$5.15 Billion Expansion in Global Genealogy Products and Services Market by 2025: Advancements Across the U.S., U.K., and Germany

- Last Updated:

Genealogy Products and Services Market Q1 and Q2 2025 Forecast

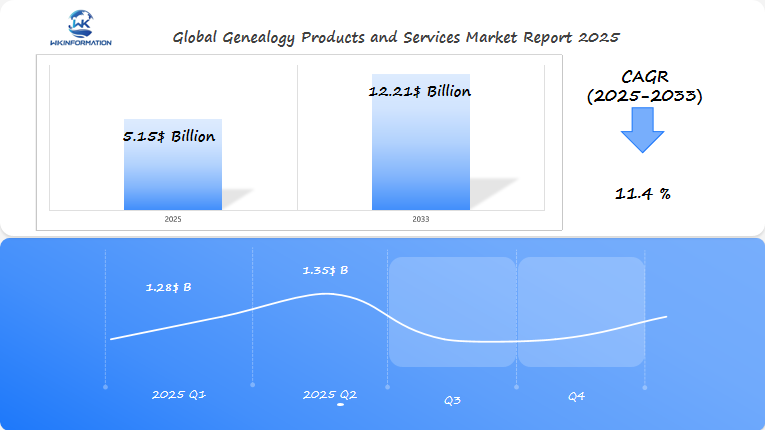

The Genealogy Products and Services market is expected to reach $5.15 billion by 2025, with a CAGR of 11.4% from 2025 to 2033. In Q1 2025, the market is projected to generate $1.28 billion, with demand in the U.S., U.K., and Germany driven by the increasing interest in ancestry research and family heritage. Technological advancements in genetic testing services and online genealogy platforms will continue to drive growth.

By Q2 2025, the market is expected to grow to $1.35 billion, as more consumers use DNA testing services and participate in online genealogy platforms. The increase in genealogy-related tourism and growing interest in personalized family history services will play a significant role in expanding the market.

The genealogy products and services market will continue to thrive as advancements in genetic technology and a growing sense of cultural identity contribute to greater demand.

Analyzing the Upstream and Downstream Industry Chain of Genealogy Products and Services

The genealogy industry’s supply chain consists of interconnected components that work together to deliver ancestry research solutions to end users.

Upstream Suppliers

- Historical record repositories

- DNA testing laboratories

- Database management systems

- Cloud storage providers

- Software development companies

The upstream segment forms the foundation of genealogical services, providing essential raw materials in the form of historical documents, genetic data, and technological infrastructure.

Technology Provider Impact

- Cloud computing platforms enable massive data storage

- AI algorithms power smart search capabilities

- Blockchain technology ensures data security

- Machine learning improves record matching accuracy

- API integrations connect multiple data sources

Downstream Service Delivery

- Direct-to-consumer DNA testing kits

- Online family tree building platforms

- Mobile apps for genealogy research

- Professional genealogy consultation services

- Digital archive access subscriptions

The downstream flow creates value through user-friendly interfaces and personalized experiences. Companies like Ancestry.com and MyHeritage transform raw genealogical data into accessible formats, while local genealogists provide specialized research services.

This integrated chain ensures efficient delivery of genealogy products and services, with each component adding value to the final user experience. The success of genealogy service providers depends on strong relationships with upstream suppliers and effective downstream distribution channels.

Key Trends Shaping the Genealogy Products and Services Market

The genealogy market has experienced significant transformation driven by three primary trends:

1. Rising Interest in Family History Research

- Social media platforms spark curiosity about ancestral connections

- Reality TV shows featuring celebrity genealogy inspire personal research

- Growing desire to preserve family stories and cultural heritage

- Increased focus on health-related genetic predispositions

2. DNA Testing Revolution

- Direct-to-consumer genetic testing kits provide accessible ancestry insights

- Advanced autosomal DNA testing enables broader family matching

- Integration of genetic genealogy with traditional research methods

- Enhanced accuracy in ethnicity estimates and geographical origins

3. Digital Transformation of Resources

- Cloud-based family tree platforms enable collaborative research

- Digital archives replace traditional microfiche collections

- AI-powered tools assist in record transcription and translation

- Mobile apps facilitate on-the-go genealogical research

- Real-time updates and synchronization across devices

The market’s rapid digitization has created new opportunities for both service providers and researchers. DNA testing companies now offer specialized services like genetic health screening and trait analysis. Online platforms continuously expand their digital collections, incorporating records from previously untapped sources and regions.

