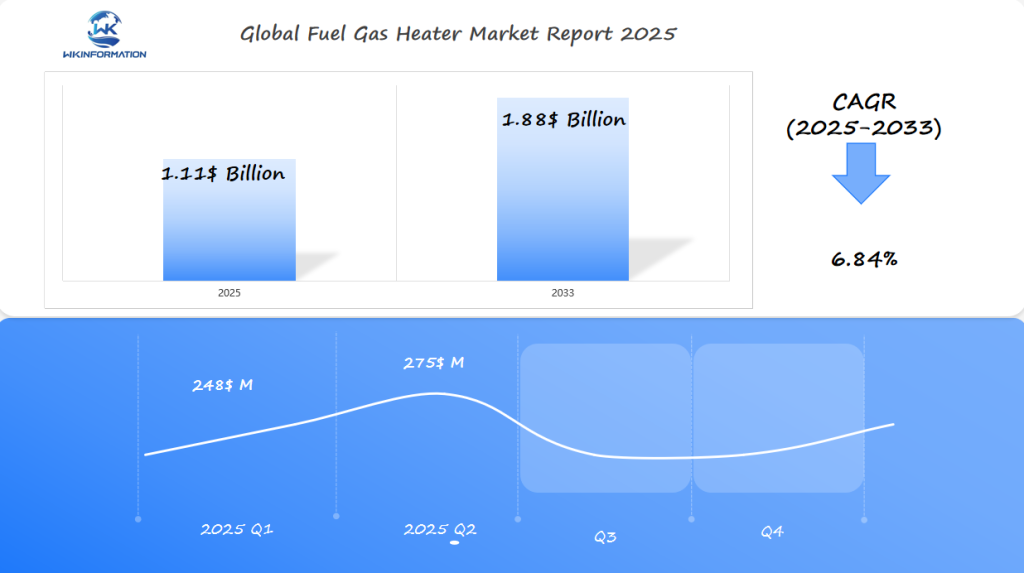

Fuel Gas Heater Market on Track to Reach $1.11 Billion by 2025: Strategic Growth Across the U.S., South Korea, and Saudi Arabia

Fuel Gas Heater Market projected to reach $1.11 billion by 2025, driven by strategic growth and technological advancements across the U.S., South Korea, and Saudi Arabia.

- Last Updated:

Fuel Gas Heater Market Sees Gradual Momentum in Q1 and Q2 2025

The Fuel Gas Heater market is expected to reach $1.11 billion in 2025, with a CAGR of 6.84% from 2025 to 2033. Revenue in Q1 2025 is projected at approximately $248 million, increasing to around $275 million in Q2.

This growth is supported by continued investments in power generation and petrochemical facilities where gas heating systems are critical. The market is also benefiting from retrofitting of aging energy infrastructure in industrial plants. The U.S., South Korea, and Saudi Arabia are key countries to monitor, with a strong focus on thermal efficiency, emissions reduction, and compliance with newer safety standards. Innovations in modular heater design and IoT-based performance monitoring are steadily reshaping supplier competition.

Understanding the Fuel Gas Heater Market in Energy Sectors

To understand the fuel gas heater market, we need to look at its upstream and downstream landscape across key energy sectors.

Upstream Landscape

The upstream landscape consists of various components and suppliers that contribute to the fuel gas heater market:

- Component manufacturing forms the backbone, with suppliers delivering burners, heat exchangers, control panels, and safety valves.

- Raw materials—primarily steel, advanced alloys, and refractory linings—are sourced from global metals markets.

- Engineering firms design bespoke systems for industrial clients, aligning heater performance with sector-specific requirements.

Downstream Applications

The downstream applications include industries that rely on fuel gas heaters for their operations:

- Oil & Gas: Refineries depend on fuel gas heaters for pre-heating process streams and maintaining optimal temperatures in pipelines.

- Power Generation: Combined-cycle plants utilize these heaters for gas turbine inlet heating and steam generation, ensuring efficiency under fluctuating loads.

- Industrial Manufacturing: Sectors such as chemicals, cement, and food processing employ fuel gas heaters for direct and indirect process heating.

