Motor Insurance Market Projected to Surpass $960.69 Billion by 2025 Fueled by Mobility Demand in the U.S., China, and the U.K.

Discover how digital technologies, artificial intelligence, and market dynamics are reshaping the motor insurance industry. Learn about coverage types, regulatory challenges, and emerging trends across global markets including the US, UK, and China.

- Last Updated:

Motor Insurance Market Outlook for Q1 and Q2 2025

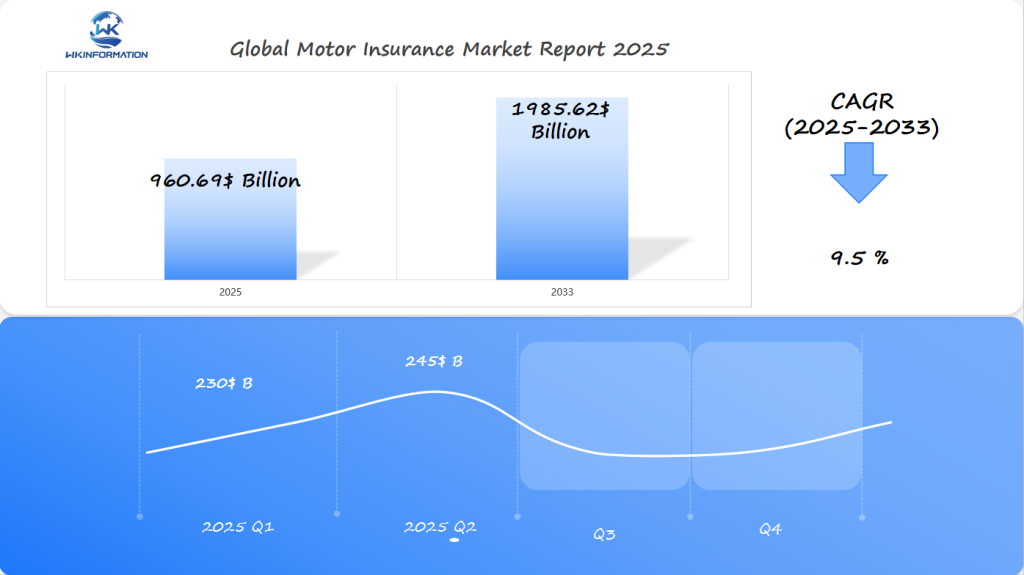

The Motor Insurance market is set to reach $960.69 billion in 2025, with a CAGR of 9.5% from 2025 to 2033. In Q1 2025, the market will likely see steady growth, reaching approximately $230 billion, as consumer confidence in the global economy continues to rise. The U.S., China, and the U.K. will be the dominant players, with higher insurance premiums in line with increased vehicle ownership and more stringent regulations related to safety standards.

By Q2 2025, the market is projected to grow to around $245 billion, driven by technological innovations in insurance policies such as telematics-based pricing and more customized coverage options. The U.S. will continue to lead the market, with the adoption of usage-based insurance policies expected to grow. China’s rapidly expanding middle class and increasing vehicle ownership will contribute to the surge in motor insurance uptake, while the U.K. will see growth driven by newer, electric vehicle (EV) models entering the market.

Motor Insurance market ecosystem from upstream to downstream

The motor insurance market is a complex web of players working together to provide full insurance services. This chain goes from the start to the end, involving many steps.

Key Players in the Motor Insurance Ecosystem

Key players in this ecosystem include:

- Insurance Companies

- Underwriters

- Risk Assessment Specialists

- Technology Providers

- Claims Processing Agencies

It’s important to know how these players work together. This helps us understand how insurance services are made, priced, and given to people.

The Two Stages of the Motor Insurance Process

The motor insurance process can be divided into two main stages:

- Early Stages: These involve activities like risk evaluation, policy design, premium calculation, and reinsurance arrangements.

- Later Parts: These deal with customer interactions such as sales and distribution, customer support, claims management, and policy servicing.

Technology is changing this world, making things more efficient and smart.

Digital transformation and telematics trends in Motor Insurance

The motor insurance world is changing fast thanks to digital transformation. Telematics technology is changing how insurers figure out risk, set prices, and talk to customers. Usage-based insurance is a big change, using real-time data to make insurance more personal.

Key changes in digital transformation for motor insurance:

- Advanced sensor technologies tracking driver behavior

- Artificial intelligence-powered risk assessment

- Real-time policy customization

- Smartphone apps for instant policy management

Telematics devices are changing old ways of insurance. Connected car technologies let insurers get exact driving data. This means drivers can pay less if they drive safely.

