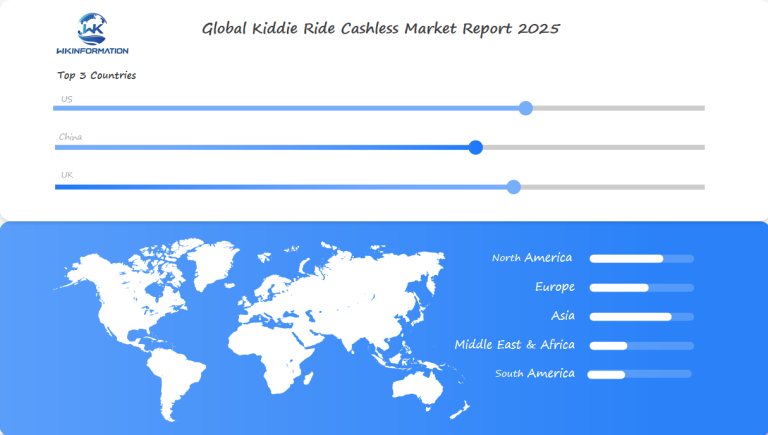

Kiddie Ride Cashless Market Expected to Reach $1.26 Billion Globally by 2025: Contactless Payment Adoption in the U.S., China, and the U.K.

Discover the latest trends in the Kiddie Ride Cashless Market as global contactless payment solutions transform amusement experiences. Market insights reveal significant growth through 2025.

- Last Updated:

Kiddie Ride Cashless Market Predictions for Q1 and Q2 2025 with Regional Emphasis

The Kiddie Ride Cashless market is set to achieve $1.26 billion in 2025, growing at a CAGR of 5.29%. Q1 figures are projected at $295 million, reflecting steady adoption of contactless payment systems in amusement venues. Growth accelerates slightly in Q2, reaching $320 million as consumer preference shifts towards convenience and hygiene.

Key Takeaways

- Global kiddie ride cashless market expected to hit $1.26 billion by 2025

- Contactless payment solutions transforming amusement industry technology

- Digital transactions increasing convenience for parents and operators

- Enhanced security features driving market adoption

- Technological innovation reshaping entertainment payment experiences

Understanding upstream and downstream aspects of the kiddie ride cashless ecosystem

The cashless ecosystem for kiddie rides is a complex network. It involves new technologies and strategic partnerships. Ride makers are changing how we pay by adding digital solutions to their rides.

Important players in the payment chain are key to smooth transactions:

- Technology providers create contactless payment systems

- Payment processors ensure transaction safety

- Ride operators add digital payment options

- Users enjoy easy payment methods

Technology Integration Challenges

Ride manufacturers face significant obstacles in implementing cashless technology. They must combine advanced technology with user-friendly features for families and children.

Economic Impact

| Ecosystem Component | Investment Potential | Technology Complexity |

| Payment Infrastructure | High | Advanced |

| User Experience Design | Medium | Moderate |

| Security Protocols | Critical | High |

The cashless ecosystem is changing how ride makers and operators use digital payments. It opens up new chances for innovation and better user experiences.

Trends accelerating cashless payment integration in kiddie rides

The amusement industry is going digital fast. Mobile wallets are changing how parents and kids enjoy rides. This new way is making entertainment more fun and easy.

- NFC technology makes transactions quick and safe

- Cloud-based systems track everything in real-time

- Digital payments give parents more control

- Less cash handling means better efficiency

Technological Innovations Driving Change

Near Field Communication (NFC) is key in updating payment systems for kiddie rides. Now, parents can pay with their phones, skipping tokens and cash.

More people are using mobile wallets for rides. Venues see the value in digital payments for their ease and safety. These platforms offer:

- Smooth transaction experiences

- Quick purchase tracking

- Loyalty programs

- Strong data security

Changes in Consumer Behavior

Young parents prefer digital-first experiences. They appreciate cashless payments for their convenience and quickness. This shift is transforming the way rides are paid for.

Regulatory and Security Restrictions Shaping Adoption

The world of cashless payments for kiddie rides is full of challenges. Rules and regulations play a big role in how technology is used. These rules help keep payments safe and protect customer data.

Keeping customer data safe is a top priority for businesses using cashless systems. They must follow strict laws to make sure transactions are secure.

Key Compliance Considerations

- PCI compliance requires strict security measures for handling electronic payments

- Protecting personal information involves using strong encryption technologies

- Transaction monitoring systems must adhere to industry-standard security benchmarks

To achieve PCI compliance, several security measures are necessary. Banks and payment companies verify these measures to prevent fraud and protect customer information.

Consumer Trust and Security Measures

For cashless payments to work well, clear security plans are key. Businesses need to show they care about keeping user data safe with strong security plans.

- Real-time transaction verification

- Advanced encryption protocols

- Continuous security audits

By focusing on rules and keeping data safe, kiddie ride operators can win trust. This leads to smooth and secure cashless payment experiences for everyone.

Geopolitical factors influencing payment technology deployment

The world of digital payments is changing fast. Geopolitical factors are key in how different regions adopt new payment technologies. Each country has its own way of looking at cashless payments, based on its economy, tech, and laws.

