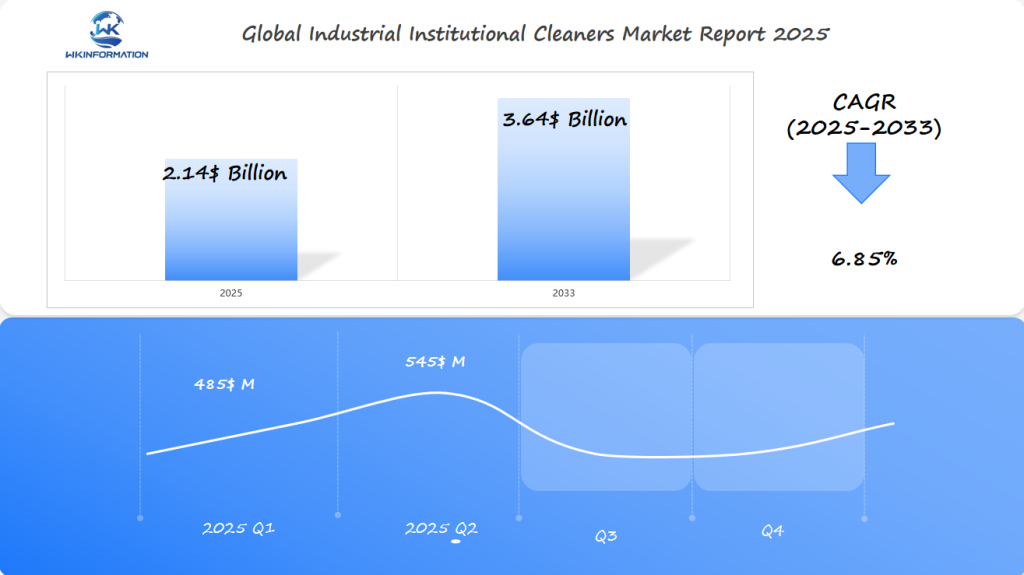

Industrial Institutional Cleaners Market Estimated at $2.14 Billion Worldwide by 2025: Key Drivers in the U.S., Canada, and Brazil

Industrial Institutional Cleaners Market analysis reveals a comprehensive overview of the supply chain, market trends, challenges, and regional insights. Key drivers include heightened hygiene awareness, sustainability trends, multi-functional product innovation, and expanding end-use sectors like commercial, healthcare, food processing, and industrial applications.

- Last Updated:

Industrial Institutional Cleaners Market Q1 and Q2 of 2025 Forecast and Regional Overview

The Industrial Institutional Cleaners market is projected to reach $2.14 billion by 2025, supported by a CAGR of 6.85% through 2033. Market activity in early 2025 is expected to be uneven, with Q1 revenues at about $485 million and a subsequent rise to $545 million in Q2.

Demand is influenced by sanitation standards, regulatory requirements, and seasonal cleaning cycles across manufacturing plants, healthcare, and public facilities. The U.S. leads with strict environmental and safety regulations driving product innovation. Canada’s institutional cleaning sector continues to expand, while Brazil benefits from increased infrastructure and industrial activities. These regions will be critical for tracking regulatory trends and sustainability initiatives shaping product development.

Understanding the Industrial Institutional Cleaners Market: A Deep Dive into the Supply Chain

To truly grasp the dynamics of the Industrial Institutional Cleaners Market, we need to explore its supply chain in detail. This chain is intricate and requires specialized knowledge.

1. Raw Material Sourcing

The journey of industrial institutional cleaners begins with sourcing raw materials. Here’s a closer look:

- Surfactants are crucial, making up almost 29% of revenue share. They are responsible for mixing oils and breaking down dirt in various cleaning products.

- Bio-based agents like plant-based solvents and renewable surfactants are becoming more popular due to environmental regulations and the increasing demand for eco-friendly cleaning solutions.

- Suppliers obtain chemicals from around the world, balancing costs, quality, and compliance with ever-changing safety standards.

2. Manufacturing Processes

Once the raw materials are sourced, they go through specific manufacturing processes:

- The first step is blending, where precise amounts of surfactants, solvents, fragrances, and stabilizers are mixed together.

- Next comes formulation, which is tailored to the specific use of the product. For example, industrial degreasers have different requirements compared to institutional sanitizers.

- Rigorous quality control measures are in place at every stage. Each batch undergoes testing to ensure effectiveness, safety, and compliance with regulations before it is released into the market.

3. Distribution Channels

After manufacturing, the products need to reach their intended customers. This is where distribution channels come into play:

- Wholesalers act as middlemen between manufacturers and end-users.

