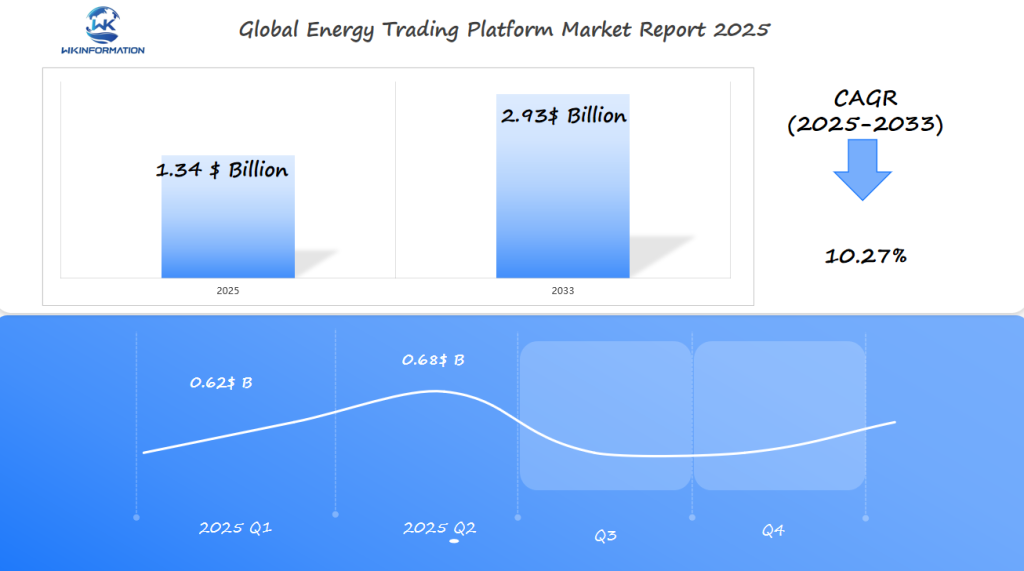

Energy Trading Platform Market Expected to Exceed $1.34 Billion Globally by 2025 with Leading Growth in the U.S., Germany, and China

Discover the rapidly growing Energy Trading Platform Market, expected to reach $1.34 billion globally by 2025.

- Last Updated:

Energy Trading Platform Market Q1 and Q2 of 2025 Analysis and Regional Highlights

The Energy Trading Platform market is expected to reach $1.34 billion in 2025, with a CAGR of 10.27% through 2033, reflecting rapid technological adoption and market modernization. For Q1 and Q2 of 2025, estimated revenues stand at $0.62 billion and $0.68 billion, respectively, signaling an accelerating demand for agile, AI-driven trading solutions.

Regional Insights

- The U.S. market leads with sophisticated infrastructure investments and regulatory frameworks supporting blockchain-enabled energy transactions.

- Germany’s energy transition strategy, focused on renewables and smart grid deployment, boosts platform integration and demand.

- China’s aggressive energy reforms and expansion of trading hubs further enhance market growth.

Key Drivers

Increasing complexity in energy sourcing and the need for real-time price optimization reinforce the platform’s role in enhancing market efficiency, risk management, and sustainability goals. These trends suggest a promising outlook for stakeholders across the upstream and downstream energy trading value chain.

Analyzing the Upstream and Downstream Chains in Energy Trading Platforms

The operational efficiency of energy trading platforms depends on the harmony between their upstream and downstream chains.

- The upstream chain involves the production and supply of energy, encompassing activities such as exploration, production, and transportation of energy resources.

- In contrast, the downstream chain focuses on the distribution and consumption of energy, including refining, processing, and marketing.

Understanding the Supply Chain Dynamics

The supply chain dynamics in energy trading platforms are complex and multifaceted. Efficient supply chain management is crucial for ensuring a stable and reliable supply of energy. It involves coordinating various stakeholders, including producers, suppliers, and consumers, to meet the demand for energy.

