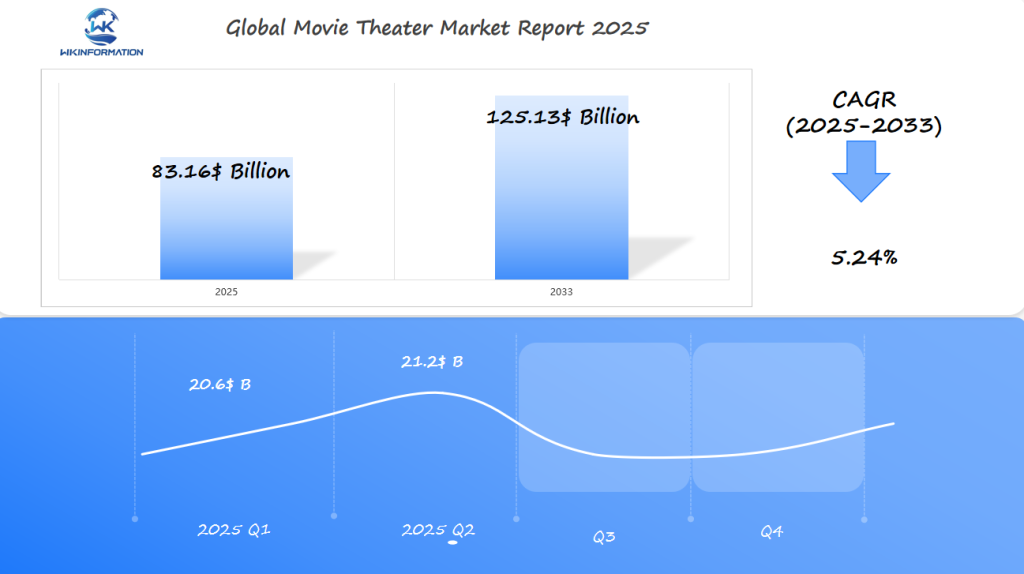

Movie Theater Market to Hit $83.16 Billion by 2025: Booming Demand in the U.S., China, and Germany

Discover insights into the booming movie theater market, projected to reach $83.16 billion by 2025. Explore key growth drivers in the U.S., China, and Germany, including technological innovations, changing consumer preferences, and industry adaptations. Learn about market challenges, emerging trends, and future developments shaping the theatrical experience, from AI integration to immersive technologies. Get comprehensive analysis of competitive dynamics, regional market characteristics, and strategic initiatives transforming the global cinema landscape.

- Last Updated:

Movie Theater Market Q1 and Q2 2025 Forecast

The Movie Theater market is projected to reach $83.16 billion in 2025, growing at a CAGR of 5.24% from 2025 to 2033. In Q1 2025, the market is expected to generate around $20.6 billion, as cinema chains across the U.S., China, and Germany continue to recover from the impacts of the COVID-19 pandemic. The increasing popularity of blockbuster films, along with the return of audiences to theaters, is expected to drive growth in both ticket sales and concessions.

By Q2 2025, the market is projected to grow to approximately $21.2 billion, as premium formats like IMAX, 4DX, and Dolby Cinema become increasingly popular, attracting film enthusiasts seeking more immersive viewing experiences. China is expected to lead growth in Asia, while Germany sees steady demand for both Hollywood and local films.

Analyzing the Upstream and Downstream Dynamics in the Movie Theater Market

The movie theater industry’s supply chain reveals complex interactions between content creators, distributors, and exhibitors.

Upstream dynamics

Upstream dynamics encompass relationships with:

- Film production studios

- Distribution companies

- Technology providers

- Equipment manufacturers

- Digital content delivery systems

These upstream partners directly influence theater operations through content availability, technical specifications, and delivery schedules. Major studios like Disney, Warner Bros., and Universal maintain significant control over release windows and revenue-sharing agreements.

Downstream dynamics

Downstream dynamics focus on consumer interaction points:

- Ticket sales platforms

- Concession suppliers

- Marketing channels

- Customer service systems

- Payment processors

Consumer spending patterns shape theater operations in multiple ways:

- Peak viewing times drive staffing decisions

- Food and beverage preferences affect inventory management

- Premium format demand influences equipment investments

- Seasonal variations impact programming schedules

The role of content creators and distributors has evolved with digital transformation. Studios now leverage data analytics to:

- Optimize release timing

- Target specific demographics

- Adjust marketing strategies

- Determine screen allocation

Theater chains must balance these upstream pressures with downstream consumer demands. Revenue sharing typically follows a sliding scale, with theaters earning:

- 20-25% of ticket sales in opening weeks

- Increasing percentages in subsequent weeks

- 80-85% of concession revenues

- Additional income from pre-show advertising

This complex ecosystem requires careful management of both supply chain relationships and consumer expectations to maintain profitability in the competitive entertainment market.

