$3.08 Billion Mycelium Meat Market to Drive Sustainable Protein Sources in the U.S., Netherlands, and India by 2025

Explore the growing mycelium meat market, valued at $3.49B in 2025, projected to reach $8.15B by 2033, driven by sustainability and health-conscious trends.

- Last Updated:

Mycelium Meat Market Q1 and Q2 2025 Outlook

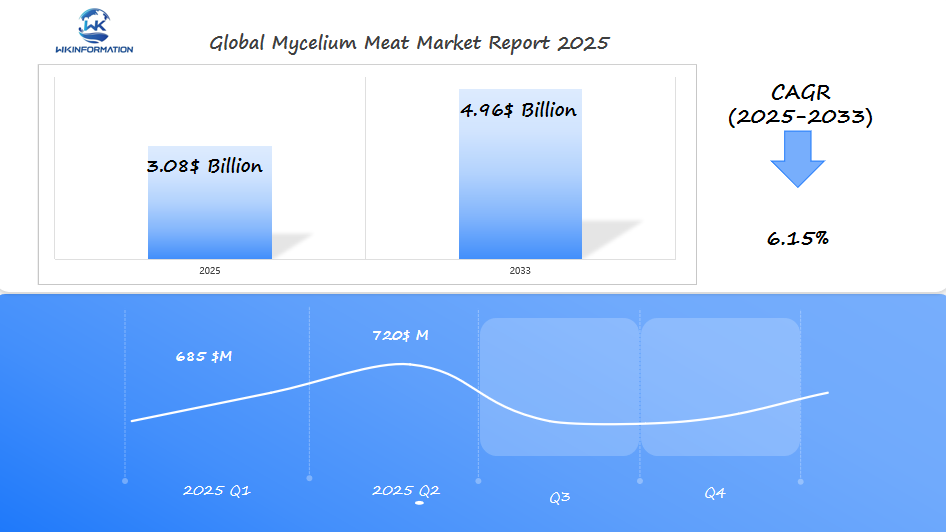

The mycelium meat market is estimated to reach $3.08 billion in 2025, with a 6.15% CAGR from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $685 million, as the popularity of sustainable, plant-based protein sources accelerates. The increasing global awareness about the environmental impacts of meat production, combined with innovations in food technology, positions mycelium meat as a viable alternative.

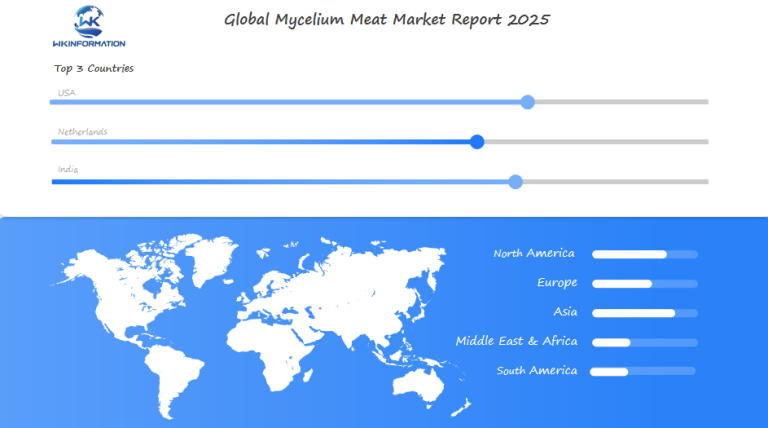

The U.S., Netherlands, and India are leading this trend. In the U.S., the plant-based food market has seen explosive growth, and mycelium meat is increasingly seen as a premium sustainable alternative to traditional meats. The Netherlands, with its reputation for food innovation, is also driving the development of new mycelium products, while India, with its massive vegetarian population, is capitalizing on mycelium meat to offer an affordable and environmentally friendly protein source.

By Q2 2025, the market is projected to grow to approximately $720 million, with continued production scale-ups in India and increasing consumer demand in the U.S. and the Netherlands. Mycelium-based meats are expected to see a significant expansion in food retail, further boosting the market in these regions.

Key Takeaways

- The mycelium-based protein market is rapidly growing, with a valuation of $3.08 billion.