Supply chain disruptions can have significant impacts on energy trading platforms, leading to price volatility and potential losses. Therefore, understanding the dynamics of the supply chain is essential for mitigating risks and capitalizing on opportunities.

| Supply Chain Component | Description | Impact on Energy Trading |

| Upstream Chain | Production and supply of energy | Influences energy availability and pricing |

| Downstream Chain | Distribution and consumption of energy | Affects energy demand and market trends |

By analyzing the upstream and downstream chains, energy trading platforms can gain valuable insights into the operational efficiencies and challenges faced by the industry. This understanding can help in developing strategies to optimize supply chain operations, mitigate risks, and improve overall performance.

Key Market Trends Shaping the Energy Trading Platform Industry

The energy trading platform industry is being reshaped by various market trends, including the rise of renewable energy. As the global energy landscape evolves, trading platforms are adapting to new challenges and opportunities.

Emerging Trends in Energy Trading

Several emerging trends are influencing the energy trading platform industry. These include:

- Increased adoption of renewable energy sources: Renewable energy is becoming more prevalent, changing the dynamics of energy supply and demand.

- Digitalization and automation: The use of advanced technologies like AI and blockchain is enhancing trading efficiency and transparency.

- Decentralized energy trading: Peer-to-peer energy trading is gaining traction, allowing consumers to buy and sell energy directly.

Impact of Renewable Energy on Trading Platforms

The rise of renewable energy is significantly impacting energy trading platforms. As renewable energy sources become more integrated into the grid, trading platforms must adapt to:

- Variable supply and demand patterns: Renewable energy sources like solar and wind are intermittent, requiring trading platforms to be more flexible.

- New market participants: Renewable energy producers and prosumers are entering the market, changing the traditional dynamics.

The shift towards renewable energy is driving innovation in energy trading platforms. Companies are investing in new technologies to manage the complexities of renewable energy trading, such as advanced forecasting tools and real-time data analytics.

Impact of Regulatory Restrictions on Energy Trading Platforms

Regulatory Frameworks and Compliance

Energy trading platforms must operate within established regulatory frameworks that dictate trading activities, risk management, and reporting requirements. Compliance with these regulations is not only mandatory but also crucial for maintaining market trust and avoiding legal repercussions.

The regulatory environment for energy trading is continually evolving, with updates and new regulations being introduced to address emerging challenges and market changes. For instance, regulations may focus on enhancing transparency, reducing systemic risk, and promoting fair trading practices.

To ensure compliance, energy trading platforms must implement robust internal controls, conduct regular audits, and provide ongoing training to their staff. This proactive approach helps in identifying and mitigating compliance risks, thereby safeguarding the platform’s reputation and operational stability.

Key compliance measures include:

- Implementing effective risk management systems

- Maintaining accurate and transparent records

- Adhering to trading limits and position reporting requirements

- Ensuring adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations

By prioritizing compliance and staying abreast of regulatory changes, energy trading platforms can navigate the complex regulatory landscape effectively, minimize risks, and capitalize on market opportunities.

Geopolitical Factors Affecting the Energy Trading Platform Market

Geopolitical factors, including political instability and trade agreements, have a profound impact on the energy trading platform market. The complex interactions of global energy trade are influenced by various geopolitical elements that can either stabilize or disrupt the market.

Geopolitical Influences on Energy Trade

The energy trading platform market is sensitive to geopolitical tensions and conflicts, which can lead to fluctuations in energy prices and availability. For instance, sanctions imposed on oil-producing countries can reduce global oil supply, thereby affecting prices.

Key geopolitical factors influencing the energy trading platform market include:

- Political tensions between energy-producing and energy-consuming countries

- Trade agreements that can either facilitate or hinder energy trade

- Conflicts in regions with significant energy reserves

These factors can lead to market volatility, making it essential for energy trading platforms to be adaptable and responsive to geopolitical changes.

Understanding the geopolitical landscape is crucial for stakeholders in the energy trading platform market. It enables them to anticipate potential disruptions and make informed decisions.

Energy Trading Platform Market Segmentation by Type

The energy trading platform market has various types of platforms, each created for specific trading activities. This variety enables market participants to select platforms that best meet their requirements.

Types of Energy Trading Platforms

Energy trading platforms can be broadly categorized into several types based on their functionality and the services they offer. These include:

- Exchange-based platforms: These platforms facilitate trading on energy exchanges, providing a marketplace for buyers and sellers.

