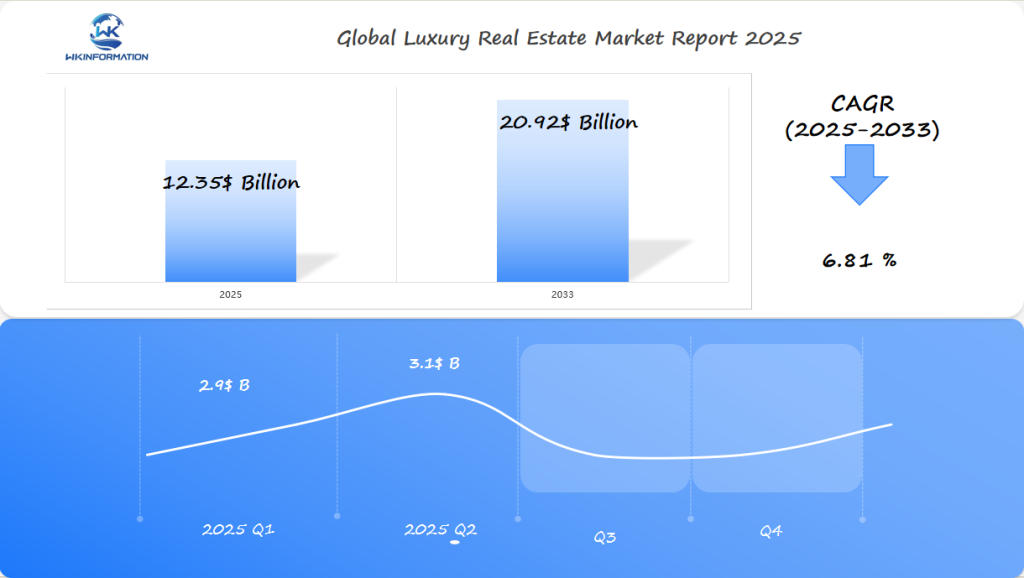

Luxury Real Estate Market Projected at $12.35 Billion by 2025: Investment Trends in the U.S., India, and the UAE

Explore the evolving Luxury Real Estate Market trends, investment opportunities, and growth projections. Discover prime locations and market insights shaping high-end property investments globally.

- Last Updated:

Luxury Real Estate Market Q1 Q2 2025 Forecast and Regional Highlights

The Luxury Real Estate market is projected to hit $12.35 billion in 2025, with a steady CAGR of 6.81% through 2033. Market size in Q1 is estimated around $2.9 billion, rising to $3.1 billion in Q2, reflecting ongoing demand for high-end properties driven by wealth accumulation, urbanization, and international investment flows.

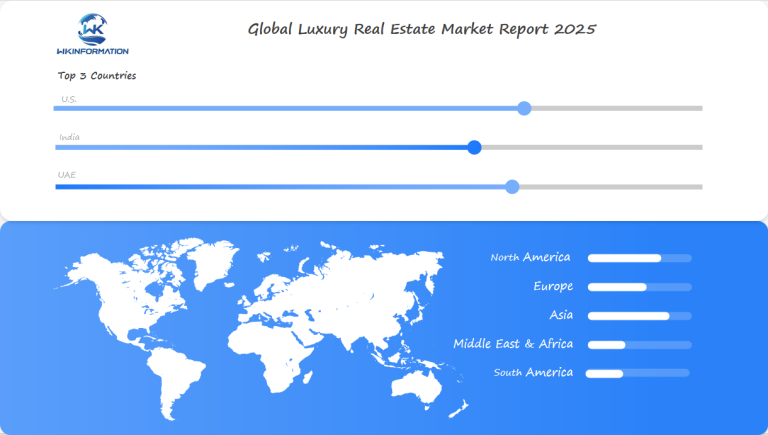

The primary regions include the U.S., India, and the UAE. The U.S. luxury real estate market benefits from diverse metropolitan hubs like New York and Los Angeles; India sees rising demand from affluent buyers in metros such as Mumbai and Delhi; the UAE, especially Dubai, remains a global hotspot for luxury properties thanks to its tax advantages and global connectivity. Sustainability features and smart home technologies are increasingly influencing buyer preferences.

