$4.94 Trillion Booming FMCG Market in the U.S., India, and Brazil by 2025

Comprehensive analysis of the $4.94 trillion Fast-Moving Consumer Goods (FMCG) market, examining growth trends across the U.S., India, and Brazil through 2025. Explores key market dynamics including digital transformation, health-conscious consumption, sustainability initiatives, and supply chain innovations. Features detailed insights into regional market variations, industry challenges, and emerging opportunities in the evolving FMCG landscape.

- Last Updated:

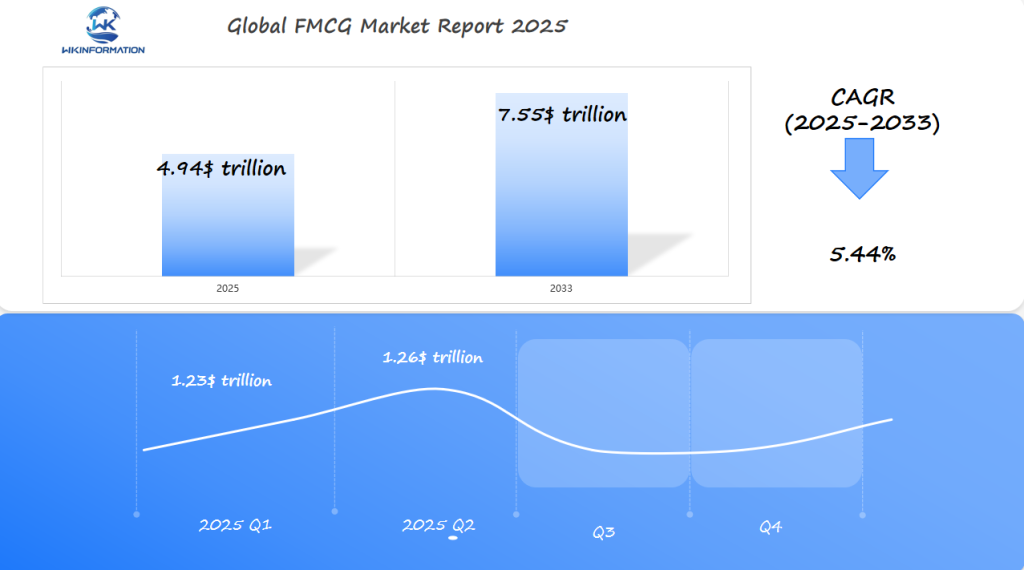

FMCG Market Q1 and Q2 2025 Forecast

The FMCG (Fast-Moving Consumer Goods) market is projected to reach $4.94 trillion in 2025, growing at a CAGR of 5.44% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $1.23 trillion, fueled by strong demand in sectors like food and beverages, personal care, and household products in the U.S., India, and Brazil. The increasing consumer preference for convenient and affordable products will drive FMCG sales, especially in emerging markets like India and Brazil.

By Q2 2025, the market is expected to reach $1.26 trillion, with significant growth in India and Brazil, where urbanization and a rising middle class are creating a larger consumer base for FMCG products. The expansion of e-commerce platforms and online grocery services will further fuel the demand for fast-moving consumer goods.

Exploring the Global FMCG Supply Chain and Industry Trends

The FMCG supply chain operates as a complex network connecting manufacturers, distributors, retailers, and consumers across global markets. This intricate system requires precise coordination between multiple stakeholders to ensure products reach consumers efficiently.

Key Players in the FMCG Supply Chain:

- Raw Material Suppliers: Companies like Cargill and ADM provide essential ingredients

- Manufacturers: Giants such as Nestlé, P&G, and Unilever transform raw materials into finished products

- Distributors: Organizations like Sysco and US Foods manage product transportation

- Retailers: Walmart, Amazon, and regional supermarket chains bring products to consumers

The FMCG industry witnesses rapid transformations driven by technological advancements and changing consumer preferences. Current Industry Trends reshape supply chain operations:

- AI-powered demand forecasting

- Blockchain technology for supply chain transparency

- Automated warehouse management systems

- Last-mile delivery optimization

- Smart packaging solutions

These technological integrations enable companies to:

- Reduce operational costs by 15-20%

- Decrease inventory holding time

- Enhance product tracking capabilities

- Improve delivery speed and accuracy

- Minimize waste through better forecasting

The rise of direct-to-consumer (D2C) models pushes FMCG companies to adapt their supply chains. Companies now invest in regional distribution centers and micro-fulfillment facilities to meet rapid delivery demands. This shift creates new opportunities for local logistics partners and technology providers in the FMCG ecosystem.

