Global Fasteners Market: Unveiling Trends, Market Share & Comprehensive Industry Analysis (2025-2033)

- Last Updated:

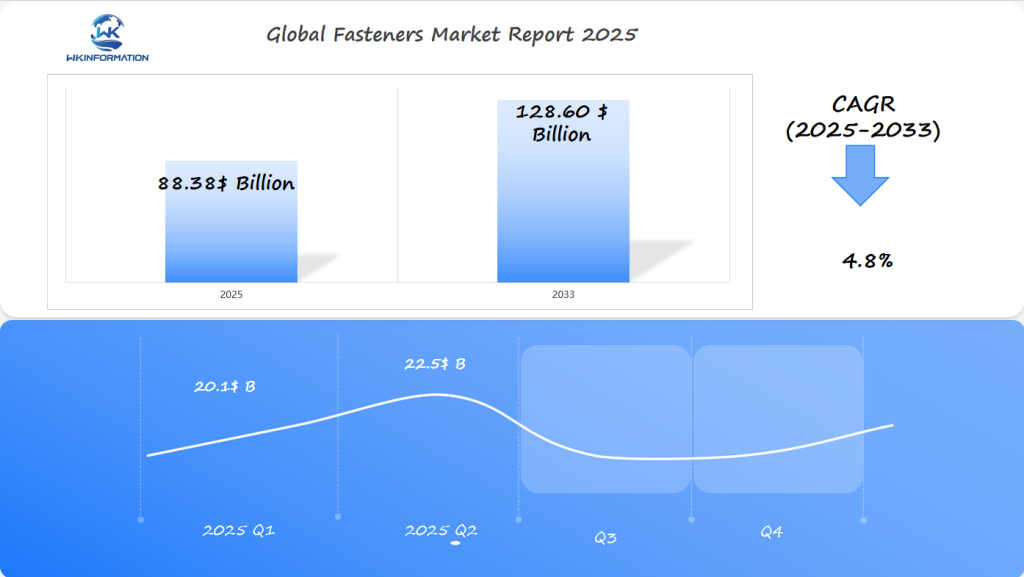

Fasteners Market Forecast for Q1 and Q2 2025

In 2025, the global fasteners market is projected to reach a size of $88.38 billion, with a compound annual growth rate (CAGR) of 4.8% expected from 2025 to 2033. Based on this annual market size, Q1 and Q2 are likely to show a gradual yet steady performance, influenced by seasonal demand variations and global industrial activities.

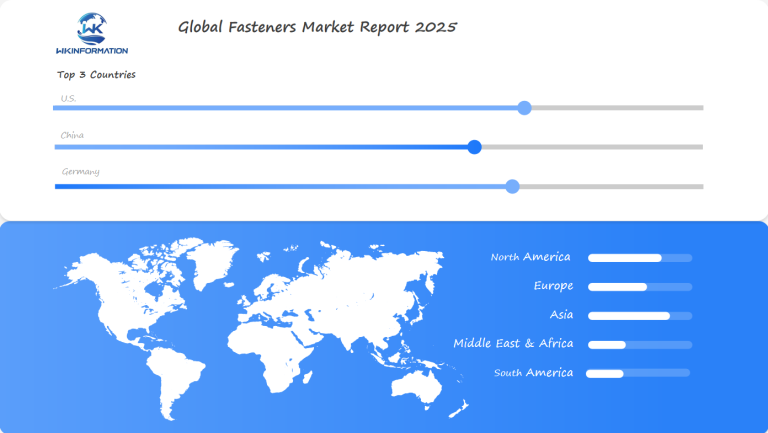

By the close of Q1 2025, the market is forecasted to generate approximately $20.1 billion, while Q2 is expected to see a slight increase, reaching around $22.5 billion, driven by a surge in production and construction activities. The United States, China, and Germany are identified as the most critical regions for this sector, with the U.S. maintaining a strong demand for fasteners across automotive and construction industries, China being a dominant producer, and Germany contributing significantly to the demand in the manufacturing and aerospace sectors. These countries warrant further in-depth analysis due to their integral roles in both production and consumption trends, shaping the overall market dynamics for fasteners in 2025.

