Palm Kernel Oil Market Outlook: $5.13 Billion Global Expansion by 2025 with Key Insights from Indonesia, Malaysia, and Nigeria

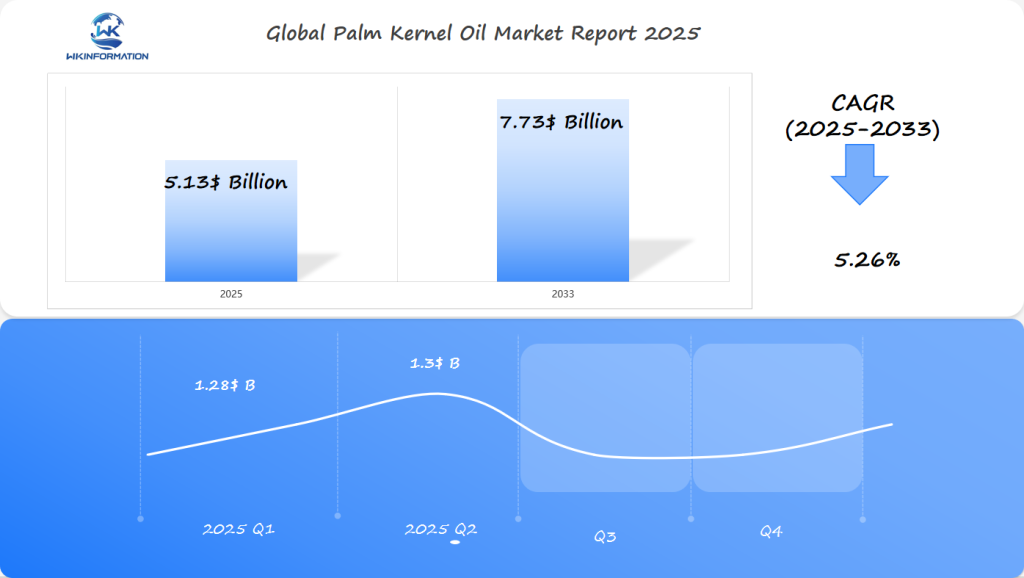

In 2025, the global Palm Kernel Oil Market reached an estimated value of USD 5.13 billion, with projections indicating growth to USD 7.73 billion by 2033 at a compound annual growth rate (CAGR) of 5.26%. This growth is driven by increasing utilization of palm kernel oil in personal care products, rising demand for biofuels, and growing consumer expenditure capacities. The market is also influenced by trends toward sustainable production practices and the health benefits associated with palm kernel oil

- Last Updated:

Palm Kernel Oil Market Q1 and Q2 2025 Forecast

The Palm Kernel Oil market is projected to reach $5.13 billion in 2025, growing at a CAGR of 5.26% from 2025 to 2033. In Q1 2025, the market will likely generate approximately $1.28 billion, supported by continued demand for sustainable oils in Indonesia, Malaysia, and Nigeria as these regions remain key producers of palm-based products for food, cosmetics, and biofuel industries.

By Q2 2025, the market is expected to reach $1.3 billion, driven by the increased consumption of palm kernel oil in both domestic and export markets. There will be a steady rise in adoption due to the growing preference for vegetable oils in plant-based food products. The market will also see more focus on sustainability and traceability in the supply chain, addressing deforestation concerns.

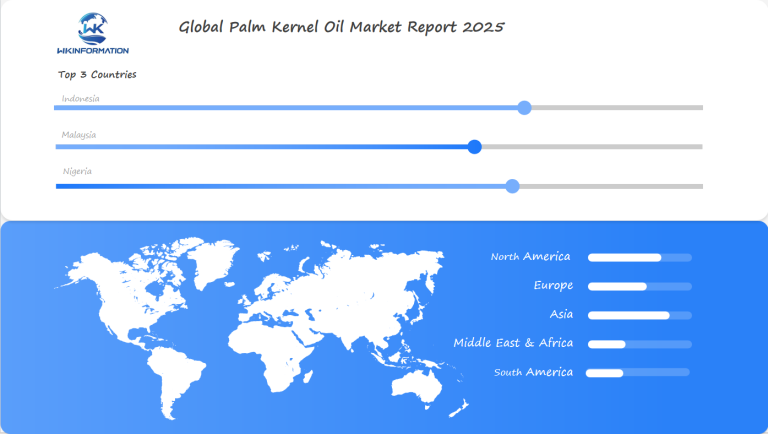

With significant production in Indonesia and Malaysia, these countries will remain dominant in the palm kernel oil market, though Nigeria is expected to increase its contribution as it builds capacity in production and exports.

