Online Jewellery Market Insights: $46.1 Billion Global Growth by 2025 with Key Insights from the U.S., India, and the U.K.

Explore the dynamic world of online jewellery retail, from supply chain intricacies to market trends. Learn about key industry players, technological innovations, regulatory challenges, and regional online jewellery market performances across the US, India, and UK. Discover how consumer preferences, distribution channels, and emerging technologies shape this evolving sector.

- Last Updated:

Online Jewellery Market Q1 and Q2 2025 Forecast

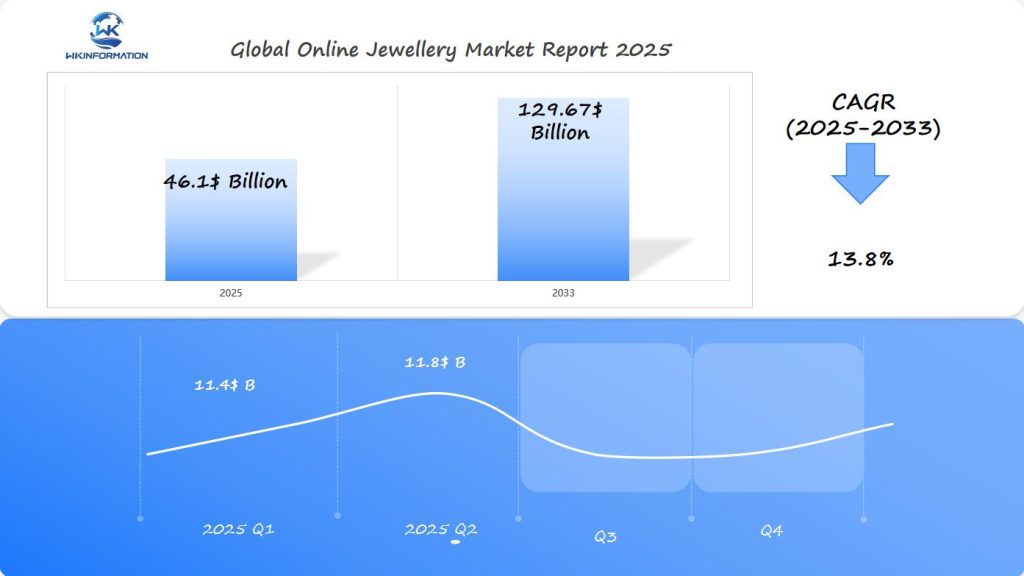

The Online Jewellery market is expected to reach $46.1 billion in 2025, growing at a CAGR of 13.8% from 2025 to 2033. In Q1 2025, the market will likely generate $11.4 billion, driven by the growing adoption of e-commerce platforms for purchasing luxury items. The U.S., India, and the U.K. will remain the largest markets for online jewellery sales, fueled by rising disposable incomes, increased digital engagement, and changing consumer preferences towards online shopping.

By Q2 2025, the market is expected to reach $11.8 billion, with increased demand for customized, personalized jewellery and ethical materials driving sales. The U.S. will continue to dominate, but emerging markets like India will see substantial growth, driven by the increasing penetration of e-commerce and mobile shopping.

The surge in online purchasing will be driven by the convenience and accessibility offered by digital platforms, alongside innovations in virtual try-ons and augmented reality shopping experiences.

Upstream and Downstream Insights into the Online Jewellery Industry

The online jewellery industry operates through a complex network of suppliers, manufacturers, and distributors working together to deliver precious pieces to consumers.

Key Players in the Supply Chain

The supply chain of the online jewellery industry consists of several key components:

- Raw material suppliers (precious metals, gemstones)

- Design houses and artisans

- Manufacturing facilities

- Quality control specialists

- Digital platform providers

- Logistics partners

The Production Process

The production process begins with sourcing raw materials from mines and suppliers. These materials undergo strict authentication and quality checks before entering the manufacturing phase. Skilled artisans and modern manufacturing facilities transform these materials into finished pieces through various stages:

- Initial Design: CAD modeling and prototyping

- Crafting: Metal forming, stone setting, polishing

- Quality Assurance: Testing for durability and authenticity

- Digital Documentation: Photography and product listing creation

Evolution of Distribution Channels

Distribution channels in the online jewellery sector have evolved significantly over time. Here are some of the key distribution methods currently being used:

- Direct-to-Consumer (D2C): Branded websites offering exclusive collections

- Marketplace Platforms: Amazon, Etsy, specialized jewellery marketplaces

- Social Commerce: Instagram shops, Facebook marketplace

- Hybrid Models: Online-offline integration with virtual try-ons and physical showrooms

Factors Influencing Online Jewellery Sales

The success of online jewellery sales depends on several critical factors:

- Secure payment systems

- Reliable shipping partners

- Comprehensive insurance coverage

To ensure authenticity and traceability throughout the supply chain, leading brands often implement blockchain technology as an additional measure.

