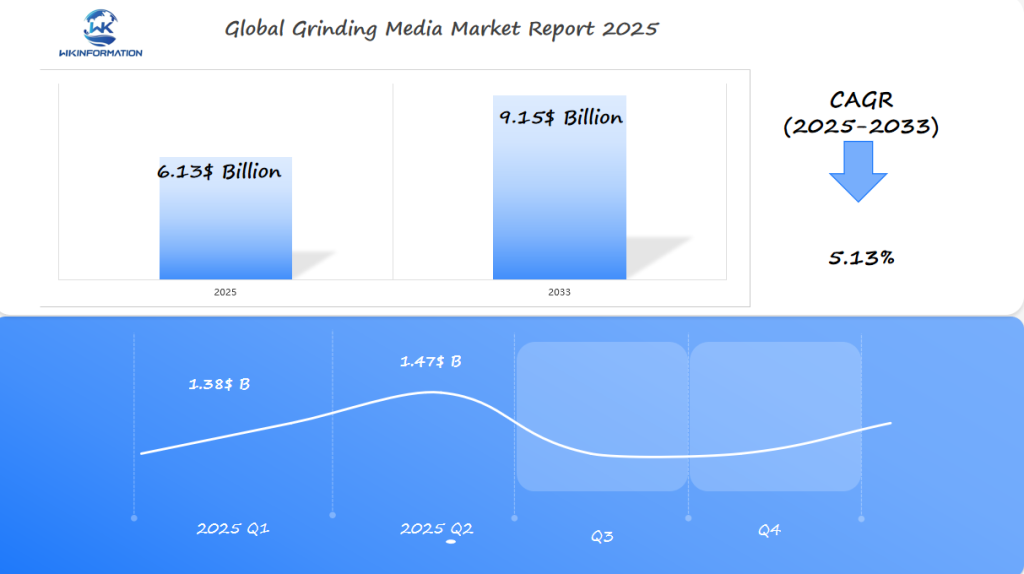

Grinding Media Market Set to Reach $6.13 Billion by 2025: Key Growth Drivers in the U.S., China, and India

Explore the evolving grinding media market dynamics, industry growth projections, and key market influences in the U.S., China, and India. Comprehensive analysis of market trends, technological advancements, and future developments in the grinding media industry, projected to reach $6.13 billion by 2025.

- Last Updated:

Grinding Media Market Forecast for Q1 and Q2 2025

The global grinding media market is expected to reach $6.13 billion in 2025, with a CAGR of 5.13% through 2033. For the first half of 2025, Q1 is estimated to generate around $1.38 billion, and Q2 is projected to grow to approximately $1.47 billion. This steady growth can be attributed to increasing demand for grinding media in industries such as mining, cement, and manufacturing.

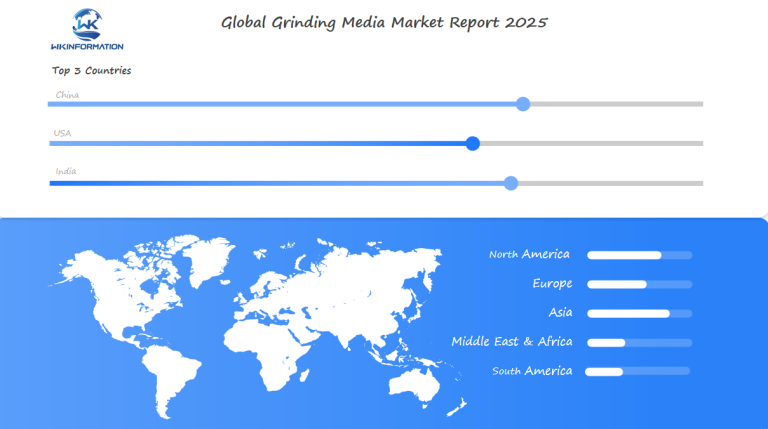

The U.S., China, and India are critical markets for grinding media, with the U.S. leading due to its advanced manufacturing sector and industrial applications. China, as one of the largest global producers of steel and cement, remains a key consumer of grinding media, particularly in the mining industry. India also shows robust growth in grinding media consumption, driven by the expanding construction and cement sectors. These countries are essential for analyzing the dynamics and opportunities within the global grinding media market.

Understanding the Upstream and Downstream Dynamics in the Grinding Media Market

The grinding media supply chain involves a complex network of raw material suppliers, manufacturers, and end-users. By understanding these dynamics, stakeholders can optimize their operations and stay competitive.