Key Takeaways

- Luxury real estate market is expected to reach $12.35 billion by 2025

- Investment trends show strong interest in U.S., Indian, and UAE markets

- Premium properties are viewed as strategic financial assets

- High-net-worth individuals are driving market expansion

- Architectural innovation and location are critical for luxury investments

Understanding the Luxury Real Estate Market: Upstream and Downstream Analysis

The luxury real estate supply chain consists of various professionals and organizations working together. This network plays a crucial role in driving the growth of the market. By understanding this complex web of connections, we can gain insights into the industry’s dynamics and identify potential investment opportunities.

Key Stakeholders in the Luxury Real Estate Ecosystem

The luxury real estate market has many important players. They build its complex structure:

Upstream Participants:

- Land acquisition specialists

- Architectural design firms

- High-end construction companies

- Materials and technology providers

Downstream Participants:

- Premium real estate agencies

- Property management organizations

- Marketing and branding experts

- Investment consultants

Market Growth Factors in the Supply Chain

Several key factors shape the luxury real estate supply chain:

- Technological innovation in design and construction

- Globalization of real estate investment

- Increasing demand for sustainable and smart properties

- Sophisticated client expectations

The efficiency and strategic alignment of these parts greatly affect the market. They create a strong ecosystem for luxury real estate growth and investment.

Trends in branded residences and community amenities

The luxury real estate market is changing fast. High-end hotel chains and famous fashion brands are making homes that are more than just places to live. They offer unique experiences that go beyond what you’d find in a regular house.

Luxury amenities are key in the high-end property world. Developers are spending a lot to create lifestyle experiences that appeal to wealthy buyers. These extras offer something special:

- 24/7 concierge services with personalized help

- Top-notch fitness centers with expert training

- Exclusive social clubs and networking spots

- Private wellness centers and spas

- Smart home tech that makes life easier

Brand-Driven Property Value Trends

Property values are more about the brand than ever before. Partnerships between luxury hotels like Four Seasons and fashion brands like Armani are boosting demand. These branded homes often sell for 30% more than regular luxury properties.

Investors love these homes for more than just their looks. They want the lifestyle and status that comes with them. Adding famous brand experiences to homes is changing how we see luxury real estate.

Market restrictions due to economic volatility and interest rates

The luxury real estate market is facing big challenges. Economic ups and downs and changing interest rates are making things tough. Investors and developers have to deal with complex financial situations that can greatly affect their investments.

Economic uncertainty is a big risk for luxury real estate. When interest rates change, people become more careful about buying. This affects how the market works.

Key Market Restriction Factors

- Increased mortgage borrowing costs

- Reduced investor confidence

- Potential property value fluctuations

- Tighter lending standards

Smart investors know that interest rates are key to the luxury real estate market. When rates go up, borrowing money gets more expensive. This can slow down demand in the high-end property market.

Strategic Response Mechanisms

| Strategy Impact Diversification | Mitigates market risks |

| Flexible Financing | Attracts potential buyers |

| Target Ultra-High-Net-Worth Clients | Reduces sensitivity to economic shifts |

Developers and investors need to be quick to adapt. They must understand that luxury real estate risks are linked to the economy. By taking proactive steps, they can lessen the impact of economic ups and downs.

Geopolitical influences on foreign investment and property regulations

The luxury real estate market is changing due to complex global politics. These changes affect how foreign investors plan their strategies. Now, investors must consider political stability, international relations, and property rules when deciding where to invest.