Key Trends Driving the Growth of the Online Jewellery Market

Rising disposable incomes across global markets have transformed consumer spending patterns in the luxury jewellery sector. The average household now allocates 2-3% of their annual income to jewellery purchases, with a significant portion directed toward online platforms.

Income-Driven Market Dynamics:

- Middle-class expansion in emerging markets

- Increased spending power in developed nations

- Growing preference for investment-grade jewellery pieces

The perception of jewellery as a status symbol has evolved dramatically in the digital age. Luxury brands report a 45% increase in first-time buyers through online channels, particularly among millennials seeking distinctive pieces that reflect their personal style and social status.

Technology Integration Reshaping Customer Experience:

- Virtual try-on solutions using AR technology

- 360-degree product visualization

- AI-powered personalized recommendations

- Blockchain authentication for precious stones

Digital innovations have revolutionized the traditional jewellery shopping experience. Leading retailers now offer immersive features that bridge the gap between physical and online shopping:

- Real-time gemstone certification verification

- Custom design tools with instant pricing

- Virtual styling consultations

- Mobile-first shopping experiences

The integration of social commerce has created new purchase pathways, with platforms like Instagram and Pinterest driving 38% of discovery-based jewellery purchases among younger consumers.

Challenges and Regulatory Factors Impacting Online Jewellery

The online jewellery market faces significant regulatory hurdles that shape its operational landscape. Hallmarking requirements across different regions create complex compliance scenarios for retailers operating in multiple markets. In the U.S., the Federal Trade Commission (FTC) enforces strict guidelines on precious metal content claims, while the U.K. maintains mandatory hallmarking through the British Hallmarking Council.

Key compliance challenges include:

- Authentication and certification requirements for precious stones

- Cross-border trade regulations affecting international shipping

- Digital payment security standards

- Consumer protection laws specific to luxury goods

- Supply chain transparency documentation

Market barriers present substantial obstacles for online jewellery businesses. The need for substantial initial capital investment limits market entry for new players. Traditional consumer preferences for in-person purchases create resistance to online shopping, particularly for high-value pieces.

Critical operational challenges:

- Building consumer trust in digital platforms

- Managing returns and sizing issues

- Implementing secure payment gateways

- Meeting varied regional quality standards

- Maintaining inventory accuracy across digital channels

The regulatory environment becomes particularly complex for businesses operating across multiple jurisdictions. India’s implementation of the Good and Services Tax (GST) has created additional compliance requirements for online jewellers, while the European Union’s strict consumer protection laws demand specific product information disclosures and return policies.

Geopolitical Factors Affecting Online Jewellery Production and Sales

Global political dynamics create significant ripples across the online jewellery industry’s supply chains and market performance. Recent trade tensions between major economies have triggered price fluctuations in precious metals and gemstones, directly impacting production costs and retail prices.

Supply Chain Disruptions

- Border restrictions and diplomatic conflicts affect raw material sourcing

- Shipping delays due to geopolitical tensions increase operational costs

- Alternative supply routes often result in higher transportation expenses

Trade Policy Impact

- Tariff changes influence pricing strategies across markets

- Import duties affect profit margins for cross-border sales

- Currency fluctuations create pricing challenges for international retailers

Regional Market Performance

- Political stability affects consumer confidence in specific markets

- Sanctions on certain regions limit market access and growth

- Local regulations vary based on diplomatic relationships

The Russia-Ukraine conflict has demonstrated how geopolitical events can disrupt diamond supply chains, forcing jewellery retailers to seek alternative sources. Similarly, trade tensions between the U.S. and China have led to increased costs for precious metal procurement, affecting pricing strategies for online retailers.