Upstream Components:

- Raw material extraction and processing

- Quality control and material testing

- Transportation and storage logistics

- Supply agreements with manufacturers

The production process heavily relies on high-quality raw materials such as steel alloys, ceramic compounds, zirconia-based materials, and advanced composite materials.

Downstream Elements:

- Distribution networks

- End-user industries

- Quality assurance testing

- Application-specific customization

Several key industries drive the demand for grinding media products, including mining operations, cement manufacturing, chemical processing, ceramic production, and power generation facilities.

Each downstream sector has its own specific requirements that influence product specifications and manufacturing processes. For example, mining companies need durable media that can withstand heavy impacts, while ceramic manufacturers require precise solutions for fine grinding applications.

Supply chain disruptions can have a significant impact on production capabilities and market prices. To ensure a steady supply of raw materials and meet diverse customer demands, manufacturers establish strategic partnerships with multiple suppliers.

The interaction between upstream suppliers and downstream consumers creates a dynamic market environment where product innovation and quality improvements fuel industry growth. Companies that invest in vertical integration gain better control over their supply chains and can respond more quickly to changes in the market.

Key Trends Shaping the Grinding Media Industry

The grinding media industry is experiencing rapid transformation driven by technological advancements and changing market demands. Here are the key trends revolutionizing the sector:

1. Advanced Material Development

- Hybrid ceramic-metal composites offering enhanced durability

- Nano-engineered materials with superior wear resistance

- Smart materials capable of self-monitoring wear patterns

2. Digital Integration

- AI-powered quality control systems

- Real-time monitoring of grinding media performance

- Predictive maintenance algorithms reducing downtime

3. Sustainable Manufacturing Practices

- Energy-efficient production methods reducing carbon footprint

- Recycled materials integration in manufacturing

- Water conservation techniques in production processes

4. Performance Optimization

- Custom-designed media shapes for specific applications

- Surface treatment innovations improving grinding efficiency

- Size distribution optimization for better grinding results

The industry’s shift toward green manufacturing has sparked significant innovations. Companies are investing in closed-loop production systems, reducing waste generation by up to 40%. These sustainable practices have attracted environmentally conscious clients, creating new market opportunities.

Research facilities are developing bio-based binding materials and exploring alternative raw material sources. The integration of renewable energy in production processes has reduced operational costs by 25-30%, making sustainable grinding media more commercially viable.

The adoption of smart manufacturing technologies has enabled precise quality control and improved product consistency. Manufacturers using IoT sensors report a 15% increase in production efficiency and a 20% reduction in material waste.

Barriers to Growth in the Grinding Media Market

The grinding media market faces several significant challenges that impact its expansion potential. These challenges include:

- Raw Material Price Volatility: Unpredictable cost structures for manufacturers, affecting profit margins and market stability. Steel prices, a crucial component in grinding media production, have shown substantial fluctuations in recent years.

- High Initial Capital Requirements: Setting up manufacturing facilities requires a significant amount of money upfront, which can be a barrier for new players entering the market.

- Stringent Environmental Regulations: Production processes are affected by strict environmental regulations, which may increase operational costs and limit production capacity.

- Limited Availability of Skilled Technical Workforce: The lack of skilled workers with technical expertise poses a challenge for manufacturers in maintaining efficient operations and producing high-quality products.

- Rising Energy Costs: Operational expenses are impacted by increasing energy costs, which can eat into profit margins and make it harder for manufacturers to compete.

Regional Economic Disparities

Regional economic disparities present additional hurdles for market growth. These disparities include:

- North America: Labor cost pressures and regulatory compliance expenses

- Asia-Pacific: Infrastructure gaps and inconsistent power supply

- Europe: High operational costs and strict environmental standards

- Latin America: Currency fluctuations and political instability

Supply Chain Disruptions

Supply chain disruptions have emerged as a critical challenge, with manufacturers experiencing delays in raw material procurement and finished product distribution. The complex nature of grinding media production requires specialized equipment and expertise, creating substantial barriers to entry for new market players.

Demand Uncertainties

The cyclical nature of end-user industries, particularly mining and cement manufacturing, introduces demand uncertainties that affect market stability. These fluctuations force manufacturers to maintain flexible production capabilities, adding operational complexity and cost pressures.

Geopolitical Factors Impacting Grinding Media Production

The grinding media industry faces significant challenges due to shifting geopolitical landscapes. Recent trade tensions between major economies have disrupted established supply chains, creating uncertainty in raw material procurement and distribution networks.

