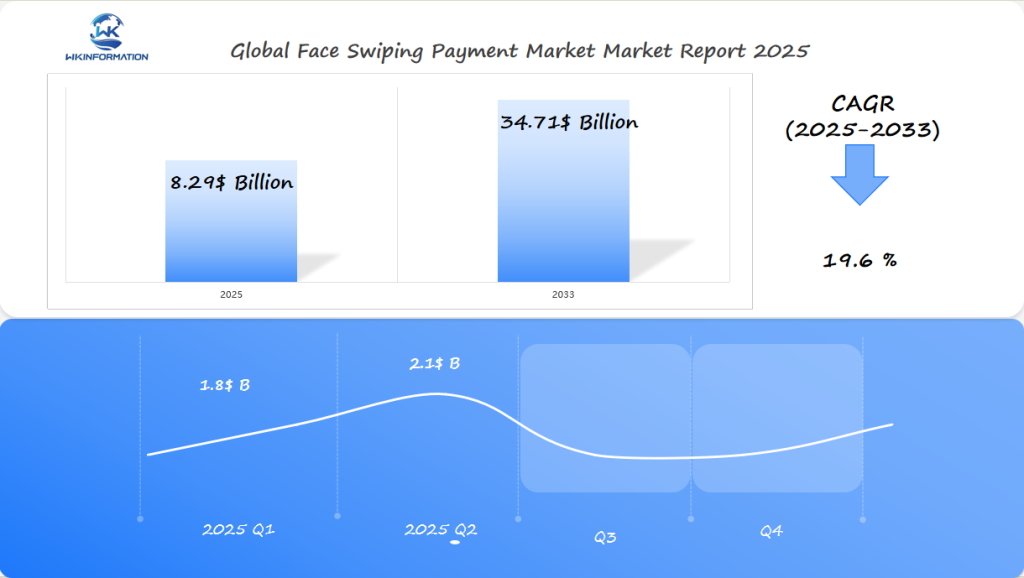

Face Swiping Payment Market Surging to $8.29 Billion by 2025: Momentum from China, the U.S., and South Korea

Explore the Face Swiping Payment Market’s rapid growth to $8.29B by 2025. Learn how facial recognition transforms digital payments across China, the U.S., and global markets.

- Last Updated:

Face Swiping Payment Market: Q1 and Q2 of 2025 Analysis

The Face Swiping Payment market is projected to reach $8.29 billion by 2025, growing at a CAGR of 19.6% from 2025 to 2033. In Q1 of 2025, the market size is expected to be approximately $1.8 billion, with growth continuing in Q2 to $2.1 billion. This cutting-edge payment method, leveraging biometric technology, is gaining traction due to its convenience and enhanced security features.

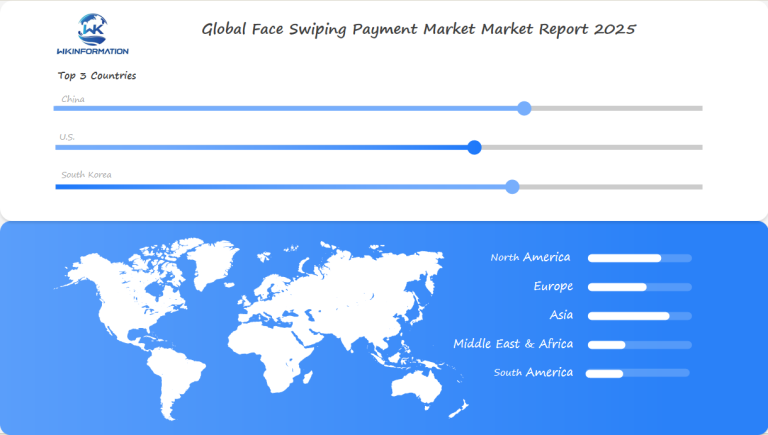

China, the U.S., and South Korea are the leading countries driving the growth of this market. In China, widespread adoption is bolstered by the nation’s advanced digital payment infrastructure, while in the U.S. and South Korea, there is growing interest in contactless payment solutions. The rising demand for seamless, frictionless payment experiences across both online and offline retail environments is fueling this market’s growth. With improvements in AI and facial recognition technologies, the market is expected to expand rapidly in the coming years.

Key Takeaways

- The face swiping payment market is expected to reach $8.29 billion by 2025.

- Technological innovation is being led by China, the U.S., and South Korea.

- Biometric payment systems offer enhanced security and convenience.

- Facial recognition payments are transforming digital transaction methods.

- Contactless payments are becoming mainstream across global markets.

Exploring the Upstream and Downstream Industry Chain of Face Swiping Payment

The world of face swiping payments is a complex network of technology and various players involved. At the forefront are the providers of facial recognition technology, who play a crucial role in this industry. They are responsible for developing sophisticated algorithms and hardware that enable seamless biometric checks.