- Over-the-counter (OTC) trading platforms: OTC platforms enable direct trades between parties without the supervision of an exchange.

- Brokerage platforms: These platforms act as intermediaries, connecting buyers and sellers and facilitating trades.

Each type of platform has its advantages and is suited to different market participants and trading strategies.

The characteristics of energy trading platforms vary significantly across different types. The following table summarizes some key features:

| Platform Type | Key Features | Target Market |

| Exchange-based | Standardized contracts, transparent pricing | Large traders, institutional investors |

| OTC | Customizable contracts, direct trading | Large corporations, financial institutions |

| Brokerage | Intermediary services, flexible trading options | Small to medium-sized traders, individuals |

Understanding these characteristics is crucial for market participants to select the most appropriate platform for their energy trading needs.

Applications Driving Adoption of Energy Trading Platforms

The energy trading platform market is experiencing significant growth due to various applications driving its adoption. These platforms are being increasingly used across the energy sector to facilitate efficient trading and risk management.

The key applications in energy trading include trading interfaces, analytics tools, and risk management solutions. These applications enable companies to optimize their trading activities, make informed decisions, and mitigate potential risks.

Key Applications in Energy Trading

Some of the key applications driving the adoption of energy trading platforms include:

- Trading interfaces that provide real-time market data and facilitate fast execution of trades.

- Analytics tools, such as those offered by Tableau, that help companies analyze market trends and make informed decisions.

- Risk management solutions that enable companies to mitigate potential risks and optimize their trading activities.

energy trading platform applications

The adoption of these applications is driving the growth of the energy trading platform market. As the energy sector continues to evolve, the demand for innovative energy trading platforms is expected to increase.

By leveraging these applications, companies can improve their trading activities, reduce costs, and enhance their overall competitiveness in the market.

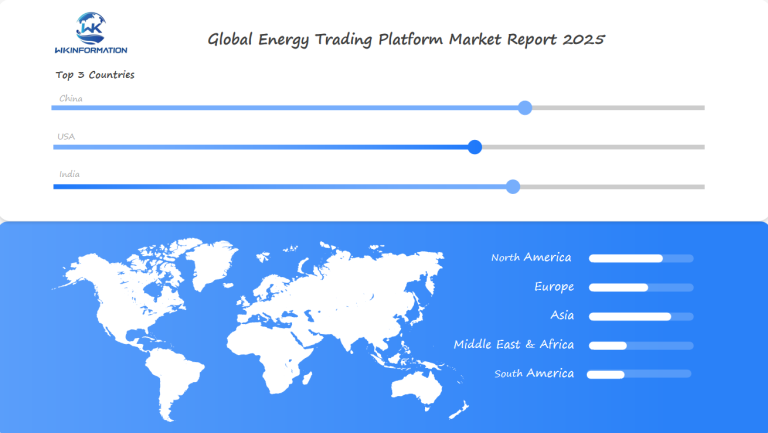

Global Regional Breakdown of Energy Trading Platform Market

Regional dynamics are important in shaping the energy trading platform market worldwide. Different regions have their own characteristics influenced by factors like regulatory frameworks, technological advancements, and energy demand.

Regional Market Analysis

The energy trading platform market is diverse, with various regions contributing to its growth.

North America

North America is a significant player due to its advanced infrastructure and favorable regulatory environment. The region’s focus on renewable energy sources and grid modernization drives the adoption of energy trading platforms.

Europe

In Europe, the market is driven by the transition towards cleaner energy and the integration of renewable energy sources into the grid. The European Union’s policies and directives, such as the Renewable Energy Directive, support the growth of energy trading platforms.

Asia-Pacific

The Asia-Pacific region is emerging as a lucrative market due to its rapid industrialization and increasing energy demand. Countries like China and India are investing heavily in energy infrastructure, creating opportunities for energy trading platform providers.

Key factors influencing the regional market analysis include:

- Regulatory frameworks and compliance requirements

- Technological advancements and innovation

- Energy demand and consumption patterns

- Geopolitical influences and trade agreements

Understanding these regional dynamics is crucial for energy trading platform providers to tailor their strategies and capitalize on emerging opportunities.

