2025 Oil Surge Relay (OSR) Market: Unlocking $1.32 Billion Global Growth, Driven by Demand in China, US, India

Discover key insights into the global Oil Surge Relay (OSR) market, focusing on the top three markets – China, US, and India. This comprehensive analysis explores market dynamics, technological advancements, and growth prospects through 2025, highlighting industry applications, competitive strategies, and emerging trends in transformer protection technology.

- Last Updated:

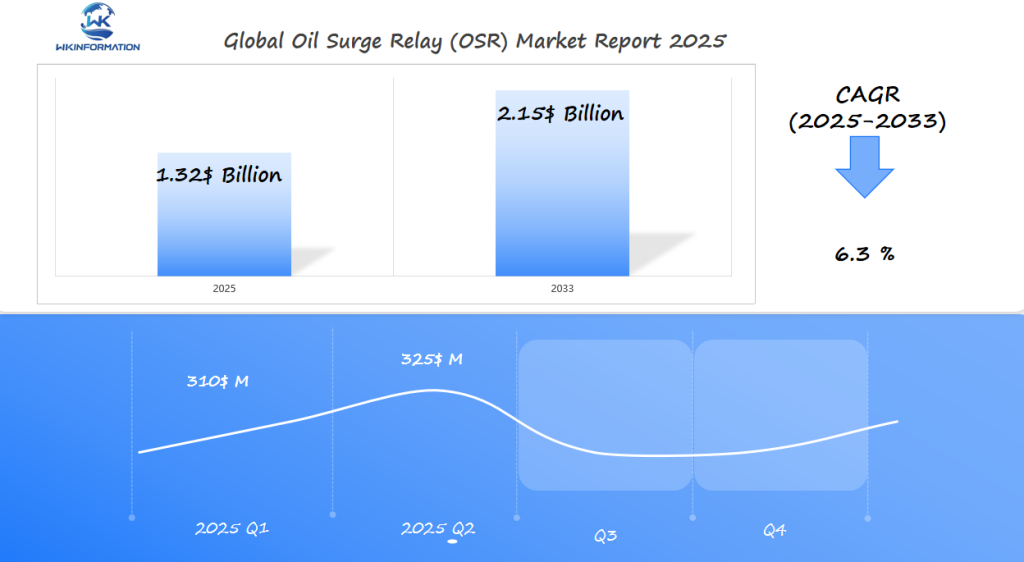

Projected Market Data for Oil Surge Relay (OSR) in Q1 and Q2 of 2025

The global Oil Surge Relay (OSR) market is on track to reach an estimated value of USD 1.32 billion by the end of 2025, reflecting a steady growth trajectory with a compound annual growth rate (CAGR) of 6.3% from 2025 to 2033. For the first two quarters of 2025, we can expect a robust market performance, with Q1 generating approximately USD 310 million, followed by Q2 with an estimated USD 325 million. These projections account for seasonal demand fluctuations and the increasing integration of OSR solutions in key industrial sectors.

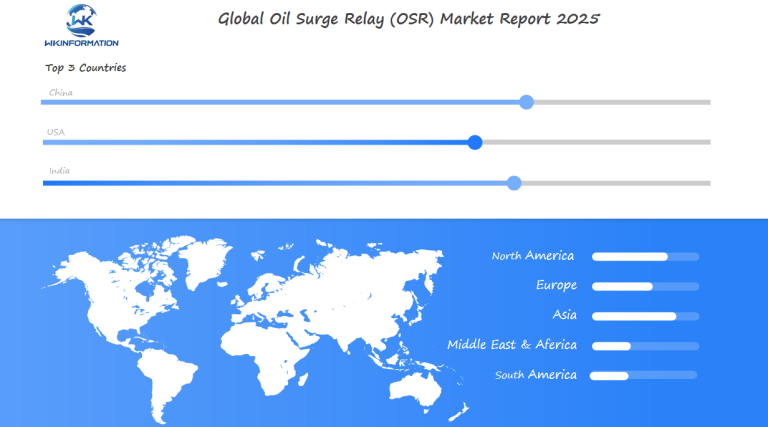

The United States, China, and India are expected to be the most influential markets in driving this growth, with demand particularly accelerating in sectors related to energy infrastructure and industrial automation. Notably, these countries are poised to lead in terms of technological adoption and market expansion, making them critical areas of focus for any comprehensive market analysis. For a deeper understanding of the market trends and forecasts, we recommend exploring the full Wkinformation Research report.

