Electronic Sow Feeding (ESF) System Market to Reach $2.93 Billion by 2025 with US, Germany, and China Leading Growth

Explore how the US, Germany, and China are revolutionizing the Electronic Sow Feeding (ESF) System market through technological innovation, government support, and sustainable practices. Learn about key market trends, challenges, and future outlook as these nations lead agricultural advancement towards 2025.

- Last Updated:

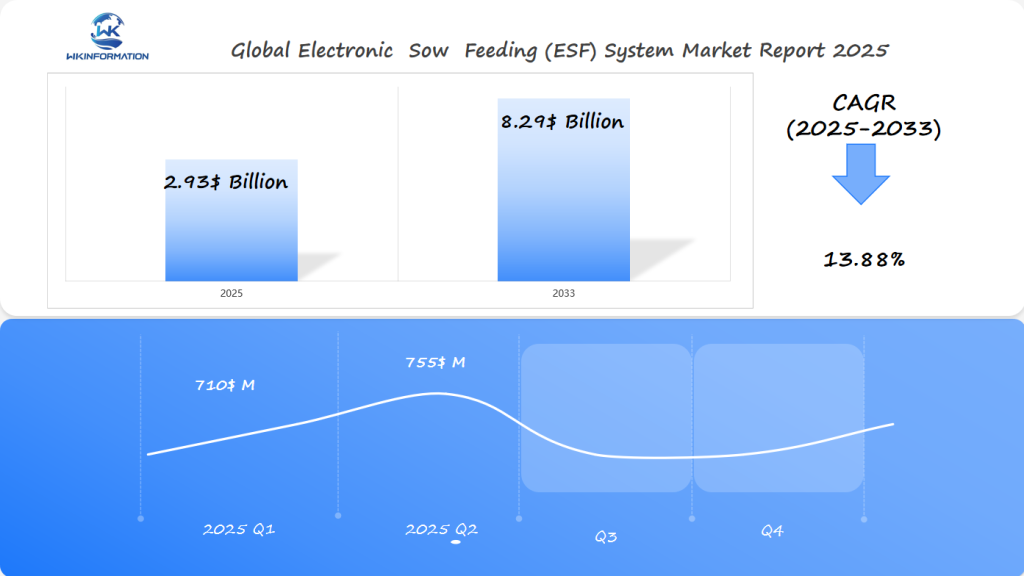

Electronic Sow Feeding (ESF) System Market Forecast for Q1 and Q2 of 2025

The Electronic Sow Feeding (ESF) System market is projected to reach USD 2.93 billion in 2025, growing at a CAGR of 13.88% from 2025 to 2033. The first half of 2025 will see strong growth, especially in key markets such as the US, Germany, and China, as the agricultural sector increasingly adopts automation and precision farming technologies.

In Q1, the market is expected to reach around USD 710 million, with the US leading the demand due to its advanced agricultural technology and growing adoption of automated systems for hog farming. Germany, with its emphasis on precision farming, will see steady growth in ESF systems. China, with its large scale in animal farming, will continue to adopt these systems as part of its drive to modernize agriculture. By Q2, the market is projected to grow to approximately USD 755 million, fueled by increasing investments in automated feeding systems and their proven efficiency in large-scale farming operations. The US, Germany, and China will be the primary markets to watch in the first half of 2025.

Understanding the Supply Chain of the Electronic Sow Feeding (ESF) System

For those involved in the livestock industry, knowing how the supply chain works for the Electronic Sow Feeding (ESF) system is essential. The ESF technology consists of several important parts that are crucial for effective feeding management:

Key Components of the ESF System

- Computer-Controlled Feeders: These feeders are the heart of the system and are responsible for dispensing precise amounts of feed according to each sow’s nutritional requirements.

- RFID Technology: Used for identifying sows, RFID tags ensure accurate and timely delivery of feed. This technology guarantees that each sow receives its designated portion, minimizing competition and aggression during feeding times.

- Software Platforms: These platforms enable data collection and analysis, offering insights into feeding patterns and assisting in optimizing dietary plans.

The Significance of RFID Technology: In the ESF system, RFID technology plays a crucial role by ensuring correct identification of each sow. This accuracy is vital for maintaining individual feeding routines, which directly affects animal health and productivity. By reducing human error and enhancing precision, RFID technology facilitates better management decisions.

