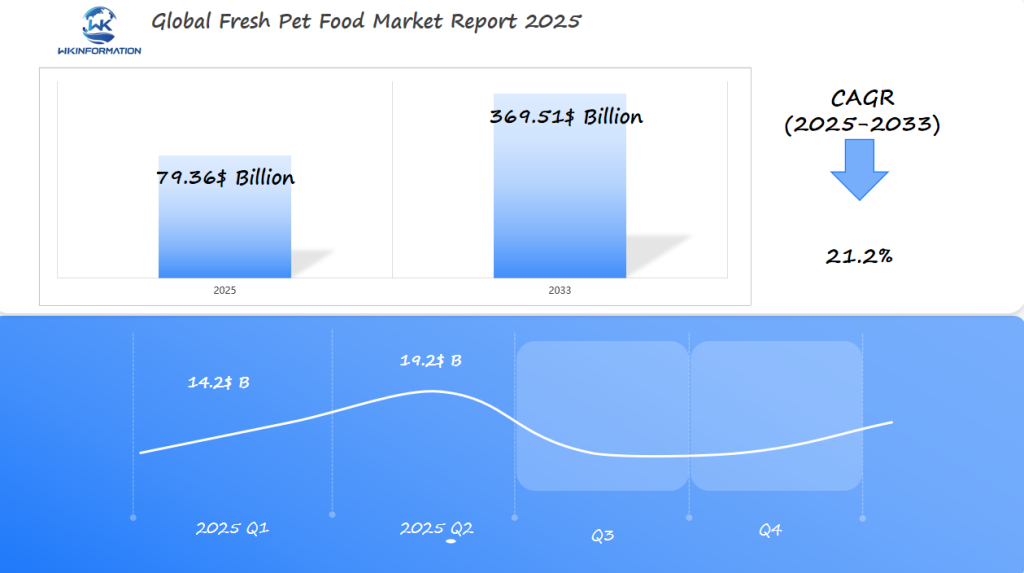

Fresh Pet Food Market on Track to Hit $79.36 Billion Globally by 2025: Surging Demand in the U.S., Canada, and Australia

Discover the latest trends and opportunities in the rapidly growing Fresh Pet Food Market. From market analysis to future strategies, explore key insights driving the $79.36 billion industry by 2025. Learn about pet nutrition, supply chain dynamics, regulatory challenges, and more.

- Last Updated:

Fresh Pet Food Market Q1 and Q2 2025 Performance Insights

The Fresh Pet Food market is expected to reach $79.36 billion by the end of 2025, with a remarkable CAGR of 21.2% from 2025 to 2033. Estimated revenue for Q1 is around $14.2 billion, with a significant increase to $19.2 billion in Q2. This growth pattern is attributed to the growing pet humanization trend and the increasing demand for healthier, organic food options for pets as the weather warms up and people are more inclined to purchase premium products for their pets during summer months.

The United States dominates the market, driven by the strong adoption of pets and rising consumer preference for high-quality, fresh food products for their animals. Canada follows closely, where pet owners increasingly seek high-protein, low-preservative foods as part of the growing focus on pet wellness. In Australia, a similar trend toward premium and fresh pet foods is emerging, largely influenced by the pet wellness movement and organic food growth.

Key Takeaways

- The global pet food market is expected to reach $79.36 billion by 2025.

- Increasing awareness of pet health and nutrition is driving market growth.

- The U.S., Canada, and Australia are leading the demand for fresh pet food.

- The market is driven by the rising demand for high-quality pet nutrition.

- Pet owners are seeking healthier options for their pets.

In-Depth Analysis of the Fresh Pet Food Market

A detailed examination of the fresh pet food market uncovers the complex workings of its supply chain, including raw material sourcing and delivery of the final product. This understanding is essential for assessing the overall health of the market and finding areas that need improvement.

The supply chain is the backbone of the fresh pet food industry, covering everything from obtaining raw materials to getting final products into the hands of consumers. It is crucial for all involved parties to grasp its intricacies.

Understanding the Supply Chain

The supply chain in the fresh pet food market involves multiple stages, including raw material sourcing, manufacturing, packaging, and distribution. Each stage plays a critical role in ensuring the quality and safety of the final product.

Raw Material Sourcing

Raw material sourcing is a critical component of the supply chain, as it directly impacts the quality of the final product. The fresh pet food industry relies heavily on high-quality ingredients, such as fresh meats, vegetables, and whole grains.

