$1.52 Billion Ferrite Shielding Sheet Market Grows in 2025: Japan, U.S., and South Korea Lead Electronics Innovation

Discover the expanding $1.52 Billion Ferrite Shielding Sheet Market in 2025, led by Japan, the U.S., and South Korea in electronics.

- Last Updated:

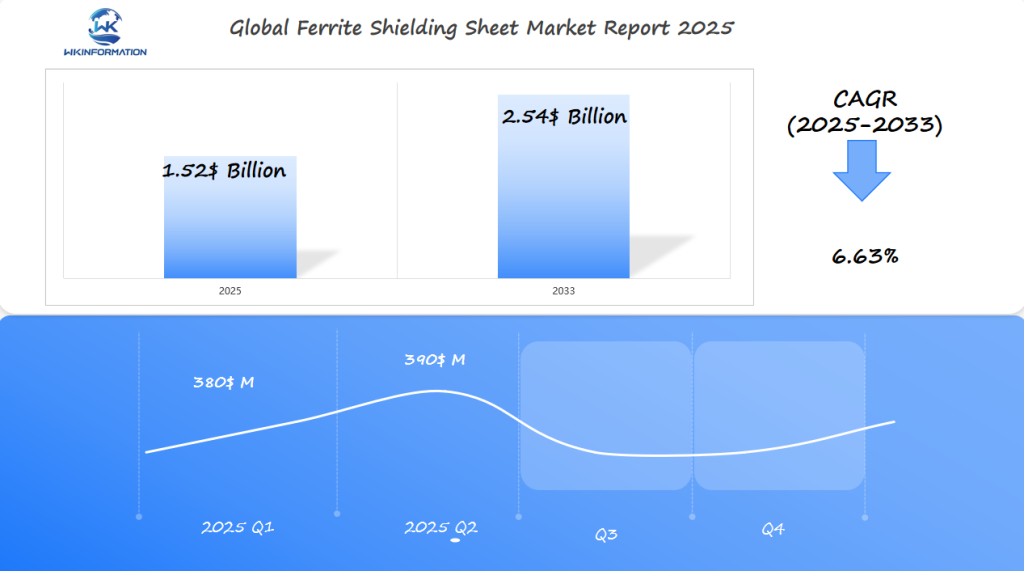

Ferrite Shielding Sheet Market Q1 and Q2 2025 Forecast

The Ferrite Shielding Sheet market is estimated to reach $1.52 billion in 2025, with a CAGR of 6.63% from 2025 to 2033. In Q1 2025, the market is expected to generate approximately $380 million, driven by strong demand from the electronics, telecommunications, and automotive industries in Japan, the U.S., and South Korea.

Ferrite shielding sheets are widely used for electromagnetic interference (EMI) shielding, especially in mobile devices, computers, and automotive electronics. By Q2 2025, the market is projected to reach $390 million, with South Korea continuing to be a major player in electronics manufacturing and automotive innovations.

The U.S. and Japan will see growth in consumer electronics, particularly in the smartphone and electric vehicle sectors, where ferrite shielding sheets play a crucial role in ensuring device performance and compliance with EMI regulations.

Understanding the Upstream and Downstream Industry Chains for Ferrite Shielding Sheets

The ferrite shielding sheet industry has two main parts: upstream and downstream chains. The upstream starts with raw materials and the downstream ends with the users. Knowing this helps businesses improve production and meet customer needs.

Upstream Chains: From Raw Materials to Production

Upstream chains begin with mining and refining. Companies like Sumitomo Metal and TDK Corporation provide these materials. The quality of these materials affects how well the shielding works and its cost.

Then, the materials are turned into shielding sheets through production. This process uses advanced techniques to shape the materials. It also needs skilled workers and expensive equipment.

Downstream Chains: Distribution and End Users

The downstream chains handle distribution and use. Distributors like Avnet and Mouser Electronics sell the sheets to tech and car companies. Big buyers include phone makers and companies building 5G networks.