- Retailers handle smaller-scale distribution for institutions with moderate demand.

- Direct sales to large institutions allow for customization and a more consistent supply of products.

4. Market Efficiency

In simple terms:

- Suppliers provide raw materials

- Manufacturers convert these into finished goods

- Distributors ensure products reach customers efficiently

A well-functioning industrial institutional cleaners supply chain allows for quick adjustments in response to changing regulations or shifts in demand. This efficiency is crucial in maintaining product quality and meeting strict hygiene standards across various industries.

Critical Market Trends Propelling the Industrial Institutional Cleaners Sector

Market growth drivers in the industrial institutional cleaners sector are shaped by a blend of public health priorities, sustainability trends, and evolving client demands.

Hygiene Awareness

Heightened public health awareness fuels demand for disinfectants and cleaning chemicals. The COVID-19 pandemic shifted industry expectations—routine cleaning is no longer sufficient; disinfection protocols now define best practices in healthcare, hospitality, and food processing. Facilities management teams are under pressure to demonstrate compliance with sanitation standards, especially in high-traffic commercial spaces.

Sustainability Trends

Regulatory impact is seen in the rapid adoption of sustainable and bio-based cleaning agents. Government mandates around volatile organic compound (VOC) emissions and water quality drive companies to invest in eco-friendly solutions. Bio-based surfactants and biodegradable formulas gain traction as both clients and regulators push for greener alternatives.

Product Innovation

Multi-functional products have become a focal point for manufacturers. Cleaning agents now routinely combine cleaning, disinfecting, and deodorizing effects into single formulations. This innovation streamlines facility operations by reducing inventory needs and simplifying staff training.

End-Use Expansion

Growth in commercial real estate and healthcare infrastructure directly increases product demand. New office buildings, hospitals, clinics, and retail spaces require comprehensive cleaning protocols—each space presenting unique requirements that reinforce the market’s upward trajectory.

These trends continue to redefine product development roadmaps and investment strategies for suppliers across North America and Latin America.

Factors Limiting the Growth of Industrial Institutional Cleaners Market

Several factors limit the growth of the industrial institutional cleaners market:

- Impact of stringent regulations on chemical formulations and usage limitations: Regulatory bodies impose strict guidelines on the composition and permissible use of cleaning chemicals. These regulations ensure safety and environmental compliance but can limit formulation flexibility, hindering product innovation and market expansion.

- Volatility in raw material prices affecting production costs and profit margins: The prices of essential raw materials like surfactants and solvents can fluctuate due to various economic factors. This volatility impacts manufacturing costs, making it challenging for companies to maintain consistent profit margins.

- Environmental compliance requirements increasing operational complexities: Companies must adhere to environmental standards that govern waste management, emissions control, and biodegradability. Compliance with these regulations requires additional resources, complicating operations and potentially increasing overhead costs.

- Competition from alternative cleaning technologies or localized products: Emerging cleaning technologies such as ultrasonic cleaners or localized products tailored to specific regional needs present significant competition. These alternatives can offer cost-effective or specialized solutions that challenge traditional industrial institutional cleaners.

Geopolitical Factors Reshaping the Industrial Institutional Cleaners Industry

The geopolitical impact on the Industrial Institutional Cleaners Market is significant, shaping both operational efficiency and market reach. Trade tariffs and import-export restrictions, particularly in North America and Latin America, alter supply chain dynamics. Manufacturers in the U.S., Canada, and Brazil often face delays and increased costs when sourcing key raw materials or finished products due to shifting trade policies.

Impact of Trade Tariffs and Import-Export Restrictions

- Trade tariffs: Higher tariffs on chemical inputs or packaging materials can lead to sudden cost spikes.

- Import-export restrictions: Regulatory bottlenecks disrupt timely delivery of cleaning agents, especially for multinational buyers.

Role of Regional Regulations

- In the U.S., Canada, and Brazil, frameworks designed to promote hygiene set high standards for product efficacy and safety.

- At the same time, these regulations create compliance complexities that require ongoing investments in reformulation and documentation.

Influence of Urbanization Policies

Urbanization policies are accelerating infrastructure development across metropolitan regions, driving up demand for cleaning solutions in commercial buildings and healthcare facilities.

Impact of Government-led Healthcare Investments

Government-led healthcare investments—particularly in Brazil—fuel market expansion but introduce new compliance hurdles tied to public procurement rules and sanitary standards.

Risks from Political Instability

Political instability remains a critical risk factor. Any disruption at major manufacturing centers or distribution hubs—whether from labor unrest or abrupt policy changes—can quickly ripple through regional supply chains, impacting product availability and pricing.

