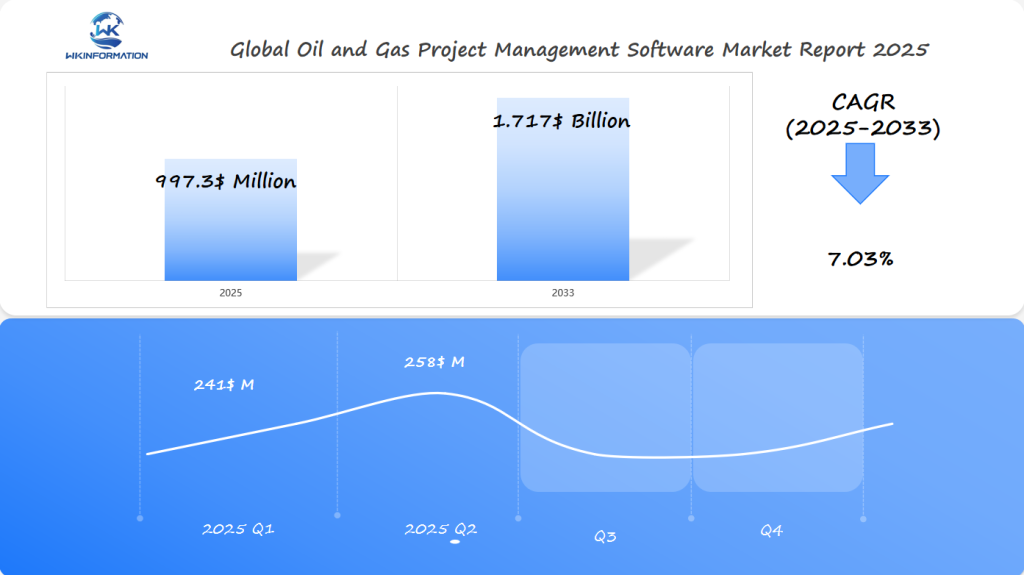

2025 Oil and Gas Project Management Software Market Projected at $997.3 Million with Growth in the U.S., Russia, and UAE

Explore the expanding Oil and Gas Project Management Software Market driven by digital transformation, operational efficiency demands, and cloud-based solutions in the U.S. energy sector.

- Last Updated:

Oil and Gas Project Management Software Market Forecast for Q1 and Q2 of 2025

Key Takeaways

- Market projected to reach $997.3 million by 2025

- Compound annual growth rate of 7.03% from 2025 to 2033

- Digital transformation driving software adoption

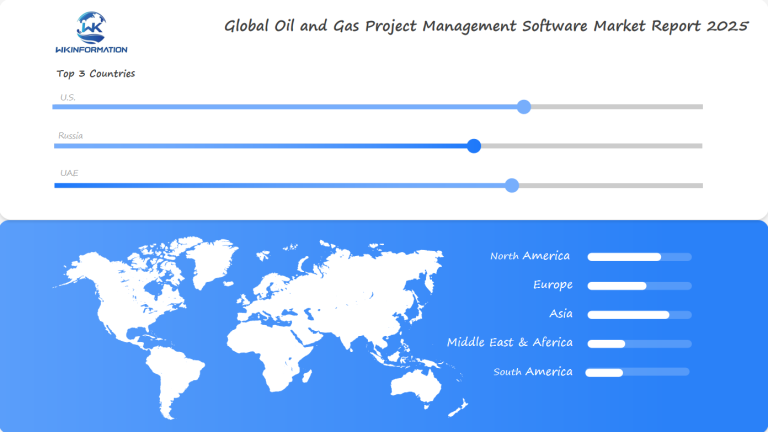

- U.S., Russia, and UAE leading market expansion

- Operational efficiency remains primary growth catalyst

- Cloud-based solutions gaining significant traction

- Technological innovation continues to reshape industry landscape

Upstream and Downstream Supply Chain Insights for Oil and Gas Project Management Software

The oil and gas industry needs top-notch project management software. This software helps manage supply chains in both upstream and downstream operations. It makes complex processes more efficient and precise.

Upstream operations face special challenges. Project management software tackles these with its capabilities:

- Exploration data management

- Drilling optimization

- Production forecasting

- Resource allocation tracking

Downstream operations also get a lot from this software. It improves refining, distribution, and inventory control.

| Operation Type | Software Capabilities | Key Benefits |

|---|---|---|

| Upstream | Geological data analysis | Reduced exploration risks |

| Downstream | Inventory management | Enhanced distribution efficiency |

The Oil and Gas Project Management Software market is expected to hit $997.3 million by 2025. This shows how vital these technologies are for the energy industry’s supply chain. Companies using these tools gain a big edge by making better decisions and seeing their operations more clearly.