Analyzing the Upstream and Downstream Industry Chain of Palm Kernel Oil

The palm kernel oil industry chain consists of two distinct segments: upstream production and downstream processing, each playing a crucial role in bringing the final product to market.

Upstream Production Process

The upstream segment involves several key stages:

- Cultivation: Palm trees require 4-5 years of growth before fruit production

- Harvesting: Fresh fruit bunches (FFB) are collected every 10-14 days

- Transportation: FFBs must reach processing facilities within 24 hours

- Initial Processing:

- Sterilization of fresh fruit bunches

- Stripping and separation of fruits

- Extraction of kernels

- Crushing and pressing of kernels

Downstream Processing and Distribution

Downstream operations transform raw palm kernel oil into various products:

Primary Processing

- Refining through degumming

- Bleaching and deodorization

- Fractionation into different grades

Distribution Channels

- Direct bulk sales to manufacturers

- Industrial packaging for B2B markets

- Consumer packaging for retail markets

End-User Industries

- Food manufacturing

- Confectionery products

- Bakery items

- Processed foods

- Personal care

- Cosmetics

- Soaps

- Hair care products

- Industrial applications

- Lubricants

- Biofuels

- Chemical processing

The efficiency of this industry chain depends heavily on infrastructure quality, technological capabilities, and market demand. Modern processing facilities employ automated systems for quality control and production optimization, while established distribution networks ensure timely delivery to end-users.

Recent technological advancements have improved extraction rates from 45% to 52%, significantly increasing production efficiency. These improvements have led to better resource utilization and reduced waste throughout the supply chain.

Key Trends Shaping the Palm Kernel Oil Market

The palm kernel oil market is experiencing several significant trends that indicate a strong potential for growth. These trends are driven by changing consumer preferences and adjustments within the industry.

1. Health-Conscious Consumer Demands

Health-conscious consumers are driving demand for palm kernel oil with their specific preferences and requirements. Some key factors influencing this trend include:

- Rising awareness of saturated fats benefits in balanced diets

- Increased preference for natural preservatives in food products

- Growing demand for palm kernel oil in dietary supplements

- Shift towards clean-label products driving natural ingredient adoption

2. Sustainability Initiatives

Sustainability has become a crucial aspect of the palm kernel oil industry, with various initiatives being implemented to address environmental concerns. Some notable sustainability efforts include:

- Implementation of RSPO (Roundtable on Sustainable Palm Oil) certification

- Adoption of zero-deforestation commitments by major producers

- Investment in sustainable farming practices and technologies

- Development of traceable supply chain systems

3. Industrial Applications Evolution

The use of palm kernel oil in various industries is evolving, leading to new opportunities for growth. Some areas where palm kernel oil is finding increased applications include:

- Expansion in cosmetics and personal care product formulations

- Rising demand in pharmaceutical applications

- Integration into biofuel production processes

- Growth in specialized oleochemical applications

4. Market Innovation Drivers

Innovation plays a vital role in shaping the future of the palm kernel oil market. Several factors are driving innovation within the industry, such as:

- Development of hybrid palm varieties for improved yield

- Advanced processing technologies for better oil quality

- Smart farming practices implementation

- Blockchain integration for supply chain transparency

5. Economic Factors

Economic factors also influence the growth prospects of the palm kernel oil market. Some key economic considerations include:

- Price competitiveness against alternative vegetable oils

- Growing middle-class population in developing markets

- Increased industrial production in emerging economies

- Rising disposable income driving processed food demand

The palm kernel oil market is actively responding to these trends by adapting and innovating continuously. Industry players are investing in research and development to meet changing consumer needs while ensuring sustainable practices are upheld. The ability of the market to respond effectively to these trends will shape its growth trajectory and impact production strategies across major producing regions.

