Jam Market to Reach $5.04 Billion by 2025: Rapid Growth in the U.S., France, and Brazil

Explore the global jam market’s growth projections, key trends, and challenges. Learn about market segmentation, geopolitical influences, and culinary applications shaping industry demand through 2025.

- Last Updated:

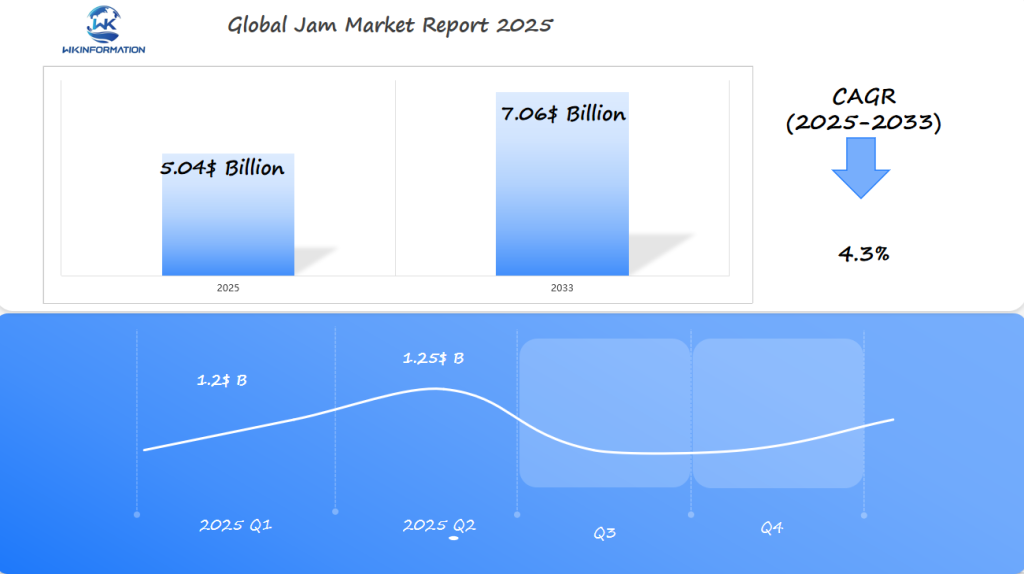

Jam Market Q1 and Q2 2025 Forecast

The Jam market is projected to reach $5.04 billion in 2025, growing at a CAGR of 4.3% from 2025 to 2033. In Q1 2025, the market is expected to generate around $1.2 billion, driven by the rising demand for natural and organic jam varieties as consumers increasingly prioritize health-conscious and clean-label food products. The U.S., France, and Brazil will remain key players, with Brazil seeing a significant increase in domestic consumption as well as exports of fruit-based spreads.

By Q2 2025, the market will likely grow to approximately $1.25 billion, with the growing popularity of artisanal and premium jams in the U.S. and Europe, particularly in the wake of the local food movement. Consumers will increasingly seek low-sugar and no-additive variants, further driving growth in the market.

Understanding the Jam Market: Upstream and Downstream Dynamics

The jam industry involves a complex supply chain with various players such as farmers, processors, and retailers. One crucial aspect of this industry is how raw materials are sourced, particularly fruits. Fruit suppliers have strict quality standards in place to meet the demands of production.

Key Sources of Raw Materials

Here are the main sources from which the jam industry obtains its raw materials:

- Local fruit farms providing fresh seasonal produce

- International suppliers for exotic fruit varieties

- Sugar refineries supplying essential sweetening agents

- Pectin manufacturers delivering crucial gelling components

The way jam products are distributed has undergone significant changes over time. This evolution has been driven by shifts in consumer behavior and market demands. Currently, supermarkets play a dominant role in the retail sector, accounting for 65% of global jam sales. These large retail chains leverage their extensive networks and storage capabilities to ensure that their stores always have a consistent supply of jam products.