Key Trends and Developments in Oil and Gas Project Management Software in 2025

The oil and gas project management software market is changing fast in 2025. Digital transformation is changing how companies manage projects. New solutions are leading to big changes in the industry.

Several key technological advancements are changing the sector:

- Integration of artificial intelligence and machine learning for predictive maintenance

- Adoption of cloud-based collaborative platforms

- Advanced real-time data analytics capabilities

- Enhanced sustainability and regulatory compliance tools

Artificial intelligence is making a big impact in project management software. Machine learning algorithms help predict risks and improve operations. This means companies can spot project challenges before they happen.

Cloud-based solutions are making things more efficient. They allow teams worldwide to work together smoothly. This reduces communication problems and improves project coordination. The market is expected to grow to $997.3 million, showing the need for advanced project management tools.

The competition is getting fiercer, with both big names and new startups coming up with new solutions. Developers are working on tools that are easier to use and handle complex projects. These tools rely on data to make smart decisions.

The future of oil and gas project management lies in intelligent, adaptive technologies that can respond quickly to changing industry dynamics.

Exploring the Challenges and Restrictions in the Oil and Gas Project Management Software Market

The Oil and Gas Project Management Software market has big challenges that slow its growth. There are tough barriers to overcome when using software in the energy sector. Companies face many technical and operational hurdles to use new project management tools.

Key challenges include:

- Data security concerns in sensitive energy infrastructure

- Complex regulatory compliance requirements

- Integration challenges with legacy technological systems

- High customization needs for specific industry workflows

Energy companies find it hard to adopt new project management tech. Cybersecurity risks are a big worry, with software makers working hard to protect against these threats. Despite these hurdles, the market is expected to grow to $997.3 million by 2025.

Software makers are working to solve these problems. They’re creating software that’s more flexible, secure, and easy to use. New platforms offer better integration, easier user experiences, and training to help with the transition in the oil and gas sector.

Successful software adoption requires a strategic approach that balances technological innovation with industry-specific operational requirements.

The best project management software will be adaptable, secure, and easy to integrate. It will help overcome current challenges and meet the oil and gas industry’s changing needs.

Geopolitical Impact on the Oil and Gas Project Management Software Sector

The global oil and gas project management software market is changing fast. This is due to complex geopolitical factors. The market is expected to grow to $997.3 million by 2025. International relations and energy dynamics are changing how we invest in technology and plan our strategies.

Key geopolitical influences impacting the sector include:

- Shifting global market dynamics in energy production

- Evolving industry regulations across different regions

- International trade policy modifications

- Cross-border technology transfer challenges

Software providers are adapting to complex geopolitical landscapes. The ability to develop flexible, compliant solutions has become crucial for maintaining competitive edge. Russian and Middle Eastern markets, in particular, present unique challenges and opportunities for project management software developers.

“Geopolitical resilience is now a fundamental requirement for software innovation in the oil and gas sector.” – Energy Technology Analyst

The ongoing tensions between major energy-producing nations are compelling software companies to develop more robust, region-specific solutions. These adaptations address critical needs such as sanctions compliance, localized regulatory requirements, and seamless international collaboration tools.

Software providers must continuously monitor global market dynamics. They need to ensure their platforms remain adaptable and responsive to rapidly changing geopolitical environments. The most successful companies will be those who can quickly pivot their technological offerings to meet emerging industry regulations and regional challenges.

Type Segmentation: How It's Shaping the Future of Oil and Gas Project Management Software

The oil and gas industry is changing fast in project management software. Market segmentation is key to creating solutions for specific challenges. New software categories are coming up to handle complex tasks better.

Some software types leading the way include:

- Enterprise Project Management (EPM) software

- Risk Management tools

- Resource Allocation platforms

- Collaborative workflow systems

- Predictive analytics software

Each type meets different needs in the industry. Enterprise Project Management solutions manage big projects well. They help teams work together smoothly. Risk management tools spot problems early and plan how to fix them.

New software is changing how oil and gas projects are managed. It uses artificial intelligence and machine learning. This gives deep insights into how projects are doing and how they can get better.

The trend of market segmentation shows a need for software made for oil and gas. Companies are spending more on tech that is precise, efficient, and gives them an edge.

Applications Driving the Demand for Oil and Gas Project Management Software

The oil and gas industry is changing fast with new software. These tools help solve big problems in many areas. They make work more efficient and better.