- The U.S., Netherlands, and India are leading the way in developing sustainable protein systems.

- Mycelium meat offers a solution to reduce dependence on resource-intensive livestock farming.

- This market expansion is driven by both economic growth and environmental benefits.

- There is a growing consumer demand for ethical and eco-friendly foods, which is driving innovation in sustainable protein production.

Exploring the Upstream and Downstream Industry Chains for Mycelium Meat

Every mycelium meat product has a complex background. It involves producers, suppliers, and distributors. The plant-based innovation begins in labs and farms, where mycelium grows through biotechnology. This includes choosing the right strain, fermenting it, and scaling up production to meet demand.

On the downstream side, companies work with food makers and retailers. They turn raw mycelium into products like burgers, sausages, or snacks. The distribution network must keep the products fresh and get them to stores, restaurants, and online. Companies like MycoTechnology and Impossible Foods are making these supply chains more sustainable.

Upstream and Downstream Processes

- Upstream: Cultivation tech → Raw material refinement

- Downstream: Product formulation → Consumer delivery

“The supply chain isn’t just about logistics—it’s where plant-based innovation meets consumer needs,” says a 2023 industry report by FoodTech Analytics.

Logistics and partnerships are key. Startups work with farmers to get non-GMO substrates. Meanwhile, packaging companies create eco-friendly materials. This system ensures mycelium meat gets to markets efficiently, balancing cost and environmental impact.

As demand increases, automation and data analytics help both ends of the chain. From lab to table, each link supports the market’s growth. It’s expected to hit a $3 billion valuation by 2025.

Key Trends in the Mycelium Meat Market: Sustainability and Plant-Based Foods

More people want to eat in a way that’s good for the planet. This is making alternative meat options more popular. Mycelium-based foods are leading this change, showing a move towards greener proteins.

As shoppers care more about the environment, companies are working to make food that’s both tasty and kind to the planet.

- Climate-conscious eating drives demand for meat-free proteins.

- Product diversity expands with improved taste and texture mimicking conventional meat.

- Corporate partnerships accelerate production scaling and market entry.

“60% of consumers now seek eco-labeled foods, prioritizing brands with low carbon footprints,” a 2023 market analysis revealed.

Big names like Beyond Meat and Impossible Foods are leading the plant-based market. But startups like MycoTechnology are making waves with mycelium-based products. These products are made without antibiotics and are grown in labs.

Stores like Walmart and Whole Foods are now carrying these alternative meat options. This shows that they’re becoming more mainstream.

Now, it’s all about being open about where food comes from and what certifications it has. Investors are putting money into research to make these products better and cheaper. Mycelium is seen as a big player in the future of protein because it uses less land and water than raising animals.

Challenges in the Production and Consumer Acceptance of Mycelium Meat

Scaling upstream mycelium production is tough for makers. Labs struggle with uneven growth and contamination risks. These problems slow down production and increase costs.

- Technical Limits: Growing mycelium on a big scale needs exact temperature and pH settings. This makes things more complicated.

- Cost Pressures: Using a lot of energy for cleaning and bioreactors makes it hard to keep prices low.

Many people are still unsure about mycelium-based foods. In the U.S., 40% of shoppers don’t know much about them. They want it to taste and feel like real meat.

“The gap between lab innovation and kitchen tables hinges on transparency,” said Dr. Lena Torres, a food tech analyst at AgriFuture Labs. “Consumers need clear stories connecting science to their plates.”

Ensuring quality in upstream mycelium production is key. Companies like MycoProtein Inc. are working on automation to make things better. But, it’s a slow process.

- Labeling Confusion: Unclear terms like “lab-grown” might scare off some buyers.

- Regulatory Gaps: Rules for mycelium products are still being made, making it hard to enter the market.

To overcome these obstacles, scientists, regulators, and marketers need to work together. As the industry grows, solving these problems could make mycelium a big player in sustainable protein.

Geopolitical Impact on the Mycelium Meat Market

Global trade policies and regulatory differences shape how downstream mycelium applications expand. Countries like the U.S., Netherlands, and India face varying hurdles in scaling mycelium-based foods. Export restrictions or tariffs on biotechnology ingredients can delay product launches in key markets.