Key Impact Areas:

- Trade tariffs between the U.S. and China have led to increased costs for steel-based grinding media products

- Export restrictions on rare earth materials affect zirconia grinding media production

- Regional conflicts create supply chain bottlenecks in critical manufacturing zones

The implementation of strict trade policies has reshaped the competitive dynamics of the grinding media market. Countries with substantial raw material reserves now leverage their position to influence global pricing and availability.

Policy Implications:

- Import duties on steel products affect manufacturing costs

- Environmental regulations impact production capabilities

- Local content requirements force manufacturers to adjust supply strategies

Recent sanctions and trade disputes have prompted manufacturers to diversify their supply sources and establish regional production facilities. This shift has created new opportunities for emerging markets while challenging traditional manufacturing hubs.

The growing emphasis on domestic production capabilities has led to:

- Investment in local manufacturing facilities

- Development of alternative material sources

- Formation of strategic partnerships across regions

These geopolitical dynamics have pushed industry players to adopt robust risk management strategies, including stockpiling critical raw materials and developing alternative supply routes to maintain production stability.

Grinding Media Market Segmentation: Types and Their Impact on Performance Characteristics

The grinding media market features distinct product categories, each engineered for specific industrial applications and performance requirements. Understanding these segments helps manufacturers and end-users make informed decisions based on their unique grinding needs.

Key Market Segments:

- Ceramic Grinding Media

- Steel Grinding Media

- Zirconia-Based Products

- Specialty Materials

The selection of grinding media type directly influences operational efficiency, cost-effectiveness, and final product quality. Different materials offer varying levels of:

- Wear resistance

- Impact strength

- Chemical stability

- Cost efficiency

- Environmental impact

Zirconia Grinding Media

Zirconia grinding media stands out as a premium choice in high-performance applications. Its exceptional material properties include:

- Density: 6.0 g/cm³

- Hardness: 1250 HV

- Wear resistance: 2x higher than alumina

- Chemical stability: Resistant to acidic and alkaline environments

Applications:

- Electronic materials processing

- Fine ceramic production

- Pharmaceutical ingredient preparation

- Advanced coating materials

- Specialty chemical manufacturing

The superior wear resistance of zirconia grinding media translates to:

- Reduced contamination in ground materials

- Extended service life

- Lower maintenance requirements

- Consistent particle size distribution

Performance Benefits:

- Achieves particle sizes down to nano-scale

- Maintains spherical shape throughout service life

- Provides uniform grinding results

- Minimizes media consumption rates

The growing demand for ultra-fine particles in electronics and advanced materials sectors drives the adoption of zirconia grinding media. Industries requiring precise particle size control and high purity levels particularly value these characteristics.

Research indicates a 15% annual increase in zirconia grinding media adoption across precision manufacturing sectors. This trend reflects the material’s ability to meet increasingly stringent quality requirements in modern industrial processes.

Steel Grinding Media

Steel grinding media is essential in industrial grinding applications, providing an ideal combination of cost-effectiveness and performance. These durable grinding components come in various forms:

- Forged Steel Balls: Known for superior impact resistance

- Cast Steel Balls: Preferred in high-volume operations

- Steel Rods: Ideal for specialized grinding requirements

The versatility of steel grinding media makes it particularly valuable across multiple sectors:

Cement Production

- Used in raw material grinding

- Essential in clinker processing

- Critical for final cement grinding stages

Mining Operations

- Mineral processing

- Ore reduction

- Metal extraction processes

Steel grinding media’s durability and wear characteristics vary based on carbon content and heat treatment processes. High-carbon variants (0.8% to 1.0%) deliver enhanced hardness, while medium-carbon options offer better impact resistance.

Key advantages of steel grinding media include:

- Cost-effective production methods

- Wide availability of raw materials

- Consistent performance in demanding conditions

- Adaptability to different mill types

- Extended service life under proper maintenance

The market demand for steel grinding media continues to grow, particularly in regions with expanding infrastructure development and mining activities. Manufacturing innovations focus on improving wear resistance and reducing energy consumption during the grinding process.

Applications Shaping Global Demand for Grinding Media Products

The grinding media market serves diverse industrial applications, each requiring specific types of media to achieve optimal performance. Here’s a breakdown of key industries driving market demand:

1. Mining and Mineral Processing

- Ore crushing and grinding operations

- Precious metal extraction

- Coal preparation plants

- Mineral separation processes

2. Cement Manufacturing

- Raw material grinding

- Clinker production

- Final cement grinding

- Specialty cement formulations

3. Chemical Industry Applications

- Paint and pigment production

- Agricultural chemical processing

- Pharmaceutical ingredient preparation

- Specialty chemical manufacturing

4. Power Generation Sector

- Coal grinding for thermal power plants

- Biomass processing

- Waste-to-energy applications

- Fly ash processing

These industries require grinding media products with specific characteristics such as wear resistance, impact strength, and chemical compatibility. The mining sector particularly values high-chrome media for its durability, while cement manufacturers often prefer forged steel balls for their cost-effectiveness and reliable performance.

