Industrial Ethernet Market to Achieve $12.2 Billion Globally by 2025: Smart Factories Accelerate Adoption in Japan, Germany, and the U.S.

Explore the Industrial Ethernet Market growth driven by smart factory adoption, rising automation needs, and IIoT integration. Discover key trends, challenges, and opportunities through 2025.

- Last Updated:

Industrial Ethernet Market Performance in Q1 and Q2 of 2025

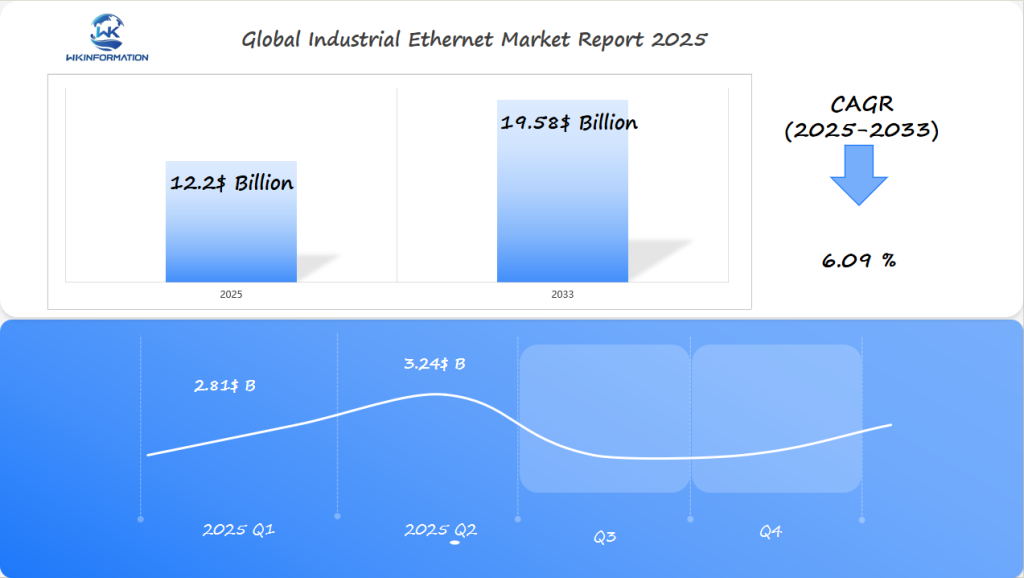

The global Industrial Ethernet market is forecast to reach $12.2 billion in 2025, supported by a CAGR of 6.09% from 2025 to 2033. Q1 revenues are estimated at $2.81 billion, with Q2 accelerating to approximately $3.24 billion, driven by increased adoption of connected automation and factory control systems. This Q2 uplift corresponds with fiscal-year procurement cycles and expansion of Industry 4.0 initiatives.

China, Canada, and France are leading the demand trajectory, supported by large-scale digital infrastructure investments, energy grid modernization, and government-driven smart manufacturing roadmaps. Rising demand for real-time data processing and edge computing within industrial systems further cements their strategic role in global Ethernet deployment.

Key Takeaways

- Industrial Ethernet Market expected to hit $12.2 billion by 2025

- Smart factories driving significant technological transformation

- Japan and Germany lead global Industrial Ethernet adoption

- Network infrastructure critical for modern manufacturing

- Digital connectivity enables more efficient production systems

Overview of the Industrial Ethernet Market's Upstream and Downstream Industry Chain

The Industrial Ethernet market is a complex web of technologies and industries. It has a supply chain with many key parts. These parts help drive innovation and connectivity in today’s factories.

Upstream Industry: The Foundation of Industrial Ethernet Solutions

The upstream industry is vital for creating the basics of Industrial Ethernet solutions. Important players in this area include:

- Semiconductor manufacturers

- Network component producers

- Networking hardware developers

- Chipset and processor designers

Downstream Industries: Turning Technology into Real Solutions

Downstream industries take these core technologies and turn them into real industrial networking solutions. These groups include:

- Industrial automation companies

- Network integration specialists

- Equipment manufacturers

- System solution providers

The supply chain shows how technology and practical use go hand in hand. Each part brings its own special skills to make strong Industrial Ethernet systems.

Important interactions in the supply chain create a lot of market value. They make sure communication is smooth across different industrial settings.

| Supply Chain Segment | Primary Contributions | Key Technologies |

| Upstream Industry | Core Technology Development | Semiconductor Design, Networking Protocols |

| Midstream Industry | Component Integration | Network Infrastructure, Connectivity Solutions |

| Downstream Industry | Solution Implementation | Industrial Automation, System Design |

Working together, the upstream and downstream industries push Industrial Ethernet technology forward.