Successful online jewellery businesses now implement robust risk management strategies, including:

- Diversified supplier networks across multiple regions

- Local warehousing in key markets

- Dynamic pricing models accounting for geopolitical risks

- Strategic partnerships with suppliers in stable regions

Segmentation by Type: Understanding Online Jewellery Categories

The online jewellery market features distinct product categories that cater to diverse consumer preferences and occasions. Here’s a comprehensive breakdown of the main jewellery segments:

Primary Product Categories:

- Rings: Wedding bands, engagement rings, fashion rings

- Necklaces: Pendants, chains, chokers, statement pieces

- Earrings: Studs, hoops, drops, chandeliers

- Bracelets: Tennis bracelets, bangles, charm bracelets

- Watches: Luxury timepieces, smart watches, fashion watches

Popular Materials and Styles:

- Precious MetalsGold (yellow, white, rose)

- Platinum

- Sterling silver

- GemstonesDiamonds

- Colored stones (sapphires, emeralds, rubies)

- Semi-precious stones

Market data reveals strong consumer preferences for customizable pieces and minimalist designs. Stackable rings and layered necklaces have gained significant traction, particularly among millennial buyers. The rise of sustainable jewellery has created a new sub-category featuring recycled metals and ethically sourced gemstones.

Price point segmentation plays a crucial role:

- Entry-level fashion jewellery ($50-$500)

- Mid-range fine jewellery ($500-$5,000)

- Luxury segment ($5,000+)

The fastest-growing category remains demi-fine jewellery, which bridges the gap between fashion and fine jewellery, offering quality materials at accessible price points.

Applications of Online Jewellery and Their Influence on Demand

The online jewellery market thrives on diverse purchasing occasions that drive consumer demand throughout the year. Here’s how different applications shape the market:

1. Special Occasions & Celebrations

- Wedding jewelry represents 28% of online purchases

- Anniversary gifts account for 22% of sales

- Birthday celebrations drive 18% of transactions

- Holiday season purchases peak during December

2. Cultural Significance

- Traditional Indian weddings boost gold jewelry demand

- Chinese New Year sparks jade and gold item purchases

- Religious festivals increase demand for specific designs

- Regional preferences shape local market trends

3. Personal Milestones

- Graduation ceremonies fuel charm bracelet sales

- Career achievements drive luxury watch purchases

- Self-gifting trends rise among young professionals

- Personal style expression influences buying patterns

4. Seasonal Influences

- Valentine’s Day drives romantic jewelry sales

- Mother’s Day boosts pendant and ring purchases

- Summer wedding season increases bridal jewelry demand

- Year-end bonuses spark luxury item investments

The gifting culture significantly impacts purchase patterns, with 65% of online jewelry buyers selecting items as presents for others. Cultural traditions continue to shape design preferences, particularly in markets like India where traditional gold jewelry maintains strong demand during festivals and ceremonies.

The rise of self-purchasing among women has created new market opportunities, with personal milestone celebrations driving 35% of non-gifting purchases in the online jewelry sector.

Regional Market Performance and Key Growth Regions

The global online jewellery market showcases distinct regional patterns, with Asia Pacific leading at 39.28% market share in 2024. This dominance stems from rapid digitalization and increasing smartphone penetration across the region.

Regional consumer behavior trends reveal unique purchasing patterns:

- U.S. Market: Preference for customized pieces and sustainable jewellery

- Indian Market: Traditional designs with modern twists, festival-driven purchases

- U.K. Market: Focus on affordable luxury and ethical sourcing

The growth trajectory varies significantly across regions, influenced by:

- Local economic conditions

- Digital infrastructure development

- Cultural preferences

- Retail modernization pace

These regional variations create diverse opportunities for market players, with emerging markets in Southeast Asia and Latin America showing promising growth potential. The shift toward online platforms has accelerated across all regions, particularly in urban areas with high internet penetration rates.

U.S. Market: The Role of E-Commerce in Online Jewellery Growth

The U.S. online jewellery market, valued at $9.8 billion, is experiencing a significant shift towards digital retail. American consumers have specific preferences when it comes to shopping for jewellery online:

Key Market Characteristics:

- Mobile shopping accounts for 67% of online jewellery purchases

- Average cart value stands at $257 for fine jewellery

- Peak shopping periods align with major holidays (Valentine’s Day, Christmas)

The U.S. market has advanced digital infrastructure and high internet usage rates. Leading platforms like Blue Nile and James Allen have transformed the traditional way of buying jewellery by introducing:

- Virtual try-ons using AR technology

- 360-degree product visualization

- AI-powered size recommendations

Consumer Demographics:

- Primary buyers: Professional women aged 25-45

- Rising segment: Male shoppers (engagement rings)

- Key motivation: Self-purchase luxury items

U.S. retailers are adjusting to changing consumer preferences by offering new features:

- Buy-now-pay-later options

- Virtual consultations with gemologists

- Same-day delivery in major metropolitan areas

- Customization services through digital platforms

The market shows strong growth potential in sustainable and ethical jewellery segments, with 73% of U.S. consumers expressing interest in transparent sourcing practices.