Both chains affect the market. Shortages or delays can stop production. But, good partnerships between suppliers and makers lead to better products and reliability. This keeps the industry moving forward.

Key Trends Driving the Ferrite Shielding Sheet Market: Growth in 5G and EMI Protection

The rise of 5G technology advancements is changing how we design electronics. It’s creating a big need for better protection against electromagnetic interference (EMI). As 5G networks grow, devices send out stronger signals at higher frequencies. This means we need shielding materials to stop signal distortion.

This change is making more people buy ferrite shielding sheets. It’s helping industries like telecom and automotive a lot.

1. 5G infrastructure rollout

Telecom companies like Verizon and AT&T are using ferrite sheets. They shield 5G base stations and antennas from interference.

2. Consumer electronics upgrade

Smartphones from brands like Samsung now use thinner ferrite layers. This meets 5G device EMI standards without making them bulkier.

3. Automotive innovation

Electric vehicle makers like Tesla use these sheets. They shield sensors and batteries from high-frequency 5G signals.

Companies like TDK and Murata are making more flexible ferrite films. With global 5G subscriptions expected to hit 2 billion by 2028, the need for advanced EMI solutions will keep growing.

Challenges in Ferrite Shielding Sheet Manufacturing and Material Efficiency

Creating ferrite shielding sheets is a precise and innovative process. Companies must balance quality with cost. High-quality ferrites often need rare earth metals, which can become a supply chain risk.

For example, China’s control over rare earth exports worries the global market. This could affect production worldwide.

Scalability Challenges

Scalability is another big challenge. The demand for 5G and EV parts is growing fast. This requires new production methods.

Smaller companies find it hard to keep up with giants like TDK and TAIYO YUDEN. These big players spend a lot on research and development.

Material Shortages and Environmental Regulations

- Material shortages make it hard to keep production steady.

- High energy costs during sintering processes are expensive.

- Environmental rules get stricter, leading to costly upgrades.

Trade Policies and Geopolitical Issues

Trade policies also affect manufacturing. Tariffs on raw materials can increase costs. For example, U.S.-China trade issues have made some companies look for new suppliers.

Changes in rare earth mining partnerships add to the complexity. This makes long-term planning harder.

To solve these problems, recycling scrap materials and finding rare earth alternatives are key. Partnerships between tech companies and mining firms could help stabilize supply chains. By tackling these issues, the market can grow while keeping quality high.

Geopolitical Influence on the Ferrite Shielding Sheet Market

Global trade policies shape the demand and pricing of ferrite shielding sheets. Trade disputes and tariffs affect the availability of flexible and rigid variants. This changes how manufacturers work around the world. Countries like the U.S., Japan, and South Korea see their supply chains get disrupted as tensions grow.

Impact of Geopolitical Factors on Ferrite Shielding Sheets

- Trade wars make materials more expensive for those using flexible or rigid variants.

- Regional alliances help with exporting shielding materials.

- Sanctions on key minerals slow down the making of high-demand shielding sheets.

| Country | Key Factor | Impact on Flexible Variants | Impact on Rigid Variants |

| United States | Tariff Policies | Higher import fees | Delayed supply chains |

| Japan | Trade Agreements | Streamlined exports | Advanced material R&D |

| South Korea | Technology Partnerships | Cost-efficient production | Higher quality outputs |

Manufacturers need to adjust to changing policies. For example, U.S. tech companies pay more for flexible variants because of metal tariffs. On the other hand, South Korean companies use partnerships to get rigid variants for 5G projects. To stay competitive, they must plan their supply chains carefully.

Ferrite Shielding Sheet Market by Type: Flexible and Rigid Variants

Ferrite shielding sheets come in two types: flexible and rigid. Both are EMI protection solutions, but they’re used differently. Flexible sheets can bend to fit around curves, while rigid sheets are strong for heavy-duty tasks.

| Flexible | Thin, lightweight, bendable | Smartphones, automotive dashboards, wearable devices | Easy to shape; ideal for compact electronics |

| Rigid | Thick, rigid structure | Data centers, industrial machinery, aerospace parts | High durability; blocks strong electromagnetic fields |

Rigid sheets are often used in stable equipment like servers and satellites. Flexible sheets are growing in demand for thinner smartphones and IoT devices. Buyers choose based on the device’s design and how much interference it needs to block. Both types help ensure electronics are safe and reliable.