Regional Insights into The Grinding Media Market Dynamics By Region With Focus On Major Markets Including U.S., China And India

The grinding media market exhibits distinct regional characteristics across major global markets, particularly in the United States, China, and India. Each region presents unique opportunities and challenges shaped by local industrial demands, manufacturing capabilities, and economic conditions.

United States Market Landscape

- Strong focus on high-performance grinding media

- Advanced manufacturing facilities with automated processes

- Emphasis on quality control and product consistency

- Growing demand from mining and cement industries

- Investment in research and development for innovative solutions

Chinese Market Characteristics

- Largest producer and consumer of grinding media globally

- Competitive pricing advantages

- Extensive manufacturing infrastructure

- Strong government support for industrial development

- Integrated supply chain networks

- Growing focus on quality improvements and technological upgrades

Indian Market Features

- Rapidly expanding market driven by infrastructure growth

- Significant demand from cement and mining sectors

- Emerging hub for grinding media manufacturing

- Focus on cost-effective production methods

- Increasing adoption of advanced technologies

- Strong domestic market with export potential

U.S. Grinding Media Market: Opportunities and Innovations

The U.S. grinding media market presents significant opportunities and innovations within the industrial manufacturing sector. This analysis explores key aspects shaping the market’s development and future prospects.

Market Overview

The U.S. grinding media market is experiencing robust growth, driven by:

- Increasing industrial automation

- Rising demand in mining and cement industries

- Advanced material development

- Integration of smart manufacturing technologies

Key Innovation Areas

1. Advanced Materials

- High-performance composite materials

- Wear-resistant coatings

- Custom alloy formulations

- Nano-engineered surfaces

2. Digital Technologies

- AI-powered quality control

- IoT-enabled performance monitoring

- Predictive maintenance systems

- Digital twin modeling

3. Sustainable Solutions

- Eco-friendly manufacturing processes

- Recycled material utilization

- Energy-efficient production methods

- Water conservation techniques

Market Opportunities

Manufacturing Sector

- Automated production lines

- Quality control optimization

- Reduced operational costs

- Enhanced productivity

Mining Industry

- High-durability products

- Custom grinding solutions

- Performance monitoring capabilities

- Technical support services

Construction Sector

- Specialized grinding media

- Cost-effective solutions

- Improved wear resistance

- Application-specific designs

China's Dominance In The Global Grinding Media Industry

China’s position as the leading force in the global grinding media market stems from its robust manufacturing infrastructure and strategic resource advantages. The country’s market share accounts for approximately 35% of global grinding media production, supported by:

Raw Material Accessibility

- Abundant iron ore reserves

- Extensive steel production capabilities

- Strategic mineral deposits

Manufacturing Capabilities

- Advanced production facilities

- High-volume output capacity

- Cost-effective labor resources

Chinese manufacturers have established a competitive edge through their integrated supply chain networks. Local producers leverage state-of-the-art technology to manufacture high-quality grinding media products at competitive prices, serving both domestic and international markets.

The country’s grinding media sector benefits from:

- Government SupportIndustrial development policies

- Infrastructure investment

- Research and development funding

- Market DynamicsStrong domestic demand

- Export opportunities

- Price competitiveness

Chinese companies have invested heavily in automation and quality control systems, enabling them to meet international standards while maintaining cost advantages. The country’s grinding media producers serve diverse industries, including:

- Mining operations

- Cement manufacturing

- Power generation

- Chemical processing

Recent technological advancements in Chinese manufacturing facilities have resulted in improved product quality and performance characteristics. These developments include enhanced wear resistance properties and longer service life for grinding media products, strengthening China’s position as a global market leader.

India's Role in Grinding Media Production and Demand

India’s grinding media market has great potential for growth, thanks to its strong manufacturing sector and infrastructure development initiatives. The country’s cement industry, with a production capacity of 500 million tonnes per year, creates a significant demand for high-quality grinding media products.

Key factors driving India’s grinding media market:

- Infrastructure Development: The government’s focus on infrastructure projects such as smart cities and transportation networks is driving up the demand for construction materials.

- Mining Sector Growth: India’s expanding mining operations require advanced grinding solutions for processing minerals.

- Manufacturing Excellence: Local manufacturers have gained expertise in producing cost-effective grinding media while maintaining quality standards.

