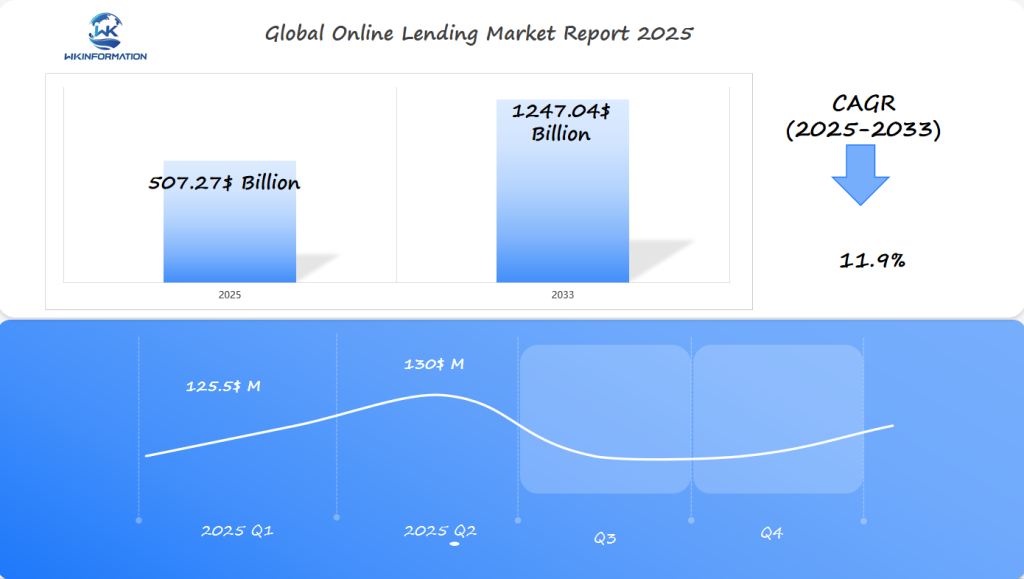

Online Lending Market Expansion: $507.27 Billion Global Opportunity by 2025 with Key Insights from the U.S., India, and the U.K.

In 2025, the global Online Lending market reached an estimated value of USD 507.27 billion, with projections indicating growth to USD 1247.04 billion by 2033 at a compound annual growth rate (CAGR) of 11.9%. This growth is driven by the increasing adoption of digital lending platforms, enhanced customer experiences, and the rising penetration of internet services, which expand access to online lending solutions across various demographics and regions

- Last Updated:

Online Lending Market Q1 and Q2 2025 Forecast

The Online Lending market is projected to reach $507.27 billion in 2025, growing at a CAGR of 11.9% from 2025 to 2033. In Q1 2025, the market will likely generate around $125.5 billion, driven by increasing adoption of digital lending platforms in the U.S., India, and the U.K. as consumers and businesses increasingly turn to alternative credit sources.

By Q2 2025, the market is expected to reach $130 billion, boosted by the expanding fintech ecosystem, a growing shift toward online credit access, and regulatory frameworks improving for peer-to-peer lending and micro-loans. The U.S. will continue to lead the market, while India and the U.K. will see rapid adoption due to the growing need for financial inclusion and alternative financing options.

The online lending market will continue its upward trajectory as digital solutions become more embedded in traditional financial systems, particularly for unbanked and underbanked populations, and as borrowers seek faster, more convenient lending solutions.

Analyzing the Upstream and Downstream Industry Chain of Online Lending

The online lending ecosystem operates through a complex network of upstream and downstream participants, creating a seamless flow of financial services.

Upstream Components

- Technology Infrastructure Providers: Companies like AWS and Microsoft Azure supply cloud computing services

- Data Analytics Firms: Credit bureaus and alternative data providers enable risk assessment

- Payment Gateway Services: PayPal, Stripe, and similar platforms facilitate fund transfers

- Traditional Financial Institutions: Banks and credit unions provide capital backing

- Software Development Companies: Build and maintain lending platforms

Downstream Elements

- Individual Borrowers: Seeking personal loans, education financing, or debt consolidation

- Small Business Owners: Looking for working capital or expansion funds

- Real Estate Investors: Pursuing property financing options

- Student Loan Seekers: Exploring education funding alternatives

The interaction between these components creates a dynamic market environment. Upstream providers develop innovative technologies for credit scoring, fraud detection, and automated underwriting. These advancements enable downstream consumers to access loans through mobile apps and web platforms with minimal documentation.