Effects of Geopolitics on Mycelium Supply Chains

Trade agreements between nations directly affect supply chains. For instance, EU regulations on novel foods may require extensive testing for downstream mycelium applications, slowing their entry into European markets. Meanwhile, U.S. partnerships with tech firms like MycoTechnology highlight how alliances boost local production.

Key Factors Influencing Mycelium Supply Chains

- Regulatory barriers: Differing safety standards delay certifications for new products.

- Trade dependencies: 40% of mycelium biomass raw materials come from Asia, risking supply chain disruptions.

- Policy incentives: The Netherlands offers grants for sustainable tech, encouraging R&D in downstream applications.

“Geopolitical shifts are forcing companies to rethink global strategies for mycelium-based proteins,” said a 2023 industry report by AgriTech Analytics. “Localizing production reduces reliance on unstable imports.” This sentiment is echoed in a Citi Research report, which emphasizes the need for strategic shifts in response to geopolitical challenges.

Political Tensions and Their Impact on Mycelium Investments

Political tensions over food security may accelerate domestic investments. In India, government subsidies aim to boost local downstream mycelium applications to reduce meat imports. Meanwhile, cross-border collaborations, like U.S.-Netherlands R&D partnerships, aim to standardize regulations, fostering global market growth.

Types of Mycelium Meat: Varieties and Processing Techniques

Mycelium meat comes in many forms, thanks to innovative food tech. You can find everything from textured fillets to ground substitutes. These products look and taste like traditional meats but are better for the planet.

| Type Description Processing Method Fibrous Strips | Resembles chicken or beef strips | Culturing in controlled airflow systems |

| Ground Varieties | Used for burgers and sausages | High-pressure homogenization |

| 3D-Printed Shapes | Customizable cuts | Additive manufacturing with mycelium biomass |

Food tech is key in making mycelium meat. It uses methods like precision fermentation and enzymatic treatments. These methods improve the meat’s texture and taste, making it more appealing to consumers.

- Extrusion: Forms shapes under heat and pressure

- Cellular structuring: Mimics meat fibrous layers

- Flavor infusion: Natural compounds added during growth

“Our technology lets mycelium grow into complex structures, revolutionizing meat alternatives.” – MycoTechnology R&D Team

Brands focus on making mycelium meat scalable and consistent. Companies like Quorn pick the best strains for high protein content. Startups use AI for quality control. These efforts ensure mycelium meat is safe and meets market standards in the U.S.

Applications of Mycelium Meat in Alternative Proteins and Food Industry

Mycelium meat is changing kitchens and grocery stores. It’s a key part of eco-friendly meat alternatives. Its texture fits well in many dishes, from burgers to spreads. It’s also great because it tastes neutral, blending well into familiar foods.

1. Burgers & Sausages

Mycelium-based products mimic meat’s chewiness, used in plant-based patties and sausages by brands like Quorn.

2. Snacks & Protein Powders

Crushed mycelium becomes a protein-rich additive in chips, bars, and shakes.

3. Chefs’ Creativity

Restaurants experiment with it in vegan stews, meatless lasagna, and gourmet dips.

Chefs and scientists love it for its eco-friendly benefits. Restaurants like New York’s Green Bites use it in healthy menus. It’s good for the planet because it uses less water than animal farming. It’s also full of protein without any fake stuff, making it a hit with those who care about their health.

Global Insights into the Mycelium Meat Market

Global food trends are moving towards sustainable proteins, and mycelium meat is leading the way. This new sector shows how people around the world want eco-friendly food that tastes good. They’re looking for tasty meat alternatives.

How fast mycelium meat grows depends on where it is. Different places have their own needs and ideas. Here’s how different areas are influencing the market:

- North America: At the forefront with tech startups like Meati and Quorn. They focus on making products quickly and efficiently.

- Europe: Focuses on rules and working with farm-tech companies. They aim to mix old traditions with new ideas.