Key Trends Reshaping the Movie Theater Industry

The movie theater industry is going through a significant change due to new technological advancements. Virtual reality (VR) has become a major influence, with theaters introducing VR pods and interactive areas. Companies like IMAX have opened VR Experience Centers in certain locations, providing immersive entertainment beyond regular movie showings.

Audio-Visual Advancements Redefining Cinema

Improvements in audio and visual technology have completely transformed the movie-watching experience:

- Laser Projection Systems: Offering incredibly clear 4K images with brighter and more contrasting visuals

- Dolby Atmos Sound: Providing three-dimensional sound with up to 64 individual speakers

- Screen X Technology: Creating wide-angle viewing experiences with 270-degree projection

- LED Screens: Using Samsung’s Onyx LED technology for superior picture quality

The Rise of Private Screenings

Private screenings have become increasingly popular, leading theaters to adapt their business models. AMC Theatres reported a 300% increase in private watch parties from 2021 to 2022. These exclusive events provide:

- Customizable content selection

- Flexible scheduling options

- Personal space for social gatherings

- Opportunities for corporate events

Integration of Smart Technology in Theaters

Theaters are incorporating smart technology features to enhance the customer experience:

- AI-powered seat selection systems for personalized seating arrangements

- Automated concession ordering platforms for convenient snack purchases

- Digital wayfinding solutions for easy navigation within the theater

- Contactless payment options for seamless transactions

The Emergence of Experiential Cinema

The rise of experiential cinema has introduced concepts like 4DX theaters, which include environmental effects such as moving seats, simulated weather conditions, and scent elements. These innovations have resulted in a 15% increase in premium format ticket sales across major cinema chains.

Barriers to Growth in the Movie Theater Sector

The movie theater industry faces significant challenges that hinder its projected growth to $83.16 billion by 2025.

Competition from Streaming Platforms

The rise of streaming platforms has created intense competition for viewers’ attention and entertainment budgets. Netflix, Disney+, and Amazon Prime offer extensive content libraries at competitive monthly rates, allowing consumers to access new releases without leaving their homes.

Ongoing Impact of COVID-19

COVID-19’s impact continues to ripple through the industry. Theater chains report 20-30% lower attendance rates compared to pre-pandemic levels, with some demographics showing persistent hesitation about returning to crowded indoor spaces.

This behavioral shift has forced theaters to:

- Implement costly safety measures

- Reduce seating capacity

- Adjust staffing levels

- Modify concession operations

Economic Pressures on the Industry

Rising inflation affects various aspects of the movie theater business, including:

- Ticket prices

- Concession costs

- Operating expenses

- Consumer discretionary spending

The combination of these factors has led to changes in consumer behavior. Many viewers now wait for films to appear on streaming platforms rather than paying premium prices for theatrical releases. This shift particularly affects mid-budget films, which traditionally served as reliable revenue generators for theaters.

Justifying Value Against Home Entertainment Options

Theater chains face increasing pressure to justify their value proposition against home entertainment options. The cost of modernizing facilities and implementing new technologies strains operational budgets, while reduced attendance impacts revenue streams needed for these investments.

Navigating Relationships with Film Studios

The competitive landscape requires theaters to navigate complex relationships with film studios, who increasingly experiment with simultaneous streaming and theatrical releases. This hybrid distribution model challenges traditional theatrical exclusivity windows and revenue-sharing agreements.

Geopolitical Factors Affecting Movie Theater Operations

The movie theater industry faces complex geopolitical challenges that shape its global operations. Different regulatory frameworks across countries create varying operational requirements:

- China’s Film Quota System: Limits foreign film releases to 34 titles annually, impacting Hollywood studios’ market access

- Russia’s Content Restrictions: Mandatory dubbing laws and content censorship affecting international releases

- European Union’s Screen Quotas: Requirements for theaters to show specific percentages of European productions

Cultural preferences significantly influence movie consumption patterns:

- Bollywood dominance in South Asian markets limits Western film penetration

- Korean Wave (Hallyu) creates strong regional preferences in East Asia

- Religious and social sensitivities affect content distribution in Middle Eastern markets

Trade relations between countries directly impact film distribution:

- U.S.-China trade tensions affect revenue-sharing agreements

- Brexit’s influence on UK-EU film distribution networks

- International co-production treaties shaping market access

Local content protection policies create additional market barriers:

- Screen time regulations favoring domestic productions

- Government subsidies for local film industries

- Import tariffs on foreign film distributions

These geopolitical factors create a complex landscape where movie theaters must navigate varying regulations, cultural expectations, and international trade dynamics. Market success often depends on understanding and adapting to these regional specificities while maintaining profitable operations across different territories.

