$22.7 Billion Expansion in Global Health Beverage Market by 2025: Advancements Across the U.S., China, and India

A comprehensive analysis of the projected $22.7 billion growth in the global health beverage market through 2025, exploring key developments and market dynamics across major regions including the United States, China, and India.

- Last Updated:

Health Beverage Market Q1 and Q2 2025 Forecast

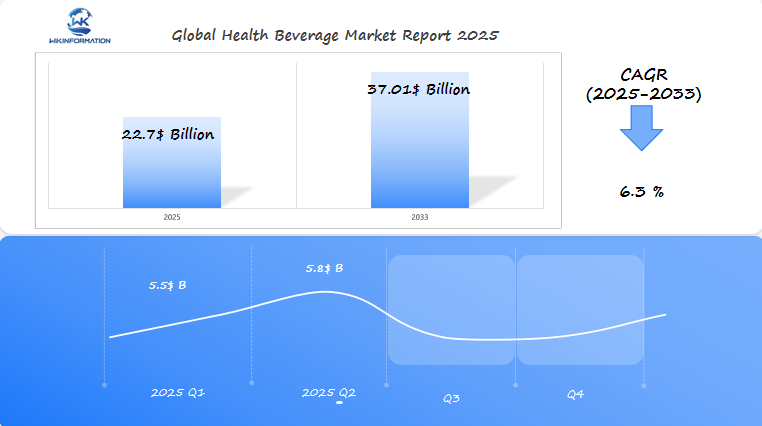

The Health Beverage market, expected to reach $22.7 billion in 2025, will grow at a CAGR of 6.3% from 2025 to 2033. In Q1 2025, the market is forecasted to generate $5.5 billion, driven by increasing demand for functional drinks in the U.S., China, and India, especially in the form of energy drinks, protein shakes, and immunity-boosting beverages.

By Q2 2025, the market is expected to grow to $5.8 billion, fueled by innovations in plant-based drinks and low-sugar beverages, catering to health-conscious consumers. China and India will continue to see strong growth in health beverage demand, driven by rising middle-class populations and increasing awareness of healthy lifestyles.

The health beverage market will continue to expand as consumers seek more functional and nutritious beverage options, aligning with growing interest in health and wellness.

Analyzing the Upstream and Downstream Industry Chain of Health Beverages

The health beverage industry operates through a complex network of suppliers, manufacturers, and distributors.

Upstream Supply Chain

The upstream supply chain starts with raw material producers, including:

- Agricultural suppliers providing fruits, herbs, and natural ingredients

- Chemical manufacturers producing vitamins, minerals, and functional additives

- Packaging material suppliers creating bottles, caps, and labels

Production Process

The production process involves multiple key players working in synchronized stages:

- Ingredient processors who extract, purify, and prepare raw materials

- Beverage formulators developing proprietary blends and recipes

- Contract manufacturers handling large-scale production

- Quality control specialists ensuring product safety and consistency

Downstream Distribution Channels

Downstream distribution channels have evolved to meet changing consumer demands:

- Traditional retail through supermarkets and convenience stores

- Direct-to-consumer shipping via e-commerce platforms

- Specialty health food stores catering to health-conscious consumers

- Fitness centers and sports facilities offering functional beverages

- Vending machines in high-traffic locations

The rise of digital marketplaces has transformed distribution patterns, with many brands now adopting omnichannel strategies.

Importance of Supply Chain Transparency

Supply chain transparency has become crucial, as consumers demand clear information about ingredient sourcing and production methods. Companies investing in vertical integration gain better control over product quality and cost management.

Key Trends Shaping the Health Beverage Market

The health beverage market is undergoing significant changes due to shifting consumer preferences and advancements in technology. Health consciousness has become a primary factor influencing purchasing decisions, with consumers actively seeking drinks that offer specific health benefits.