Key Trends in the FMCG Market: E-commerce, Health Consciousness, and Sustainability

The FMCG market has seen a significant shift towards online platforms, with e-commerce sales growing at an unprecedented rate. Major retailers and brands are investing heavily in their online presence, creating dedicated mobile apps and implementing AI-powered recommendation systems to enhance the shopping experience.

Health-Conscious Consumer Behavior

Health-conscious consumer behavior has reshaped product offerings across the FMCG spectrum. Brands now prioritize:

- Sugar-free and low-calorie alternatives

- Plant-based protein products

- Natural and organic ingredients

- Fortified foods with added nutrients

- Clean-label products with transparent ingredients

Sustainability Initiatives

Sustainability initiatives have become a central focus in FMCG production and packaging. Companies are adopting:

- Recyclable packaging materials

- Reduced plastic usage

- Zero-waste manufacturing processes

- Energy-efficient production methods

- Water conservation practices

The market has seen a 47% increase in sustainable packaging solutions since 2020, with major players like P&G and Unilever committing to 100% recyclable packaging by 2025. This shift reflects growing consumer demand for environmentally responsible products.

Digital transformation has enabled real-time tracking of sustainability metrics, allowing brands to measure and communicate their environmental impact to consumers. Companies now leverage blockchain technology to ensure transparency in their supply chains and validate sustainability claims.

Challenges in FMCG Manufacturing: Supply Chain and Logistics Efficiency

FMCG manufacturers face significant operational hurdles in maintaining efficient production and distribution systems. The industry’s fast-paced nature demands precise coordination across multiple supply chain touchpoints.

Key Manufacturing Challenges:

- Raw material price volatility

- Production line bottlenecks

- Quality control maintenance

- Inventory management complexities

- Labor shortages and skill gaps

Logistics efficiency stands as a critical factor in the FMCG sector’s success. The need for rapid product delivery, especially for perishable goods, requires sophisticated transportation networks and warehouse management systems. Companies must maintain optimal stock levels while preventing stockouts or excess inventory.

Supply Chain Disruption Mitigation Strategies:

- Implementation of AI-powered demand forecasting

- Diversification of supplier networks

- Strategic buffer stock maintenance

- Real-time tracking systems

- Alternative transportation routes planning

The adoption of digital technologies has become essential for addressing these challenges. Smart manufacturing solutions, including IoT sensors and automated quality control systems, help maintain consistent production standards. Advanced warehouse management systems optimize storage space utilization and reduce picking errors.

Companies investing in predictive analytics can anticipate potential disruptions and adjust their operations accordingly. This proactive approach helps maintain steady production flows and ensures timely product delivery to retailers and consumers.

Geopolitical Impact on the FMCG Market

Geopolitical factors such as trade policies, international relations, and economic sanctions have a significant influence on the FMCG (Fast-Moving Consumer Goods) market. Recent global events have shown us how political decisions can create widespread effects on the industry’s supply chains and market access.

Trade Tensions and Their Effects

Trade tensions between major economies directly impact the operations of FMCG companies:

- U.S. Market Impact: Tariff changes have led to increased costs for raw materials, affecting product pricing and manufacturing decisions.

- India’s Policy Shifts: Local manufacturing initiatives and import regulations have pushed global FMCG brands to establish domestic production facilities.

- Brazil’s Trade Relations: Regional trade agreements within MERCOSUR influence product availability and pricing structures.

Political Instability and Market Disruptions

Political instability can cause significant disruptions in the market:

- Supply chain rerouting due to conflict zones

- Currency fluctuations affecting procurement costs

- Changes in consumer spending patterns during political uncertainty

The Role of Regional Trade Policies

Regional trade policies also play a crucial role in shaping the FMCG market:

- Import duties affecting product costs

- Local content requirements

- Regulatory compliance standards

- Cross-border taxation policies

The Russia-Ukraine Conflict: A Case Study

The ongoing conflict between Russia and Ukraine serves as a prime example of how geopolitical factors can impact FMCG markets. This conflict has resulted in:

- Disruption of grain supplies

- Fluctuations in energy costs

- Shortages of raw materials

- Restructuring of supply chains

Risk Mitigation Strategies Adopted by Companies

In response to these challenges, companies are now implementing various risk mitigation strategies such as:

- Diversified supplier networks

- Establishing a local manufacturing presence

- Exploring alternative logistics routes

- Implementing strategic inventory management techniques

Types of FMCG Products: Food & Beverages, Personal Care, and Household Goods

The FMCG market includes three main types of products, each catering to different consumer needs and preferences:

1. Food & Beverages

This category includes various edible products and drinks such as:

- Ready-to-eat meals and convenience foods

- Snacks and confectionery items

- Beverages (soft drinks, juices, dairy)

- Packaged foods and condiments

- Health supplements and functional foods

Recent trends indicate a significant shift towards:

- Plant-based alternatives

- Sugar-free options

- Organic and natural ingredients

- Fortified foods with added nutrients

2. Personal Care Products

These are products designed for personal grooming and hygiene, including:

- Skincare and cosmetics

- Hair care products

- Oral hygiene items

- Deodorants and fragrances

- Baby care products

The personal care industry has seen substantial growth driven by:

- Clean beauty movement

- Natural and organic formulations

- Sustainable packaging solutions

- Personalized skincare routines

3. Household Goods

This segment comprises items used for household maintenance such as:

- Cleaning supplies

- Laundry products

- Air fresheners

- Paper products

- Pet care items

Consumer preferences in household goods reflect:

- Eco-friendly formulations

- Concentrated products

- Multi-purpose cleaning solutions

- Biodegradable packaging

These product categories continue to evolve with changing consumer demands, technological advancements, and sustainability requirements. The market sees constant innovation in formulations, packaging, and delivery methods to meet diverse consumer needs across different demographics and regions.

Applications of FMCG in Retail, Online Sales, and Consumer Goods Strategies

The retail landscape for FMCG products spans both traditional brick-and-mortar stores and digital platforms.

Importance of Physical Retail Stores

Physical retail stores maintain their significance through:

- Immediate product accessibility

- Tactile shopping experiences

- Personal customer service

- In-store promotions and displays

Revolutionizing FMCG Distribution with Digital Platforms

Digital platforms have changed the way FMCG products are distributed with features like:

- Same-day delivery options

- Subscription-based purchasing

- AI-powered product recommendations

- Digital loyalty programs

Shift in Consumer Behavior Towards Online Purchasing

Consumer behavior shows a clear shift toward online purchasing, driven by:

- Mobile shopping apps

- Voice-activated ordering systems

- Social media commerce integration

- Digital payment solutions

Multi-Channel Strategies Implemented by Brands

Brands implement multi-channel strategies to maximize visibility:

- Digital Presence Enhancement

- Social media marketing campaigns

- Influencer partnerships

- Virtual shopping experiences

- Retail Integration

- Smart shelf technology

- QR code product information

- Interactive displays

- Data-Driven Approaches

- Customer behavior analytics

- Personalized marketing

- Inventory optimization

Creating Seamless Shopping Experiences

The integration of physical and digital retail creates seamless shopping experiences through click-and-collect services, digital catalogs, and real-time inventory tracking systems.

Leveraging Technology for Personalized Shopping Journeys

Brands leverage these technological advancements to create personalized shopping journeys and strengthen customer relationships across multiple touchpoints.

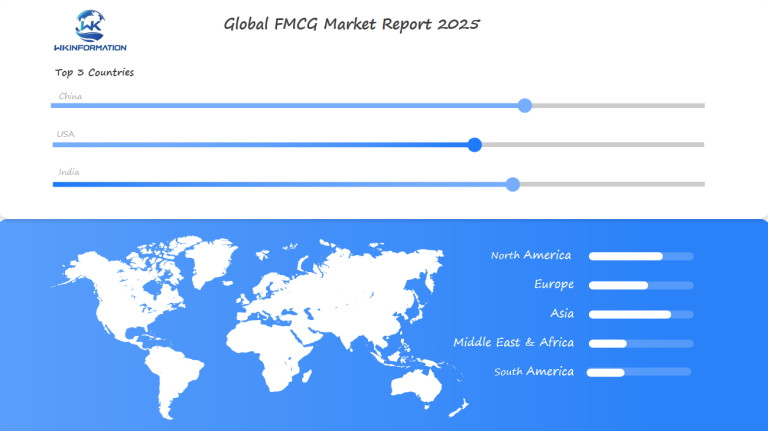

Global Insights into the FMCG Market

The Asia-Pacific region is leading the growth of the FMCG market and is expected to contribute 44% to the global market expansion by 2025. This growth is driven by factors such as rapid urbanization, increasing disposable incomes, and a growing middle-class population.