“Digital transformation in motor insurance is not just about technology, but about creating more responsive and personalized customer experiences.” – Insurance Technology Insights

Benefits of Telematics and digital platforms:

- Improved risk assessment accuracy

- Dynamic pricing models

- Enhanced customer engagement

- Proactive safety recommendations

Insurance companies are putting a lot into digital transformation. They see usage-based insurance growing fast. This is because people want fair and clear prices.

Regulatory challenges and pricing pressures in Motor Insurance

The world of motor insurance is getting more complex. New insurance rules are making it tough for companies to keep up. They must quickly adjust to these changes to stay in business.

Some big challenges for motor insurance include:

- Stricter consumer protection guidelines

- Enhanced data privacy requirements

- Mandatory risk assessment protocols

- Increased transparency in pricing models

Insurers face a big problem. They need to follow the rules and make money at the same time. Customers want good deals, but insurers have to deal with many costs and risks.

The biggest hurdles in motor insurance rules are:

- Adapting to new tech

- Managing risk with algorithms

- Using data for pricing

- Protecting customers fully

Advanced analytics and machine learning are key for insurers to handle these tough rules. Companies that use tech well and follow the rules closely will stand out in the market.

The future of motor insurance is about smart rules and clear prices.

Geopolitical and economic impacts on vehicle insurance markets

The global motor insurance market is changing fast. This is due to complex geopolitical factors and economic influences. Insurers face big challenges as they try to keep up with these changes.

Geopolitical factors affecting vehicle insurance markets

Key geopolitical factors affecting vehicle insurance markets include:

- Trade policy shifts affecting automotive manufacturing

- Regional economic instability impacting insurance premiums

- Cross-border regulatory changes

- International supply chain disruptions

Economic influences on vehicle insurance markets

Economic factors are also very important. Macroeconomic trends like inflation and interest rates affect how many people own cars. This, in turn, changes how much insurance is needed.

Challenges for insurers

Insurance companies need to find ways to deal with market ups and downs. They must use advanced risk models. These models should include information on geopolitics and economic forecasts.

| Geopolitical Factor | Insurance Market Impact | Risk Level |

| Trade Tensions | Increased Vehicle Import/Export Costs | High |

| Regional Conflicts | Premium Rate Adjustments | Medium |

| Economic Sanctions | Reduced Market Access | High |

Managing risks well is key for insurers in today’s world. By understanding both economic and geopolitical factors, companies can make insurance products that meet new challenges.

Segmentation of Motor Insurance by coverage type and risk category

The motor insurance market keeps changing with new ways to sort customers and risks. Insurers now use detailed methods to match insurance with what drivers need and their risk levels.

Risk categories are key in setting insurance prices and what’s covered. Insurers group drivers based on several important factors:

- Driving history and accident record

- Vehicle type and age

- Driver’s age and experience

- Geographic location

- Annual mileage

Insurance coverage types have grown to offer more specific protection. The main types are:

- Comprehensive Coverage: Covers non-collision damages like theft, natural disasters, and vandalism

- Collision Coverage: Deals with damages from car accidents

- Liability Coverage: Covers damages to others in an accident

- Personal Injury Protection: Pays for medical costs for drivers and passengers

“Effective market segmentation allows insurers to create more personalized and affordable insurance solutions for diverse driver profiles.” – Insurance Industry Analyst

Digital tech has changed how we sort risks, making insurance more tailored. With data analytics and telematics, insurers can now offer insurance that fits each driver’s unique habits and risks.

Applications across personal, commercial, and fleet vehicle insurance

The world of motor insurance is vast and varied. It covers personal auto, commercial vehicle, and fleet management. Insurers aim to offer full protection in these areas.

Personal Auto Insurance

Personal auto insurance is key for drivers. It’s made to fit each person’s unique needs. Insurers use data to craft policies that match what each driver needs.

Commercial Vehicle Insurance

Commercial vehicle insurance is more complex. It must protect businesses with many drivers and vehicles. Comprehensive coverage strategies help companies avoid big losses from accidents.

Fleet Management Insurance

Fleet management insurance is a smart way to manage risks for big fleets. It uses advanced tech to track vehicles and drivers. This helps insurers set prices based on real-time data.