Key Market Trends

Here are some of the key trends shaping the health beverage market:

1. Functional Ingredient Integration

Beverage companies are increasingly incorporating functional ingredients known for their health benefits into their products. Some examples include:

- Adaptogenic herbs like ashwagandha and rhodiola for stress relief

- Collagen peptides derived from animal sources or plant-based alternatives for skin health

- Prebiotics such as inulin and probiotics like Lactobacillus for gut health

- Natural energy boosters like green tea extract or yerba mate

2. Innovation in Product Development

To cater to evolving consumer preferences, beverage manufacturers are focusing on innovative product development. This includes:

- Sugar-free formulations using natural sweeteners like stevia or monk fruit

- Plant-based alternatives to traditional dairy or protein-based drinks

- Personalized nutrition drinks tailored to individual dietary needs or goals

- Enhanced hydration solutions with added electrolytes or coconut water

3. Rise of the Clean-Label Movement

The clean-label movement has gained significant momentum, pushing manufacturers to:

- Remove artificial ingredients from their formulations

- Use natural sweeteners instead of refined sugars

- Include recognizable ingredients that consumers can understand

- Adopt transparent labeling practices by clearly stating all ingredients used

4. Growing Demand for Organic Options

Consumer demand for organic options has sparked a surge in:

- Cold-pressed juices made from fresh, organic fruits and vegetables

- Kombucha variations brewed with organic teas and sweeteners

- Natural sports drinks containing organic coconut water or fruit extracts

- Herbal tea blends featuring organic herbs and botanicals

These market shifts have prompted beverage companies to invest heavily in research and development (R&D), creating products that align with modern health priorities while maintaining taste and convenience. The integration of superfoods such as acai, spirulina, or turmeric along with functional ingredients continues to drive new product development, meeting consumer expectations for beverages that serve multiple health purposes.

Understanding the Restrictions Impacting the Health Beverage Industry

The health beverage industry faces strict regulatory frameworks across global markets. The FDA maintains rigorous standards for ingredient safety, requiring manufacturers to prove their products are Generally Recognized as Safe (GRAS). Similar bodies in the EU and Asia enforce their own sets of regulations, creating a complex web of compliance requirements.

Key Regulatory Challenges:

- Product formulation restrictions

- Health claim verifications

- Safety testing requirements

- Cross-border compliance variations

Manufacturers encounter significant hurdles in maintaining compliance across different regions. A beverage approved for sale in the U.S. might require reformulation to meet EU standards, impacting production costs and market entry timelines.

Labeling Standards Impact:

- Mandatory nutritional information display

- Allergen declarations

- Health benefit claim restrictions

- Ingredient list requirements

The evolution of labeling standards directly influences product development cycles. Companies must invest in extensive testing to substantiate health claims, while packaging designs undergo multiple revisions to meet regional requirements.

Compliance Costs:

- Testing and documentation: $50,000-$100,000 per product

- Label redesigns: $5,000-$15,000 per SKU

- Regulatory consultations: $10,000-$30,000 annually

These restrictions shape product innovation strategies, pushing manufacturers to balance regulatory requirements with market demands. Companies increasingly adopt digital compliance management systems to navigate these complex regulatory landscapes efficiently.

Geopolitical Factors Affecting Health Beverage Production and Distribution

Trade Agreements and Their Impact

Trade agreements shape the economic landscape of health beverage production. The U.S.-China trade tensions have resulted in increased tariffs on ingredients, pushing production costs up by 15-20% for manufacturers operating in these markets. Companies now face strategic decisions about relocating production facilities or finding alternative suppliers.

Supply Chain Disruptions

Several factors can disrupt the supply chain for health beverages:

- Border restrictions during global crises

- Currency fluctuations affecting ingredient costs

- Changes in diplomatic relations impacting trade routes

Regional Market Access Barriers

Health beverage companies may encounter barriers when accessing regional markets:

- Non-tariff measures in developing markets

- Local content requirements

- Product registration complexities

Political Relationships and Market Accessibility

Political relationships between nations create varying levels of market accessibility. Countries with strong diplomatic ties often enjoy preferential trade terms, while strained relations can lead to increased scrutiny and delays in customs clearance.

The Belt and Road Initiative’s Influence

The Belt and Road Initiative has opened new distribution channels for health beverage companies in Asia, reducing transportation costs by up to 30%. These infrastructure developments create opportunities for market expansion while presenting challenges in maintaining consistent quality control across diverse regulatory environments.

Local Stability and Investment Decisions

Local political stability affects investment decisions in production facilities. Companies often establish regional manufacturing hubs in politically stable countries to serve surrounding markets, minimizing risks associated with geopolitical uncertainties.

Exploring Health Beverage Market Segmentation by Type

The health beverage market divides into two primary categories:

1. Traditional Health Beverages

- Natural fruit juices

- Herbal teas

- Plant-based milk alternatives

- Mineral water enriched with vitamins

2. Functional Drinks

- Sports drinks with electrolytes

- Energy drinks containing caffeine and B-vitamins

- Probiotic beverages

- Protein shakes

Sports drinks dominate the functional segment, capturing 35% of market share. These beverages target athletes and fitness enthusiasts with specialized formulations for pre-workout energy, during-exercise hydration, and post-workout recovery.