Several key geopolitical factors are changing the luxury property market:

- Shifting diplomatic relationships between major economies

- Changes in foreign investment regulations

- Economic sanctions and trade agreements

- Regional political stability assessments

Emerging Investment Landscapes

Investors are getting smarter about where to put their money. They look for places with clear property rules and stable politics. The United Arab Emirates, Singapore, and some European countries are top choices for luxury real estate.

Regulatory Challenges and Opportunities

Property rules differ a lot around the world. Some places have strict rules for foreign investors, while others welcome them more. Savvy investors study the risks and rewards of each place before investing in luxury real estate.

The mix of foreign investment policies and global politics is changing the luxury real estate world. It offers both challenges and new chances for smart investors.

Segmentation by Type: Condominiums, Villas, and Penthouses

The luxury real estate market offers a wide range of property types. Each type caters to the preferences of different investors and lifestyles. Analyzing these types allows us to gain insights into the evolving landscape of high-end real estate.

Luxury Condominiums: Urban Sophistication

Luxury condominiums offer a top-notch urban living experience. They attract professionals and investors who want convenience and luxury. These properties usually have:

- Centralized locations in prime metropolitan areas

- High-end architectural designs

- Integrated security systems

- Shared wellness and recreational facilities

Luxury Villas: Exclusive Privacy and Space

Luxury villas are for those who want lots of space and privacy. They are known for:

- Standalone properties with extensive land holdings

- Customizable architectural designs

- Private amenities like swimming pools and gardens

- Potential for significant appreciation in value

Luxury Penthouses: The Best of Urban Living

Luxury penthouses are the best of urban living. They offer amazing views and exclusive features. These top-floor homes stand out with:

- Panoramic cityscape or oceanfront perspectives

- Premium interior finishes

- Advanced smart home technologies

- Exclusive access to building amenities

Investors need to think about market trends, demographic changes, and their goals. They should choose between luxury condominiums, villas, and penthouses wisely.

Segmentation by Application: Residential, Commercial, and Rental Investments

The luxury real estate market is very diverse. It appeals to sophisticated investors and high-net-worth individuals. They look for strategies beyond just owning property.

Luxury real estate investments fall into three main categories:

- Residential luxury properties

- Commercial luxury real estate

- Luxury rental investments

Residential Property Dynamics

Ultra-high-net-worth buyers want exclusive homes. They look for properties with top-notch amenities and the best locations. Luxury residential properties showcase their wealth and style.

Commercial Real Estate Opportunities

Investors are eyeing offices, retail, and mixed-use developments for big returns. These commercial properties are in prime spots. They have great design and the latest tech.

Rental Investment Strategies

Luxury rental investments are becoming popular for steady income. High-end vacation rentals and long-term leases in top markets are drawing investors.

Global regional analysis of the Luxury Real Estate market

The global luxury real estate market is full of investment chances in different areas. Key markets and growth drivers are changing the international property scene. This creates great opportunities for investors and developers all over the world.

Each region has its own special features in the luxury real estate market:

- North America leads with top cities like New York and San Francisco.

- European markets mix old-world charm with new architectural styles.

- The Asia-Pacific area is growing fast with luxury city projects.

- Middle Eastern markets show off stunning, modern buildings.

Emerging Luxury Real Estate Hotspots

New places are becoming hot spots for luxury real estate. Emerging destinations offer unique benefits:

- Singapore is known for its modern, high-end urban projects.

- Dubai is famous for its cutting-edge buildings.

- Tokyo is known for its tech-savvy, premium properties.

- Shanghai’s high-end real estate is growing fast.

Investors can spread their money across different areas thanks to global connections. This lets them use the strengths of each region to grow their investments.

The U.S. market's resilience amid economic fluctuations

The U.S. luxury real estate market has shown great strength during tough economic times. Even with global challenges, big cities keep seeing strong sales.