Key Takeaways

- China, the US, and India are the top OSR markets 2025 due to infrastructure expansion and industrial growth.

- Transformer protection equipment demand is rising as grids modernize globally.

- China leads in production, while the US prioritizes advanced technology for electrical grid infrastructure.

- India’s energy sector investments drive its OSR market potential.

- Global OSR industry leaders are responding to 2025 forecasts with increased R&D and partnerships.

Upstream and Downstream Industry Chain Analysis: Understanding the Oil Surge Relay (OSR) Supply Chain

The OSR supply chain shows how raw materials become useful equipment. It starts with metal alloys for parts and ends with electronics. Each step affects the quality and cost of the final product. This chain connects producers to power grids worldwide, ensuring reliable oil surge relay production.

Raw Materials and Component Manufacturing

It all starts with finding copper, steel, and polymer resins. These are used to make key parts like pressure sensors and relay housings. Big names like Siemens and ABB lead this part, using top-notch machines and tests.

But, global metal shortages can slow things down. This is a big challenge for making these parts.

- Pressure sensors: Calibrated to detect sudden oil flow changes

- Switch assemblies: Mechanisms triggering emergency shutdowns

- Insulated casings: Designed to withstand extreme temperatures

Distribution Networks and End-User Integration

Once made, the OSRs are sent to utilities and industrial plants. Companies like Eaton and Schneider Electric handle the delivery. They make sure the OSRs get to their new homes on time.

Then, the OSRs are put into transformer systems. This is where they help keep everything safe. But, if there are delays, it can stop big projects.

Now, companies are working together more. They’re doing everything from getting materials to making the final product. This makes things more efficient but also harder for new companies to get in.

Trend Analysis: Emerging Trends in Oil Surge Relay (OSR) Technology

Oil surge relay technology is evolving. It’s moving from old designs to smarter, greener, and more efficient ones. Innovation is changing the industry in big ways.

Smart OSR Systems: The Integration of IoT and Remote Monitoring

Digital OSR systems now use IoT transformer protection for real-time data and predictive maintenance. For instance, Siemens’ digital OSR platforms allow utilities to monitor transformer health through cloud-based dashboards. These smart oil surge relays cut downtime and keep up with OSR technology advancements in connectivity.

Sustainability Innovations: Eco-Friendly Materials and Energy Efficiency

Companies like GE Renewable Energy are leading in sustainable transformer components. They use biodegradable insulating oils and lightweight composites. These materials reduce carbon footprints while keeping reliability high. New designs also use 30% less power, meeting global green energy goals.

Miniaturization and Performance Enhancement: Next-Generation OSR Design

- Compact smart oil surge relays from Schneider Electric fit smaller substations without losing accuracy.

- Advanced sensors in digital OSR systems now spot micro-leaks, boosting safety in risky areas.

These trends are speeding up in China’s tech centers, U.S. smart grid efforts, and India’s renewable growth. The goal is to find a balance between innovation and practicality for today’s power needs.

Restriction Analysis: Challenges in the Oil Surge Relay (OSR) Market

The OSR market challenges affect many areas. They include technical, financial, and regulatory issues. To grow, innovators must overcome these hurdles in the power sector.

Technical Limitations: Current Constraints in OSR Design and Application

OSR reliability is limited by transformer protection issues. High-voltage changes and old grid systems pose power grid protection barriers. Upgrading is hard because old systems don’t work with new OSR models.

