Global Dozer Blades Market to Reach $4.08 Billion by 2025 – U.S., China, and India Lead the Way

Explore the growing Dozer Blades Market, driven by infrastructure development and mining activities. Analysis of trends, key players, and regional market dynamics through 2025.

- Last Updated:

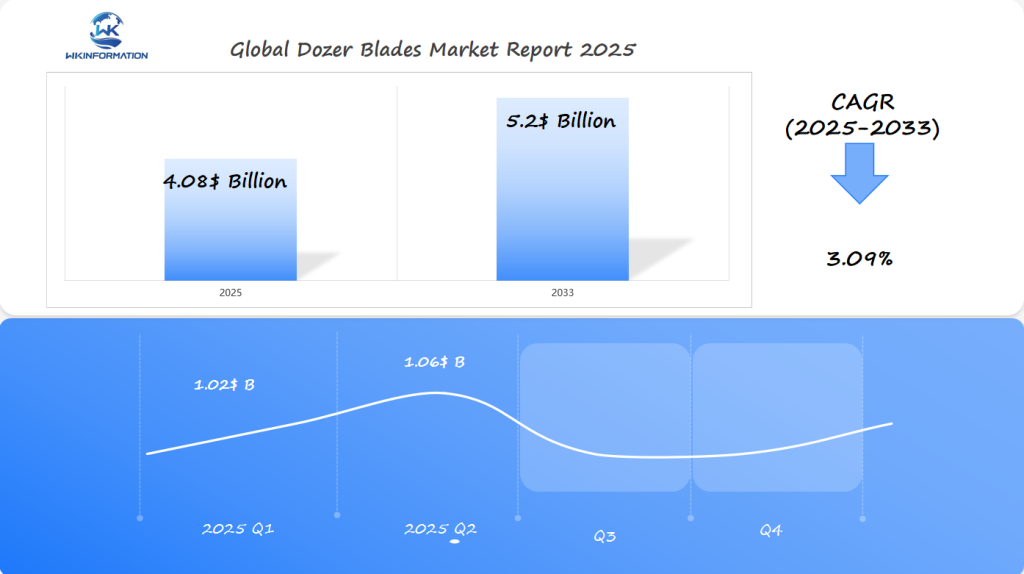

Dozer Blades Market Forecast for Q1 and Q2 of 2025

The global dozer blades market is anticipated to reach USD 4.08 billion by 2025, growing at a CAGR of 3.09% from 2025 to 2033. Dozer blades, used in various industries such as construction, mining, and earthmoving, are crucial for maintaining efficient operations and managing large-scale excavation tasks.

By the end of Q1 2025, the market size is projected to be around USD 1.02 billion, with demand driven by an increase in infrastructure development projects and the growth of mining operations globally.

By Q2 2025, the market is expected to expand further to approximately USD 1.06 billion, with the U.S., China, and India leading the growth in demand. The growing urbanization and industrialization in these regions, combined with large-scale construction projects, will significantly contribute to the demand for heavy machinery and the associated dozer blades.

Key Takeaways

- Projected market value of $4.08 billion by 2025

- United States, China, and India lead global market growth

- Infrastructure and mining sectors drive market expansion

- Technological innovations enhance blade performance

- Increasing demand across multiple industrial sectors

- Strategic investments fueling market development

Dozer Blades Market Upstream and Downstream Industry Chain: Unveiling Key Relationships

The dozer blades market is a complex web of suppliers, manufacturers, and customers. It shows how different parts work together to drive growth and innovation.

Upstream suppliers are key in the dozer blades market. They give raw materials and parts needed to make blades. Important suppliers include:

- Steel and metal alloy manufacturers

- Cutting-edge material research laboratories

- Specialized engineering component producers

- Heavy machinery component suppliers

Downstream customers are the main drivers of demand for dozer blades. Companies in construction, mining, and infrastructure projects need these blades. The way suppliers and customers work together affects the market.

| Upstream Suppliers | Downstream Customers | Market Impact |

|---|---|---|

| Steel Manufacturers | Construction Companies | High Demand for Durable Blades |

| Metal Alloy Producers | Mining Operations | Advanced Material Requirements |

| Engineering Component Makers | Infrastructure Projects | Technological Innovation |

The relationship between suppliers and customers pushes the dozer blade technology forward. Manufacturers must keep up with changing needs, making new solutions for complex industrial tasks.