Digital payment plans vary a lot around the world. Here are some main points:

- Rich countries often have more advanced digital payment systems

- Poorer countries are skipping old payment methods and going straight to new ones

- Government support is key in making cashless payments more common

Cross-Border Payment Challenges

International fun parks and entertainment spots face significant challenges with cashless payments. Integrating various payment systems is a major hurdle for those seeking seamless transactions.

Key factors in payment technology include:

- Different laws in countries

- The ability of countries to adapt to new technology

- Public perception towards digital payments

- The level of economic development in a country

Emerging Trends in Global Payment Technologies

New solutions are being developed to address the challenges of making payments across borders. Technologies such as blockchain and mobile payments are playing a crucial role in making digital transactions more interconnected and secure on a global scale.

Segmentation by payment types and technology platforms

The kiddie ride cashless market is changing fast. New payment types are making it easier for parents and kids to enjoy rides and shows.

New payment options are popping up everywhere. They bring more convenience and safety to families. The main types changing the game are:

- Contactless cards with near-field communication (NFC) technology

- Mobile payments through smartphone applications

- QR code systems enabling quick digital transactions

- Biometric payment solutions using facial recognition

Emerging Digital Payment Platforms

Mobile payments are becoming more popular. Now, kids and parents can make payments easily with digital wallets on their phones. QR codes add more flexibility, making it easy to pay without touching cards.

Technology Integration Strategies

Contactless cards are leading the way in cashless payments. They’re fast and secure. Amusement parks are now using different payment methods to meet everyone’s needs.

Biometric payments are the next big thing. Soon, facial recognition and fingerprint scanning might be how we pay. This could make paying for fun even easier and safer.

Application analysis in amusement parks, malls, and entertainment centers

Cashless payment systems are changing amusement parks and entertainment centers. They make visits smoother and give insights into what people like.

Modern entertainment centers use data to change how they meet guests. They offer multi-ride packages and easy payment options. This makes visits more personal and easy.

Key Benefits of Cashless Payment Systems

- Reduced wait times for rides and attractions

- Enhanced security for financial transactions

- Simplified tracking of guest spending patterns

- Customized loyalty programs

Amusement parks see big benefits from cashless tech. They can understand what guests want and make them happier.

Implementation Strategies

Entertainment centers use different ways to add cashless payments. They use wristbands and mobile apps to make things easier for guests. This makes things run smoother.

The future of entertainment places is in using data and making payments easy. This will make visits even better for everyone.

Global Regional Market Insights for Kiddie Ride Cashless Solutions

The global market for cashless solutions in kiddie rides is changing fast. It’s all about new tech and how different places adopt it. Each area has its own way of using these contactless payment systems.

- North America is ahead with its tech

- Asia-Pacific is growing fast

- Europe focuses on following rules

North American Market Characteristics

In North America, cashless payments for kiddie rides are growing fast. People here love new tech and use digital payments a lot. Big amusement parks are adding contactless systems to make things better for everyone.

Asia-Pacific Market Trends

Asia-Pacific is a huge opportunity for cashless ride solutions. Rapid urbanization, increased disposable income, and widespread smartphone adoption are driving its growth. Countries like China and India are investing heavily in their digital payment ecosystems.

European Market Landscape

In Europe, things are a bit different. They have to follow strict rules about data protection. They want to make sure payments for kids’ fun are safe, clear, and easy to use.

U.S. Advances in Contactless Payment Systems

The United States is experiencing significant changes in how we pay for things. New technologies are changing how we make payments, especially in fun places like kiddie rides.

Contactless payments in the U.S. have grown a lot lately. The use of EMV chip cards has been key in this change. More people are using mobile payments, which helps businesses make transactions easier.

Key Drivers of Contactless Payment Adoption

-

- Enhanced security features of EMV chip cards

- Increasing smartphone penetration

- Consumer demand for faster, more convenient payment methods

- Reduced transaction processing times

The kiddie ride market is quickly adopting these new payment methods. They see how contactless payments can make things better for customers and for them. Mobile payment technologies, which are now essential in the modern entertainment world, are making a significant impact in this sector.

Consumer Preferences and Technology Trends

Studies show U.S. consumers are getting used to contactless payments. The ease of tapping a card or phone has made paying easier and more straightforward.

China's Rapid Adoption of Mobile Payment Technologies

China has changed the game in mobile payments, leading the world in digital transactions. WeChat Pay and Alipay dominate the scene, changing how people use tech and shop.

The growth of mobile payments in China is amazing. QR code payments are everywhere, making shopping easy for everyone.

Key Drivers of Mobile Payment Innovation

- Widespread smartphone penetration

- Government support for digital financial technologies

- Consumer preference for convenient payment methods

WeChat Pay and Alipay have led the way in mobile payments. They’ve combined social media, finance, and payments into one app.

Impact on Consumer Behavior

QR code payments have changed how people deal with businesses. From street vendors to fun spots, mobile payments are the go-to choice.