Some key areas where software is making a big difference include:

- Capital project management

- Asset lifecycle tracking

- Regulatory compliance monitoring

- Environmental sustainability planning

- Renewable energy integration

Software is now key for handling complex projects. It helps companies make better decisions, save money, and stay ahead in the energy world.

| Application Category | Primary Function | Operational Impact |

|---|---|---|

| Capital Project Management | Budget tracking and resource allocation | Reduces financial overruns |

| Asset Lifecycle Management | Equipment performance monitoring | Extends asset operational life |

| Compliance Tracking | Regulatory requirement monitoring | Minimizes legal risks |

The market for oil and gas project management software is expected to hit $997.3 million in 2025. This shows how important these tools are for companies wanting to improve and get ahead.

Regional Market Analysis: Oil and Gas Project Management Software in Global Markets

The global market for oil and gas project management software is changing fast. It’s filled with new technologies and chances for growth. Each area has its own way of using software, based on its tech setup and industry needs.

Key regional insights include:

- North American markets lead in technology integration

- Middle Eastern regions show rapid digital transformation

- European markets prioritize software efficiency and compliance

- Asia-Pacific demonstrates emerging market potential

Market chances differ a lot around the world. Regional adoption rates show big differences in how software is used. Things like tech readiness, rules, and money matters affect how software is adopted.

The market is expected to grow to $997.3 million by 2025. This shows how important it is to know about different markets. Energy companies are seeing the benefits of using advanced project management tools. These tools help them work better and make smarter choices.

Software makers need to come up with plans that fit each area’s needs. They should think about things like:

- Local rules and laws

- Technology setup

- How mature the industry is

- How much money is available for investment

To succeed, they need to really get to know the tech scene in each area. They also need to offer software that meets the unique needs of each industry.

USA's Oil and Gas Project Management Software Market: Key Drivers and Challenges

The U.S. market for oil and gas project management software is changing fast.

Several factors are driving this market:

- More money going into digital changes

- Higher demand for better efficiency

- More advanced tech being used

- Deeper project management needs

Energy policies in the U.S. are pushing for new software use. Companies see the need for advanced tools. These tools help deal with tough rules and make work flows better.

But, the market has its hurdles. High start-up costs and ongoing training needs are big ones. Yet, companies like ZeroAvia show how new tech can solve these problems.

The field is competitive but not too crowded. Many players are working on top-notch solutions. These solutions help manage projects better, from start to finish.

Russia's Oil and Gas Project Management Software Market: Trends and Projections

The Russian oil and gas project management software market is at a turning point. Big changes in technology are changing the industry.

What’s driving this growth includes:

- More demand for digital tools in energy

- Investments in new tech

- More focus on Arctic exploration and using resources better

Adapting to new technology is a big challenge for Russian energy firms. The complex political scene has made companies work on their own software. This software must work well even with international sanctions.

State-owned companies see the value of digital change to stay ahead. They are moving towards better project management software. This shows Russia’s smart use of new tech in its key energy sector.

UAE's Market for Oil and Gas Project Management Software: Opportunities and Growth

The United Arab Emirates is leading the way in technology in the Middle East’s energy sector. It aims to grow its economy by using new project management tools in oil and gas. This move is creating big chances for software companies looking to innovate.

Key opportunities in the UAE market include:

- Enhanced offshore operation management

- Smart oilfield technology integration

- Advanced project tracking systems

- Real-time data analytics platforms

The UAE’s oil and gas software market is growing fast. It’s expected to reach $997.3 million by 2025. This shows the UAE’s strong focus on digital change. Companies are now using advanced tools to make their work more efficient.

The UAE is working hard to create top-notch solutions. It’s doing this by teaming up with global tech providers. This makes the UAE a digital leader in the Middle East’s energy world.

There are new trends in software that are getting a lot of investment. These include:

- Predictive maintenance capabilities

- Integrated risk management

- Cloud-based collaboration platforms

- AI-powered decision support systems

As the UAE updates its energy systems, the need for advanced software will grow. This opens up great chances for tech companies that focus on oil and gas.

The Future of Oil and Gas Project Management Software: Innovation and Technology Outlook

The oil and gas industry is on the verge of a big change. Project management software is key to these changes. By 2025, the market is expected to hit $997.3 million, showing a lot of new tech coming in.

