Light Beer Market Set to Reach $4.56 Billion by 2025 Globally: Emerging Consumption in Mexico, Japan, and the U.K.

Industry chain analysis of the Light Beer market, exploring upstream raw material suppliers like barley and hops, the impact of weather and global conditions on supply, the role of craft and major breweries, and distribution channels including retail and horeca sectors.

- Last Updated:

Light Beer Q1 and Q2 2025 Market Overview

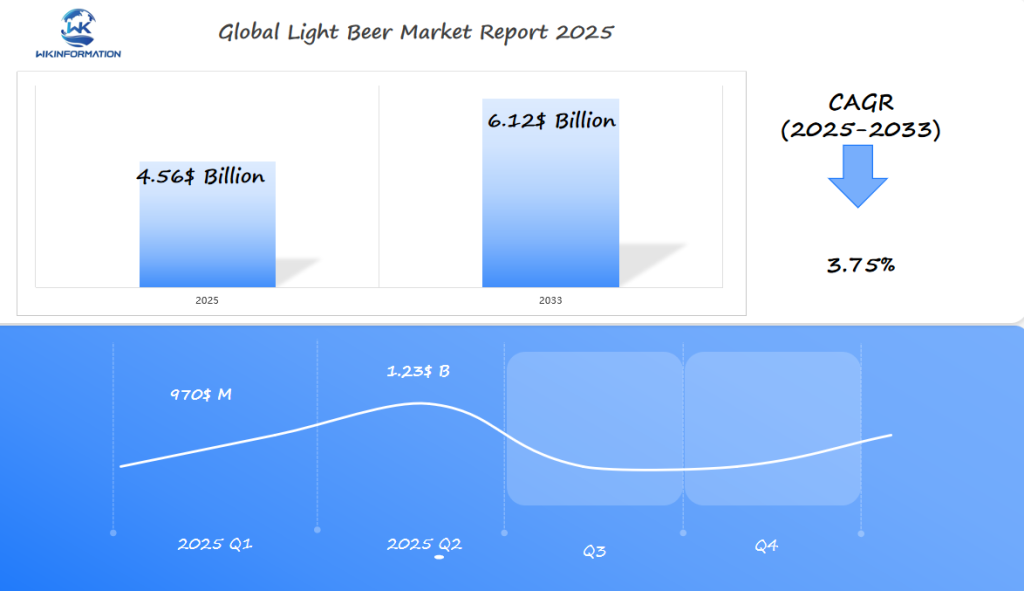

The global Light Beer market is set to reach $4.56 billion in 2025, growing steadily at a CAGR of 3.75% from 2025 to 2033. In Q1, sales are projected at approximately $970 million, as colder weather and post-holiday consumption lulls reduce demand, especially in Western markets. By Q2, the market is forecast to rebound to around $1.23 billion, driven by warmer climates and seasonal spikes tied to outdoor events and sports.

Mexico leads in both production and exports, particularly to the U.S. Japan maintains a niche premium market with low-calorie beer variants, while the U.K. reflects a shift toward healthier alcoholic choices. These three countries represent strategic focal points for innovation, seasonal consumption analysis, and regulatory trends in the light beer industry.

Industry chain analysis of upstream and downstream in the Light Beer market

Upstream Analysis

- Raw material suppliers play a crucial role in the light beer industry. Barley and hops, integral components of beer production, are sourced from agricultural producers worldwide. The quality and availability of these ingredients are influenced by weather patterns and global market conditions. For instance, adverse weather can lead to poor harvests, affecting supply chains and escalating costs.

- Breweries, both craft and major brands, are pivotal in transforming these raw materials into finished products. Craft breweries emphasize small-batch production with unique flavors, while major brands focus on consistency and large-scale output. The brewing process itself is heavily dependent on efficient logistics to ensure timely delivery of ingredients.

