Electronic Document Management System Market Set to Hit $7.34 Billion by 2025: Key Insights from the U.S., China, and Germany

In 2025, the global market reached an estimated value of USD 5.12 billion, with projections indicating growth to USD 13.01 billion by 2033 at a compound annual growth rate (CAGR) of 12.36%. This growth is driven by factors such as the increasing need for digital transformation, enhanced data security, compliance with regulatory requirements, and the rising adoption of cloud-based solutions across various industries. The shift towards remote work and the demand for efficient document management solutions further contribute to the market’s expansion.

- Last Updated:

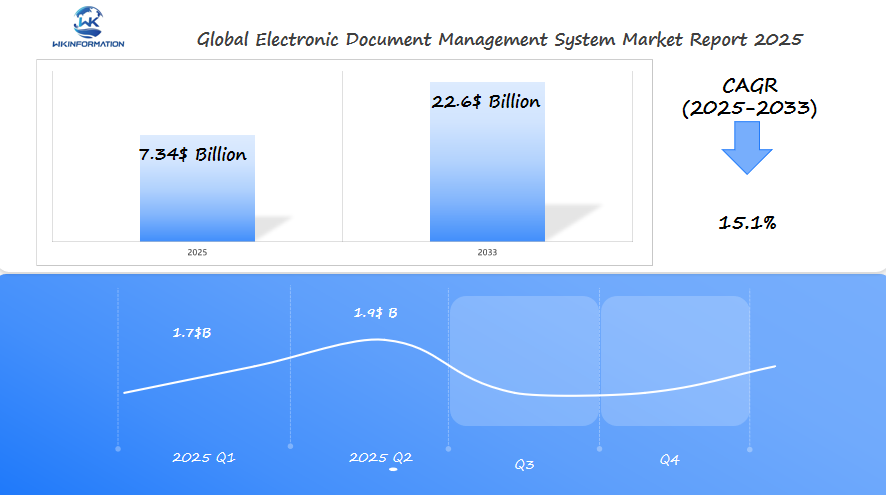

Electronic Document Management System Market Forecast for Q1 and Q2 2025

The electronic document management system (EDMS) market is projected to reach $7.34 billion in 2025, with a CAGR of 15.1% through 2033. In Q1 2025, the market is forecasted to generate around $1.7 billion, while Q2 is expected to experience further growth, reaching approximately $1.9 billion, as businesses worldwide continue to prioritize digital transformation and efficiency.

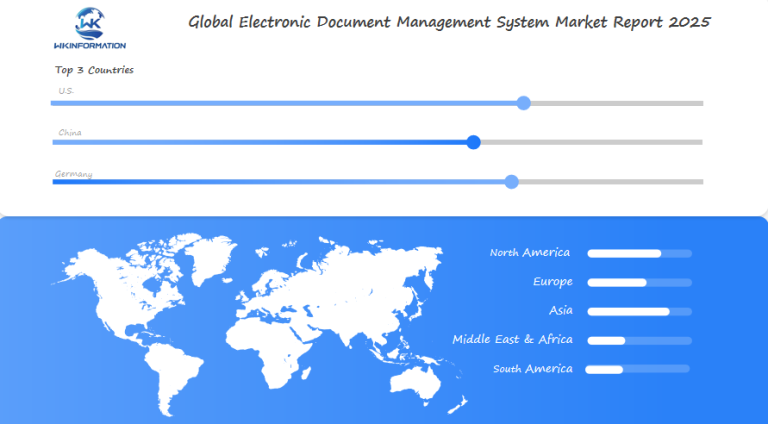

The U.S., China, and Germany are key regions for EDMS adoption. The U.S. leads in market size, driven by its need for secure, scalable document management solutions across sectors such as healthcare, finance, and government. China’s rapid push toward digitalization, particularly within government and private enterprises, is expected to significantly boost EDMS demand. Germany, with its strong manufacturing and technology sectors, continues to adopt EDMS solutions as part of its broader digitalization efforts. These countries are crucial for understanding global EDMS trends, particularly in the context of digital workflows and compliance.

Key Upstream and Downstream Forces Shaping the Electronic Document Management System Industry

The growth of the Electronic Document Management System (EDMS) market is influenced by strong upstream and downstream forces. These forces create a constantly changing environment of innovation and adoption.

