$561.63 Billion Rapid Growth in Home Appliances Market in the U.S., India, and Japan by 2025

Explore the evolving home appliances market, from technological innovations and sustainability trends to competitive dynamics and future growth prospects. Discover how urbanization, lifestyle changes, and smart technology are reshaping consumer preferences and market strategies through 2033. Learn about regional variations, market challenges, and emerging opportunities in this comprehensive industry analysis.

- Last Updated:

Home Appliances Market Q1 and Q2 2025 Forecast

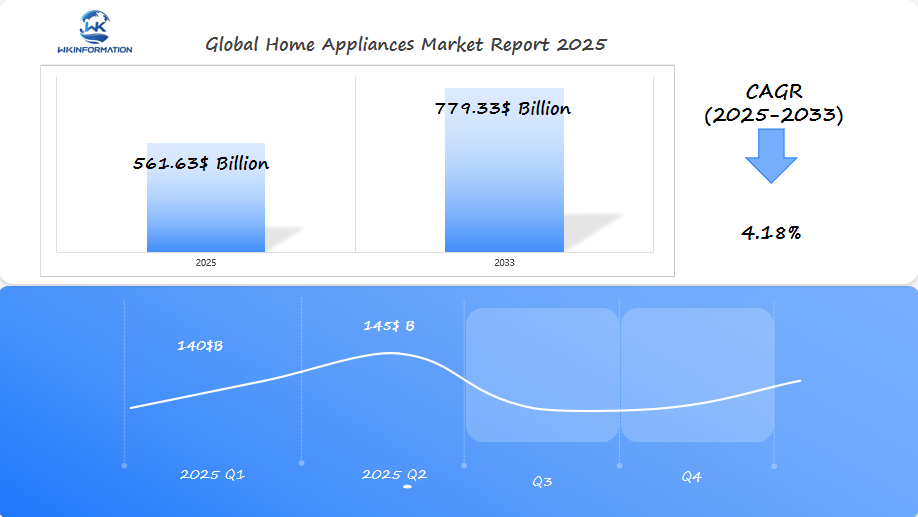

The Home Appliances market is expected to reach $561.63 billion in 2025, with a CAGR of 4.18% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $140 billion, driven by the demand for smart home appliances, energy-efficient products, and automation in the U.S., India, and Japan. Increasing disposable income, urbanization, and the rise of smart home technologies are fueling market growth.

By Q2 2025, the market is forecasted to reach $145 billion, supported by innovations in appliance design and technologies such as IoT-enabled devices, voice-controlled appliances, and energy-efficient systems. The U.S. continues to be a major market for high-tech home appliances, while India sees a growing demand for affordable and energy-efficient products, and Japan leads in robotics and home automation.

Understanding the Supply Chain of Home Appliances

The supply chain for home appliances is a complex system that connects manufacturers to consumers through various intermediaries. This system ensures that products are efficiently delivered from factories to homes around the world.

Who’s Involved in the Supply Chain?

The supply chain involves several key players:

- Manufacturers: Companies like Whirlpool, Samsung, and Haier produce appliances in specialized facilities

- Component Suppliers: Providers of essential parts, electronics, and raw materials

- Distributors: Regional and national companies managing bulk inventory

- Retailers: Traditional stores and e-commerce platforms selling directly to consumers

- Logistics Partners: Transportation companies handling warehousing and delivery

How Digital Transformation Has Changed the Game

The traditional model of selling appliances through physical stores has undergone significant changes due to digital transformation. Today’s supply chains now include:

- Direct-to-consumer shipping

- Real-time inventory tracking

- Automated warehousing systems

- Digital payment processing

- Smart logistics solutions

The Impact of E-commerce on Distribution Channels

E-commerce platforms have completely transformed how appliances are distributed. This has led to a hybrid model where consumers can:

- Research products online

- Compare prices across multiple retailers

- Purchase through digital marketplaces

- Schedule home delivery or in-store pickup

Adapting Strategies for Traditional Retailers

As a result of this transformation, traditional retailers are being forced to adapt their strategies. They are now offering omnichannel experiences that combine physical showrooms with the convenience of online shopping.

Meeting Consumer Demands with Specialized Delivery Services

The rise of specialized delivery services has created new opportunities for same-day delivery and installation services. This is in response to the growing consumer demand for immediate gratification.

