Forklift Tracking in Warehouse Market Projected to Reach $422.17 Million by 2025 Globally: Logistics Optimization in the U.S., Germany, and Japan

The forklift tracking in warehouse market is experiencing rapid growth, projected to reach $422.17 million by 2025. This surge is driven by the increasing demand for warehouse automation and logistics optimization. In warehouse operations, the significance of forklift tracking cannot be overstated. Real-time location data, provided by technologies such as RFID, Bluetooth®, and Ultra Wideband (UWB), plays a crucial role in enhancing efficiency. These systems help improve productivity, optimize routes, reduce maintenance costs, and ensure staff safety.

- Last Updated:

Forklift Tracking in Warehouse Market Forecast for Q1 and Q2 2025

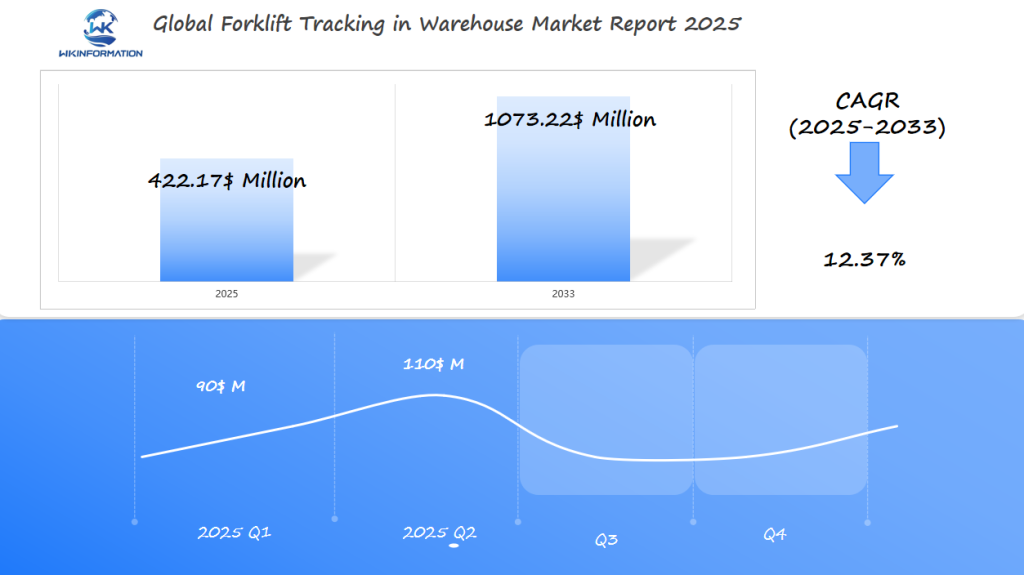

The Forklift Tracking in Warehouse market is projected to reach $422.17 million in 2025, demonstrating a strong CAGR of 12.37% through 2033. The Q1 2025 market is estimated at about $90 million, with gradual adoption influenced by warehouse modernization projects and budget cycles. In Q2, the market is expected to expand rapidly to nearly $110 million, driven by growing emphasis on warehouse safety, asset utilization, and real-time operational analytics. The U.S., Germany, and Japan lead this market due to their advanced logistics infrastructure, technological innovation, and high labor cost environments encouraging automation. These countries are critical benchmarks for early 2025 market uptake and technology deployment.

The global forklift tracking market is poised for significant growth, projected to reach $422.17 million by 2025, driven by the escalating demand for warehouse automation and logistics optimization. Advanced tracking technologies such as RFID, Bluetooth®, Ultra Wideband (UWB), IoT integration, and AI-powered insights are central to enhancing operational efficiency, safety, and predictive maintenance in warehouses. Regional market dynamics, stringent safety regulations, data security concerns, and geopolitical factors influence the adoption and deployment of these systems. Leading industry players like Toyota Material Handling and KION Group are spearheading innovation with robust hardware and cloud-based fleet management solutions. The ongoing transition to electric forklifts and the integration of robotics further position forklift tracking as a critical component in shaping future-ready, smart warehousing ecosystems globally.