The interconnectivity between sectors drives market evolution. When technology providers introduce new security features, lenders can offer safer transactions to borrowers. Similarly, changing borrower preferences influence upstream development priorities, such as the creation of specialized lending algorithms for specific industries or loan types.

Key Trends Shaping the Online Lending Market

The rapid adoption of smartphones has changed the way loans are applied for. 73% of consumers now prefer using mobile banking apps for financial transactions, which has prompted lenders to create user-friendly mobile interfaces. As a result, there are now opportunities for instant loan approvals and real-time credit assessments through mobile platforms.

Changes in Digital Lending Driven by Millennials and New-to-Credit Segments

Millennials and individuals with no credit history are playing a significant role in reshaping digital lending:

- Alternative Credit Scoring: Lenders are placing less importance on traditional credit scores and instead focusing on analyzing digital footprints and transaction histories.

- Personalized Loan Products: Loan offerings are being tailored based on individual spending patterns and financial behaviors.

- Quick Disbursement: Same-day funding options are being made available through digital wallets and UPI systems.

Technological Advancements Transforming Lending Processes

Technological advancements have brought about significant changes in the way lending processes operate:

- AI-Powered Risk AssessmentMachine learning algorithms are being used to evaluate credit worthiness.

- Pattern recognition techniques are being employed to detect fraudulent activities.

- Document verification is being automated for efficiency.

- Blockchain IntegrationSmart contracts are being utilized to create transparent loan agreements.

- Decentralized lending platforms are emerging as an alternative to traditional models.

- Enhanced security measures are being implemented to protect borrower data.

These innovations have led to a reduction in loan processing times, going from weeks to just minutes, while also improving the accuracy of risk assessments. Digital platforms are now capable of handling complex credit decisions through automated systems, allowing lenders to cater to previously underserved market segments with customized financial products.

Understanding the Restrictions Impacting the Online Lending Industry

The regulatory landscape for online lending varies significantly across regions, creating complex compliance requirements for digital lenders.

Regulations in India

India’s Reserve Bank has implemented strict guidelines requiring digital lenders to:

- Maintain transparent loan terms

- Disclose all fees upfront

- Register with regulatory authorities

- Follow data protection protocols

- Implement grievance redressal mechanisms

These regulations aim to protect borrowers while fostering industry growth. Digital loan aggregators must now display their RBI registration status prominently on their platforms, building trust through transparency.

Regulations in the United States

The U.S. regulatory framework presents its own challenges, with state-by-state variations in lending laws creating operational complexities. Lenders must navigate:

- State usury laws

- Licensing requirements

- Fair lending practices

- Consumer protection regulations

- Anti-money laundering compliance

Impact of Compliance Costs

The cost of regulatory compliance impacts operational efficiency, with smaller platforms facing significant challenges. A typical online lender spends 15-20% of operational costs on compliance-related activities, including:

- Legal consultations

- Technology upgrades

- Staff training

- Documentation systems

- Regular audits

Effects on Innovation and Market Access

Digital lenders balancing innovation with regulatory requirements often face delayed product launches and restricted market access. These limitations affect their ability to serve underbanked populations, particularly in emerging markets where regulatory frameworks continue to evolve.

Geopolitical Factors Affecting the Online Lending Ecosystem

Geopolitical stability plays a crucial role in shaping the online lending landscape across global markets. In emerging economies like India, political uncertainties can directly impact investor confidence and lending patterns. The 2023 market data reveals that stable political environments correlate with a 23% higher adoption rate of digital lending platforms.

Key Regional Impacts:

1. India’s Market Dynamics

- Political reforms supporting digital transactions

- State-level policy variations affecting lender operations

- Rural-urban divide influenced by regional political priorities

2. U.S. Political Climate

- Federal interest rate decisions

- State-specific regulatory frameworks

- Cross-border lending policies

3. U.K. Post-Brexit Landscape

- Revised financial services regulations

- New international lending partnerships

- Modified compliance requirements

Political decisions in these regions create ripple effects across the global lending ecosystem. The U.S. Federal Reserve’s policy shifts influence interest rates worldwide, while Brexit has reshaped the U.K.’s fintech relationships with EU markets.