Distribution Channels for Jam Products

Here’s a breakdown of the different distribution channels used for jam products:

- Supermarkets/Hypermarkets: 65%

- Convenience Stores: 15%

- Online Retailers: 12%

- Specialty Food Stores: 8%

The emergence of e-commerce platforms has opened up new opportunities for jam manufacturers to sell directly to consumers. As a result of this shift towards online shopping, producers are now adapting their packaging and logistics strategies to accommodate longer delivery times while still ensuring that their products remain fresh.

Supermarkets maintain their competitive advantage through strategic shelf placement and promotional activities. By offering multiple brands and varieties of jam under one roof, these retail giants continue to attract consumers who value convenience and choice. Additionally, the bulk purchasing power of supermarkets influences production volumes, directly impacting manufacturers’ production schedules and inventory management practices.

Key Trends Driving Growth in the Jam Industry

The jam industry’s growth reflects changing consumer preferences and health-conscious lifestyles.

1. Rise of Organic and Natural Jams

Organic and natural jams have gained significant market share, with consumers actively seeking products free from artificial preservatives, colors, and flavors. These organic variants often feature locally-sourced fruits and natural sweeteners, appealing to environmentally conscious buyers.

2. Health-Conscious Innovations

Health-conscious options dominate market innovations:

- Low-sugar jams using alternative sweeteners

- Sugar-free varieties sweetened with stevia or monk fruit

- Reduced-calorie spreads for diet-conscious consumers

- Fiber-enriched formulations for added nutritional benefits

3. Convenience Food Revolution

The convenience food sector has transformed jam packaging and consumption patterns. Single-serve portions, squeeze bottles, and travel-friendly containers meet the needs of busy consumers. Ready-to-use jam packets in hotels, restaurants, and airlines have created new market opportunities.

4. Evolving Consumer Preferences

Consumer buying patterns show strong preferences for:

- Portable packaging solutions

- Easy-spread consistencies

- Multi-fruit combinations

- Premium artisanal offerings

These market shifts have prompted manufacturers to develop innovative product lines that combine health benefits with convenience. Brands now offer specialized jam varieties targeting specific dietary needs, including keto-friendly options and products enriched with functional ingredients like chia seeds or collagen.

Challenges Impacting Jam Production and Distribution

The jam industry faces significant production and distribution hurdles that affect market stability.

1. Raw Material Sourcing Challenges

Weather conditions directly impact fruit harvests, making raw material sourcing a critical challenge for the industry. Unexpected events such as frost, drought, or excessive rainfall can lead to crop failures, causing disruptions in the supply chain and fluctuations in prices.

2. Quality Control Concerns

Maintaining consistent quality is crucial in jam production. Manufacturers must pay close attention to various factors such as:

- Fruit-to-sugar ratios

- Pectin levels

- Cooking temperatures

- pH levels

Any deviations in these parameters can result in subpar products and dissatisfied customers.

3. Rising Storage and Transportation Costs

The costs associated with storing and transporting jam products have significantly increased due to several factors:

- Fluctuations in fuel prices impacting delivery expenses

- Cold chain requirements for preserving product quality

- Increases in warehouse rental costs

- Labor shortages causing delays in distribution networks

These rising costs put additional pressure on manufacturers’ profitability.

4. Compliance with Food Safety Regulations

Producers must adhere to strict food safety regulations to ensure their products are safe for consumption. This involves:

- Regular inspections of facilities

- Training programs for employees

- Documentation of production processes

- Implementation of Hazard Analysis Critical Control Point (HACCP) protocols

Compliance with these requirements can be time-consuming and costly for manufacturers.

5. Market Volatility and Pricing Strategies

Pricing strategies in the jam industry are influenced by market volatility. Manufacturers need to strike a balance between their production costs and consumer expectations when determining the prices of their products. Rising ingredient prices, especially for organic fruits, pose challenges to profit margins.

