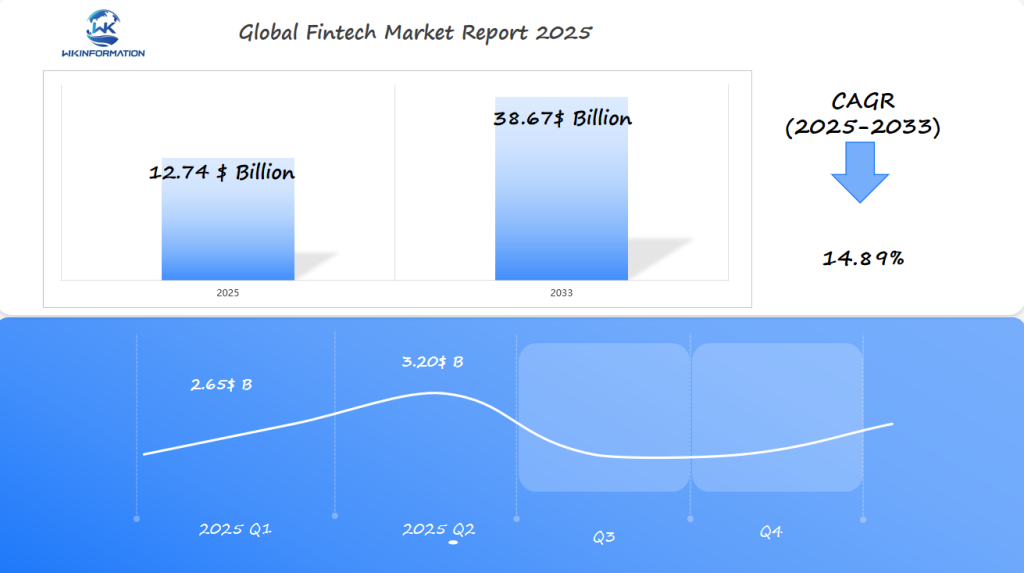

Fintech Market Projected to Reach $12.74 Billion by 2025: Key Regions Include the U.S., U.K., and Singapore

The Fintech Market is expected to reach $12.74 billion by 2025, with the U.S., U.K., and Singapore leading the way. Learn more about this dynamic industry.

- Last Updated:

Fintech Market Q1 and Q2 of 2025 Forecast and Regional Overview

The Fintech market is forecasted to reach a substantial $12.74 billion in 2025, with an impressive CAGR of 14.89% through 2033. Early 2025 shows an uneven revenue pattern, with Q1 expected at $2.65 billion and Q2 rising significantly to $3.20 billion. This reflects accelerating adoption of digital payments, blockchain, and AI-based financial services.

Key Regional Insights

- The U.S. leads innovation with a mature ecosystem of startups and regulatory frameworks fostering fintech growth.

- The U.K. remains a global financial hub, driving demand for advanced fintech solutions.

- Singapore serves as a strategic financial center for Southeast Asia, emphasizing cross-border digital finance and regulatory technology.

These countries offer deep insights into market evolution and investment trends.

Comprehensive Review of the Fintech Industry Chain: Technology Providers and Financial Institutions

A detailed examination of the Fintech industry chain highlights the crucial roles played by technology providers and financial institutions. The Fintech Market operates within a complex ecosystem where technology providers create cutting-edge financial solutions, while financial institutions offer the essential infrastructure and resources.

Industry Chain Overview

The industry chain in Fintech involves a series of processes, from the development of financial technologies to their implementation and management. Technology providers play a crucial role in this chain by developing innovative solutions such as mobile payments, digital wallets, and blockchain technologies.

On the other hand, financial institutions are essential for providing the necessary infrastructure, resources, and regulatory compliance. They work closely with technology providers to integrate these innovations into their existing systems, enhancing their services and improving customer experience.

Technology Providers and Financial Institutions

The collaboration between technology providers and financial institutions is a key driver of the Fintech Market’s growth. Some of the key activities in this collaboration include:

- Developing new financial products and services

- Improving existing financial solutions

- Enhancing customer experience through digital channels

- Ensuring regulatory compliance and managing risk

Some notable examples of technology providers in the Fintech space include companies like Stripe, Square, and PayPal, which offer innovative payment solutions. Financial institutions such as JPMorgan Chase, Bank of America, and Goldman Sachs are also significant players, as they provide the necessary infrastructure and resources for these technologies to be implemented effectively.