Smart manufacturing, IIoT, and automation drive evolving Ethernet needs

The world of industry is changing fast. Smart manufacturing, Industrial Internet of Things (IIoT), and new automation are leading the way. These systems are changing how we set up networks and connect devices.

Why is Industrial Ethernet so popular?

What’s making Industrial Ethernet so popular? It’s because of:

- Real-time data processing

- Better operational efficiency

- Predictive maintenance

- Smooth device communication

Automation is pushing for better networking solutions. Smart factories need fast, reliable networks. These networks must handle complex systems well.

| Technology | Ethernet Impact | Performance Improvement |

| IIoT Sensors | Increased data transmission | Up to 40% faster |

| Robotic Systems | Real-time control | Precision within 0.1 milliseconds |

| Smart Manufacturing | Integrated network infrastructure | 99.99% reliability |

More and more, companies see Industrial Ethernet as key for digital change. The mix of IIoT, automation, and smart manufacturing is sparking new network ideas.

Barriers include cybersecurity risks, high deployment costs, and legacy system integration

The Industrial Ethernet market has big challenges that slow down its use in factories. Cybersecurity risks are a big worry for companies wanting to use new networking solutions. These risks come from the connections between industrial systems, making them vulnerable to cyber attacks.

Another big problem is the cost of setting up Industrial Ethernet. The money needed for network upgrades is too much for many companies, especially small ones.

- Legacy system integration poses complex technical challenges

- Cybersecurity risks demand advanced protection strategies

- High deployment costs limit rapid technological transformation

Companies need to find ways to overcome these hurdles. Some possible solutions are:

- Using strong cybersecurity measures

- Upgrading the network bit by bit

- Updating old systems slowly

Planning carefully and understanding technology can help factories deal with these issues. Proactive risk management and targeted investment are key to using Industrial Ethernet well.

Geopolitical policies promoting digital transformation and factory connectivity

Governments around the world are changing industrial technology with strategic plans. These plans aim to speed up digital changes and improve factory connections in many areas. They focus on updating manufacturing to stay competitive globally.

Key policy approaches include:

- Incentivizing technology investments in smart manufacturing

- Developing national digital infrastructure programs

- Creating tax benefits for industrial technology upgrades

- Supporting research and development infactory connectivity

The United States is leading in using policies to support new technologies. Federal and state programs offer a lot of funding and rules to help digital changes in making things.

| Country | Policy Focus | Key Investment Areas |

| United States | Advanced Manufacturing | Industrial Ethernet, IoT Infrastructure |

| Germany | Industry 4.0 | Automation, Network Integration |

| Japan | Smart Factory Development | Robotics, Connectivity Solutions |

Working together internationally is key to improving industrial networking. Governments see that teaming up can speed up digital changes better than going it alone.

These policies are building strong systems for ongoing tech growth in factory connections. They help countries lead in the global industrial change.

Industrial Ethernet market segmentation by type: copper Ethernet, fiber-optic Ethernet, wireless Ethernet

The industrial Ethernet world has three main types: copper Ethernet, fiber-optic Ethernet, and wireless Ethernet. Each has its own strengths, making them suitable for different industrial settings.

1. Copper Ethernet

Copper Ethernet is a key part of many networks. It’s reliable and affordable for many uses. It works well for short distances, perfect for small spaces and local networks.

- Copper Ethernet supports standard transmission speeds

- Relatively lower implementation costs

- Suitable for proximity-based network designs

2. Fiber-optic Ethernet

Fiber-optic Ethernet is for those needing long distances and protection from interference. It uses light to send data, offering fast speeds and long reach.

- Supports ultra-high-speed data transmission

- Immune to electrical interference

- Enables long-distance network connectivity

3. Wireless Ethernet

Wireless Ethernet brings flexibility to industrial networks. It removes the need for cables, making networks more dynamic and mobile-friendly.

- Enables seamless device mobility

- Reduces complex wiring infrastructure

- Supports expanding Internet of Things (IoT) ecosystems

As automation grows, these Ethernet types are key in creating smart factories. They meet specific needs with accuracy and speed.

Industrial Ethernet market segmentation by application: factory automation, energy, transportation, oil & gas

Industrial Ethernet has changed how we connect in key industries. It makes digital infrastructure better. This tech lets different systems talk to each other smoothly.

1. Factory Automation

In factory automation, Industrial Ethernet is a big deal. It helps make smart factories that work better and use less. It’s used for:

- Real-time machine monitoring

- Automated production line control

- Predictive maintenance systems

- Quality control integration

2. Energy Sector

The energy sector uses Industrial Ethernet a lot. It helps manage big power systems. This includes power generation, distribution, and green energy.