The Flow of Products in the ESF System Market

The movement of products from manufacturers to end-users in the ESF system market involves several stages:

- Manufacturing: Specialized companies produce components such as feeders, RFID tags, and software.

- Distribution: These products are then distributed through a network of dealers or directly to farm operators.

- Implementation: Farmers install and integrate these systems into their existing operations, often with assistance from technicians or consultants.

Effective management of the supply chain ensures prompt delivery and installation of ESF systems. This enables livestock producers to utilize advanced technologies for better operational results. By understanding this process, stakeholders can navigate the challenges associated with adopting ESF technology more effectively.

The Flow of Products in the ESF System Market

The movement of products from manufacturers to end-users in the ESF system market involves several stages:

- Manufacturing: Specialized companies produce components such as feeders, RFID tags, and software.

- Distribution: These products are then distributed through a network of dealers or directly to farm operators.

- Implementation: Farmers install and integrate these systems into their existing operations, often with assistance from technicians or consultants.

Effective management of the supply chain ensures prompt delivery and installation of ESF systems. This enables livestock producers to utilize advanced technologies for better operational results. By understanding this process, stakeholders can navigate the challenges associated with adopting ESF technology more effectively.

Transformative Trends Shaping the ESF System Industry

The Electronic Sow Feeding (ESF) system industry is undergoing significant changes driven by recent advancements in feeding technologies. These innovations are not only improving productivity but also leading to substantial reductions in labor costs. Automated feeding systems now use advanced software and hardware solutions, allowing for precise delivery of feed amounts tailored to each sow’s nutritional needs.

Key Developments Driving Transformation

Several important developments are influencing this transformation:

- Precision Feeding Technologies: The combination of RFID technology and computerized feeders enables accurate monitoring and control over feed intake. This ensures that each sow receives the appropriate amount of nutrients based on its physiological needs, minimizing waste and maximizing feed efficiency.

- Data-Driven Decision Making: Advanced data analytics tools are being used to gather insights from feeding patterns. These insights help farmers optimize feeding schedules and strategies, ultimately improving the overall health and productivity of their herds.

- Automation and Labor Efficiency: By automating the feeding process, farms can significantly reduce reliance on manual labor. This not only cuts costs but also allows staff to focus on other critical tasks within the operation, driving overall efficiency.

The Shift Towards Individual Feeding Systems

The transition towards individual feeding systems represents a crucial change in pig farming operations. Unlike traditional group feeding methods, these systems cater to each animal’s unique dietary needs, enhancing growth rates and reproductive performance. Additionally, they address issues related to competition and aggression among sows during feeding times, fostering a peaceful environment conducive to better welfare standards.

Commitment to Sustainable Practices

The move towards individualized care reflects a broader commitment within the industry to adopt sustainable practices that align with both economic goals and consumer expectations for ethical livestock management. As producers continue to embrace these advancements, the ESF system market is poised for ongoing growth and innovation.

Challenges and Market Barriers Slowing the Adoption of ESF Systems

The Electronic Sow Feeding (ESF) System Market encounters several barriers that hinder widespread adoption, despite its potential benefits. One of the primary obstacles is the high initial investment costs associated with installing these systems on farms. The advanced technology required for ESF systems demands a significant financial commitment, which can be daunting for many producers, especially small to medium-sized operations.

Effective staff training and data management practices are crucial for the smooth operation of ESF technologies. The complexity of these systems necessitates a skilled workforce capable of managing sophisticated software and hardware components. This requirement can pose challenges, as it involves not only training existing staff but also potentially hiring new employees with the requisite expertise.

However, the integration of artificial intelligence in agriculture could provide a solution by simplifying some aspects of data management and operational efficiency, thereby reducing the training burden on staff.

Resistance to change remains a notable barrier within the industry. Traditional farmers often express hesitation when it comes to embracing automated feeding solutions like ESF systems. This reluctance is primarily due to comfort with established methods and skepticism about new technologies’ reliability and effectiveness.

Understanding these market barriers is essential for stakeholders aiming to facilitate the broader adoption of ESF systems. By addressing these challenges—whether through financial incentives, comprehensive training programs, or demonstration projects showcasing successful implementations—industry players can work towards overcoming these hurdles. Encouraging a mindset shift among traditional farmers will be instrumental in accelerating the transition toward more efficient and sustainable feeding solutions.