1. Technology Provider Influence

- Cloud service providers like AWS and Microsoft Azure drive EDMS development through infrastructure capabilities

- Software developers introduce AI-powered features for automated document processing

- Hardware manufacturers shape compatibility requirements for scanning and storage solutions

2. User-Driven Market Evolution

- Organizations demand seamless integration with existing business applications

- Remote work requirements push for mobile-friendly document access

- Cost reduction initiatives fuel interest in paperless solutions

- Small businesses seek scalable, pay-as-you-go pricing models

3. Regulatory Impact on Implementation

- Data protection laws mandate specific security protocols

- Industry-specific regulations shape feature development:

- Healthcare: HIPAA compliance requirements

- Finance: SEC document retention rules

- Government: Freedom of Information Act considerations

The interaction between technology providers, user needs, and regulatory requirements creates a complex market environment. Technology providers respond to user demands while ensuring compliance with evolving regulations. This dynamic relationship drives continuous innovation in document management solutions, pushing the market toward more sophisticated, secure, and efficient systems.

Emerging Trends and Key Drivers in the Electronic Document Management Market

Cloud-based EDMS solutions have changed the way organizations manage documents. These systems offer significant advantages:

- Reduced Infrastructure Costs: Organizations eliminate the need for on-premises servers

- Automatic Updates: Software updates and maintenance handled by service providers

- Scalability: Easy adjustment of storage and user capacity based on needs

- Remote Accessibility: Access documents from anywhere with internet connectivity

The integration of collaboration tools transforms EDMS platforms into dynamic workspaces. Modern systems include:

- Real-time document editing

- Built-in chat and commenting features

- Version control tracking

- Task assignment capabilities

- Project management tools

Advanced security measures have become essential components of EDMS platforms:

- Multi-factor Authentication: Adds extra layers of protection beyond passwords

- End-to-end Encryption: Safeguards documents during transmission and storage

- Granular Access Controls: Enables precise management of user permissions

- Audit Trails: Tracks all document activities and user interactions

- Data Backup: Automated backup systems prevent data loss

These security features protect sensitive information while maintaining compliance with industry regulations. Organizations can customize security protocols based on their specific needs and risk profiles.

Barriers and Restrictions Impacting Growth in Electronic Document Management

The Electronic Document Management System market faces significant challenges from evolving data privacy regulations. The General Data Protection Regulation (GDPR) has created strict requirements for organizations handling EU citizens’ data:

- Consent Management: EDMS providers must implement robust mechanisms for obtaining and tracking user consent

- Data Portability: Systems need built-in capabilities to export user data in machine-readable formats

- Right to Erasure: EDMS solutions must enable complete deletion of personal data upon request

Healthcare organizations implementing EDMS face additional hurdles due to HIPAA compliance requirements:

- Mandatory audit trails for all document access

- Encrypted data transmission and storage

- Role-based access control systems

- Secure backup and disaster recovery protocols

These regulatory demands create substantial development costs for EDMS vendors, impacting product pricing and market accessibility. Small businesses often struggle with implementation costs and compliance requirements, limiting market penetration in certain sectors.

Regional variations in data protection laws create complexity for global EDMS deployment:

- Asia-Pacific: Diverse regulatory frameworks across countries

- United States: State-specific privacy laws like CCPA

- European Union: Strict GDPR enforcement with hefty penalties

The need to maintain separate data centers in different jurisdictions adds operational costs and technical complexity to EDMS solutions, affecting scalability and market growth potential.

Geopolitical Factors Affecting the Global Electronic Document Management Market

The global EDMS market is facing significant disruption due to ongoing geopolitical tensions. Trade disputes between major economies have a widespread impact on the technology sector, affecting various aspects such as:

- The stability of supply chains for hardware components

- Software licensing agreements

- The ability to transfer data across borders

- Opportunities for technology partnerships

Regional Market Dynamics

The following factors highlight how regional dynamics are influenced by geopolitical tensions:

- U.S.-China trade tensions have led Chinese organizations to prioritize domestic EDMS providers.

- European companies are increasingly seeking EU-based solutions to avoid complications with international data transfers.

- Emerging markets are facing limited access to advanced EDMS features due to trade restrictions.

Regulatory Landscape Variations

Different regions have their own regulatory requirements that impact the EDMS market:

- Middle Eastern countries require local data storage for government-related documents.

- Russia mandates data localization for citizen information.

- Asia-Pacific regions implement varying levels of data sovereignty requirements.

The changing geopolitical climate is resulting in distinct market segments with specific needs. Organizations must navigate complex international relationships when choosing EDMS providers. Local vendors have a competitive advantage in areas affected by trade restrictions, while global providers are adapting their offerings to meet the demands of specific regions.

