$7.86 Billion Frozen Fruit Market Heats Up in the U.S., Canada, and Brazil – 2025 Expansion & Industry Forecast

Explore an in-depth analysis of the global frozen fruit market, examining trends, market share, and comprehensive industry analysis from 2025 to 2033. This detailed report covers market dynamics, technological innovations, consumer preferences, and regional insights, highlighting the industry’s growth trajectory from USD 4.86 billion in 2025 to USD 7.14 billion by 2033. Learn about key market drivers, including health consciousness trends, convenience demands, and technological advancements in freezing methods, while understanding challenges and opportunities shaping this evolving sector.

- Last Updated:

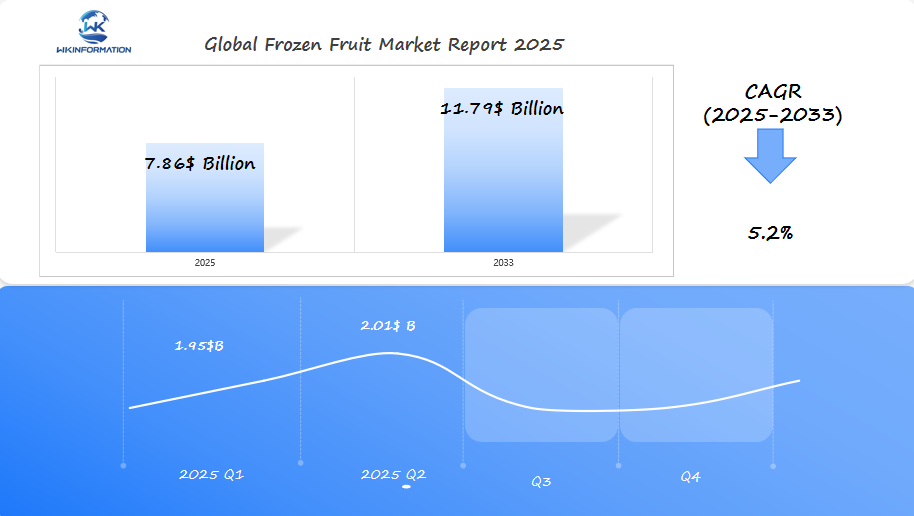

Frozen Fruit Market Q1 and Q2 2025 Forecast

The Frozen Fruit market is expected to reach $7.86 billion in 2025, with a CAGR of 5.2% from 2025 to 2033. In Q1 2025, the market is projected to generate approximately $1.95 billion, driven by the rising demand for healthy, convenient food options, increased frozen food consumption, and expanding retail distribution networks in the U.S., Canada, and Brazil. The growing popularity of smoothies, frozen fruit snacks, and plant-based diets is also supporting market growth.

By Q2 2025, the market is forecasted to reach $2.01 billion, supported by innovation in freezing technologies, the introduction of organic and exotic frozen fruit varieties, and e-commerce expansion. The U.S. remains a major market with high consumer preference for frozen berries and tropical fruits, Canada sees steady growth in retail and foodservice segments, while Brazil capitalizes on local fruit production and export demand.

With advancements in IQF (Individually Quick Frozen) technology, sustainable packaging solutions, and rising health-conscious consumption trends, the frozen fruit market will continue its upward trajectory.

The Frozen Fruit Market in 2025: Supply Chain Insights and Industry Shifts

The frozen fruit supply chain has undergone significant transformation, adapting to meet evolving market demands projected to reach $7.86 billion by 2025. This complex network encompasses multiple stages:

1. Harvesting & Processing

- Direct partnerships with farmers

- Immediate flash-freezing technology implementation

- Quality control measures at source

2. Storage & Distribution

- Temperature-controlled warehousing

- Strategic distribution centers

- Cold chain logistics management

Key industry players like Del Monte International and Nature’s Touch have established robust networks, integrating vertical supply chains to maintain product quality and market competitiveness. These companies control operations from farm sourcing to retail distribution, ensuring consistent supply year-round.

E-commerce has revolutionized traditional distribution methods, with direct-to-consumer frozen fruit sales experiencing a 35% growth in 2024. Companies now utilize:

- Advanced packaging solutions for home delivery

- AI-powered inventory management systems

- Mobile apps for seamless ordering

The shift toward digital platforms has prompted established players to adapt their infrastructure, incorporating:

- Smart warehousing solutions

- Last-mile delivery optimization

- Real-time tracking systems

This digital transformation has created new opportunities for market expansion while maintaining product integrity throughout the supply chain.