The impact of these collaborations is significant, as they drive digital transformation, improve financial inclusion, and enhance the overall efficiency of financial services. By understanding the roles of technology providers and financial institutions, we can better appreciate the complexities of the Fintech industry chain and its potential for future growth.

Market Trends Driving Digital Transformation and Financial Inclusion

The combination of digital transformation and financial inclusion is changing the Fintech Market. As technology keeps improving, financial institutions are using digital solutions to provide better customer service and reach more people.

Digital Transformation Trends

Digital transformation is enabling Fintech companies to provide more efficient and convenient services. According to a recent report, “the use of digital payments is expected to increase by 50% by 2025, driven by the growing adoption of mobile devices and the need for contactless transactions.” This shift towards digital payments is not only convenient but also reduces transaction costs and increases financial inclusion.

The key drivers of digital transformation in the Fintech Market include:

- Adoption of artificial intelligence

- Implementation of blockchain technology

- Utilization of cloud computing

These technologies are enabling Fintech companies to develop innovative products and services that meet the evolving needs of consumers.

Financial Inclusion Initiatives

Financial inclusion initiatives are critical to expanding access to financial services for underserved populations. Fintech companies are playing a vital role in promoting financial inclusion by providing:

- Mobile banking services

- Digital wallets

- Microfinance solutions

Regulatory Restrictions Affecting Compliance and Data Security

Fintech companies must navigate a complex web of regulatory restrictions to ensure compliance and maintain robust data security. The Fintech Market is subject to various regulatory restrictions that impact compliance and data security, making it crucial for companies to stay ahead of the curve.

Regulatory Challenges

The regulatory landscape for Fintech is constantly evolving, with new challenges emerging regularly. One of the primary regulatory challenges is the need to comply with multiple regulations across different jurisdictions. Fintech companies operating globally must ensure they meet the regulatory requirements of each country they operate in.

Another significant challenge is the balancing act between innovation and compliance. Fintech companies are driven to innovate and provide new services, but they must do so within the bounds of regulatory frameworks. This requires a deep understanding of the regulatory environment and the ability to adapt quickly to changes.

Compliance and Data Security Measures

To address these challenges, Fintech companies are implementing various compliance and data security measures. These include:

- Implementing robust data security protocols to protect customer data

- Conducting regular compliance audits to ensure adherence to regulatory requirements

- Investing in compliance technology to streamline regulatory reporting and monitoring

Regulatory bodies also play a crucial role in shaping the Fintech Market. By providing clear guidelines and oversight, they help to create a stable environment in which Fintech companies can operate. Effective regulatory frameworks can foster innovation while protecting consumers and maintaining financial stability.

The interplay between regulatory restrictions, compliance, and data security is complex. Fintech companies must remain vigilant and proactive in managing these aspects to succeed in a rapidly changing landscape.

Geopolitical Factors Influencing Market Entry and Cross-Border Transactions

Geopolitical risks are a major challenge for Fintech companies looking to enter new markets and carry out cross-border transactions. As the Fintech industry becomes more global, it’s essential to understand these risks for successful market expansion.

Geopolitical Risks

Fintech companies face a variety of geopolitical risks when expanding into new markets. These include regulatory challenges, political instability, and trade tensions. For example, changes in government policies can impact the viability of certain financial technologies.

Regulatory Hurdles

Different countries have varying regulatory requirements that Fintech companies must comply with.

Political Instability

Political unrest can disrupt financial services, impacting cross-border transactions.

Trade Tensions

Tariffs and trade restrictions can increase the cost of doing business across borders.

Cross-Border Transactions

Cross-border transactions are a critical component of the Fintech Market, enabling the global flow of capital. However, these transactions are also subject to geopolitical risks.

Strategies for Mitigating Geopolitical Risks:

- Diversification: Fintech companies can mitigate risks by diversifying their operations across multiple markets.

- Local Partnerships: Partnering with local businesses can help navigate regulatory environments and reduce political risks.

- Technology: Leveraging advanced technologies, such as blockchain, can enhance the security and efficiency of cross-border transactions.

By understanding and addressing geopolitical factors, Fintech companies can better navigate the complexities of market entry and cross-border transactions, ultimately driving growth in the Fintech Market.

Type Segmentation Covering Payments, Lending, Wealth Management, and Blockchain Solutions

Fintech companies are changing the way financial services work through different types of segmentation. The Fintech Market is diverse, including a wide range of financial services such as payments, lending, wealth management, and blockchain solutions.