U.S. Energy Trading Platform Market: Trends and Opportunities

The U.S. is leading the energy trading platform market, thanks to advancements in technology and changing energy dynamics. This leadership position is further strengthened by the country’s significant shale gas production and a growing shift towards renewable energy sources.

Market Dynamics

The U.S. energy trading platform market is characterized by a high degree of competition and innovation. Key players are investing heavily in technology to enhance trading efficiency and reduce costs. The rise of digital platforms has enabled more participants to enter the market, increasing liquidity and driving growth.

Shale gas production has been a significant factor in the U.S. energy landscape, contributing to lower energy prices and increased energy independence. This has led to a surge in energy trading activities, with platforms adapting to handle the increased volume and complexity of trades.

The growing demand for renewable energy is another trend shaping the U.S. energy trading platform market. As more renewable energy sources come online, trading platforms are evolving to accommodate the variable output of these sources, ensuring a stable and efficient energy supply.

Opportunities for Growth

Several opportunities for growth exist in the U.S. energy trading platform market. These include:

- Increased adoption of blockchain technology to enhance transparency and security in energy trading.

- Expansion of trading platforms to include new types of energy products, such as renewable energy credits.

- Development of more sophisticated analytics tools to help traders make informed decisions.

As the energy market continues to evolve, the U.S. energy trading platform market is poised for sustained growth, driven by technological innovation and changing energy trends.

Germany Energy Trading Platform Market: Market Insights and Developments

Germany’s commitment to renewable energy is driving innovations in its energy trading platform market. As a significant player in the European energy landscape, Germany’s energy policies and technological advancements are shaping the future of energy trading.

This transformation is not just limited to the adoption of renewable sources, but also includes a comprehensive overhaul of the existing energy trading platforms. The integration of advanced technologies such as AI and blockchain is revolutionizing the way energy is traded in Germany.

These developments are indicative of a larger trend towards digitalization in the energy sector, which is expected to enhance efficiency, transparency, and security in energy trading transactions.

Market Analysis

The Germany energy trading platform market is characterized by a growing demand for renewable energy sources, driven by government initiatives and declining costs of renewable technologies. This shift is leading to an increased adoption of energy trading platforms that can efficiently manage and trade renewable energy.

Key Trends:

- Increased focus on renewable energy integration

- Advancements in digitalization and data analytics

- Growing demand for flexibility and risk management tools

The market is also witnessing significant investments in infrastructure, including the development of smart grids and energy storage facilities. These developments are expected to enhance the efficiency and reliability of energy trading in Germany.

| Segment | 2023 | 2025 |

| Renewable Energy | 40% | 55% |

| Conventional Energy | 60% | 45% |

The table above illustrates the projected shift towards renewable energy in Germany’s energy mix, further driving the demand for advanced energy trading platforms.

The future of Germany’s energy trading platform market looks promising, with continued innovations and investments expected to drive growth.

China Energy Trading Platform Market: Growth Drivers and Challenges

China’s energy market is expected to grow significantly due to the increasing demand for efficient energy trading. This growth is being fueled by government initiatives aimed at promoting clean energy and reducing carbon emissions, which are driving a major transformation in China’s energy landscape.

Market Dynamics

The growth of the energy trading platform market in China is driven by several key factors, including:

- Increasing demand for energy due to rapid industrialization and urbanization

- Government policies promoting the use of clean energy and reducing reliance on fossil fuels

- Advancements in technology, enabling more efficient and secure energy trading

Despite these growth drivers, the market also faces several challenges, such as:

- Regulatory complexities and the need for compliance with government policies

- The risk of cyber threats and data breaches

- Competition from established players and new entrants in the market

Future Outlook and Development in the Energy Trading Platform Market

Key Growth Drivers

-

Renewable Energy Transition

-

Integration of intermittent sources like wind, solar, and hydro necessitates real-time, flexible trading platforms.

- Deregulation & Market Liberalisation

-

Global energy market reforms enable more participants—including IPPs and retailers—to enter the trading field.

