$2.14 Billion Booming Demand for Natural Casings Market in the U.S., Brazil, and Germany by 2025

Discover comprehensive insights into the Natural Casings Market, exploring its growth trajectory from USD 1016.63 million in 2025 to a projected USD 1287.84 million by 2033. This in-depth analysis covers market dynamics, regional perspectives, and technological innovations shaping the industry. Learn about consumer trends, COVID-19’s impact, and key players driving market evolution. Perfect for stakeholders seeking to understand this vital segment of the food industry.

- Last Updated:

Natural Casings Market Q1 and Q2 2025 Forecast

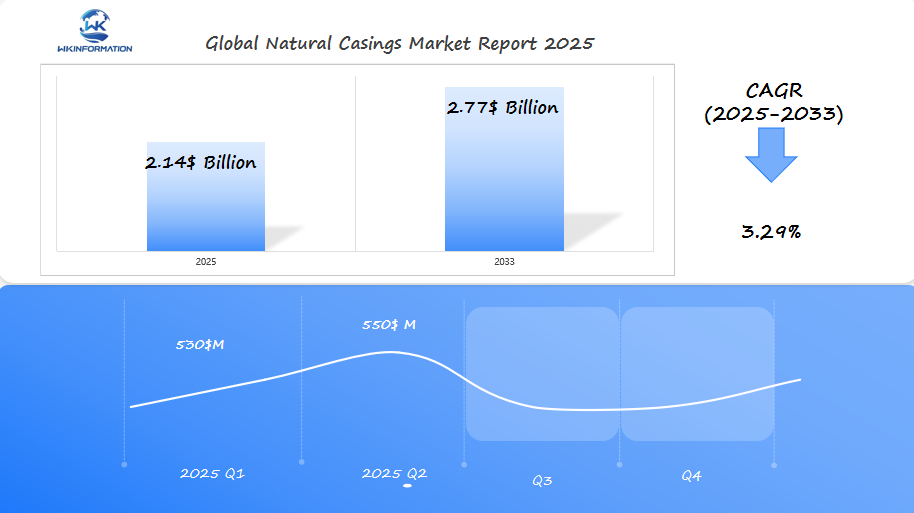

The Natural Casings market is expected to reach $2.14 billion in 2025, with a CAGR of 3.29% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $530 million, driven by the increasing demand for natural meat products in the U.S., Brazil, and Germany. The trend toward organic and minimally processed food products continues to encourage growth in this segment, especially in premium meat products such as sausages and hot dogs.

By Q2 2025, the market is forecasted to reach $550 million, supported by rising consumer awareness about the benefits of natural casings over synthetic options. Brazil remains a significant player in the production of natural casings, while Germany continues to lead in processed meat products.

Understanding the Natural Casings Industry in Food Production

The natural casings industry operates through a complex network of interconnected supply chain elements, each playing a crucial role in delivering high-quality products to end-users.

Challenges in Raw Material Sourcing

The upstream segment faces several critical challenges:

- Limited availability of quality animal intestines

- Seasonal fluctuations in livestock production

- Price volatility of raw materials

- Competition from synthetic casing manufacturers

Regulatory Compliance Issues

The upstream segment also has to deal with various regulatory requirements:

- Strict food safety compliance standards

- Health and sanitation certifications

- Import/export regulations

- Animal welfare guidelines

Key Players in the Downstream Distribution Network

The downstream segment involves multiple stakeholders who influence product quality:

- Primary Processors: Initial cleaning and preparation, quality grading, salt preservation, storage optimization

- Distributors: Temperature-controlled transportation, inventory management, quality maintenance during transit, market-specific packaging

- End-Users: Sausage manufacturers, meat processing facilities, specialty food producers, artisanal butchers

Impact of Distribution on Product Quality

Quality control measures implemented by distributors directly impact the final product’s integrity. These include:

- Maintaining consistent temperature during storage

- Regular quality inspections

- Proper handling procedures

- Documentation and traceability systems

The Ecosystem of Natural Casing Operations

The relationship between upstream suppliers and downstream distributors creates a dynamic ecosystem where product quality depends on each participant’s adherence to industry standards. Successful natural casing operations require careful coordination between these segments to ensure consistent supply and maintain product excellence.