Regional breakdown and adoption trends in Motor Insurance

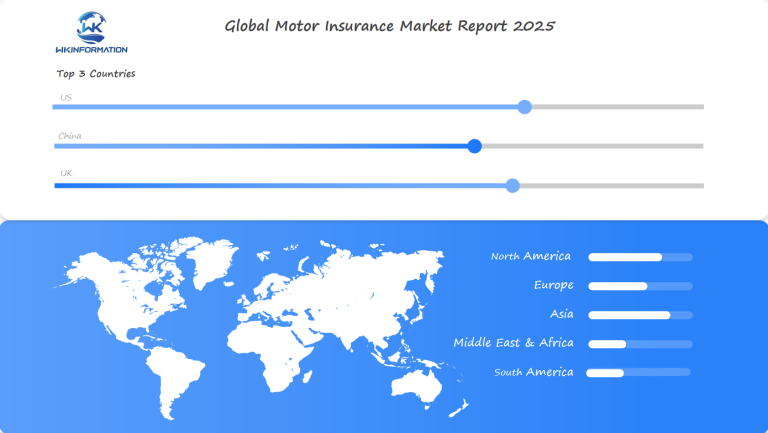

The global motor insurance scene shows different regional markets with their own traits. These traits affect how people take up motor insurance in various. It’s key for insurers to grasp these differences when they enter new markets.

Each area has its own way of using motor insurance. In North America, there’s a lot of car ownership and advanced insurance systems. In contrast, Asia-Pacific is growing fast because of more cars and roads.

- North America: Advanced digital integration

- Europe: Stringent regulatory frameworks

- Asia-Pacific: Rapid market expansion

- LAMEA: Emerging insurance opportunities

Insurance trends show big differences in how risks are seen, prices are set, and tech is used around the world. Insurers need to tailor their plans for each area. They must think about local economies, rules, and how people act.

| Region | Market Maturity | Adoption Rate | Key Drivers |

| North America | High | 95% | Technology, Risk Management |

| Europe | Established | 90% | Regulatory Compliance |

| Asia-Pacific | Growing | 65% | Economic Development |

| LAMEA | Emerging | 40% | Infrastructure Growth |

Technology and rules play big roles in how motor insurance is used globally. Insurers must keep changing their plans to fit the needs of each area.

U.S. Motor Insurance market driven by vehicle ownership and tech

The U.S. auto insurance market is changing fast. This is thanks to more cars on the road and new technology. With about 280 million registered vehicles, there’s a big need for new insurance ideas to keep Americans safe.

Several things are making the U.S. motor insurance market grow:

- More cars in cities and towns

- New technology in insurance services

- Telematics and data to assess risks

- People want insurance that fits their needs

The Impact of Technology on Insurance

New technology is changing how insurance works. Artificial intelligence and machine learning help make insurance better. Now, insurers can offer lower prices to safe drivers. Digital insurance sales have gone up 30% in a year, showing a big move to online services.

The Role of State Regulations

Rules from each state also matter a lot. Insurers have to deal with these rules while using technology to offer good deals. The market is growing because of these tech steps.

The Future of U.S. Motor Insurance

As more cars are bought and technology gets better, the U.S. motor insurance market is leading the way. It promises better, more tailored, and smart insurance for everyone.

China’s expanding auto market shaping Motor Insurance needs

The auto insurance market in China is changing fast. This is because of the country’s quick economic growth and more people owning cars. Markets like China are changing the global motor insurance world. They do this with new consumer needs and tech.

Several things are making insurance needs in China grow:

- More people buying cars

- More money in the pockets of the middle class

- New digital insurance services

- Help from the government

China’s car industry is full of chances for insurance companies. The country’s strong economy means there’s room for new insurance products. These products can meet the needs of different people.

“China represents the most significant growth potential in the global motor insurance market” – Global Insurance Insights Report

New tech is changing how insurance works. Things like telematics and AI help make insurance more personal. This means insurers can set prices that better fit the Chinese market.

| Market Segment | Growth Projection | Key Drivers |

| Personal Auto Insurance | 12.5% CAGR | Urbanization, Income Growth |

| Commercial Vehicle Insurance | 9.8% CAGR | Logistics Expansion, Fleet Management |

Insurance companies are using digital platforms to reach more people. Mobile apps and online services are key in China’s fast-paced insurance world.

U.K. adoption of digital platforms in Motor Insurance solutions

The United Kingdom’s auto insurance is going through a big change. InsurTech companies are making old insurance models better. They use new digital platforms that make things easier for customers and work more smoothly.

There are many new things happening in UK motor insurance:

- Real-time policy management through mobile apps

- AI-powered risk assessment algorithms

- Personalized insurance pricing models

- Instant claims processing technologies

Top digital insurance platforms use new tech to offer better insurance. Telematics-based insurance products are very popular. They let insurers charge based on how you drive, rewarding safe driving.

The UK is a world leader in InsurTech, getting lots of investment. Startups are shaking things up by using data to make insurance easier and cheaper.

“The future of UK auto insurance lies in seamless digital experiences that prioritize customer convenience and personalization.” – Insurance Technology Review

More people want digital services, and insurance needs to be easy to use. As tech gets better, UK auto insurance will use even more AI and machine learning.

Motor Insurance innovation with AI and policy personalization

The world of motor insurance is changing fast, thanks to artificial intelligence and data analytics. AI is making it possible for insurers to create policies that fit each customer’s needs. It also helps them understand and manage risks better.