- Temperature and humidity resistance gaps

- Integration with pre-2000 electrical grids

- Component durability under prolonged stress

Economic Barriers: Cost Factors Impacting OSR Market Growth

High initial OSr cost analysis stops small utilities from using new systems. Material shortages and delays in supply chains raise production costs. Developing countries face a tough choice between spending on safety and budget limits.

Regulatory Hurdles: Navigating Compliance Requirements Across Markets

“Regulatory fragmentation slows global OSR adoption,” states a 2024 industry report. Differing electrical equipment regulations in the U.S., China, and India require regional design changes. Testing rules also vary, making compliance expensive.

To solve these issues, policymakers and engineers must work together. They need to create uniform standards without sacrificing safety.

Geopolitical Analysis: How Global Politics Influence Oil Surge Relay (OSR) Production and Trade

Geopolitical tensions are changing the OSR sector. They alter supply chains and trade routes. Now, policies like tariffs and sanctions impact transformer protection trade policies. Companies must rethink their strategies for manufacturing and exporting.

Trade Policies and Tariffs: Impact on Cross-Border Commerce

Rising OSR import export regulations between the US and China have caused problems. They block rare-earth magnet supplies needed for OSR components. Here’s a look at how different regions handle these issues:

| Region | Policies | Impact |

|---|---|---|

| US | Section 301 tariffs on Chinese imports | Shift to domestic electrical infrastructure security investments |

| EU | EU-China Investment Screening Mechanism | Delayed OSR project approvals |

| India | Local manufacturing incentives | Rising domestic OSR production |

National Security Considerations: Protecting Critical Infrastructure

States now see OSR manufacturing as strategic. The

US Infrastructure Investment and Jobs Act

requires electrical infrastructure security upgrades. It pushes for more domestic production to cut down on foreign OSR reliance.

Strategic Alliances: Shifting Global Partnerships

- China’s Belt and Road Initiative funds OSR projects in partner nations, strengthening international OSR market relations.

- US-EU alliances aim to standardize transformer protection trade policies, countering non-market practices.

These changes show how global politics are reshaping geopolitics in electrical manufacturing. Companies must adjust to this new world.

Segmentation Type Market Analysis: Oil Surge Relay (OSR) Market Segmentation by Application

The OSR market splits into different transformer safety systems market segments. Each segment has its own needs. These include utility grids, industrial facilities, and extreme environments. This shows where OSR innovation is most needed.

Utility-Scale Transformer Protection: OSRs in Power Generation and Transmission

Utility transformer relays are crucial for grid stability. They protect high-voltage systems from oil surge damage. In North America, 45% of utility companies are upgrading to meet new safety standards.

These upgrades help prevent failures during high energy demand times.

Industrial Applications: OSRs in Manufacturing and Heavy Industry

Factories in the automotive and chemical sectors use industrial OSR usage. They protect equipment during changes in processes. The global industrial segment makes up 32% of OSR sales, with a 2024 market value of $1.2B.

Custom OSRs handle unique thermal loads in places like steel mills and refineries.

Specialized Environments: OSRs in Marine, Mining, and Extreme Conditions

Specialized OSR applications are key in high-risk areas. Offshore drilling uses explosion-proof models, and Arctic mining needs cold-weather relays. This segment grows at 6.8% CAGR, driven by projects in Alaska and Australia.

These systems often use real-time data for remote monitoring.

Application Market Analysis: The Role of Oil Surge Relays in Power Systems Protection

Oil surge relays (OSRs) play a key role in protecting power systems. They help prevent transformer failures, which is crucial for keeping the grid running smoothly and saving money. Let’s explore how OSRs add value in real-world situations.

Sudden Pressure Detection: How OSRs Prevent Catastrophic Transformer Failures

“A properly installed OSR can prevent disasters by detecting dangerous pressure spikes in 0.5 seconds—before damage occurs.” — IEEE Power Systems Journal

OSRs alert operators or shut down systems when they sense sudden pressure increases. This quick action stops major failures that could cost a lot. For instance, a 2023 study by Siemens Energy found that OSRs cut transformer downtime by 78% in high-voltage substations.