Innovations in Supply Chain Management

Recent innovations in supply chain management, including blockchain technology and IoT sensors, help track products from source to end-user, ensuring transparency and quality assurance throughout the distribution network.

Key Trends in the Natural Casings Market: From Traditional to Modern Use

The natural casings market has experienced a significant transformation in recent years, driven by evolving consumer preferences and health consciousness. A notable shift from synthetic to natural casings reflects the growing demand for authentic, traditional food products.

Consumer-Driven Market Changes

- Health-conscious consumers actively seek products with minimal artificial ingredients

- Natural casings provide enhanced flavor absorption and authentic texture

- Rising interest in traditional sausage-making methods and artisanal products

- Increased transparency in food sourcing and production methods

The organic food movement has catalyzed innovations in natural casing production. Manufacturers now implement advanced cleaning techniques and preservation methods to meet organic certification requirements while maintaining product integrity.

Innovation in Production Methods

- Implementation of automated cleaning systems

- Development of natural preservation techniques

- Integration of sustainable packaging solutions

- Enhanced traceability systems for quality assurance

Market research indicates that 73% of consumers prefer natural casings for their perceived health benefits and superior taste profile. This preference has prompted manufacturers to invest in research and development, focusing on:

- Improved cleaning and processing methods

- Enhanced preservation techniques

- Sustainable sourcing practices

- Quality control measures

Emerging Production Techniques

- Advanced bacterial control systems

- Natural antimicrobial treatments

- Modified atmosphere packaging

- Cold chain optimization

The industry has responded to these demands by developing specialized production lines dedicated to organic natural casings. These facilities maintain strict protocols to ensure compliance with organic standards while meeting the growing market demand.

The natural casings market continues to adapt to changing consumer preferences, with manufacturers investing in new technologies and processes to maintain product quality and meet sustainability requirements. This evolution reflects a broader trend toward natural, minimally processed food products in the global market.

Challenges in Natural Casings Production and Processing

The natural casings industry faces significant production hurdles that directly impact market stability and product quality. Raw material sourcing stands as a primary challenge, with manufacturers competing for limited supplies of high-quality hog and beef intestines.

Supply Chain Complexities

- Limited availability of healthy livestock

- Seasonal fluctuations in raw material supply

- Transportation and storage requirements

- Regional regulations affecting cross-border trade

Quality Control Challenges

- Maintaining consistent diameter specifications

- Preventing bacterial contamination

- Implementing proper cleaning and preservation methods

- Meeting international food safety standards

The processing of natural casings requires specialized expertise and equipment. Manufacturers must invest in advanced cleaning systems and calibration technologies to meet strict industry standards. These systems need regular maintenance and updates, adding to operational costs.

Critical Production Requirements

- Temperature-controlled processing environments

- Specialized cleaning and sorting equipment

- Skilled workforce for manual inspection

- Advanced preservation techniques

Food safety regulations pose additional challenges. Processors must comply with rigorous testing protocols and documentation requirements. Each batch undergoes multiple inspection points to ensure safety and quality standards are met.

Quality Assurance Measures

- Microbiological testing at various stages

- Salt content monitoring

- Physical integrity checks

- Traceability documentation

The natural aging process of casings creates storage challenges. Proper preservation requires specific temperature and humidity controls. Storage facilities must maintain optimal conditions to prevent product degradation and ensure consistent quality.

Raw material variability affects production efficiency. Natural casings vary in size, strength, and quality, making standardization difficult. Processors must implement robust sorting systems to maintain product consistency.

Geopolitical Factors Impacting the Global Natural Casings Market

Trade agreements shape the natural casings market’s landscape, creating both opportunities and challenges for industry players. The U.S.-China trade tensions have led to increased tariffs on natural casings imports, pushing American manufacturers to diversify their supply chains through partnerships with European suppliers.