The strength of the dozer blades market lies in its interconnected supply chain and responsive innovation ecosystem.

With new tech and partnerships, the industry keeps growing. This ensures the global dozer blades market continues to develop.

Emerging Trends Reshaping the Dozer Blades Market Landscape

The dozer blades market is going through big changes. New technologies and green initiatives are leading the way. These changes are making construction and earthmoving better and more efficient.

Several key trends are shaping the market:

- Smart blade systems with IoT and AI

- Advanced GPS for precise grading

- Green manufacturing methods

- Data analytics for predictive maintenance

New tech is making dozer blades more powerful. Millimetre-accurate leveling systems bring unmatched precision to work sites. AI helps predict when equipment might break, cutting down on downtime and costs.

| Technology | Impact | Potential Efficiency Gain |

|---|---|---|

| GPS Grade Control | Precision Leveling | Up to 50% Reduced Material Waste |

| Telematics Systems | Real-time Performance Monitoring | 15-25% Operational Efficiency |

| Electric Blade Systems | Zero On-site Emissions | Sustainable Construction Solutions |

Green efforts are key in making new equipment. Big companies are moving to electric and hybrid options. This aims to cut down on emissions. The electric construction equipment market is expected to grow fast, showing a big move towards eco-friendly tech.

These trends show the dozer blades market’s focus on innovation, efficiency, and caring for the planet.

Overcoming Challenges: Navigating Restrictions in the Dozer Blades Market

The dozer blades market is facing big challenges that need smart solutions. Keeping up with regulations is key for companies to stay ahead globally.

Some major issues in the industry are:

- Strict environmental rules that limit what equipment can be made

- Disruptions in the supply chain that mess up production and delivery

- Changes in raw material prices that make things uncertain for businesses

Companies are coming up with clever plans to tackle these problems. Adaptive design approaches are a big help in dealing with strict rules. They’re using new tech to cut down on environmental harm without losing performance.

“Innovation is the key to navigating complex market restrictions and maintaining technological leadership.” – Construction Industry Expert

Supply chain problems have made companies rethink how they buy and make things. They’re now using flexible ways to get materials and setting up local factories to avoid global market risks.

The best companies are those that stay on top of regulations and keep things running smoothly. By using the latest tech and flexible business models, dozer blade makers can turn challenges into chances for growth and new ideas.

Geopolitical Factors Influencing Dozer Blades Market Dynamics

The global dozer blades market faces many challenges. These come from geopolitical impacts that affect how countries trade and access markets. Countries like China, the United States, and India are changing the market a lot.

Important factors affecting the dozer blades market include:

- Trade tensions between major manufacturing countries

- Shifting international regulations on manufacturing and export

- Infrastructure development initiatives in emerging economies

- Strategic investments in construction and mining sectors

The Asia-Pacific region is growing fast. It’s seeing a lot of industrial growth. This growth means there’s a big need for new dozer blade technologies. Geopolitical strategies are increasingly determining market entry and expansion opportunities for manufacturers looking to grow.

Trade policies are very important for market access. Companies need to keep up with changing rules. This affects how they price things, manage their supply chains, and compete with others. The market is expected to grow to $4.08 billion by 2025, making it crucial to navigate these complex relationships well.

Government investments and infrastructure projects are driving growth. Companies that understand and act on these geopolitical changes will likely lead the market.

Dozer Blades Market Segmentation: Analyzing Diverse Blade Types

The dozer blades market is a key part of heavy machinery. It’s important to understand the different types of blades. Each type is made for specific tasks in various industries.

There are mainly three types of blades:

- Straight Blades: Great for basic earthmoving and general use

- Semi-U Blades: Better for keeping material in place for medium projects

- U-Blades: Best for handling a lot of material in big projects

Demand for these blades changes based on the industry. Construction, mining, and infrastructure need specific blades. Each type has its own benefits:

- Straight blades are good for pushing and spreading materials

- Semi-U blades help keep material in place on complex terrain

- U-blades are great for moving a lot of material in big projects

Companies are now focusing on making different types of blades. This helps them meet the needs of many customers. Being able to offer specific blades is what sets them apart in the market.

Exploring Varied Applications Driving Dozer Blades Market Growth

The dozer blades market is growing fast in many areas. It shows how versatile these tools are. Construction, mining, agriculture, and forestry are key areas where dozer blades are making a big difference.