Emerging Consumer Trends Boosting Demand for Frozen Fruit

Modern lifestyles drive significant changes in food consumption patterns, with frozen fruits emerging as a practical solution for health-conscious consumers. The demand for convenient, nutritious options has sparked a 47% increase in frozen fruit purchases since 2020.

1. Convenience Foods Revolution

- Ready-to-blend smoothie packs gain popularity among busy professionals

- Pre-portioned fruit combinations save preparation time

- Extended shelf life reduces food waste and shopping frequency

2. Smoothie Culture Impact

- Home smoothie-making surges 68% year-over-year

- Instagram-worthy bowls fuel social media trends

- Subscription-based smoothie delivery services expand market reach

3. Diet-Specific Adaptations

- Vegan Movement: Frozen fruits serve as dairy-free smoothie bases

- Keto-Friendly Options: Low-carb berry selections support ketogenic lifestyles

- Paleo Preferences: Unsweetened frozen fruits align with ancestral eating

Consumer behavior data shows 73% of millennials prefer frozen fruits for their convenience and nutritional value. Health-conscious shoppers appreciate the ability to access out-of-season fruits year-round, maintaining consistent nutrient intake regardless of seasonal availability.

The rise of home cooking during recent years has positioned frozen fruits as pantry staples. Consumers integrate these versatile ingredients into breakfast bowls, baked goods, and homemade preserves, expanding usage beyond traditional applications.

Challenges in Production, Distribution, and Market Expansion for Frozen Fruit

The frozen fruit market faces significant hurdles despite its promising growth trajectory. A persistent challenge lies in consumer perception of nutritional value. Many buyers believe frozen fruits contain fewer vitamins and minerals compared to fresh alternatives – a misconception that contradicts scientific research showing frozen fruits often retain more nutrients due to rapid preservation methods.

Supply Chain Complexities:

- Seasonal fruit availability creates inventory management difficulties

- Weather-dependent harvesting periods affect consistent supply

- Storage capacity limitations during peak harvest seasons

- Variable fruit quality across different growing regions

Distribution Hurdles:

- Temperature control requirements throughout transportation

- High energy costs for cold storage facilities

- Last-mile delivery challenges for maintaining product integrity

- Complex customs clearance processes for international shipments

The logistics of frozen fruit distribution present unique challenges. Maintaining the cold chain from farm to consumer requires specialized equipment, trained personnel, and precise timing. A single break in temperature control can compromise entire shipments, leading to significant losses.

Storage facilities must operate at specific temperatures (-18°C or below) to maintain fruit quality. This requirement strains energy resources and increases operational costs, particularly in regions with unreliable power supplies or extreme climates.

Market expansion efforts also face resistance from traditional retail channels, which often prioritize fresh produce shelf space over frozen options. This space allocation challenge limits product visibility and accessibility to potential consumers.

How Global Trade and Geopolitical Factors Impact Frozen Fruit Supply

International trade agreements shape the frozen fruit market’s landscape through complex networks of regulations and partnerships. The United States-Mexico-Canada Agreement (USMCA) has created preferential trade conditions, reducing barriers and fostering increased frozen fruit trade between North American countries.

Trade Tensions and Their Effects on Frozen Fruit

Trade tensions between major economies directly affect frozen fruit availability and pricing:

- China-US trade disputes have led to increased tariffs on certain frozen fruit categories, pushing U.S. buyers to seek alternative suppliers

- Brexit has disrupted established EU-UK frozen fruit supply chains, creating new documentation requirements and delays

- Latin American political instability impacts production reliability in key growing regions

Recent Regulatory Changes

Recent regulatory changes have introduced new compliance requirements:

- Stricter food safety protocols

- Enhanced traceability systems

- Increased documentation for cross-border movement

Impact of the Russian-Ukrainian Conflict

The Russian-Ukrainian conflict has disrupted traditional European supply routes, forcing companies to:

- Develop alternative logistics pathways

- Build new supplier relationships

- Adjust pricing strategies to accommodate increased transportation costs

Tariff Structures and Their Influence

Tariff structures significantly influence market dynamics:

Current average tariffs on frozen fruits:

- EU: 10.5-14.4%

- USA: 4.5-7%

- China: 15-30%

These varying rates create competitive advantages for certain countries while limiting market access for others, directly impacting global frozen fruit trade flows and regional market development.