Key Regional Growth Indicators

Here are the projected compound annual growth rates (CAGR) for different regions:

- APAC Markets: 7.2% CAGR, driven by China and India’s expanding consumer base

- North America: 3.5% CAGR, led by health-conscious product demands

- Europe: 2.8% CAGR, with a focus on sustainable packaging solutions

- Middle East & Africa: 4.6% CAGR, supported by digital retail expansion

- South America: 3.9% CAGR, influenced by modernizing retail infrastructure

Growth Patterns in Developed and Emerging Markets

The growth disparity between developed and emerging markets reveals distinctive patterns:

Developed Markets

- Saturated consumer base

- Innovation-driven growth

- Premium product preference

- Digital-first shopping behavior

Emerging Markets

- Rising middle-class population

- Value-seeking consumers

- Traditional trade channels

- Rapid e-commerce adoption

Varying Consumer Preferences

Regional market dynamics showcase varying consumer preferences:

- Emerging markets focusing on essential goods

- Developed markets gravitating toward premium, sustainable products

This divergence creates unique opportunities for FMCG companies to tailor their strategies according to specific market needs and consumption patterns.

U.S. FMCG Market: Growth in Health-Conscious Products and Digital Sales

The U.S. FMCG market demonstrates a significant shift toward health-conscious products, with 73% of Americans actively seeking healthier food options. This consumer behavior has sparked innovations in:

- Plant-based alternatives

- Sugar-free beverages

- Organic snacks

- Natural personal care items

- Clean-label household products

Digital Transformation in U.S. FMCG Sales Channels

Digital transformation is revolutionizing U.S. FMCG sales channels through:

1. Mobile-first Shopping Experiences

- 64% of Americans use shopping apps

- Quick-commerce platforms offering 15-minute deliveries

- AI-powered personalized recommendations

2. Direct-to-Consumer (D2C) Models

- Subscription boxes for health foods

- Customized wellness products

- Regular delivery schedules

The U.S. market is seeing rapid adoption of digital payment solutions and contactless shopping experiences. Major retailers like Walmart and Target are expanding their digital presence through:

- Curbside pickup options

- Same-day delivery services

- Smart shopping carts

- Virtual try-on features

Health-Focused Brands Embracing Digital Channels

Health-focused brands are capitalizing on digital channels to educate consumers about ingredients and sourcing practices. This transparency builds trust and drives sales growth, with the U.S. organic food sector reaching $57.5 billion in annual sales.

India's FMCG Market: Urbanization and Rising Disposable Income

India’s FMCG sector is undergoing rapid transformation driven by urbanization and increased consumer spending power. The market shows distinctive growth patterns in both urban centers and rural areas, with urban regions contributing 55% of total FMCG sales.

Key Urban Market Dynamics:

- Convenience-focused product preferences

- Premium brand adoption

- Ready-to-eat meal segment expansion

- Digital payment integration

The rising disposable income among India’s middle class creates new consumption patterns. Average household spending on FMCG products has increased by 18% year-over-year, particularly in categories like:

- Personal care products

- Packaged foods

- Home care items

- Premium beauty solutions

Rural markets demonstrate significant potential with a 14% growth rate, supported by:

- Infrastructure development

- Digital connectivity

- Direct-to-consumer channels

- Modern retail penetration

Local brands like Patanjali and Dabur capitalize on traditional preferences while incorporating modern packaging and distribution methods. The market sees increased demand for:

The Indian FMCG landscape reflects a unique blend of traditional values and modern consumption habits. Companies adapt their strategies to serve both price-sensitive consumers and premium segment buyers, creating diverse product portfolios that cater to varying income levels across urban and rural markets.

Brazil's FMCG Market: Consumption Patterns and Regional Growth

Brazil’s FMCG market showcases distinct consumption patterns shaped by regional diversity and cultural preferences. Brazilian consumers demonstrate strong brand loyalty, with 76% preferring established national brands over international alternatives.

Key Consumer Behaviors:

- Price sensitivity drives purchasing decisions, leading to the popularity of smaller package sizes

- Strong preference for local flavors and ingredients in food products

- High adoption rate of private label products, growing at 13% annually

- Emphasis on convenience products due to busy urban lifestyles

The regional growth within South America centers on Brazil’s economic zones:

Southeast Region (São Paulo, Rio de Janeiro)

- Highest concentration of retail chains

- Advanced distribution networks

- Premium product demand

Northeast Region

- Rapid urbanization driving FMCG adoption

- Growing middle-class consumer base

- Emerging e-commerce penetration

Brazil’s market benefits from:

- Strategic location for South American distribution

- Large youth population driving innovation

- Developed retail infrastructure

- Growing digital payment adoption

The country’s retail modernization has sparked a 15% increase in organized retail channels, with supermarkets accounting for 55% of FMCG sales. Local manufacturers leverage regional preferences to compete effectively against multinational brands, particularly in food and beverage categories.