Key raw materials include:

- Fresh meats (e.g., chicken, beef, fish)

- Vegetables and fruits

- Whole grains

The sourcing of these materials must be done carefully to ensure they meet the required standards for pet consumption.

| Raw Material | Source | Quality Control Measure |

| Fresh Meats | Local farms and suppliers | Regular inspections and audits |

| Vegetables and Fruits | Local farmers and organic farms | Quality grading and testing |

| Whole Grains | Certified grain suppliers | Moisture content testing |

The table above illustrates the various raw materials used in the fresh pet food industry, their sources, and the quality control measures in place to ensure their integrity.

By understanding the supply chain and raw material sourcing, stakeholders in the fresh pet food market can better navigate the complexities of the industry and make informed decisions.

Trend Analysis: Innovations Transforming the Fresh Pet Food Industry

The fresh pet food industry is undergoing a significant transformation driven by emerging trends in pet nutrition and technological advancements.

The industry’s shift towards more nutritious and sustainable pet food options is driven by pet owners’ increasing awareness of their pets’ dietary needs.

Emerging Trends in Pet Nutrition

Pet nutrition is evolving, with a focus on personalized nutrition and sustainable ingredients. Pet owners are seeking products that cater to their pets’ specific needs, such as age, breed, and health conditions.

- Increased demand for natural and organic ingredients

- Growing popularity of raw and frozen pet food

- Rise of personalized nutrition plans for pets

Impact of Technology on Pet Food Production

Technology is changing the way pet food is produced, making it possible for manufacturers to create high-quality, safe, and nutritious products.

- Advanced food processing techniques

- Improved supply chain management

- Enhanced quality control measures

The impact of technology on pet food production can be seen in the following table:

| Technological Advancement | Impact on Pet Food Production |

| Advanced food processing techniques | Improved nutritional retention and safety |

| Improved supply chain management | Reduced risk of contamination and improved quality control |

| Enhanced quality control measures | Increased consumer trust and confidence in pet food products |

The fresh pet food industry is expected to continue evolving, driven by emerging trends in pet nutrition and technological advancements. As pet owners become increasingly discerning, manufacturers must adapt to meet their changing needs.

Challenges and Limitations in the Fresh Pet Food Market

Despite the rising demand for fresh pet food, the industry faces several obstacles. The growth of the fresh pet food market is influenced by various factors, including regulatory challenges and shifting consumer preferences.

Regulatory Challenges

The fresh pet food industry is subject to stringent regulations that vary across different regions. Compliance with these regulations is crucial for manufacturers to ensure the safety and quality of their products.

Regulatory challenges include obtaining necessary permits, adhering to food safety standards, and complying with labeling requirements. These challenges can be particularly daunting for small and medium-sized enterprises.

Consumer Perception and Preferences

Consumer perception plays a significant role in the fresh pet food market. Pet owners are becoming increasingly discerning about the ingredients, nutritional value, and production processes of pet food.

A key factor influencing consumer preferences is the growing demand for transparency and sustainability in pet food production. Manufacturers must adapt to these changing preferences by providing clear labeling and adopting environmentally friendly practices.

| Challenge | Description | Impact on Industry |

| Regulatory Compliance | Adhering to varying regional regulations | Increased operational costs |

| Consumer Preferences | Meeting demands for transparency and sustainability | Innovation in product labeling and production processes |

| Supply Chain Management | Managing the sourcing of high-quality ingredients | Enhanced quality control measures |

The fresh pet food market must navigate these challenges to continue its growth trajectory. By understanding and addressing regulatory challenges and consumer preferences, manufacturers can capitalize on the opportunities presented by the growing demand for fresh pet food.

Geopolitical Factors Affecting the Global Fresh Pet Food Supply

Geopolitical factors are important in determining the global fresh pet food supply. The complex interactions of international relations, trade agreements, and geopolitical tensions have a significant impact on the production, distribution, and availability of fresh pet food around the world.

Trade Policies and Their Impact

Trade policies are crucial in the global fresh pet food market. Tariffs, quotas, and trade agreements can either make it easier or harder for goods to move between countries. For example, if tariffs are imposed on imported pet food ingredients, production costs may rise, potentially leading to higher prices for consumers.