Key Trends Driving Growth in the Fuel Gas Heater Market

1. Adoption of Smart Digital Controls for Precision Heating

The move towards smart digital controls in the fuel gas heater market is revolutionizing precision heating. These advanced systems enable real-time monitoring and adjustments, ensuring optimal temperature control and energy efficiency. With features like remote access and automated responses, smart digital controls cater to the growing demand for intelligent heating solutions.

2. Integration with Renewable Energy Sources

Fuel gas heaters are increasingly being integrated with renewable energy sources such as solar and wind power. This integration supports sustainability goals by reducing reliance on fossil fuels and lowering carbon emissions. Solar-assisted fuel gas heaters, for example, utilize solar panels to preheat gas, enhancing overall system efficiency and aligning with eco-friendly practices.

3. Modular and Scalable Heater Designs

The trend towards modular and scalable heater designs offers significant flexibility and efficiency benefits. Modular fuel gas heaters can be easily expanded or reconfigured to meet varying heating demands, making them ideal for diverse applications in industrial, commercial, and residential settings. This adaptability not only improves operational efficiency but also reduces installation and maintenance costs.

These technological trends highlight the dynamic evolution of the fuel gas heater market, driven by innovation and a commitment to sustainability.

Constraints include emissions regulation, safety compliance, and high retrofitting costs

Stringent emissions regulations continue to shape the evolution of fuel gas heater design. Manufacturers now face tighter limits on nitrogen oxides (NOx), carbon monoxide (CO), and particulate matter emissions. These requirements push for the integration of advanced combustion technology and low-emission burners, which can increase development complexity and cost.

Safety compliance stands as another critical market constraint. Regulatory bodies demand strict adherence to standards such as ASME, CSA, and ISO for pressure vessels, flame safeguards, and leak detection systems. You must ensure every installation passes rigorous inspection protocols—including emergency shutdown mechanisms—before commissioning. Any deviation risks legal liabilities and operational delays.

High retrofitting costs create clear economic barriers, especially in older facilities where legacy heating equipment dominates. Upgrading to modern fuel gas heaters often requires extensive piping modifications, new control systems, and sometimes structural changes to accommodate different heater footprints. These capital investments can deter operators from rapid adoption, particularly in regions with aging infrastructure or limited financial incentives.

Regulatory complexity combined with cost considerations continues to define how quickly new fuel gas heating solutions can penetrate established markets.

Geopolitical Strategies Influencing Natural Gas Heating Systems and Infrastructure Rollout

Government intervention remains a core driver in shaping the direction of the Fuel Gas Heater Market. National energy agendas in the U.S., South Korea, and Saudi Arabia directly impact how natural gas is sourced, distributed, and integrated into heating systems across industrial and commercial sectors.

1. United States:

Federal and state-level policies prioritize energy security and emission reduction. Programs such as the U.S. Department of Energy’s Clean Energy initiatives spur demand for efficient gas heating systems by offering incentives for infrastructure upgrades. The push for pipeline modernization further supports widespread adoption of advanced fuel gas heaters in both new builds and retrofits.

2. South Korea:

Energy diversification strategies place natural gas at the center of heating system upgrades. Large-scale investments target expansion of LNG import terminals and internal distribution networks. These efforts underpin government-backed incentives for cleaner gas-based heating, aligning with national ambitions to reduce greenhouse gases.

3. Saudi Arabia:

Vision 2030 emphasizes downstream investment, prompting significant capital allocation toward refining capacity and associated gas infrastructure. State-backed projects accelerate the rollout of high-efficiency fuel gas heaters, particularly within expanding petrochemical clusters and industrial parks.

Strategic investment in pipeline networks and distribution hubs enables rapid deployment of modern heating technologies. This integrated approach ensures reliable access to natural gas while supporting national goals for energy efficiency, emissions reduction, and economic development across key regions.

Type Analysis: Direct Fired, Indirect Fired, and Electric-Assisted Gas Heaters

1. Direct Fired Heaters

Direct fired heaters operate by combusting fuel gas directly within the heater’s chamber, transferring heat quickly and efficiently to process streams. These units are widely used in oil & gas extraction and refining, where immediate and robust heating is necessary for dehydration, regeneration, or boosting temperatures before further processing.