Downstream Analysis

- Distribution channels form the backbone of the light beer market’s downstream activities. Manufacturers rely on an extensive network to move products from breweries to retail sectors, including supermarkets, convenience stores, and horeca (hotels, restaurants, cafes). The efficiency of these logistics impacts market dynamics significantly.

- In retail outlets, light beer competes for shelf space alongside other alcoholic beverages. Horeca channels are vital for brand visibility and volume sales, often serving as a launchpad for new products. Efficient supply chain management ensures that light beers remain accessible to consumers while maintaining freshness and quality.

The interplay between upstream suppliers and downstream distributors is essential for sustaining market growth in the light beer segment.

Trends in Brewing, Branding, and Health-Conscious Preferences in Light Beer

Rise of Craft Breweries Emphasizing Unique Flavors and Small-Batch Production

Craft breweries are changing the light beer market. These smaller producers focus on quality and innovation, offering unique flavors that set them apart from mass-market brands. Small-batch production allows for greater experimentation with ingredients, leading to distinctive taste profiles that attract discerning consumers. Examples include fruit-infused light beers and seasonal varieties that provide a refreshing change from traditional options.

Popular Brands Driving Market Growth

Established brands like Miller Lite, Bud Light, Coors Light, and Michelob Ultra continue to dominate the market. Their extensive distribution networks and strong brand recognition drive significant sales volumes. These brands capitalize on their trusted reputation while adapting to consumer preferences for lighter beverages. Marketing campaigns often highlight the health benefits of lower-calorie and lower-alcohol options.

Increasing Consumer Demand for Low-Calorie and Lower-Alcohol Beers

Health-conscious consumers are shifting towards low-calorie and lower-alcohol beers. This trend is fueled by a growing awareness of health and wellness, with many individuals seeking to reduce their caloric intake while still enjoying alcoholic beverages. Light beers meet this demand by offering refreshing flavors with fewer calories and less alcohol content compared to regular beers.

Innovation with Fruit-Infused and Flavored Light Beers

Innovation is key in attracting health-aware demographics. Fruit-infused and flavored light beers are gaining popularity for their appealing taste profiles and perceived health benefits. Brands experiment with various fruits such as citrus, berries, and tropical flavors to create vibrant, refreshing options that cater to modern tastes. These innovations not only broaden the appeal of light beers but also position them as healthier alternatives within the broader beverage market.

The dynamic interplay between brewing trends, branding strategies, and evolving consumer preferences underscores the growth trajectory of the light beer market. By emphasizing quality, unique flavors, and health benefits, both craft breweries and major brands are well-positioned to meet the changing demands of today’s consumers.

Market Limitations Due to Taxation and Regulatory Controls in Light Beer

Beer taxation is a major factor shaping the economics of the light beer market. Countries impose different tax schemes based on alcohol content, volume, or type of beverage. For example:

- In the United States, federal excise taxes differ for small and large breweries, directly affecting their pricing strategies.

- The European Union imposes minimum rates, but member states can exceed them, leading to significant price differences between markets.

- Emerging economies often adjust beer taxes to control consumption or boost public revenue, causing fluctuations in production costs.

Pricing strategies depend on these policies. Brands producing light beer with lower alcohol percentages sometimes benefit from reduced tax rates, but inconsistent definitions of “light” across jurisdictions create compliance headaches. Brewers pass increased costs onto consumers or absorb them to remain competitive—both routes compress profit margins.

Regulatory challenges extend into advertising, labeling, and distribution:

- Strict advertising rules restrict promotion of alcoholic beverages in many regions. For instance, television and online ads for beer are limited in countries like France and Norway.

- Labeling requirements vary widely. Some markets demand prominent health warnings or detailed nutritional information, especially in regions where low-calorie claims drive purchasing decisions.

- Distribution laws impact how light beer reaches consumers. Certain states or countries enforce monopolies or limit sales to licensed outlets only.