- Asia-Pacific: Growing fast because of more people wanting protein. Companies like Nature’s Fynd are making fungal proteins for big markets.

| Region | Growth Drivers | Key Companies |

| North America | Investment in biotech, consumer health awareness | Meati, Quorn |

| Europe | Sustainability policies, EU funding for alt-proteins | MycoTechnology, Fungi Perfecti |

| Asia-Pacific | Population growth, urbanization | Nature’s Fynd, Impossible Foods |

Mycelium meat is changing how we think about food globally. As more people want it, working together and sharing ideas will help it grow faster.

U.S. Market Demand for Mycelium Meat in Plant-Based Food Innovations

The US market growth of mycelium meat is driven by its role in plant-based food innovations. Health-conscious and eco-aware consumers are leading this shift. Companies like Meati and MycoTechnology are at the forefront, creating products that are both tasty and ethically produced.

“Consumer demand for sustainable proteins is reshaping food markets, and mycelium meat offers a viable solution.” – Industry analyst, Food Innovation Group

Factors Driving U.S. Market Growth

- Health trends: High protein content and low saturated fats attract health-focused buyers.

- Environmental impact: Lower carbon footprint compared to traditional meat production.

- Local demand: Growing interest in lab-grown and alternative proteins fuels US market growth.

Retailers and food manufacturers are teaming up to meet the growing demand. In 2023, plant-based meat sales in the U.S. jumped 15%. This shows strong interest. Startups and established brands are pouring money into research and development to improve texture and scalability.

Consumer surveys reveal 60% of Americans prefer sustainable options when they’re affordable. This matches with federal policies that support alternative proteins. As technology advances, mycelium-based products could take a bigger slice of the $3.08 billion market.

Netherlands’ Role as a Leader in Sustainable Meat Alternatives

The Netherlands is leading the way in sustainable food innovation. The government is collaborating with companies to reduce emissions and promote plant-based foods. Farms and laboratories in the Netherlands are developing new sources of protein, such as those derived from mycelium, to decrease reliance on livestock.

Key Initiatives in Netherlands Sustainable Food

- €150M investment in circular agriculture by 2025

- Public-private partnerships like the Brightlands Food Campus

- Startups such as Vivera and The ProteinStichting advancing mycelium tech

Wageningen University plays a crucial role in agricultural research. Their areas of focus include:

| Focus Area | Impact |

| Lab-grown proteins | 30% less water use than traditional meat |

| Alternative protein networks | 120+ companies in Dutch protein ecosystem |

These initiatives align with EU sustainability objectives. The Netherlands is regarded as a model for environmentally friendly food systems, inspiring global brands to adopt similar practices through its innovative approaches.

India’s Growing Market for Mycelium Meat as a Protein Source

India is moving towards sustainable protein sources like mycelium meat. With over 1.4 billion people, there’s a big need for affordable proteins. Food tech innovations are making mycelium products more available. This change fits with India’s goal for green alternatives.

Factors Driving the Growth of Mycelium Meat in India

- Rising urbanization boosting demand for modern protein solutions

- Government support for lab-grown and alternative protein R&D

- Cultural openness to plant-based diets

| Traditional Protein | Mycelium Meat |

| High water use | Uses 90% less water |

| Animal farming emissions | Carbon footprint reduced by 50% |

| Limited scalability | Can be mass-produced |

Startups like Heura Foods and Impossible Foods are teaming up with Indian companies. By 2025, mycelium meat might be cheaper than chicken. This move could make India a key player in the protein shift worldwide.

The Future of Mycelium Meat: Technological Advances and Sustainability Goals

The future of mycelium meat is bright, thanks to food industry trends focusing on innovation and green practices. Startups and big food companies are working hard to make mycelium proteins better and cheaper. They want to make these products as common as chicken nuggets.

Technological Advances

Here are some technological advances that are expected to contribute to the growth of mycelium meat:

- AI-driven strain optimization for faster growth cycles

- Corporate partnerships with agri-tech firms to scale production

- Biodegradable packaging solutions aligned with UN sustainability goals

“Mycelium’s adaptability makes it a blueprint for the next decade of food systems,” says Dr. Lena Torres, bioprocess engineer at MycoProtein Labs.

Sustainability Goals

By 2030, companies like Meati Foods hope to use 70% less water than beef. They plan to use vertical farming to make mycelium a key part of sustainable food systems. This move is in line with big retailers like Walmart and Nestlé going for net-zero goals.