Each sector uses dozer blades in its own way. In construction, they help clear land and prepare sites. Mining uses them to move earth and get to minerals deep underground.

- Construction: Site preparation and landscape modification

- Mining: Material handling and terrain management

- Agriculture: Land leveling and field preparation

- Forestry: Clearing paths and managing woodland areas

Agriculture is seeing a lot of growth in dozer blade tech. Farmers use them to level land for crops. Precision engineering makes these machines great at changing hard land into good farmland.

In forestry, dozer blades are key for managing the environment. They help make firebreaks and clear paths in dense woods. These tools are very useful in tough places.

Modern dozer blades are more than just tools for moving earth. They are advanced tools for changing landscapes.

The global dozer blades market is expected to hit $4.08 billion by 2025. This shows how much demand there is in different fields. New tech keeps making these tools better and more useful.

Global Dozer Blades Market: Regional Analysis and Growth Hotspots

The global dozer blades market is growing fast in many places. This growth is thanks to new economies and their focus on building better infrastructure. They also use the latest technology.

Looking at the market, we see big chances in different areas:

- North America is leading with its tech.

- Asia-Pacific is growing fast.

- Europe is all about making things precise.

Experts at PennDOT’s innovation center say what makes each area grow differently.

Getting into new markets is key for lasting success in the dozer blades business. Companies need to understand local needs and tech to grab new chances.

US Dozer Blades Market: Leading Innovation and Adoption

The United States leads in dozer blades market innovation, pushing construction equipment tech forward. Market leadership in the US construction has seen major leaps in machine control systems and precision engineering.

Several key innovations have changed the US dozer blades market. These include:

- Advanced GPS integration in dozers

- Intuitive touchscreen control interfaces

- Automated machine control systems

- Enhanced cybersecurity protocols

The US market trends show a strong focus on technology adoption. Companies like Topcon have been key in advancing dozer blade tech. They aim to create autonomous construction vehicles that can handle complex tasks with little human help.

Important milestones in the US dozer blades market include:

- Introduction of factory-fit control systems in 2013

- Dramatic reduction in memory chip costs

- Development of integrated machine control technologies

China's Dozer Blades Market: Rapid Expansion and Technological Advancements

The Chinese dozer blades market is growing fast. This is thanks to strong manufacturing and smart export plans. Companies are using new tech and cost-saving methods to change the game worldwide.

Key developments in the Chinese market include:

- Significant investments in research and development

- Expanding manufacturing infrastructure

- Enhanced precision engineering techniques

- Competitive pricing strategies

Chinese companies are making big moves in the global market. They’ve reached top-notch manufacturing levels. This lets them make high-quality dozer blades that stand up to big names.

Export plans have gotten smarter, too. Chinese makers are eyeing new markets in building and construction. The focus on technological advancements has helped them create new solutions for all kinds of needs.

China’s dozer blades market represents a dynamic and rapidly evolving segment of the global heavy machinery industry.

The market’s growth is backed by smart government policies and constant tech upgrades. Chinese makers are committed to meeting top quality standards. As they grow globally, they’re set to shape the future of dozer blade tech.

India's Dozer Blades Market: Emerging Opportunities and Infrastructure Boom

India’s dozer blades market is growing fast. This is thanks to big infrastructure projects and more demand at home. The country’s big plans for its infrastructure are opening up new chances for makers and sellers of dozer blades.

Key highlights of India’s dozer blades market include:

- Robust growth in construction and mining sectors

- Increasing investment in national infrastructure projects

- Rising domestic manufacturing capabilities

The Indian market is really showing its strength in making advanced dozers like the BD475-2. This crawler dozer weighs 100 tons and is powered by a 950 HP Cummins QST30 electronic engine. It shows India’s skill in making heavy equipment.

The BD475-2 dozer shows India’s goal to be more self-reliant in making heavy equipment. It has a big semi-U blade and meets strict environmental standards. This dozer is a mix of power and care for the planet.

The Asia-Pacific region, especially India, is a big player in the global dozer blades market. It has a lot of demand from construction, mining, and farming.

Future Development Prospects in the Dozer Blades Market

The dozer blades market is set for big changes. New technologies and changes in the industry will drive this growth. The global market is expected to grow to $4.08 billion by 2025.

Key future development prospects include:

- Advanced technological integration

- Sustainability-focused design

- Enhanced automation capabilities

- Electrification of heavy machinery

New technologies are changing the industry. Manufacturers are investing in electric and hybrid dozer blade technologies. This is in response to environmental rules and the need for more efficient machines.