On the other hand, trade agreements that reduce or eliminate tariffs can make it more cost-effective for manufacturers to source ingredients globally, benefiting both producers and consumers. These policies have multiple effects, influencing not only the cost but also the availability and variety of fresh pet food products.

The Influence of Geopolitical Tensions

Geopolitical tensions can disrupt supply chains and impact the global supply of fresh pet food. Political instability, conflicts, and sanctions can interrupt the production and transportation of pet food ingredients, resulting in shortages and increased costs.

For instance, geopolitical tensions in regions that produce key pet food ingredients can create bottlenecks in the supply chain, making it difficult for manufacturers to maintain a steady supply of fresh pet food. This can ultimately affect consumer satisfaction and loyalty.

Potential Consequences of Geopolitical Factors

The global fresh pet food market must deal with these complicated geopolitical issues to ensure a stable supply of products. Here are some potential consequences:

- Disruptions in global supply chains due to geopolitical tensions.

- Increased costs associated with sourcing alternative ingredients.

- Potential shortages of specific fresh pet food products.

By understanding how trade policies and geopolitical tensions impact their industry, stakeholders can better prepare for possible disruptions and seize opportunities as they arise.

Type-Specific Market Analysis for Fresh Pet Food Products

The fresh pet food industry includes various products such as dog food and cat food, each with its own market characteristics.

It’s important for stakeholders who want to take advantage of the increasing demand for fresh pet food to understand these characteristics.

Dog Food vs. Cat Food

The dog food segment dominates the fresh pet food market, driven by the increasing number of dog owners and the humanization of pets.

Dog owners are willing to spend more on premium and healthy food options for their pets, fueling the growth of this segment.

In contrast, the cat food segment is also significant, with cat owners showing a preference for high-quality, nutrient-rich food.

The rise in cat ownership, particularly among younger demographics, has contributed to the expansion of this segment.

Other Pet Food Types

While dog and cat food are the largest segments, other pet food types, such as food for birds, fish, and small mammals, also contribute to the market.

These niche segments are gaining attention as pet owners become more aware of the nutritional needs of their pets.

Application-Driven Opportunities in the Fresh Pet Food Sector

Application-driven opportunities are transforming the fresh pet food industry. The sector is experiencing significant growth due to the increasing demand for fresh pet food products. This growth is driven by various applications, including online sales channels and specialty pet stores.

Online Sales Channels

The rise of e-commerce has significantly impacted the fresh pet food market. Online sales channels have become a crucial distribution method, offering convenience and a wider range of products to pet owners. This shift towards online shopping is driven by the increasing demand for premium and customized pet food products.

Specialty Pet Stores

Specialty pet stores are another significant application driving growth in the fresh pet food sector. These stores offer a curated selection of high-quality pet food products, catering to the specific needs of pet owners. Specialty pet stores provide personalized service and expert advice, enhancing the shopping experience for pet owners.

Regional Distribution Trends in the Fresh Pet Food Market

As the fresh pet food market expands, regional distribution trends are becoming increasingly important. The way pet owners access fresh pet food varies significantly across different regions, influenced by factors such as local preferences, regulatory environments, and logistical capabilities.

Regional Preferences

Regional preferences play a crucial role in shaping the distribution strategies for fresh pet food. For instance, in the United States, there’s a growing demand for online sales channels and home delivery services, driven by consumer convenience and the increasing popularity of e-commerce.

In contrast, European markets may exhibit different preferences, with a stronger emphasis on specialty pet stores and veterinary clinics as primary distribution channels. Understanding these regional nuances is essential for businesses aiming to expand their market share.

Despite the growing demand for fresh pet food, several distribution challenges persist. These include maintaining the cold chain to ensure product freshness, managing logistical complexities, and complying with regional regulations.

Key distribution challenges:

- Maintaining consistent refrigeration during transportation

- Navigating regional regulatory requirements

- Managing inventory levels to minimize waste

A detailed analysis of these challenges and regional preferences can be seen in the following table:

| Region | Preferred Distribution Channels | Major Challenges |

| North America | Online sales, specialty stores | Cold chain maintenance, regulatory compliance |

| Europe | Specialty pet stores, veterinary clinics | Logistical complexities, inventory management |

| Asia-Pacific | Online sales, traditional pet stores | Regulatory compliance, cold chain maintenance |

By understanding these regional distribution trends and challenges, businesses can develop targeted strategies to improve their market penetration and customer satisfaction.