New tech is changing how we manage projects. Here are some examples:

- Internet of Things (IoT) for real-time monitoring

- Blockchain for clearer supply chains

- Augmented reality for remote management

- Advanced analytics for better decisions

These technologies will make software that tackles tough project management issues. Artificial intelligence and machine learning will help with planning, risk prediction, and workflow improvement.

| Technology | Potential Impact | Implementation Timeline |

|---|---|---|

| IoT Sensors | Real-time asset monitoring | 2024-2026 |

| Blockchain | Enhanced supply chain transparency | 2025-2027 |

| Augmented Reality | Remote training and operations | 2024-2025 |

As we move towards more renewable energy, project management software needs to change too. Companies that invest in advanced tech will lead the way. They will make the industry more efficient and innovative.

Competitive Landscape: Leading Players in Oil and Gas Project Management Software

The Oil and Gas Project Management Software market is very competitive. They are using new strategies and technologies to do this.

-

Honeywell – United States

-

Microsoft – United States

-

IBM – United States

-

Aker Solutions – Norway

-

Hexagon – Sweden

-

Siemens – Germany

-

Oracle – United States

-

Bentley Systems – United States

-

Schlumberger – United States

-

AVEVA Group – United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Oil and Gas Project Management Software Market Report |

| Base Year | 2024 |

| Segment by Type | · Asset Management

· Scheduling · Inventory Management · Costing · Analytics · Contract Management · Maintenance · Others |

| Segment by Application | · Onshore Oil and Gas

· Marine Oil and Gas |

| Geographies Covered | · North America(United States,Canada)

· Europe(Germany,France,UK,Italy,Russia) · Asia-Pacific(China,Japan,South Korea,Taiwan) · Southeast Asia(India) · Latin America(Mexico,Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast,company share,competitive landscape,growth factors and trends |

The oil and gas project management software market is set to grow a lot. It’s expected to reach $1.717 billion by 2033. This growth shows how the industry is moving towards digital solutions. It also highlights the need for better technology to manage projects.

Investors see great chances in this field. They look for software that helps track projects well, manage resources, and make operations smoother. This is key for success in the oil and gas world.

The market is expected to keep growing. This is because of new technologies that make managing projects better. They help cut costs and make decisions easier. The US, Russia, and UAE are seeing a lot of interest in these digital changes.

Investments that focus on these new technologies are likely to do well. They need to offer real-time data, predictive maintenance, and better workflow management. Companies with software that can grow and adapt will get a lot of attention.

As the market changes, companies need to stay quick to adapt. The best investments will be in software that’s flexible, offers deep analytics, and meets complex project needs. This will help them succeed in different work settings.

Global Oil and Gas Project Management Software Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Oil and Gas Project Management Software Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Oil and Gas Project Management SoftwareMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Oil and Gas Project Management Softwareplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Oil and Gas Project Management Software Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Oil and Gas Project Management Software Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Oil and Gas Project Management Software Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofOil and Gas Project Management SoftwareMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

How does project management software impact upstream and downstream operations?

The software makes supply chain management better. It boosts operational efficiency and helps in making smarter decisions. This is true for all stages from exploration to distribution.

What are the key technological trends in Oil and Gas Project Management Software for 2025?

Big trends include artificial intelligence and machine learning for predictive maintenance. Big data analytics will help in making better decisions. Cloud-based solutions will also improve collaboration.

What challenges do companies face when implementing project management software in the oil and gas industry?

Companies face many challenges. These include keeping data safe, following regulations, and integrating with old systems. They also struggle with user adoption and need software tailored to their industry.

How do geopolitical factors influence the Oil and Gas Project Management Software market?

Global politics, trade policies, and energy demand affect software adoption. They also impact technology sharing and international collaborations in the oil and gas sector.

What types of project management software are available in the oil and gas sector?

There’s a variety of software available. This includes Enterprise Project Management (EPM), Risk Management software, and tools for managing resources. There are also new categories for specific industry needs.

What are the primary applications driving demand for this software?

Demand is driven by key applications. These include managing capital projects, tracking asset lifecycles, and following regulations. New areas like renewable energy and environmental sustainability are also growing.

Which regions are showing the most significant growth in Oil and Gas Project Management Software?

The United States, Russia, and the United Arab Emirates are leading the growth. Each region has its own unique technology, regulations, and challenges.

What emerging technologies are likely to transform Oil and Gas Project Management Software?

New technologies like IoT for real-time monitoring and blockchain for supply chain transparency are emerging. Augmented reality for remote operations is also on the horizon.

How are software providers addressing the competitive landscape?

Providers are differentiating themselves through innovation and expertise. They focus on customer service, strategic partnerships, and keeping up with technology advancements.