Upstream and Downstream Ecosystem of Forklift Tracking Solutions

The forklift tracking ecosystem relies on a network of specialized players, each contributing distinct components and capabilities to deliver end-to-end solutions for modern warehouses.

Key Components:

- Hardware Manufacturers: Suppliers develop core devicessuch as RFID tags , UWB modules, Bluetooth® beacons, proximity sensors, and GPS units. These devices gather real-time data on forklift position, movement, and operational status.

- Software Developers: Fleet management platforms process incoming hardware data for actionable insights. Cloud-based dashboards enable route optimization, utilization monitoring, predictive maintenance scheduling, and compliance reporting.

- Telematics Providers: Specialists like Powerfleet integrate hardware with advanced telematics systems for seamless data transmission, connectivity, and analytics. They play a crucial role in merging sensor data with enterprise resource planning (ERP) or warehouse management systems (WMS).

Role of Manufacturers & Technology Integrators:

Manufacturers design forklifts compatible with tracking technologies while technology integrators ensure interoperability between new and existing infrastructure. These partners often customize deployments based on warehouse layouts or operational requirements.

End-User Industries:

Warehousing companies, third-party logistics providers (3PLs), manufacturers with large-scale material handling needs, and e-commerce fulfillment centers form the primary user base. These end-users benefit from improved asset utilization, reduced downtime, safer operations, and real-time visibility across their fleets.

The forklift tracking ecosystem’s strength lies in its collaborative structure—hardware innovators, software developers, telematics providers, and logistics operators work together to drive continuous improvement in warehouse performance. This collaboration also extends to the implementation of essential metrics and KPIs for manufacturers which are vital for evaluating performance and driving strategic decision-making in areas such as operational efficiency and cost managementMetrics & KPIs for Manufacturers.

Key Trends in Warehouse Automation and Tracking Technologies

Warehouse automation is increasingly shaped by the deployment of advanced tracking technologies, with RFID, Bluetooth®, and Ultra Wideband (UWB) leading the charge. These systems deliver real-time visibility into forklift locations and inventory movement, allowing you to pinpoint assets with a high degree of accuracy—critical for reducing lost time and improving workflow efficiency.

Advanced Tracking Technologies

The following tracking technologies are revolutionizing warehouse operations:

- RFID tags: Commonly embedded on pallets and forklifts, enabling seamless asset identification without line-of-sight requirements.

- Bluetooth® beacons: Providing cost-effective proximity detection, ideal for zone-based monitoring within busy warehouse aisles.

- UWB technology: Surpassing traditional options for precise indoor location tracking, making it suitable for large-scale facilities where real-time accuracy is non-negotiable.

IoT Integration and Predictive Maintenance

IoT integration has become standard in modern forklift tracking systems. Sensors feed operational data into centralized platforms, supporting predictive maintenance by alerting you before breakdowns occur. This not only minimizes downtime but also extends equipment lifespan.

AI-Powered Insights

AI-powered fleet management tools analyze large data sets from these connected devices. You gain actionable insights into operator behavior, equipment utilization, and route optimization—each contributing to higher productivity and lower operational costs.

Transition to Electric Forklifts

The transition to electric forklifts powered by lithium-ion batteries also marks a significant shift. These vehicles offer longer run times, faster charging cycles, and reduced emissions, aligning with both sustainability goals and the demand for lower total cost of ownership in warehouse operations.

Restrictions Influencing Forklift Tracking System Deployment

Impact of Safety Regulations

Safety regulations significantly influence the deployment pace of forklift tracking systems in warehouses. Compliance with stringent workplace safety standards often requires additional investments and modifications to existing infrastructure, which can delay implementation. These regulations, while necessary for employee well-being, can create barriers that slow down the adoption process.

Data Security and Privacy Concerns

Deploying forklift tracking solutions entails handling large volumes of data, raising concerns about data security and privacy. Ensuring that sensitive information is protected from breaches and misuse is paramount. This involves robust cybersecurity measures and adherence to privacy laws, such as those outlined in this resource on Artificial Intelligence and privacy issues, which can complicate system deployment.

Technological Barriers

Several technological factors hinder the widespread adoption of forklift tracking systems:

- Infrastructure Compatibility: Older warehouse setups may require significant upgrades to be compatible with advanced tracking technologies such as RFID or IoT-enabled sensors.