U.S. Fresh Pet Food Market Dynamics and Future Potential

The U.S. fresh pet food market is experiencing significant growth, driven by increasing consumer demand for healthier pet options. This trend is supported by the rising awareness among pet owners about the benefits of fresh pet food, including improved health and well-being for their pets.

Market Size and Growth Rate

The U.S. fresh pet food market has seen a considerable increase in size over the past few years, with a growth rate that surpasses many other segments of the pet food industry.

The market size has expanded due to the rising demand for fresh, natural, and organic pet food products. According to industry reports, this trend is expected to continue, with projections indicating a substantial growth rate in the coming years. The increasing preference for premium pet food products is a key driver of this growth.

Competitive Landscape

The U.S. fresh pet food market is characterized by a competitive landscape, with numerous players competing for market share. Key companies are focusing on product innovation and strategic partnerships to enhance their market presence.

Companies are responding by diversifying their product portfolios and investing in marketing campaigns to educate consumers about the benefits of fresh pet food.

By analyzing the market size, growth rate, and competitive landscape, it’s clear that the U.S. fresh pet food market has significant potential for future growth. As consumers continue to prioritize their pets’ health and well-being, the demand for fresh pet food is likely to increase.

Canada’s Growing Influence in the Fresh Pet Food Industry

Canada is becoming an important player in the global fresh pet food industry. The country’s pet food market is driven by a growing number of pets and increasing consumer awareness about pet health and nutrition.

The Canadian pet food market is experiencing a significant shift towards fresh pet food, driven by consumer demand for high-quality and nutritious products. This trend is expected to continue, fueled by the growing awareness of the importance of pet health and wellness.

Market Trends

The fresh pet food market in Canada is characterized by several trends, including the increasing popularity of online sales channels and the growing demand for natural and organic products. Online sales channels are becoming increasingly important, with many consumers preferring the convenience of online shopping.

Another significant trend is the growing demand for customized pet food, with pet owners seeking products tailored to their pets’ specific needs and preferences.

Opportunities for Growth

The Canadian fresh pet food market presents several opportunities for growth, including the expansion of online sales channels and the development of new products that cater to the specific needs of Canadian pet owners.

| Market Segment | Growth Rate | Opportunities |

| Dog Food | 8% | Expansion of online sales channels |

| Cat Food | 7% | Development of new products |

| Other Pets | 5% | Increasing awareness about pet health |

Canada Pet Food Market Trends

The growth opportunities in the Canadian fresh pet food market are significant, driven by the increasing demand for high-quality and nutritious products. As the market continues to evolve, companies that adapt to changing consumer preferences and trends are likely to succeed.

Australia’s Fresh Pet Food Market: Growth and Innovations

Innovative products are driving the growth of Australia’s fresh pet food market, catering to the evolving needs of pet owners. The market is witnessing a significant shift towards premium and natural pet food products.

Market Overview

The Australian fresh pet food market is characterized by a growing demand for healthy and nutritious pet food. Pet owners are increasingly seeking out products that are made from natural ingredients and are free from preservatives and additives.

The trend towards pet humanization is also driving the market, with pet owners willing to spend more on premium products that enhance the health and wellbeing of their pets.

Innovative Products

Some of the innovative products in the Australian fresh pet food market include fresh frozen pet food and raw pet food. These products are gaining popularity due to their perceived health benefits.

Another trend is the rise of customized pet food, where products are tailored to the specific needs of individual pets.

| Product Type | Market Share | Growth Rate |

| Fresh Frozen Pet Food | 30% | 10% |

| Raw Pet Food | 25% | 12% |

| Customized Pet Food | 15% | 15% |

The market is expected to continue growing, driven by consumer demand for innovative and healthy pet food products.

Future Development Strategies for the Fresh Pet Food Market

To take advantage of the growing trend, fresh pet food companies are looking into different strategies to expand their market and come up with new products. The rising popularity of fresh pet food has led to a competitive environment where businesses need to come up with new ideas to get noticed.

Market Expansion Strategies

Effective market expansion is crucial for companies looking to increase their market share in the fresh pet food industry. This can be achieved through several strategies:

- Geographic expansion into new regions

- Targeting new customer segments

- Enhancing distribution channels

Geographic Expansion

Geographic expansion allows companies to tap into new markets, both domestically and internationally. For instance, companies can explore emerging markets where pet ownership is on the rise.