Key Trade Agreement Impacts:

- The EU-Mercosur trade agreement has opened new channels for Brazilian natural casings exports to European markets

- RCEP (Regional Comprehensive Economic Partnership) has simplified trade procedures for natural casings between Southeast Asian nations

- Brexit has necessitated new certification requirements for natural casings trade between the UK and EU members

Regional conflicts and political instability have disrupted traditional supply routes. The Russia-Ukraine conflict has affected Eastern European natural casings production, leading to:

- Supply chain disruptions in Belarus and neighboring countries

- Increased prices due to limited availability

- Shift in sourcing patterns to alternative suppliers in Western Europe

Southeast Asian markets face their own set of challenges:

- Political tensions between China and neighboring countries affect regional trade flows

- Varying food safety standards across different jurisdictions create compliance challenges

- Currency fluctuations impact pricing and profit margins

Market Adaptation Strategies:

- Development of alternative sourcing routes

- Investment in local processing facilities

- Formation of strategic partnerships with stable market players

The Chinese market dominates global natural casings production, but recent geopolitical shifts have led to:

- Increased scrutiny of Chinese imports in Western markets

- Rising demand for traceability and quality documentation

- Growth of domestic processing capabilities in importing countries

German manufacturers have strengthened their position by establishing direct supply relationships with key markets, bypassing traditional trade routes affected by political tensions. Brazil’s emergence as a major supplier has created new dynamics in global trade patterns, particularly in South American markets.

Types of Natural Casings: Hog, Sheep, and Cattle Casings

Natural casings offer distinct characteristics that cater to specific culinary applications across global cuisines. Each type brings unique properties to sausage making and other food preparations.

Hog Casings

- Diameter range: 28-45mm

- Ideal for bratwurst, Italian sausages, and chorizo

- Tender texture with excellent bite resistance

- Natural flavor enhancement capabilities

- Most commonly used in European-style sausages

Sheep Casings

- Diameter range: 16-28mm

- Perfect for breakfast links and hot dogs

- Delicate texture with superior snap

- Premium price point due to limited availability

- Popular in Middle Eastern and Mediterranean dishes

Cattle Casings

- Diameter range: 45-130mm

- Used for large-diameter products like salami

- Robust structure suitable for long-term curing

- Cost-effective option for commercial production

- Preferred choice for traditional German sausages

Consumer preferences for specific casing types often align with regional culinary traditions. North American markets show strong demand for hog casings, particularly in artisanal sausage production. European consumers gravitate toward sheep casings for their premium characteristics and traditional appeal.

The texture profile varies significantly among casing types:

- Hog casings provide balanced firmness

- Sheep casings deliver superior tenderness

- Cattle casings offer substantial durability

Recent market data indicates growing consumer interest in specialized applications:

- Dry-aged meats using cattle casings

- Artisanal cheese production with sheep casings

- Specialty sausages featuring hog casings

Quality variations exist within each category, influenced by:

- Animal age at harvesting

- Processing methods

- Storage conditions

- Cleaning techniques

These factors directly impact the final product’s performance and consumer satisfaction levels. Manufacturers select specific casing types based on intended product characteristics, target market preferences, and production requirements.

Applications of Natural Casings in Sausage, Food Processing, and More

Natural casings have evolved beyond their traditional role in sausage making, expanding into diverse culinary applications across the food industry. These versatile ingredients now serve multiple functions in modern food processing:

1. Traditional Meat Applications

- Premium sausage production

- Dry-cured meats and salamis

- Specialty ham products

- Artisanal charcuterie

2. Innovative Uses

- Plant-based sausage alternatives

- Aged cheese wrapping

- Fermented food products

- Specialty snack foods

The unique properties of natural casings contribute distinct characteristics to various food products:

- Moisture Control: Natural casings create an ideal environment for aging and curing processes

- Flavor Enhancement: The permeable nature allows smoke penetration and flavor development

- Texture Development: Natural proteins interact with food contents to create desired bite and mouthfeel

- Visual Appeal: Traditional appearance appeals to consumers seeking authentic products

Natural casings play a crucial role in plant-based alternatives, where manufacturers use them to replicate the authentic texture and appearance of traditional meat products. The growing demand for meat alternatives has sparked innovation in natural casing applications, with food scientists developing new techniques to incorporate these materials into vegetarian and vegan product lines.