Typical advantages include low installation cost and straightforward operation, making them a go-to solution for remote sites or facilities prioritizing rapid deployment.

2. Indirect Fired Heaters

Indirect fired heaters use a heat transfer fluid—such as glycol or thermal oil—that is heated by combustion but kept separate from the process stream. This design eliminates direct contact between combustion products and the end fluid or gas.

Industrial settings favor indirect fired models for their ability to maintain precise temperature control, reduce contamination risks, and comply with stringent safety requirements. Applications include chemical processing plants, power generation stations, and locations handling sensitive materials where purity is non-negotiable.

3. Electric-Assisted Gas Heaters

Electric-assisted gas heaters blend traditional gas heating with electric elements to provide additional thermal input during peak demand or when tighter temperature regulation is needed.

These hybrid units support facilities undergoing decarbonization efforts or those integrating renewable energy into their operations.

| Common Applications Direct Fired Heaters | Fast response, simple setup | Oil & Gas fields, dehydration units |

| Indirect Fired Heaters | Enhanced safety, fluid separation | Chemical plants, power stations |

| Electric-Assisted Gas Heaters | Flexible output, supports decarbonization | Hybrid industrial systems, energy transition sites |

Each product type addresses distinct operational priorities—speed, safety, precision—enabling tailored solutions across varied industry needs.

Application Analysis: Role of Oil & Gas, Chemical, Power Generation, and Industrial Manufacturing Industries in Fuel Gas Heater Market Growth

Fuel gas heaters are crucial for various industries because they are efficient and dependable. The main areas where these heaters are used include:

Oil & Gas Heating

In the oil & gas sector, fuel gas heaters are critical for both extraction and refining activities. They maintain optimal temperatures for separating crude oil, improve the efficiency of natural gas processing facilities, and ensure smooth pipeline operations by preventing hydrate formation.

Chemical Industry Heaters

Chemical processing plants need precise temperature control to maintain product quality and process integrity. Fuel gas heaters provide consistent heat for different chemical reactions, supporting the production of polymers, petrochemicals, and specialty chemicals.

Power Generation Heating Solutions

Power generation plants depend on fuel gas heaters for effective temperature control. These heaters play a role in combined cycle power plants by preheating fuel gases, resulting in higher efficiency and lower emissions.

Industrial Manufacturing

In industrial manufacturing, fuel gas heaters find applications in various sectors such as metal processing and food production. They deliver reliable heat for drying processes, curing coatings, and maintaining controlled environments essential for producing high-quality products.

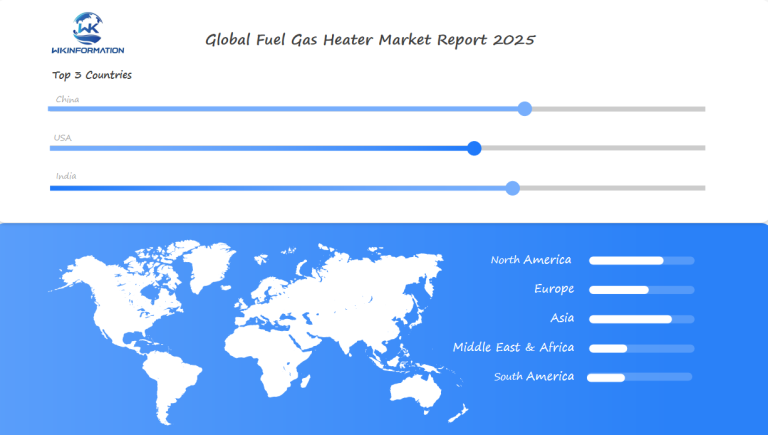

Regional Insights: Fuel Gas Heater Market Demand Across Major Energy-Consuming Regions

Global market insights indicate that the demand for fuel gas heaters is not evenly distributed. Regional market analysis reveals distinct consumption patterns driven by energy policies, industrial activity, and climate considerations.

1. Asia Pacific: The Dominant Player

Asia Pacific leads the global Fuel Gas Heater Market, accounting for the highest revenue share among energy-consuming regions. Rapid industrialization in China, Japan, and South Korea, combined with government incentives for cleaner energy infrastructure, underpins this dominance. The region’s manufacturing hubs and expanding petrochemical sectors consistently drive high uptake of both standard and advanced fuel gas heating systems.