As more people become interested, expect to see mycelium-based foods in stores. This change isn’t just about being kind to animals—it’s about what’s possible in a world focused on sustainability. The next five years will show if mycelium can grow big while staying green, setting a new trend in the food industry trends.

Competitive Dynamics in the Mycelium Meat Market

- MycoTechnology – Aurora, Colorado, United States

- Beyond Meat – El Segundo, California, United States

- Quorn Foods – Stokesley, North Yorkshire, United Kingdom

- Aleph Farms – Rehovot, Israel

- Meati Foods – Boulder, Colorado, United States

- Atlast Food Co.

- Avant Meats – Singapore

- Prime Roots – San Francisco, California, United States

- The Good Food Institute – Washington, D.C., United States

- Redefine Meat – Rehovot, Israel

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Mycelium Meat Market Report |

| Base Year | 2024 |

| Segment by Type |

· Bacon & Deli Meats · Chicken · Whole-Cut Steak · Others |

| Segment by Application |

· Commercial · Household |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The mycelium meat market is growing fast, aiming for $3.08 billion by 2025. It’s all about finding the right balance between new ideas and making things accessible. New tech is changing how we grow and process mycelium-based proteins.

This tech tackles big issues like making more and tasting better. Companies in the U.S., Netherlands, and India are leading the way. They’re working to make these products as good as traditional meat.

Teams around the world are working together to make progress faster. In the U.S., startups are working hard to make things efficient. The Netherlands is using its biotech skills to improve growth conditions.

India sees mycelium as a way to meet protein needs without breaking the bank. These efforts help the planet by reducing harm from traditional farming.

Teaching people about mycelium meat is crucial. Talking about its health benefits and how it’s good for the planet can help. As costs go down and flavors get better, mycelium could become a common protein choice.

The next few years will show how fast these changes will happen. They could lead to a future where eating sustainably and using new tech go together.

Global Mycelium Meat Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Mycelium Meat Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Mycelium Meat Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Mycelium Meatplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Mycelium Meat Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Mycelium Meat Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Mycelium Meat Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Mycelium Meat Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Mycelium Meat?

Mycelium meat is a plant-based protein made from fungi. It tastes and feels like real meat, making it a favorite among those looking for meat alternatives.

How is Mycelium Meat produced?

Mycelium meat is grown in a special environment. Fungi eat organic materials like old plants. This method is innovative and environmentally friendly, producing healthy food.

Why is Mycelium Meat considered a sustainable option?

Mycelium Meat is better for the planet because it requires less land and water compared to traditional meat production, and it also generates less pollution. This aligns with our goals of protecting and preserving the Earth.

What are the key markets for Mycelium Meat?

The U.S., Netherlands, and India are significant markets. People in these countries are looking for food options that are environmentally friendly.

What challenges does the Mycelium Meat Market face?

The main challenges for the Mycelium Meat Market are:

- Making it: Developing and producing high-quality mycelium-based meat products.

- Keeping it good: Ensuring that the taste, texture, and nutritional value of mycelium meat are maintained throughout production and distribution.

- Getting people to try it: Overcoming consumer skepticism and encouraging people to give mycelium meat a chance.

These challenges need to be addressed in order to expand the market.

How are geopolitical factors influencing the Mycelium Meat Market?

Rules and trade deals from countries can really affect how it’s made and sold. This changes how the market grows in different places.

What trends are shaping the Mycelium Meat Market?

More people want food that’s good for the planet and their health. New products and health awareness are leading these changes.

How does mycelium meat fit into the food industry?

Mycelium meat plays a crucial role in the emergence of new protein alternatives. It can be found in nutritious menus and recipes, contributing to the creation of more sustainable food options for our planet.

What is the future of the Mycelium Meat Market?

The future looks promising. New technology and a focus on sustainability will contribute to its growth. Additionally, more people are expected to develop an appreciation for it.

How is the Netherlands leading in sustainable meat production?

The Netherlands is leading thanks to government support and private money. They’re making big steps in making meat alternatives better.

What factors are driving the growth of mycelium meat in India?

India’s large population and changing food preferences are contributing to its growth. Additionally, new food technology is also playing a significant role.