Small-scale producers often struggle to compete with larger manufacturers who benefit from economies of scale.

How Geopolitical Factors Are Shaping the Jam Market

Trade Agreements and Their Impact

Trade agreements directly impact the jam industry’s global landscape. The EU-Japan Economic Partnership Agreement has eliminated tariffs on European jams entering the Japanese market, creating new opportunities for French and German manufacturers. Similar agreements between the U.S. and Canada have facilitated smoother cross-border trade in North America.

The Role of Political Stability

Political stability plays a crucial role in market development:

- Stable Regions: Countries with consistent political environments, like France and Germany, maintain steady production and distribution networks

- Emerging Markets: Political uncertainties in developing nations can disrupt supply chains and affect market growth

- Currency Fluctuations: Political events influence exchange rates, impacting international trade costs

Trade Restrictions and Sanctions

Trade restrictions and sanctions shape market dynamics:

- Import duties on sugar affect production costs

- Regulations on preservatives vary by region

- Quality certification requirements differ across borders

Recent Global Events Impacting the Jam Market

Recent global events have triggered shifts in the jam market:

- Supply chain disruptions force local sourcing

- Changes in border policies affect distribution routes

- Agricultural subsidies influence production costs

The Impact of Brexit

Brexit has reshaped trade patterns between the UK and EU, creating new challenges and opportunities for jam manufacturers. British producers now face different regulatory requirements when exporting to European markets, while EU manufacturers adapt to new import procedures.

Market Segmentation by Jam Type: An In-Depth Look

The jam market showcases distinct consumer preferences across different fruit varieties, with strawberry maintaining its position as the dominant flavor, capturing 35% of global market share. This classic favorite appeals to both traditional consumers and innovative food enthusiasts seeking new culinary applications.

Popular jam varieties by market share:

- Strawberry (35%)

- Raspberry (22%)

- Blackberry (15%)

- Mixed Berry (12%)

- Apricot (8%)

- Other varieties (8%)

Consumer preferences have evolved beyond traditional single-fruit jams. Exotic combinations and unique flavor profiles are gaining traction, particularly among younger demographics. These include:

- Strawberry-Basil

- Raspberry-Lavender

- Peach-Bourbon

- Fig-Honey

Product formulations vary significantly based on regional tastes:

North America: Prefers sweeter profiles with chunky fruit pieces

Europe: Favors smooth textures with intense fruit flavors

Asia-Pacific: Growing demand for tropical fruit varieties

The rise of artisanal jam makers has introduced premium segments featuring:

- Small-batch production

- Local fruit varieties

- Seasonal limited editions

- Unique flavor combinations

These market segments reflect changing consumer behaviors, with 68% of buyers willing to pay premium prices for high-quality, distinctive jam varieties that offer unique taste experiences or align with specific dietary preferences.

The Role of Applications in Shaping Jam Demand

The versatility of jams across culinary applications drives significant market growth. Modern consumers use jams beyond traditional breakfast spreads, creating diverse demand patterns across different meal occasions.

Breakfast Applications

- Toast and bread spreads remain the primary use

- Mixing with yogurt and overnight oats

- Incorporation into breakfast smoothie bowls

- Popular addition to pancakes and waffles

Dessert Applications

- Filling for pastries and baked goods

- Layer cake components

- Cheesecake toppings

- Mix-ins for ice cream and frozen desserts

Creative Culinary Uses

- Glazing for meats and vegetables

- Base for savory-sweet sauces

- Cocktail ingredients and mixers

- Cheese board accompaniments

The foodservice industry amplifies jam demand through innovative menu applications. Restaurants increasingly feature artisanal jams in signature dishes, while bakeries rely on high-quality preserves for commercial production.

Home baking trends push jam usage beyond simple spreads. You’ll find dedicated home bakers selecting specific jam varieties for thumbprint cookies, filled donuts, and custom pastry creations. This diversification of jam applications creates new market opportunities and drives product innovation in texture, flavor profiles, and packaging formats.