Exploring Movie Theater Market Segmentation by Format

The movie theater industry consists of different formats that cater to various audience preferences and viewing experiences:

1. Multiplexes

- Dominate 65% of market revenue

- Multiple screens under one roof

- Flexible scheduling and varied content options

- Premium amenities like luxury seating and dining services

2. IMAX Theaters

- Generate 20% of market revenue

- Specialized projection technology

- Premium pricing structure

- Exclusive partnerships with blockbuster releases

3. Independent Cinemas

- Represent 15% of market revenue

- Focus on art house and foreign films

- Unique architectural character

- Community-centered programming

Revenue patterns show multiplexes leading in urban areas, while IMAX theaters command higher ticket prices and per-screen revenue. Independent cinemas maintain steady growth through loyal customer bases and specialized programming.

Consumer preferences vary by demographic:

- Young adults (18-34): Prefer multiplexes for social experiences

- Film enthusiasts: Gravitate toward independent venues

- Families: Choose IMAX for special occasions

- Urban professionals: Select luxury multiplex experiences

Market research indicates rising demand for specialized viewing experiences:

- Private screening rooms

- Boutique cinema concepts

- Hybrid formats combining multiple experiences

- Enhanced sound and projection systems

The segmentation continues to evolve with technological advancements and changing viewer expectations. Theaters adapt their formats to match local market demands and demographic preferences, creating unique positioning strategies within their respective segments.

How Applications Are Impacting Movie Theater Demand

Mobile Ticketing Apps

-

Impact: Simplify booking, reduce queue times, and encourage spontaneous visits.

-

Examples: AMC Theatres app, Fandango, BookMyShow (India), Atom Tickets.

-

Benefit: Real-time seat selection, loyalty integration, digital payments.

Streaming Integration & Promotions

-

Impact: Some theaters partner with streaming platforms for exclusive premieres.

-

Result: Creates hybrid interest and crossover demand between streaming and theatrical releases.

Cinema Management Software

-

Impact: Used internally for scheduling, ticketing, customer analytics, and inventory.

-

Effect: Increases efficiency and tailors offerings to audience demand.

Global Insights into the Movie Theater Market Landscape

The movie theater market displays distinct regional characteristics across different continents, shaped by local preferences and economic conditions. Asia-Pacific leads market growth, driven by rising disposable incomes and urbanization trends. India’s market stands out with its unique mix of regional cinema and Bollywood productions, attracting diverse audience segments.

Latin American theaters have embraced premium formats, with Mexico and Brazil showing strong adoption rates for 3D and IMAX screenings. The region’s market benefits from a growing middle class and increased entertainment spending.

Key market indicators reveal interesting patterns:

- Ticket Price Variations

- Europe: €8-15 average

- Asia: $3-12 range

- North America: $9-15 standard

- Screen Density

- South Korea: Highest screens per capita

- Africa: Lowest theater penetration

- Middle East: Rapid expansion in UAE and Saudi Arabia

The European market maintains steady growth through art house cinema circuits and government support for local film industries. Australia and New Zealand demonstrate strong preference for premium viewing experiences, with luxury cinema concepts gaining popularity.

Regional content preferences significantly impact market dynamics, with local language films commanding substantial market share in countries like Japan, South Korea, and France. This cultural diversity drives unique distribution strategies and programming choices across different territories.

U.S. Movie Theater Market: Trends, Challenges, and Opportunities

The U.S. movie theater market demonstrates remarkable resilience post-pandemic, with box office revenues reaching $9 billion in 2023 – a 21% increase from 2022. This recovery signals a strong return of American audiences to theaters, driven by blockbuster releases and enhanced viewing experiences.

Market Leaders and Strategic Initiatives

- AMC Entertainment: Leads the market with 7,850 screens across 950 venues

- Cinemark: Operates 4,500 screens in 420 locations

- Regal Cinemas: Maintains 6,787 screens in 505 theaters

These major players have implemented aggressive recovery strategies:

Enhanced Premium Offerings

- IMAX expansions

- Dolby Cinema installations

- Premium large format screens

Digital Innovation

- Mobile ordering for concessions

- Contactless payment systems

- AI-powered scheduling optimization

The U.S. market sees substantial investments in modernization, with theaters allocating $2.5 billion for facility upgrades in 2023-2024. These improvements include:

- 4K laser projection systems

- Luxury recliner seating

- Advanced sound systems

- Enhanced concession options

Private equity firms show renewed interest in the sector, injecting $1.2 billion in theater chain modernization projects. This investment surge focuses on:

- Digital infrastructure development

- Sustainable energy solutions

- Premium viewing experiences

- Alternative content programming

Subscription services emerge as a key revenue stream, with AMC Stubs A-List and Cinemark Movie Club reporting membership growth of 30% in 2023. These programs generate steady income while fostering customer loyalty through exclusive benefits and discounted concessions.