Applications of Ferrite Shielding Sheets in Consumer Electronics, Automotive, and Telecommunications

Ferrite shielding sheets are key in today’s tech world. They block electromagnetic interference (EMI), making devices work better. In consumer electronics, they guard sensitive parts in laptops, TVs, and gadgets. For instance, these ferrite shielding sheets are used extensively in smartphones and home appliances to reduce EMI.

Cars use them to keep EMI out of electric vehicles and entertainment systems. This is particularly important as the automotive industry shifts towards electric and connected cars, pushing for lighter, stronger shielding.

Telecom towers and routers also depend on them for clear signals. This is crucial for 5G networks. The demand for ferrite shielding in 5G is reshaping global market trends, with telecoms investing in better shielding to meet EMI rules.

Global Market Trends

- Consumer Electronics: Reducing EMI in smartphones and home appliances.

- Automotive: Shielding battery systems and driver-assist technologies.

- Telecom: Enhancing 5G network stability and device performance.

More devices are using ferrite shielding, especially in IoT and self-driving cars. This shows how ferrite sheets are vital for tech progress globally.

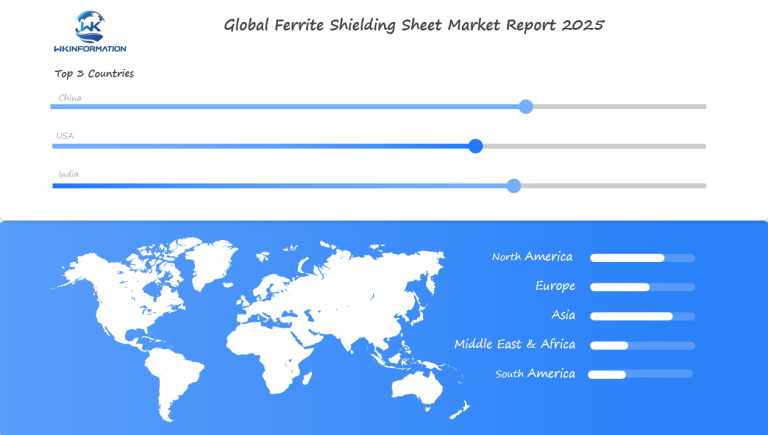

Global Insights into the Ferrite Shielding Sheet Market

Advanced magnetic shielding is changing the game worldwide. The Asia-Pacific region leads with 45% of the market. This is thanks to tech giants in Japan, China, and South Korea. North America and Europe are close behind, driven by needs in the automotive and aerospace sectors.

- Japan is the top producer, sending 60% of its ferrite shielding sheets to other countries.

- Brazil and India are quickly adopting these solutions for renewable energy projects.

- In the U.S., companies like Laird and Emerson are pushing the limits with high-frequency tech.

| Region | Key Players | Market Focus |

| Asia-Pacific | TDK, Murata | Consumer electronics manufacturing |

| North America | Laird, Emerson | Aerospace and automotive |

| Europe | CoorsTek, Hutchinson | Industrial machinery and healthcare |

Emerging markets in Southeast Asia and the Middle East are embracing advanced magnetic shielding for 5G. Partnerships between Japanese companies and African tech startups are showing promise. The push for sustainable materials is also sparking innovation.

Japan’s Leadership in Advanced Magnetic Shielding Solutions

Japan is a top player in high-frequency electromagnetic shielding innovation. Companies like TDK and Murata Manufacturing have created materials that block interference in 5G networks and car systems. These products help speed up data and cut down signal problems in today’s gadgets.