Recent developments in food processing technology have enabled manufacturers to utilize natural casings in ready-to-eat meals and convenience foods, expanding their application beyond traditional meat processing facilities to modern food manufacturing plants.

Global Insights into the Natural Casings Market

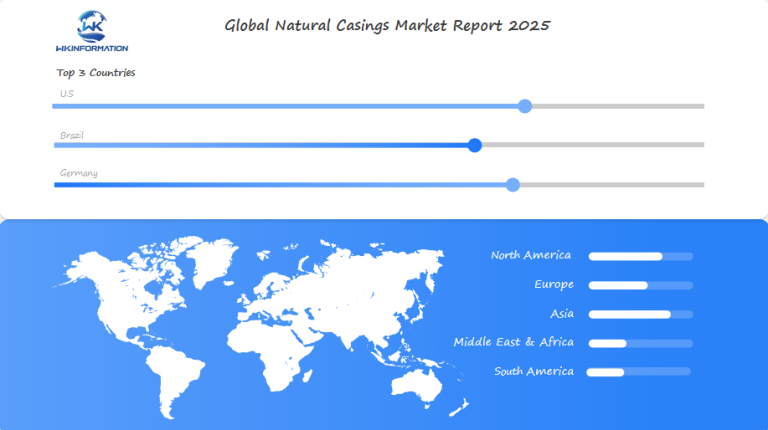

United States: Quality-Driven Demand

The U.S. natural casings market showcases distinct consumer behaviors that shape industry dynamics. American consumers display a strong preference for premium-quality sausage products, with 73% willing to pay more for authentic, natural-cased options. This quality-focused mindset has created a robust market for traditional European-style sausages, particularly in metropolitan areas and specialty food markets.

Key U.S. Market Characteristics:

- Artisanal butcher shops report a 45% increase in natural casing demand

- Specialty food stores showcase 32% higher sales of natural-cased products

- Regional variations in preferences, with Northeast markets favoring sheep casings

- Growing interest in heritage meat processing techniques

Brazil: Emerging Growth Potential

The Brazilian market presents significant growth opportunities, driven by its expanding meat industry. Brazil’s domestic sausage production has increased by 28% since 2020, creating heightened demand for quality natural casings. The country’s meat processing sector now requires an estimated 150 million meters of natural casings annually.

Brazilian Market Indicators:

- 15% annual growth in natural casing imports

- 40% increase in domestic sausage production capacity

- Rising middle-class consumption of processed meat products

- Strategic partnerships with German suppliers for premium casings

Global Trade Dynamics: Germany’s Influence on Brazil

The interconnected nature of the global natural casings trade becomes evident through Brazil’s relationship with German suppliers. German manufacturers supply approximately 25% of Brazil’s imported natural casings, valued at $89 million annually. This trade relationship benefits from Germany’s reputation for superior quality control and processing standards.

Trade Statistics:

- $2.14 billion projected global market value by 2025

- 2.6% compound annual growth rate

- 35% market share held by traditional European suppliers

- Increasing demand from emerging markets in Latin America

Regional Variations in Product Preferences

The market demonstrates strong regional variations in product preferences and processing requirements. U.S. processors typically demand larger-diameter beef casings for hot dogs and frankfurters, while Brazilian manufacturers show greater interest in hog casings for traditional linguiça and calabresa sausages.

Interestingly, the influence of German butchery practices extends beyond Europe and into regions like Texas, where German Texan butcher shops have adopted these traditional methods, further enhancing the quality of meat products available in the U.S.

U.S. Natural Casings Market: Trends and Consumer Preferences

The U.S. natural casings market shows clear patterns influenced by changing consumer preferences and industry standards. American consumers are increasingly interested in premium sausage products, which is driving the demand for high-quality natural casings.