Alcohol regulations are rarely harmonized globally. Each market maintains its own set of legal frameworks, influencing how brands enter and expand:

- Market Entry Barriers: Import duties and local content laws complicate foreign brand launches.

- Expansion Limits: Varying legal drinking ages and restrictions on cross-border sales restrict brand reach.

- Operational Complexity: Navigating different approval processes for new flavors or packaging slows innovation rollouts.

Brands need robust compliance teams to align operations with local laws, adding another layer of cost and complexity. These factors collectively shape light beer’s global footprint—making regulatory navigation as crucial as marketing or brewing innovation in this sector.

Geopolitical Factors Influencing the Import/Export of Light Beer

The global light beer market operates within a complex environment influenced by geopolitical factors. Trade agreements and tariffs have a significant impact on the movement of light beer across borders:

1. Trade Agreements

Bilateral and multilateral trade agreements can either facilitate or hinder the import and export of light beer. For instance, free trade agreements (FTAs) between countries can reduce tariffs, making it easier for breweries to expand their reach globally. The European Union’s FTAs with countries like Japan have eased trade barriers, boosting light beer exports.

2. Tariffs

Tariffs imposed by governments affect pricing strategies and competitiveness in international markets. High tariffs on imported beer can deter foreign brands from entering a market, while low tariffs might encourage imports and create competitive pressure for local breweries.

Political stability plays a crucial role in maintaining efficient supply chains in major producing regions:

3. Supply Chain Stability

Political instability can disrupt supply chains, affecting both production and distribution. Countries experiencing political unrest may face challenges in maintaining consistent supply chains for raw materials like barley and hops, impacting the brewing industry.

4. Regional Stability

Stable political environments foster robust logistics networks, ensuring timely delivery of light beer to various markets. For example, Mexico’s stable political climate supports its growing local production and export of light beers.

Geopolitical dynamics also impact regulatory frameworks governing the beer industry:

5. Regulatory Changes

Shifts in government policies due to geopolitical changes can alter regulations surrounding advertising, labeling, and distribution of light beer. These changes require breweries to adapt swiftly to remain compliant and competitive.

6. Market Entry Barriers

Differences in legal frameworks across regions can pose significant barriers to market entry. Understanding and navigating these regulations is crucial for breweries looking to expand internationally.

The relationship between geopolitics and the light beer market highlights the need for strategic planning among breweries aiming for global success.

Light Beer by Type: Lager, Pilsner, and Low-Calorie Variants

Characteristics Distinguishing Lager vs. Pilsner Light Beers in the Global Market

Lager: Typically characterized by a clean, crisp taste with a smooth finish. Light lagers are often brewed with bottom-fermenting yeast at cooler temperatures. They are highly popular due to their refreshing nature and lower calorie count compared to regular lagers.

Pilsner: Known for its slightly more robust flavor profile than lagers. Pilsners tend to have a subtle hop bitterness and a lighter body, making them an appealing option for light beer enthusiasts seeking a bit more complexity in taste.

Growth in Popularity of Low-Calorie Variants Targeting Health-Conscious Consumers

The increasing demand for healthier beverage options has led to significant growth in low-calorie light beers. Brands such as Michelob Ultra have become market leaders by offering beers that cater specifically to health-conscious consumers.

Innovations include fruit-infused and flavored low-calorie beers that appeal to those looking for both refreshment and mindful drinking choices. This trend is particularly strong among younger demographics who prioritize wellness without compromising on social drinking experiences.

By exploring these types of light beer, you can better understand the diverse options available in the market and how each caters to different consumer preferences.

Light Beer by application: retail, horeca, and private label

Sales Performance in Retail Outlets

Retail channels, including supermarkets and convenience stores, play a crucial role in the distribution of light beer. These outlets cater to a wide range of customers, making it easy and convenient for consumers looking for healthier drink options to find what they want. Popular light beer brands such as Bud Light and Miller Lite often occupy prime shelf space due to their widespread popularity and established presence in the market. The retail sector drives significant sales volume, supported by strategic placement and promotional activities that increase consumer awareness.