Government initiatives also drive market growth through:

- Digital infrastructure development

- Financial inclusion programs

- Cross-border transaction policies

- Cybersecurity frameworks

Recent data shows countries with supportive government policies experience 15-20% faster growth in their online lending sectors compared to markets with restrictive approaches.

Exploring Online Lending Market Segmentation by Type

The online lending market divides into distinct segments, each serving specific borrower needs and financial requirements:

1. P2P Lending

- Direct matching between individual lenders and borrowers

- Lower interest rates compared to traditional banks

- Popular for personal loans and debt consolidation

2. Business Lending

- Short-term working capital solutions

- Equipment financing options

- Invoice factoring services

- Merchant cash advances

3. Consumer Lending

- Personal loans for various purposes

- Buy-now-pay-later services

- Credit builder loans

- Emergency funding options

4. Student Lending

- Education refinancing

- Private student loans

- School-specific lending programs

Each segment utilizes unique underwriting criteria and risk assessment models. P2P platforms often employ social scoring mechanisms, while business lenders focus on cash flow analysis and asset valuation. Consumer lending platforms typically use alternative data points beyond traditional credit scores, including utility payments and rent history.

The market segmentation reflects evolving borrower preferences and technological capabilities. Digital platforms now offer specialized products tailored to specific industries, demographics, and credit profiles. This specialization drives innovation in credit assessment methods and loan product development.

The Role of Applications in Shaping Online Lending Demand

Mobile applications have transformed the lending industry, making financial services more accessible than ever before. According to recent data, 78% of loan applications now come from mobile devices, indicating a significant change in how consumers behave.

How Lending Apps Are Changing the Borrowing Experience

Lending apps have introduced advanced features that have greatly improved the borrowing process:

- Faster loan decisions: Using artificial intelligence (AI), lenders can now make instant decisions on loan applications.

- Easy document verification: Borrowers can simply use their smartphone cameras to verify documents, eliminating the need for physical paperwork.

- Convenient loan processing: With digital signatures, borrowers can complete the loan process without any physical paperwork.

- Automated repayments: Loan repayments are now linked directly to borrowers’ bank accounts, making it easier for them to stay on track with payments.

These technological advancements have significantly reduced the time it takes to process loans, going from weeks to just minutes. This has led to more borrowers choosing these apps, especially those who need quick access to funds.

Gamification in Lending Apps: Encouraging Responsible Borrowing

Popular lending apps such as SoFi and Lending Club have incorporated gamification techniques to promote responsible borrowing habits:

- Monitoring credit scores

- Providing educational resources on personal finance

- Offering rewards for timely loan repayments

- Tailoring loan recommendations based on individual needs

The success of these apps can be attributed to their ability to offer:

“An effortless user experience combined with clear lending terms and competitive interest rates” – Digital Lending Report 2023

Specialized Lending Apps for Small Business Owners

Small business owners particularly benefit from specialized lending apps that cater to their unique needs:

- Financing options for unpaid invoices

- Credit lines based on inventory value

- Loans specifically designed for seasonal businesses

- Quick access to working capital

These specialized features provided by lending applications contribute to market growth as they continuously introduce new functionalities and offerings to meet various borrowing requirements.

Regional Insights into the Global Online Lending Market

The global online lending landscape presents distinct characteristics across different regions, shaped by local economic conditions, technological infrastructure, and regulatory environments.

Asia-Pacific Region

- Fastest-growing market

- High smartphone penetration driving digital lending adoption

- Significant untapped potential in rural areas

- Strong presence of P2P lending platforms in China and Southeast Asia

North America

- Mature market with sophisticated lending technologies

- High adoption rates among small businesses

- Strong focus on alternative credit scoring methods

- Leading region in AI-powered lending solutions

Europe

- Strict regulatory framework under EU guidelines

- Growing popularity of open banking initiatives

- Strong emphasis on cybersecurity and data protection

- Increasing cross-border lending activities

Latin America

- Rapid growth in mobile-first lending solutions

- Rising fintech investments in Brazil and Mexico

- Focus on serving underbanked populations

- Emerging blockchain-based lending platforms

Middle East and Africa

- Growing Islamic fintech lending solutions

- Mobile money services driving digital lending

- Increasing focus on SME financing

- Regulatory sandboxes promoting innovation

The regional distribution of online lending activities reflects varying levels of digital infrastructure development and financial inclusion efforts. Market penetration rates range from 8% in developing regions to 67% in advanced economies, indicating significant growth potential in emerging markets.