- Cost Considerations: High initial costs for installation and ongoing maintenance of these systems can be prohibitive for many businesses, especially smaller operations.

These barriers highlight the challenges faced by companies attempting to optimize logistics through forklift tracking solutions in the warehouse market.

Geopolitical Factors Impacting Supply Chains for Forklift Tracking Solutions

Geopolitical influence on supply chains is reshaping sourcing, manufacturing, and distribution for forklift tracking systems. Changes in global trade policies directly affect the availability of critical components, such as semiconductors, RFID tags, and IoT sensors—many of which are sourced from regions with fluctuating diplomatic ties or subject to export controls.

1. Global Trade Tensions

Tariff hikes, sanctions, and supply chain disruptions triggered by U.S.-China trade disputes or regional conflicts often result in delays and increased costs for hardware procurement. These hurdles can slow down the rollout of new forklift tracking projects, particularly when manufacturers rely on a globalized component supply network.

2. Regional Industrial Growth

Asia Pacific stands out due to robust manufacturing output and booming e-commerce sectors. Countries like China, South Korea, and India continue to expand their warehousing infrastructure. This rapid growth drives up demand for advanced forklift tracking solutions while also encouraging local production of components—a trend that can buffer against some geopolitical risks.

A dynamic geopolitical landscape means logistics companies must adapt sourcing strategies quickly to maintain operational continuity in their forklift tracking deployments.

Trade policies affecting the forklift tracking market will remain a key variable as regional blocs adjust tariffs and tech transfer rules. Companies invested in resilient supply chains often diversify suppliers across multiple regions to hedge against sudden policy shifts or bottlenecks. This approach ensures steady access to high-quality tracking technology even during times of international uncertainty.

Type Segmentation: RFID, GPS, and Sensor-Based Tracking Systems in Forklift Tracking Solutions

RFID Technology for Asset Identification in Forklifts

RFID tracking systems for forklifts are increasingly popular due to their ability to provide real-time data on asset location and status. Utilizing radio frequency identification tags, these systems offer several advantages:

- Enhanced Inventory Accuracy: RFID technology ensures precise tracking of inventory, reducing errors and improving warehouse efficiency.

- Real-Time Location Data: The ability to monitor forklift movements in real-time helps optimize routes and boost productivity.

- Ease of Integration: RFID systems can be seamlessly integrated with existing warehouse management systems (WMS), making implementation straightforward.

GPS-Based Monitoring in Warehouse Environments

In large-scale or outdoor warehouse settings, GPS-based monitoring is essential for accurate positioning and efficient fleet management. Key benefits include:

- Wide Coverage Area: GPS tracking systems are ideal for expansive environments where traditional indoor technologies may fall short.

- High Precision: Accurate positioning capabilities enable effective monitoring of forklift utilization and movement patterns.

- Operational Efficiency: By providing real-time location data, GPS systems facilitate efficient route planning and resource allocation.

Both RFID and GPS-based tracking solutions play a critical role in enhancing operational efficiency, ensuring safety, and optimizing logistics within warehouses. Additionally, the integration of warehouse automation technologies can further streamline operations and improve overall productivity.

Application Analysis: Enhancing Warehouse Operations with Forklift Tracking Systems

Forklift tracking solutions play a crucial role in improving warehouse operations. By using advanced technologies, these systems greatly increase productivity through efficient route planning and resource allocation.

1. Efficient Route Planning

Forklift telematics applications in logistics optimization allow for precise tracking of forklift movements within the warehouse. This data enables warehouse managers to design optimal routes, reducing travel time and fuel consumption. Efficient routing minimizes congestion and ensures quicker turnaround times.

2. Resource Allocation

Real-time data on forklift locations helps in better allocation of resources. Managers can assign tasks based on the proximity of forklifts to the required location, ensuring swift handling of goods and materials.

Real-time monitoring and management of fleet operations are other critical benefits provided by forklift tracking systems.

3. Real-Time Monitoring

Continuous visibility into the fleet’s status allows managers to monitor forklift usage patterns, identify idle times, and address inefficiencies promptly. This real-time insight is invaluable for maintaining optimal operational flow.