Key Trends Shaping the Future of Home Appliances

The home appliances industry is rapidly evolving due to technological advancements and changing consumer preferences. Here are some key trends shaping its future:

The Rise of Smart Home Devices

Smart home devices with Internet of Things (IoT) capabilities are now leading the market. These devices offer various features such as:

- Remote temperature control

- Real-time energy consumption monitoring

- Automated maintenance alerts

- Voice-activated commands

- Smartphone integration

Demand for Premium Appliances

The growth of urban living and higher disposable incomes have increased the demand for premium appliances. Modern consumers are looking for sophisticated features like:

- AI-powered cooking assistants

- Self-diagnosing washing machines

- Customizable refrigerator compartments

- Touch-screen interfaces

- Remote monitoring capabilities

Focus on Energy Efficiency

Consumers are becoming more aware of their environmental impact, which has led to a shift in product development. Energy-efficient appliances now offer benefits such as:

- Up to 50% reduction in power consumption

- Smart grid compatibility

- Solar power integration options

- Auto-adjusting power modes

- Energy usage analytics

Innovative solutions like heat pump dryers, inverter technology refrigerators, and smart dishwashers that optimize water usage have emerged in response to this demand. These advancements not only appeal to environmentally conscious consumers but also align with cost-saving priorities, making energy-efficient appliances an increasingly attractive choice for homeowners.

Challenges in Home Appliances Manufacturing: Supply Chains and Materials

The home appliances manufacturing sector faces significant operational hurdles that impact production efficiency and market dynamics. The COVID-19 pandemic exposed critical vulnerabilities in global supply chains, creating unprecedented disruptions in component availability and delivery timelines.

Key Manufacturing Challenges:

- Semiconductor shortages affecting smart appliance production

- Limited availability of shipping containers

- Port congestion and increased freight costs

- Labor shortages in manufacturing facilities

- Extended lead times for essential components

Raw material costs have surged dramatically, putting pressure on manufacturers’ profit margins. Steel prices increased by 215% between March 2020 and March 2021, while copper prices rose by 80% during the same period. These price hikes directly affect the production costs of:

- Refrigerators

- Washing machines

- Dishwashers

- Air conditioners

- Small kitchen appliances

Natural disasters and regional conflicts create additional supply chain vulnerabilities. The 2021 Texas winter storm disrupted plastic resin production, causing shortages in appliance components. Similarly, the Suez Canal blockage highlighted the fragility of global shipping routes.

Manufacturers are responding by:

- Diversifying supplier networks

- Implementing inventory management systems

- Exploring alternative materials

- Investing in local production facilities

- Developing strategic partnerships with logistics providers

These challenges have pushed manufacturers to reevaluate their pricing strategies, with many brands implementing price increases to maintain profitability while balancing market competitiveness.

Geopolitical Impact on Home Appliances Demand and Production

Trade policies shape the global home appliances market in significant ways. The implementation of tariffs between major economies has created ripple effects across the industry’s supply chains. For instance, the U.S.-China trade tensions have led to a 20-30% increase in production costs for manufacturers operating in affected regions.

Key geopolitical factors affecting the industry include:

- Trade Barriers: Import duties and regulatory requirements influence pricing strategies

- Regional Agreements: Free trade zones create competitive advantages for specific manufacturing hubs

- Political Relations: Diplomatic ties between nations affect market access and investment decisions

Manufacturing location decisions now reflect these complex geopolitical dynamics. Companies like Samsung and LG have diversified their production bases across multiple countries to mitigate risks. Vietnam has emerged as a preferred manufacturing destination, with its home appliance exports growing by 15% annually.

The reshaping of global supply chains has led to:

- Increased domestic manufacturing in key markets

- Rise of alternative production hubs in Southeast Asia

- Strategic partnerships with local manufacturers

- Investment in automated production facilities

Recent sanctions and export controls have pushed manufacturers to develop regional supply networks. Companies now prioritize building resilient supply chains that can withstand geopolitical uncertainties while maintaining cost efficiency.

Types of Home Appliances: Smart Devices, Kitchenware, and More

Home appliances can be classified into different categories based on how they work and how advanced their technology is:

1. Major Appliances

These are large household devices that perform specific tasks:

- Refrigerators and freezers

- Washing machines and dryers

- Dishwashers

- Ovens and ranges

- HVAC systems

2. Smart Devices

These appliances incorporate technology for added convenience:

- AI-powered refrigerators with inventory tracking

- Voice-controlled cooking appliances

- Smart thermostats

- Connected washing machines with remote monitoring

- Automated vacuum cleaners and robot mops

3. Kitchen Essentials

These are essential tools found in most kitchens:

- Food processors

- Coffee makers

- Microwave ovens

- Blenders and mixers

- Air fryers

Consumer preferences have shifted dramatically toward multifunctional appliances that save time and space. The rise of compact living spaces has sparked demand for:

- Space-saving combo units

- Portable appliances

- Multi-purpose kitchen devices

The smart device category sees the fastest growth, with buyers prioritizing:

- Remote operation capabilities

- Energy consumption tracking

- Predictive maintenance features

- Integration with smart home ecosystems

Kitchen appliances with health-focused features gain popularity as wellness trends shape buying decisions. Air fryers, steam ovens, and nutrient-preserving cooking devices reflect this shift in consumer priorities.