In-Depth Analysis of the U.S. Online Lending Market

The U.S. online lending market is a leader in digital financial innovation, with strong technology infrastructure and high consumer adoption rates. Recent data shows that 78% of American consumers prefer digital lending platforms over traditional banks for personal loans.

Key Factors Driving the Market

Several factors are driving the growth of the online lending market in the U.S.:

- Strong fintech ecosystem: Companies like LendingClub and Prosper have transformed peer-to-peer lending

- Advanced credit scoring systems: Use of alternative data points for assessing risk

- Regulatory clarity: Clear guidelines from the SEC and OCC supporting digital lending operations

Recent Changes in the U.S. Market

Recent developments in the U.S. online lending market indicate significant changes:

- Emergence of specialized lending platforms focusing on specific industries

- Adoption of blockchain technology for improved security

- Collaborations between traditional banks and online lenders

Intensifying Competition in the U.S. Market

Competition in the U.S. online lending market has increased with new players introducing innovative products. Square Capital offers merchant cash advances based on real-time transaction data, while SoFi has expanded its services beyond student loan refinancing to provide comprehensive financial solutions.

Factors Supporting Growth in the U.S. Market

The growth of the U.S. online lending market is supported by:

- Increasing adoption of mobile payments

- Rise of embedded lending solutions within e-commerce platforms

These factors indicate ongoing expansion and innovation in digital lending services in the U.S.

Trends and Growth in India's Digital Lending Market

India’s digital lending landscape has transformed dramatically. The country’s vast population of tech-savvy millennials drives substantial growth in alternative lending platforms.

Key Growth Drivers:

- Rising smartphone penetration in rural areas

- Government’s push for financial inclusion

- Increasing adoption of UPI payments

- Growing acceptance of digital KYC

The Reserve Bank of India’s regulatory framework has strengthened consumer trust in digital lending platforms. This structured approach has attracted significant investments from venture capital firms and established financial institutions.

Popular Digital Lending Segments:

- MSME business loans

- Personal loans

- Buy Now Pay Later (BNPL)

- Education financing

- Supply chain financing

Indian digital lenders have pioneered innovative credit assessment models using alternative data points:

- Social media footprint

- Utility bill payments

- Online shopping behavior

- Digital transaction history

The market has seen rapid adoption in Tier 2 and Tier 3 cities, where traditional banking infrastructure remains limited. Digital lending platforms have successfully bridged this gap by offering:

- Vernacular language support

- Quick loan disbursement

- Minimal documentation

- Flexible repayment options

Recent partnerships between fintech companies and traditional banks have created hybrid lending models, combining the efficiency of digital platforms with the trust of established financial institutions.

The U.K.'s Online Lending Market

The U.K.’s online lending market is a leader in financial innovation, supported by strong regulations and advanced technology. The Financial Conduct Authority (FCA) is responsible for overseeing digital lenders and ensuring stability in the market.

Key Features of the Market:

- Peer-to-peer lending platforms are widely available

- Many people are using digital banking services

- Open banking infrastructure is highly developed

- AI-driven credit assessment tools are being used

British consumers prefer digital financial services, with 71% of loan applications now submitted online. The market has seen significant growth in specific areas of lending:

- Property Finance: Digital mortgage platforms

- SME Lending: Alternative business funding solutions

- Consumer Credit: Buy-now-pay-later services

- Student Loans: Education finance platforms

Local fintech companies like Funding Circle and Zopa have transformed lending practices by introducing automated underwriting systems and real-time risk assessment capabilities. These innovations have reduced loan processing times from weeks to minutes.

The U.K.’s regulatory sandbox approach has allowed new lending models to thrive while still protecting consumers. This balance between innovation and regulation has attracted significant investment in the industry, with London becoming Europe’s top fintech hub for digital lending solutions.

Future Development Prospects for Online Lending

The online lending landscape is expected to undergo significant changes by 2025 and beyond. Artificial Intelligence and Machine Learning algorithms will transform credit scoring systems, allowing lenders to evaluate creditworthiness using unconventional data such as social media activity and online behavior.