These geopolitical factors are driving the development of region-specific EDMS solutions, leading to a fragmented market landscape. Companies operating in multiple jurisdictions are facing higher costs and increased complexity in maintaining compliant document management systems.

Segmenting the Electronic Document Management System Market by Type

The EDMS market divides into two primary segments: software and services, each serving distinct organizational needs.

Software Segment

The software segment commands a 65% market share, featuring:

- Document capture and imaging solutions

- Records management tools

- Workflow automation platforms

- Content management systems

- Search and retrieval functionalities

Services Segment

Services account for 35% of the market, including:

- Implementation support

- Training programs

- System maintenance

- Technical consulting

- Custom integration services

Deployment Types: On-Premise vs Cloud-Based

Organizations face a critical choice between two main deployment types:

On-Premise Deployment

- Complete control over data and infrastructure

- Higher initial investment costs

- Internal IT team requirements

- Enhanced security customization options

Cloud-Based Solutions

- Reduced upfront costs

- Scalable storage options

- Automatic updates and maintenance

- Remote accessibility

- Pay-as-you-go pricing models

Factors Influencing Deployment Choices

The choice between deployment types depends on specific organizational factors:

- Company size and budget

- Security requirements

- Geographic distribution of workforce

- Industry compliance standards

- IT infrastructure capabilities

Shifting Trends: Rise of Cloud-Based Solutions

Recent market data shows cloud-based solutions gaining significant traction, with a 73% adoption rate among new EDMS implementations in 2024. This shift reflects organizations’ growing preference for flexible, scalable document management solutions that support remote work capabilities.

How Applications Are Driving Demand for Electronic Document Management Systems Across Industries

The adoption of Electronic Document Management Systems spans diverse industries, each leveraging specific applications to address unique operational challenges:

1. Government Sector Applications

- Digital archiving of citizen records and legal documents

- Streamlined permit processing and license management

- Secure storage of classified information

- Inter-department document sharing and collaboration

2. Healthcare Industry Implementation

- Patient records management with HIPAA compliance

- Medical imaging documentation

- Insurance claims processing

- Clinical trial documentation tracking

3. Financial Services Integration

- Automated invoice processing

- Bank statement archival

- Investment portfolio documentation

- Regulatory compliance reporting

4. Operational Efficiency Enhancements

- Automated Workflow Management: Reduces manual document routing by 75%

- Version Control Systems: Eliminates duplicate document creation

- Access Control Features: Ensures document security through role-based permissions

- Audit Trail Capabilities: Tracks document modifications and user interactions

5. Manufacturing Sector Benefits

- Quality control documentation

- Standard operating procedures management

- Equipment maintenance records

- Supply chain documentation

These industry-specific applications demonstrate EDMS’s role in transforming traditional paper-based processes into streamlined digital workflows. Organizations implementing EDMS report up to 30% reduction in document processing time and 40% decrease in storage costs.

Regional Insights into the Global Electronic Document Management Market

North America: The Leader in EDMS Market

North America is the leading region in the Electronic Document Management System (EDMS) market, holding 42% of the global market share. This leadership position can be attributed to several factors:

- Early adoption of technology

- Presence of major technology companies

- Strong digital infrastructure

- High spending on IT across various industries

Key Players in North America

The key players in the North American EDMS market include:

- Microsoft Corporation – Leading with SharePoint and OneDrive integration

- Oracle Corporation – Offering robust enterprise content management solutions

- OpenText – Specializing in industry-specific EDMS solutions

Asia-Pacific: A Region with High Growth Potential

The Asia-Pacific region offers significant growth opportunities for the EDMS market, with a projected compound annual growth rate (CAGR) of 18.2% through 2025. Several factors contribute to this expansion:

- Government-led digital transformation initiatives

- Rising adoption rates of cloud technology

- Increasing mobile workforce

- Growing digitalization among small and medium-sized enterprises (SMEs)

China and India: Key Contributors to Growth

China and India are expected to be the primary drivers of growth in the Asia-Pacific EDMS market:

China

- Market value of $1.2 billion

- Annual growth rate of 25%

- Presence of strong domestic EDMS providers

India

- Rapid development of cloud infrastructure

- Increasing enterprise mobility

- Government initiatives promoting digitalization in India

- Growing ecosystem of startups

Different Deployment Preferences

There are distinct preferences in deployment models based on regional adoption patterns. Organizations in North America tend to favor hybrid solutions, while businesses in the Asia-Pacific region are more inclined towards cloud-based systems due to cost advantages and scalability benefits.