The type segmentation in the Fintech Market can be divided into several main areas. Each of these segments has its own characteristics and factors that contribute to its growth.

Overview of Type Segmentation

The Fintech Market’s type segmentation includes payments, lending, wealth management, and blockchain solutions. These segments are transforming the financial landscape by offering innovative solutions to traditional financial services.

Payments, Lending, Wealth Management, and Blockchain Solutions

Payments involve digital transaction solutions that are faster and more secure. Lending includes peer-to-peer lending and other alternative lending platforms. Wealth management encompasses robo-advisory services and investment platforms. Blockchain solutions involve the use of distributed ledger technology for secure and transparent transactions.

| Segment | Description | Growth Drivers |

| Payments | Digital transaction solutions | Increasing demand for contactless payments |

| Lending | Peer-to-peer and alternative lending | Rising demand for alternative credit sources |

| Wealth Management | Robo-advisory and investment platforms | Growing need for digital investment solutions |

| Blockchain Solutions | Distributed ledger technology | Increasing adoption for secure transactions |

The competitive landscape of the Fintech Market is shaped by companies that are innovating within these segments. As the market continues to evolve, we can expect to see new trends and opportunities emerging in payments, lending, wealth management, and blockchain solutions.

Application Analysis Focused on Consumer Finance, SMEs, and Enterprise Solutions

Fintech innovations are changing the game for financial services, especially in three key areas: consumer finance, SMEs, and enterprise solutions. These innovations are reshaping how financial services are provided and used, with a wide range of applications across various sectors.

Application Analysis Overview

The Fintech market has seen a significant shift towards catering to the needs of various sectors, including consumer finance, SMEs, and enterprises. This shift is driven by the need for more personalized and efficient financial services.

Fintech Market Application Analysis

Consumer finance has benefited greatly from Fintech through the development of digital lending platforms and mobile payment systems. These innovations have made financial services more accessible to a wider audience.

SMEs are also leveraging Fintech solutions to improve their financial management and access to capital. Fintech companies are providing SMEs with digital tools for invoicing, cash flow management, and financing options.

Enterprise solutions are another area where Fintech is making a significant impact. Large enterprises are adopting Fintech solutions for treasury management, cross-border payments, and trade finance. These solutions are enhancing operational efficiency and reducing costs.

The application analysis of Fintech solutions across these sectors highlights the industry’s potential for growth and innovation. As Fintech continues to evolve, we can expect to see even more sophisticated solutions tailored to the specific needs of consumer finance, SMEs, and enterprises.

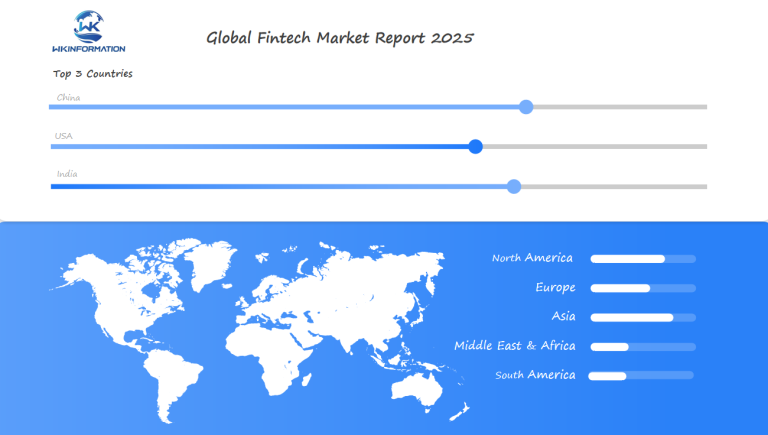

Global Regional Overview Highlighting Innovation Hubs and Market Penetration

The Fintech Market is experiencing significant growth worldwide, with various regions emerging as innovation hubs. This growth is fueled by the increasing adoption of digital financial services, advancements in technology, and changing consumer behaviors.

Regional Overview

The Fintech Market is a global phenomenon, with different regions contributing to its growth. North America, Europe, and Asia-Pacific are among the leading regions, each with its unique characteristics and innovation hubs.

North America

In North America, the United States is a prominent Fintech hub, with numerous startups and established companies innovating in areas such as payments, lending, and wealth management. The region’s advanced financial infrastructure and favorable regulatory environment have contributed to its leadership in the Fintech Market.

Europe

In Europe, the U.K. and Germany are notable Fintech hubs, with a strong focus on digital payments and blockchain technology.

