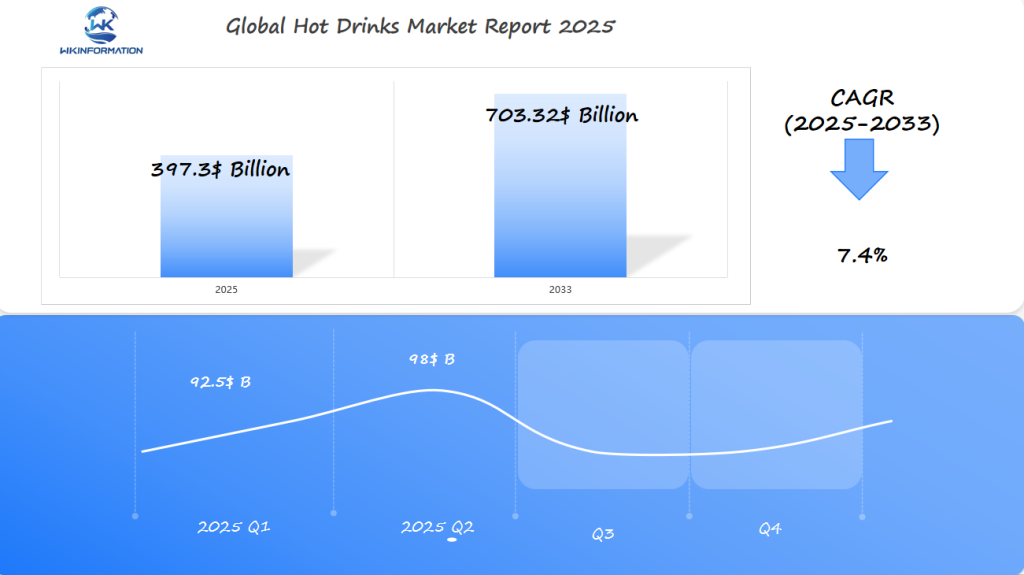

Hot Drinks Market Set to Reach $397.3 Billion by 2025: Key Drivers of Growth in the U.S., Brazil, and Japan

A comprehensive analysis of the global hot drinks market, exploring growth projections, key trends, and market dynamics across major regions. The report details market segmentation, consumer behavior shifts, and industry innovations, with special focus on the U.S., Brazil, and Japan’s contributions to market development through 2025.

- Last Updated:

Hot Drinks Market Forecast for Q1 and Q2 2025

The global hot drinks market is expected to reach $397.3 billion in 2025, with a CAGR of 7.4% through 2033. The market will see strong demand in the first half of 2025, with Q1 estimated at around $92.5 billion and Q2 expected to rise to approximately $98 billion. The growth in the hot drinks market is driven by increasing consumer interest in beverages such as coffee, tea, and hot chocolate.

The U.S., Brazil, and Japan are key markets for hot drinks. The U.S. continues to dominate the market, driven by its strong coffee culture and the growing popularity of premium hot beverages. Brazil, as one of the largest coffee producers globally, also maintains a significant consumption rate of hot drinks, particularly coffee. Japan, known for its unique tea culture, remains a key player in the market, with a growing interest in high-quality, specialty hot beverages. These countries are essential to understanding the trends and consumer behaviors shaping the global hot drinks market.

Understanding the Hot Drinks Market: Upstream and Downstream Dynamics

The hot drinks supply chain involves various players such as producers, manufacturers, and consumers who interact with each other in complex ways. At the upstream level, the sourcing of raw materials is crucial for maintaining product quality and market stability.

Upstream Supply Chain Components

Here are the key components of the upstream supply chain in the hot drinks market:

- Coffee bean cultivation in regions like Brazil, Vietnam, and Colombia

- Tea leaf production across India, China, and Kenya

- Processing facilities for ingredient preparation

- Quality control and certification processes

- Raw material storage and transportation systems

The manufacturing processes in the hot drinks industry involve strict temperature control, precise brewing methods, and specialized packaging techniques. These factors have a direct impact on the taste, aroma, and shelf life of the final product.