Importance of Horeca Channels

The horeca sector—hotels, restaurants, cafes—plays a significant role in promoting brand visibility and driving sales of light beer. These establishments are often key places where consumers can discover new products and try them out for themselves. Craft breweries greatly benefit from partnerships with horeca venues, as it allows them to feature their distinct flavors and small-batch creations in a social setting. This direct interaction with consumers helps build brand loyalty and expand market reach.

Private Label Dynamics

Private label light beers are becoming more popular as retail chains create their own branded products to appeal to budget-conscious consumers. These offerings often compete on price while maintaining quality levels similar to established brands. The rise of private label products highlights the competitive nature of the light beer market, emphasizing the need for innovation and differentiation.

By examining these different areas within the light beer market, you can gain a better understanding of the various strategies used by brands to attract different consumer groups across multiple distribution channels.

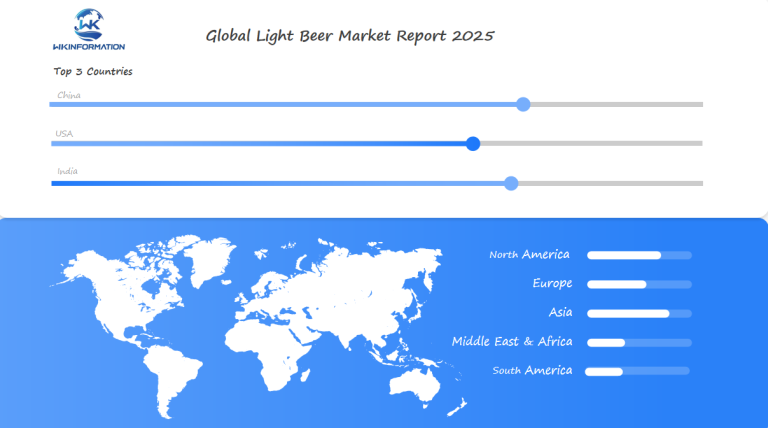

Regional dynamics in the global Light Beer market

Distinct regional beer markets shape the Light Beer Market’s growth trajectory. In the Asia Pacific, accelerated urbanization and a surge in disposable incomes contribute to growing demand for light beer. Cities like Shanghai, Mumbai, and Tokyo report strong adoption rates as younger consumers gravitate toward lighter, sessionable beverages that align with evolving lifestyles. Multinational brewers aggressively expand their light beer portfolios in this region, responding to both volume demand and a preference for international brands.

1. Asia Pacific

- Rapid urban population growth drives higher consumption of premium alcoholic beverages.

- Rising middle-class affluence enables consumers to trade up from standard lagers to branded light beers.

- Local players and global giants invest in marketing campaigns tailored for health-conscious drinkers.

2. United States & Europe

- The U.S. and Europe host a dense concentration of craft breweries, each leveraging small-batch production and unique flavor profiles.

- Craft brewers fuel innovation in the light beer segment with experimental hops, yeast strains, and adjuncts that appeal to niche audiences.

- Established brands face direct competition from microbreweries emphasizing authenticity and locality.

Regional differences in consumer behavior, regulatory environments, and brand positioning create diverse opportunities for both established players and new entrants within the global Light Beer Market. This dynamic landscape continues to redefine how light beer is produced, marketed, and consumed across continents.

Mexico’s Light Beer Market Penetration and Local Production

Mexico’s light beer market has seen strong growth, with local breweries expanding rapidly to meet the demand for lighter alcoholic beverages. Major producers like Grupo Modelo and Cuauhtémoc Moctezuma have introduced low-calorie lagers and innovative variations to attract this consumer preference. Brands such as Corona Ligera and Victoria Chingones have become widely recognized, particularly among younger drinkers seeking a premium refreshing experience without the heaviness of traditional beers.