Understanding the Upstream and Downstream Forces in the Fasteners Market

The fasteners market operates through a complex network of upstream and downstream forces that shape product availability, pricing, and market dynamics.

Upstream Forces in the Fasteners Supply Chain

- Raw material suppliers providing steel, aluminum, and other metals

- Equipment manufacturers producing machinery for fastener production

- Research and development teams creating new material compositions

- Quality control systems and testing facilities

Downstream Forces in the Fasteners Supply Chain

- Distribution networks and wholesalers

- Retail outlets specializing in industrial supplies

- End-user industries (automotive, construction, aerospace)

- Installation and maintenance service providers

The interaction between these forces creates a dynamic market environment where supply meets demand. Raw material suppliers represent the starting point of the supply chain, providing essential metals and materials to fastener manufacturers. These manufacturers transform these materials into finished products through specialized production processes.

Key Supply Chain Components

- Material procurement and storage

- Manufacturing and quality testing

- Packaging and inventory management

- Distribution and logistics

- Customer service and technical support

Price fluctuations in the fasteners market often stem from changes in raw material costs, which cascade through the supply chain. When steel prices rise, manufacturers typically adjust their pricing structures, affecting downstream distributors and end-users. This ripple effect influences product availability and market competitiveness.

Supply Chain Impact on Market Dynamics

- Raw material cost variations affect product pricing

- Production capacity influences product availability

- Transportation costs impact regional market access

- Inventory levels determine delivery times

Manufacturing efficiency plays a crucial role in managing these forces. Advanced production techniques and automation help manufacturers optimize their operations, reducing costs and improving product consistency. These improvements benefit both upstream suppliers and downstream customers through better quality control and more reliable delivery schedules.

The relationship between upstream and downstream forces requires careful management to maintain market stability. Successful manufacturers maintain strong partnerships with both suppliers and distributors, creating resilient supply chains that can adapt to market changes and maintain consistent product availability.

Emerging Trends in the Fasteners Industry

The fasteners industry is undergoing significant transformations driven by sustainability demands and technological innovations. Manufacturers now prioritize eco-friendly materials and production methods to reduce environmental impact. Biodegradable fasteners and recycled metal components have gained traction, with several companies developing alternatives to traditional steel and plastic fasteners.

Sustainable Production Methods:

- Solar-powered manufacturing facilities

- Waste reduction through precision engineering

- Water conservation in cooling processes

- Recycled material integration in production lines

The rise of electric vehicles has changed the way fasteners are made. EVs need lightweight but strong fasteners that can handle high-voltage conditions. These specialized parts must have:

- Better electrical insulation properties

- Reduced weight without losing strength

- Corrosion resistance for battery compartments

- Thermal management capabilities

Smart Manufacturing Technologies reshape production processes through:

- AI-powered quality control systems

- Automated assembly lines

- 3D printing for prototype development

- Digital twin technology for testing

The integration of Internet of Things (IoT) sensors in fastening systems enables real-time monitoring of:

- Torque levels

- Vibration patterns

- Wear and tear

- Temperature variations

Industry leaders invest in nano-coating technologies to enhance fastener performance. These coatings provide:

- Superior corrosion resistance

- Self-lubricating properties

- Improved thermal stability

- Enhanced durability

The shift toward modular design in manufacturing creates demand for adaptable fastening solutions. Companies develop versatile fasteners that accommodate multiple applications, reducing inventory requirements and simplifying assembly processes.

