Metal Service Centers Market Set to Reach $323.73 Billion by 2025: Key Insights from the U.S., China, and India

A comprehensive analysis of the metal service centers market dynamics, trends, and growth prospects, highlighting the market’s projected value of $323.73 billion by 2025. The study explores key market drivers, regional insights, and technological advancements shaping the industry’s future, with particular focus on developments in major markets including the U.S., China, and India. This analysis covers crucial aspects such as supply chain optimization, emerging technologies, and competitive strategies that are transforming the metal service centers landscape.

- Last Updated:

Metal Service Centers Market Forecast for Q1 and Q2 2025

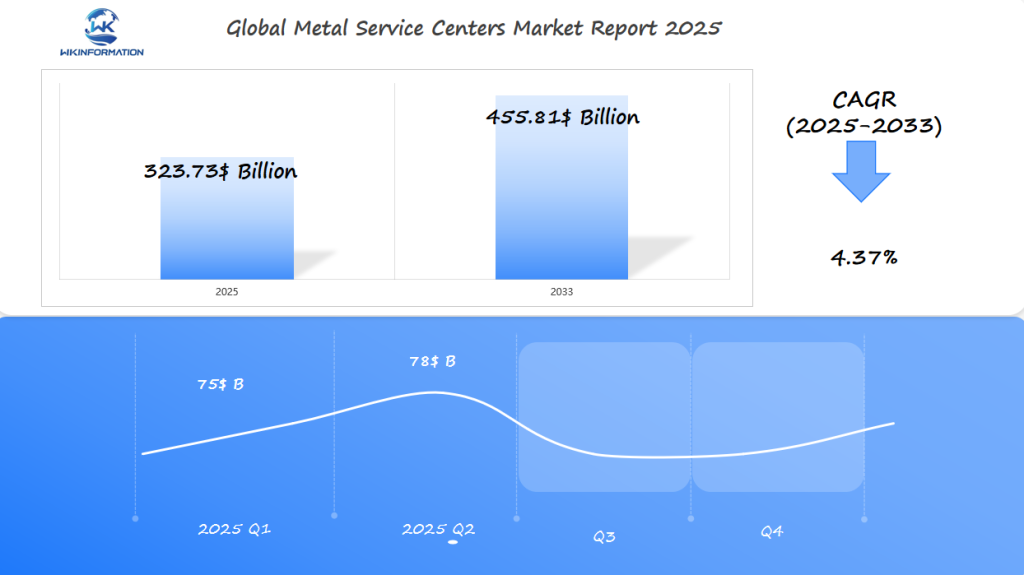

The global metal service centers market is expected to reach $323.73 billion in 2025, with a CAGR of 4.37% through 2033. In the first half of 2025, Q1 is projected to generate around $75 billion, with Q2 seeing moderate growth to approximately $78 billion. The demand for metal service centers is largely driven by the industrial and construction sectors, with key industries such as automotive, aerospace, and manufacturing requiring high-quality, processed metal products.

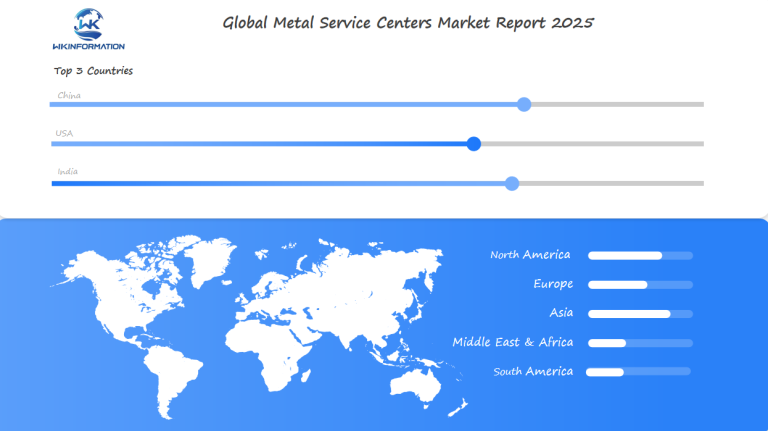

The U.S., China, and India are major markets for metal service centers. The U.S. continues to be a leading market due to its strong manufacturing base and ongoing construction projects. China follows with a booming industrial sector, requiring substantial amounts of processed metal for its infrastructure and manufacturing needs. India, with its rapidly growing economy, also plays a significant role in the metal service centers market as industrial and infrastructural projects continue to rise. These countries are essential for understanding the dynamics of the global metal service centers market.