2. Europe: A Growing Segment

Europe emerges as a fast-growing segment, propelled by stringent climate goals. The European Union’s aggressive decarbonization targets are pushing industries to adopt low-emission heating technologies. Demand is especially strong in Germany, France, and the Nordics where there is a focus on modernizing legacy energy systems with efficient fuel gas heaters.

3. North America: A Steady Market

North America maintains a significant share of the global market. The United States and Canada see robust demand from oil & gas extraction sites, chemical plants, and the power generation sector. Retrofit projects—driven by efficiency mandates and carbon reduction incentives—continue to shape purchasing trends in these markets.

U.S. Market Demand: Industrial Heating Retrofits and Smart Systems Leading the Way

The U.S. market demand for fuel gas heaters is rapidly increasing, mainly due to a rise in industrial heating retrofits and the implementation of smart heating systems in manufacturing, energy, and processing industries.

Key factors shaping this trend include:

- Aging Infrastructure: Many American industrial facilities use old heating equipment that no longer meets modern efficiency or emission standards. Upgrading these systems with advanced fuel gas heaters allows companies to follow new environmental regulations while lowering operational costs.

- Decarbonization Goals: States like California and New York are enforcing emission reduction targets, forcing industries to replace outdated boilers and burners with low-emission, high-efficiency gas heaters.

- Operational Reliability: Downtime caused by heating system failure can result in significant production losses. Retrofit projects often aim to improve system reliability and resilience by using the latest heater technology.

Smart temperature control technologies are rapidly transforming plant operations:

- Digital Controls & IoT Integration: Facilities now use heaters with advanced sensors, real-time monitoring, and automated modulation. This precision leads to better process control and measurable energy savings.

- Predictive Maintenance: Smart systems analyze usage data to predict potential failures before they happen, reducing maintenance costs and unplanned outages.

- Remote Access: Plant managers can now adjust settings or diagnose issues remotely through cloud-based platforms.

The adoption of these innovations puts U.S. industries at the forefront of efficient and sustainable heating management while quickly responding to regulatory and market pressures.

South Korea's Investment Focus: Hybrid Fuel Technologies and Decarbonized Heat Systems Driving Innovation in Fuel Gas Heaters Market

South Korea is actively investing in hybrid fuel technologies, combining gas and electric systems to enhance efficiency and sustainability. Government incentives are crucial in promoting the development of hybrid fuel gas-electric heaters. These incentives aim to encourage manufacturers to innovate and produce advanced heating solutions that meet strict environmental standards.

Reducing carbon emissions is a top priority for South Korea. The integration of advanced heat pumps plays a vital role in achieving this goal. Heat pumps are designed to use renewable energy sources, such as solar power, resulting in lower carbon emissions. By integrating these systems with traditional fuel gas heaters, South Korea is leading efforts toward decarbonized heating solutions.

Key Investment Focus:

- Hybrid fuel gas-electric heater development: Supported by government incentives, manufacturers are creating more efficient and eco-friendly heating systems.

- Advanced heat pump integration: Emphasizing the use of renewable energy sources, these systems help reduce carbon emissions.

South Korea’s strategic investments highlight its commitment to innovation in the fuel gas heater market. This focus on hybrid technologies and decarbonized systems positions the country as a leader in sustainable heating solutions.

Saudi Arabia's Strategy: Boosting Heater Installations to Meet Heating Needs in Oil Refining Sector And Downstream Processing Industry

Saudi Arabia is scaling up heater installations to address critical oil refining sector heating needs and ensure efficient downstream processing heat solutions. The nation’s aggressive refinery capacity expansions, including new projects and upgrades at facilities like Jazan and Jubail, demand advanced thermal management. Reliable fuel gas heaters are central to maintaining process consistency, optimizing product yields, and minimizing operational downtime.

Key drivers shaping the Fuel Gas Heater Market in Saudi Arabia:

1. Expansion of Oil Refinery Capacities

With investments aimed at increasing crude processing volumes and enhancing petrochemical integration, efficient heating equipment becomes a prerequisite. Modern fuel gas heaters deliver consistent heat for distillation, catalytic cracking, and hydroprocessing—core operations in refineries with growing throughput targets.