Overcoming the Barriers to Fastener Market Expansion

The fasteners industry faces significant regulatory hurdles that impact market growth. Safety standards across different regions create complex compliance requirements:

- ISO 898-1 standards for mechanical properties

- AS9100 certification for aerospace applications

- RoHS compliance for environmental safety

Raw material volatility presents another critical challenge. The industry grapples with:

- Price fluctuations in steel and aluminum

- Supply chain disruptions affecting material availability

- Quality inconsistencies from different suppliers

Cost Management Strategies

To address these challenges, companies can implement the following cost management strategies:

- Implementing lean manufacturing processes

- Developing alternative material sources

- Building strategic supplier partnerships

- Investing in automation to reduce labor costs

Market entry barriers pose substantial challenges for new players. The established manufacturers maintain competitive advantages through:

- High initial capital requirements

- Complex distribution networks

- Long-standing customer relationships

- Technical expertise requirements

Successful Market Entry Approaches

New entrants can overcome market entry barriers by adopting the following approaches:

- Focusing on niche markets

- Developing innovative product solutions

- Creating strategic partnerships

- Investing in digital marketing and e-commerce platforms

Companies succeeding in the fasteners market employ data-driven decision-making to navigate these challenges. They invest in:

- Advanced inventory management systems

- Quality control automation

- Supply chain visibility tools

- Market intelligence platforms

The regulatory landscape requires manufacturers to maintain strict quality control measures. Successful companies implement:

- Regular quality audits

- Employee training programs

- Documentation systems

- Compliance monitoring tools

These strategic approaches help companies overcome market barriers while maintaining profitability and market share in the competitive fasteners industry.

Geopolitical Impacts on Fastener Manufacturing and Trade

Global trade dynamics shape the fastener industry’s landscape through complex international relationships and regional policies. Recent trade tensions between major economies have created significant ripples across the fastener supply chain.

Trade Agreement Influences

- The U.S.-China trade disputes have led to increased tariffs on fastener imports

- EU’s stringent quality standards affect manufacturing requirements

- USMCA agreement creates new rules of origin requirements for automotive fasteners

Supply Chain Disruptions

- Political tensions cause sudden shifts in sourcing strategies

- Border delays impact just-in-time manufacturing schedules

- Export restrictions on raw materials affect production capabilities

Regional manufacturing advantages create distinct competitive positions in the global market:

Asia-Pacific Region

- Lower labor costs

- High production volume capabilities

- Established supplier networks

European Manufacturing

- Advanced automation systems

- High-precision manufacturing expertise

- Strong quality control standards

North American Production

- Strategic location for automotive sector

- Advanced R&D capabilities

- Robust intellectual property protection

The current geopolitical climate has pushed manufacturers to adopt new strategies:

- Diversification of supplier networks across multiple regions

- Investment in local production facilities

- Development of regional manufacturing hubs

- Implementation of risk management protocols

Trade policies continue to reshape manufacturing decisions, with companies increasingly adopting dual-sourcing strategies and establishing production facilities closer to end markets. These adaptations help mitigate risks associated with international trade uncertainties and political tensions.

The fastener industry’s response to geopolitical challenges demonstrates its resilience and ability to adapt to changing market conditions. Companies that successfully navigate these complexities gain competitive advantages through strategic positioning and risk management.

Fastener Market Segmentation by Type: Bolts, Screws, Nuts, and More

The fastener market divides into distinct product categories, each serving specific industrial applications and requirements. Let’s examine the key segments and their market dynamics:

1. Bolts

- Hex bolts dominate industrial applications

- Carriage bolts serve woodworking needs

- U-bolts for pipe and tube securing

- Structural bolts for construction projects

2. Screws

- Machine screws lead in precision engineering

- Self-tapping screws gain popularity in automotive

- Wood screws maintain steady demand

- Sheet metal screws show growth in manufacturing

3. Nuts

- Hex nuts remain the standard choice

- Lock nuts see increased adoption in vibration-heavy applications

- Wing nuts serve quick-release needs

- Flange nuts grow in automotive assembly

4. Specialty Fasteners

- Rivets

- Washers

- Anchors

- Clips and pins

Recent market data reveals shifting demand patterns across these categories. The automotive sector drives innovation in lightweight fastener solutions, particularly in aluminum and composite-compatible products. Construction industry requirements push the development of corrosion-resistant options.