Understanding the Upstream and Downstream Dynamics of the Metal Service Centers Market

The metal service centers market operates through a complex network of upstream and downstream activities that shape its efficiency and market value.

Upstream Supply Sources

The upstream segment of the metal service centers market includes various sources of supply that provide the necessary raw materials for operations. These sources include:

- Raw material extraction from mines and quarries

- Primary metal production facilities

- Steel mills and aluminum smelters

- Scrap metal recycling operations

However, this segment faces significant challenges in maintaining a consistent supply of raw materials due to several factors such as:

- Price volatility in raw materials

- Environmental regulations

- Energy cost fluctuations

- Transportation logistics issues

Downstream Processes

Once the raw materials are obtained, they undergo various processes to add value before reaching the end-users. The downstream segment involves activities such as:

- Material processing and customization

- Quality control and testing

- Inventory management systems

- Just-in-time delivery services

Metal service centers play a crucial role in transforming these raw materials through various value-added services, including:

- Cutting and shaping

- Heat treatment

- Surface finishing

- Custom packaging

Impact on Market Efficiency

The integration of both upstream and downstream operations directly impacts the efficiency of the market in several ways:

Supply Chain Optimization

By streamlining processes and improving coordination between different stakeholders, metal service centers can achieve:

- Reduced lead times in sourcing and delivering materials

- Lower inventory costs through effective management practices

- Improved material utilization by minimizing waste during processing

- Enhanced quality control measures to meet customer specifications

Customer Service Enhancement

In addition to operational improvements, service centers also focus on enhancing customer experience through:

- Customized product solutions tailored to specific requirements

- Technical support for troubleshooting and problem-solving

- Market intelligence to stay updated on industry trends and demands

- Flexible delivery options to accommodate varying schedules

These dynamics create a robust ecosystem where service centers act as crucial intermediaries between manufacturers and end-users, streamlining the flow of materials and information throughout the supply chain.

Key Trends Driving the Metal Service Centers Industry

The metal service centers industry is going through a rapid transformation due to changing customer needs and technological advancements. Custom processing services now hold a significant market share, as manufacturers are looking for specialized solutions to meet their specific production requirements.

1. Rising Demand for Customization

Manufacturers are increasingly seeking tailored solutions to optimize their production processes. This has led to a rise in demand for various customization services, including:

- Just-in-time inventory management

- Precision cutting and shaping services

- Material-specific processing techniques

- Specialized coating and finishing options

2. Technology Integration

Technological advancements play a crucial role in meeting the evolving demands of the metal service centers industry. Key technologies being integrated into operations include:

- AI-powered inventory tracking systems

- Automated processing equipment

- Digital twin technology for process optimization

- Real-time supply chain monitoring

The industry shows strong growth potential with an expected compound annual growth rate (CAGR) of 4.37% until 2025. This growth is driven by several factors, including:

- Increased adoption of industrial automation

- Rising demand in emerging economies

- Infrastructure development projects

- Expansion of the manufacturing sector

Advanced processing capabilities enable metal service centers to offer value-added services, such as:

- High-precision cutting

- Complex shape formation

- Surface treatments

- Quality control automation

These technological advancements not only reduce operational costs but also enhance the quality of services provided. Metal service centers that invest in digital solutions report efficiency improvements ranging from 15% to 20% and reduced material waste.

The integration of smart technologies is transforming traditional inventory management practices within the industry. Modern facilities now utilize Internet of Things (IoT) sensors and predictive analytics to maintain optimal stock levels and anticipate market demands.