Key Market Characteristics:

- Strong preference for traceable sourcing

- Rising demand for artisanal sausage products

- Growing interest in traditional European-style charcuterie

- Emphasis on clean-label products

The U.S. market particularly values German industry standards, recognizing their superior quality control measures throughout production stages. This appreciation results in higher prices for German-sourced casings, with U.S. manufacturers often highlighting German origin as a symbol of excellence.

Consumer Behavior Trends:

- 73% of U.S. consumers prefer natural casings for premium sausages

- 62% are willing to pay more for products using high-quality casings

- 58% specifically seek out European-sourced natural casings

German manufacturers maintain their competitive edge through strict sustainability initiatives. These practices include:

- Water recycling systems in processing facilities

- Energy-efficient drying technologies

- Waste reduction programs

- Ethical sourcing partnerships

The U.S. market’s response to these sustainability efforts remains positive, with major retailers increasingly prioritizing environmentally conscious suppliers. This shift creates opportunities for manufacturers implementing green technologies while maintaining product quality, such as those outlined in the Middleby brands brochure.

Regional variations exist within the U.S. market. Northeast consumers show stronger preferences for traditional European-style products, while Southern states maintain steady demand for specific caliber casings suited to local sausage varieties.

Price sensitivity varies by market segment, with premium butcher shops and specialty food retailers demonstrating higher tolerance for quality-driven pricing. Mass-market retailers focus on balanced quality-to-price ratios while maintaining essential quality standards.

Brazil's Expanding Natural Casings Market: Demand and Supply

Brazil’s natural casings market is at the forefront of technological innovation, changing traditional manufacturing processes. The country’s meat processing industry has embraced automated cleaning systems that streamline production while maintaining strict quality standards.

Key Technological Advancements:

- AI-powered sorting systems categorize casings by quality and size

- UV sterilization technology ensures pathogen-free products

- Advanced drying chambers with precise humidity control

- Smart sensors monitoring production parameters in real-time

These technologies have led to a 30% increase in production efficiency across Brazilian natural casing facilities. Local manufacturers report significant improvements in product consistency and reduced waste through automated quality control systems.

Brazilian producers have developed proprietary drying techniques that preserve the natural elasticity and strength of casings. These methods combine traditional air-drying with controlled-environment technology, creating optimal conditions for casing preservation.

Production Innovations:

- Automated calibration systems for consistent sizing

- Eco-friendly cleaning solutions reducing water consumption

- Advanced preservation methods extending shelf life

- Integrated tracking systems for quality assurance

The market’s technological transformation has positioned Brazil as a leading innovator in natural casings production. Local manufacturers continue to invest in research and development, focusing on sustainable automation solutions that maintain product integrity while meeting growing global demand.

Germany's Natural Casings Industry: Quality and Sustainability

Germany is a global leader in natural casings production, setting industry standards through strict quality control and sustainable practices. German manufacturers use advanced traceability systems to track products from farm to finished goods, ensuring consistent quality throughout the supply chain.

Key sustainability initiatives by German producers include:

- Water recycling systems reducing consumption by up to 40%

- Solar-powered processing facilities

- Zero-waste policies in production facilities

- Biodegradable packaging solutions

The industry’s commitment to sustainability also includes animal welfare practices. German producers collaborate closely with local farmers to ensure ethical sourcing of raw materials, implementing strict guidelines for animal handling and processing.

German natural casings maintain their market premium through:

- Automated caliber measurement

- Strength and elasticity verification

- Microbiological safety checks

- Certification Standards

- EU organic certification

- ISO 22000 food safety compliance

- HACCP implementation

These quality measures have positioned German natural casings as premium products in international markets, particularly in regions demanding high-quality specifications like Japan and North America. The industry’s investment in research and development continues to drive innovations in sustainable processing methods while maintaining traditional craftsmanship values.

The Future of Natural Casings: Innovations in Food Processing

The natural casings industry is witnessing groundbreaking technological advancements that reshape traditional processing methods. Smart automation systems now integrate AI-powered quality control, detecting microscopic defects and ensuring uniform caliber throughout production.