India’s Booming Online Jewellery Market: Trends and Innovations

India’s online jewellery market has great potential for growth, driven by a combination of traditional preferences and digital innovation. The market holds a 39.28% share in the Asia Pacific region, with local consumers increasingly using online platforms to buy their jewellery.

Key Market Features

Some key characteristics of the Indian online jewellery market are:

- Digital-First Brands: Companies like CaratLane and Bluestone have transformed the industry by introducing features such as virtual try-ons and 3D imaging.

- Traditional-Modern Fusion: There is a blending of traditional craftsmanship with modern designs to attract younger buyers.

- Regional Customization: Online platforms are offering designs that cater to specific regions, taking into account the diverse cultural preferences across the country.

Innovation in the Market

The market is also witnessing various innovations, including:

- AI-powered design recommendations that suggest personalized jewellery options based on customer preferences.

- Blockchain technology being used to verify the authenticity of products and ensure transparency in the supply chain.

- Virtual showrooms that provide detailed visualizations of products, allowing customers to explore items from the comfort of their homes.

Consumer Preferences

Indian consumers have specific preferences when it comes to jewellery:

- They tend to favor 22K and 24K gold jewelry for its purity and value.

- Traditional wedding collections hold significant importance as they are often passed down through generations.

- Contemporary daily wear pieces are gaining popularity among those looking for versatile and stylish options.

Adaptations by Local Players

In response to these market demands, local players have made several adaptations:

- Flexible payment options such as EMI (Equated Monthly Installment) plans are being implemented to make high-value purchases more accessible.

- Hybrid shopping experiences that combine online convenience with offline touchpoints (such as pop-up stores or partner boutiques) are being offered.

- Specialized platforms focusing solely on wedding jewelry are being created to cater to this specific segment.

Impact of Mobile Commerce

The rise of mobile commerce has had a significant impact on purchasing patterns in the online jewellery market. According to recent statistics, 78% of online jewelry purchases now take place through smartphones. This shift in behavior has prompted retailers to prioritize developing mobile-first shopping experiences that are optimized for smaller screens. Additionally, there is a growing emphasis on enhancing security features during transactions and streamlining payment processes for a seamless checkout experience.

The U.K. Market: Online Jewellery Adoption and Consumer Preferences

The U.K. online jewellery market demonstrates unique characteristics shaped by British consumer behavior and digital shopping preferences. British shoppers show a strong inclination towards personalized jewellery pieces and sustainable, ethically sourced materials.

Key Market Characteristics

- Price-conscious purchasing: U.K. consumers actively compare prices across multiple platforms before making decisions

- Mobile shopping dominance: 67% of jewellery purchases occur through mobile devices

- Brand loyalty: British shoppers display strong attachment to established domestic jewellery brands

Popular Product Categories in the U.K. Market

- Sterling silver pieces (42% of sales)

- Fashion jewellery under £100 (31% of sales)

- Fine jewellery in the £100-500 range (18% of sales)

- Luxury items above £500 (9% of sales)

British consumers prioritize authenticity certificates and detailed product descriptions when making online jewellery purchases. The market shows significant growth in the demi-fine jewellery segment, bridging the gap between costume and fine jewellery.

Local brands like Links of London and Astley Clarke have adapted their digital platforms to meet these preferences, offering virtual try-ons and detailed sizing guides. The U.K. market also sees strong performance in occasion-specific jewellery, particularly for weddings and anniversaries, with peak sales occurring during the summer months.

Future Developments in Online Jewellery Sales and Marketing

The online jewellery sector is set for significant changes through new technologies and innovative marketing methods. Artificial Intelligence and Machine Learning are transforming product recommendations, with brands using AR technology for virtual try-on solutions to create immersive shopping experiences.