4. Fleet Management

Advanced tracking solutions facilitate comprehensive fleet management by providing detailed analytics on forklift performance, maintenance schedules, and operator behavior. Predictive maintenance features help prevent unexpected breakdowns, reducing downtime and maintenance costs.

By integrating these technologies, warehouses can achieve significant improvements in logistics efficiency and overall operational effectiveness.

Understanding Forklift Tracking Adoption in Different Regions: A Closer Look at the U.S., Germany, and Japan

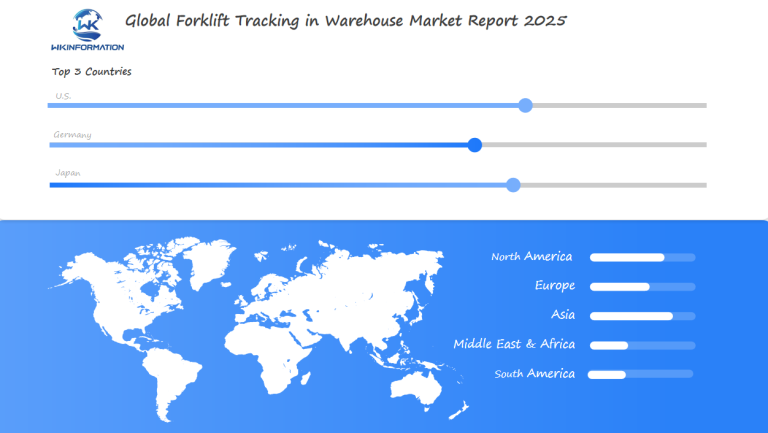

Forklift telematics adoption rates vary across regions due to different industrial priorities and market drivers:

North America (U.S.)

The U.S. is leading the world in adopting forklift tracking systems. This is mainly because of strict safety regulations and a focus on being open about operations. Advanced logistics hubs in the U.S. regularly use cutting-edge technologies like telematics, Internet of Things (IoT) integration, and real-time tracking as part of their standard procedures. To stay competitive, large distribution centers require strong fleet management solutions.

Europe (Germany)

Germany has a well-established logistics industry that places great importance on smoothly incorporating digital technologies. The government’s extensive support for Industry 4.0 initiatives is speeding up the implementation of systems such as RFID, Ultra-Wideband (UWB), and sensors in warehouses. The region’s complex transportation networks and economy driven by exports necessitate having real-time visibility of assets for both compliance purposes and improving efficiency.

Asia Pacific (Japan)

The rapid growth of e-commerce in the Asia Pacific region, particularly in countries like China and Japan, is creating a significant need for advanced tracking technologies. Warehouses in Japan are focusing on automation and precision by utilizing RFID and artificial intelligence (AI) powered analytics to streamline the movement of materials. Additionally, there is a growing emphasis on labor efficiency which is leading to increased investment in intelligent forklift telematics.

Here are some key trends we can observe:

- North America prioritizes following regulations and fostering innovation.

- Europe takes advantage of government policies and strives for excellence in logistics.

- Asia Pacific benefits from the ongoing digital transformation driven by the expansion of e-commerce.

The speed and depth at which forklift tracking solutions become integrated into each market are influenced by various factors such as economic conditions, cultural attitudes towards adopting technology, and the structure of industries involved.

U.S. Warehouse Tracking Market Developments: Driving Forces Behind Telematics Adoption

Forklift telematics market trends in the U.S. are influenced by a combination of regulatory requirements and operational needs. The Occupational Safety and Health Administration (OSHA) and other federal agencies enforce strict safety standards for warehouse operations, motivating companies to deploy advanced telematics systems for their forklift fleets.

1. Regulatory pressure

U.S.-based warehouses face intense scrutiny over workplace incidents involving forklifts. Real-time telematics solutions allow for continuous monitoring of operator behavior, ensuring compliance with speed limits, seat belt usage, and safe driving practices. Automated alerts and data logs help managers respond quickly to unsafe actions, reducing the risk of costly violations or accidents.

2. Insurance incentives

Many insurance providers offer reduced premiums for facilities using telematics-enabled forklifts due to lower incident rates and improved risk management. This financial incentive accelerates adoption among large distribution centers and third-party logistics providers.