Downstream Distribution Channels

The downstream distribution channels play a vital role in getting hot drinks products to consumers. Here are the main channels through which these products are distributed:

- Hypermarkets and supermarkets (43% market share)

- Specialty stores and cafes

- Online retailers and e-commerce platforms

- Convenience stores

- Food service establishments

With the rise of digital platforms, there has been a significant shift in downstream dynamics. This has opened up new opportunities for direct-to-consumer sales. Modern distribution networks now include:

- Smart inventory management systems

- Temperature-controlled transportation

- Real-time tracking capabilities

- Last-mile delivery solutions

These technological advancements have made it easier for consumers to access hot drinks products while ensuring that quality standards are maintained throughout the supply chain. Additionally, the integration of blockchain technology allows for better traceability, guaranteeing product authenticity from farm to cup.

Key Trends Shaping the Hot Drinks Industry

1. Health-Conscious Choices

Health consciousness drives significant changes in consumer preferences across the hot drinks market. A notable shift toward beverages with functional benefits has emerged, with 73% of consumers actively seeking drinks that boost immune system function. Popular options include:

- Green tea enriched with antioxidants

- Turmeric lattes with anti-inflammatory properties

- Matcha drinks packed with L-theanine

- Herbal infusions supporting digestive health

2. Specialty Coffee Revolution

The specialty coffee sector has transformed the market landscape, recording a 20% growth in 2022. Coffee enthusiasts now demand:

- Single-origin beans

- Precise brewing methods

- Transparent sourcing practices

- Artisanal roasting techniques

3. Innovative Flavors and Technologies

Product innovation shapes consumer experiences through unique flavor combinations and brewing technologies. Recent market developments include:

- Nitrogen-infused hot beverages

- CBD-enhanced coffee blends

- Plant-based milk alternatives specifically designed for hot drinks

- Smart brewing systems with customizable temperature controls

4. Evolving Tastes and Values

The rise of experiential consumption has pushed brands to create distinctive offerings. Japanese-inspired beverages like hojicha lattes and Brazilian cold brew variations demonstrate the market’s evolution toward sophisticated taste profiles. These innovations reflect changing consumer values, emphasizing both health benefits and premium experiences in their daily hot beverage choices.

Barriers to Growth in the Hot Drinks Market

The hot drinks market faces several significant challenges that could impact its projected growth trajectory. Rising production costs present a substantial hurdle for manufacturers, with raw material expenses increasing by 15-20% in 2023 alone.

1. Supply Chain Disruptions

- Transportation bottlenecks affecting timely delivery

- Weather-related crop damage impacting coffee and tea harvests

- Storage and preservation challenges in different climates

2. Market Competition Barriers

- Ready-to-drink beverages capturing younger demographics

- Energy drinks market growing at 8.2% CAGR

- Increased competition from smoothie bars and juice shops

3. Economic Constraints

- Consumer spending limitations during inflationary periods

- Price sensitivity in emerging markets

- High operational costs for specialty coffee shops

The rise of health-conscious consumers has led to reduced caffeine consumption, with 23% of millennials reporting decreased coffee intake. Alternative beverages like kombucha and sparkling water have gained market share, particularly in urban areas.

Regulatory challenges add another layer of complexity. Food safety requirements, labeling regulations, and sustainability certifications create additional costs for producers. Small-scale manufacturers struggle to meet these requirements while maintaining competitive pricing.

The premium segment faces resistance in price-sensitive markets, where traditional brewing methods remain prevalent. This price resistance limits market penetration for specialty products and innovative brewing technologies.

Geopolitical Factors Affecting Hot Drinks Production

The hot drinks industry faces significant challenges from global political dynamics and environmental changes. Trade tensions between major economies directly impact the cost and availability of essential ingredients like coffee beans and tea leaves.

Trade Policy Impact

- Tariffs on coffee imports can raise consumer prices by 15-25%

- Export restrictions in producing countries affect global supply chains

- Changes in trade agreements influence market access and distribution

Climate Change Effects

- Rising temperatures threaten traditional growing regions

- Unpredictable weather patterns disrupt harvest cycles

- Reduced crop yields in key production areas

Regional Political Stability

- Civil unrest in producing regions disrupts supply chains

- Currency fluctuations affect pricing and trade relationships

- Changes in labor laws impact production costs

The intersection of these factors creates complex challenges for hot drinks producers. Brazil’s coffee exports face pressure from changing rainfall patterns, while Japanese tea producers navigate strict agricultural regulations. U.S. companies adapt to shifting international trade policies that affect their supply chain costs.

Recent sanctions and trade disputes have led to a 12% increase in transportation costs for hot beverages. Companies now diversify their sourcing strategies, establishing relationships with multiple suppliers across different regions to maintain stable production levels.