Addressing Barriers to Growth in Metal Service Centers

The metal service centers market faces significant challenges that impact its growth trajectory. The automotive sector’s recent slowdown has created immediate pressure on service centers, with reduced demand affecting inventory turnover rates and profit margins.

Short-Term Market Constraints:

- 15% decrease in automotive sector demand

- Supply chain disruptions

- Raw material price volatility

- Cash flow management issues

Regulatory compliance presents a persistent challenge for metal service centers. Environmental regulations, trade policies, and safety standards create operational complexities and increase operational costs. Companies must allocate substantial resources to maintain compliance while staying competitive.

Long-Term Industry Barriers:

- Complex environmental regulations

- International trade restrictions

- Rising operational costs

- Intense market competition

- Skilled labor shortages

Metal service centers are implementing strategic solutions to navigate these challenges:

1. Digital Transformation

- Advanced inventory management systems

- Automated processing equipment

- Real-time tracking capabilities

2. Operational Excellence

- Lean manufacturing practices

- Energy efficiency programs

- Staff training initiatives

3. Market Diversification

- Expanded service offerings

- New market penetration

- Value-added processing capabilities

The industry’s response to these challenges demonstrates its resilience and adaptability. Companies that successfully implement these strategies position themselves for sustained growth in the competitive landscape.

Geopolitical Factors Impacting Metal Service Centers Operations

The metal service centers landscape has transformed dramatically due to shifting geopolitical dynamics. U.S. tariffs on steel imports have created significant ripples across the industry, with a 25% duty leading to a 13.5% decrease in imports while boosting domestic production by 5% in 2018.

Trade Agreement Impacts:

- USMCA implementation has reshaped North American supply chains

- EU-Asia trade partnerships affect material sourcing decisions

- Regional trade blocs influence pricing strategies

Local Production Dynamics:

- Increased investment in U.S. steel mills

- Enhanced domestic processing capabilities

- Rising employment in local service centers

Political stability in key regions directly affects supply chain reliability. Recent disruptions in:

- Southeast Asian shipping routes

- Middle Eastern raw material sources

- European transportation networks

These geopolitical shifts have prompted metal service centers to:

- Diversify supplier networks

- Build regional stockpiles

- Implement risk management protocols

- Develop alternative sourcing strategies

The evolving trade landscape has pushed service centers to maintain higher inventory levels, with U.S. facilities reporting a 15% increase in steel stockpiles. This adaptation ensures consistent supply despite global uncertainties and trade policy fluctuations.

Exploring Metal Service Centers Market Segmentation: Key Types

Metal service centers operate across distinct segments, each catering to specific market demands and manufacturing requirements. The market divides into two primary material categories:

1. Steel Service Centers

Steel service centers focus on various aspects of steel processing and distribution. Their key areas of expertise include:

- Carbon steel processing

- Stainless steel handling

- Specialty alloy distribution

- High-strength steel solutions

2. Aluminum Service Centers

Aluminum service centers specialize in different forms of aluminum products and services. Their core offerings include:

- Sheet and plate processing

- Extrusion products

- Custom alloy mixing

- Aerospace-grade materials

Service-based segmentation creates another layer of specialization:

3. Processing Centers

Processing centers within the metal service industry concentrate on value-added services that enhance the functionality of raw materials. These services encompass:

- Cutting and shaping

- Heat treatment

- Surface finishing

- Quality testing

- Custom fabrication

4. Distribution Centers

Distribution centers play a crucial role in the supply chain by efficiently managing inventory and ensuring timely delivery of metal products. Their primary functions involve:

- Inventory management

- Just-in-time delivery

- Warehousing

- Supply chain optimization

The market’s strength lies in providing tailored solutions for manufacturers. A steel processing center might offer specialized cutting services for automotive parts, while an aluminum distributor could focus on aerospace-grade materials with strict quality controls.