Applications of Home Appliances in Everyday Life and Smart Homes

Home appliances make our daily lives easier by using advanced technology and working together with other devices. These modern appliances create a connected system in our homes, making it simpler to manage tasks and enjoy a comfortable living environment.

Examples of Smart Home Integration:

- Voice-controlled lighting systems adjust automatically based on time of day

- Refrigerators send grocery notifications when supplies run low

- Robot vacuums learn house layouts and clean on scheduled routines

- Smart ovens allow remote temperature monitoring and control

The integration of appliances into smart home systems brings unprecedented convenience. You can now control your entire home through centralized apps:

Key Smart Home Functions:

- Temperature regulation through smart thermostats

- Security monitoring via connected cameras and sensors

- Energy usage optimization across all devices

- Automated maintenance alerts and diagnostics

Smart appliances adapt to your lifestyle patterns. Your coffee maker starts brewing when your morning alarm goes off, while your dishwasher runs during off-peak electricity hours. These personalized automations reduce manual intervention and create time-saving efficiencies.

The Home Appliances Market continues to innovate with cross-device compatibility. Leading manufacturers develop products that communicate through standardized protocols, enabling seamless integration across different brands and devices. This interoperability allows you to build a customized smart home ecosystem that matches your specific needs and preferences.

Global Home Appliances Market Insights: Growth Potential Across Regions

Key Growth Indicators by Region

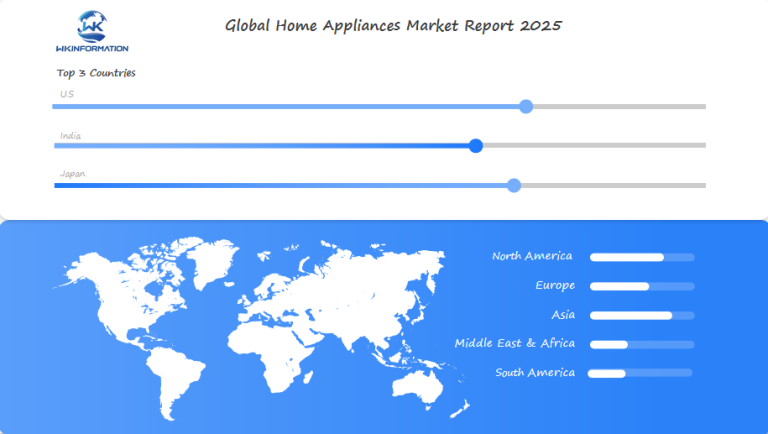

Here are the key factors driving growth in different regions:

- North America: The U.S. market is expected to reach $342.71 billion by 2032

- Asia-Pacific: This region is growing the fastest due to rapid urbanization

- Europe: There is a strong demand for energy-efficient appliances in this region

- Middle East & Africa: An emerging market with increasing disposable income

Understanding Market Dynamics

The factors influencing the market differ significantly between developed and emerging markets:

Developed Markets

In developed markets, we see:

- High adoption of smart appliances

- Focus on premium products

- Strong replacement demand

Emerging Markets

On the other hand, emerging markets are experiencing:

- First-time purchases driving growth

- Rising middle-class population

- Increasing electrification rates

Regional Market Shares and Consumer Preferences

The distribution of market shares across regions reflects different consumer preferences and economic conditions. The Asia-Pacific region holds the largest share of the market due to:

- Large population base

- Rising disposable incomes

- Rapid technological adoption

- Growing urbanization rates

Aligning with Changing Lifestyles and Technology

The expansion of the market is in line with evolving consumer lifestyles and technological advancements in various parts of the world. Each region offers distinct opportunities for manufacturers and retailers to leverage local market conditions and cater to specific consumer preferences.

U.S. Home Appliances Market: Consumer Preferences and Trends

American consumers have specific preferences when it comes to buying home appliances, influenced by changes in lifestyle and advancements in technology. The U.S. market shows strong demand for:

1. Premium Features

- Voice-activated controls

- Remote monitoring capabilities

- Custom finish options

- Built-in water/air filtration systems

2. Energy Efficiency

The ENERGY STAR certification influences 87% of American purchasing decisions, with buyers willing to pay 15-20% more for energy-efficient appliances.