Key technological advancements shaping the future:

- Embedded Finance Integration – Lending services directly integrated into e-commerce platforms and business software

- Voice-Activated Lending – Loan applications and account management through smart speakers and virtual assistants

- Blockchain-Based Systems – Decentralized lending platforms offering improved security and reduced transaction costs

The emergence of Banking-as-a-Service (BaaS) platforms will open doors for non-financial companies to provide lending products. It is anticipated that companies like Shopify and Uber will broaden their financial service offerings, including loans for merchants and drivers.

In the competitive landscape, personalization will play a vital role in distinguishing lenders. By utilizing big data analytics, lenders will be able to design tailored loan products that cater to the specific behaviors and requirements of individual borrowers. This transformation will result in:

- Faster loan approvals

- Flexible interest rates based on borrower profiles

- Automated solutions for managing debt

- Predictive analysis to prevent defaults

Furthermore, the integration of Internet of Things (IoT) devices will facilitate ongoing monitoring of business performance for commercial loans. This advancement will empower lenders to modify loan terms according to real-time data and risk evaluations.

Competitive Landscape of the Online Lending Industry

The online lending industry is a competitive space with a mix of established financial institutions and innovative fintech startups vying for market share.

Market Leaders:

1. Funding Circle Limited —— UK

2. On Deck Capital Inc. —— USA

3. Prosper Marketplace, Inc. —— USA

4. LendInvest Limited —— UK

5. Bizfi LLC —— USA

6. Salesforce —— USA

7. PhonePe —— India

8. Tata Capital —— India

9. L&T Finance —— India

10. Hero FinCorp —— India

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Online Lending Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global online lending market is currently undergoing a significant transformation. It is expected to reach $507.27 billion by 2025 and further expand to $1247.04 billion by 2033. This impressive growth is driven by shifts in consumer behavior and advancements in technology.

Key Market Dynamics

Several factors are contributing to the growth of the online lending market:

- An average annual growth rate of 11.90% projected until 2033

- Two-thirds of borrowers now prefer digital loan applications

- Strong market presence in the U.S., U.K., and India

- Increasing adoption among millennials and individuals with no credit history

Critical Factors Shaping the Market’s Evolution

The evolution of the online lending market is influenced by several key factors:

- Digital transformation: This is driving operational efficiency in the industry.

- Regulatory frameworks: These are enhancing stability in the market.

- Strategic partnerships: Collaborations between traditional banks and fintech companies are becoming more common.

- Innovation in risk assessment: The use of AI and machine learning is improving how lenders evaluate creditworthiness.

The future of online lending depends on its ability to adapt to changing consumer needs while ensuring strong security measures are in place. Companies that can effectively combine technological innovation with regulatory compliance will gain a significant share of the market. This digital revolution in lending is making it easier for people to access credit, creating opportunities for both established players and new fintech startups.

Global Online Lending Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Online Lending Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Online LendingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Online Lendingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Online Lending Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Online Lending Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Online Lending Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofOnline LendingMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the online lending market by 2025?

The online lending market is expected to reach a value of $507.27 billion by 2025, driven by increasing adoption of digital platforms and changing consumer behavior.

What are the key components of the online lending industry chain?

The online lending industry chain consists of upstream players such as lenders and technology providers, and downstream consumers including borrowers and end-users, all of whom interact within the online lending ecosystem.

What trends are currently shaping the online lending market?

Key trends include increasing smartphone adoption for loan applications, a shift towards online loan applications among millennials and new-to-credit segments, and advancements in technology like AI and blockchain that enhance lending processes and risk assessment.

How do regulations affect the online lending industry?

Current regulations impact online lending by imposing compliance requirements that vary by region. In India, for example, transparency among digital loan aggregators is crucial for building consumer trust, while regulatory frameworks can create challenges in terms of compliance costs for lenders.

What geopolitical factors influence the online lending ecosystem?

Geopolitical stability significantly impacts lending markets, especially in emerging economies like India. Government policies also play a vital role in shaping online lending growth in regions such as the U.S. and U.K.

What insights can be gained from analyzing specific regional markets like the U.S., India, and U.K.?

Each region has unique dynamics affecting its online lending landscape; for instance, the U.S. market is characterized by advanced technological integration, India’s market shows rapid growth in digital solutions, while the U.K. focuses on regulatory compliance and consumer protection measures.