The market landscape in India has some unique features:

- Regional Manufacturing Hubs: Industrial zones in Gujarat, Maharashtra, and Tamil Nadu are home to concentrated manufacturing activities.

- Product Preferences: There is a high demand for forged steel grinding media due to its durability and cost-effectiveness.

- Technology Adoption: Indian manufacturers are increasingly adopting automated production processes to improve product consistency.

Indian grinding media producers are focusing on:

- Implementing quality control measures that meet international standards

- Conducting research and development for wear-resistant materials

- Adopting energy-efficient manufacturing processes

- Exploring export opportunities to neighboring Asian markets

The domestic market is benefiting from strategic partnerships between local manufacturers and international technology providers. These partnerships enable knowledge transfer and product innovation. Indian companies are also investing in expanding their production capacity to meet the growing demand from cement plants, power generation facilities, and mineral processing units.

Current market trends indicate a shift towards specialized grinding media products for specific applications, particularly in the pharmaceutical and ceramic industries. This trend presents new opportunities for market players to develop solutions tailored to these specific applications.

Future Developments in the Grinding Media Market

The grinding media market is on the verge of a technological transformation. 3D printing technology is emerging as a game-changing innovation, enabling manufacturers to create complex geometrical shapes with unprecedented precision. These advanced manufacturing capabilities allow for:

- Custom-designed grinding media with optimized surface patterns

- Reduced material waste during production

- Faster prototype development and testing cycles

Smart manufacturing integration brings new possibilities to grinding media production. IoT sensors embedded in grinding media can now:

- Monitor wear rates in real-time

- Track performance metrics

- Predict maintenance requirements

- Optimize grinding efficiency

The rise of eco-friendly materials shapes the next generation of grinding media products. Research developments focus on:

- Bio-based composites with enhanced durability

- Recyclable materials that maintain high performance

- Energy-efficient production methods

Artificial Intelligence applications in grinding media manufacturing promise to revolutionize:

- Quality control processes

- Production scheduling

- Performance prediction models

- Material selection optimization

These technological advancements create opportunities for market players to develop innovative solutions. The integration of digital technologies with traditional manufacturing processes positions the grinding media market for significant growth and evolution in the coming years.

Competitive Landscape in the Grinding Media Industry

The grinding media industry is moderately consolidated, with a mix of global giants and regional players competing on price, quality, innovation, and service. The competition is shaped by the growing demand from mining, cement, and power generation industries, as well as the pressure to deliver cost-effective and durable products.

-

Moly-Cop – Australia

-

ME Elecmetal – United States

-

Magotteaux – Belgium

-

AIA Engineering – India

-

EVRAZ NTMK – Russia

-

Scaw Metals Group – South Africa

-

Litzkuhn & Niederwipper – Germany

-

TOYO Grinding Ball Co. Ltd. – Japan

-

Metso Outotec Corporation – Finland

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Grinding Media Market Report |

| Base Year | 2024 |

| Segment by Type |

· Zirconia Grinding Media · Steel Grinding Media |

| Segment by Application |

· Mining and Mineral Processing · Cement Manufacturing · Chemical Industry Applications · Power Generation Sector |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The grinding media market continues to evolve as a critical component of industrial processing across multiple sectors. As global industrialization advances, the demand for efficient grinding solutions remains strong, particularly in emerging economies. The industry faces both opportunities and challenges, from technological innovations in material science to sustainability concerns and supply chain complexities.

Global Grinding Media Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Grinding Media Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Grinding MediaMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Grinding Mediaplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Grinding Media Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Grinding Media Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Grinding Media Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofGrinding MediaMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the grinding media market by 2025?

The grinding media market is projected to reach $6.13 billion by 2025, driven by significant growth in key regions such as the U.S., China, and India.

What are the key drivers for growth in the grinding media market?

Key drivers for growth in the grinding media market include increasing industrial demand, innovations in product development, and a shift towards sustainable manufacturing practices.

How do geopolitical factors impact the grinding media production supply chain?

Geopolitical tensions and trade policies can significantly affect global supply chains for grinding media products, influencing raw material availability and production costs.

What types of grinding media are commonly used in industrial applications?

Common types of grinding media include zirconia and steel. Zirconia is favored for its high density and wear resistance, while steel balls or rods are widely utilized for their cost-effectiveness across various industries.

Which industries are major consumers of grinding media products?

Key industries leveraging grinding media include metallurgy and cement production, where different forms of grinding media play a crucial role in enhancing processing efficiency.

What future developments are expected in the grinding media market?

Future developments may include technological advancements like 3D printing techniques that could revolutionize product design, offering complex geometries and improving performance characteristics.