Understanding the Restrictions Impacting the Palm Kernel Oil Industry

The palm kernel oil industry faces significant operational challenges that directly affect production capabilities and market dynamics. These restrictions create ripple effects throughout the global supply chain.

1. Labor Shortages

- Critical worker deficits in major producing regions

- 20-30% reduction in harvesting efficiency due to understaffing

- Increased production costs from higher wages to attract workers

- Delayed harvesting schedules affecting oil quality

2. Regulatory Measures

- Strict sustainability certifications required for market access

- Environmental impact assessments mandatory for new plantations

- Buffer zone requirements limiting expansion potential

- Waste management protocols increasing operational costs

3. Supply Chain Disruptions

- Limited transportation options due to container shortages

- Port congestion causing delivery delays up to 3-4 weeks

- Storage capacity constraints at processing facilities

- Quality control challenges during extended transit times

4. Sustainability Compliance

- RSPO certification requirements adding 15-20% to production costs

- Mandatory deforestation monitoring systems

- Regular audits and compliance reporting

- Investment needs for sustainable practices implementation

5. Weather-Related Challenges

- Unpredictable rainfall patterns affecting crop yields

- Extended dry seasons reducing oil content in kernels

- Flood risks in low-lying plantation areas

- Climate adaptation costs for protective measures

These industry restrictions have led to a 25% increase in production costs since 2022. Processing facilities operate at 70-80% capacity due to these combined challenges. Small-scale producers face particular hardship, with many struggling to maintain profitability under increasing regulatory pressure and labor costs.

The palm kernel oil industry’s adaptation to these restrictions shapes current market prices and influences future production strategies. Producers implementing automated harvesting systems report 40% reduction in labor dependency, pointing toward technology as a potential solution to current restrictions.

Geopolitical Factors Affecting the Palm Kernel Oil Trade

The palm kernel oil trade landscape is constantly changing due to complex geopolitical factors. Recent global events have had a significant impact on the market:

1. Trade Relations Impact

- China-US trade tensions have redirected palm kernel oil flows, with Chinese buyers increasing purchases from Southeast Asian producers

- Brexit regulations have introduced new documentation requirements for UK-EU palm kernel oil transactions

- Russian-Ukraine conflict has disrupted traditional shipping routes, forcing traders to find alternative pathways

2. Supply Chain Disruptions

- Port congestions in major Asian hubs have extended delivery times by 15-20 days

- Container shortages have pushed shipping costs up by 300% since 2021

- Limited vessel availability has created bottlenecks in key export regions

3. Price Volatility Factors

- Currency fluctuations in producing countries affect export competitiveness

- Trade tariffs and policy changes influence market accessibility

- Regional conflicts create uncertainty in supply commitments

4. Regional Trade Dynamics

- Indonesia’s export restrictions have forced buyers to diversify suppliers

- Malaysia’s bilateral agreements shape preferential trade terms

- Nigeria’s port infrastructure challenges impact West African distribution

5. Logistics Challenges

- Rising fuel costs have increased transportation expenses by 25%

- Labor strikes at major ports disrupt loading schedules

- Weather-related delays affect shipping reliability

The palm kernel oil market continuously adapts to these geopolitical pressures. Companies implement strategic measures such as:

- Building buffer stocks to manage supply uncertainties

- Developing alternative shipping routes

- Establishing direct supplier relationships

- Creating regional processing hubs

- Investing in digital tracking systems

These adaptations reshape trade patterns and influence global palm kernel oil availability and pricing structures.

Exploring Palm Kernel Oil Market Segmentation by Type

The palm kernel oil market divides into distinct segments based on processing methods and quality grades:

1. Crude Palm Kernel Oil (CPKO)

- Raw, unprocessed form extracted directly from palm kernels

- Higher fatty acid content

- Primary use in industrial applications

- Rich in lauric acid (48-50%)

2. Refined Palm Kernel Oil (RPKO)

- Processed through refining, bleaching, and deodorizing

- Lower free fatty acid content

- Enhanced stability and longer shelf life

- Preferred choice for food applications

3. Fractionated Palm Kernel Oil

- Separated into liquid and solid components

- Creates specialized products for specific industries

- Premium pricing due to additional processing

- Used in cosmetics and personal care products

4. Quality Grades

- Food Grade: Strict quality control, meets international food safety standards, higher price point

- Technical Grade: Less stringent quality requirements, used in industrial applications, more competitive pricing

Each market segment serves specific industry needs, with food-grade products commanding premium prices due to stricter quality controls and processing requirements. The segmentation reflects the versatility of palm kernel oil across various applications, from food production to industrial uses.