Geopolitical Analysis of the Electronic Sow Feeding (ESF) System Market

Geopolitical factors and global trade policies play a crucial role in shaping the ESF system market. Agricultural policies set by governments can either promote or hinder the growth of these technologies across different regions.

Impact of Agricultural Policies on ESF Adoption

In countries like the United States, supportive agricultural regulations aimed at improving animal welfare have fostered increased adoption of ESF systems. These policies often align with consumer demands for more humane farming practices, driving technological advancements in livestock management.

The European Union, particularly Germany, has stringent agricultural regulations that emphasize sustainability and animal welfare. Such regulations create opportunities for ESF systems as they offer solutions that align with policy mandates. Germany’s focus on smart farming technology further enhances the integration of ESF systems into its robust pork production industry.

Significance of Global Trade Relations

Global trade relations significantly affect the import and export dynamics of ESF technology. The interconnectedness of markets means that trade agreements between major players like the US, Germany, and China are critical. For instance:

- The US benefits from exporting its advanced ESF technologies to burgeoning markets like China.

- China’s rapid industrialization in pig farming creates a substantial demand for innovative feeding solutions, including imports from established markets.

- German engineering excellence in automated solutions often leads to exports of high-quality ESF systems to other European countries and beyond.

These complex interdependencies highlight how geopolitical factors and global trade policies influence the availability and spread of ESF systems worldwide. Understanding these dynamics is crucial for stakeholders looking to navigate the landscape effectively.

With evolving trade agreements and shifting agricultural policies, staying informed is key for those invested in this growing market.

Understanding the Different Types of Automated Feeding Solutions in the ESF System Market

The Electronic Sow Feeding (ESF) system market offers a range of automated solutions designed to enhance feeding efficiency and livestock management. These systems cater to the unique dietary needs of each sow, ensuring optimal health and productivity.

1. Standard Electronic Sow Feeders

These feeders are equipped with basic functions that allow for the distribution of predetermined feed quantities based on a sow’s individual requirements. They rely on RFID technology for precise identification and tracking.

2. Advanced Electronic Sow Feeders

Incorporating enhanced features such as real-time monitoring, these systems adjust feed delivery dynamically according to changes in a sow’s condition or gestation stage. Such feeders often include data analytics tools for improved decision-making.

3. Multi-Station Systems

Designed to support large operations, these systems manage multiple feeding stations simultaneously, capable of serving between 40 to 60 sows per station. This setup minimizes competition during feeding times, promoting better welfare and nutritional outcomes.

4. Integrated Management Systems

These provide a comprehensive approach by integrating feeding solutions with other farm management software. This integration facilitates seamless data sharing and operational efficiency across various aspects of livestock management.

Embracing these diverse types of ESF systems can lead to significant improvements in feed management strategies, aligning with the growing demand for automated solutions in modern agriculture.

Understanding the Different Types of Automated Feeding Solutions in the ESF System Market

The Electronic Sow Feeding (ESF) system market offers a range of automated solutions designed to enhance feeding efficiency and livestock management. These systems cater to the unique dietary needs of each sow, ensuring optimal health and productivity.

1. Standard Electronic Sow Feeders

These feeders are equipped with basic functions that allow for the distribution of predetermined feed quantities based on a sow’s individual requirements. They rely on RFID technology for precise identification and tracking.

2. Advanced Electronic Sow Feeders

Incorporating enhanced features such as real-time monitoring, these systems adjust feed delivery dynamically according to changes in a sow’s condition or gestation stage. Such feeders often include data analytics tools for improved decision-making.

3. Multi-Station Systems

Designed to support large operations, these systems manage multiple feeding stations simultaneously, capable of serving between 40 to 60 sows per station. This setup minimizes competition during feeding times, promoting better welfare and nutritional outcomes.

4. Integrated Management Systems

These provide a comprehensive approach by integrating feeding solutions with other farm management software. This integration facilitates seamless data sharing and operational efficiency across various aspects of livestock management.

Embracing these diverse types of ESF systems can lead to significant improvements in feed management strategies, aligning with the growing demand for automated solutions in modern agriculture.