U.S. Electronic Document Management System Market: Trends Opportunities Challenges Ahead

The U.S. EDMS market is experiencing dynamic growth driven by rapid technological adoption and evolving business needs. Microsoft leads the market with SharePoint, offering integrated collaboration features and AI-powered document processing. The company’s strategic focus on cloud-native solutions positions it strongly against emerging competitors. Oracle maintains its market presence through robust enterprise-level document management solutions, emphasizing security and compliance features.

Key Market Dynamics:

- Remote work acceleration has pushed U.S. businesses toward cloud-based EDMS solutions

- Integration of AI-powered analytics for improved document classification

- Rising demand for mobile-first document management platforms

- Enhanced focus on cybersecurity measures within EDMS implementations

Business Transformation Trends:

- 76% of U.S. organizations report increased EDMS adoption post-pandemic

- Digital signature integration becomes standard practice

- Automated workflow implementations rise by 45% year-over-year

- Small businesses embrace SaaS-based document management solutions

The shift toward paperless operations drives significant market opportunities. U.S. businesses implementing EDMS report:

- 30% reduction in operational costs

- 40% improvement in document retrieval time

- 50% decrease in storage space requirements

- 65% enhancement in team collaboration efficiency

Competition intensifies as new vendors enter the market with specialized solutions for specific industries. Healthcare and financial services sectors lead EDMS adoption, implementing advanced features like blockchain-based document verification and automated compliance monitoring.

China's Role In Shaping The Future Of The Global Edms Landscape

China’s rapid digital transformation has created a dynamic EDMS market environment, driven by strategic government initiatives and technological innovation. The Digital China strategy has accelerated EDMS adoption across public and private sectors, with notable impacts:

Government-Led Initiatives

- Implementation of the “Internet Plus” policy

- Mandatory digital record-keeping requirements

- Smart city development programs supporting digital infrastructure

Chinese organizations demonstrate unprecedented EDMS adoption rates, with key sectors showing remarkable growth:

- Banking and Financial Services: 156% YoY increase

- Healthcare: 89% adoption rate

- Manufacturing: 67% digital transformation rate

Local EDMS providers have developed unique market positions through:

- AI-Enhanced FeaturesNative language processing capabilities

- Automated workflow systems

- Custom compliance modules

Leading Chinese EDMS providers like Kingdee and Yonyou have established competitive advantages through:

- Integration with WeChat and AliPay platforms

- Mobile-first development approach

- Region-specific regulatory compliance features

- Cloud deployment options optimized for local infrastructure

The market has seen significant developments in specialized solutions:

- Industry-specific templates

- Real-time collaboration tools

- Blockchain-based document verification

- Cross-border data handling capabilities

Chinese EDMS vendors are expanding their presence in Southeast Asian markets, leveraging their experience with similar regulatory environments and business practices.

Germany's Influence On Setting Standards For Data Protection Compliance In The EDMS Space

Germany is a leader in data protection regulations, setting strict standards that shape EDMS implementations in Europe and beyond. The German market’s unique approach to data security has created a model for global EDMS compliance requirements.

Key Regulatory Features:

- Strict enforcement of GDPR principles

- Mandatory data processing agreements

- Regular security audits

- Documentation requirements for data flows

- Enhanced user consent mechanisms

German tech companies have responded to these rigorous standards by developing innovative EDMS solutions. SAP, a prominent player in the German market, has pioneered AI-driven document classification systems that maintain compliance while boosting efficiency.

Notable German EDMS Innovations:

- Automated compliance checking

- Real-time data protection monitoring

- Intelligent document routing

- Privacy-by-design architectures

- Multi-layer encryption protocols

The German approach to EDMS implementation emphasizes:

“Security and privacy cannot be afterthoughts – they must be built into the core architecture of any document management system”

Local providers like DocuWare and Easy Software have developed specialized features to address German market requirements:

- Automated data retention schedules

- Geographic data storage restrictions

- Comprehensive audit trails

- Built-in privacy impact assessments

- Advanced access control mechanisms

These innovations have positioned German EDMS providers as leaders in secure document management solutions, influencing global standards for data protection in digital document handling.