The Role of Applications in Shaping Palm Kernel Oil Demand

Palm kernel oil’s versatility drives its increasing demand across multiple industries. The food sector remains the primary consumer, utilizing palm kernel oil’s unique properties for:

- Confectionery Products: Its high melting point makes it ideal for chocolate coatings and fillings

- Bakery Items: Creates stable emulsions in bread, cakes, and pastries

- Non-dairy Creamers: Provides creamy texture and extended shelf life

The cosmetics industry harnesses palm kernel oil’s rich fatty acid content for:

- Moisturizing creams and lotions

- Hair care products

- Lipsticks and makeup foundations

Industrial Applications continue to expand:

- Biofuel production

- Lubricants manufacturing

- Specialty chemicals development

The pharmaceutical sector values palm kernel oil for:

- Drug Delivery Systems: Enhanced absorption properties

- Topical Medications: Anti-inflammatory formulations

- Dietary Supplements: Natural vitamin E source

Recent market data shows a 15% increase in demand from personal care manufacturers, while food applications maintain steady 8% annual growth. The biofuel sector demonstrates particularly strong potential, with European markets showing 25% year-over-year consumption growth in renewable energy applications.

The animal feed industry incorporates palm kernel oil as a high-energy supplement, particularly in poultry and livestock nutrition programs, contributing to approximately 12% of total market demand.

Regional Insights into the Global Palm Kernel Oil Market

The global palm kernel oil market exhibits distinct regional characteristics, with each major region displaying unique market dynamics and consumption patterns.

North America

- Rising demand in food manufacturing sector drives market growth

- Price sensitivity to crude oil fluctuations impacts market stability

- Strong presence of oleochemical industries maintains steady consumption

- Growing preference for natural ingredients boosts market demand

Asia Pacific

- Dominant market share due to high production capabilities

- Increased biofuel consumption shapes regional demand

- Expanding food processing industry drives market growth

- Labor shortages impact production capabilities

- Weather conditions affect harvest yields

European Market Dynamics

- Strict sustainability regulations shape import patterns

- RSPO certification requirements influence supplier selection

- Premium pricing for certified sustainable products

- Limited domestic production creates import dependency

Regional Price Variations

- North American prices: $1,450-1,600 per metric ton

- Asia Pacific prices: $1,300-1,450 per metric ton

- European prices: $1,600-1,800 per metric ton

Supply Chain Considerations

- Port congestion affects delivery timelines

- Transportation costs vary significantly by region

- Storage capacity limitations impact regional availability

- Cross-border regulations influence trade flows

The Asia Pacific region maintains its position as the largest consumer market, accounting for 60% of global consumption. North American demand continues to grow at 4.2% annually, driven by industrial applications. European markets demonstrate increasing preference for certified sustainable products, with 75% of imports now requiring sustainability documentation.

Recent logistical challenges have created regional price disparities, with European markets experiencing 15-20% higher prices compared to Asian markets. These regional variations reflect local regulatory environments, transportation costs, and market-specific demand patterns.

In-Depth Analysis of Key Producing Countries' Palm Kernel Oil Industries

Indonesia: Leading Global Production

Indonesia is the largest producer of palm kernel oil in the world. The country’s success can be attributed to:

- Advanced mechanization in harvesting processes

- Strategic plantation management systems

- Efficient processing facilities across major production regions

However, Indonesian producers also face specific challenges such as:

- Labor shortages in remote plantation areas

- Weather-related disruptions affecting crop yields

- Infrastructure limitations in certain regions

Malaysia’s Strategic Market Position

Malaysia remains the second-largest producer of palm kernel oil. The country has implemented sustainable certification programs and developed high-yield cultivation techniques to maintain its position.

The Malaysian palm kernel oil sector demonstrates strength through:

- Advanced research and development initiatives

- Robust quality control measures

- Strategic export partnerships with key markets

Nigeria’s Emerging Potential

Nigeria’s palm kernel oil industry shows promising growth potential. The country is investing in modern processing facilities and developing smallholder farming programs to boost production.