Categories of Frozen Fruit: A Breakdown of Market Segments

The frozen fruit market divides into distinct segments, each serving unique consumer needs and preferences. Here’s how the market breaks down:

1. Citrus Fruits

- Orange segments

- Lemon pieces

- Lime chunks

- Grapefruit sections

These fruits maintain their vitamin C content exceptionally well during the freezing process, making them popular choices for year-round consumption.

2. Tropical Fruits

- Mango chunks

- Pineapple pieces

- Papaya slices

- Dragon fruit

- Passion fruit

The tropical segment shows strong growth in North American markets, driven by increasing consumer interest in exotic flavors and nutritional diversity.

3. Berries – The Market Leader

- Strawberries

- Blueberries

- Raspberries

- Blackberries

Berries dominate the frozen fruit market with a 45% share, attributed to their:

- High antioxidant content

- Versatility in recipes

- Year-round demand for smoothies

- Extended shelf life compared to fresh berries

4. Stone Fruits

- Peaches

- Plums

- Cherries

- Apricots

These fruits retain their natural sweetness and texture particularly well in frozen form, making them popular for baking applications and desserts.

The nutritional profile of each segment plays a crucial role in consumer selection. Berries lead in antioxidant content, while tropical fruits offer unique vitamins and minerals less common in Western diets. Citrus fruits provide essential vitamin C, and stone fruits deliver beneficial compounds like beta-carotene and potassium.

Key Industry Applications Driving the Frozen Fruit Market Forward

The versatility of frozen fruits spans across multiple industry applications, creating diverse market opportunities. Food service establishments have embraced frozen fruits as cost-effective alternatives that maintain consistent quality year-round.

Culinary Applications

Frozen fruits are widely used in various culinary applications, including:

- Smoothie chains rely on frozen fruits for signature beverages

- Bakeries incorporate frozen fruits into pastries, muffins, and bread

- Ice cream manufacturers use frozen fruit pieces as premium mix-ins

- Food processors create fruit-based sauces and preserves

Food Service Industry Impact

The food service industry has seen a significant impact from the use of frozen fruits:

- Hotels and restaurants maintain steady supply for desserts

- Educational institutions use frozen fruits in meal programs

- Healthcare facilities incorporate them into dietary plans

- Catering services ensure year-round availability

Retail Market Integration

Frozen fruits have also made their way into the retail market:

- Ready-to-blend smoothie packs gain popularity

- Private label brands expand frozen fruit offerings

- Meal kit companies include frozen fruits in recipes

- Convenience stores stock single-serve portions

Innovation Trends

Several innovation trends are shaping the frozen fruit industry:

- Individual quick freezing (IQF) technology preserves texture

- Resealable packaging extends storage life

- Pre-portioned blends for specific recipes

- Mixed fruit combinations target specific health benefits

The adoption of frozen fruits in commercial kitchens has sparked new product development. Manufacturers now offer specialized cuts and blends designed for specific applications, from garnishes to purees. These innovations drive market growth while meeting evolving industry needs.

Global Frozen Fruit Market: Demand, Supply, and Growth Forecast

The global frozen fruit market shows different patterns in demand and supply across regions. Currently, North America is the leading market, accounting for 38% of global demand. This is mainly due to its well-established cold chain infrastructure and strong retail networks.

Regional Market Distribution 2024:

- North America: 38%

- Europe: 27%

- Asia Pacific: 22%

- Rest of World: 13%

The Asia Pacific region has the highest growth potential, with a projected compound annual growth rate (CAGR) of 7.8% through 2032. The expanding middle class in China and India, along with the increasing adoption of Western dietary habits, are driving this growth.

Supply Chain Analysis by Region:

- North America: Strong domestic production, established processing facilities

- Asia Pacific: Growing processing capabilities, increasing export focus

- Europe: Heavy reliance on imports, sophisticated distribution networks

Market projections indicate a significant increase in global demand, reaching $8.29 billion by 2032. This growth can be attributed to several factors:

- Rising health consciousness among consumers

- Expansion of retail freezer space in supermarkets and grocery stores

- Enhanced preservation technologies that extend the shelf life of frozen fruits

- Growing requirements of the food service industry

On the supply side, developments such as automated processing facilities and improved cold chain logistics are expected to play a crucial role in meeting this rising demand. These advancements are particularly important in emerging markets where production capabilities may need to catch up with consumer demand.