The rising popularity of charcuterie boards introduces jams to new consumption occasions. Specialty varieties like fig, apricot, and berry preserves pair with cheese and cured meats, elevating jams from breakfast staples to sophisticated entertaining essentials.

Global Market Trends in the Jam Industry

Regional Preferences Shaping the Jam Market

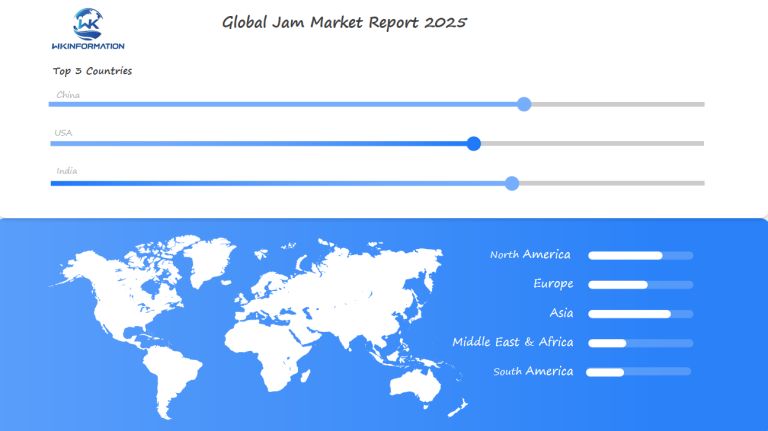

Different regions around the world have their own unique preferences when it comes to jam, which are influencing the global market. Here’s a breakdown of what each region prefers:

- North America: Consumers here tend to stick with traditional fruit flavors like strawberry and grape. These jams are widely available in stores and are still popular choices.

- Europe: European consumers have more refined tastes. In Western Europe, there’s a high demand for organic and reduced-sugar options. Eastern Europe is seeing a growing interest in locally-sourced ingredients, while Mediterranean countries have a strong preference for citrus-based preserves.

- Asia-Pacific: This region is experiencing rapid growth in the jam market. China, in particular, is showing an increasing interest in imported jams, which presents new opportunities for international brands.

- Emerging Markets: Countries like Brazil and India have significant growth potential in their jam sectors. Brazil’s jam industry expects an annual growth rate of 6.2%, while India’s market shows a 7.1% expansion rate. Southeast Asian countries are also reporting rising demand for tropical fruit varieties.

Key Drivers of Growth

Several factors are driving the growth of the jam industry globally:

- Health Consciousness: With consumers becoming more health-conscious, there is a rising demand for organic and reduced-sugar variants of jams.

- Convenience Factor: Jams are often seen as convenient spreads that can be used in various recipes or enjoyed on their own.

- E-commerce Boom: The growth of online shopping has made it easier for consumers to access a wide range of jam products, including artisanal and specialty brands.

Future Outlook

Market forecasts suggest that certain trends will shape the future of the jam industry:

- Plant-based and vegan-friendly options are expected to gain popularity as more people adopt these lifestyles.

- Developing economies will see premium positioning as consumers become willing to pay more for high-quality products.

- Innovative flavor combinations targeting younger demographics will attract new customers who are looking for unique taste experiences.

- Sustainable packaging solutions will become increasingly important as environmental concerns continue to rise.

The Latin American region also holds promise, with Mexico and Argentina joining Brazil as key markets for both domestic production and international trade in jams.

Examining the U.S. Jam Market: Growth Drivers and Insights

The U.S. jam market is experiencing significant growth, driven by unique consumer behaviors and changing dietary preferences. American consumers have a strong preference for strawberry-based products, with the average person consuming 4.85 pounds of strawberries each year. This consumption pattern directly impacts jam production and the overall market.