This environment demands resilience from suppliers, distributors, and manufacturers operating within the Industrial Institutional Cleaners Market.

Detailed Market Segmentation for Industrial Institutional Cleaners

Product segmentation in the industrial institutional cleaners market highlights clear leaders and emerging trends shaping purchasing decisions and product development.

Key Insights from Product Segmentation

- Surfactants: Surfactants maintain a commanding presence in the raw materials segment, constituting nearly 28–29% of market revenue. Their role is central to detergents and degreasers, delivering essential performance in breaking down oils, fats, and particulate soils. Industrial buyers consistently prioritize surfactant-rich formulations for heavy-duty cleaning tasks.

- General-purpose cleaners: General-purpose cleaners account for a significant share due to their versatility and cost-effectiveness. These products are staples for offices, schools, and public institutions where a single cleaning agent must handle multiple surfaces and varied contaminants. Facilities managers often select these solutions to reduce inventory complexity and streamline procurement.

- Bio-based cleaners: Bio-based cleaners are rapidly gaining ground as consumer demand shifts toward sustainable options. Enabled by stricter environmental legislation and rising awareness around workplace safety, this segment includes plant-derived surfactants and biodegradable solvents. Institutions seeking green certifications or compliance with eco-labels frequently adopt such products.

- Specialized product categories: Specialized product categories like disinfectants, degreasers, and enzymatic cleaners address niche requirements across healthcare, food processing, and manufacturing. Regulatory-driven specifications often dictate the use of these tailored solutions to meet sector-specific standards.

This detailed approach to segmentation ensures each industry vertical can find products that align with both regulatory obligations and operational needs.

How Different Industries Are Fueling the Growth of Industrial Institutional Cleaners

The growth of the industrial institutional cleaners market is largely driven by various industries, each with its own specific cleaning needs.

1. Commercial Sector

The commercial sector is the largest user of industrial institutional cleaners. Places like offices, retail stores, and hotels require extensive cleaning solutions to maintain cleanliness and attractiveness. Since these areas have a lot of foot traffic, regular and thorough cleaning is necessary, leading to an increased demand for industrial institutional cleaners.

2. Healthcare Facilities

In healthcare settings, strict sanitation protocols are crucial to prevent infections. Hospitals, clinics, and other medical facilities heavily rely on effective cleaning agents to ensure a sterile environment. The growing emphasis on patient safety and infection control directly translates into a higher demand for specialized disinfectants and cleaners.

3. Food Processing Industry

The food processing industry requires specialized cleaners to meet strict safety standards. Keeping food processing areas clean is essential to avoid contamination and uphold product quality. Compliance with food safety regulations drives the demand for industrial institutional cleaners specifically designed for this industry.

4. Industrial Applications

Manufacturing plants and similar facilities prioritize degreasing and maintenance cleaning. These environments often deal with heavy machinery and equipment that need powerful cleaning agents capable of removing grease, dirt, and other residues effectively.

Each of these sectors plays a unique role in the growth of the industrial institutional cleaners market, driven by their specific hygiene requirements and regulatory obligations.

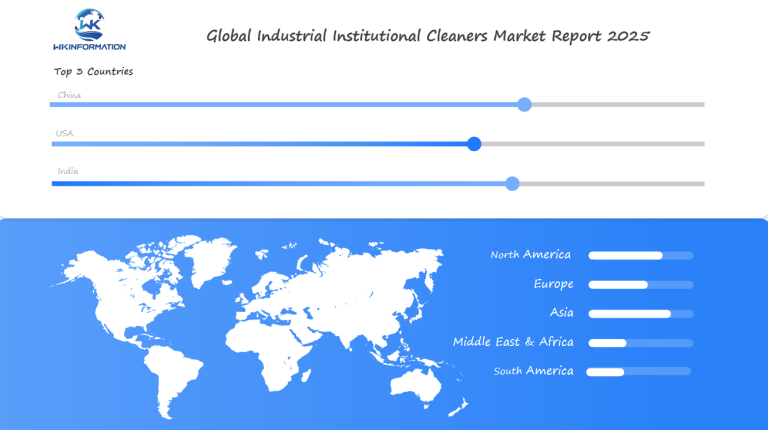

Regional Overview of the Global Industrial Institutional Cleaners Market

The global market for industrial institutional cleaners is projected to reach approximately USD 2.14 billion by 2025, exhibiting steady CAGR growth. North America remains a significant stronghold, with the U.S. and Canada contributing the majority of market shares due to stringent hygiene regulations and high sanitation awareness.