China's Movie Theater Market: Key Insights and Expansion Drivers

China’s movie theater industry has become a global leader, earning $6.7 billion in box office revenues in 2023. Since 2020, the market has experienced an impressive average annual growth rate of 35%, making it the world’s largest film market in terms of the number of screens.

Key Growth Drivers:

- Increasing middle-class population with more disposable income

- Strong demand for domestic film productions

- Government support for cinema infrastructure development

- Adoption of advanced screening technologies

The success of local films has transformed China’s cinema landscape. Chinese-made movies now account for 70% of total box office revenue, with record-breaking hits like The Battle at Lake Changjin leading the way.

Leading Cinema Chains in China:

- Wanda Film – 780 theaters, 6,900 screens

- China Film Digital Cinema – 650 theaters, 5,800 screens

- Shanghai United Circuit – 450 theaters, 4,200 screens

These chains have implemented innovative strategies to attract audiences:

- Smart ticketing systems with AI-powered seat allocation

- Premium viewing experiences with 4D and IMAX screens

- Food delivery services to theater seats

- Digital payment integration through WeChat and Alipay

The market has seen significant investment in theater infrastructure, particularly in tier-2 and tier-3 cities where expansion is being driven. Chinese theaters have also embraced technological advancements, with 95% of screens now equipped with digital projection systems and 3D capabilities.

Recent partnerships between domestic chains and international technology providers have further enhanced viewing experiences by introducing advanced sound systems and projection quality. This sets new standards for cinema entertainment across Asia.

Germany's Role in the Growing Movie Theater Market

Germany is a major player in the European cinema scene, with annual box office revenues exceeding €1 billion. The German market’s success can be attributed to its extensive network of 3,900+ cinema screens across the country and a population that has a strong interest in both local and international films.

Viewing Preferences of German Audiences

German audiences have specific preferences when it comes to watching movies:

- They strongly support local productions, with German-language films accounting for 25-30% of the market share.

- There is a high demand for dubbed versions of international releases.

- Weekday evening showings are preferred by many viewers.

- Premium formats like IMAX and Dolby Cinema are gaining popularity.

Key Players in the German Theater Market

Several major players are shaping the German theater industry:

1. Major Cinema Operators:

- CinemaxX AG – operates 31 locations nationwide

- UCI Kinowelt – has 22 multiplexes across major cities

- Cineplex Group – largest theater network with 90 locations

- Yorck Kinogruppe – leading arthouse cinema chain in Berlin

The strength of the market lies in its dual-track approach, which combines commercial multiplexes with arthouse venues. This structure allows for both mainstream blockbusters and independent productions to thrive, resulting in a diverse theatrical ecosystem.

Embracing Technological Innovation

German theaters have embraced technological innovation to enhance the moviegoing experience:

- Laser projection systems have been implemented for superior image quality.

- Mobile ticketing platforms have been integrated for convenient booking.

- Concession offerings now include local specialties to cater to regional tastes.

- Subscription-based viewing models are being developed to attract frequent moviegoers.

Government Support for Resilience

The resilience of the German theater market is further strengthened by significant government support. The German Federal Film Fund (DFFF) plays a crucial role in providing financial assistance for theater modernization and film production. This support system helps maintain Germany’s position as an important player in the global movie theater market.

Looking Ahead: Future Developments in the Movie Theater Industry

The movie theater industry is on the verge of major technological changes that will transform the way we experience films. Here are some key areas where we can expect to see advancements:

1. AI-Powered Enhancements

Artificial intelligence (AI) will play a significant role in improving various aspects of the movie theater experience:

- Smart Seat Selection: AI algorithms will analyze viewing angles and acoustics to help viewers choose the best seats in the house.

- Automated Concessions: Robotic systems will handle food and beverage orders, making the concession process faster and more efficient.

- Predictive Programming: Data-driven showtime scheduling based on audience patterns will ensure that movies are screened at times when they are most likely to attract large crowds.