3. Brand Loyalty

U.S. consumers demonstrate strong brand allegiance, with 73% staying loyal to preferred manufacturers. Top brands like Whirlpool, GE, and KitchenAid maintain market dominance through:

- Extensive warranty programs

- Reliable customer service

- American manufacturing heritage

4. Shopping Patterns

Recent data reveals shifting purchase behaviors:

- 65% research online before buying

- 42% prefer omnichannel shopping experiences

- 38% use mobile apps for appliance maintenance tracking

The pandemic accelerated the adoption of contactless shopping, with 52% of Americans now comfortable purchasing major appliances online. Regional variations exist, with coastal markets showing higher preference for smart features while midwest consumers prioritize durability and traditional functionality.

India's Growing Home Appliances Market: Embracing Technology

India’s home appliances market has great potential for growth, thanks to the rapid increase in urbanization and a tech-savvy middle class. The market has its own unique features influenced by local preferences and economic factors:

Key Factors Driving the Market

- Rising disposable income among urban households

- Increasing nuclear family structures

- Growing adoption of smart home technologies

- Government initiatives promoting digital infrastructure

The Indian consumer base has distinct buying habits, with a strong preference for energy-efficient appliances that address local challenges such as voltage fluctuations and humid climate conditions. Manufacturers like Godrej, Voltas, and Havells have tailored their product offerings to meet these specific needs.

Popular Product Categories

- Air conditioners with inverter technology

- Smart refrigerators with power backup features

- Water purifiers with multi-stage filtration

- Washing machines with water-saving capabilities

The rural market holds significant untapped potential, with companies developing specialized products at competitive prices. E-commerce platforms have transformed distribution channels, making premium appliances available to tier-2 and tier-3 cities.

Local manufacturing initiatives under “Make in India” have attracted international brands to set up production facilities, reducing reliance on imports and offering competitive pricing. This shift has sparked technological innovation and knowledge transfer within the domestic manufacturing sector.

Japan's Innovative Home Appliances Market: Automation and Design

Japan’s home appliances market is known for its cutting-edge innovation, projected to reach $25.66 billion by 2025. The Japanese market stands out through:

1. Unique Product Features

- Built-in bidets with heated seats and automated cleaning functions

- Rice cookers with AI-powered cooking algorithms

- Ultra-compact appliances designed for smaller living spaces

- Advanced air purifiers with multi-stage filtration systems

2. Strong Consumer Preferences

The Japanese consumer base demonstrates strong preferences for:

- High-quality, durable products

- Energy-efficient appliances

- Minimalist design aesthetics

- Multi-functional capabilities

3. Local Manufacturer Innovation

Local manufacturers like Panasonic and Sharp lead innovation through:

- Integration of IoT capabilities in standard appliances

- Development of voice-controlled home systems

- Implementation of predictive maintenance features

- Creation of appliances with health-monitoring capabilities

4. Demand from Aging Population

The market’s growth is driven by Japan’s aging population, creating demand for:

- Automated cleaning robots

- Smart cooking appliances with safety features

- Voice-activated controls for elderly users

- Health-monitoring refrigerators

5. Global Influence of Japanese Design Philosophy

Japanese design philosophy influences global trends through:

- Space-saving solutions

- Quiet operation technology

- Aesthetic minimalism

- Enhanced energy efficiency

Japan’s commitment to automation and sophisticated design continues to position it as a global leader in home appliance innovation, with manufacturers focusing on practical solutions for modern living challenges. In fact, the top 10 Japanese home appliances that will transform your daily life in 2024 exemplify this trend, showcasing the blend of functionality, design, and advanced technology that characterizes the industry.

The Future of Home Appliances: Smart Technology and Sustainability

The home appliances industry is going through a major change where smart technology and environmental responsibility come together. With the help of artificial intelligence (AI), appliances can now understand user preferences and automatically adjust settings for better performance and energy efficiency. These smart systems also have the ability to predict when maintenance is needed, which can prevent unexpected breakdowns and increase the lifespan of products.

Key Innovations Reshaping Home Appliances:

- Self-diagnosing systems that detect and report issues before they escalate

- Renewable energy integration with solar-powered functionality

- Zero-waste features in washing machines and dishwashers

- Biodegradable components and recycled materials in manufacturing

Manufacturers are being driven by the need for sustainability to create solutions that use less energy. For example, new refrigerators are now using advanced cooling technologies that consume 40% less power compared to traditional models. Washing machines are also incorporating water recycling systems, which can save up to 30% water per cycle.