Key Players in the Upstream Segment

The upstream segment of the face swiping payment industry consists of several key players, including:

- Developers of cutting-edge facial recognition software

- Manufacturers of semiconductors producing specialized biometric chips

- Engineering firms specializing in hardware design for advanced scanning technologies

The Importance of Payment Processors in the Downstream

In the downstream segment, payment processors hold significant importance. They integrate facial recognition technology into the financial sector, enhancing security and convenience for all users during transactions.

Interesting Applications of New Technologies by Merchants

It is fascinating to observe how merchants are adopting and utilizing these new technologies:

- Retail sectors embracing contactless payment solutions

- Financial institutions implementing biometric verification methods

- Technology companies creating innovative payment platforms

Recent trends in emerging markets indicate a rapid growth of facial recognition payment systems, with global technological ecosystems becoming more interconnected than ever before.

Emerging tech and trends in the Face Swiping Payment ecosystem

The face swiping payment world is changing fast thanks to new tech. New solutions are making payments safer and easier for everyone.

New tech is making facial recognition in payments better than ever. It’s creating smarter ways to pay that are both easy and safe.

Artificial Intelligence Advancements

AI is making facial recognition tech much better. Now, machine learning helps with:

- Ultra-fast facial matching in just milliseconds

- Better accuracy in all kinds of lighting

- Adapting to changes in faces

Integration with IoT Devices

IoT is making payments work together across different devices. Smart devices now offer:

- Easy authentication with facial recognition

- Touchless payments on many devices

- More personalized experiences for users

Blockchain for Enhanced Security

Blockchain is adding extra security to biometric payments. It brings:

- Secure, decentralized ways to verify identities

- Safe, unchangeable records of transactions

- Less chance of identity theft

These new tech combinations are changing digital payments. They make face-swiping payments safer, faster, and more user-friendly than ever.

Limitations slowing adoption of Face Swiping Payment systems

Face swiping payment tech faces big hurdles to becoming common. Privacy worries top the list, as people get nervous about their biometric data. They fear their faces could be tracked without permission.

Costs to set up these systems are also a big issue. Businesses need a lot of money to start and keep these systems running. Small companies often can’t afford it.

- High initial setup expenses

- Complex technological infrastructure requirements

- Ongoing maintenance and upgrade costs

Rules about using biometric data also slow things down. Compliance with changing privacy laws is hard for tech companies.

| Challenge Category | Key Considerations | Potential Impact |

| Privacy Concerns | Data protection and user consent | Reduced consumer trust |

| Infrastructure Costs | Technology investment and maintenance | Limited market penetration |

| Regulatory Landscape | Compliance with diverse legal frameworks | Potential market restrictions |

But, tech keeps getting better to tackle these issues. New encryption, clear data use policies, and cheaper ways to start up are helping. These steps are making face swiping payments more appealing.

Geopolitical factors reshaping the biometric payment landscape

The world of biometric payments is getting more complex. This is because of global politics and rules about data. Governments are trying to find a balance between new tech and keeping data safe.

Some big challenges for biometric payments include:

- Strict rules for protecting data worldwide

- Trade fights between big countries

- Following rules in different places

- Keeping biometric data safe for national security

Trade wars between the U.S., China, and others make it hard to move money across borders. Each country has its own rules for keeping biometric data safe. This makes it tough to build a global payment system.

| Country | Biometric Regulation Strictness | Cross-Border Transaction Impact |

| United States | High | Moderate Restrictions |

| European Union | Very High | Significant Limitations |

| China | Moderate | Flexible Approach |

The changing global scene needs smart plans from tech companies. They must create strong ways to follow rules and still offer new payment options.

Types of Face Swiping Payment Technology

Facial recognition technology has changed how we make payments. It offers secure and easy ways to handle money. The growth in biometric accuracy has led to various systems for different needs.

The world of face swiping payments has three main ways to recognize faces:

2D Facial Recognition Systems

2D facial recognition is the basic method in biometric payments. It uses two-dimensional images to check identities. It’s known for:

- Lower computational needs

- Fast processing

- Being cost-effective

- Working well in standard light

3D Facial Recognition Systems

3D facial recognition is more advanced. It uses depth-mapping to scan faces in detail. It’s better because it:

- Is more accurate than 2D

- Works well in different lights

- Is hard to trick

- Looks at complex face features

Infrared Facial Recognition Technology

Infrared face scanning is the latest in payment security. It uses thermal imaging to add an extra layer of security. This method is hard to beat.

These technologies keep getting better. They promise more secure and advanced ways to handle money in the future.

Insights on Face Swiping Payment Usage

The world of fintech facial recognition is changing fast. It’s now how businesses talk to customers in many fields. Face swiping payments are making buying things easier and safer in different areas.