Key Growth Drivers in the U.S. Market:

1. Health-Conscious Consumption

- Increasing demand for organic jam varieties

- Preference for products with natural sweeteners

- Growing interest in preservative-free options

2. Convenience Factor

- Single-serve packaging options

- Squeeze bottle innovations

- Travel-friendly containers

The U.S. market also has specific regional preferences, with different states showing distinct consumption patterns. New England states tend to prefer traditional fruit preserves, while Western states lead in organic jam consumption.

Consumer Behavior Analysis:

- 73% of U.S. households regularly purchase jam products

- 42% prefer strawberry flavor

- 28% actively seek organic options

- 35% prioritize low-sugar variants

Recent market research shows a significant change in American consumer preferences:

Price Sensitivity: 45% of consumers willing to pay premium for organic options Brand Loyalty: 62% stick to preferred brands Purchase Frequency: 8.2 jars per household annually

Market Distribution Channels:

- Supermarkets: 65% of sales

- Specialty stores: 18%

- Online retailers: 12%

- Others: 5%

The U.S. jam market benefits from strong distribution networks and advanced cold chain infrastructure. This infrastructure allows for efficient delivery of premium products while maintaining quality standards.

Innovation Trends:

- Smart packaging solutions

- Superfood-infused varieties

- Seasonal flavor launches

- Artisanal small-batch productions

Regional manufacturers play an important role in the market, with local producers capturing significant market share through:

- Direct-to-consumer sales

- Farmers’ market presence

- Custom flavor development

- Local ingredient sourcing

The U.S. market shows great potential for growth in the premium segment, with consumers

France's Role in the Expanding Jam Market

France is a key player in the European jam market, known for its rich culinary heritage that drives innovation and quality standards. The French market stands out with its strict regulations on fruit content, requiring a minimum of 35% fruit in standard jams and 45% for extra varieties.

Preferences of French Consumers

French consumers have specific preferences when it comes to jam:

- Artisanal productions – Small-batch jams from local producers

- Protected geographical indications – Regional specialties like Lorraine Mirabelle plum jam

- High-end varieties – Premium jams featuring unique fruit combinations

Economic Impact of the French Jam Industry

The French jam industry generates approximately €500 million annually, with domestic consumption reaching 4.2 kg per household. Local producers have adapted to changing market demands by introducing:

- Sugar-reduced variants maintaining traditional taste profiles

- Seasonal limited editions featuring regional fruits

- Luxury packaging options for gift markets

Growth of French Jam Exports

French jam exports have seen a 15% growth rate in the past five years, particularly in Asian markets where French culinary products command premium prices. The country’s jam manufacturers have capitalized on France’s reputation for gastronomic excellence, positioning their products as luxury items in international markets.

Innovations in French Jam Production

Recent innovations in French jam production include the integration of superfruits and the development of specialized breakfast spreads targeting health-conscious consumers. These adaptations reflect France’s ability to maintain traditional quality while embracing modern market trends.

Brazil's Jam Market Landscape: Key Insights and Opportunities

Brazil’s jam market shows great potential for growth, fueled by rapid urbanization and changing consumer preferences. The country’s diverse fruit production capabilities create unique opportunities for local jam manufacturers to develop distinctive flavor profiles.

Key Market Drivers:

- Rising middle-class population with increased disposable income

- Growing adoption of Western breakfast habits

- Expansion of modern retail formats

- Strong domestic fruit production infrastructure

The Brazilian jam industry benefits from the country’s rich agricultural heritage, with local producers leveraging native fruits like açaí, goiaba, and maracujá to create unique product offerings. These distinctive flavors appeal to both domestic consumers and export markets seeking exotic taste experiences.

Market Opportunities:

- Development of sugar-free variants for health-conscious consumers

- Integration of superfoods into jam formulations

- Premium packaging solutions for gift markets

- Expansion into institutional sales channels

Brazilian consumers show increasing interest in premium jam products, particularly in urban centers like São Paulo and Rio de Janeiro. Local manufacturers are responding by introducing artisanal production methods and emphasizing natural ingredients in their product formulations.