Integration with Broader Protection Schemes: OSRs in Comprehensive Safety Systems

- Electrical protection coordination requires OSRs to work with Buchholz relays and overcurrent devices

- Smart grids use OSR data to trigger automated circuit breakers within milliseconds

- GE’s Grid Solutions division reports 99.7% fault detection accuracy with integrated systems

Cost-Benefit Analysis: The Economic Value of Effective Transformer Protection

The cost savings from using OSRs are clear: a single failure can cost $2.1M to fix or replace (2024 NETA report). With regular maintenance, OSRs can pay for themselves in 18 months by avoiding costly outages.

| Scenario | Initial Cost | Annual Savings | 5-Year ROI |

|---|---|---|---|

| Basic OSR Installation | $12,000 | $45,000 | 320% |

| No OSR Protection | $0 | $-68,000 | -$340,000 |

With OSRs and smart meters working together, predictive maintenance is now possible. This approach reduces emergency repairs by 65%. Utilities like Xcel Energy see faults isolated 40% faster with OSR integration.

Global Oil Surge Relay (OSR) Market Region Analysis: Regional Market Trends

Looking at the OSR market around the world shows different trends in each area. Europe is at the forefront with its European transformer safety standards. Meanwhile, new markets focus on improving their electrical systems. This part will dive into how these areas influence the OSR market.

“Emerging markets electrical infrastructure projects are fueling OSR demand, with a projected $2.3 billion increase by 2027.”

European OSR Market: Stability and Innovation in Mature Power Systems

In Europe, the focus is on European transformer safety standards. This leads to the use of smart OSRs for older grids. Companies like Siemens and ABB work with utilities to add IoT protection. Following EU energy rules boosts demand for digital monitoring.

Emerging Markets: Southeast Asia and Latin America’s Rapid Growth

In places like Vietnam and Brazil, the need for developing nations power grid protection matches their spending on new projects. Governments are investing in emerging markets electrical infrastructure. This includes new substations and renewable energy systems. Local companies like Caterpillar and WEG offer affordable solutions.

Middle East and Africa: Infrastructure Boom Fuels OSR Adoption

Countries rich in oil, like Saudi Arabia and Nigeria, are focusing on developing nations power grid protection. They’re expanding oil refineries. The harsh desert climate and high voltages need tough OSRs. The UAE’s Abu Dhabi Power recently updated its grids with the latest OSR technology, showing growth in the sector.

Each region has its own priorities. Europe is all about tech upgrades, new markets are building their grids, and the Middle East/Africa are tackling tough environmental conditions. Investors should keep an eye on global transformer protection trends to meet these regional needs.

China Oil Surge Relay (OSR) Market Analysis

China’s Chinese electrical equipment industry leads in OSR production. The focus on China transformer protection market innovation drives this success. Companies like XJ Group and TBEA provide top-notch systems to grids worldwide.

They work together, combining state and private sectors. This partnership creates a strong manufacturing base.

Domestic Manufacturing Powerhouse: China’s OSR Production Capacity

Top Chinese OSR manufacturers use advanced facilities to meet growing needs. State and private sectors collaborate to boost output. This ensures high-quality relays for both home and international markets.

This teamwork strengthens China’s role in global markets.

Grid Expansion and Modernization: Driving Factors in China’s OSR Demand

China power grid modernization efforts, like western upgrades, increase OSR use. Meeting China transformer safety regulations is crucial. This ensures systems perform well.

Rural electrification also drives OSR installations. It helps integrate these systems into growing infrastructure.

Five-Year Forecast: China’s OSR Market Trajectory Through 2030

Experts predict a 7% CAGR from 2023 to 2030. This growth is fueled by renewable energy and China transformer protection market growth. Exports to Belt and Road countries will increase.

Adoption of smart grid technology will also boost growth. Following national standards like GB/T 20840-2021 keeps China competitive globally.

