$2.91 Billion Rapid Growth in Gallium Market in the U.S., China, and Japan by 2025

Discover comprehensive insights into the rapidly expanding gallium market, projected to reach $2.91 billion by 2025. Explore how this versatile metal drives innovation in semiconductors, solar technology, and electronics across the U.S., China, and Japan, while examining key market trends, production challenges, and future growth opportunities in this essential industry.

- Last Updated:

Gallium Market Q1 and Q2 2025 Forecast

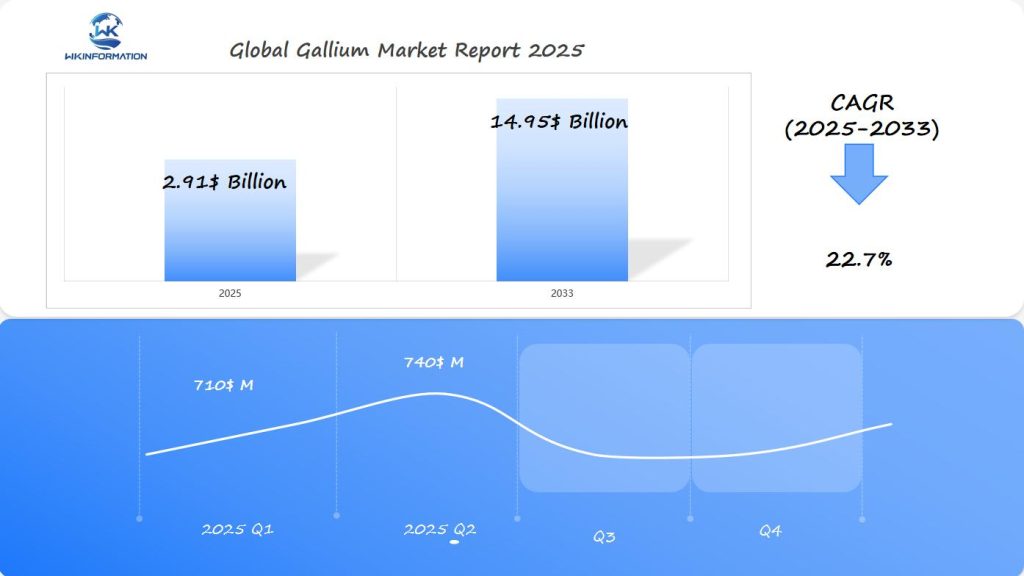

The Gallium market is expected to reach $2.91 billion in 2025, with a CAGR of 22.7% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $710 million, driven by increasing demand for gallium-based semiconductors in the U.S., China, and Japan. Gallium’s critical role in the production of LEDs, solar panels, and high-performance electronics is fueling market growth.

By Q2 2025, the market is forecasted to reach $740 million, supported by the growing adoption of gallium nitride (GaN) technologies in 5G infrastructure and electric vehicles. China and Japan remain key players in the gallium supply chain, while the U.S. continues to expand its demand for advanced semiconductor applications.

Exploring the Gallium Industry’s Global Upstream and Downstream Industry Chains

The gallium industry operates through a complex network of upstream and downstream processes, creating a sophisticated supply chain that spans multiple continents.

Upstream Production Process

The extraction and refinement of gallium follows several critical stages:

- Primary Extraction: Gallium exists as a trace element in bauxite and zinc ores, requiring specialized extraction methods

- Refining Process: Raw gallium undergoes multiple purification steps to achieve the 99.99% purity needed for industrial applications

- Secondary Production: Recycling and recovery from manufacturing scrap contributes significantly to the global supply

China dominates the upstream market, controlling approximately 95% of global primary gallium production. Japan maintains a strong position through its advanced refining capabilities and technological expertise in secondary production.