The retail landscape transformation has created new distribution channels, with convenience stores and specialty food shops gaining prominence alongside traditional supermarkets. This diversification enables jam producers to target different consumer segments effectively through varied pricing and packaging strategies.

Future Prospects for the Jam Industry

The jam industry is expected to see significant innovations through 2025 and beyond. Here are some key trends to watch out for:

Smart Packaging Technologies

Smart packaging technologies are set to revolutionize the market, with intelligent labels tracking freshness and temperature-sensitive indicators ensuring product quality. These advancements align with consumer demands for transparency and food safety.

Flavor Innovations

Flavor innovations will push traditional boundaries:

- Exotic Fruit Blends: Combinations like dragon fruit-passion fruit and lychee-pomegranate

- Savory-Sweet Fusions: Incorporating herbs and spices into traditional fruit jams

- Functional Ingredients: Addition of probiotics, collagen, and adaptogens

Market Growth Projections

Market projections indicate a compound annual growth rate (CAGR) of 4.3% from 2025-2030. This growth stems from:

- Rising health consciousness driving demand for sugar-alternatives

- Increased adoption of jam in food service sectors

- Expansion of premium and artisanal jam segments

Sustainable Packaging Solutions

Sustainable packaging solutions will gain prominence:

- Biodegradable materials replacing traditional plastic containers

- Refill stations in supermarkets reducing packaging waste

- Smart portion-control packaging addressing food waste concerns

Increased Personalization Options

The industry will see increased personalization options, with manufacturers offering custom flavor profiles and dietary-specific formulations. Direct-to-consumer channels will expand, allowing small-batch producers to reach niche markets efficiently.

Competitive Dynamics in the Jam Market

The jam market features a diverse competitive landscape with both global corporations and local manufacturers vying for market share.

-

Smucker’s – United States

-

Bonne Maman – France

-

Conagra Brands – United States

-

Hero Group – Switzerland

-

B&G Foods Inc. – United States

-

F. Duerr & Sons Ltd – United Kingdom

-

Andros Group – France

-

Orkla ASA – Norway

-

Welch’s – United States

-

Kraft Foods – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name |

Global Jam Market Report |

|

Base Year |

2024 |

| Segment by Type |

· Fruit-Based Jams · Exotic & Unique Flavor Combinations · Premium Jams |

|

Segment by Application |

· Breakfast Applications · Dessert Applications · Creative Culinary Uses |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units |

USD million in value |

| Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The jam market continues to evolve with remarkable dynamism, driven by changing consumer preferences and innovative applications. Traditional uses remain strong while new culinary applications emerge, creating diverse market opportunities. The industry’s future appears promising, with growth expected across multiple segments and regions.

As the market continues to mature, opportunities for growth exist in both traditional and emerging segments, making the jam industry a vibrant and evolving sector of the global food market.

Global Jam Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Jam Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- JamMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Jamplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Jam Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Jam Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Jam Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofJam Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the jam market by 2025?

The jam market is expected to reach $5.04 billion by 2025, driven by rapid growth in key regions such as the U.S., France, and Brazil.

What are the key trends driving growth in the jam industry?

Key trends include an increasing demand for organic and natural jams, a rise in low-sugar and sugar-free variants, and a shift towards convenience foods among consumers.

How do geopolitical factors influence the jam market?

Geopolitical factors such as trade policies and political stability significantly impact jam exports/imports and overall market growth in various regions.

What challenges does the jam production and distribution face?

Challenges include sourcing quality ingredients, maintaining product consistency and safety, and navigating economic factors that affect distribution costs.

How is the jam market segmented by type?

The jam market is segmented by various types including popular varieties like strawberry and raspberry, with consumer preferences influencing flavor choices and product differentiation.

What role do culinary applications play in shaping jam demand?

Jams are versatile food items used in various culinary settings, from breakfast staples to desserts, which enhances their demand across different consumer segments.