Energy drinks represent the fastest-growing category, with a 12% annual growth rate. Manufacturers now offer natural alternatives to conventional energy drinks, using ingredients like green tea extract, guarana, and ginseng.

Recent market innovations spotlight non-alcoholic options:

- Zero-proof spirits

- Adaptogenic drinks

- Nootropic beverages

- CBD-infused drinks

These emerging categories respond to growing consumer demand for alcohol alternatives that deliver specific health benefits. Adaptogenic beverages, designed to help manage stress and boost immunity, saw a 45% sales increase in 2022.

The ready-to-drink segment continues expanding with:

- Kombucha variations

- Prebiotic sodas

- Enhanced water products

- Functional shots

These products blend convenience with health benefits, appealing to busy consumers seeking nutritional advantages in portable formats.

The Role of Applications in Shaping Health Beverage Demand

Health beverage applications cater to various consumer needs, creating different market segments driven by specific wellness goals. The fitness industry requires beverages with specific benefits:

Fitness Sector Demands

- Pre-workout drinks: High caffeine content, amino acids

- Post-workout recovery: Protein-enriched, electrolyte-rich formulations

- Endurance beverages: Extended-release carbohydrates, minerals

Wellness applications appeal to different consumer groups:

Wellness Applications Attracting Different Consumer Groups

- Stress relief: Adaptogens, herbs like chamomile

- Immunity boost: Vitamin C, zinc, elderberry

- Digestive health: Probiotics, fiber supplements

Target demographics show distinct preferences:

Preferences of Target Demographics

Young Professionals (25-35)

- Energy-boosting beverages

- Mental focus enhancers

- Convenient on-the-go formats

Health-Conscious Adults (35-50)

- Sugar-free alternatives

- Natural ingredients

- Preventive health benefits

Active Seniors (50+)

- Joint health formulations

- Heart-healthy options

- Blood sugar management

Lifestyle choices have a significant impact on consumption patterns. Urban professionals prefer portable formats and premium ingredients. Health enthusiasts look for organic certifications and sustainable packaging. Athletes prioritize performance-enhancing formulations backed by scientific evidence.

The growing trend of personalized nutrition is driving demand for specialized beverages that target specific health conditions, dietary restrictions, and fitness goals. This customization also includes packaging sizes, consumption occasions, and delivery formats.

Regional Insights into the Global Health Beverage Market

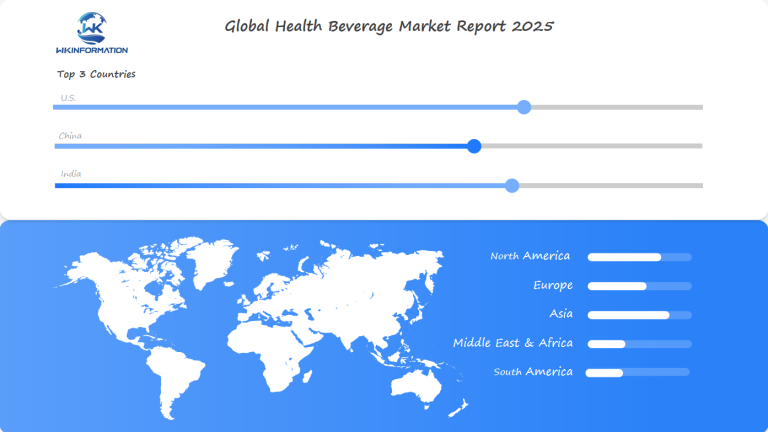

The global health beverage market displays distinct characteristics across key regions, with the U.S., China, and India leading significant market transformations.

United States Market Dynamics

- Premium pricing strategies dominate the market

- Strong preference for ready-to-drink wellness products

- High adoption rates of subscription-based beverage services

China’s Market Landscape

- Traditional Chinese medicine influences product development

- Digital payment systems drive impulse purchases

- Cross-border e-commerce platforms boost international brand access

India’s Emerging Opportunities

- Ayurvedic ingredient incorporation drives local market growth

- Price-sensitive consumer base shapes packaging decisions

- Strong retail penetration in tier-2 and tier-3 cities

The growth drivers vary significantly by region:

- U.S.: Health-conscious millennials, gym culture, preventive healthcare

- China: Rising disposable income, urbanization, digital retail channels

- India: Young population, increasing health awareness, workplace wellness programs

Consumer behavior patterns show distinct regional preferences:

- U.S. consumers prioritize sugar-free and organic certifications

- Chinese buyers focus on functional benefits and brand reputation

- Indian customers seek value-for-money and traditional ingredient blends

These regional variations create unique opportunities for manufacturers to develop market-specific products and distribution strategies.