Smart Integration Capabilities:

- Cross-device communication for synchronized operation

- Energy consumption monitoring and optimization

- Remote troubleshooting and firmware updates

- Voice-activated controls and smartphone integration

There is a growing demand in the market for modular appliances that are designed to be easily repaired and have component upgrades. This approach helps reduce electronic waste while also extending the lifespan of products. Manufacturers are now focusing on creating appliances that not only perform well but also have minimal impact on the environment by using eco-friendly refrigerants and sustainable packaging materials.

Competitive Landscape in the Home Appliances Industry

- Whirlpool Corporation – Benton Harbor, Michigan, USA

- Samsung Electronics Co. Ltd. – Suwon, South Korea

- LG Electronics Inc. – Seoul, South Korea

- Haier Group Corporation – Qingdao, China

- Bosch-Siemens Hausgeräte GmbH (BSH) – Munich, Germany

- Electrolux AB – Stockholm, Sweden

- Panasonic Corporation – Kadoma, Osaka, Japan

- Midea Group Co. Ltd. – Foshan, China

- GE Appliances (Haier) – Louisville, Kentucky, USA

- Sharp Corporation – Sakai, Osaka, Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Home Appliances Market Report |

| Base Year | 2024 |

| Segment by Type | · Major Appliances

· Small Appliances |

| Segment by Application | · Online

· Offline |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The home appliances market is currently undergoing a significant transformation, driven by technological innovation and changing consumer preferences. It is expected to grow to $561.63 billion by 2025, indicating strong market fundamentals in the U.S., India, and Japan.

Key Market Dynamics

The following factors are shaping the home appliances market:

- Smart Technology Integration: Traditional appliances are being transformed into connected devices through the integration of artificial intelligence (AI) and Internet of Things (IoT) capabilities.

- Sustainability Focus: Energy-efficient products are gaining popularity among environmentally conscious consumers, reflecting a growing emphasis on sustainability.

- Regional Growth Patterns:

- U.S.: The leading country in adopting smart home technology

- India: Rapid urbanization is driving the expansion of the market

- Japan: Known as an innovation hub for automated solutions

Factors Influencing Future Success

The future success of the industry will depend on several key factors:

- Manufacturers’ ability to adapt to supply chain challenges

- Development of energy-efficient products

- Integration of advanced features at competitive price points

- Response to regional market preferences

Market leaders who embrace these changes while maintaining product quality and competitive pricing will be well-positioned to capture significant market share.

The home appliances sector continues to evolve, influenced by technological advancement, environmental consciousness, and shifting consumer needs in these three major markets.

The projected compound annual growth rate (CAGR) of 6.33% through 2032 indicates strong growth opportunities for manufacturers, retailers, and technology providers in this dynamic market landscape.

Global Home Appliances Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Home Appliances Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Home Appliances Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Home Appliancesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Home Appliances Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Home Appliances Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Home Appliances Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Home Appliances Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key players in the home appliances supply chain?

The key players involved in the home appliances supply chain include manufacturers, distributors, retailers, and logistics providers. Each of these stakeholders plays a crucial role in ensuring that products reach end consumers efficiently.

How have distribution channels for home appliances evolved over time?

Distribution channels for home appliances have evolved significantly, with a notable rise in online retailing alongside traditional brick-and-mortar stores. This shift reflects changing consumer preferences and the increasing importance of e-commerce in the market.

What trends are shaping the future of home appliances?

Key trends shaping the future of home appliances include the growing demand for smart appliances equipped with IoT capabilities, increased consumer interest in energy-efficient products, and premiumization driven by rising disposable incomes and urbanization.

What challenges do manufacturers face in the home appliances sector?

Manufacturers in the home appliances sector face several challenges, including supply chain disruptions caused by events like the COVID-19 pandemic, rising costs of raw materials such as metals and plastics, and implications for pricing strategies and profit margins.

How do geopolitical factors affect the demand and production of home appliances?

Geopolitical factors, such as trade policies and tariffs, influence international trade flows within the home appliances industry. Additionally, geopolitical tensions may affect production locations where brands choose to manufacture their products based on cost advantages or proximity to key markets.

What role do smart technologies play in modern home appliances?

Smart technologies enhance the functionality of modern home appliances by enabling features like remote control via mobile apps, voice activation, and integration with other household functions. These innovations improve convenience and efficiency in daily living experiences.