Downstream Applications and Market Distribution

The refined gallium enters various industrial sectors through specialized manufacturing processes:

Electronics Manufacturing

- Semiconductor production

- LED manufacturing

- Integrated circuit fabrication

Renewable Energy

- Solar cell production

- Photovoltaic systems

- Energy storage solutions

Telecommunications

- 5G infrastructure components

- Radio frequency devices

- Mobile phone components

The distribution of gallium products follows regional industrial strengths:

- Asia Pacific: Concentrated in semiconductor manufacturing

- North America: Focus on defense and aerospace applications

- Europe: Emphasis on renewable energy systems

The value chain creates multiple interdependencies between regions, with raw material suppliers, refiners, and end-product manufacturers forming crucial partnerships. Japan’s technological expertise complements China’s production capacity, while U.S. companies drive innovation in downstream applications.

Key manufacturing hubs have emerged near major technology centers, optimizing logistics and reducing transportation costs. These strategic locations enable rapid response to market demands and facilitate just-in-time production schedules for high-tech manufacturers.

Key Trends Driving the Gallium Market: Semiconductor and Solar Demand

The semiconductor industry’s rapid evolution has positioned gallium as a critical material in next-generation electronic devices. GaN transistors represent a significant advancement in semiconductor technology, offering:

- Higher switching speeds – Up to 1000x faster than traditional silicon

- Improved thermal performance – Operating at temperatures above 300°C

- Enhanced power efficiency – 40% reduction in energy consumption

- Smaller device footprint – Enabling compact electronic designs

These properties make GaN semiconductors essential in:

- 5G infrastructure development

- Electric vehicle charging systems

- Data center power supplies

- Military radar applications

The solar energy sector has embraced gallium-based materials to push the boundaries of photovoltaic efficiency. Recent innovations include:

- Achieved conversion rates of 47.1% using gallium arsenide

- Reduced material costs through thin-film technology

- Enhanced performance in concentrated solar applications

Emerging Applications

- Building-integrated photovoltaics (BIPV)

- Space-based solar power systems

- Portable solar chargers

- Solar-powered vehicles

Market research indicates a 35% annual increase in GaN semiconductor adoption rate, driven by automotive and consumer electronics manufacturers. Solar panel manufacturers have reported a 25% rise in gallium-based cell production, responding to growing renewable energy demands.

The integration of gallium compounds in both sectors has sparked innovative research directions:

- Development of hybrid solar-semiconductor devices

- Advanced power electronics for smart grid systems

- New manufacturing techniques for higher yield rates

- Improved recycling methods for gallium-containing products

These technological advances continue to fuel demand for high-purity gallium, creating opportunities for market expansion and material innovation across both industries.

Challenges in Gallium Production: Resource Availability and Sustainability

The gallium market faces significant production hurdles tied to resource availability and environmental sustainability. Raw gallium extraction presents unique challenges due to its scattered distribution in the Earth’s crust, with typical concentrations ranging from 15 to 20 parts per million.

Resource Availability Constraints

- Limited primary sources – Gallium exists primarily as a trace element in bauxite and zinc ores

- Low recovery rates – Current extraction methods yield only 10-15% of available gallium

- Ore grade variations – Quality fluctuations affect production efficiency and costs

- Geographic limitations – Concentrated deposits in specific regions create supply chain vulnerabilities

Environmental Impact Assessment

Traditional gallium production methods raise substantial environmental concerns:

- High energy consumption during extraction processes

- Chemical waste generation from processing operations

- Water pollution risks from mining activities

- Carbon emissions from energy-intensive refinement

Sustainable Production Initiatives

Leading manufacturers are implementing innovative approaches to address these challenges:

- Advanced recycling technologies to recover gallium from electronic waste

- Energy-efficient extraction methods using improved chemical processes

- Water conservation systems in processing facilities

- Waste reduction strategies through process optimization

The industry faces mounting pressure to develop sustainable practices while meeting growing demand. Companies investing in research and development are exploring alternative extraction methods, including:

- Biohydrometallurgical processes

- Green chemistry applications

- Enhanced recovery techniques

- Circular economy approaches

Current production methods require approximately 50-100 times more energy to extract gallium compared to common metals. This energy intensity drives up costs and environmental impact, pushing manufacturers to seek innovative solutions for more sustainable operations.