Overall, the global frozen fruit market is poised for significant growth in the coming years, driven by both demand and supply factors across various regions.

U.S. Frozen Fruit Industry: Consumer Trends and Market Performance

The U.S. frozen fruit sector commands a 35% share of the global market, positioning itself as a dominant force in the industry. This substantial market presence stems from sophisticated cold chain infrastructure and widespread retail distribution networks.

Purchasing Patterns in Frozen Fruit

American consumers display distinct purchasing patterns in the frozen fruit category:

- Health-conscious buying decisions drive 72% of frozen fruit purchases

- Convenience-seeking behavior influences 65% of consumer choices

- Price sensitivity affects 45% of purchasing decisions

Preferences for Specific Frozen Fruit Varieties

The U.S. market showcases strong preferences for specific frozen fruit varieties:

- Mixed berries (28% market share)

- Strawberries (24% market share)

- Tropical fruit blends (18% market share)

Shifts in Online Purchasing Patterns

Online purchasing patterns reveal significant shifts in consumer behavior:

- Direct-to-consumer sales grew by 156% since 2020

- Subscription-based frozen fruit delivery services saw 89% growth

- Mobile app purchases increased by 234% year-over-year

Health-Conscious Choices and Demographic Insights

Health-conscious Americans increasingly turn to frozen fruits as nutritious alternatives, with 78% of consumers citing nutritional preservation as a key factor in their purchase decisions. The market sees particular strength in demographic groups aged 25-40, who prioritize both health benefits and convenience in their food choices.

Spending Habits and Seasonal Trends

Recent data indicates U.S. consumers spend an average of $47 monthly on frozen fruits, with peak purchasing periods during summer months for smoothie preparation and winter months for baking applications.

Canada's Role in the Frozen Fruit Sector: Rising Demand and Supply Chain Evolution

Canada’s frozen fruit market has become an important part of the North American market, with an estimated value of $650 million in 2024. Its strategic location in global trade and strong cold chain infrastructure make Canada a key player in the frozen fruit industry.

Key Market Dynamics

- Canadian processors handle 90% of locally grown berries

- British Columbia leads production with 65% market share

- Quebec represents 20% of national frozen fruit processing

- Ontario contributes 15% to domestic production

Consumer Preferences in Frozen Fruit Consumption

Canadian consumers have specific preferences when it comes to frozen fruit:

- Berries are the top-selling category, accounting for 45% of the market share

- Mixed fruit blends follow at 30%

- Tropical fruits make up 25%

Advantages of the Canadian Frozen Fruit Sector

The Canadian frozen fruit sector has several advantages that contribute to its success:

- Advanced cold storage facilities

- Established relationships with U.S. distributors

- Strong food safety regulations

- Year-round supply capabilities

Shifts in Consumer Behavior and Market Demands

Recent changes in Canadian consumer behavior have had an impact on market demands:

- Home cooking has increased by 68% since 2020

- Smoothie consumption has risen by 42%

- Adoption of plant-based diets has grown by 35%

- Organic frozen fruit purchases have increased by 28%

Retailer Adaptation to Changing Consumer Preferences

In response to these changes, Canadian retailers have made adjustments to their offerings. They have expanded their frozen fruit sections and introduced private label options. Major grocery chains are now dedicating 20% more shelf space to frozen fruits compared to 2019, reflecting the growing interest among consumers in convenient and nutritious food choices.

Brazil's Position in the Global Frozen Fruit Market: Export and Domestic Growth

Brazil’s frozen fruit market has great potential for growth, with export values reaching $150 million in 2023. The country’s diverse climate zones allow for year-round production of tropical fruits, making Brazil an important supplier in the global frozen fruit trade.

Export Market Dynamics

- Mangoes lead Brazil’s frozen fruit exports at 35%

- Açaí berries capture 28% of export share

- Pineapple and papaya combined represent 20%

Strategic Market Advantages

- Advanced freezing technologies

- Cost-effective production methods

- Strong agricultural infrastructure

- Established trade relationships with EU and US markets

The domestic market also shows promising growth, driven by:

- Rising health consciousness among Brazilian consumers

- Increased adoption of smoothie culture

- Growing preference for convenient food options

- Expansion of retail frozen food sections

Local producers are adapting to meet this dual demand through:

- Investment in processing facilities

- Implementation of quality control measures

- Development of value-added products

- Sustainable farming practices

Brazilian frozen fruit producers are taking advantage of the country’s natural resources and agricultural expertise to satisfy both export demands and increasing domestic consumption. The growth of this sector reflects wider trends in global health food preferences while utilizing Brazil’s unique position as a leading producer of tropical fruits.