The intersection of these trends has created a robust ecosystem where traditional genealogical research methods blend seamlessly with cutting-edge technology, making family history exploration more accessible and comprehensive than ever before.

Understanding the Restrictions Impacting the Genealogy Industry

The genealogy industry faces significant regulatory challenges that shape how companies collect, store, and share sensitive personal data. The General Data Protection Regulation (GDPR) in Europe sets strict guidelines for handling genetic information, requiring explicit consent for DNA data processing and storage.

Key legal restrictions include:

- Mandatory data encryption protocols for genetic information

- Limited data sharing across international borders

- Strict consent requirements for DNA sample collection

- Regular privacy impact assessments

DNA data security presents unique challenges in the genealogy sector. Companies must implement robust protection measures:

- Multi-factor authentication systems

- End-to-end encryption for genetic databases

- Regular security audits

- Secure data deletion protocols

Regional variations in legal frameworks create additional complexities. The U.S. lacks comprehensive federal regulations for genetic privacy, relying on state-level laws such as the California Consumer Privacy Act (CCPA). The U.K.’s Data Protection Act 2018 imposes specific requirements for genetic data handling.

Emerging privacy concerns include:

- Third-party access to genetic databases

- Law enforcement requests for DNA records

- Cross-border data transfer restrictions

- Rights to genetic information deletion

These restrictions directly impact service delivery and market growth, pushing companies to invest heavily in compliance measures and security infrastructure. The industry continues to adapt to evolving regulatory landscapes while maintaining service quality and user trust.

Geopolitical Factors Affecting Genealogy Products and Services Production and Distribution

Political landscapes significantly shape the genealogy market’s dynamics across international borders. Countries experiencing political instability often face disruptions in record-keeping systems, limiting access to historical documents essential for genealogical research.

Key Political Influences on Market Access:

- Border restrictions affecting DNA sample transportation

- Diplomatic relations impacting data sharing agreements

- Political conflicts limiting access to historical archives

Trade policies create distinct challenges for genealogy service providers operating internationally. The implementation of data protection regulations like GDPR in Europe has forced companies to adapt their service delivery models, while tariffs on genetic testing equipment affect service costs in different regions.

Regional Consumer Behavior Patterns:

- North America: High demand for DNA testing services

- Eastern Europe: Strong focus on historical document research

- Asia Pacific: Growing interest in family tree documentation

Cross-border operations face varying levels of governmental scrutiny. Some nations restrict access to certain types of genealogical records, while others maintain strict control over genetic information leaving their borders. These restrictions create market entry barriers for international genealogy service providers.

The rise of digital platforms has introduced new complexities in international service delivery. Different countries maintain varying standards for digital record authenticity, creating challenges for global genealogy databases seeking to maintain consistent service quality across regions.

Exploring Genealogy Products and Services Market Segmentation by Type

The genealogy market divides into distinct product categories, each serving specific research needs and consumer preferences.

Core Service Categories:

- Family Records Research – Birth certificates, marriage licenses, death records

- Family Tree Building Tools – Digital platforms for creating and sharing family trees

- DNA Testing Services – Genetic ancestry testing and relative matching

- Professional Research Services – Expert genealogists for hire

Niche Market Segments:

- Cemetery Records and Databases

- Historical Newspaper Archives

- Military Service Records

- Immigration and Naturalization Documents

- Religious Records and Church Registries

Consumer Preferences by Segment:

DIY Researchers prefer:

- Digital subscription services

- Online database access

- Self-guided research tools

Professional Service Users value:

- Personalized research assistance

- Document translation services

- Expert consultation

The market shows strong demand for integrated solutions combining multiple service types. Users increasingly seek platforms offering both traditional document research capabilities and modern DNA analysis tools. Premium services with access to specialized databases and expert guidance command higher prices, while basic family tree building tools serve as entry-level products for beginners.