The intersection of resource scarcity and environmental concerns creates a complex challenge for market growth. Industry leaders must balance increasing demand with responsible production practices to ensure long-term market stability.

Geopolitical Factors Impacting Gallium Trade and Production

The global gallium market is facing major disruptions due to changing trade policies and geopolitical tensions. China’s dominant position, controlling about 80% of global gallium production, creates a complicated power dynamic in international trade relations.

1. Trade Policy Impact on Global Supply

- Export restrictions implemented by China in 2023 require special permits for gallium shipments

- U.S. semiconductor companies face supply chain vulnerabilities due to dependency on Chinese exports

- Price volatility triggered by policy changes affects manufacturing costs worldwide

2. Regional Power Dynamics

The U.S. has responded to market pressures by:

- Establishing domestic gallium recycling programs

- Developing strategic partnerships with allied nations

- Investing in alternative production methods

3. Market Control and Security Concerns

China’s market dominance raises several critical issues:

- Strategic leverage in trade negotiations

- Control over critical technology supply chains

- Influence on global pricing mechanisms

4. Emerging Trade Patterns

Recent developments show shifting trade dynamics:

- Japan’s increased investment in domestic production capabilities

- European Union’s efforts to secure alternative supply sources

- Growing importance of bilateral trade agreements for gallium access

5. Supply Chain Diversification

Manufacturing nations are adopting new strategies:

- Development of regional processing facilities

- Investment in research for alternative materials

- Creation of stockpiles to buffer against supply disruptions

The interaction between trade policies and geopolitical tensions continues to reshape the gallium market landscape. Countries are actively pursuing supply chain resilience through diplomatic channels and strategic investments. These dynamics influence not just pricing and availability but also drive technological innovation and regional manufacturing capabilities.

Types of Gallium Products: Gallium Arsenide, Gallium Nitride, and More

The gallium compounds market features two primary powerhouses: Gallium Arsenide (GaAs) and Gallium Nitride (GaN). Each compound brings unique properties that make them invaluable across different industries.

1. Gallium Arsenide (GaAs)

GaAs stands out with its exceptional electron mobility and direct bandgap properties. These characteristics make it ideal for:

- High-frequency applications in 5G networks

- Satellite communications systems

- Military radar equipment

- Infrared light-emitting diodes

- Solar cells with efficiency rates up to 40%

2. Gallium Nitride (GaN)

GaN devices showcase superior performance in power electronics applications:

- Higher breakdown voltage capability

- Faster switching speeds

- Better thermal conductivity

- Smaller form factor requirements

- Enhanced energy efficiency in power conversion

Other Significant Gallium Compounds

Gallium Phosphide (GaP) and Gallium Indium Arsenide (GaInAs) are two other significant gallium compounds with their own set of applications:

Gallium Phosphide (GaP)

- Used in red, orange, and green LEDs

- Essential component in optocouplers

- Applied in specialized electronic displays

Gallium Indium Arsenide (GaInAs)

- Powers high-speed fiber optic communications

- Enables advanced night vision technology

- Supports quantum computing applications

The market demand for these compounds varies by application. GaN devices dominate the power electronics sector, while GaAs maintains its stronghold in RF applications and optoelectronics. The compound selection often depends on specific performance requirements:

- Speed Requirements: GaAs for ultra-high-frequency applications

- Power Handling: GaN for high-voltage operations

- Light Emission: GaP for specific wavelength requirements

- Thermal Performance: GaN for high-temperature environments

Research continues to unlock new applications for these compounds, particularly in quantum computing and advanced telecommunications systems. The development of hybrid solutions combining different gallium compounds pushes the boundaries of electronic device capabilities.

Applications of Gallium in Electronics, Solar Energy, and LED Technology

The versatility of gallium compounds drives innovation across multiple industries, revolutionizing how we power our world and advance technology.