3. Transportation Industry

The transportation industry needs fast and reliable networks. Industrial Ethernet helps with this. It’s used for things like:

- Signaling on railways

- Tracking goods

4. Oil and Gas World

In the oil and gas world, Industrial Ethernet is key. It works in tough places like offshore and pipelines. It’s used for:

- Secure data transmission

- Tracking equipment

- Integrating safety systems

- Managing operations from afar

These examples show how Industrial Ethernet changes industries. It boosts efficiency, connects systems, and sparks new ideas.

Regional Performance of the Global Industrial Ethernet Market

The global Industrial Ethernet market shows big differences in each region. Each area has its own growth path and unique features. Regional market performance shows how different places connect and adopt technology.

Here are some key insights into the global Industrial Ethernet adoption:

- Asia-Pacific: Leads the market with the biggest share and fastest growth.

- Western Europe: Its strong manufacturing base supports steady tech integration.

- North America: Its advanced tech ecosystem fuels quick digital changes.

Economic factors, tech infrastructure, and local policies shape the market’s performance. New markets are getting into smart manufacturing, opening up chances for Industrial Ethernet growth. The digital shift in industries is pushing global Industrial Ethernet adoption. Regions are spending a lot on connectivity and smart manufacturing tech.

Japan Industrial Ethernet Market: Robotics and Factory Connectivity

Japan leads in industrial automation, bringing big changes to the Japan Industrial Ethernet market. The country’s tech skills have made factory connections better with advanced robotics and smart networks. Companies like FANUC Corporation have created top robotic systems using Industrial Ethernet.

The Japanese way of making things shows great strengths in connecting industries. Their methods include:

- High-precision robotic integration

- Seamless factory connectivity solutions

- Advanced real-time communication networks

- Intelligent automation systems

Role of Robots in Japan’s Industrial Ethernet Market

Robots are key in growing Japan’s Industrial Ethernet market. Makers are using smart networks for fast data sharing and better machine talks.

Using Industrial Ethernet in factories is a smart move for better work and efficiency. Japanese tech leaders are always improving, making factories smarter and more efficient worldwide.

Germany Industrial Ethernet market: Industry 4.0 and manufacturing upgrades

Germany leads in industrial networking technology, pushing the Germany Industrial Ethernet market forward with Industry 4.0. The country’s factories use new networking solutions to boost productivity and efficiency.

Important changes in Germany’s Industrial Ethernet scene include:

- Quick adoption of smart manufacturing tech

- Investments in upgrading factories

- Wide digital transformation plans

Germany’s factories are changing with new Industrial Ethernet solutions. Companies are making their production lines smarter and more connected. This tech lets them watch data in real-time, predict when things need fixing, and talk better across their networks.

The Germany factory scene puts Industry 4.0 at the top of its list. It mixes the latest networking tech with top automation systems. This makes Germany a world leader in making things better.

Things that help the Germany Industrial Ethernet market grow include:

- Strong engineering setup

- Good research and development skills

- Government backing for new tech

Factories in Germany see Industrial Ethernet as key to going digital. By using the latest networking tech, they make their factories more flexible, efficient, and strong in the market.

U.S. Industrial Ethernet market: automation in automotive and aerospace

The U.S. Industrial Ethernet market is growing fast. This is thanks to new automation in the automotive and aerospace fields. These areas are using advanced networks to make production better and stay competitive worldwide.

How car makers are using Industrial Ethernet

Car makers are using Industrial Ethernet to change how they make cars. They focus on:

- Real-time machine communication

- Enhanced production line monitoring

- Predictive maintenance systems

- Integrated quality control mechanisms

How the aerospace industry is benefiting from Industrial Ethernet

In aerospace, Industrial Ethernet brings new levels of precision and connection. Companies use it to:

- Streamline complex manufacturing workflows

- Improve component tracking

- Reduce operational downtime

- Enhance overall system reliability

The U.S. Industrial Ethernet market is getting bigger. Big investments from car and plane makers are pushing tech forward. Networking is getting smarter, making factories more intelligent and quick to respond.

New trends show the market will keep growing. There’s a lot of money going into better networking in these key areas.

Future expansion through 5G convergence and edge processing

The world of industrial networking is changing fast. This is thanks to 5G convergence and edge processing. These new technologies are changing how systems talk to each other, handle data, and make quick decisions.

Some big changes coming to Industrial Ethernet include:

- Ultra-low latency network communications

- Enhanced real-time data processing at network edges

- Improved machine-to-machine connectivity

- Seamless integration of distributed industrial systems

5G convergence is a big deal for industrial networks. It brings fast bandwidth and connectivity. This lets manufacturers make smarter and quicker production environments. Edge processing adds to this by making calculations closer to where data is.