Key Regional Insights:

- Latin American Markets: Led by Brazil, these regions are experiencing rapid expansion fueled by advancements in healthcare infrastructure. The increasing number of health facilities in Brazil drives demand for quality cleaning solutions.

- Comparative Analysis: Regional regulatory environments play a crucial role in shaping growth trajectories. North America’s stringent regulations ensure high standards, while Latin America’s evolving frameworks provide growth opportunities amidst compliance challenges.

Understanding these regional dynamics is essential for stakeholders aiming to navigate the complex landscape of the industrial institutional cleaners market. Each region’s unique regulatory and infrastructural context influences product availability and market expansion strategies.

U.S. Industrial Institutional Cleaners Market: Trends and Growth Opportunities

The U.S. market size for industrial cleaners stands out as the largest in North America, capturing over 93% of the region’s market share. This dominance is the result of several converging factors that create a dynamic environment for both established brands and emerging innovators.

Key Drivers of Growth

- Commercial sector growth in the U.S. remains a primary engine for market expansion. New office buildings, public institutions, and retail complexes continuously increase the demand for high-performance cleaning agents that meet strict hygiene standards.

- Increasing sanitation requirements in healthcare settings drive significant purchasing volume from hospitals, clinics, and long-term care facilities. The pandemic accelerated adoption of hospital-grade disinfectants and surface cleaners, pushing manufacturers to invest in advanced formulations that offer broad-spectrum efficacy.

- Regulatory standards in the U.S.—set by agencies such as the EPA, OSHA, and FDA—dictate rigorous criteria for product safety, labeling, and efficacy. Both federal and state-level regulations require constant innovation from suppliers to ensure compliance while maintaining product competitiveness.

- As buyers seek assurance on sustainability alongside performance, product certifications like Green Seal or EPA Safer Choice have become critical differentiators.

Implications for Manufacturers

Manufacturers serving this market must prioritize R&D to keep pace with evolving expectations around safety, sustainability, and multi-functionality. Direct engagement with institutional buyers has become common practice, enabling rapid feedback loops and faster adaptation to regulatory shifts or end-user needs.

Canada’s Industrial Institutional Cleaners Market Development and Prospects

Keywords: Canadian cleaning chemicals market growth, hospital demand Canada, institutional sanitation standards

Growth in the Canadian cleaning chemicals market is largely driven by hospital establishments requiring high-grade cleaning solutions. The healthcare sector’s stringent sanitation protocols necessitate specialized products to maintain hygiene and prevent infections.

Government-led initiatives across provinces promote institutional hygiene standards, influencing product development and regulatory compliance. These programs aim to elevate cleanliness levels in public spaces, educational facilities, and healthcare institutions.

There is an emerging interest in eco-friendly products aligning with national sustainability goals. Consumers and institutions favor biodegradable and low-VOC cleaners that minimize environmental impact while ensuring effective sanitation.

Opportunities for new entrants are significant, particularly for those focusing on specialized institutional cleaner formulations. Innovations in multi-functional cleaning agents that combine disinfecting, degreasing, and deodorizing properties are highly sought after, providing an edge in this competitive market.

Key Points:

- Hospital establishments driving demand for high-grade cleaning solutions.

- Government initiatives promoting provincial hygiene standards.

- Rising interest in eco-friendly products supporting sustainability goals.

- Opportunities for new entrants with specialized cleaner formulations.

Brazil’s Industrial Institutional Cleaners Market: Current Status and Future Potential

Brazil’s industrial cleaners market growth factors stem from a sharp rise in healthcare infrastructure, with hospitals and clinics prioritizing infection control. Demand for specialized cleaning and disinfecting agents continues to surge as public and private healthcare facilities implement stricter hygiene protocols. Regulatory frameworks in Brazil require the use of certified sanitizing agents across hospitality, food service, and institutional sectors—driving compliance-focused purchasing decisions.

Key Growth Factors

- The hospitality and food industries are subject to rigorous standards, prompting widespread adoption of high-efficacy industrial institutional cleaners.

- Urbanization trends have accelerated the development of commercial real estate, retail complexes, and office spaces. This expansion translates directly into higher consumption of cleaning chemicals tailored for large-scale use.

Sustainability is emerging as a significant theme within the Latin America cleaning trends. Brazilian manufacturers are exploring bio-based formulations to align with both national regulations and growing customer interest in eco-friendly solutions. With its robust distribution networks and established manufacturing base, Brazil acts as a strategic gateway for the Industrial Institutional Cleaners Market across Latin America.

Market participants view Brazil not only as a high-potential domestic market but also as a launchpad for reaching broader Latin American customers seeking advanced hygiene solutions.