Asia-Pacific

The Asia-Pacific region, led by countries such as China, Singapore, and Australia, is also experiencing rapid growth, driven by the adoption of mobile payments and digital wallets.

Importance of Innovation Hubs

Innovation hubs are critical to the growth of the Fintech Market, as they foster creativity, collaboration, and innovation. These hubs are often characterized by the presence of startups, accelerators, incubators, and financial institutions, which work together to develop new financial products and services.

Significance of Market Penetration

Market penetration is another key aspect of the Fintech Market, as companies seek to expand their reach into new regions and customer segments. Strategies for market penetration include:

- Partnerships with local financial institutions

- Adoption of local regulations

- Development of region-specific products

As the Fintech Market continues to evolve, understanding the regional dynamics and innovation hubs will be crucial for companies seeking to expand their presence globally.

U.S. Leadership in Fintech Innovation

The U.S. is a leader in Fintech innovation, thanks to a strong ecosystem that supports growth and development. This leadership is the result of several factors, including technological advancement, regulatory support, and a culture that encourages entrepreneurship.

U.S. Fintech Ecosystem

The U.S. Fintech ecosystem is known for its variety and the presence of important players in both finance and technology. Major financial hubs like New York and San Francisco provide the infrastructure and talent necessary for Fintech companies to succeed.

Innovation hubs across the country, from Silicon Valley to emerging tech centers, drive the development of new technologies and business models. This ecosystem is further strengthened by the presence of venture capital, which invests in startups and early-stage companies, helping them grow and compete globally.

Innovation and Growth

Innovation in the U.S. Fintech sector is driven by advancements in technologies such as AI, blockchain, and cloud computing. These technologies enable Fintech companies to offer personalized financial services, improve risk management, and enhance user experience.

| Fintech Segment | Key Technologies | Impact on Financial Services |

| Payments | Blockchain, Mobile Technologies | Enhanced security, faster transactions |

| Lending | AI, Big Data | Personalized loan products, improved credit scoring |

| Wealth Management | Robo-advisors, AI | Automated investment advice, diversified portfolios |

The U.S. Fintech market is also known for its ability to adapt to regulatory changes, ensuring compliance while still being innovative. This flexibility puts the U.S. at the forefront of the global Fintech Market.

The importance of the U.S. in shaping the global Fintech Market cannot be emphasized enough. With its innovative ecosystem, the U.S. sets standards and trends that are followed worldwide. As the Fintech industry continues to change, the U.S. is expected to remain a leader, driving innovation and growth in the financial technology sector.

U.K.’s Regulatory Environment and Market Maturity

The U.K. has established itself as a leader in Fintech, thanks to its favorable regulatory environment. This leadership is not accidental; it is the result of careful planning and execution by regulatory bodies and industry stakeholders.

The U.K.’s regulatory framework is designed to be supportive of innovation while ensuring consumer protection and financial stability. The Financial Conduct Authority (FCA) plays a crucial role in overseeing the Fintech sector, providing guidance and regulation that helps to foster a competitive and innovative environment.

U.K. Regulatory Environment

The regulatory environment in the U.K. is known for being open to new technologies and business models. The FCA’s regulatory sandbox is a prime example of this, allowing Fintech firms to test new products and services in a controlled environment without the immediate need for full regulatory compliance.

This approach has encouraged many Fintech companies to set up operations in the U.K., contributing to the market’s growth and diversity.

Market Maturity

The U.K. Fintech market is considered mature, with a high level of adoption and a wide range of services available. This maturity is reflected in the variety of Fintech solutions offered, including payments, lending, wealth management, and blockchain-based services.

The table below shows the distribution of market share across different Fintech segments in the U.K. and their respective growth rates, highlighting the dynamic nature of the market.

| Fintech Segment | Market Share (%) | Growth Rate (%) |

| Payments | 30 | 15 |

| Lending | 25 | 20 |

| Wealth Management | 20 | 12 |

| Blockchain | 15 | 25 |

Singapore: A Growing Regional Fintech Hub

Singapore is quickly becoming an important Fintech hub in the region, thanks to its innovative ecosystem and supportive regulations. The city’s strategic location and strong infrastructure make it a desirable place for Fintech companies wanting to grow in Asia.

Singapore Fintech Ecosystem

The Singapore Fintech ecosystem is characterized by a strong collaboration between the government, financial institutions, and technology providers. This synergy has fostered an environment conducive to innovation and growth.