3. Operational visibility

U.S. companies leverage forklift tracking data to optimize shift schedules, monitor equipment utilization, and identify bottlenecks in high-traffic areas. Integration with warehouse management systems (WMS) delivers actionable insights on fleet efficiency and maintenance needs.

4. Data-driven safety training

Incident analytics from telematics platforms inform targeted training programs, focusing on high-risk behaviors or specific teams. This approach not only improves compliance but also supports a proactive safety culture.

Large players like Powerfleet, Crown Equipment, and Raymond are setting benchmarks by embedding IoT sensors, RFID tags, and cloud connectivity across their U.S. product lines. These advances reinforce the role of telematics in shaping safer, smarter warehouse environments nationwide.

Germany’s Advanced Logistics Infrastructure Supporting Growth: A Catalyst for Forklift Tracking Innovation

Germany’s position as a leader in logistics technology advancement is crucial for the forklift tracking market in warehouses. The country’s strong logistics network allows for smooth integration between forklifts and advanced tracking systems like IoT-enabled sensors or cloud-based platforms.

How Germany’s Advanced Infrastructure Supports Forklift Tracking Innovation

Germany’s advanced infrastructure supports these innovations by providing:

- Reliable Connectivity: Essential for real-time tracking and communication between devices.

- High-Tech Manufacturing Capabilities: Ensures the production of cutting-edge forklift tracking solutions tailored to meet diverse industry needs.

- Government Support: Encourages technological adoption through incentives and regulations aimed at enhancing warehouse efficiency.

The Impact of IoT-Enabled Sensors and Cloud-Based Platforms

The integration of these technologies in Germany’s logistics sector drives operational excellence, making it a catalyst for forklift tracking innovation globally.

1. IoT-Enabled Sensors

These sensors offer real-time data on forklift location, operational status, and maintenance needs. This ensures that logistics operations can be optimized with minimal downtime.

2. Cloud-Based Platforms

Utilizing cloud technology allows for efficient data storage and access, enabling instant updates and analytics that enhance decision-making processes within warehouses.

Japan’s Focus on Automation and Forklift Tracking Integration: Paving the Way for Future-Ready Warehouses

Japan’s commitment to robotics-driven warehouse automation is evident in its strategic approach to integrating robotics with advanced telematics solutions. This combination results in smart, self-optimizing warehouses capable of handling complex tasks autonomously.

1. Robotics Integration

Japan leverages cutting-edge robotics technology to enhance forklift operations, ensuring precise and efficient material handling. Robots equipped with AI and machine learning algorithms perform tasks such as loading, unloading, and transporting goods with minimal human intervention.

2. Sophisticated Telematics Solutions

Forklift tracking systems in Japan utilize technologies like RFID, Bluetooth®, and UWB to provide real-time location data and operational insights. These systems enable seamless communication between forklifts and warehouse management systems (WMS), optimizing routes and improving inventory accuracy.

3. Smart Warehouses

The integration of IoT-enabled sensors and cloud-based platforms allows for real-time monitoring and predictive maintenance of forklifts. This ensures reduced downtime and enhanced operational efficiency.

4. Autonomous Operations

By combining robotics with sophisticated telematics, Japanese warehouses can operate autonomously, handling complex logistics tasks such as sorting, picking, and packing efficiently. This innovation drives productivity while maintaining high safety standards.

Japan’s strategic focus on automation and forklift tracking integration positions it at the forefront of creating future-ready warehouses that are both efficient and scalable.

Future Prospects for Forklift Tracking Innovations: Shaping the Next Generation of Smart Warehousing Solutions

Emerging trends shaping the future landscape of forklift telematics technology are transforming warehouse operations. AI-driven predictive maintenance models are at the forefront, leveraging machine learning algorithms to foresee equipment failures before they occur. These models significantly minimize downtime risks during critical operational periods such as peak seasons or high-volume order fulfillment cycles, where timely deliveries are paramount.