Key Factors Driving the Market

Several factors are driving the growth of the light beer market in Mexico:

- Increase in Local Breweries: Small and medium-sized Mexican breweries are ramping up production of light beer styles, investing in modern brewing technology to ensure consistency while also experimenting with flavors that appeal to regional tastes.

- Health-Conscious Consumption: More Mexican consumers are viewing low-calorie and lower-alcohol beers as healthier options. Initiatives such as calorie labeling, fitness marketing, and partnerships with wellness influencers have contributed to changing perceptions.

- Retail and HORECA Engagement: Light beer products are prominently displayed in supermarkets, convenience stores, and bars across major cities, leading to higher sales volumes.

This increase in local production aligns with a broader trend towards healthier drinking habits. The light beer market in Mexico is continuously adapting to changing lifestyles and remains flexible in its response to emerging trends.

Japan’s Light Beer Market Growth Through Product Diversification

Japan’s light beer market is experiencing growth due to innovative brewing methods and product differentiation. One of the key strategies being employed is the introduction of flavored infusions, which have proven to be popular among younger consumers who are seeking out unique and diverse flavor profiles.

Catering to Younger Consumers with Flavored Infusions

Flavored light beers, such as those infused with citrus or other fruits, are specifically designed to appeal to this demographic. These options not only provide a refreshing alternative to traditional beers but also align with the growing demand for healthier beverage choices.

Combining Tradition with Modern Health Trends

In addition to catering to younger consumers, Japan’s brewing industry is also adapting to modern health trends. Breweries are now focusing on creating light beers that maintain the rich taste of regular brews while reducing alcohol content and calorie count.

This approach not only attracts health-conscious individuals but also reflects the global movement towards healthier lifestyles.

Leading the Way in Product Diversification

Major Japanese breweries like Asahi Group Holdings and Kirin Holdings are at the forefront of this trend. They are constantly experimenting with new flavors and brewing techniques in order to stay relevant in an ever-changing market.

By diversifying their product offerings, these companies are able to meet the evolving preferences of consumers and drive sustained growth in the light beer segment.

U.K. Light Beer Market Trends in Health-Conscious and Younger Consumers

UK light beer consumption has seen a marked shift as calorie content now plays a decisive role in purchasing habits. Recent market data indicates that 41% of adults in the UK actively consider calorie content when selecting their alcoholic beverages. This trend pushes breweries to prominently display nutritional information, driving reformulation of products to deliver lower-calorie options without sacrificing taste.

Younger consumers, especially those under 35, prefer drinks that align with a healthy lifestyle while offering exciting new experiences. Their preferences are fueling demand for:

- Novel flavors such as citrus, berry, and botanical infusions

- Craft-inspired light beers featuring small-batch production methods

- Eco-friendly packaging and transparency about ingredient sourcing

Popular brands in the Light Beer Market have responded with limited-edition releases and collaborations with local craft brewers, introducing unique recipes that stand out on crowded shelves. Social media campaigns targeting younger audiences highlight flavor experimentation and wellness benefits, contributing to the growth of light beer sales in pubs, supermarkets, and convenience stores across the UK.

Increased competition from hard seltzers and other low-calorie alternatives also motivates light beer brands to innovate continuously, with product launches tailored specifically for health-conscious urban consumers seeking both refreshment and reduced alcohol intake.

Future direction and development strategies in Light Beer

The future light beer trends are increasingly shaped by sustainability practices and innovative flavor experimentation. As consumer awareness around environmental impact grows, breweries are prioritizing sustainable brewing processes. This includes:

- Reducing water usage: Implementing water-saving technologies to minimize waste.

- Energy-efficient brewing methods: Utilizing renewable energy sources to power brewing operations.

- Eco-friendly packaging: Transitioning to recyclable materials for bottles and cans.

These practices not only address environmental concerns but also appeal to eco-conscious consumers who seek brands that align with their values.