The Asia-Pacific region will be key for market growth. It’s expected to see a +3.09% CAGR by 2035. Countries like China and India will lead this growth, pushing innovation and market development.

Emerging trends show a move towards:

- Smart connectivity features

- Precision engineering

- Reduced environmental impact

- Modular design capabilities

The future for dozer blades looks bright. Technological innovation and strategic investments will open up new growth chances in global infrastructure and construction.

Competitive Landscape: Key Players Shaping the Dozer Blades Market

The global dozer blades market is very competitive. Many key manufacturers are pushing for new technologies and growth strategies. They aim to get a bigger share of the market.

Top manufacturers in the dozer blades market include:

-

Caterpillar Inc. – United States

-

CNH Industrial N.V. – Netherlands

-

Komatsu Ltd. – Japan

-

Doosan Infracore Co., Ltd. – South Korea

-

JCB Inc. – United Kingdom

-

LiuGong Machinery Co., Ltd. – China

-

Shantui Construction Machinery Co., Ltd. – China

-

Zoomlion Heavy Machinery Company Ltd. – China

-

BHL-New Holland – Italy

-

Atlas Copco AB – Sweden

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Dozer Blades Market Report |

| Base Year | 2024 |

| Segment by Type | · Straight Blades

· Angled Blades · U-Blades · Semi-U Blades · Others |

| Segment by Application | · Construction

· Mining · Agriculture · Forestry · Others |

| Geographies Covered | · North America(United States,Canada)

· Europe(Germany,France,UK,Italy,Russia) · Asia-Pacific(China,Japan,South Korea,Taiwan) · Southeast Asia(India) · Latin America(Mexico,Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast,company share,competitive landscape,growth factors and trends |

The global dozer blades market is growing fast, expected to hit $4.08 billion by 2025. Companies need a solid plan to grab these new chances. They should watch the market closely, especially in the U.S., China, and India, where tech is advancing quickly.

Investing in dozer blades means focusing on new tech and partnerships. Big names like Hyundai are leading the way with big investments. These moves show a bright future, with a focus on tech like self-driving cars and AI.

For success, companies should mix up their tech, team up with others, and stay ready for changes. The outlook is good for those who invest in new ideas, green practices, and growing in new places.

As the world builds more, the need for dozer blades will keep growing. Businesses need to stay quick and ready for new trends. The dozer blades market is full of chances for growth, especially for those who invest in the latest tech and flexible plans.

Global Dozer Blades Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Dozer Blades Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Dozer BladesMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Dozer BladesPlayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Dozer Blades Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Dozer Blades Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Dozer Blades Consumer Insights

- Demographics and Buying Behaviors

- TargetAudience Profiles

Chapter 8: Key Findings and Recommendations

- Summary of Dozer Blades Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What is the projected market value for dozer blades by 2025?

The global dozer blades market is expected to hit $4.08 billion by 2025. This growth is fueled by more infrastructure projects and mining activities around the world.

Which countries are leading the dozer blades market?

The United States, China, and India lead the dozer blades market. They are key players in driving growth and innovation.

What are the main types of dozer blades?

Main types include straight blades, semi-U blades, and U-blades. Each is made for different jobs in construction, mining, and other fields.

How are technological advancements impacting the dozer blades market?

New tech like smart blades, IoT, and AI is changing how dozer blades work. It makes them more efficient and effective.

What industries primarily use dozer blades?

Dozer blades are used a lot in construction, mining, agriculture, and forestry. Each sector has its own needs and drives innovation.

What challenges are facing the dozer blades market?

Challenges include tough environmental rules, supply chain issues, and price and tech competition. Keeping prices down and improving tech is key.

How do geopolitical factors affect the dozer blades market?

Trade wars, tariffs, and global politics affect market access and prices. They also impact supply chains for dozer blades.

What are the key trends in dozer blade manufacturing?

Trends include focusing on sustainability, using advanced manufacturing, and adding smart tech. There’s also a push for greener, more efficient blade designs.

Which regions are showing the most growth in the dozer blades market?

Asia-Pacific, especially India and China, is growing fast. North America and Europe also remain strong markets.

What future developments are expected in the dozer blades market?

Expect more automation, green tech, and advanced IoT. Blade design and materials will also see big improvements.