TDK’s nanocrystalline alloys and Murata’s thin-film technologies are used all over the world. They reduce electromagnetic noise in places like data centers and smart factories. Japanese companies work with global tech giants to meet the growing need for high-frequency electromagnetic shielding in IoT devices and electric cars.

Key Contributions from Japanese Companies

- TDK’s MuRata cores reduce signal loss in 5G base stations

- Murata’s shielding films protect wearable electronics from radiofrequency interference

- NEDO-funded research projects boost material durability by 30% since 2020

Japan’s work on making things smaller and more heat-resistant puts them at the top in markets needing high-frequency electromagnetic shielding. Their solutions are now key in US tech supply chains, ensuring reliable performance for industries from aerospace to healthcare. Their ongoing R&D keeps them ahead, making them a major supplier to Apple and Tesla, among others.

The U.S.’s Role in Driving Demand for High-Frequency Electromagnetic Shielding

The U.S. tech sector is a significant player in the demand for advanced shielding materials. With 5G networks expanding and IoT innovations on the rise, companies like Apple and Qualcomm are seeking better ways to block electromagnetic interference (EMI). High-frequency devices require shielding to avoid signal problems, making the U.S. a key player in this demand.

5G and IoT Innovations Driving U.S. Market Growth

Several factors are driving this trend:

- Government investments in 5G infrastructure projects

- Partnerships between tech firms and material suppliers

- R&D funding for ultra-thin shielding materials

IoT innovations in healthcare and smart cities also increase demand. Devices like wearable sensors and connected vehicles need strong EMI protection. This opens up opportunities for U.S. manufacturers to create next-gen ferrite shielding sheets, such as those produced by Laird Technologies and Taconic, who are already ramping up production to meet these needs.

The future hinges on meeting 5G’s high-frequency requirements. The U.S. market’s focus on innovation positions it strongly, balancing tech progress with shielding performance.

South Korea’s Rising Market for Ferrite Shielding Sheets in 5G and IoT Devices

South Korea’s tech industry is growing fast, especially for ferrite shielding sheets. Companies like Samsung and LG Electronics are using ultra-thin high-performance materials. These materials help make devices smaller and block unwanted signals.

These new materials can reduce signal loss by up to 30%. This makes them perfect for small gadgets.

The government is helping with the Digital New Deal program. It funds research and development for new shielding solutions. This support lets companies innovate quicker.

Major Players Shaping the Industry

Here’s how major players are changing:

- Samsung Electro-Mechanics uses ultra-thin ferrite films in 5G base stations.

- LG Innotek integrates flexible shielding sheets into wearable IoT devices.

- SKC Haesung develops lightweight options for drone and sensor tech.

Market Growth Projections

| 2023 | 12% | 5G infrastructure expansion |

| 2024 | 18% | IoT device production surge |

South Korean companies are teaming up with global tech leaders. They focus on ultra-thin high-performance materials. This makes them important suppliers for new 6G and smart city projects.

This growth helps them aim to become a global tech leader by 2030.

The Future of Ferrite Shielding Sheets: Ultra-Thin and High-Performance Materials

Material science is changing ferrite shielding sheets. Companies like TDK and Murata are working on ultra-thin designs. These designs keep EMI protection but are smaller. They aim to fit the needs of 5G and IoT devices.

Key Innovations in Ferrite Shielding Materials

- Nano-composite materials improving thermal stability

- AI-driven simulations optimizing material formulas

- Flexible substrates enabling wearable tech integration

| Current Materials | Future Innovations | Benefits |

| Rigid ceramic blends | Graphene-infused layers | 20% thinner profiles |

| Standard ferrite cores | Self-healing polymer coatings | Extended lifespan |

The competitive market landscape is making companies focus on being green. They’re looking at using recycled materials. This could make production 15% cheaper by 2030. Suppliers like Ferroxcube are exploring bio-based resins for eco-friendly shielding.

Car and plane makers are quick to use these new materials. Thinner sheets make cars lighter, which helps electric cars go further. As 5G grows, the need for materials that work at high frequencies will lead to more research.