Analyzing ESF System Market by Application: Enhancing Livestock Farming Efficiency

Electronic Sow Feeding (ESF) systems have transformed livestock farming, particularly within the pork production sector. The precise feed management offered by ESF systems is instrumental in optimizing sow nutrition. This technology ensures each sow receives a diet tailored to her specific needs, considering factors such as gestation stage and individual health requirements.

Key Applications in Pork Production

1. Individualized Feeding Plans

By using RFID technology, ESF systems identify individual sows and dispense the appropriate feed quantity. This approach reduces feed wastage and ensures nutritional adequacy, promoting healthier and more productive animals.

2. Improved Animal Welfare

With ESF systems, competition among sows during feeding times diminishes significantly. The system’s ability to cater to individual dietary needs minimizes stress and aggression, fostering a more harmonious environment.

3. Enhanced Data Management

Farmers benefit from detailed data on each sow’s feed intake and health metrics. This information supports proactive management decisions, enhancing overall herd productivity.

These applications highlight the significant role of ESF systems in advancing efficiency within livestock operations. As the market expands, continued innovations are expected to drive further improvements in productivity and welfare outcomes across the industry.

Global Expansion of Electronic Sow Feeding System Market: Where’s the Biggest Demand?

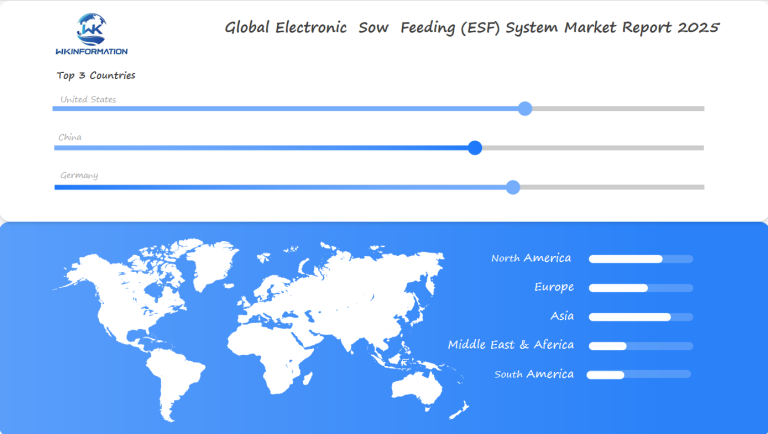

The global demand trends for ESF systems across different regions reveal a dynamic landscape with pronounced growth in specific markets. Notably, the United States, China, and Germany emerge as frontrunners in the adoption of Electronic Sow Feeding (ESF) systems.

United States

- Large-Scale Pork Production: The U.S. boasts a robust pork production industry, which is a significant driver behind the increasing demand for ESF systems. With over 200,000 sows already managed using these systems, the country continues to expand its adoption rate.

- Animal Welfare Regulations: Stricter animal welfare regulations encourage producers to transition from traditional stalls to more humane solutions like ESF systems that allow for individualized feeding.

China

- Rapid Industrialization: Pig farming in China is undergoing rapid industrialization, making it a fertile ground for technological advancements such as ESF systems. This shift aligns with efforts to enhance productivity and efficiency in pig farming operations.

- Government Support: Initiatives by the Chinese government to modernize agricultural practices have further accelerated the adoption of ESF technology in the region.

Germany

- Focus on Smart Farming: Germany leads Europe in smart farming practices, making it a key player in the ESF system market. The country’s emphasis on precision agriculture enhances feed management strategies through advanced feeding technologies.

- Sustainability Goals: German farmers are increasingly adopting ESF systems as part of their commitment to sustainable farming practices that prioritize animal welfare and resource efficiency.

These regions exemplify how varied factors—ranging from regulatory frameworks to technological support—drive demand for ESF systems. Their collective progress underscores a broader global trend towards more efficient and humane livestock management solutions.

US ESF System Market Analysis Adoption Rates and Market Leaders

The U.S. market for Electronic Sow Feeding (ESF) systems is evolving rapidly, with adoption rates among American pig farmers continuing to rise. This growth is largely attributed to the system’s ability to enhance productivity and improve animal welfare, aligning with consumer preferences for ethically produced pork.

Current State of the US ESF System Market:

- The adoption of ESF systems is particularly prevalent in large-scale operations where efficiency gains are critical.

