Industrial Automation | 10% |

New uses in 5G and AI are growing the China technology market. Even with U.S. trade limits, Chinese companies like Canatu and Sunny Optical are gaining more market share. They do this by using local supply chains. Domestic demand now makes up over 40% of global photodiode use.

Germany's Contribution to Photodiode Arrays Development

Germany’s photodiode market is known for its engineering skill and innovation. The country’s precision optics ensure photodiodes meet high standards. This growth greatly benefits the European semiconductor industry. Germany’s expertise in sensor technology and advanced manufacturing is crucial to global optoelectronics.

German Engineering Excellence and Precision Manufacturing

Germany is a leader in automotive photodiode applications. They manufacture sensors for LiDAR systems and automotive photodiode applications in self-driving vehicles. Their German precision optics contribute to high-precision imaging for automotive safety.

Key Applications of German Engineering:

- Automotive sensors for ADAS (Advanced Driver Assistance Systems) and autonomous vehicles

- High-reliability components for industrial automation

- Precision optics used in medical and defense systems

European Research Collaborations and Innovation Networks

Germany’s German optoelectronic research grows through partnerships like the Fraunhofer Society. Working with EU groups speeds up tech progress in the European semiconductor industry. EU funding helps in projects like new photodiode materials.

These partnerships keep Germany at the forefront of German optoelectronic research. They turn lab discoveries into real products. By combining German precision optics with EU resources, Germany boosts its role in the photodiode world.

Future Prospects and Innovations in Photodiode Arrays

New advancements in photodiode technology are changing industries. Advanced photodiode arrays and innovative optical sensors could lead to billions in new opportunities. The photodiode market forecast shows growth thanks to new materials and uses.

Emerging Technologies and Next-Generation Photodiodes

Scientists are exploring new materials to boost performance:

| Material Key Advantage Target Use Case Organic Semiconductors | Flexibility, low cost | Wearable health monitors |

| Quantum Dots | Wider spectral range | AR/VR headsets |

| 2D Materials (Graphene) | High conductivity | Quantum computing interfaces |

New Application Frontiers and Market Opportunities

- Environmental sensing networks for pollution tracking

- Medical diagnostics using real-time imaging

- Automotive lidar systems for self-driving cars

Edge computing makes data processing quicker. Using recyclable materials could cut waste by 40%. The photodiode market forecast sees a 12% CAGR by 2035, thanks to these trends.

| Application | Market Potential | Key Enabler |

| Healthcare | $2.1B by 2030 | Miniaturized sensors |

| Smart Infrastructure | 15% market share growth | Wireless sensor networks |

Competitive Landscape of Photodiode Arrays Market

Leading photodiode manufacturers such as Osram, Hamamatsu Photonics, and Excelitas Technologies dominate the market through innovation and global customer outreach. However, these companies are facing intense competition from emerging players and partnerships that are reshaping the industry.

-

OSI Optoelectronics – United States

-

Advanced Photonix – United States

-

Opto Diode – United States

-

Hamamatsu – Japan

-

Excelitas Technologies – United States

-

Sensors Unlimited – United States

-

Laser Components – Germany

-

Luna Optoelectronics – United States

-

First Sensor – Germany

-

Detection Technology – Finland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Photodiode Arrays Market Report |

| Base Year | 2024 |

| Segment by Type |

· Linear Photodiode Arrays · Area Photodiode Arrays |

|

Segment by Application |

· Medical and Biomedical Imaging Applications · Industrial Automation and Quality Control Systems |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The photodiode arrays market is on a trajectory of significant growth, driven by expanding applications in telecommunications, medical imaging, and environmental monitoring. Analysts project a robust CAGR of over 6.51% through 2033, highlighting the market’s potential for remarkable development. Key trends such as innovations in materials and integration with advanced imaging systems are pivotal in shaping the market dynamics. Staying informed about these developments is crucial for stakeholders to capitalize on emerging opportunities and navigate the evolving landscape effectively.

Global Photodiode Arrays Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Photodiode Arrays Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Photodiode ArraysMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Photodiode Arraysplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Photodiode Arrays Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Photodiode Arrays Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Photodiode Arrays Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPhotodiode ArraysMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are photodiode arrays and why are they important?

Photodiode arrays are groups of photodiodes that turn light into electrical signals. They are key in many fields like healthcare, telecommunications, and consumer electronics. They help improve technologies in medical imaging, communication, and robotics, making them vital today.

What factors are driving the growth of the photodiode arrays market?

The market is growing due to technological advancements, more demand in medical imaging and industrial automation, and big R&D investments in places like the U.S., Germany, and China. Also, the use of AI and machine learning is opening up new uses for photodiodes.

How are photodiode arrays manufactured?

Making photodiode arrays starts with getting raw materials like silicon and germanium. Then, they go through etching, doping, and assembly. Making them with high precision is key to their performance and sensitivity in different uses.

Which industries benefit from photodiode arrays?

Many industries gain from photodiode arrays. In healthcare, they’re used in diagnostic tools. In automotive, they help in LiDAR for self-driving cars. And in telecommunications, they speed up data transmission. Their wide range of uses makes them crucial for many tech advancements.

What challenges does the photodiode arrays market face?

The market faces issues like:

- Technical limitations: noise and temperature sensitivity

- Manufacturing hurdles: affecting quality

- Pricing pressures: competition adding to the market’s complexity

How do geopolitical factors affect the photodiode arrays market?

Geopolitical issues, such as trade policies and international relations, have an impact on supply chains and production processes. For instance, tensions between the U.S. and China can lead to changes in production and market access, which in turn affects the distribution of photodiode arrays globally.

What is the future outlook for photodiode arrays?

The future looks bright with new technologies like quantum dots and organic semiconductors. These could change the market a lot. New uses in wearable technology and environmental sensing will also create big growth opportunities.

Who are the major players in the photodiode arrays market?

Big names in the market include Hamamatsu Photonics, Texas Instruments, and Osram Opto Semiconductors. The competition is fierce, with companies forming partnerships, merging, and acquiring others to improve their tech and reach more markets.