Future Prospects For Electronic Document Management Systems: Embracing AI Innovations And Beyond

AI and machine learning technologies are changing the game for Electronic Document Management Systems (EDMS) by introducing new features and capabilities. Here’s how these technologies are making an impact:

1. Intelligent Document Processing (IDP)

- Automated classification of incoming documents

- Real-time data extraction from unstructured content

- Pattern recognition for improved filing accuracy

2. Advanced Search Capabilities

- Natural language processing for context-aware searches

- Image recognition for visual content identification

- Semantic analysis for better search results

The COVID-19 pandemic has sped up innovation in EDMS, with AI-powered features becoming essential:

3. Automated Workflow Enhancement

- Smart routing based on document content

- Predictive analytics for process optimization

- Auto-generation of document metadata

4. Remote Collaboration Advancements

- Real-time document co-editing with AI assistance

- Smart version control and conflict resolution

- Automated language translation for global teams

Cloud-based EDMS solutions are incorporating these AI capabilities to provide even greater benefits:

- Reduced manual data entry by up to 90%

- 60% faster document processing times

- 99% accuracy in document classification

- Enhanced security through AI-powered threat detection

These technological advancements are steering the EDMS market towards intelligent automation. Organizations are witnessing significant improvements in productivity and cost savings through AI-enabled features.

Competitive Landscape in the Electronic Document Management Market

- IBM Corporation — Armonk, New York, USA

- Microsoft Corporation — Redmond, Washington, USA

- Oracle Corporation — Austin, Texas, USA

- OpenText Corporation — Waterloo, Ontario, Canada

- Xerox Corporation — Norwalk, Connecticut, USA

- Canon Inc. — Ōta, Tokyo, Japan

- Hyland Software Inc. — Westlake, Ohio, USA

- Ricoh USA Inc. — Exton, Pennsylvania, USA

- M-Files Inc. — Austin, Texas, USA (originally from Tampere, Finland)

- FUJIFILM Business Innovation Co. Ltd. — Tokyo, Japan

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Electronic Document Management System Market Report |

| Base Year | 2024 |

| Segment by Type | · Installation and Integration

· Consulting · Training · Others |

| Segment by Application | · Government

· Medical · Corporate · BFSI · Legal · Education |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Adopting an Electronic Document Management System (EDMS) offers transformative benefits for organizations keen on staying competitive in an increasingly digital landscape.

Strategic recommendations for those considering EDMS adoption include:

- Evaluate Needs: Assess your specific document management requirements, considering factors such as scalability, security, and integration capabilities.

- Prioritize Security: Opt for solutions that provide robust data protection to address increasing concerns regarding data privacy.

- Leverage Cloud Solutions: Consider cloud-based options for their flexibility and cost-effectiveness, especially beneficial for small and medium-sized enterprises.

- Embrace Technological Advancements: Integrate AI and machine learning capabilities to enhance document classification and streamline processes.

Global Electronic Document Management System Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Electronic Document Management System Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Electronic Document Management SystemMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Electronic Document Management Systemplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Electronic Document Management System Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Electronic Document Management System Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Electronic Document Management System Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofElectronic Document Management SystemMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key upstream and downstream forces shaping the Electronic Document Management System (EDMS) industry?

The key forces include supply chain dynamics, technology adoption, user demand for efficiency and cost-effectiveness, and the influence of regulatory requirements on the adoption and implementation of EDMS.

What emerging trends are driving growth in the Electronic Document Management market?

Emerging trends include the rise of cloud-based EDMS solutions, integration of collaboration tools for enhanced productivity, and the importance of advanced security measures to safeguard sensitive documents.

What barriers are impacting the growth of Electronic Document Management Systems?

Barriers include stringent data privacy regulations like GDPR, compliance requirements such as HIPAA for healthcare organizations, and market limitations that restrict widespread adoption.

How do geopolitical factors affect the global Electronic Document Management market?

Geopolitical factors such as regional regulations, international trade policies, and economic conditions can influence technology adoption rates and impact how EDMS solutions are deployed across different regions.

How is the U.S. Electronic Document Management System market evolving in terms of trends and opportunities?

The U.S. market is characterized by leading companies like Microsoft and Oracle adapting to trends such as remote work culture and a shift towards paperless operations, presenting various business opportunities in a rapidly evolving landscape.

What role does AI play in the future prospects of Electronic Document Management Systems?

AI innovations and machine learning technologies are enhancing document processing capabilities in modern EDMS by enabling intelligent search functionality and automated metadata extraction, which are crucial for future growth trajectories post-COVID.