Key drivers of Singapore’s Fintech ecosystem include:

- Supportive regulatory frameworks that encourage innovation while ensuring consumer protection.

- A robust infrastructure that includes high-speed connectivity and advanced data analytics capabilities.

- A talent pool that is highly skilled in both finance and technology.

Regional Fintech Hub

As a regional Fintech hub, Singapore is playing a pivotal role in shaping the Fintech landscape across Asia. The country’s Fintech sector is not only driving local innovation but also influencing the broader regional market.

The impact of Singapore’s Fintech hub is evident in several areas:

- Increased adoption of digital payment systems.

- Growth in peer-to-peer lending and other alternative financing models.

- Advancements in blockchain technology and its applications.

Singapore’s emergence as a leading Fintech hub underscores its potential to drive financial inclusion and digital transformation across the region. As the Fintech market continues to evolve, Singapore is well-positioned to remain at the forefront of this growth.

Future Development Emphasizing AI, Blockchain, and Open Banking

Looking ahead, it’s evident that AI, blockchain, and open banking will be key players in shaping the Fintech Market. These technologies have the potential to:

- Drive innovation

- Foster growth

However, they also bring forth challenges that industry stakeholders must navigate.

Future Development Trends

The Fintech Market is expected to witness significant advancements in the coming years, driven by the adoption of emerging technologies. AI and machine learning will enhance customer experience and enable personalized financial services. Blockchain technology will improve security and transparency, while open banking will facilitate greater collaboration and innovation among financial institutions.

AI, Blockchain, and Open Banking

The integration of AI, blockchain, and open banking will revolutionize the Fintech Market in various ways. For instance, AI-powered chatbots will provide 24/7 customer support, while blockchain-based systems will ensure secure and transparent transactions. Open banking APIs will enable third-party developers to create innovative financial products and services.

| Technology | Key Benefits | Potential Applications |

| AI | Enhanced customer experience, personalized services | Chatbots, credit scoring, risk management |

| Blockchain | Improved security, transparency, and efficiency | Secure transactions, identity verification, supply chain finance |

| Open Banking | Increased collaboration, innovation, and customer choice | API-based services, third-party apps, financial data sharing |

The future development of the Fintech Market will be characterized by the convergence of these technologies, leading to new business models and revenue streams. As the industry continues to evolve, it is essential for stakeholders to stay ahead of the curve and capitalize on the opportunities presented by AI, blockchain, and open banking.

Competitive Landscape Featuring Leading Fintech Firms

The Fintech Market is highly competitive, with innovation and growth driving the industry. Several leading Fintech firms are playing a crucial role in shaping the industry.

- Stripe – United States

- Square – United States

- PayPal – United States

- Adyen – Netherlands

- Robinhood – United States

- Plaid – United States

- SoFi – United States

- Revolut – United Kingdom

- Klarna – Sweden

- Affirm – United States

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Fintech Report |

| Base Year | 2024 |

| Segment by Type |

· Payments · Lending · Wealth Management · Blockchain Solutions |

| Segment by Application |

· Consumer Finance · SMEs · Enterprise Solutions |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Global Fintech Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Fintech Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalFintech players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Fintech Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Fintech Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Fintech Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the current size of the Fintech Market?

The Fintech Market is expected to reach $12.74 billion by 2025.

Which regions are leading the Fintech Market?

The U.S., U.K., and Singapore are leading the Fintech Market.

What are the key drivers of the Fintech Market?

The Fintech Market is driven by:

- Technological advancements

- Increasing demand for digital financial services

- Collaborations between technology providers and financial institutions

What are the major segments of the Fintech Market?

The Fintech Market can be divided into four main segments:

- Payments

- Lending

- Wealth management

- Blockchain solutions

What are the applications of Fintech solutions?

Fintech solutions have various applications across consumer finance, SMEs, and enterprise solutions.

How is the Fintech Market regulated?

The Fintech Market is subject to various regulatory restrictions that impact compliance and data security.

What are the geopolitical factors influencing the Fintech Market?

Geopolitical factors, such as market entry and cross-border transactions, play a significant role in shaping the Fintech Market.

The Role of AI, Blockchain, and Open Banking in the Fintech Market

AI, blockchain, and open banking are expected to drive innovation and growth in the Fintech Market.

Who are the leading players in the Fintech Market?

The Fintech Market is characterized by a competitive landscape, with several leading Fintech firms driving innovation and growth.