Frozen Fruit Market Outlook: Future Innovations and Growth Strategies

The frozen fruit market is experiencing a rise in new product developments and strategic growth initiatives. Companies are investing in advanced freezing technologies to preserve nutritional value and improve product quality.

Key innovations shaping the market include:

- Smart packaging solutions with temperature indicators

- Individual quick freezing (IQF) technology advancements

- Sustainable packaging materials

- AI-powered sorting and quality control systems

Organic Product Development

The organic frozen fruit segment presents significant growth potential. Market leaders are:

- Implementing regenerative farming practices

- Developing pesticide-free cultivation methods

- Creating certified organic product lines

- Establishing direct partnerships with organic farmers

Strategic Market Capture

Companies are adopting multi-faceted approaches to penetrate emerging markets:

- Localized product development tailored to regional tastes

- Digital marketing campaigns targeting health-conscious consumers

- Strategic partnerships with local distributors

- Investment in cold chain infrastructure

Technology Integration

Advanced technological solutions are transforming the industry:

- Blockchain implementation for supply chain transparency

- IoT sensors for temperature monitoring during transport

- Mobile apps for product traceability

- Automated processing and packaging systems

The market’s future depends on sustainable practices and technological integration. Companies investing in these innovations are likely to capture larger market shares and meet evolving consumer demands.

Competitive Analysis: Major Players in the Frozen Fruit Industry

- Dole plc – Dublin, Ireland

- Chiquita Brands International S.à.r.l. – Étoy, Switzerland

- Bonduelle S.A. – Villeneuve-d’Ascq, France

- Driscoll’s – Watsonville, California, USA

- Ardo – Ardooie, Belgium

- Hortex – Warsaw, Poland

- Earthbound Farm – San Juan Bautista, California, USA

- SunOpta Inc. – Eden Prairie, Minnesota, USA

- Titan Frozen Fruit – Santa Maria, California, USA

- Welch’s – Concord, Massachusetts, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Frozen Fruit Market Report |

| Base Year | 2024 |

| Segment by Type | · Blueberrues

· Cherries · Strawberries · Raspberries · Apples · Apricots · Peaches · Others |

| Segment by Application | · Direct Consumption

· Processing Consumption |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Frozen Fruit Market is set for significant change as it responds to shifting consumer demands and embraces technological advancements. Businesses must stay flexible, adapting to these changes by prioritizing sustainability, quality, and convenience. Looking ahead, industry trends will likely continue to be influenced by health-conscious consumers seeking organic options and innovative freezing methods like IQF. By aligning their strategies with these dynamics, companies can position themselves to capture a larger market share while meeting the expectations of environmentally-aware customers.

Global Frozen Fruit Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Frozen Fruit Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Frozen Fruit Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Frozen Fruitplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Frozen Fruit Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Frozen Fruit Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Frozen Fruit Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Frozen Fruit Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key players in the frozen fruit supply chain?

The frozen fruit supply chain includes various key players such as growers, processors, distributors, and retailers. Each plays a crucial role in ensuring the quality and availability of frozen fruits to consumers.

How are consumer trends influencing the demand for frozen fruit?

Emerging consumer trends indicate a growing demand for convenience foods and health-conscious choices, significantly boosting the popularity of frozen fruits. The rise of smoothie culture and dietary preferences like vegan, keto, and paleo diets further drive this demand.

What challenges does the frozen fruit market face in production and distribution?

The frozen fruit market faces several challenges including perceptions regarding nutritional value compared to fresh fruits, seasonal dependency affecting supply chains, and logistics issues that complicate distribution.

How do global trade and geopolitical factors impact the frozen fruit supply chain?

Global trade agreements can influence the availability of frozen fruits, while geopolitical tensions may affect sourcing from key regions such as Latin America. Additionally, tariffs and regulations play a significant role in shaping market dynamics.

What are the major categories within the frozen fruit market?

The frozen fruit market is segmented into various categories including citrus fruits, tropical fruits, and berries. Berries have emerged as a segment leader due to their popularity and nutritional benefits driving consumer preferences.

What innovations are expected to shape the future of the frozen fruit market?

Future innovations in the frozen fruit market may include organic product offerings and new culinary applications. Companies are likely to adopt strategies that focus on capturing emerging markets through product innovation and partnerships.