2. Adoption of Low-Emission Technologies

National energy diversification goals underscore the adoption of low-emission fuel gas heaters. Advanced combustion controls, improved burner designs, and integration with waste heat recovery systems support compliance with tightening emission standards set by the Kingdom’s Vision 2030 framework. These technologies enable refineries and downstream plants to meet both environmental requirements and operational cost objectives.

Saudi Arabia’s approach combines large-scale infrastructure investment with a clear mandate for sustainability-focused innovation. The result is a rapidly growing market for next-generation heater systems tailored for heavy industrial use, driving demand for proven providers in the Fuel Gas Heater Market.

Next-Generation Fuel Gas Heaters: A Look into Future Technologies Like Hydrogen Blending And Smart Metering Integration

Next-generation fuel gas heaters are starting to incorporate hydrogen blending technology, setting a new standard in emission reduction strategies. By mixing hydrogen into existing natural gas streams, manufacturers and utilities can achieve significant decreases in carbon dioxide output without the need for wholesale infrastructure overhaul. This approach leverages current pipeline networks and heater designs, making it a cost-effective path toward cleaner combustion. Utilities in Europe and Asia have already begun pilot projects that blend up to 20% hydrogen with natural gas, aiming to strike a balance between operational reliability and environmental impact.

Smart metering integration is another advancement transforming the fuel gas heater landscape. Intelligent metering systems now enable real-time monitoring of energy consumption, offering end-users and facility managers granular data on heater performance and efficiency. These systems support predictive maintenance by flagging anomalies before they escalate into costly failures. Utilities benefit from this technology through improved load forecasting and demand management, while industrial users can tailor heating cycles to production needs, minimizing wasted energy.

The convergence of these next-generation solutions is driving the fuel gas heater market toward lower emissions, higher efficiency, and greater operational intelligence. This momentum is expected to accelerate as policy incentives align with advancing technology capabilities.

Overall

Competitive Landscape: Analyzing Strategies And Technological Focus Among Global Fuel Gas Heater Providers

Global manufacturers in the Fuel Gas Heater Market are using a combination of competitive strategies and technological innovation to gain market share and drive growth.

- John Zink Hamworthy Combustion – United States

- Eclipse Inc. – United States

- Honeywell – United States

- Maxon Corporation – United States

- Eclipse Combustion – United States

- Precision Combustion, Inc. – United States

- Eclipse – United States

- Hauck Manufacturing Company – United States

- Coen Company – United States

- Fives Group – France

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key upstream and downstream components in the fuel gas heater market across energy sectors?

The fuel gas heater market’s supply chain involves upstream suppliers providing essential components and downstream consumers utilizing heaters in sectors such as oil & gas, power generation, and industrial manufacturing.

Which technological trends are driving growth in the fuel gas heater market?

Growth is propelled by digital temperature control for precision heating, integration with renewable energy sources like solar and wind, and modular, scalable heater designs enhancing flexibility and efficiency.

What constraints impact the development and deployment of fuel gas heaters?

Constraints include stringent emissions regulations affecting heater design, safety compliance requirements for operational standards, and high retrofitting costs associated with upgrading existing heating systems.

How do geopolitical strategies influence natural gas heating systems and infrastructure rollout?

Government policies in countries like the U.S., South Korea, and Saudi Arabia shape natural gas utilization through strategic investments in pipeline and distribution infrastructure, thereby affecting fuel gas heater market dynamics.

What types of fuel gas heaters are available, and what are their applications?

Fuel gas heaters come in direct fired, indirect fired, and electric-assisted types. Direct fired heaters are common for general heating needs; indirect fired heaters offer advantages in industrial settings due to safety and efficiency; electric-assisted heaters support hybrid applications.

How are regional markets like the U.S., South Korea, and Saudi Arabia advancing fuel gas heater technologies?

In the U.S., industrial heating retrofits combined with smart systems drive market demand. South Korea focuses on hybrid fuel technologies and decarbonized heat systems through government incentives. Saudi Arabia expands heater installations to meet oil refining sector needs aligned with energy diversification goals.