Key technological advancements shaping the future:

- 3D printing enabling rapid prototyping and customization

- Blockchain technology for authentication and transparency

- AI-powered chatbots providing 24/7 personalized customer service

- Virtual showrooms offering lifelike product visualization

Marketing strategies are evolving to meet changing consumer expectations. Brands are adopting data-driven personalization to deliver targeted content and product suggestions based on browsing history, purchase patterns, and style preferences.

Innovative marketing approaches gaining traction:

- User-generated content campaigns featuring real customers

- Social commerce integration with Instagram and Pinterest

- Live streaming events showcasing new collections

- Influencer collaborations with micro-influencers in specific niches

Sustainability messaging is becoming central to marketing strategies, with brands highlighting ethical sourcing and eco-friendly practices. The rise of subscription-based models for fine jewelry is creating new revenue streams, while virtual styling sessions are bridging the gap between online and offline experiences.

Companies are investing in voice commerce capabilities, preparing for the growing adoption of smart speakers and voice-activated shopping. These technological integrations are reshaping how consumers discover, interact with, and purchase jewelry online.

Competitive Landscape: Leading Online Jewellery Players

The online jewellery market features several dominant players who set industry benchmarks through innovative strategies and market presence:

-

Chow Tai Fook Jewellery – China

-

LVMH – France

-

Richemont – Switzerland

-

Signet Jewelers – United States

-

Amazon – United States

-

Alibaba – China

-

Etsy – United States

-

Tiffany & Co. – United States

-

Harry Winston Inc. – United States

-

HStern – Brazil

-

GRAFF – United Kingdom

-

De Beers – United Kingdom

-

Pandora – Denmark

-

Cartier – France

-

Chopard & Cie SA – Switzerland

-

Swarovski – Austria

-

Pomellato – Italy

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Online Jewellery Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The online jewellery market is currently undergoing a significant transformation due to advancements in technology, changes in consumer behavior, and shifts in the market. It is expected to grow to $46.1 billion by 2025, indicating its strong potential and ability to adapt.

Key Market Indicators

The following factors highlight the positive outlook for the market:

- Digital Integration: The use of AR/VR technologies to create immersive shopping experiences

- Regional Diversity: A strong presence in the U.S., India, and U.K. markets, each with its own unique growth patterns

- Consumer Evolution: An increase in demand for luxury items and personalized experiences, which is influencing product offerings

Critical Success Factors

The success of the market depends on several key factors:

- Optimizing supply chains

- Complying with regulations

- Innovating through technology

- Enhancing customer experience

Leading brands are adapting their strategies to incorporate:

- Personalized shopping experiences

- Multi-channel retail approaches

- Sustainable practices

- Digital-first marketing initiatives

The industry’s growth trajectory indicates that it will continue to expand, driven by rising disposable incomes and increased digital adoption. Market players who embrace innovation, prioritize customer experience, and remain flexible in their business models are likely to capture a significant share of this growing digital landscape.

Global Online Jewellery Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Online Jewellery Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Online Jewellery Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalOnline Jewellery Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Online Jewellery Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Online Jewellery Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Online Jewellery Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Online Jewellery Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key players in the online jewellery supply chain?

The online jewellery supply chain includes various key players such as manufacturers, wholesalers, distributors, and retailers. Each player plays a crucial role in the production processes and distribution channels that bring jewellery pieces to consumers.

How is consumer behavior impacting the online jewellery market?

Rising disposable incomes and an increasing inclination towards luxury items as status symbols are significantly driving demand in the online jewellery market. Consumers are more willing to invest in high-quality, luxurious pieces, which is reshaping purchasing trends.

What challenges do online jewellery retailers face regarding regulations?

Online jewellery retailers encounter several regulatory challenges, including compliance issues that vary across regions. These challenges can impact operations and sales strategies, making it essential for businesses to stay updated on local laws and regulations.

How do geopolitical factors influence online jewellery production?

Geopolitical tensions can affect supply chains and production costs within the online jewellery sector. Trade policies also play a vital role in determining how international sales and exports of jewellery products are conducted.

What are the popular applications for purchasing online jewellery?

Popular applications for online jewellery purchases include gifting occasions such as weddings and anniversaries. Cultural significance also influences consumer preferences for specific types or designs of jewellery items, affecting overall demand.

Which regions are currently leading in the online jewellery market growth?

Recent data indicates that North America, particularly the U.S., along with India and the U.K., are key growth regions in the online jewellery market. These areas showcase distinct consumer behavior trends that contribute to their respective market performances.