In-Depth Analysis of the U.S. Health Beverage Market

The U.S. health beverage market is a dynamic ecosystem valued at $8.3 billion, characterized by rapid product innovation and sophisticated consumer preferences. American consumers have strong purchasing power and are willing to pay premium prices for beverages that offer specific health benefits.

Key Market Characteristics:

- High demand for sugar-free alternatives

- Strong preference for natural ingredients

- Growing interest in CBD-infused beverages

- Rising popularity of functional hydration products

The functional drinks segment dominates the U.S. market, with sports and energy drinks leading the category. Sports drinks account for 42% of functional beverage sales, followed by energy drinks at 35%. These products target specific consumer needs:

Popular Categories:

- Pre-workout beverages enhanced with caffeine and amino acids

- Recovery drinks rich in electrolytes and proteins

- Daily wellness shots with concentrated nutrient blends

- Brain-boosting beverages containing nootropic ingredients

The competitive landscape features established brands like Gatorade and Red Bull alongside emerging players such as Celsius and Liquid Death. Major beverage companies acquire promising startups to expand their functional drink portfolios, while local craft beverage makers carve out niches by offering unique formulations and targeting specific health benefits.

Recent market data shows that U.S. consumers are increasingly seeking beverages that combine multiple functional benefits. This trend is driving manufacturers to develop hybrid products that address various health concerns simultaneously.

Trends and Growth in the Chinese Health Beverage Market

China’s health beverage market has great potential for growth, mainly due to the increasing number of middle-class consumers. Chinese buyers are now spending more of their disposable income on health-related products, including beverages.

Key Factors Driving Market Growth:

- Rising disposable incomes in major cities

- Increased awareness of health issues after the pandemic

- Growing preference for preventive healthcare through daily consumption

The preferences of Chinese consumers when it comes to health beverages are quite distinct:

Popular Categories:

- Drinks infused with traditional Chinese medicine

- Beverages enriched with protein

- Sugar-free alternatives

- Functional teas with added benefits

Consumer Behavior Patterns:

- 76% of urban Chinese consumers prioritize health benefits over taste

- Young professionals aged 25-35 represent the largest consumer segment

- Digital purchasing channels account for 40% of health beverage sales

The market shows a strong demand for products that combine traditional Chinese ingredients with modern health benefits. Local brands are taking advantage of this cultural connection by incorporating ingredients such as goji berries, chrysanthemum, and green tea into their innovative beverage formulations.

Chinese consumers are becoming more sophisticated in their purchasing behaviors. They actively research product benefits through social media platforms and seek scientific validation for health claims. This educated consumer base is pushing manufacturers to uphold high standards of product quality and be transparent about their ingredient sourcing practices.

An Overview of India's Health Beverage Market

India’s health beverage market has great potential for growth, thanks to increasing urbanization and changing dietary preferences. As more people move to cities and have higher incomes, there is a noticeable shift towards consuming healthier products.

Factors Driving the Market

Several factors are contributing to the growth of India’s health beverage market:

- The rising middle-class population in major cities

- Growing awareness about preventive healthcare

- A transition from traditional beverages to functional drinks

- Young people looking for convenient ways to stay healthy

Mix of Modern and Traditional

The market is a combination of modern health trends and traditional wellness practices. Indian consumers have a strong preference for drinks that include local ingredients:

- Ayurvedic herbs like tulsi and ashwagandha

- Traditional spices such as turmeric and ginger

- Local superfoods like amla and moringa

Importance of Regional Flavors

Product development in the health beverage sector is heavily influenced by regional flavor preferences. Manufacturers are introducing drinks that blend global health trends with familiar Indian tastes. Some popular variations include:

- Masala-flavored protein shakes

- Spiced green tea options

- Probiotic beverages with traditional fruit flavors

Growth in Smaller Cities

The market is experiencing steady growth in tier-2 and tier-3 cities, where awareness about health is quickly catching up with larger metropolitan areas. Local brands are taking advantage of this expansion by offering affordable health drinks that cater to specific regional tastes, giving them an advantage over international competitors.