- An estimated 200,000 sows in the U.S. are currently managed using these advanced feeding technologies.

Major Players Leading the Market:

- Big Dutchman, a prominent name in livestock equipment, offers a comprehensive range of ESF solutions tailored for various farm sizes.

- Nedap Livestock Management provides RFID-based systems that facilitate individualized feeding strategies, ensuring optimal nutrition management.

- Schauer Agrotronic is also a key player, offering automated feeding solutions that integrate seamlessly into existing farm infrastructures.

Factors Influencing Adoption Rates:

- Economic Considerations: Reduction in labor costs and feed wastage plays a significant role in the decision-making process for American producers.

- Regulatory Environment: Shifts in agricultural policies promoting animal welfare have encouraged producers to transition from traditional gestation stalls to ESF systems.

- Technological Advancements: Improved user interfaces and data analytics capabilities make these systems more appealing by simplifying management tasks and enhancing operational efficiency.

The trend towards automated feeding solutions within the U.S. highlights an industry shift toward embracing technology-driven agricultural practices, setting the stage for future innovations in pig farming operations.

China ESF System Market Analysis: Rapid Industrialization of Pig Farming

China’s pig farming industry is undergoing rapid industrialization, leading to increased adoption of advanced technologies like electronic sow feeders. This shift is driven by the need for more efficient production methods to meet the growing pork demand.

Overview of China’s Pig Farming Landscape

- Scale and Scope: China is the world’s largest producer and consumer of pork, making up a significant portion of its agricultural output. The industry features a mix of small-scale farms and large, industrial operations.

- Technological Adoption: With the push towards modernization, many farms are integrating advanced systems such as ESF to enhance productivity and reduce manual labor.

Growth Rate of ESF System Adoption

- Rising Popularity: The adoption rate of Electronic Sow Feeding (ESF) systems in China is accelerating as producers recognize the benefits in terms of feed management precision and animal welfare.

- Efficiency Gains: By implementing ESF systems, farms can optimize feeding strategies tailored to individual sow needs, leading to better growth rates and improved overall herd health.

Government Initiatives Supporting Technological Advancements

- Policy Support: The Chinese government has introduced several initiatives aimed at modernizing agriculture, including subsidies and incentives for adopting new technologies.

- Focus on Sustainability: There is a strong emphasis on sustainable farming practices, with ESF systems playing a key role in reducing waste and minimizing environmental impact.

The intersection of government support and technological advancement positions China as a leader in electronic sow feeding system adoption. This trend reflects a broader movement within the country towards smart farming solutions that enhance both productivity and sustainability.

Germany ESF System Market Analysis: Leading the Way in Smart Farming

Germany is a leader in smart farming practices, prioritizing technological innovation and sustainable agriculture. The country’s livestock industry is increasingly adopting Electronic Sow Feeding (ESF) systems due to their ability to enhance productivity while meeting strict animal welfare standards.

Key Factors Driving ESF Adoption in Germany

Several factors are driving the adoption of ESF systems in Germany:

- Technological Integration: German farms are integrating advanced technologies such as RFID and IoT for precise feed management. This integration supports efficient operations and allows farmers to monitor animal health and nutrition closely.

- Regulatory Support: Germany’s agricultural policies promote sustainable farming practices. Incentives for adopting eco-friendly technologies encourage the deployment of ESF systems, which help reduce environmental impact by optimizing feed usage.

- Market Leaders: Prominent players like Big Dutchman and WEDA Dammann & Westerkamp are at the forefront, providing cutting-edge feeding solutions tailored to German farming needs.

The focus on smart farming not only boosts efficiency but also strengthens Germany’s position as a global leader in innovative agricultural practices. This commitment positions German farmers to meet rising consumer demands for ethically produced pork products while maintaining competitive advantages in the global market.

Future Trends in ESF System Market Innovations and Sustainability Practices

The Electronic Sow Feeding (ESF) system market is on the verge of significant technological advancements, promising to reshape the landscape of livestock management. Innovations in data analytics are leading the way, enabling farmers to gain deeper insights into feeding patterns and sow health, which helps optimize feed efficiency and improve animal welfare.