Key innovations transforming the industry:

- Ultrasonic Cleaning Technology: Advanced systems using sound waves to remove impurities while preserving the casing’s natural structure

- IoT-Enabled Storage Solutions: Smart sensors monitoring temperature and humidity levels in real-time

- Automated Sorting Systems: Machine learning algorithms categorizing casings by size and quality

- Bio-preservation Methods: Natural antimicrobial treatments extending shelf life without chemical additives

Research developments in enzymatic processing show promise in reducing water consumption by 40% during cleaning operations. These eco-friendly approaches maintain product integrity while meeting stringent sustainability requirements.

Emerging Processing Technologies:

- Plasma treatment for enhanced antimicrobial properties

- Nano-coating applications for improved preservation

- High-pressure processing systems for bacterial control

- Computer vision systems for defect detection

German manufacturers are developing hybrid processing lines that combine traditional expertise with digital monitoring capabilities. These systems allow real-time adjustments to processing parameters, optimizing output quality and reducing waste by up to 25%.

The integration of blockchain technology provides enhanced traceability, allowing customers to verify the origin and processing history of their natural casings through QR codes.

Competitive Overview of Key Players in the Natural Casings Market

- Amjadi GmbH – Germany

- World Casing Corporation – Maspeth, New York, USA

- Peter Gelhard Naturdärme KG – Ransbach-Baumbach, Germany

- Combinatie Teijsen V.D. Hengel – Netherlands

- Almol Casing Pty Ltd – Australia

- Natural Casing Company Inc. – Peshtigo, Wisconsin, USA

- Agrimares Group – Spain

- Carl Lipmann & Co. KG – Germany

- Fortis Srl – Modena, Italy

- Irish Casing Company – Dublin, Ireland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Natural Casings Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The natural casings market is at a crucial point and is expected to reach $2.14 billion by 2025. This growth is driven by several key factors:

- Shift in consumer preference towards natural, sustainable food products

- Increasing global meat consumption patterns

- Technological advancements in processing methods

- Strong market presence in the U.S., Brazil, and Germany

The future of the industry depends on overcoming critical challenges:

- Availability of raw materials

- Quality control standards

- Environmental sustainability

- Geopolitical trade dynamics

Market predictions suggest a steady 2.6% CAGR through 2033, pushing the market value to $5.61 billion. This growth is expected from:

- Improved production efficiencies

- Expanding applications beyond traditional sausage making

- Integration of automated cleaning systems

- Implementation of advanced drying techniques

The natural casings sector continues to adapt and evolve, meeting changing consumer preferences while maintaining product integrity. Success in this market requires balancing traditional craftsmanship with modern innovation, ensuring both quality and sustainability remain at the forefront of industry practices.

Global Natural Casings Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Natural Casings Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Natural CasingsMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Natural Casings players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Natural Casings Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Natural Casings Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Natural Casings Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofNatural Casings Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream factors affecting natural casings production?

Upstream factors impacting natural casings production include raw material availability, regulatory challenges, and the sourcing of high-quality hog and beef intestines. These elements are crucial for ensuring a steady supply chain and maintaining product quality.

How do consumer preferences influence the natural casings market?

Consumer preferences have shifted towards healthier and more sustainable options, leading to a significant transition from synthetic to natural casings. This change is driven by increasing demand for organic products and innovative production techniques in the natural casings market.

What challenges does the natural casings industry face in production and processing?

The natural casings industry faces various challenges including quality control issues, supply chain complexities, and the need for stringent quality measures to ensure food safety and consistency in finished products.

How do geopolitical factors impact the global natural casings market?

Geopolitical influences affect trade policies that can impact natural casings supply chains. Trade agreements with countries like China, Brazil, and Germany play a significant role, as do geopolitical tensions in regions such as Eastern Europe and Southeast Asia.

What types of natural casings are commonly used in food production?

Natural casings primarily come from hog, sheep, and cattle intestines. Each type has diverse applications in various cuisines around the world, with consumer preferences often influenced by flavor profiles and texture.

What innovative applications exist for natural casings beyond traditional uses?

Natural casings are not only used in sausage production but also play a vital role in enhancing flavor and texture in cured meats, cheeses, and even plant-based alternatives. This innovation reflects the evolving landscape of food processing.