Current Market Trends

- Rising demand for titanium fasteners in aerospace

- Increased adoption of micro-fasteners in electronics

- Growth in plastic fastener alternatives

- Custom-engineered solutions for specific applications

The manufacturing sector’s automation trend creates demand for standardized fastener designs that work seamlessly with robotic assembly systems. This shift influences product development across all categories, pushing manufacturers to adapt their offerings.

Raw material preferences continue to evolve, with stainless steel fasteners showing strong growth in food processing and medical applications. The electronics industry drives miniaturization trends, creating new opportunities in micro-fastener development.

Applications Driving the Fasteners Market Demand

The fasteners market thrives on diverse industrial applications, with the automotive and construction sectors leading demand growth. Let’s explore the key industries shaping market dynamics:

1. Automotive Sector

- Electric vehicle manufacturing requires specialized fasteners for battery compartments

- Lightweight materials demand innovative fastening solutions

- Safety-critical components need high-strength fasteners

- Automated assembly lines require standardized fastener designs

2. Construction Industry

- High-rise buildings utilize structural fasteners for load-bearing joints

- Bridge construction demands corrosion-resistant fastening systems

- Prefabricated construction methods increase fastener usage

- Seismic-resistant structures require specialized anchor bolts

3. Aerospace Applications

- Aircraft assembly uses precision-engineered fasteners

- Space vehicles need thermal-resistant fastening solutions

- Maintenance operations require certified aerospace-grade fasteners

- Composite materials demand specialized joining techniques

4. Industrial Machinery

- Heavy equipment manufacturing uses large-diameter fasteners

- Vibration-resistant fasteners for rotating machinery

- Quick-release fasteners for maintenance access

- Custom solutions for specialized equipment

5. Consumer Electronics

- Miniature fasteners for mobile devices

- Heat-dissipating fasteners for computing equipment

- Anti-tampering fasteners for security

- Design-specific fasteners for aesthetic appeal

The market demand patterns reflect industry-specific requirements:

- Automotive: 35% market share, driven by vehicle production rates

- Construction: 28% share, influenced by infrastructure projects

- Aerospace: 15% share, growing with air travel demands

- Industrial: 12% share, steady growth in manufacturing

- Electronics: 10% share, rapid innovation cycles

These sectors demonstrate unique growth drivers:

- Raw material preferences

- Safety regulations

- Production volumes

- Assembly automation

- Maintenance requirements

Global Fasteners Market Overview and Trends

The global fasteners market is experiencing strong growth, with Asia-Pacific becoming the leading region.

Key Drivers of Growth

Several factors are driving the growth of the fasteners market:

- Infrastructure Development: The ongoing construction projects and infrastructure development initiatives in emerging economies are fueling the demand for fasteners.

- Automotive Industry Revival: The recovery of the automotive industry post-pandemic is boosting the requirement for fasteners in vehicle manufacturing.

- Aerospace and Defense Investments: Increased investments in aerospace and defense sectors are creating opportunities for specialized fasteners.

Distribution Channels

The market structure reveals interesting patterns in distribution channels:

- Direct sales to OEMs

- Distributor networks

- Online retail

Recent Shifts in Demand

Recent market shifts point to increased demand for specialized fasteners in high-tech applications. The aerospace sector requires titanium-based fasteners, while medical devices demand precision-engineered micro-fasteners.

Raw Material Dynamics

Raw material availability shapes market dynamics, with steel remaining the primary material choice at 65% market share. Alternative materials like aluminum and titanium show increased adoption rates, particularly in lightweight applications.

Impact of Digital Transformation

The digital transformation affects distribution patterns, with e-commerce platforms gaining prominence. Digital marketplaces now account for 15% of total fastener sales, showing a year-over-year growth rate of 12%.