Several key factors help keep the market strong:

- Consistent demand from high-net-worth individuals

- Strategic investment from international buyers

- Innovative luxury property developments

- Robust financial infrastructure

Metropolitan Market Dynamics

Cities like New York, Los Angeles, and San Francisco are key in luxury real estate growth. These cities attract a lot of domestic and international investments. This makes them hot spots for high-end property deals.

Wealth distribution and demographic changes make luxury real estate more appealing. Investors see the value and stability of top properties in the best locations.

Investment Safe Haven

The U.S. real estate market is seen as a safe place for money. It has clear rules, potential for growth, and a wide range of properties in different cities.

India's premium housing segment and developer strategies

The Indian luxury real estate market is changing fast. New strategies from developers and a more savvy consumer base are driving this change. Cities like Mumbai, Delhi NCR, and Bengaluru are seeing huge growth in premium housing. This shows how high-end living is becoming more popular in India.

Developers are now focusing on more than just building homes. They’re creating unique experiences that stand out. Some key strategies include:

- Integrating smart home technologies

- Partnering with international luxury brands

- Designing exclusive community amenities

- Implementing sustainable and eco-friendly features

Emerging Trends in Luxury Residential Development

The luxury real estate market in India is seeing new trends. Developers are targeting wealthy individuals with unique homes. These homes combine the latest in design, prime locations, and tech.

Technology and personalized design concepts are pushing the premium housing segment ahead. Developers are spending a lot on understanding what buyers want. They’re creating homes that offer more than just shelter; they offer a complete lifestyle.

Market Challenges and Opportunities

Despite its huge potential, the Indian luxury real estate market faces hurdles. Issues like complex regulations and limited infrastructure are challenges. But, recent economic reforms have made things clearer and more welcoming for investors. This is boosting investment in the premium housing sector.

The UAE's emergence as a super-prime real estate destination

The United Arab Emirates has become a top player in luxury real estate worldwide. It attracts investors with its amazing buildings and smart market strategy. Dubai’s property market shines bright for those looking to invest big.

Several factors have led to the fast growth of super-prime properties in the UAE:

- Innovative architectural developments

- Tax-friendly investment policies

- Strategic geographical location

- Cutting-edge infrastructure

Investment Attractions in the UAE Real Estate Market

Investors love Dubai’s property market for its special perks. The government has made it easier to invest by offering:

- Long-term residency visas for property investors

- Free zone investment opportunities

- Transparent property ownership regulations

The UAE is setting itself up as the go-to place for luxury real estate. It uses its modern infrastructure and smart investment plans. Investors see these super-prime properties as great for both living and making money.

Future Development Outlook in the Luxury Real Estate Market

The luxury real estate market is changing fast. New technologies and a focus on green homes are leading the way. These changes are making high-end real estate more appealing to wealthy buyers.

How New Technologies Are Shaping Luxury Homes

New tech is making luxury homes smarter. Now, homes can be controlled with ease. They come with advanced features that change how we live:

- AI-powered home management systems

- Advanced security technologies

- Energy-efficient design solutions

- Integrated wellness amenities

Sustainability Takes Center Stage

More people want eco-friendly homes. Builders are using green materials and technology to reduce harm to the environment while still keeping homes looking great.

Shifting Demographics and Market Dynamics

Younger buyers are changing what luxury homes offer. Wellness-focused amenities, flexible spaces, and tech are now key. They make luxury homes stand out.

Emerging Market Innovations

New ideas are emerging in the luxury real estate sector. This includes high-end co-living spaces and homes designed to cater to international preferences. These concepts provide more than just accommodation; they offer a lifestyle experience.

Competitor analysis and market positioning strategies

Key Players:

-

Related Companies – USA

-

Brookfield Asset Management – Canada

-

The Trump Organization – USA

-

Tishman Speyer – USA

-

Extell Development Company – USA

-

Hines Interests Limited Partnership – USA

-

The Blackstone Group – USA

-

Vornado Realty Trust – USA

-

Silverstein Properties – USA

-

CIM Group – USA

The luxury real estate market is all about standing out. Top developers and brands use smart strategies to attract high-net-worth clients. They aim to offer unique property experiences.