Hot Drinks Market Segmentation: Key Types and Their Influence

The hot drinks market is divided into three main segments, each playing a crucial role in shaping industry dynamics:

1. Coffee Segment (60% Value Share)

- Premium arabica beans drive specialty coffee market growth

- Ready-to-drink coffee products attract younger consumers

- Cold brew innovations expand coffee’s market reach

- Sustainable sourcing practices influence consumer choices

2. Tea Segment (33.4% Value Share)

- Green tea leads health-conscious consumer preferences

- Herbal blends capture wellness-focused demographics

- Premium loose-leaf teas create high-value opportunities

- Bubble tea trends boost market innovation

3. Other Hot Drinks (6.6% Value Share)

- Hot chocolate maintains steady seasonal demand

- Malted drinks appeal to nutrition-conscious consumers

- Herbal infusions target specific health benefits

The coffee segment’s dominance comes from the widespread adoption of café culture and the increasing preference for brewing coffee at home. Tea’s significant market share reflects its traditional roots and growing appreciation for its health properties. The smaller “other hot drinks” category creates niche opportunities through specialized offerings and seasonal products.

Market data shows that coffee is growing at a rate of 8.2% annually, while tea is experiencing a growth rate of 6.7%. These segments respond differently to consumer trends, with coffee leading the development of premium products and tea driving health-focused innovations.

Applications Driving Demand for Hot Drinks Globally

The daily consumption patterns of hot beverages reveal distinct applications driving market growth. Modern workplace culture has transformed hot drinks into essential productivity companions, with 73% of professionals incorporating coffee breaks into their daily schedules.

Hot beverages serve multiple purposes in consumers’ lives:

- Morning Ritual: 64% of consumers start their day with a hot drink, creating a stable demand during breakfast hours

- Social Connector: Coffee shops and tea houses function as meeting spots, driving out-of-home consumption

- Wellness Applications: Hot drinks are increasingly used for specific health benefits:

- Green tea for metabolism boost

- Herbal infusions for sleep and relaxation

- Black coffee for pre-workout energy

The rise of remote work has sparked new consumption patterns. Home brewing equipment sales increased by 32% since 2020, indicating a shift toward domestic hot beverage preparation.

Seasonal applications significantly influence demand cycles:

- Hot chocolate consumption spikes during winter months

- Specialty tea blends gain popularity during cold and flu season

- Iced coffee variations dominate summer markets

Cultural applications vary across regions, with traditional ceremonies and social customs driving specific product demands. Japanese tea ceremonies, Brazilian coffee culture, and British tea time traditions shape local market preferences and consumption patterns.

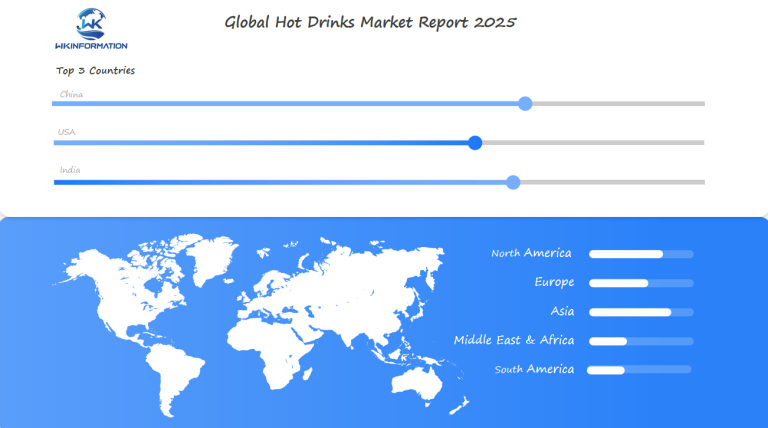

Regional Insights into the Global Hot Drinks Market

The Asia-Pacific region is the leader in the global hot drinks market, holding a significant 40.2% share of the total market value. This dominance can be attributed to several key factors:

- Population Density: The large number of consumers in this region creates an unprecedented demand for hot beverages.

- Cultural Integration: Countries like China, Japan, and India have long-standing tea traditions that are deeply ingrained in their cultures.

- Economic Growth: With rising disposable incomes, people are now able to spend more on premium hot drinks.