These specialized services create value through:

- Reduced manufacturing costs

- Decreased inventory holding

- Improved production efficiency

- Enhanced product quality

- Faster time-to-market

The ability to customize solutions has become essential as manufacturers demand increasingly specific material specifications and processing requirements. Service centers that can adapt their offerings to meet these precise needs gain competitive advantages in their respective market segments.

How Applications Are Shaping Metal Service Centers Demand

The various industries that use metal service centers show how important this industry is to modern manufacturing. Heavy industry holds the largest market share because it has a high demand for materials in:

- Manufacturing construction equipment

- Producing mining machinery

- Developing industrial infrastructure

Machine Shops

Machine shops also play a significant role in driving demand. They require:

- Materials that are cut with precision

- Delivery services that are timed perfectly

- Specialized processing of metals

Automotive Sector

The automotive sector has its own specific needs, which include:

- Components that are shaped according to custom specifications

- Requirements for high-quality aluminum

- Strict standards for quality control

Specialized Services Offered by Metal Service Centers

To meet these specific demands from different sectors, metal service centers offer specialized services such as:

Value-Added Processing

These processes add value to the raw materials and make them more suitable for specific applications:

- Precision cutting and shaping

- Heat treatment

- Surface finishing

- Component assembly

Industry-Specific Solutions

These solutions cater to the unique requirements of certain industries:

- Certification of materials for aerospace applications

- Compliance with regulations in the nuclear industry

- Adherence to military specifications

Consumer Appliance Industry

The consumer appliance industry also influences demand in its own way:

- Consistent quality standards for materials

- Cost-effective solutions for processing

- Flexible management of inventory

These specific demands from various sectors push metal service centers to enhance their capabilities. They invest in advanced equipment for processing, develop specialized knowledge in handling materials, and improve techniques for processing metals.

By being able to meet these diverse needs, metal service centers become crucial partners in the supply chain of manufacturing.

Regional Insights into the Global Metal Service Centers Market

The global metal service centers market displays distinct regional patterns, with Asia Pacific commanding a 40% market share in 2022. This dominance stems from rapid industrialization and extensive manufacturing activities across China, India, and Southeast Asian nations.

North America: The Second-Largest Player

North America holds the second-largest position, driven by:

- Advanced technological infrastructure

- High-value processing capabilities

- Strong automotive and aerospace sectors

- Robust distribution networks

Europe: An Established Industrial Base

Europe’s market share reflects its:

- Established industrial base

- Focus on precision engineering

- Stringent quality standards

- Investment in automation

Factors Shaping Regional Demand Variations

Regional demand variations are shaped by:

- Labor costs: Lower in Asia Pacific, higher in North America and Europe

- Technology adoption: Advanced in developed regions, emerging in developing markets

- Raw material proximity: Influences pricing and supply chain efficiency

- Infrastructure development: Determines service center distribution

Understanding Supply Chain Dynamics Across Regions

Supply chain dynamics differ significantly:

- Asia Pacific: High volume, cost-competitive, export-oriented

- North America: Value-added services, customization-focused

- Europe: Specialized processing, quality-driven approach

- Middle East: Growing infrastructure development, increasing local capacity

The Latin American market shows promising growth potential, particularly in Brazil and Mexico, where automotive and construction sectors drive demand for metal processing services.

The U.S. Metal Service Centers Market: Trends and Key Insights

The U.S. metal service centers market is experiencing significant growth after the implementation of a 25% tariff on steel imports. This strategic decision led to a 5% increase in domestic shipments while reducing imports by 13.5% in 2018.

Key Market Indicators:

- Local steel production capacity utilization reached 80.3%

- Domestic steel prices stabilized at competitive levels

- Manufacturing sector employment increased by 3.2%

Prominent Players in the U.S. Market

Several key players are shaping the U.S. metal service centers industry:

- Reliance Steel & Aluminum Co. – Leading with innovative processing capabilities and extensive distribution network

- Ryerson Holding Corporation – Specializing in value-added processing services

- Olympic Steel Inc. – Known for custom metal solutions and just-in-time delivery

Transformation in Local Manufacturing

Local manufacturing has undergone significant changes through:

- Investment in advanced processing equipment

- Integration of digital inventory management systems

- Development of specialized coating technologies

- Enhanced quality control measures

Regional Variations in the Market

The market shows strong regional differences, with the Midwest remaining the primary hub for metal service centers. The Southeast region is experiencing rapid growth due to expanding automotive and aerospace sectors. The Western states are benefiting from increased construction activities and infrastructure development projects.