Competitive Landscape in the Ferrite Shielding Sheet Market

Big names like TDK and Murata Manufacturing lead the world in making ferrite sheets. They use the latest in R&D to create ultra-thin sheets. This meets the needs of 5G and IoT, which are growing fast.

Here are some of the key players in the ferrite shielding sheet market:

- TDK Corporation – Japan

- Wurth Elektronik – Germany

- Laird Performance Materials – United States

- EMI Thermal – United States

- Kitagawa Industries – Japan

- Fair-Rite Products Corp. – United States

- SRMCO – United States

- Amphenol RF – United States

- E-SONG EMC – Taiwan

- Max Echo Technology – Taiwan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Ferrite Shielding Sheet Market Report |

| Base Year | 2024 |

| Segment by Type |

· Flexible · Rigid Variants |

| Segment by Application |

· Consumer Electronics · Automotive · Telecommunications |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The ferrite shielding sheet market continues to evolve with technological advancements across consumer electronics, automotive, and telecommunications sectors. As EMI protection becomes increasingly critical in our interconnected world, these materials play a vital role in ensuring device performance and reliability. The market shows strong growth potential, driven by 5G expansion, electric vehicle adoption, and the constant innovation in consumer electronics.

With ongoing developments in material science and manufacturing processes, ferrite shielding sheets will remain essential components in modern technology, adapting to meet the ever-changing demands of various industries while addressing environmental and efficiency challenges. The future of this market will likely see continued innovation in ultra-thin materials, enhanced shielding capabilities, and more sustainable production methods to meet the growing global demand for EMI protection solutions.

Global Ferrite Shielding Sheet Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Ferrite Shielding Sheet Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Ferrite Shielding SheetMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Ferrite Shielding Sheetplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Ferrite Shielding Sheet Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Ferrite Shielding Sheet Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Ferrite Shielding Sheet Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofFerrite Shielding SheetMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market size of the Ferrite Shielding Sheet Market by 2025?

The Ferrite Shielding Sheet Market is expected to grow to $1.52 billion by 2025. This growth will come from countries like Japan, the U.S., and South Korea.

What factors are driving growth in the Ferrite Shielding Sheet Market?

The market is growing due to the fast adoption of 5G technology. There’s also a big need for electromagnetic interference (EMI) protection.

What challenges does the Ferrite Shielding Sheet manufacturing industry face?

The industry faces challenges like improving material efficiency and scaling up production. It also deals with external pressures like regulatory changes and economic factors.

How do geopolitical issues affect the Ferrite Shielding Sheet Market?

Geopolitical issues can change international trade, impact tariffs, and affect regulations. This can alter supply and prices in the Ferrite Shielding Sheet Market.

What are the different types of Ferrite Shielding Sheets available?

There are mainly two types: flexible and rigid. Each type is used in different ways in the electronics industry.

Industries that use Ferrite Shielding Sheets

Ferrite Shielding Sheets are used in many areas, including:

- Consumer electronics

- Automotive

- Telecommunications

They help reduce electromagnetic interference.

What global trends are impacting the Ferrite Shielding Sheet Market?

Global trends show growth in different regions. They highlight key players and growth opportunities, especially in new markets.

What innovations are Japanese companies bringing to the Ferrite Shielding Sheet Market?

Japanese companies are leading in innovation. They’re creating advanced magnetic shielding solutions. This includes new products and research.

How is the U.S. influencing the demand for Ferrite Shielding Sheets?

The U.S. is driving demand with technological advancements. It’s addressing domestic needs and investing in high-frequency shielding.

What is South Korea’s role in the Ferrite Shielding Sheet Market?

South Korea’s market is growing fast, especially in 5G and IoT devices. This growth is thanks to technology advancements and government support.

What future trends might we see in the Ferrite Shielding Sheet Market?

The future might see a focus on ultra-thin and high-performance materials. This reflects progress in product development and changing market forecasts.

Who are the key players in the Ferrite Shielding Sheet Market?

The market has several key players. A detailed overview can show their market shares and strategies in the industry.