1. Sustainability Practices

Sustainability practices have become crucial as producers strive to reduce their environmental impact. The integration of renewable energy sources such as solar power for operating ESF systems is gaining popularity, aligning with global sustainability objectives. This transition not only lowers operational costs but also enhances the environmental reputation of pig farming operations.

2. Use of IoT Devices

Another emerging trend is the use of IoT devices within ESF systems. These devices enable real-time monitoring and automated adjustments to feeding schedules, ensuring precise nutrient delivery tailored to each sow’s requirements. This level of accuracy minimizes feed waste and enhances overall herd performance.

3. Biosecurity Measures

Furthermore, there is a growing focus on biosecurity measures within ESF systems. Advanced filtration and ventilation technologies are being incorporated to reduce disease transmission risks, thereby protecting herd health while maintaining high productivity levels.

The path towards innovation and sustainability in the ESF system market signifies a dedication to improving livestock management practices that are both economically viable and environmentally responsible.

Competitive Analysis: Who’s Leading the ESF Market?

In the competitive landscape of the Electronic Sow Feeding (ESF) system market, several key players are driving innovation and setting industry standards.

-

Osborne Industries

-

WEDA

-

Fancom

-

Big Dutchman

-

SKIOLD GROUP

-

Schauer Agrotronic

-

Nedap

-

Maximus

-

MPSAGRI

-

TOPIGS Norsvin

Overall

| Report Metric | Details |

| Report Name | Global Electronic Sow Feeding (ESF) System Market Report |

| Base Year | 2024 |

| Segment by Type |

|

| Segment by Application |

|

|

Geographies Covered |

|

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The Electronic Sow Feeding (ESF) system market is experiencing strong growth and is expected to reach $2.93 billion by 2025. The main markets driving this growth are the United States, Germany, and China, each with its own approach to using advanced feeding technologies in managing livestock.

Significant Factors Fueling Market Growth:

- Technological Advancements: Innovations in RFID technology and automated feeding solutions are enhancing efficiency and productivity in pig farming.

- Animal Welfare: Increasing consumer demand for ethical farming practices is pushing producers towards ESF systems that allow for more natural sow behaviors.

- Cost Efficiency: By reducing labor costs through automation and optimizing feed strategies, ESF systems present a cost-effective solution for modern farms.

Despite the positive outlook, there are challenges such as high initial setup costs and resistance from traditional farmers that still need to be overcome. However, the potential benefits—such as improved animal welfare and efficient farm management—highlight the transformative impact of ESF systems on the livestock industry.

The competitive landscape includes major players who are constantly innovating to gain market share. As global demand increases, especially in leading pork-producing countries, the ESF system market is expected to play a crucial role in shaping the future of sustainable livestock production.

Global Electronic Sow Feeding (ESF) System Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Electronic Sow Feeding (ESF) System Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Electronic Sow Feeding (ESF) SystemMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Electronic Sow Feeding (ESF) System players and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Electronic Sow Feeding (ESF) System Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Electronic Sow Feeding (ESF) System Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Electronic Sow Feeding (ESF) System Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Electronic Sow Feeding (ESF) SystemMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected growth of the Electronic Sow Feeding (ESF) System market?

The Electronic Sow Feeding (ESF) System market is projected to reach $2.93 billion by 2025, with significant contributions from countries such as the US, Germany, and China.

What are the key components of an ESF system?

Key components of an ESF system include RFID technology for accurate feed delivery, automated feeding solutions, and management software that ensures efficient feeding management and data tracking.

What challenges are hindering the adoption of ESF systems in pig farming?

Challenges slowing the adoption of ESF systems include high initial investment costs, the need for staff training on new technologies, and resistance from traditional farmers who may prefer conventional feeding methods.

How does geopolitical analysis affect the ESF system market?

Geopolitical factors such as agricultural policies and global trade relations significantly influence the ESF system market by affecting growth prospects and trade dynamics between major markets like the US, Germany, and China.

What applications benefit most from Electronic Sow Feeding (ESF) technology?

ESF technology is particularly beneficial in pork production for enhancing feed management efficiency, improving animal welfare outcomes, and increasing overall productivity in livestock farming operations.

Which regions show the highest demand for Electronic Sow Feeding Systems?

The highest demand for Electronic Sow Feeding Systems is observed in regions like the US, China, and Germany, driven by advancements in pig farming practices and a shift towards automation in livestock management.