For kiddie rides and fun places, these payments bring ease and tracking. Parents can keep an eye on spending with mobile apps.

U.K. Evolution in Cashless Entertainment Payments

The United Kingdom is leading the way in cashless payments. This change has transformed how we pay for fun, like at amusement parks. Contactless cards have made paying easier and faster.

U.K. cashless payments have grown a lot. This growth is thanks to a few main reasons:

- Rapid adoption of contactless payment technologies

- Open banking initiatives supporting digital transactions

- Consumer preference for quick and convenient payment methods

Brexit’s Impact on Payment Technologies

Brexit has changed how payments work. Open banking rules have led to better, safer payment options. Now, kiddie ride operators are using new contactless systems to make payments smoother.

Market Transformation Strategies

Entertainment businesses are using contactless cards to make payments easy. They’re also focusing on mobile and digital payments. This attracts tech-savvy families and boosts customer happiness.

Future outlook for kiddie ride cashless market expansion

The kiddie ride market is about to undergo a significant transformation, driven by new technologies and payment methods. These advancements will enhance amusement experiences for both children and parents.

Here are some key developments to look out for:

- Advanced IoT in amusement integration for seamless payment experiences

- Blockchain-powered secure transaction mechanisms

- Artificial Intelligence-driven personalized ride recommendations

- Augmented reality payment interfaces

Technological Disruption in Payment Ecosystems

New technologies are changing how we pay. Things like contactless NFC payments and mobile wallets are making it easier to go cashless. This is especially true in places where kids play.

| Technology | Potential Impact | Adoption Timeline |

| IoT Payment Systems | Enhanced User Experience | 2024-2026 |

| Blockchain Payments | Increased Security | 2025-2027 |

| AI-Powered Interfaces | Personalized Interactions | 2023-2025 |

New technologies are bringing big changes to how we pay for kiddie rides. Things like sustainability, keeping users interested, and new tech will help the market grow. This will happen in the next few years.

Competitive analysis of cashless payment providers

Key players in the kiddie ride cashless payment market are focusing on technological advancements to enhance payment flexibility and operational efficiency. They are expanding operations in regions such as North America and Europe, where the adoption of contactless and mobile payment solutions is increasing. Strategic collaborations with amusement operators and investments in versatile payment systems are enabling these companies to strengthen their market presence and meet the evolving preferences of consumers seeking convenient and secure payment options for children’s amusement rides.

Key Players:

-

Nayax (Israel)

-

USA Technologies (United States)

-

PayRange (United States)

-

Ingenico Group (France)

-

Square (United States)

-

Verifone (United States)

-

PAX Technology (China)

-

Adyen (Netherlands)

-

Worldline (France)

-

Stripe (United States)

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Kiddie Ride Cashless Market Report |

| Base Year | 2024 |

| Segment by Type |

· Contactless Cards with Near-field Communication (NFC) Technology · Mobile Payments Through Smartphone Applications · QR Code Systems Enabling Quick Digital Transactions · Biometric Payment Solutions Using Facial Recognition · Emerging Digital Payment Platforms |

|

Segment by Application |

· Amusement Parks · Malls · Entertainment Centers |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Kiddie Ride Cashless Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Kiddie Ride Cashless Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Kiddie Ride Cashless Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Kiddie Ride Cashless Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Kiddie Ride Cashless Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Kiddie Ride Cashless Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Kiddie Ride Cashless Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Kiddie Ride Cashless Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market size for cashless kiddie rides by 2025?

The global cashless kiddie ride market is expected to hit $1.26 billion by 2025. This growth is fueled by the rise of contactless payment tech in the amusement world.

How are contactless payment systems changing traditional kiddie rides?

Contactless payments are making kiddie rides better by offering easy, mobile-friendly ways to pay. This makes the experience smoother for users and helps operators manage transactions more efficiently.

What technologies are enabling cashless payments for kiddie rides?

Technologies like NFC, RFID, mobile wallets, and QR codes are key. They make quick and easy transactions possible.

Are cashless payment systems secure for children’s rides?

Yes, they are. Operators use strong security measures like PCI compliance and fraud prevention to keep transactions and user data safe.

Which regions are leading in cashless kiddie ride payment adoption?

North America, China, and the UK are currently at the forefront of cashless kiddie ride payment adoption. The Asia-Pacific region is also experiencing rapid growth, driven by urban expansion and increasing incomes.

What payment methods are most popular for kiddie rides?

Contactless cards, mobile payments, and QR code payments are the top choices for kiddie rides.

How do cloud-based management systems benefit kiddie ride operators?

Cloud systems offer real-time monitoring and data insights. This helps operators improve ride quality and customer satisfaction.

What future technologies might impact cashless payments for kiddie rides?

New tech like IoT, AI, and blockchain could change the game. They might bring even more efficiency and security to cashless payments.

How are privacy concerns addressed in cashless payment systems?

Operators follow strict data rules like GDPR. They ensure data is collected and stored safely.

Can cashless systems support loyalty programs for kiddie rides?

Yes, they can. Digital payments make it easy to set up loyalty programs. This lets operators offer special deals and personalized experiences.