Market Distribution Across Regions

The distribution of the hot drinks market across different regions shows some interesting trends:

- Asia-Pacific: 40.2% market share

- China leads in tea consumption

- Japan is at the forefront of innovation with ready-to-drink options

- India is experiencing rapid growth in both tea and coffee segments

- Europe: 25.8% market share

- Coffee culture is strong in this region

- Consumers prefer premium products

- Specialty beverages are widely adopted

- North America: 20.5% market share

- Coffee consumption dominates this region

- There is a growing interest in functional hot drinks

- Major retail chains have a strong presence here

- Rest of World: 13.5% market share

- Emerging markets show significant growth potential

- Beverage preferences are increasingly westernized

- Café culture is on the rise

Growth Projections for Asia-Pacific Region

The growth trajectory of the Asia-Pacific region indicates a projected compound annual growth rate (CAGR) of 8.2% through 2025, which is higher than other regions. This growth can be attributed to factors such as urbanization, increasing consumption of hot drinks in workplaces, and the expansion of retail chains in major cities.

U.S. Hot Drinks Market: Trends and Insights

The U.S. hot drinks market has unique trends influenced by a strong café culture and changing consumer preferences. On average, Americans spend $1,100 each year on coffee, showing how deeply integrated hot beverages are into their daily lives.

Key Market Characteristics:

- Ready-to-drink hot beverages grew by 33% in 2023

- Specialty coffee shops recorded a 20% increase in foot traffic

- Plant-based milk alternatives in hot drinks rose by 42%

The U.S. café culture has changed traditional drinking habits. Coffee shops now serve as places to socialize and work remotely, increasing the demand for high-quality hot beverage choices. As a result, there has been a rise in artisanal coffee roasters and independent tea houses in major cities.

Consumer Behavior Shifts:

- 65% of Americans prefer customizable drink options

- 78% value sustainable sourcing practices

- 42% seek functional benefits in their hot beverages

The third-wave coffee movement continues to shape what U.S. consumers want, focusing on direct trade relationships and single-origin products. This trend has prompted big chains to offer premium options and transparent sourcing practices.

The increase in sales of home brewing equipment shows that consumers are taking a two-pronged approach – they enjoy going to cafés but also want to prepare their drinks at home using advanced methods. In 2023, smart coffee makers and temperature-controlled kettles experienced a 55% rise in sales, indicating the growth of the home brewing market.

Brazil's Role in Hot Drinks Demand

Brazil stands as a powerhouse in the global hot drinks market, particularly through its dominant coffee industry. The country’s coffee production reached 55 million bags in 2023, making it the world’s largest coffee producer and exporter.

Key Market Dynamics:

- Brazilian coffee farms cover 2.2 million hectares

- Local consumption accounts for 21 million bags annually

- Domestic market represents 30% of total production

The Brazilian hot drinks landscape showcases unique consumption patterns. Local consumers demonstrate strong preferences for traditional preparation methods, with 81% of households using cloth filters for brewing coffee.

Consumer Behavior Trends:

- Morning coffee remains a cultural staple

- Rising popularity of specialty coffee shops in urban areas

- Growing demand for premium coffee varieties

Brazil’s coffee industry has adapted to changing market demands through sustainable farming practices and quality improvements. The country’s coffee certification programs have gained international recognition, attracting premium prices for certified beans.

Production Innovations:

- Implementation of advanced irrigation systems

- Adoption of mechanical harvesting

- Investment in post-harvest processing technology

The domestic market has seen significant growth in premium coffee consumption, with specialty coffee shops expanding by 30% in major cities since 2020. This trend reflects a shift in consumer preferences toward higher-quality hot beverages and experiential consumption.

Japan's Contribution to the Hot Drinks Industry

Japan has made a significant impact on the global hot drinks market through its rich cultural heritage and innovative approach to beverage creation. The country’s traditional tea ceremonies, known as chanoyu, have evolved into modern practices that influence consumer preferences worldwide.

Key Elements of Japan’s Hot Drinks Market:

1. Traditional Tea Culture

- Matcha remains a cornerstone of Japanese beverages

- Premium green tea varieties command high market prices

- Ceremonial grade teas create unique market segments

2. Innovation in Ready-to-Drink Sector

- Canned hot coffee vending machines

- Temperature-controlled beverage technology

- Seasonal hot drink variations

Japanese beverage companies have introduced unique products, such as hot drinks sold through the extensive vending machine network in the country. These machines ensure precise temperatures and provide both traditional and modern beverage choices around the clock.