U.S. Fasteners Market: Trends and Development Opportunities

The U.S. fasteners market has significant growth potential. This growth is driven by several important factors:

1. Reshoring Initiatives

- Local manufacturing expansion creates new opportunities

- Reduced dependency on international supply chains

- Investment in domestic production capabilities

2. Aerospace and Defense Sector Impact

- High-precision fastener demand for aircraft assembly

- Military modernization programs driving specialized requirements

- Strict quality control standards pushing innovation

3. Infrastructure Development

- $1.2 trillion infrastructure bill boosting construction demand

- Bridge and highway repairs requiring specialized fasteners

- Renewable energy projects creating new market segments

4. Technology Integration

- Smart fasteners with embedded sensors gaining traction

- Advanced coating technologies for enhanced durability

- Automation in manufacturing processes

The U.S. market stands out with its strict quality standards and technological advancements. American manufacturers prioritize producing high-value products, especially in specialized industries that require top-performing fasteners.

Recent investments in research and development have led to breakthroughs in material science and manufacturing methods, placing U.S. companies at the forefront of producing premium fasteners.

The automotive sector continues to be a major driving force, as electric vehicle manufacturers seek lightweight and strong fasteners. These demands challenge U.S. manufacturers to create new alloys and composite materials that align with the evolving needs of the industry.

China's Influence on the Global Fasteners Market

China’s dominance in the global fasteners market comes from its strong manufacturing capabilities and cost-effective production methods. The country currently controls 35% of the global fasteners production, with key manufacturing hubs in:

- Zhejiang Province

- Jiangsu Province

- Guangdong Province

Strategic Investments by Chinese Manufacturers

Chinese manufacturers have gained significant market share through strategic investments in:

- Advanced automation systems

- Quality control measures

- Research and development initiatives

Steady Growth of China’s Fastener Exports

The country’s fastener exports have seen a steady annual growth rate of 6.0%, driven by competitive pricing and increasing quality standards. Chinese manufacturers now produce specialized fasteners for high-tech applications, moving beyond their traditional focus on standard components.

Recent Developments in China’s Fastener Industry

Recent developments in China’s fastener industry include:

- Implementation of Industry 4.0 technologies

- Adoption of sustainable manufacturing practices

- Development of proprietary fastening solutions

Impact of the “Made in China 2025” Initiative

The “Made in China 2025” initiative has sparked investments in precision manufacturing, enabling Chinese producers to compete in premium market segments. This strategic shift has resulted in improved product quality and expanded market reach, particularly in aerospace and automotive sectors.

Pursuit of International Certifications by Chinese Manufacturers

Chinese manufacturers are actively pursuing certifications from international quality assurance bodies, strengthening their position in global supply chains. The country’s vast raw material resources and established logistics networks continue to reinforce its competitive advantage in the fasteners market.

Germany's Role in the Fasteners Industry

Germany is a major player in the European fasteners market, thanks to its strong automotive and manufacturing industries.

Strengths of German Fastener Manufacturers

German fastener manufacturers excel in:

- Precision Engineering: Production of high-tolerance fasteners for critical applications

- Quality Control: Implementation of rigorous testing and certification processes

- Innovation: Development of specialized fastening solutions for emerging industries

Key Drivers of Fastener Demand

The German automotive sector remains a primary driver of fastener demand, with companies like BMW, Mercedes-Benz, and Volkswagen requiring premium-quality components. These manufacturers prioritize:

- Lightweight materials for fuel efficiency

- High-strength fasteners for safety applications

- Specialized solutions for electric vehicle assembly

Industry Leadership through Innovation

German fastener producers have established themselves as industry leaders through:

- Advanced automation in manufacturing processes

- Investment in research and development

- Strong focus on sustainability and eco-friendly production methods

Strategic Positioning for Export

The country’s strategic location in central Europe positions it as a key export hub, serving markets across the EU and beyond. German manufacturers maintain competitive advantages through specialized product offerings and technical expertise, particularly in high-performance applications requiring precise engineering tolerances.

Technological Advancements in Manufacturing

The integration of Industry 4.0 principles in German fastener manufacturing facilities has enhanced production efficiency and quality control, setting new standards for the global industry. These technological advancements enable real-time monitoring, predictive maintenance, and automated quality assurance systems.