Adapting to Changing Market Demands

The U.S. metal service centers are adjusting to changing market needs by offering specialized processing capabilities and improved customer service. These centers now provide custom cutting, forming, and finishing services to meet specific industry requirements.

China's Role in Metal Service Centers Expansion

China plays a crucial role in the growth of Metal Service Centers (MSC) worldwide, thanks to its strong manufacturing industry. The country has seen significant growth in its industrial production, with steel production reaching 1.1 billion tons in recent years.

Evolution of Chinese MSCs

Chinese MSCs have transformed from simple distribution centers into advanced service providers. They now offer a range of services to meet the needs of manufacturers:

- Advanced processing capabilities

- Just-in-time delivery systems

- Customized material solutions

- Digital inventory management

Government Initiatives Driving Growth

The Chinese government has implemented strategic initiatives to support the growth of the MSC market:

Smart City Projects

These projects focus on integrating technology into urban development, which includes:

- Implementing Internet of Things (IoT) solutions in metal processing

- Establishing automated warehouse systems for efficient storage and retrieval

- Enabling real-time tracking capabilities for better visibility and control over operations

Made in China 2025

This initiative aims to upgrade the country’s manufacturing sector by emphasizing:

- High-end manufacturing practices

- Technological advancements in metal processing techniques

- Continuous improvement efforts to enhance product quality

Impact on MSC Infrastructure

The government’s support through these programs has led to increased investments in MSC infrastructure. Specialized industrial zones are being developed, creating clusters of metal service centers that optimize supply chain efficiency and reduce operational costs.

Technological Advancements in Chinese MSCs

Chinese MSCs are quickly embracing advanced technologies such as artificial intelligence (AI) for inventory management and robotic systems for processing tasks. This integration of technology has positioned China as a leader in modern metal service center operations, setting benchmarks for global industry standards and practices.

Reflection of Industrial Transformation

The growth of China’s MSC market is indicative of the country’s broader industrial transformation. Service centers are evolving to meet the demands of increasingly complex manufacturing processes, aligning with the changing landscape of global production.

India's Growing Demand for Metal Service Centers

India’s metal service centers market has great potential for growth, thanks to rapid industrialization and infrastructure development. The country’s industrial output has been steadily increasing, with manufacturing sectors such as automotive, construction, and machinery driving the demand for processed metals.

Key Growth Drivers in the Indian Market:

- Industrial corridors initiative connecting major cities

- Rising domestic steel production capacity

- Expansion of manufacturing facilities

- Implementation of smart city projects

- Growth in automotive and construction sectors

The establishment of dedicated industrial corridors has created strategic zones for metal service centers. These corridors, including the Delhi-Mumbai Industrial Corridor (DMIC) and Chennai-Bengaluru Industrial Corridor (CBIC), are expected to boost the growth of the metal service center market.

India’s infrastructure development projects have led to an increased demand for processed metals:

- Metro rail projects in major cities

- Highway construction initiatives

- Port modernization programs

- Railway infrastructure upgrades

The government’s “Make in India” initiative has attracted significant investments in manufacturing, creating new opportunities for metal service centers. Local metal service centers are expanding their processing capabilities to meet specialized requirements across various sectors, including automotive components and heavy machinery manufacturing.

The rise of tier-2 and tier-3 cities as manufacturing hubs has encouraged metal service centers to set up regional facilities. This ensures faster delivery and customized processing services to local manufacturers.