- Innovative architectural design that goes beyond the usual

- Choosing the best locations worldwide

- Using the latest technology and green features

- Creating personalized lifestyle experiences

Market Positioning Dynamics

Successful luxury real estate developers do more than just build homes. They craft compelling brand stories that appeal to global investors.

| Strategy | Key Focus | Target Market |

| Ultra-Personalization | Custom design options | High-net-worth individuals |

| Technology Integration | Smart home features | Tech-savvy investors |

| Sustainable Luxury | Eco-friendly design | Environmentally conscious buyers |

The best luxury real estate players use a mix of strategies. They focus on design, technology, and lifestyle to stand out in a crowded market.

Overall

The luxury real estate market is full of chances for smart investors. It’s expected to grow a lot, reaching $12.35 billion by 2025. High-net-worth people are now seeing luxury homes as key parts of their wealth, putting up to 6.81% of their money into real estate.

Investors can find many chances to invest worldwide, especially in places where wealthy people are moving. The UAE, the US, and Australia are top spots for luxury homes. It’s important for investors to watch out for risks in the luxury real estate world. They should look at global politics, economic ups and downs, and local rules. The market is expected to keep growing, thanks to cities getting bigger and people’s tastes changing. Special areas in luxury real estate, like branded homes and new property ideas, are great for investors looking for lasting value and to spread out their investments.

Global Luxury Real Estate Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Luxury Real Estate Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Luxury Real Estate Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Luxury Real Estate Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Luxury Real Estate Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Luxury Real Estate Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Luxury Real Estate Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Luxury Real EstateMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the global luxury real estate market by 2025?

The luxury real estate market is expected to hit about $12.35 billion by 2025. This growth is driven by more high-net-worth individuals and global real estate investments.

How do branded residences impact the luxury real estate market?

Branded residences are changing the luxury real estate scene. They offer unique living experiences with famous brands and top-notch properties. Luxury hotels and fashion brands are creating exclusive homes with the latest amenities, attracting wealthy investors.

Which global regions are emerging as key luxury real estate markets?

New markets are rising in:

- North America (New York, Los Angeles)

- Asia-Pacific (Singapore, Tokyo)

- the Middle East (Dubai, Abu Dhabi)

- some European cities

Each area offers unique investment opportunities based on local economy and market trends.

What factors influence luxury real estate investment decisions?

Many things affect investment choices, like stability, economy, interest rates, location, amenities, and the development’s reputation. These factors help investors decide.

How are technological advancements impacting luxury real estate?

New technology is transforming luxury homes with features like AI, smart systems, advanced security, and eco-friendly solutions. These innovations are appealing to younger, affluent buyers.

What property types are most popular in the luxury real estate market?

The most popular choices in the luxury real estate market are condos, villas, and penthouses. However, preferences can vary depending on the region. Each type of property offers its own unique benefits such as location and amenities.

How do economic fluctuations affect luxury real estate investments?

Economic ups and downs can have an impact on luxury real estate. The performance of the market is influenced by factors such as interest rates, buyer confidence, and global trends. To mitigate risk, investors often focus on ultra-wealthy individuals who are less susceptible to economic changes.

Why is the UAE an important luxury real estate market?

The UAE, particularly Dubai and Abu Dhabi, is a leading luxury market. It is known for its tax-friendly policies, innovative projects, strategic location, and investor-friendly regulations such as long-term visas for property buyers.

How is sustainability influencing luxury real estate development?

Eco-luxury is becoming increasingly important. Developers are incorporating green technology, sustainable materials, and wellness features into their projects to appeal to environmentally conscious affluent buyers.

What are the key investment opportunities in the luxury real estate market?

Key opportunities include new global markets, branded residences, unique properties, sustainable developments, and areas with strong economies and growth potential.