The Future of FMCG: Digital Transformation and Sustainability Initiatives

The FMCG industry is on the brink of significant changes driven by digital innovation and the need for sustainability. With the help of AI-powered demand forecasting systems, companies can now predict consumer behavior with 95% accuracy, allowing them to optimize inventory and reduce waste.

Key Digital Transformations:

- Smart packaging with QR codes for product authenticity

- Blockchain implementation for supply chain transparency

- Automated warehouses using robotics

- Personalized marketing through data analytics

- Virtual try-on experiences for cosmetic products

Sustainability Initiatives Reshaping FMCG:

- Zero-waste packaging designs

- Biodegradable alternatives to plastic

- Water conservation in manufacturing

- Renewable energy adoption

- Carbon footprint reduction programs

Digital twins technology enables manufacturers to simulate production processes, resulting in a 30% reduction in errors and a 50% decrease in development time. Companies that invest in sustainable practices are seeing a 15% increase in consumer loyalty and growth in market share.

The integration of 5G networks allows for real-time tracking and monitoring of products from the factory to the store. This advancement leads to a 20% reduction in logistics costs while ensuring that products remain fresh and of high quality.

Smart shelves equipped with IoT sensors automatically monitor inventory levels and consumer behavior patterns. This technology helps retailers maintain optimal stock levels and decrease instances of products being out of stock by 40%.

These innovations are creating a more efficient and sustainable FMCG ecosystem that meets the changing needs of consumers while minimizing harm to the environment.

Competitive Landscape in the FMCG Industry

The Fast-Moving Consumer Goods (FMCG) industry is characterized by rapid product turnover and intense competition. Key factors influencing the competitive landscape include consumer behavior shifts, technological advancements, sustainability initiatives, and strategic partnerships.

-

Nestlé S.A. – Switzerland

-

Procter & Gamble (P&G) – United States

-

Unilever PLC – United Kingdom/Netherlands

-

PepsiCo Inc. – United States

-

Coca-Cola Company – United States

-

Johnson & Johnson – United States

-

Colgate-Palmolive Company – United States

-

Kraft Heinz Company – United States

-

Mondelez International Inc. – United States

-

Reckitt Benckiser Group PLC – United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name |

Global FMCG Market Report |

| Base Year |

2024 |

| Segment by Type |

· Food & Beverages · Personal Care · Household Goods |

| Segment by Application |

· Retail · Online Sales |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

|

Forecast units |

USD million in value |

| Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The FMCG sector continues to evolve at a rapid pace, driven by the dynamic interplay between traditional retail and digital innovation. The successful integration of physical stores and online platforms has created a robust omnichannel ecosystem that caters to diverse consumer preferences. As retailers and brands adapt to changing market conditions, the focus remains on delivering seamless shopping experiences while embracing sustainability and technological advancement.

Global FMCG Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: FMCG Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- FMCGMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global FMCGplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: FMCG Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: FMCG Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: FMCG Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of FMCG Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current size and growth projection of the FMCG market?

The FMCG market is experiencing significant growth, with projections indicating continued expansion driven by various factors including e-commerce, health consciousness, and sustainability initiatives. Understanding regional trends is crucial as they influence overall market dynamics.

How does the global supply chain function in the FMCG sector?

The global supply chain in the FMCG sector involves multiple key players including manufacturers, distributors, and retailers. Each player has a specific role that contributes to the efficiency and effectiveness of delivering fast-moving consumer goods to market.

What are the major trends currently shaping the FMCG industry?

Key trends in the FMCG industry include the rise of e-commerce platforms, increasing consumer health consciousness affecting product offerings, and a growing emphasis on sustainability initiatives that influence production and packaging practices.

What challenges do FMCG manufacturers face regarding supply chain efficiency?

FMCG manufacturers encounter several challenges such as supply chain disruptions and the need for logistics efficiency. Timely delivery is critical, prompting companies to adopt strategies that mitigate these disruptions to maintain operational effectiveness.

How do geopolitical factors impact the FMCG market?

Geopolitical factors significantly influence global trade within the FMCG market. Trade policies in key markets like the U.S., India, and Brazil can alter market dynamics, while economic sanctions or political instability may disrupt supply chains.

What are the future trends expected to impact the FMCG industry?

The future of the FMCG industry will likely be shaped by advancements in digital transformation and a strong focus on sustainability initiatives. These trends are anticipated to drive significant changes in how products are marketed and consumed globally.