How New Technologies are Improving Risk Management

New technologies are opening up chances for better risk management. Machine learning lets insurers make policies that match a driver’s habits and the car’s features. This way, policies can be more precise and effective.

Here are some ways these technologies are being used:

- Real-time driving behavior analysis

- Dynamic premium calculations

- Predictive maintenance recommendations

- Personalized risk mitigation strategies

The Role of Telematics in Motor Insurance

Telematics, or connected car tech, is a big part of this change. It lets insurers get detailed data on how people drive. This data helps make pricing fairer and more accurate.

| AI Technology | Insurance Application | Customer Benefit |

| Machine Learning | Risk Assessment | Personalized Pricing |

| Predictive Analytics | Claims Processing | Faster Settlements |

| Computer Vision | Damage Evaluation | Accurate Estimates |

The Future of Motor Insurance: Hyper-Personalized Policies

The future of motor insurance is all about hyper-personalized policies. These policies use AI to offer protection that’s just right for each customer. They help lower risks and make the customer experience better.

Key insurers and market share in the Motor Insurance industry

In the United States, a few top insurance companies lead the motor insurance market. State Farm Mutual Automobile Insurance is at the top with 16.9% market share. It sets the bar for competition in the motor insurance competitive landscape.

Technology and focusing on customers are key for these insurers. They use data analytics and AI to improve their services. This helps them stay ahead in the motor insurance market.

- State Farm – USA

- Progressive – USA

- Geico – USA

- Allstate – USA

- USAA – USA

- Liberty Mutual – USA

- Farmers – USA

- American Family – USA

- Travelers – USA

- Nationwide – USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Motor Insurance Market Report |

| Base Year | 2024 |

| Segment by Type |

· Comprehensive · Third-party Liability |

| Segment by Application |

· Personal · Commercial · Fleet Management |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The motor insurance industry stands at a pivotal point of transformation and growth. The market’s evolution is driven by technological innovation, changing consumer behaviors, and evolving regulatory landscapes. Digital platforms, telematics, and AI are revolutionizing traditional insurance models, enabling more personalized coverage and dynamic risk assessment.

Looking ahead, the industry will likely continue its trajectory toward hyper-personalization and data-driven solutions. The integration of advanced technologies will further enhance risk management capabilities and customer experience. Regional markets will evolve distinctly, with the U.S. focusing on regulatory compliance and innovation, China expanding its automotive insurance infrastructure, and the U.K. leading in digital adoption.

Success in this evolving landscape will depend on insurers’ ability to:

- Embrace technological innovation

- Navigate regulatory challenges

- Adapt to changing consumer preferences

- Manage emerging risks effectively

- Develop sustainable pricing models

As the industry moves forward, the focus will increasingly shift toward creating value through personalized solutions, efficient digital processes, and enhanced customer engagement, while maintaining profitability in an increasingly competitive market.

Global Motor Insurance Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Motor Insurance Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Motor Insuranceplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Motor Insurance Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Motor Insurance Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Motor Insurance Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofMotor Insurance Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

How are digital technologies transforming motor insurance?

Digital technologies, such as telematics and usage-based insurance, are revolutionizing the industry. They enable insurers to provide personalized plans, modify premiums based on driving behavior, and enhance customer engagement through data insights.

What challenges do motor insurers face with regulations?

Insurers struggle to stay profitable while following strict rules. They must also meet changing customer demands for fair prices and deal with complex legal issues.

How do geopolitical events impact motor insurance markets?

Events like economic downturns, trade policies, and political instability can really affect car ownership, insurance costs, and market growth worldwide.

What types of motor insurance coverage are available?

There are many types of motor insurance, such as comprehensive, third-party, and specialized policies. Each one is designed for different needs and levels of risk.

Which vehicle categories are covered by motor insurance?

Motor insurance covers various types of vehicles, including:

- Personal cars

- Business vehicles

- Fleets

Each category has its own specific insurance requirements and risk evaluations.

How are artificial intelligence technologies impacting motor insurance?

AI and machine learning help insurers create more personalized policies. They also improve risk assessments, make claims processing smoother, and enhance customer service.

What makes the U.S. motor insurance market unique?

The U.S. market is unique due to several factors:

- High car ownership rates

- State-specific rules and regulations

- Technological advancements in the industry

- Detailed development of insurance products

How is China’s automotive market influencing motor insurance?

China’s rapidly growing economy, increasing number of car owners, and evolving regulations present significant opportunities and challenges for insurance companies in the largest automotive market globally.

What trends are emerging in the U.K. motor insurance market?

The U.K. is embracing digital platforms and . It’s all about using tech to improve customer service and make things more efficient.