Predicting Future Growth and Innovations in Industrial Institutional Cleaners Market

Forecasts for the industrial institutional cleaners market point to a compound annual growth rate (CAGR) ranging from 3.7% to over 8% through the early part of the next decade. Product innovation in cleaning chemicals is reshaping industry standards, with manufacturers directing resources into multi-functional formulas that go beyond basic cleaning. These advanced products now integrate disinfecting, deodorizing, and even surface protection properties, meeting the evolving expectations of facility managers and institutional buyers.

Sustainability Innovation

Sustainability innovation remains central to future trends in industrial cleaners. Companies are increasing the incorporation of bio-based ingredients to comply with tightening environmental regulations and shifting consumer preferences toward greener solutions. Plant-derived surfactants and biodegradable solvents are replacing traditional petrochemical inputs, reducing ecological impact without compromising performance.

Digital Transformation

Digital transformation is also accelerating across the value chain. Real-time supply chain tracking, automated inventory management, and AI-powered customer support tools are becoming industry norms. This digital shift improves transparency for buyers and enables tailored product recommendations based on usage data.

The next phase for this sector will be characterized by agile adaptation—rapid response to regulatory shifts, swift deployment of technological advances, and continual product refinement to stay competitive in a dynamic landscape.

Competitive Landscape and Major Players in Industrial Institutional Cleaners Industry

The Industrial Institutional Cleaners Market has a few global leaders who are driving innovation through scale, research and development (R&D), and acquisition.

- Ecolab – United States

- Diversey – United States

- Clorox Professional Products – United States

- 3M – United States

- Reckitt Benckiser – United Kingdom

- Procter & Gamble Professional – United States

- Henkel – Germany

- Zep Inc. – United States

- Spartan Chemical Company – United States

- Betco Corporation – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Industrial Institutional Cleaners Report |

| Base Year | 2024 |

| Segment by Type |

· Pressure-Sensitive Adhesive Tapes (PSA) · Double-Sided Tapes · Foam Tapes · Specialty and High-Performance Tapes · Medical and Healthcare Tapes |

| Segment by Application |

· Commercial Sector · Healthcare Facilities · Food Processing Industry · Industrial Applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Industrial Institutional Cleaners Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Industrial Institutional Cleaners Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalIndustrial Institutional Cleaners players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Industrial Institutional Cleaners Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Industrial Institutional Cleaners Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Industrial Institutional Cleaners Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the industrial institutional cleaners supply chain?

The industrial institutional cleaners supply chain includes upstream processes such as raw material sourcing with an emphasis on surfactants and bio-based agents, manufacturing processes involving blending, formulation, and quality control, and downstream distribution channels like wholesalers, retailers, and direct sales to institutions. Suppliers, manufacturers, and distributors play crucial roles in ensuring market efficiency and product availability.

What market trends are driving growth in the industrial institutional cleaners sector?

Critical market trends propelling growth include increasing public health awareness boosting demand for disinfectants and cleaners, rising adoption of sustainable and bio-based cleaning agents due to environmental regulations, innovation in multi-functional products combining cleaning, disinfecting, and deodorizing effects, and expansion of commercial spaces and healthcare infrastructure as primary end-use drivers.

What challenges are restricting the growth of the industrial institutional cleaners market?

Restrictive factors influencing growth include stringent regulations on chemical formulations and usage limitations, volatility in raw material prices affecting production costs and profit margins, environmental compliance requirements increasing operational complexities, and competition from alternative cleaning technologies or localized products.

How do geopolitical factors impact the industrial institutional cleaners industry?

Geopolitical factors such as trade tariffs and import-export restrictions affect supply chains especially in North America and Latin America. Regulatory frameworks in countries like the U.S., Canada, and Brazil promote hygiene but create compliance challenges. Urbanization policies and healthcare investments influence regional demand dynamics. Additionally, political instability can pose risks to manufacturing or distribution hubs.

What are the main product segments within the industrial institutional cleaners market?

The market is segmented by product types including surfactants which dominate raw materials across detergents and degreasers; general-purpose cleaners known for versatility and cost-effectiveness; emerging bio-based sustainable cleaning agents driven by consumer preference and legislation; as well as specialized categories like disinfectants and degreasers tailored to specific industries.

Which regions lead the global industrial institutional cleaners market and what drives their growth?

North America, particularly the U.S. and Canada, holds majority market shares with strong commercial sector growth supported by stringent hygiene regulations. Latin American markets led by Brazil are rapidly expanding fueled by healthcare infrastructure growth, urbanization, regulatory frameworks encouraging effective sanitizing agents use, and increasing demand for sustainable solutions. Regional regulatory environments significantly impact growth trajectories.