2. Virtual and Augmented Reality Integration

Virtual reality (VR) and augmented reality (AR) technologies have the potential to bridge the gap between traditional cinema and interactive entertainment:

- Several theater chains are currently testing AR-enhanced pre-show experiences where viewers can use their smartphones to interact with movie characters.

- This integration of VR and AR into the movie-watching experience opens up new possibilities for storytelling and audience engagement.

3. Evolving Audience Expectations

The COVID-19 pandemic has significantly impacted how people view movies, leading to changes in their expectations:

- There is now a growing demand for hybrid screening options that combine at-home and in-theater experiences.

- Health-safety features such as advanced air filtration systems and contactless technologies are becoming more important to audiences.

- Flexible viewing spaces, such as modular theaters that can adapt to different group sizes, are also gaining popularity.

4. New Format Innovations

Various innovative formats are emerging across the industry:

These formats aim to provide immersive experiences that go beyond traditional film screenings.

5. Technological Advancements in Theaters

Several cutting-edge technologies are being introduced in theaters:

- 8K projection systems for ultra-high-definition visuals

- Holographic displays for lifelike images

- Haptic feedback seating for physical sensations during action sequences

- Immersive sound environments for a 360-degree audio experience

These advancements enhance the overall cinematic experience by appealing to multiple senses.

6. Interactive Movie Experiences

The integration of social media and gaming elements into movie experiences suggests a future where audience participation is encouraged:

- Theaters are experimenting with choose-your-own-adventure screenings where viewers can vote on plot developments in real-time using mobile apps.

- This interactivity adds an element of unpredictability and excitement to film screenings.

These developments indicate a shift towards more personalized, technology-driven cinema experiences that still prioritize communal movie-watching while embracing digital innovation.

Competitive Landscape in the Movie Theater Sector

The movie theater industry is highly competitive, with three major players dominating the market: AMC Entertainment, Regal Entertainment, and Cinemark Holdings. Each company has its own unique strategies to stay ahead:

-

AMC Theatres – United States

-

Cinépolis – Mexico

-

PVR LTD – India

-

Regal Cinemas – United States (subsidiary of Cineworld Group, UK)

-

Wanda Cinemas – China

Overall

| Report Metric | Details |

|---|---|

|

Report Name |

Global Movie Theater Market Report |

|

Base Year |

2024 |

| Segment by Type |

· Multiplexes · IMAX Theaters · Independent Cinemas |

|

Segment by Application |

· Mobile Ticketing Apps · Streaming Integration & Promotions · Cinema Management Software |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

|

Forecast units |

USD million in value |

|

Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The movie theater industry stands at a pivotal moment of transformation and opportunity. Through technological innovation, strategic market adaptation, and evolving consumer experiences, theaters continue to demonstrate their irreplaceable role in entertainment culture. The success of mobile applications, premium viewing formats, and personalized services shows the industry’s ability to evolve with changing consumer preferences.

Despite challenges from streaming platforms and pandemic-related disruptions, movie theaters remain vital cultural spaces that offer unique, communal experiences impossible to replicate at home. The integration of advanced technologies, coupled with strategic market expansion in key regions like China and Germany, positions the industry for sustainable growth.

As theaters continue to innovate with AI-powered systems, virtual reality experiences, and enhanced viewing formats, they strengthen their value proposition to modern audiences. The future of movie theaters lies in their ability to balance traditional cinema appeal with cutting-edge entertainment technology, creating immersive experiences that continue to draw audiences back to the big screen.

Global Movie Theater Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Movie Theater Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Movie TheaterMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Movie Theaterplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Movie Theater Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Movie Theater Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Movie Theater Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofMovie Theater Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the movie theater market by 2025?

The movie theater market is projected to reach $83.16 billion by 2025, driven by booming demand particularly in the U.S., China, and Germany.

What are the key trends reshaping the movie theater industry?

Key trends include technological advancements such as virtual reality technologies, innovations in audio-visual systems, and a growth in private screenings and watch parties.

How has consumer spending impacted theater operations?

Consumer spending plays a crucial role in theater operations, influencing ticket sales, concession revenue, and overall profitability for cinema operators.

What challenges does the movie theater sector face due to streaming services?

The rise of streaming platforms poses significant challenges for the movie theater sector, affecting audience attendance and competition for consumer attention.

How is the U.S. movie theater market recovering post-pandemic?

The U.S. movie theater market is experiencing a recovery with investment opportunities aimed at modernization, as major players like AMC Entertainment and Cinemark adapt their strategies to attract audiences back.

What factors are driving the growth of China’s movie theater market?

China’s booming movie theater industry is driven by strong consumer demand, local productions, and favorable box office trends that contribute to its expansion.