Key growth drivers in Nigeria include:

- Government initiatives supporting agricultural expansion

- Rising domestic demand

- Improved access to international markets

The country’s production landscape benefits from favorable climate conditions, available arable land, and growing private sector investment.

Each country’s unique approach to production and market development shapes the global palm kernel oil industry. Indonesia focuses on volume and efficiency, Malaysia emphasizes quality and sustainability, while Nigeria builds infrastructure for future growth. These distinct strategies create a dynamic market environment that supports continued industry expansion.

Trends and Growth in Malaysia's Palm Kernel Oil Market

Malaysia’s palm kernel oil market is showing great strength through strategic innovations and market adaptations. The country’s production capacity has reached 4.2 million metric tons in 2024, marking a 15% increase from previous years.

Key Market Developments

Here are some key developments in the palm kernel oil market:

Advanced Processing Technologies

- Implementation of automated harvesting systems

- Integration of AI-driven quality control measures

- Enhanced extraction efficiency reaching 95%

Sustainable Production Initiatives

- MSPO certification adoption by 92% of producers

- Reduced water consumption by 30% through recycling

- Zero-waste practices in major processing facilities

Domestic Market Growth

The domestic market is showing strong growth patterns with:

- 25% increase in local consumption

- Rising demand from cosmetic manufacturers

- Expanded use in pharmaceutical applications

New Opportunities for Producers

Malaysian producers have found new market opportunities through:

- Direct partnerships with European buyers

- Strategic alliances in emerging Asian markets

- Value-added product development for premium segments

Recent investments in R&D have led to the development of specialized palm kernel oil variants, targeting high-value industries such as premium cosmetics and nutraceuticals. These developments position Malaysia as a leader in sustainable palm kernel oil production, with projected market share growth of 8% annually through 2025.

An Overview of Nigeria's Palm Kernel Oil Industry

Nigeria’s palm kernel oil industry has its own unique features and opportunities in the global market. The country has the capacity to produce around 955,000 metric tons of palm kernel oil each year, indicating a significant potential for growth.

Main Production Areas

The key regions in Nigeria where palm kernel oil is produced include:

- Niger Delta Region

- South-Eastern States

- Cross River State

Challenges Facing the Industry

The industry is facing specific challenges that affect its competitiveness:

- Limited use of machinery in harvesting processes

- Old palm plantations that need rejuvenation

- Gaps in infrastructure for processing facilities

Understanding Market Trends

The dynamics of the market are as follows:

- Local demand for palm kernel oil is higher than what is currently being produced

- Small-scale farmers contribute to 80% of the total production

- Increasing domestic consumption is driving growth in the market

Technological Advancements

Recent adoptions of technology have led to improvements in extraction efficiency:

- Use of modern processing equipment

- Introduction of high-yield seedling varieties

- Development of sustainable farming practices

Government Support and Private Sector Investments

The Nigerian government has shown support through agricultural policies and incentives, creating favorable conditions for the expansion of the industry. Private sector investments are targeting modernization efforts, with a focus on improving production techniques and expanding processing capabilities.

Quality Control Measures for Export Opportunities

Local processors have started implementing quality control measures to meet international standards, positioning Nigerian palm kernel oil for increased export opportunities.

Future Development Prospects for Palm Kernel Oil Beyond 2025

The palm kernel oil market shows promising growth trajectories stretching well into the 2030s. Market analysts project a compound annual growth rate (CAGR) of 5.26% from 2025 to 2033, pushing the market value beyond $7.73 billion by 2033.

Key Growth Drivers

- Rising demand in emerging economies

- Increased adoption in pharmaceutical applications

- Growing preference for natural ingredients in cosmetics

- Expansion of biofuel initiatives

Technological Innovations Reshaping Production

The integration of AI and IoT technologies promises to revolutionize palm kernel oil production methods. Smart sensors and automated harvesting systems can potentially increase yield rates by 25-30% while reducing labor costs.