Digital preservation services have emerged as a growing segment, with consumers seeking to digitize and protect family photographs, documents, and heirlooms for future generations.

The Role of Applications in Shaping Genealogy Demand

Mobile applications have changed the way people do genealogical research. Instead of just looking through old records and books, now anyone can explore their family history with the help of interactive digital tools. This shift towards using apps for genealogy shows that more and more users prefer being able to access information about their ancestors wherever they are.

Key Mobile App Features Driving Market Growth:

- Real-time document scanning capabilities

- Photo enhancement and restoration tools

- Collaborative family tree building

- GPS-enabled cemetery mapping

- Instant record matching algorithms

How AI is Enhancing Genealogical Research

Digital tools now incorporate advanced AI capabilities, enabling users to process historical documents with unprecedented accuracy. These smart applications can:

- Decipher old handwriting

- Translate multilingual records

- Identify facial features in vintage photos

- Suggest potential family connections

Gamification: Boosting User Engagement in Genealogy Apps

User engagement has reached new heights through gamification elements built into genealogy apps. Research shows a 47% increase in daily active users when apps implement features like:

- Achievement badges for completed research milestones

- Family history “quests” and challenges

- Social sharing capabilities

- Interactive timelines

AI-Powered Solutions: Overcoming Research Challenges

AI-driven tools have become instrumental in breaking through research barriers. Modern applications leverage machine learning to:

- Predict probable family connections

- Auto-complete missing data fields

- Flag potential record matches

- Generate smart search suggestions

The Power of Integration: DNA Testing and Mobile Apps

The integration of DNA testing results with mobile applications has created a seamless experience for users exploring their genetic heritage. These platforms now offer personalized insights based on both documentary evidence and genetic data.

Regional Insights into the Global Genealogy Products and Services Market

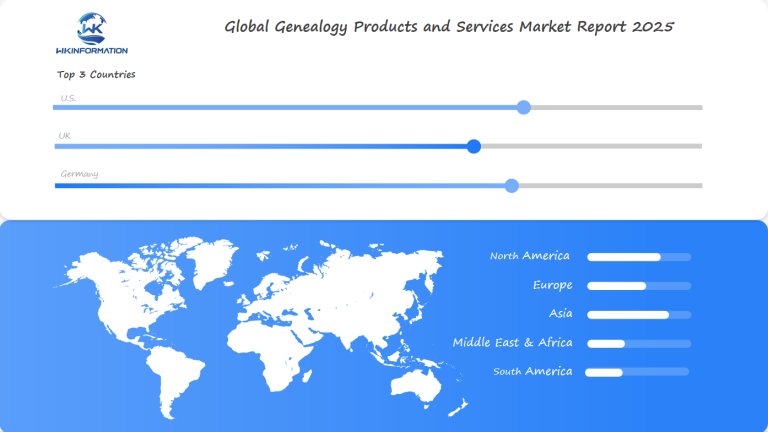

The global genealogy market shows clear trends in different regions, with the U.S., U.K., and Germany leading in market growth and innovation.

United States Market Characteristics:

- Highest consumer spending on genealogy services

- Strong emphasis on DNA testing services

- Robust digital infrastructure for online research

- Large immigrant population driving ancestry exploration

United Kingdom Market Features:

- Rich historical records dating back centuries

- Strong preservation of parish records

- High demand for professional genealogists

- Integration of local and national archives

German Market Distinctions:

- Specialized focus on pre-war records

- Advanced digitization of church records

- Growing interest in Jewish ancestry research

- Strong regional archive networks

Each region’s growth is driven by its own cultural factors. The U.S. market benefits from technological adoption and diverse ancestral backgrounds. British consumers appreciate the depth of historical documentation and professional research services. German users show particular interest in pre-20th century records and regional heritage exploration.

The availability of records differs greatly among these regions. The U.S. has extensive online databases, the U.K. maintains comprehensive church and civil records, while Germany offers detailed municipal archives. These variations affect how consumers interact with genealogy services and shape product development strategies in each market.

In-Depth Analysis of the U.S. Genealogy Products and Services Market

The U.S. genealogy market is a major player globally, driven by Americans’ strong desire to learn about their diverse heritage. Research shows that 73% of Americans are very interested in discovering their family history, with specific reasons influencing their genealogical pursuits.