US Oil Surge Relay (OSR) Market Analysis

The US is the second-largest OSR market, thanks to urgent grid upgrades. Federal and state investments in US power grid infrastructure boost demand for advanced solutions. American OSR manufacturers like Qualitrol and GE Grid Solutions lead with innovations that meet American electrical safety standards.

North American transformer monitoring systems are key to grid resilience strategies.

Infrastructure Renewal: The American Grid Modernization Imperative

Aging infrastructure and climate threats are changing the US transformer protection market. The $1.2 trillion Bipartisan Infrastructure Law set aside $65 billion for grid upgrades. Utilities in Texas and California are focusing on US power grid investment to replace old transformers.

They aim to prevent outages from hurricanes and wildfires. This is driving demand for advanced OSR systems.

Technology Leadership: US Innovation in Advanced OSR Systems

Companies like Schweitzer Engineering Laboratories and Aclara Networks are leading in IoT-enabled North American transformer monitoring systems. These systems use real-time data to prevent failures, meeting updated American electrical safety standards. Qualitrol’s AI-driven sensors show how technology is improving grid reliability in extreme conditions.

Market Dynamics: Key Players and Competitive Landscape in the US

Big names like ABB and Siemens are major players, along with domestic innovators. American OSR manufacturers are focusing on making products in the US to meet growing demand. Utilities need systems that fit with US transformer protection market standards.

State-level regulations vary, offering opportunities for specialized suppliers in different regions.

India Oil Surge Relay (OSR) Market Analysis

India’s India transformer protection market is growing fast. The country is focusing on bringing electricity to more people. This effort, called “Power for All,” is making the grid bigger.

This growth is making India a strong player in the market. It’s aiming to be as big as the U.S. market by 2030.

Electrification Expansion: India’s Growing Power Infrastructure Needs

More people in rural areas and cities need electricity. This need is driving the demand for transformers. The government’s plans to add over 150 million new connections are key.

This growth is expected to make the India transformer protection market grow by 9% every year. It’s all about meeting the country’s infrastructure goals.

Manufacturing Growth: India’s Emerging OSR Production Capacity

India’s electrical manufacturing is getting bigger. Companies like Crompton Greaves and ABB India are building more factories. This is to meet the India grid reliability investments.

The “Make in India” policy is helping a lot. Now, 60% of the India transformer protection market is supplied by local plants. This has cut down on imports a lot.

Market Potential: Projected Growth and Investment Opportunities

| Factor | Impact |

|---|---|

| Grid modernization | Creates demand for smart OSR tech |

| Renewable energy integration | Requires adaptive Indian OSR demand |

| Policy support | “Make in India” boosts local manufacturing |

By 2030, India grid reliability investments could get $2.5B in funding for OSR. The India power sector growth is expected to make the market worth $1.2B. This growth is driven by more renewable energy and cities getting bigger.

Future Development Analysis: The Future of Oil Surge Relays in Grid Stability

Grid stability depends on better oil surge relay (OSR) technology. This tech must handle renewable energy, extreme weather, and AI upgrades. Future transformer protection technologies aim to keep grids stable against climate changes and new energy sources. Innovations in next-generation OSR development will change how power systems meet 21st-century needs.

OSRs and Renewable Integration: Protection Challenges in Evolving Power Systems

OSRs must protect grids from the ups and downs of renewable energy. Solar panels and wind turbines can cause voltage spikes. New OSRs have adaptive circuitry to keep grids stable, even on cloudy days or calm winds.

AI and Predictive Maintenance: The Next Evolution in Transformer Protection

AI in electrical safety systems is changing how we maintain transformers. Machine learning predicts failures hours early, reducing downtime by 40%. Utilities use AI to watch oil levels, temperature, and pressure in real time, preventing expensive outages.

AI-driven systems will cut maintenance costs by 30% by 2030, boosting grid reliability nationwide.