Future Development of the Metal Service Centers Industry

The metal service centers industry is on the verge of a major transformation by 2025. According to market projections, it is expected to grow at a steady rate of 4.37% CAGR, reaching a value of $323.73 billion. This growth aligns with several technological innovations that are reshaping the sector:

Key Technological Advancements

- AI-powered inventory management systems

- Automated material handling robots

- Digital twin technology for process optimization

- Smart sensors for real-time quality control

- Blockchain integration for supply chain transparency

As the industry evolves, we can expect to see the rise of smart service centers that are equipped with:

- Predictive maintenance capabilities

- Advanced data analytics for demand forecasting

- IoT-enabled tracking systems

- Automated cutting and processing solutions

Market Transformation Drivers

Several factors are driving this transformation in the market:

- Rising demand for customized metal processing

- Integration of Industry 4.0 principles

- Shift toward sustainable practices

- Enhanced focus on value-added services

The adoption of these technologies has the potential to completely change the way traditional service centers operate. Companies that invest in digital transformation can expect to see significant improvements in their operations:

- 15-20% reduction in operational costs

- 25% improvement in inventory turnover

- 30% increase in processing efficiency

- 40% reduction in delivery times

These advancements will position metal service centers as strategic partners in the manufacturing supply chain, moving beyond their traditional role as mere distributors.

Competitive Landscape in the Metal Service Centers Market

The metal service centers market has several key players who are influencing the industry through strategic actions and their presence in the market.

-

Reliance Steel & Aluminum Co. – United States

-

Samuel Son & Co. – Canada

-

Ryerson Holding Corporation – United States

-

Russel Metals – Canada

-

Tata Steel – India

-

Thyssenkrupp Materials Processing Europe GmbH – Germany

-

Voestalpine Steel and Service Center GmbH – Austria

-

Mahindra Intertrade Limited – India

-

Baosteel Group – China

-

VDM Metals GmbH – Germany

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Metal Service Centers Market Report |

| Base Year | 2024 |

| Segment by Type |

· Coffee · Tea · Other Hot Drinks |

| Segment by Application |

· Consumers’ lives · Seasonal applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Metal Service Centers Market is on the verge of significant growth, expected to reach $323.73 billion by 2025. This growth reflects the industry’s crucial role in global manufacturing and distribution networks.

Key Factors Driving Growth

Several factors are contributing to this optimistic outlook:

- Technological Integration: Digital transformation initiatives streamline operations and enhance customer service

- Regional Growth Markets: China and India’s industrial expansion creates substantial opportunities

- Value-Added Services: Customization capabilities attract manufacturers seeking specialized solutions

Resilience in the Face of Challenges

The market has shown resilience by adapting to various challenges:

- Supply chain disruptions drive innovation in inventory management

- Trade policy shifts encourage domestic production capabilities

- Sustainability initiatives spark new service offerings

Global Metal Service Centers Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Metal Service Centers Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Metal Service CentersMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Metal Service Centersplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Metal Service Centers Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Metal Service Centers Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Metal Service Centers Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofMetal Service CentersMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the Metal Service Centers Market by 2025?

The Metal Service Centers Market is projected to grow to $323.73 billion by 2025, highlighting significant opportunities for industry players and stakeholders.

What are the key dynamics affecting the Metal Service Centers Market?

The market is influenced by upstream dynamics such as raw material supply and downstream processes including distribution and customer service, which impact overall market efficiency.

What trends are driving growth in the Metal Service Centers industry?

Key trends include an increasing demand for customized services, technological advancements in processing and inventory management, and economic factors contributing to industry growth.

What barriers does the Metal Service Centers Market face?

The market faces short-term challenges like automotive sector slowdowns and long-term barriers such as regulatory hurdles and competition, with proposed strategies to overcome these challenges.

How do geopolitical factors impact Metal Service Centers operations?

Geopolitical influences such as U.S. tariffs on steel imports and international trade agreements significantly affect local production, shipments, and overall supply chain dynamics.

What regions are leading in the global Metal Service Centers Market?

Regional insights reveal that North America and Asia Pacific are key markets, with varying demand and supply chain dynamics contributing to regional differences in market size.