Enhanced operational analytics provide deeper business insights. Advanced data visualization techniques coupled with real-time monitoring capabilities offer a comprehensive view of warehouse performance. State-of-the-art communication protocols like 5G or satellite-based connectivity options ensure reliable information exchange, even in challenging environments characterized by extensive physical obstructions hindering traditional wireless signals propagation paths.

These innovations are paving the way for next-generation smart warehousing solutions, enhancing efficiency and reliability in complex logistical operations.

Competitive Landscape Overview in Forklift Tracking Systems: Key Players Driving Innovation Forward

Key Players

- Zebra Technologies – United States

- Honeywell – United States

- Oracle – United States

- SAP – Germany

- JDA Software – United States (now Blue Yonder)

- Manhattan Associates – United States

- Dematic – United States (owned by KION Group, Germany)

- Körber AG – Germany

- Blue Yonder – United States (owned by Panasonic, Japan)

- Epicor Software – United States

Major forklift telematics market players such as Toyota Material Handling and KION Group are leading the way in innovation for the forklift tracking market in warehouses. These companies use their extensive knowledge to provide advanced solutions that cater to the ever-changing needs of modern warehouses.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Forklift Tracking in Warehouse Market Report |

| Base Year | 2024 |

| Segment by Type | ·RFID

·GPS |

| Segment by Application | ·warehousing

·logistics ·inventory management |

| Geographies Covered | ·North America (United States, Canada)

·Europe (Germany, France, UK, Italy, Russia) ·Asia-Pacific (China, Japan, South Korea, Taiwan) ·Southeast Asia (India) ·Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The forklift tracking market is growing due to the need for better logistics and automated warehouses. Technologies like RFID, Bluetooth®, and UWB are leading this growth by providing real-time location data and operational insights. With the integration of IoT and AI into forklift tracking systems, businesses can expect predictive maintenance and improved analytics for more efficient operations.

Global Forklift Tracking in Warehouse Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Forklift Tracking in Warehouse Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Forklift Tracking in Warehouse Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Forklift Tracking in Warehouse Players and Regional Insights

-

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

-

- Key Differentiators and Strategic Moves

Chapter 3: Forklift Tracking in Warehouse Market Segmentation Analysis

- Key Data and Visual Insights

-

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

-

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

-

- Historical Data and Growth Forecasts

- Regional Growth Factors

-

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Forklift Tracking in Warehouse Emerging and Untapped Markets

- Growth Potential in Secondary Regions

-

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Forklift Tracking in Warehouse Consumer Insights

- Demographics and Buying Behaviors

-

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Forklift Tracking in Warehouse Market Insights

Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market value of the global forklift tracking market by 2025?

The global forklift tracking market is projected to reach $422.17 million by 2025, driven by the increasing need for efficient and streamlined operations in warehouses.

Which technologies are commonly used in forklift tracking systems for warehouse automation?

Forklift tracking systems commonly utilize RFID, Bluetooth®, Ultra Wideband (UWB), IoT integration, and AI-driven fleet management technologies to enable real-time location tracking and predictive maintenance in warehouse environments.

How do regulatory and safety standards impact the deployment of forklift tracking solutions?

Regulatory compliance and workplace safety standards significantly influence the implementation pace of forklift tracking systems, as these regulations ensure safe operations but may also introduce technological limitations and cost considerations that affect widespread adoption.

What roles do hardware manufacturers and software developers play in the forklift tracking ecosystem?

Hardware manufacturers provide essential components like RFID tags and sensors, while software developers create fleet management systems; together with telematics providers, they form a comprehensive ecosystem that supports end-users such as warehousing and logistics companies.

How does regional variation affect the adoption of forklift telematics solutions globally?

Adoption rates vary across regions due to factors like e-commerce growth in Asia Pacific fueling demand for advanced tracking technologies, stringent workplace safety regulations driving rapid adoption in the U.S., and Germany’s robust logistics infrastructure facilitating seamless integration of IoT-enabled sensors and cloud platforms.

What future innovations are shaping the next generation of forklift tracking systems?

Emerging trends include AI-driven predictive maintenance models that anticipate equipment failures, enhanced operational analytics through advanced data visualization, and real-time monitoring enabled by cutting-edge communication protocols such as 5G or satellite connectivity, all contributing to smarter, more reliable warehouse operations.