Innovation in flavor profiles is another pivotal trend driving the future of light beer. Breweries are experimenting with:

- Fruit-infused varieties: Adding natural fruit extracts like citrus, berries, and tropical fruits to create refreshing, unique flavors.

- Herbal and spice blends: Incorporating ingredients such as ginger, mint, and cinnamon to enhance taste complexity.

- Low-calorie formulations: Developing beers that maintain robust flavors while reducing calorie content.

These innovations cater to health-aware demographics looking for flavorful yet lighter beverage options. The emphasis on sustainability combined with continuous flavor experimentation positions the light beer market for dynamic growth and consumer engagement.

Competitive outlook and major players in the Light Beer market

The light beer market is dominated by several major companies that have established a strong presence through brand heritage, extensive product portfolios, and strategic business moves.

- Anheuser-Busch InBev – Belgium

- Molson Coors Beverage Company – United States

- Heineken N.V. – Netherlands

- Carlsberg Group – Denmark

- Constellation Brands – United States

- Asahi Group Holdings – Japan

- Kirin Holdings – Japan

- Boston Beer Company – United States

- Pabst Brewing Company – United States

- Craft Brew Alliance – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Light Beer Report |

| Base Year | 2024 |

| Segment by Type |

· Lager · Pilsner · Low-Calorie Variants |

| Segment by Application |

· Retail · Horeca · Private Label |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global light beer market is shaped by a unique blend of innovation, shifting consumer lifestyles, and intense competition among both legacy brands and agile craft brewers. Health-focused trends push demand for lower-calorie, lower-alcohol options, while experimentation with flavors extends product appeal to younger and more diverse audiences.

Global Light Beer Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Light Beer Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalLight Beer players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Light Beer Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Light Beer Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Light Beer Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the Light Beer industry’s upstream and downstream supply chain?

The Light Beer industry’s supply chain includes upstream raw material suppliers such as barley and hops, influenced by weather and global market conditions. Breweries, including both craft and major brands, play a central role in production. Downstream, distribution channels extend from manufacturing to retail outlets and horeca sectors (hotels, restaurants, cafes). Logistics and supply chain efficiency significantly impact market dynamics.

How are brewing trends and health-conscious preferences shaping the Light Beer market?

Brewing trends in the Light Beer market emphasize craft breweries focusing on unique flavors and small-batch production. Popular brands like Miller Lite and Bud Light drive growth by innovating with fruit-infused and flavored light beers that appeal to health-aware consumers. Increasing demand for low-calorie and lower-alcohol beers reflects a shift towards health-conscious consumption.

What regulatory challenges affect the production and distribution of Light Beer?

Light Beer producers face varying taxation policies that influence production costs and pricing strategies. Regulatory constraints impact advertising, labeling, and distribution practices. Additionally, differences in legal frameworks across key markets affect market entry and expansion opportunities for Light Beer companies.

How do geopolitical factors influence the import and export of Light Beer?

Trade agreements and tariffs play a significant role in the cross-border movement of Light Beer. Political stability in major producing regions affects supply chains, impacting availability and pricing. These geopolitical aspects shape the global trade dynamics within the Light Beer market.

What are the main types of Light Beer, and how do they cater to consumer preferences?

The main types of Light Beer include lager, pilsner, and low-calorie variants. Lager and pilsner differ in characteristics that appeal to diverse consumer tastes globally. The growth in popularity of low-calorie variants targets health-conscious consumers seeking lighter alcohol content without compromising flavor.

Which regions dominate the global Light Beer market, and what local trends are influencing growth?

Asia Pacific dominates the global Light Beer market driven by urbanization and rising disposable incomes. The U.S. and Europe have a high density of craft breweries shaping their respective markets. In Mexico, local brewery expansions meet rising demand for lighter alcohol content beers amid health-conscious shifts. Japan experiences growth through product diversification such as flavored infusions catering to younger demographics, while the U.K. sees increased importance of calorie content influencing purchasing decisions among adults.