1. Automotive Electronics Applications

- Electric vehicle charging systems utilize GaN-based power electronics for faster charging speeds and improved efficiency

- Advanced driver-assistance systems (ADAS) incorporate gallium-based sensors for enhanced safety features

- Battery management systems benefit from GaN power devices, extending EV range capabilities

2. Healthcare Imaging Breakthroughs

- PET scanners employ gallium-68 isotopes for precise cancer detection

- Digital X-ray detectors use GaAs for superior image quality

- Dental imaging systems leverage gallium compounds for reduced radiation exposure

3. Solar Energy Innovations

Recent case studies highlight gallium’s impact in solar technology:

- Concentrated Photovoltaic Systems43.8% efficiency achieved in multi-junction cells using GaAs

- Commercial installation in Arizona demonstrates 30% higher energy yield

- Reduced land use requirements compared to traditional solar farms

- Thin-Film Solar ApplicationsCIGS (Copper Indium Gallium Selenide) technology enables flexible solar panels

- Building-integrated photovoltaics show 15% efficiency improvement

- Successful deployment in urban solar projects across Japan

4. LED Technology Advancements

- High-brightness LED displays using GaN achieve 2x longer lifespan

- Micro LED development enables sharper, more energy-efficient screens

- UV LED applications in sterilization systems show 99.9% effectiveness

The integration of gallium-based components in these sectors continues to push technological boundaries. Research facilities report a 40% increase in gallium-related patents for electronics applications, signaling strong industry momentum. Manufacturing facilities adapt production lines to accommodate growing demand for gallium-enhanced products, particularly in automotive and renewable energy sectors.

Global Gallium Market Insights: Growth and Future Projections

The gallium market shows great potential for growth, with forecasts suggesting an increase from $2.91 billion in 2025 to $14.95 billion by 2033. This represents a 22.7% compound annual growth rate (CAGR), indicating strong market expansion.

Key Factors Driving Market Growth

Several factors are contributing to the growth of the gallium market:

- Rising demand in emerging economies

- Increased use of gallium-based compounds in new applications

- Strategic partnerships between manufacturers and end-users

- Investment in research and development

Future Valuation of the Gallium Market

The gallium market is expected to reach a substantial value of $14.95 billion by 2033, driven by various factors:

- Deployment of 5G infrastructure

- Expansion of the electric vehicle market

- Demand for advanced medical imaging equipment

- Requirements from the military and defense sector

Regional Distribution of the Gallium Market

North America currently holds the largest share of the global gallium market, with significant contributions from Asia-Pacific regions as well. Industry analysts anticipate a shift in market dynamics as new players enter the industry and existing manufacturers increase their production capabilities.

Price Volatility and Its Impact on Market Growth

The price volatility of gallium remains a critical factor affecting the market, with current rates ranging between $300-400 per kilogram. These fluctuations directly influence market growth patterns and investment decisions in the semiconductor and electronics industries.

U.S. Gallium Market: Demand in Electronics and Clean Energy

The U.S. gallium market is experiencing significant growth due to increasing demand in electronics manufacturing and clean energy initiatives. American semiconductor manufacturers require high-purity gallium compounds for producing advanced chips used in 5G networks, artificial intelligence systems, and quantum computing applications.

Key Market Drivers:

- Defense sector requirements for GaN-based radar systems

- Electric vehicle charging infrastructure expansion

- Data center power management solutions

- Advanced medical imaging equipment production

The U.S. Department of Energy’s clean energy programs have sparked increased demand for gallium in solar cell manufacturing. Recent studies indicate that gallium-based solar cells achieve efficiency rates up to 29.1%, marking a significant improvement over traditional silicon alternatives.

U.S. manufacturers face supply chain challenges due to limited domestic gallium production. The country relies heavily on imports, with 85% of gallium compounds sourced from international markets. This dependency has prompted initiatives to establish domestic gallium recycling facilities and explore alternative extraction methods from aluminum production waste.

Recent investments in U.S. semiconductor manufacturing facilities, supported by the CHIPS Act, signal growing domestic demand for gallium. Companies like Intel and Texas Instruments have announced plans to expand their GaN semiconductor production capabilities, indicating strong market growth potential in the coming years.