Today’s retail biometrics are changing how we shop. They offer quick and safe ways to pay. New tech is breaking down old payment walls.

Retail and E-commerce Innovations

Facial recognition payments are making shopping more personal. Retailers can now:

- Recognize returning customers instantly

- Provide customized product recommendations

- Streamline checkout processes

- Reduce transaction times by up to 70%

Banking and Financial Services

Financial institutions are using fintech facial recognition to improve security and service. Banks use biometric checks to:

- Prevent unauthorized account access

- Authenticate high-value transactions

- Reduce identity fraud risks

Transportation and Mobility

Transit payment systems are getting a tech boost with face swiping. Urban transport is adding biometric tech to:

- Enable contactless ticket purchases

- Speed up passenger boarding processes

- Enhance security in public transit

The mix of retail biometrics, fintech facial recognition, and transit payment systems is a big step forward in digital payments.

Global Face Swiping Payment adoption by region

The world of face swiping payments is complex. It shows how different regions innovate and face challenges. Each area has its own pace and setup for these new payment methods.

Asia: Leading the Way with Biometric Payments

In Asia, countries like China and South Korea are leading. They’ve made biometric payments a big part of daily life. This sets a high standard for digital payments worldwide.

- China leads with widespread facial payment infrastructure

- South Korea demonstrates advanced technological integration

- Japan explores cutting-edge biometric payment systems

North America: Cautious Approach to Face Swiping Payments

In North America, the pace is slower. The US is careful about privacy while looking into face swiping payments. Laws and rules shape how these payments are used and accepted.

Europe: Balancing Privacy and Technology

Europe’s rules are key in the face swiping payment world. Laws like GDPR make companies think about privacy and tech together. This balance is important for everyone.

| Region | Adoption Rate | Key Challenges |

| Asia-Pacific | High | Infrastructure scalability |

| North America | Medium | Privacy concerns |

| Europe | Low-Medium | Regulatory compliance |

The world of face swiping payments is always changing. Each region brings its own ideas and tech to this new way of paying.

China's Facial Recognition Infrastructure and Payment Innovation

China is at the forefront of facial recognition payment technology, revolutionizing the financial industry. The fintech sector in China has experienced rapid growth, leveraging advanced biometrics across various platforms.

Key Players in the Shift

Alipay’s facial recognition technology plays a crucial role in this transformation, enabling seamless and secure transactions through a simple scan of one’s face. WeChat Pay, another major player, enhances digital payments by streamlining the user experience.

Current Landscape

- Over 850 million Chinese consumers now use facial recognition payment systems

- Technological infrastructure supports near-instantaneous transaction verification

- Government policies actively encourage biometric payment innovations

Advantages of China’s Tech Scene

China’s technology ecosystem provides significant advantages for payment solutions. Artificial intelligence and machine learning algorithms contribute to enhancing the precision and safety of facial recognition.

Continued Investment from Big Tech

Major tech corporations such as Alibaba and Tencent persistently invest in biometric payment systems, solidifying China’s position as a leading force in digital finance. Their commitment to innovation is reshaping our approach to monetary transactions.

U.S. fintech advancements driving Face Swiping Payment growth

American facial recognition startups are changing how we pay. Silicon Valley is leading the way with new biometric payment solutions. These innovations are making digital transactions better.

The U.S. fintech scene is buzzing with new facial recognition payment tech. Some key advancements include:

- Advanced AI-powered authentication systems

- Enhanced security protocols for biometric transactions

- Streamlined user verification processes

US biometric regulations help guide responsible innovation. Startups are creating advanced facial recognition tech. They focus on both tech progress and privacy.

| Startup Focus Area | Key Innovation | Market Impact |

| Biometric Authentication | 3D Facial Mapping | Increased Security |

| Payment Integration | Real-time Verification | Faster Transactions |

| Privacy Protection | Encrypted Facial Data | Consumer Trust |

Financial institutions are teaming up with facial recognition startups. This partnership is making payments secure and efficient.

South Korea's role in shaping seamless biometric commerce

South Korea is at the forefront of facial recognition systems, revolutionizing biometric commerce. The country’s tech industry has become a powerhouse for digital payments and is recognized as a leading fintech hub in Asia.

K-Pay biometrics represents a significant advancement in secure payment methods. Korean companies have developed facial recognition technology that prioritizes both security and user-friendliness.

Key Features of K-Pay Biometrics

- Advanced facial recognition algorithms with 99.7% accuracy

- Integration of AI-powered security measures

- Rapid adoption across multiple industry sectors

The approach taken by South Korea is distinctive. It combines cutting-edge technology with stringent regulations. Banks and tech companies collaborate to ensure both security and convenience.

Korean fintech companies continue to set new benchmarks, reshaping digital payments on a global scale.