Future Outlook for the Fasteners Market

The fasteners market is expected to grow significantly through 2030, with several key developments shaping its evolution:

1. Technological Integration

- Smart fasteners with embedded sensors for real-time monitoring

- IoT-enabled tracking systems for inventory management

- AI-driven quality control in manufacturing processes

2. Market Expansion Drivers

- Projected CAGR of 4.8% reaching $128.60 billion by 2033

- Rising demand from emerging economies in Asia-Pacific

- Increased infrastructure development projects globally

3. Industry-Specific Growth

- Aerospace sector demands for lightweight, high-strength fasteners

- Renewable energy installations requiring specialized fastening solutions

- Medical device manufacturing expansion

4. Innovation Focus Areas

- Development of nano-coated fasteners for enhanced durability

- Bio-based and recyclable material alternatives

- Advanced manufacturing techniques including 3D printing

5. Market Dynamics

- Shift towards customized fastening solutions

- Integration of automation in production processes

- Growing emphasis on cost-effective, sustainable products

The market’s evolution reflects broader industrial trends, with digitalization and sustainability driving product development. Companies investing in R&D and advanced manufacturing capabilities position themselves to capture emerging opportunities in specialized sectors.

Understanding the Competitive Landscape of the Fasteners Market

The fasteners market is highly competitive, with both established companies and new manufacturers competing for a share of the market.

Major Players in the Industry:

-

Precision Castparts Corp. – USA

-

Stanley Black & Decker Inc. – USA

-

NORMA Group SE – Germany

-

SFS Group AG – Switzerland

-

Fontana Gruppo S.p.A. – Italy

-

PennEngineering – USA

-

Sundram Fasteners Limited – India

-

LISI Group – France

-

ARaymond Network – France

-

Trifast plc – UK

Overall

|

Report Metric |

Details |

|---|---|

|

Report Name |

Global Fasteners Market Report |

| Base Year |

2024 |

|

Segment by Type |

|

| Segment by Application |

|

|

Geographies Covered |

|

|

Forecast units |

USD million in value |

|

Report coverage |

Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The future outlook for the fasteners market through 2033 presents promising opportunities across various sectors. Key drivers such as technological advancements and innovation in materials are expected to redefine product capabilities. Emphasis on lightweight and high-strength materials will likely enhance the utility of fasteners in automotive and aerospace applications.

1. Sustainable Practices

Growing environmental concerns are steering the industry towards sustainable manufacturing practices. Expect increased demand for eco-friendly fasteners that comply with stringent regulations.

2. Emerging Markets

Expansion in emerging markets, particularly in the Asia-Pacific region, offers significant market opportunities. As infrastructure projects proliferate, so does the need for durable fastening solutions.

3. Digital Transformation

Adoption of advanced technologies like IoT and AI could revolutionize fastener production, improving efficiency and customization. These innovations may cater to evolving consumer needs, providing a competitive edge.

The path forward is rich with possibilities, setting the stage for dynamic growth within the global fasteners market.

Global Fasteners Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Fasteners Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- FastenersMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Fastenersplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Fasteners Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Fasteners Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Fasteners Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofFasteners Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected value of the fasteners market by 2025?

The fasteners market is set to reach a value of $88.38 billion by 2025, highlighting its significant growth potential.

What are the key regions driving growth in the fasteners market?

The U.S., China, and Germany are identified as key regions that are driving growth in the fasteners market due to their robust manufacturing sectors and demand in various industries.

What are upstream and downstream forces in the fasteners market?

Upstream forces refer to suppliers and manufacturers that impact the production of fasteners, while downstream forces involve distribution and end-user demand, both of which significantly influence pricing and availability.

What emerging trends are shaping the fasteners industry?

Key trends include a shift towards sustainable materials, an increase in electric vehicle (EV) production affecting fastener requirements, and technological advancements improving manufacturing processes.

What barriers does the fasteners market face for expansion?

The fasteners market faces several barriers including regulatory hurdles, challenges related to raw material costs and availability, and other obstacles that can hinder market entry.

How do geopolitical factors influence the fasteners manufacturing and trade?

Geopolitical impacts include how international trade agreements affect exports/imports of fasteners, political tensions disrupting supply chains, and regional advantages or disadvantages in manufacturing capabilities.