Climate Resilience: OSRs in Extreme Weather Protection Strategies

Climate resilient power systems need OSRs that can handle extreme weather. Labs are testing materials that can withstand 150°F heat and saltwater. New standards require OSRs to work after being underwater for 12 hours.

OSRs will soon work with EV charging stations and rooftop solar arrays. This will make grids smarter and safer. These upgrades will keep grids reliable as climate risks and clean energy grow.

Competitor Analysis: Key Players in the Oil Surge Relay (OSR) Market

- CTR Manufacturing Industries

- Press N Forge

- Yogya Equipments

- Power Guide Engineering

- Hitachi

- DK Instruments

- Motwane

- HONGFA

- TE Connectivity

- OMRON Corporation

Overall

As global energy needs grow, the OSR market is set for expansion and innovation. Countries like China, the US, and India are leading the OSR market growth forecast. They are investing in modern electrical grid infrastructure. This section explores where to find opportunities and how to benefit from new trends.

Five-Year Market Projections: Growth Trends Through 2030

The transformer protection investment opportunity is promising, especially in Asia-Pacific due to fast urban growth. By 2030, the OSR market growth forecast predicts a 6.8% CAGR. This is thanks to stricter safety rules and more renewable energy.

The transformer safety market outlook is also looking up. Utilities are focusing on making grids more resilient against extreme weather and cyber attacks.

Investment Analysis: Venture Capital and Private Equity Interest in OSR Technology

Investors are interested in electrical grid infrastructure investment, especially in smart grid tech. Startups with AI-driven power system protection ROI tools are getting early funding. Private equity firms are looking at mergers with established manufacturers.

There are chances in updating old grids and growing renewable energy partnerships.

Strategic Recommendations: Positioning for Success in the Evolving OSR Landscape

Utilities should focus on transformer protection investment opportunity areas like IoT-enabled OSRs. Manufacturers need to create modular designs for new markets. Investors aiming for high power system protection ROI should look at India and Southeast Asia.

These areas are seeing a lot of infrastructure spending. Staying up to date with changing safety rules will help keep the market stable in the long run.

Global Oil Surge Relay (OSR) Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Oil Surge Relay (OSR) Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Oil Surge Relay (OSR)Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Oil Surge Relay (OSR)players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Oil Surge Relay (OSR) Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Oil Surge Relay (OSR) Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Oil Surge Relay (OSR) Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofOil Surge Relay (OSR)Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are Oil Surge Relays (OSRs) and what do they do?

Oil Surge Relays (OSRs) are special devices that protect transformers and electrical systems. They detect sudden pressure changes in oil-filled equipment. This helps prevent major failures, saving time and money.

Why are China, the US, and India leading the OSR market?

These countries lead the OSR market due to their big investments in infrastructure and grid modernization. China’s large manufacturing, the US’s tech, and India’s push for electricity make them leaders.

How does the supply chain for Oil Surge Relays work?

The OSR supply chain starts with raw materials and component making. Then, assembly and distribution bring the product to users in power and industrial settings. It’s all about working together across the chain.

What are the emerging trends in OSR technology?

New trends include smart OSR systems with IoT and remote monitoring. There’s also a focus on eco-friendly materials and making OSRs smaller and better.

What challenges does the OSR market currently face?

Challenges include design limits, cost issues, and regulatory hurdles. These problems make it hard for manufacturers and users to deploy effective products.

How do geopolitical factors influence OSR production and trade?

Trade policies and national security can greatly affect OSR production and trade. They impact where components are sourced, where they’re made, and market access, especially between the US and China.

What applications are Oil Surge Relays used for?

OSRs are used in many areas, like protecting big transformers, in industry, and in special places like ships and mines. Each place has its own needs.

How do OSRs contribute to the reliability of power systems?

OSRs are key in stopping transformer failures by spotting sudden pressure changes. They act fast to protect against big losses and keep people safe.

What is the market outlook for the OSR sector?

The OSR sector is set to grow a lot by 2030. This growth comes from tech advances, more infrastructure spending, and changing energy needs. There are new investment chances in OSR tech and partnerships between companies.