China’s Dominance in Gallium Production and Global Trade

China holds an unrivaled position in the global gallium market, controlling approximately 80% of worldwide production. The country’s strategic advantage stems from its extensive bauxite reserves and advanced processing capabilities.

Key Production Factors:

- Integrated mining operations with aluminum production

- Advanced processing facilities across multiple provinces

- Cost-effective labor and operational expenses

- Established supply chain networks

The Chinese government’s strategic policies have strengthened its market position through:

- Export restrictions on raw gallium

- Investment in research and development

- Support for domestic semiconductor manufacturing

- Integration of gallium production with rare earth processing

Chinese companies have developed proprietary technologies for gallium extraction and purification, achieving production costs significantly lower than international competitors. The country’s manufacturing hub, Yunnan Province, houses several major gallium processing facilities equipped with state-of-the-art technology.

Recent trade data shows China’s gallium exports reaching record levels, with primary destinations including Japan, South Korea, and Germany. The country’s pricing power influences global market dynamics, affecting industries from semiconductor manufacturing to solar panel production.

Chinese producers maintain strict quality control measures to meet international standards, particularly for high-purity gallium used in semiconductor applications. Their ability to scale production rapidly in response to market demand has reinforced China’s position as the primary source for global gallium supply.

Japan’s Gallium Market: Innovations and Technological Advancements

Japan is a leader in gallium-based technological innovations, especially in the development of advanced semiconductor materials and devices. The country’s research institutions and tech companies have made significant progress in:

1. Advanced Manufacturing Processes

- High-purity gallium refinement techniques

- Precision-controlled epitaxial growth methods

- Novel substrate development for GaN devices

Japanese companies like Sumitomo Electric and Hitachi have developed proprietary technologies for producing ultra-high-quality gallium compounds. These innovations enable the production of more efficient power devices and advanced electronic components.

2. Research Applications

- Blue LED technology using gallium nitride

- High-frequency power amplifiers for 5G networks

- Next-generation solar cell materials

The Japanese market differentiates itself through specialized applications in automotive electronics and industrial automation. Local manufacturers have created unique gallium-based solutions for electric vehicle power systems and factory automation equipment.

3. Strategic Partnerships

Japanese firms maintain strong collaborations with global tech leaders, creating value-added products for international markets. These partnerships focus on developing:

- Custom gallium compounds for specific industrial applications

- Integrated solutions for emerging technologies

- Advanced recycling methods for gallium-containing materials

Recent developments in Japan’s gallium sector include breakthroughs in miniaturization techniques and enhanced thermal management solutions for high-power electronic devices.

The Future of Gallium: Recycling and New Technologies

The gallium industry faces critical sustainability challenges, pushing manufacturers to embrace innovative recycling solutions. Current recycling rates hover around 40% for gallium-containing products, presenting significant room for improvement through advanced recovery methods.

Emerging Recycling Technologies:

- Hydrometallurgical processes using selective leaching

- Advanced chemical separation techniques

- Automated sorting systems for electronic waste

- Plasma arc recycling for GaAs recovery

3D printing technology revolutionizes gallium-based semiconductor production, enabling precise material deposition and reducing waste. This additive manufacturing approach creates intricate GaN and GaAs structures with minimal material loss, addressing both cost and sustainability concerns.

Alternative Material Development:

- Silicon carbide (SiC) alternatives for power electronics

- Indium phosphide (InP) substitutes in optoelectronics

- Organic semiconductor compounds

- Hybrid material systems combining gallium with sustainable elements

Research institutions develop bio-based extraction methods using specialized bacteria to recover gallium from electronic waste. These biological processes promise lower energy consumption and reduced environmental impact compared to traditional chemical extraction methods.

Market Impact of New Technologies:

- Reduced dependency on primary gallium sources

- Stabilized supply chains through recycling

- Lower production costs

- Enhanced material efficiency

Smart recycling facilities integrate artificial intelligence and machine learning algorithms to optimize gallium recovery processes. These systems analyze material composition in real-time, adjusting parameters for maximum extraction efficiency.