The market has experienced substantial growth in specialized tea products, with Japanese manufacturers creating new formats like instant matcha lattes and bottled hot green tea. This innovation has had an impact on global beverage trends, leading many international brands to incorporate Japanese tea elements into their offerings.

Research shows that Japanese consumers spend 30% more on premium hot beverages compared to the global average. This trend drives the development of high-quality products and advanced brewing technologies, establishing Japan as a leader in the hot drinks industry, particularly in the premium segment.

Future Growth in the Hot Drinks Market

The hot drinks market is expected to grow significantly through 2025, with projected revenues reaching $397.3 billion. This growth is driven by several key demographic and lifestyle changes:

Population-Driven Growth Factors:

- Rising urban populations in developing markets

- Growing middle-class consumer base

- Increased disposable income in emerging economies

Lifestyle Evolution Impact:

- Remote work culture boosting at-home consumption

- Rising café-style experiences in residential spaces

- Digital purchasing habits reshaping distribution channels

The future of the market shows clear consumption patterns:

Gen Z and Millennial Preferences:

- Customizable drink options

- Sustainable and ethical sourcing

- Premium, artisanal beverages

Health-Conscious Trends:

- Functional ingredients integration

- Sugar-free alternatives

- Wellness-focused formulations

Research suggests a 7.4% CAGR from 2025 to 2030, driven by product innovations and changing consumer behaviors. Ready-to-drink formats and premium instant beverages are expected to capture significant market share, particularly in urban areas. The rise of smart kitchen appliances and subscription-based models indicates a shift toward personalized hot beverage experiences at home.

The Asia-Pacific region is projected to maintain its market dominance, while North American and European markets will see growth through premiumization and health-focused offerings.

Competitive Forces in the Hot Drinks Industry

The hot drinks market is driven by various competitive forces that influence both the supply side and demand side. These forces shape product offerings, market share, and overall industry dynamics.

-

Nestlé S.A. – Switzerland

-

Starbucks Coffee Company – United States

-

The Kraft Heinz Company – United States

-

Luigi Lavazza SpA – Italy

-

Lipton Teas and Infusions (Unilever) – United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Hot Drinks Market Report |

| Base Year | 2024 |

| Segment by Type |

· Coffee · Tea · Other Hot Drinks |

| Segment by Application |

· Consumers’ lives · Seasonal applications |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The hot drinks market is poised for remarkable growth, with projections indicating a substantial expansion to $397.3 billion by 2025. This comprehensive analysis has revealed several key insights that shape the industry’s trajectory.

The market’s growth is primarily driven by shifting consumer preferences, with health consciousness and specialty beverages leading the transformation. The rise of premium coffee experiences, traditional tea appreciation, and innovative product development continues to reshape the industry landscape.

Key regional markets, including the United States, Brazil, and Japan, each contribute unique elements to the global hot drinks ecosystem. The U.S. leads in innovative café culture, Brazil dominates coffee production and consumption, while Japan brings its distinctive tea heritage and technological advancements to the global stage.

Global Hot Drinks Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Hot Drinks Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Hot DrinksMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Hot Drinks players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Hot Drinks Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Hot Drinks Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Hot Drinks Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofHot Drinks Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the hot drinks market by 2025?

The hot drinks market is projected to grow to USD 397.3 billion by 2025, reflecting significant expansion driven by factors such as health consciousness and the rise of specialty coffee consumption.

What are the key drivers of growth in the hot drinks market?

Key drivers of growth in the hot drinks market include increasing health consciousness among consumers, a rise in specialty coffee consumption, and ongoing product innovation that caters to unique consumer preferences.

How do geopolitical factors affect hot drinks production?

Geopolitical factors, including trade policies and climate change, can significantly impact the production and availability of hot drinks globally, influencing supply chains and sourcing of raw materials.

What are the main segments of the hot drinks market?

The hot drinks market is primarily segmented into coffee, which holds a 60% value share, tea with a 33.4% value share, and other hot beverages. Each segment plays a crucial role in overall market growth.

What trends are shaping consumer behavior in the U.S. hot drinks market?

In the U.S., trends such as café culture significantly influence consumer preferences for hot beverages, driving demand for specialty coffee and innovative drink options.

What applications are driving global demand for hot drinks?

Global demand for hot drinks is driven by consumer habits related to daily routines and beverage choices, with an emphasis on healthier options and unique flavor experiences.