- Smart Grids & Digitalization

-

Smart grid expansion supports data-driven trading—leveraging IoT, sensors, and automated control.

- Tech Innovation (AI, ML, Blockchain)

-

AI/ML enable price prediction, automated trading, and risk management; blockchain promises transparency and secure settlements.

-

Emerging Trends

-

Algorithmic & Automated Trading: High-frequency, algorithmic systems now handle 70 percent of European power volumes, rising from 44 percent in 2020.

-

Decentralised & Peer‑to‑Peer (P2P) Markets: Microgrids and DER-based platforms (e.g., EVs, storage) trade locally in flexibility markets.

-

Carbon & ESG-enabled Platforms: Platforms capable of trading carbon credits and green certificates are in demand as ESG considerations grow.

Competitive Analysis of Key Energy Trading Platform Providers

The energy trading platform market is highly competitive, with several major players leading the industry. These companies are constantly innovating and expanding their services to stay ahead of the competition.

Here are some of the key providers in the energy trading platform market:

- Allegro Development – United States

- Openlink – United States

- Eka Software Solutions – India

- Trayport – United Kingdom

- Aspect Enterprise Solutions – United States

- Endur by Openlink – United States

- ABB Ability – Switzerland

- ICE (Intercontinental Exchange) – United States

- Eikon by Refinitiv – United Kingdom

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Energy Trading Platform Report |

| Base Year | 2024 |

| Segment by Type |

· Exchange-based · OTC · Brokerage |

| Segment by Application |

· Enterprise · Individual |

| Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The energy trading platform market is growing, driven by the increasing use of renewable energy sources and improvements in trading technologies. As the market continues to change, it’s important for those involved to stay updated on the trends and developments that are shaping the industry.

Future Prospects

Looking ahead, the energy trading platform market is expected to witness significant growth, driven by the need for efficient and transparent energy trading practices. Market players must adapt to changing regulatory landscapes and technological advancements to remain competitive.

By understanding the dynamics of the energy trading platform market, stakeholders can make informed decisions and capitalize on emerging opportunities. The future outlook for the market is promising, with potential for expansion into new regions and the development of innovative trading solutions.

Global Energy Trading Platform Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Energy Trading Platform Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Women’s ActivewearMarket Segmentation Overview

Chapter 2: Competitive Landscape

- GlobalEnergy Trading Platform players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Energy Trading Platform Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Energy Trading Platform Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Energy Trading Platform Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofWomen’s ActivewearMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the expected growth rate of the Energy Trading Platform Market by 2025?

The Energy Trading Platform Market is expected to exceed $1.34 billion globally by 2025.

What are the key factors driving the growth of the Energy Trading Platform Market?

The growth is driven by:

- increasing demand for efficient energy trading solutions

- rising need for advanced trading platforms

- the complexities of modern energy markets

How do regulatory restrictions impact the Energy Trading Platform Market?

Regulatory restrictions are very important in shaping the market. There are different rules and regulations that control how energy is traded, and it is crucial for everyone involved in the market to follow these rules.

How Does Renewable Energy Affect Energy Trading Platforms?

The growing use of renewable energy sources is changing the way energy is traded. In response, trading platforms are adjusting to accommodate the shifts in energy supply and demand.

What are the different types of energy trading platforms?

The energy trading platform market can be segmented based on the type of platform, catering to various needs and market participants.

How do geopolitical factors influence the Energy Trading Platform Market?

Geopolitical factors play a crucial role in shaping the market. Political tensions, trade agreements, and conflicts directly impact the supply and demand of energy, which in turn affects the trading of energy commodities.

What are the key applications driving the adoption of energy trading platforms?

Various applications are driving the adoption, including simple trading interfaces, complex analytics, and risk management tools.

What is the regional breakdown of the Energy Trading Platform Market?

The market is a global phenomenon, with different regions exhibiting unique characteristics, and trends and opportunities varying across different parts of the world.

Who are the major energy trading platform providers?

The market is highly competitive, with several key players operating in the space, including major energy trading platform providers.

What is the outlook for the Energy Trading Platform Market?

The market is expected to grow significantly due to several factors such as the increasing use of renewable energy and improvements in trading technologies.