The integration of blockchain technology enables transparent tracking of recycled gallium throughout the supply chain. This innovation helps manufacturers verify the authenticity and sustainability of their gallium sources while meeting growing consumer demands for environmentally responsible products.

Manufacturers invest in closed-loop production systems, capturing and reprocessing gallium waste during manufacturing. These systems minimize material loss and reduce the need for virgin gallium, creating a more sustainable production cycle.

Competitive Landscape: Key Players in the Gallium Market

The gallium market features several dominant players shaping industry dynamics through strategic innovations and partnerships.

-

Aluminum Corporation of China Limited – China

-

East Hope Group – China

-

Infineon Technologies AG – Germany

-

NXP Semiconductors – Netherlands

-

Qorvo Inc. – United States

-

Sumitomo Electric Industries Ltd. – Japan

-

Texas Instruments Incorporated – United States

-

STMicroelectronics N.V. – Switzerland

-

MACOM Technology Solutions Holdings Inc. – United States

-

Nalco – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Gallium Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

| Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The gallium market is at a crucial point of change, expected to reach $2.91 billion by 2025. This significant growth shows how important gallium is in shaping modern technology and finding sustainable solutions.

Key Factors Driving the Market

Some key factors driving this market include:

- Technological Innovation: The advancement of GaN and GaAs technologies drives semiconductor evolution

- Sustainable Energy: Gallium’s role in solar cells supports global renewable energy initiatives

- Market Leadership: China’s dominant position influences global supply chains

- Strategic Partnerships: Industry collaborations accelerate product development and market expansion

Challenges to Overcome

However, there are also challenges that need to be addressed for the market’s future success:

- Developing sustainable extraction methods

- Implementing effective recycling programs

- Balancing geopolitical tensions affecting trade

- Advancing technological applications across industries

The projected CAGR of 22.7% signals strong investor confidence and market potential. As industries continue to embrace gallium-based solutions, the material’s significance in electronics, renewable energy, and medical applications will grow. The market’s evolution presents opportunities for both established players and new entrants to innovate and capture value in this expanding sector.

The gallium market’s growth reflects broader technological and environmental trends, positioning it as a crucial element in the future of sustainable technology development.

Global Gallium Market Report(Can Read by Free sample)–Table of Contents

Chapter 1:Gallium Market Analysis Overview

- Competitive Forces Analysis(Porter’s Five Forces)

- Strategic Growth Assessment(Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Gallium Market Segmentation Overview

Chapter 2:Competitive Landscape

- GlobalGallium Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3:Gallium Market Segmentation Analysis

- Key Data and Visual Insights

- Trends,Growth Rates,and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4:Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic,Demographic,and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5:Gallium Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends,Challenges,and Opportunities

Chapter 6:Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7:Gallium Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8:Key Findings and Recommendations

- Summary of Gallium Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the gallium market by 2025?

The gallium market is expected to experience rapid growth, reaching $2.91 billion by 2025, driven by increasing demand in the semiconductor and solar industries.

What are the key upstream and downstream processes in the gallium supply chain?

Upstream processes involve gallium extraction and refining, primarily in production regions like China and Japan. Downstream applications include its use in electronics and renewable energy sectors.

How does gallium contribute to the semiconductor and solar industries?

Gallium plays a critical role in semiconductor manufacturing, particularly in high-performance devices such as GaN transistors. Additionally, it is increasingly used in solar panels and photovoltaic cells to enhance efficiency.

What challenges does the gallium market face regarding resource availability?

The gallium market faces challenges related to resource scarcity, including ore grades and geopolitical restrictions. Environmental concerns also arise from traditional gallium production methods.

How do geopolitical factors influence gallium trade?

International trade policies significantly affect the flow of gallium between major producing countries like China and the United States. Geopolitical tensions can impact production regions, particularly due to China’s dominance in the market.

What are the major types of gallium products and their applications?

The main types of gallium compounds include Gallium Arsenide (GaAs) and Gallium Nitride (GaN), each with distinct properties. They are widely used across industries such as telecommunications and optoelectronics.