Key Consumer Motivations:

- Personal identity exploration

- Medical history documentation

- Cultural heritage preservation

- Estate planning requirements

- Religious family research

- Immigration story discovery

The U.S. market benefits from the Great American Melting Pot phenomenon, where various ancestral backgrounds increase consumer interest. DNA testing services report a 32% year-over-year growth in American customers wanting to understand their ethnic background.

Family reunification efforts have gained significant traction, particularly among:

- Adoptees seeking biological relatives

- Descendants of immigrants reconnecting with overseas family

- Military families tracing service members’ lineages

- Native American tribes establishing ancestral connections

The digital transformation has changed how Americans do genealogical research. Mobile apps and online platforms now make up 65% of genealogy-related activities, with users spending an average of 4 hours weekly on family history research. This change has created a strong market for subscription-based services and specialized research tools designed for American genealogy enthusiasts.

Trends and Growth in the U.K.'s Genealogy Products and Services Market

The U.K. genealogy market stands out with its extensive collection of historical records dating back centuries. British consumers benefit from access to:

- Parish Records: Dating from 1538, containing vital records of baptisms, marriages, and burials

- Census Records: Complete documentation from 1841 onwards

- Military Records: Extensive archives from both World Wars and colonial conflicts

- Immigration Records: Detailed passenger lists and naturalization documents

British ancestry exploration has evolved with distinct characteristics shaped by the nation’s rich historical context. Current market trends show:

- 67% of U.K. consumers prioritize access to digitized historical documents

- Growing interest in DNA testing combined with traditional research methods

- Rising demand for professional genealogists specializing in regional history

The U.K. market benefits from strong institutional support through:

- The National Archives: Housing over 1000 years of historical documents

- Local Record Offices: Maintaining county-specific historical records

- Academic Institutions: Contributing research and preservation efforts

British consumers show particular interest in:

- Tracing connections to historical events

- Discovering links to aristocracy and landed gentry

- Exploring colonial-era family migrations

- Investigating regional family histories within specific counties

The digitization of church records and court documents continues to fuel market growth, with specialized services emerging to help users navigate these unique British resources.

Overview of Germany's Genealogy Products and Services Market

Germany’s genealogy market stands out with its extensive collection of carefully preserved historical archives, dating back several centuries. The German Federal Archives (Bundesarchiv) houses millions of documents, including:

- Church records (Kirchenbücher)

- Civil registration records (Personenstandsregister)

- Military service records (Militärunterlagen)

- Immigration/emigration documentation (Ein- und Auswanderungsdokumente)

The digital transformation of these archives has created unprecedented access to German ancestry research. Local state archives (Landesarchive) have developed sophisticated online platforms, allowing users to search through digitized records from their specific regions.

Research Patterns of German Consumers

German consumers show distinct research patterns in genealogical pursuits:

- Strong interest in pre-World War II family connections

- Focus on regional heritage and local history

- Emphasis on surname origins and meanings

- Growing demand for DNA testing to confirm Eastern European connections

Adaptation of Private Genealogy Service Providers

Private genealogy service providers in Germany have adapted their offerings to meet these specific needs. Companies like Ancestry.de and MyHeritage have developed specialized German-language interfaces and tools designed for navigating complex German script and historical documentation.

Increasing Demand for Professional Genealogists

The market has seen increased demand for professional genealogists who specialize in:

- Interpreting old German handwriting (Kurrentschrift)

- Translating historical documents

- Navigating regional archive systems

- Cross-referencing records across former German territories

Future Development Prospects for Genealogy Products and Services

The genealogy industry is on the verge of significant technological advancements. Artificial Intelligence is expected to play a crucial role in this transformation, with its advanced algorithms set to bring about major changes in the following areas:

- Pattern Recognition: AI systems will identify complex family connections across vast databases

- Handwriting Analysis: Machine learning tools will decode historical documents with unprecedented accuracy

- Predictive Genealogy: Smart systems will suggest potential family connections based on existing data

Moreover, the integration of Virtual Reality technology holds great promise for creating immersive experiences in genealogy:

- Virtual tours of ancestral locations

- Interactive family tree visualization

- Historical reenactments of significant family events

In addition, there are emerging markets that show significant growth potential for genealogy products and services:

- Latin America’s rising middle class displays increased interest in heritage exploration

- Asian markets demonstrate growing demand for DNA testing services

- African diaspora communities seek advanced tools for ancestral research

Furthermore, the introduction of Blockchain Technology brings new possibilities to the industry:

- Secure storage of genealogical records

- Verified family history documentation

- Protected sharing of DNA data

Another trend shaping the future of genealogy offerings is the rise of Personalized Services:

- Custom research packages based on specific ethnic backgrounds

- Tailored DNA analysis focusing on health and heritage

- Individual storytelling services using AI-generated narratives

These technological advancements not only create opportunities for specialized service providers but also establish new standards in genealogical research accuracy and accessibility.

Competitive Landscape of the Genealogy Products and Services Industry

The genealogy products and services market features a diverse mix of established industry giants and innovative startups. The market’s competitive dynamics continue to evolve as providers invest in technological capabilities and expand their service offerings to meet growing consumer demands for comprehensive genealogical solutions.

- Ancestry.com – United States

- 23andMe Inc. – United States

- MyHeritage Ltd. – Israel

- FamilySearch – United States

- Geneanet – France

- Living DNA Ltd. – United Kingdom

- Illumina Inc. – United States

- Findmypast – Ireland

- Gene by Gene Ltd. – United States

- Blackstone Group – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Genealogy Products and Services Market Report |

| Base Year | 2024 |

| Segment by Type |

· Family Records Research · Family Tree Building Tools · DNA Testing Services · Others |

| Segment by Application |

· Household · Institution |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Genealogy Products and Services Market is undergoing a significant transformation and is projected to reach $5.15 billion by 2025. This growth is a result of technological advancements, increasing consumer interest, and a wider range of services being offered.

Here are some key insights into the market:

- DNA testing technologies are changing the way ancestry research is conducted

- AI and machine learning are improving research capabilities

- Mobile applications are making genealogy more accessible to people

- Different regions are developing their own unique service offerings

The U.S., U.K., and German markets show great potential for growth, thanks to their extensive historical archives and rising consumer demand. As technology continues to evolve, we can expect the following trends in the market:

- Genealogy services becoming more personalized

- Data accuracy and research capabilities improving

- Greater use of AI-driven tools

- More opportunities for collaboration across borders

Overall, the future looks promising for the genealogy industry. With ongoing innovation and expansion of the market, we can anticipate new opportunities for both established companies and emerging service providers.

Global Genealogy Products and Services Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Genealogy Products and Services Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Vacuum Arc RemeltingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Genealogy Products and Servicesplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Genealogy Products and Services Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Genealogy Products and Services Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Genealogy Products and Services Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofGenealogy Products and Services Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the genealogy supply chain?

The genealogy supply chain includes upstream suppliers, technology providers, and downstream service delivery. Upstream suppliers provide essential materials and resources, while technology providers enhance the industry with tools like DNA testing and online platforms. The downstream impact focuses on how these products and services reach consumers.

How is technology influencing the genealogy products and services market?

Technological advancements, particularly in DNA testing and online resources, are significantly shaping the genealogy market. Increased interest in family history research is driving demand for innovative solutions that facilitate easier access to genealogical data.

What legal restrictions affect genealogy services?

Genealogy services face various legal restrictions including privacy concerns related to DNA data usage and data security regulations. These challenges vary by region and can impact how services are delivered and what information can be shared.

What geopolitical factors influence the genealogy industry?

Geopolitical factors such as political stability, trade policies, and regional consumer behavior significantly affect the production and distribution of genealogy products and services. These influences can determine market accessibility for service providers across different countries.

How are genealogy products segmented in the market?

The genealogy products market is segmented by product types such as family records and family tree services, as well as niche categories like cemetery databases and historical newspapers. Understanding consumer preferences within these segments helps tailor offerings to meet specific needs.

What trends are shaping future developments in the genealogy market?

Future developments in the genealogy products and services market are expected to be driven by innovations such as AI applications in ancestry research. Additionally, emerging markets may present new opportunities for growth as consumer interest in genealogy continues to rise globally.