Future Development Prospects for Health Beverages

The health beverage market shows promising growth trajectories through several key developments:

1. Technological Integration

- Smart packaging with QR codes for ingredient transparency

- Blockchain implementation for supply chain tracking

- AI-powered personalization of beverage formulations

2. Sustainability Innovations

- Biodegradable packaging solutions

- Zero-waste manufacturing processes

- Water conservation technologies in production

3. Product Development Trends

- Adaptogenic beverages for stress management

- Nootropic drinks for cognitive enhancement

- Microbiome-targeted formulations

4. Market Evolution Indicators

- Direct-to-consumer subscription models

- Virtual reality shopping experiences

- Automated vending solutions with health monitoring

The integration of Internet of Things (IoT) technology enables real-time tracking of beverage freshness and optimal consumption temperatures. Manufacturers are investing in research for nano-encapsulation techniques to enhance nutrient bioavailability and extend shelf life.

Advanced fermentation processes are creating new possibilities for natural preservatives and flavor enhancement. Companies are developing beverages with mood-enhancing properties using clinically-tested botanical extracts.

The market is shifting toward hyper-personalized offerings based on genetic profiles and individual health goals. This customization trend drives the development of small-batch production capabilities and flexible manufacturing systems.

Competitive Landscape of the Health Beverage Industry

The health beverage industry features a mix of established giants and innovative startups competing for market share. Major players like PepsiCo, Coca-Cola, and Nestlé dominate through extensive distribution networks and diverse product portfolios. These companies actively acquire promising startups to maintain their competitive edge.

- PepsiCo – United States

- Coca-Cola – United States

- Unilever – UK

- Danone S.A. – France

- Mondelez International – United States

- Glanbia PLC – Ireland

- Suja Juice – United States

- Vita Coco – United States

- OLIPOP – United States

- GT’s Living Foods – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Health Beverage Market Report |

| Base Year | 2024 |

| Segment by Type |

· Traditional Health Beverages · Functional Drinks |

| Segment by Application |

· Online · Offline |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The global health beverage market is undergoing a significant transformation, with projected growth reaching $22.7 billion by 2025. This growth reflects major changes in consumer behavior and industry dynamics.

Key Insights from the Market Analysis:

- Consumer-Driven Innovation: The industry’s growth is fundamentally shaped by increasingly health-conscious consumers demanding functional benefits

- Regional Diversity: Each major market – U.S., China, and India – presents unique opportunities and challenges for manufacturers

- Technological Integration: Digital platforms and smart packaging solutions are revolutionizing product development and distribution

- Sustainability Focus: Environmental consciousness is driving the adoption of eco-friendly packaging and sustainable sourcing practices

The expansion of the health beverage market signifies more than just financial growth; it indicates a lasting shift towards healthier, more functional drinking options worldwide. This transformation presents ongoing opportunities for businesses willing to innovate and adapt to changing consumer needs.

Global Health Beverage Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Health Beverage Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Health Beverageplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Health Beverage Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Health Beverage Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Health Beverage Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofHealth Beverage Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the upstream supply chain in health beverages?

The upstream supply chain in health beverages includes sourcing raw materials, ingredient suppliers, and manufacturers who produce the final beverage products. Key players in this process are essential for ensuring quality and compliance with health standards.

How is consumer health consciousness influencing the health beverage market?

Increasing health awareness among consumers is a significant trend shaping the health beverage market. This has led to a rise in demand for functional beverages that offer added health benefits such as vitamins and probiotics.

What regulations affect the production of health beverages?

Health beverages are subject to various regulatory frameworks that dictate compliance issues, labeling standards, and safety requirements. Manufacturers must navigate these regulations to ensure their products meet legal requirements and consumer expectations.

How do geopolitical factors impact the distribution of health beverages?

Geopolitical factors such as trade policies and international relations can significantly influence beverage production costs and supply chains. Geopolitical tensions may disrupt market access, affecting how products are distributed globally.

What types of health beverages are gaining popularity in different markets?

Health beverages can be classified into functional drinks and traditional options. Popular types include sports drinks, energy drinks, and emerging non-alcoholic options that cater to diverse consumer preferences across various demographics.

What trends are shaping consumer demand for health beverages in different regions?

Regional insights reveal that unique growth drivers such as urbanization in India, middle-class consumption patterns in China, and specific market trends in the U.S. influence consumer behavior towards health beverages, leading to varied demand across these markets.