Emerging Technologies:

- Drone-based plantation monitoring

- Precision agriculture systems

- Blockchain supply chain tracking

- Advanced extraction technologies

Sustainability Innovations

New sustainable practices are being developed to address environmental concerns:

- Zero-waste processing systems

- Water recycling technologies

- Biomass energy generation

- Carbon capture implementation

Production Efficiency Developments

Research institutions are working on genetic improvements to create high-yielding palm varieties resistant to diseases and climate stress. These developments could increase oil yield by up to 40% per hectare.

Market Adaptation Strategies

Companies are investing in:

- Advanced processing facilities

- Supply chain digitalization

- Sustainable certification programs

- R&D for new applications

The integration of these technological advancements with sustainable practices positions the palm kernel oil industry for substantial growth. Industry leaders predict that by 2033, automated processes will handle 60% of production operations, significantly reducing costs and environmental impact while improving product quality and consistency.

Competitive Landscape of the Palm Kernel Oil Industry

The palm kernel oil industry has several key players who influence the market through strategic actions and production capabilities. These companies stay ahead of the competition using different methods.

Major Industry Leaders:

1. Golden Agri Resources Ltd. —— Singapore

2. Godrej Agrovet Ltd. —— India

3. PT Astra Agro Lestari Tbk —— Indonesia

4. Cargill Inc. —— USA

5. United Palm Oil Industry Public Company Ltd. —— Thailand

6. Wilmar International Ltd. —— Singapore

7. Sime Darby —— Malaysia

8. Kulim Bhd. —— Malaysia

9. Musim Mas Group —— Indonesia

10. Alami Group —— Indonesia

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Palm Kernel Oil Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The palm kernel oil market is at a crucial point, ready for significant growth to reach $5.13 billion by 2025. This growth shows the industry’s ability to adapt and meet global demands while facing challenges.

Promising Signs for the Market

Several factors indicate a positive outlook for the palm kernel oil market:

- Sustainable Growth: The projected 5.26% CAGR through 2033 signals steady market expansion

- Innovation Focus: Industry leaders continue investing in technological advancements for improved production efficiency

- Market Diversification: Growing applications across food, cosmetics, and pharmaceutical sectors strengthen market stability

Key Challenges Ahead

However, there are important challenges that the industry must overcome to ensure future success:

- Balancing production demands with environmental responsibilities

- Implementing advanced technologies for sustainable farming practices

- Developing stronger supply chain resilience against geopolitical disruptions

- Meeting evolving consumer preferences for natural and organic products

A Collaborative Approach

The combined efforts of major producing nations – Indonesia, Malaysia, and Nigeria – alongside strategic initiatives from industry leaders create a strong foundation for sustained growth. As the market changes, companies that prioritize sustainability, innovation, and responsiveness to market needs will likely become leaders in the industry.

The palm kernel oil industry’s transformation continues, driven by technological advancement, sustainability practices, and growing global demand across various sectors.

Global Palm Kernel Oil Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Palm Kernel Oil Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Palm Kernel OilMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Palm Kernel Oilplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Palm Kernel Oil Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Palm Kernel Oil Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Palm Kernel Oil Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofPalm Kernel OilMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the global palm kernel oil market by 2025?

The global palm kernel oil market is expected to reach $5.13 billion by 2025, driven primarily by significant production from countries such as Indonesia, Malaysia, and Nigeria.

What are the key trends influencing the growth of the palm kernel oil market?

Key trends shaping the palm kernel oil market include increasing health consciousness among consumers and a growing focus on sustainability practices within the industry.

How do geopolitical factors impact the palm kernel oil trade?

Geopolitical events significantly influence trade dynamics in the palm kernel oil market, affecting relationships between producing and consuming countries, as well as leading to logistical challenges that impact pricing and availability.

What restrictions currently affect the production capabilities of palm kernel oil?

Current restrictions impacting the palm kernel oil industry include labor shortages and regulatory measures aimed at promoting sustainability, which can limit production capabilities.

Which regions are seeing notable demand trends for palm kernel oil?

Demand trends for palm kernel oil are particularly strong in North America and Asia Pacific, with European regulations also playing a significant role in shaping market dynamics.

What are some future development prospects for the palm kernel oil industry beyond 2025?

Future development prospects for the palm kernel oil industry beyond 2025 include potential technological advancements that could enhance production efficiency and promote sustainable practices within the sector.