Targeting New Customer Segments

Targeting new customer segments involves understanding the needs of different pet owners and tailoring products accordingly. This could include products for pets with specific dietary needs or preferences.

Enhancing Distribution Channels

Improving distribution channels is essential for reaching a wider audience and making fresh pet food products more accessible. Companies can explore partnerships with retailers, online platforms, and other distribution networks to expand their reach.

Product Innovation as a Growth Driver

Product innovation is a key driver of growth in the fresh pet food market. Companies are investing in research and development to create new and innovative products that meet the evolving needs of pet owners.

This includes developing products with novel ingredients, improving nutritional content, and enhancing product convenience. For example, companies are introducing fresh pet food products that are made with sustainable and eco-friendly ingredients.

A notable trend is the incorporation of personalization in pet food, where products are tailored to the specific needs, health conditions, and preferences of individual pets.

Competitive Strategies and Key Players in the Fresh Pet Food Market

To take advantage of the growing trend, fresh pet food companies are looking into different strategies to expand their market and come up with new products. The rising popularity of fresh pet food has led to a competitive environment where businesses need to come up with new ideas to get noticed.

Key Players:

Freshpet, Inc. – United States

Nestlé Purina PetCare (Fresh lines under Purina) – Switzerland

The Farmer’s Dog – United States

Nom Nom (a brand of Mars, Inc.) – United States

JustFoodForDogs – United States

Spot & Tango – United States

Butternut Box – United Kingdom

PetPlate – United States

Ollie Pets Inc. – United States

Nature’s Menu Ltd. – United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Fresh Pet Food Market Report |

| Base Year | 2024 |

| Segment by Type | ·Dog Food

·Cat Food ·Other Pet Food |

| Segment by Application | ·Online Sales Channels

·Specialty Pet Stores |

| Geographies Covered | ·North America (United States, Canada)

·Europe (Germany, France, UK, Italy, Russia) ·Asia-Pacific (China, Japan, South Korea, Taiwan) ·Southeast Asia (India) ·Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Fresh Pet Food Market is growing rapidly, thanks to a greater understanding of pet health and nutrition. As discussed earlier, several factors are driving this growth, such as new developments in pet nutrition and expanding market opportunities.

Global Fresh Pet Food Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Fresh Pet Food Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Fresh Pet Food Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Fresh Pet Food Players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Fresh Pet Food Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Fresh Pet Food Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Fresh Pet Food Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Fresh Pet Food Market Insights

Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is driving the growth of the Fresh Pet Food Market?

The growth of the Fresh Pet Food Market is driven by increasing awareness of pet health and nutrition, particularly in countries like the U.S., Canada, and Australia.

What is the projected value of the Fresh Pet Food Market by 2025?

The Fresh Pet Food Market is projected to hit $79.36 billion globally by 2025.

What are the key factors affecting the global supply of fresh pet food?

Geopolitical factors, including trade policies and tensions, significantly impact the global supply of fresh pet food.

How is technology influencing the Fresh Pet Food Industry?

Technology is transforming the Fresh Pet Food Industry by improving production processes and driving innovations in pet nutrition.

What are the major challenges faced by the Fresh Pet Food Market?

The Fresh Pet Food Market faces regulatory challenges, changing consumer perceptions, and preferences.

How is the Fresh Pet Food Market segmented?

The Fresh Pet Food Market can be segmented based on the type of pet food, including dog food and cat food, and by application-driven opportunities such as online sales channels and specialty pet stores.

What are the opportunities for growth in the U.S. Fresh Pet Food Market?

The U.S. Fresh Pet Food Market has opportunities for growth due to increasing demand and a competitive environment.

How is Canada influencing the Fresh Pet Food Industry?

Canada is becoming an important player in the Fresh Pet Food Industry, driven by market trends and opportunities for growth.

What is the current situation of Australia’s Fresh Pet Food Market?

Australia’s Fresh Pet Food Market is experiencing growth, driven by innovations and changing consumer preferences.

What strategies should companies adopt to capitalize on the growing demand in the Fresh Pet Food Market?

Companies should adopt effective development strategies, including market expansion strategies and product innovation, to capitalize on the growing demand.

What are the distribution challenges in the Fresh Pet Food Market?

Regional distribution trends and challenges play a crucial role in the Fresh Pet Food Market, impacting regional preferences and market dynamics.