Industrial networks are quickly adopting these technologies. They aim to:

- Faster decision-making processes

- Reduced network congestion

- Enhanced cybersecurity capabilities

- More resilient communication protocols

The mix of 5G convergence and edge processing opens up new chances for manufacturers. They can now improve their efficiency and tech skills.

Competitor strategies among network solution providers

The industrial Ethernet market is highly competitive, with various network solution providers striving to differentiate themselves using innovative methods in an intricate technology landscape.

Key Players:

-

Cisco Systems — United States

-

Siemens — Germany

-

Rockwell Automation — United States

-

Belden — United States

-

Hirschmann — Germany

-

Moxa — Taiwan

-

Phoenix Contact — Germany

-

Advantech — Taiwan

-

HPE (Aruba Networks) — United States

-

Schneider Electric — France

Different approaches to competition

To gain an edge in the market, companies are pursuing various strategies:

- Investing in research and development

- Creating specialized industrial Ethernet switch solutions

- Building robust cybersecurity features

- Partnering with manufacturing firms

The importance of differentiation

For network solution providers, standing out from the crowd is crucial. They are placing their emphasis on specialized industrial Ethernet switches that provide exceptional performance, dependability, and seamless integration with existing systems.

Increasing competition and resource allocation

As the rivalry intensifies, companies are allocating significant resources towards developing cutting-edge technologies. Their objective is to cater to the requirements of smart manufacturing and industrial Internet of Things (IoT) applications.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Industrial Ethernet Market Report |

| Base Year | 2024 |

| Segment by Type |

· Copper Ethernet · Fiber-optic Ethernet · Wireless Ethernet |

| Segment by Application |

· Factory Automation · Energy · Transportation · Oil & Gas · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Industrial Ethernet market is set for a big change, with growth expected to hit $12.2 billion by 2025. This growth is driven by smart manufacturing and digital changes in many industries. New tech in automation, 5G, and edge processing opens up big chances for network providers.

Industrial Ethernet adoption is changing how factories work. Big names like Siemens, Cisco, and Rockwell Automation are leading in building strong networks for complex factories. Growth will likely focus on places like Japan, Germany, and the U.S., where making new things is key.

But, there are big challenges like keeping networks safe, fitting old systems into new ones, and the cost of setting up. Companies that do well will focus on digital plans that mix tech spending with keeping things running smoothly. Using Industrial Ethernet right can make factories work better, cut down on stops, and make them more reliable.

The future of Industrial Ethernet looks exciting. New tech like edge computing, AI, and robots will keep changing how networks are used. Companies that stay ahead and invest in flexible, safe networks will win big in the digital shift in making things worldwide.

Global Industrial Ethernet Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Industrial Ethernet Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Industrial Ethernet Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Industrial Ethernet Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Industrial Ethernet Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Industrial Ethernet Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Industrial Ethernet Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Industrial EthernetMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Industrial Ethernet and why is it important?

Industrial Ethernet is a powerful networking technology designed for industrial environments. It enables seamless and high-speed communication between machines, sensors, and control systems. This capability significantly enhances the efficiency of smart factories by facilitating real-time data exchange.

How is Industrial Ethernet different from traditional Ethernet?

Industrial Ethernet is built tough for harsh industrial settings. It handles extreme temperatures, interference, and more. It’s reliable, has rugged connections, and special protocols for consistent performance.

What are the primary technologies in Industrial Ethernet?

The main technologies used in Industrial Ethernet are:

- Copper

- Fiber-optic

- Wireless Ethernet

Copper is cost-effective for short distances, fiber-optic offers high-speed transmission over long distances, and wireless provides flexibility in complex environments.

Which industries are most actively adopting Industrial Ethernet?

Factory automation, energy, and transportation are leading the way. Automotive, aerospace, and oil & gas are also adopting it. They use it for better automation and efficiency.

What challenges does Industrial Ethernet face in widespread adoption?

Challenges include cybersecurity risks, high costs, and integrating with old systems. Companies need to invest in security, upgrade infrastructure, and find ways to link new tech with old systems.

How will 5G impact Industrial Ethernet?

5G will make Industrial Ethernet faster and more reliable. It will support edge computing and real-time data processing. This will lead to better remote monitoring and advanced automation.

What is the projected market value for Industrial Ethernet?

The market is expected to reach $12.2 billion by 2025. This growth is driven by the demand for smart manufacturing and industrial automation in countries such as Japan, Germany, and the U.S.

How are countries supporting Industrial Ethernet development?

Countries are backing it with policies, digital initiatives, and industry 4.0 programs. Germany, Japan, and the U.S. are setting up regulations and funding research to boost industrial networking.