Future of the Face Swiping Payment market

The future of payments looks exciting with new tech on the horizon. Facial recognition is leading the way to more secure and advanced payment systems. These changes will change how we handle money.

Contactless payments are set to grow fast in many areas. New tech is making it easier and safer to pay. This means better experiences for everyone.

Emerging Markets and Opportunities

Some markets are leading the way in biometric payments:

- Healthcare payment systems

- Educational institution transactions

- Smart city infrastructure

- Advanced retail experiences

Key players in the Face Swiping Payment competitive space

The face swiping payment market is very competitive. Tech giants and fintech companies are leading the way with new technologies. They are changing how we make payments.

Key Players:

-

PopID – United States

-

Facepay – United States

-

PayByFace – Romania

-

VisionLabs – Netherlands

-

Telepower Communications – China

-

PAX Global Technology – China

-

Alipay – China

-

NEC Corporation – Japan

-

SnapPay – Canada

-

Mastercard – United States

New startups are shaking things up with fresh ideas in facial recognition payments. They use artificial intelligence and machine learning for better and safer payments.

Working together is key in the biometric payment world. Companies team up to make facial recognition tech stronger and more user-friendly.

The race is on for the latest tech, with lots of money going into research. This is how companies stay ahead in the fast-changing face swiping payment market.

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Face Swiping Payment Market Report |

| Base Year | 2024 |

| Segment by Type |

· 2D Facial Recognition Systems · 3D Facial Recognition Systems |

| Segment by Application |

· Retail and E-commerce · Banking and Financial · Transportation and Mobility · Others |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The world of digital payments is rapidly evolving with the introduction of face swiping payments. By 2025, this technology could reach a staggering $8.29 billion. Countries such as China, the United States, and South Korea are at the forefront of making transactions safer and more convenient.

However, it’s important to acknowledge that there are still concerns regarding privacy and data security. As face swiping payments gain popularity, it becomes crucial to address these issues and ensure that individuals’ personal information remains confidential.

Despite the challenges, the advantages of face swiping payments are immense. With ongoing advancements in technology, these systems are becoming increasingly secure and dependable.

The potential for growth in this sector is substantial, with new markets emerging worldwide. As face swiping payments continue to evolve and improve, they have the power to revolutionize our shopping experiences and online payment processes across the globe.

Global Face Swiping Payment Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Face Swiping Payment Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Face Swiping Payment Market Segmentation Overview

Chapter 2: Competitive Landscape

- Global Face Swiping Payment Players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Face Swiping Payment Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Face Swiping Payment Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Face Swiping Payment Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Face Swiping Payment Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is Face Swiping Payment technology?

Face Swiping Payment is a new way to pay using your face. It uses facial recognition to check who you are and make payments. You just need to scan your face at checkout or online.

How secure is Face Swiping Payment technology?

It’s very secure. It uses smart tech like AI and special anti-spoofing methods. These help keep your face scan safe from hackers.

Which countries are leading in Face Swiping Payment adoption?

The countries at the forefront of Face Swiping Payment adoption are China, the US, and South Korea. Among these, China takes the lead with its mobile payment platforms Alipay and WeChat Pay, which have extensively integrated facial recognition technology.

What are the main challenges facing Face Swiping Payment technology?

The main challenges include:

- Privacy concerns

- High costs

- Regulatory compliance

- Data security issues

- Lack of widespread acceptance

How accurate is facial recognition payment technology?

Facial recognition payment technology is highly accurate, with success rates ranging from 95% to 99.9%. Its accuracy continues to improve thanks to advancements in AI and machine learning, resulting in faster and more precise transactions.

Which industries are most likely to adopt Face Swiping Payment?

The following industries are showing interest in adopting Face Swiping Payment:

- Retail

- Banking

- Transportation

- Hospitality

- Healthcare

- Education

These industries recognize the advantages that Face Swiping Payment can bring.

What technologies are enhancing Face Swiping Payment systems?

The following technologies are enhancing Face Swiping Payment systems:

- Artificial Intelligence (AI)

- Blockchain

- Internet of Things (IoT)

- 3D facial recognition

- Infrared facial recognition

These technologies improve security and make payments smoother.

What is the projected market value for Face Swiping Payment?

It’s expected to grow a lot. The market could hit $8.29 billion by 2025. This shows it’s becoming more popular worldwide.

How do Face Swiping Payments protect user privacy?

Face Swiping Payments protect user privacy through the following measures:

- Encrypted data: They use encryption to secure your payment information, making it unreadable to unauthorized parties.

- Anonymization: Your data is anonymized, meaning that any personally identifiable information is removed or replaced with a unique identifier.

- Strict privacy rules: Face Swiping Payments adhere to strict privacy regulations and guidelines to ensure that your data is handled responsibly.

- User consent: They obtain your consent before collecting or using your data, giving you control over how your information is used.

These practices work together to keep your personal information safe and private.