$7.5 Billion Display Glass Market to Grow Significantly in China, the U.S., and Japan by 2025

Explore the latest trends in the display glass market, including flexible displays, OLED advancements, and sustainability, driving growth across industries.

- Last Updated:

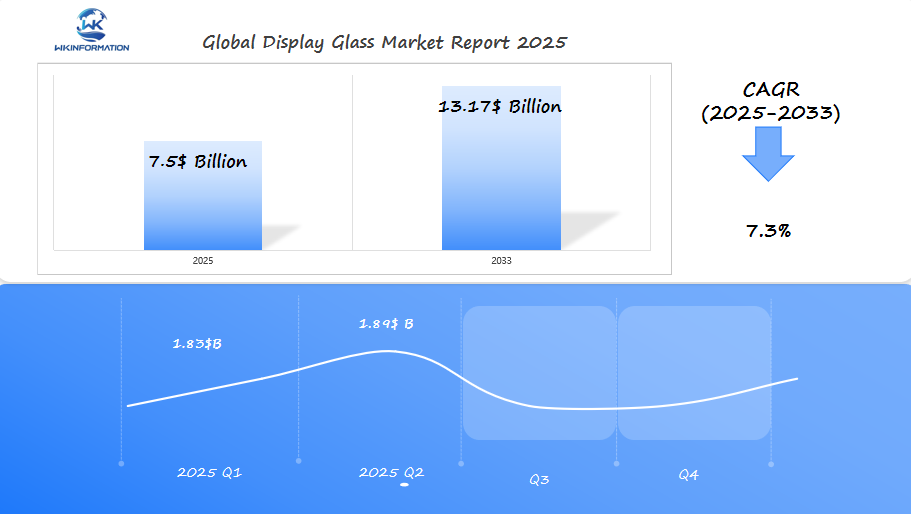

Projected Market Insights for Display Glass in Q1 and Q2 of 2025

The Display Glass market is expected to reach $7.5 billion in 2025, with a CAGR of 7.3% from 2025 to 2033. In Q1, the market is projected to generate around $1.83 billion, driven by continued demand for advanced display technologies in consumer electronics, automotive, and industrial applications.

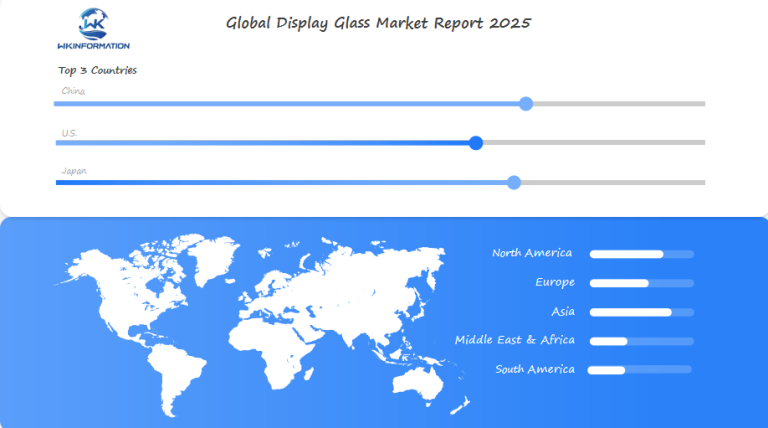

By Q2, the market is expected to grow to approximately $1.89 billion, reflecting steady growth as the need for high-definition, flexible, and durable displays rises. China, the U.S., and Japan are expected to be the key markets. China, as a manufacturing hub for electronics, will lead in demand, the U.S. continues to drive adoption of cutting-edge display technologies, and Japan’s expertise in electronics and automotive industries will continue to contribute to growth. As the trend toward larger, higher-quality displays continues, the market will experience sustained demand in these regions.

Upstream and Downstream Industry Chains for Display Glass

The display glass industry operates through a complex network of suppliers and manufacturers, each playing a crucial role in delivering high-quality products to end consumers.

Upstream Supply Chain:

Raw material suppliers provide essential components:

- High-purity silica sand

- Aluminum oxide

- Boron oxide

- Specialty chemicals for coating

Production Process:

Raw materials undergo rigorous processing:

- Melting at extreme temperatures (1500-1700°C)

- Precise forming through float glass method

- Application of specialized coatings

- Quality control and inspection

Advanced manufacturing facilities maintain strict environmental controls

Production runs 24/7 to maintain optimal glass temperature

Downstream Elements:

Display manufacturers (primary customers):

- LCD panel producers

- OLED screen manufacturers

- Touch panel makers

End-product manufacturers:

- Consumer electronics companies

- Automotive display producers

- Professional display system makers

Distribution Network:

Regional distribution centers handle storage and shipping

Specialized transportation requirements:

- Custom packaging for fragile materials

- Temperature-controlled environments

- Shock-resistant containers

Just-in-time delivery systems minimize storage costs

Direct supply agreements with major manufacturers

The efficiency of this supply chain directly impacts market pricing and availability, with logistics playing a vital role in maintaining consistent supply to manufacturing facilities worldwide.

Key Trends in the Display Glass Market

The display glass market is constantly evolving due to new technological advancements. Flexible OLED displays are changing what consumers expect, forcing manufacturers to create ultra-thin, durable glass substrates that can bend without affecting display quality.

Advanced manufacturing processes now enable:

- Higher resolution displays (8K and beyond)

- Enhanced durability through chemical strengthening

- Improved light transmission rates

- Reduced power consumption

Consumer demand for premium display experiences drives market growth in various industries. The increasing popularity of:

- Large-format TVs (65+ inches)

- Gaming monitors with high refresh rates

- Foldable smartphones

- Automotive digital cockpits

These applications create a continuous need for specialized display glass solutions.

Pricing dynamics reflect market complexities:

- Raw material costs surge 15-20% annually

- Production capacity limitations drive price increases

- Regional supply-demand imbalances affect pricing stability

Chinese manufacturers are expanding their production capabilities, which puts pressure on traditional market leaders. This competitive landscape leads to price fluctuations and adjustments in capacity. Industry leaders are responding by investing in automated production lines and advanced manufacturing technologies to maintain their market share while managing production costs.

The integration of display glass in emerging technologies like augmented reality (AR) and virtual reality (VR) devices creates new market opportunities. These applications require specialized glass compositions with improved optical properties and durability standards.

Challenges in Display Glass Production and Innovation

The display glass industry faces significant production hurdles that impact market stability and growth potential. Recent factory closures in Japan have created substantial disruptions in the global supply chain, reducing manufacturing capacity by 15% in the region.

Production Challenges:

- Raw material shortages drive up costs by 23%

- Limited specialized workforce availability

- Complex quality control requirements

- Supply chain disruptions from factory closures

Smaller manufacturers have intensified market competition by offering products at 30-40% lower prices. This pricing pressure forces established manufacturers to:

- Reduce profit margins

- Scale back R&D investments

- Delay facility upgrades

- Compromise on production quality

Rising operational costs create additional strain on manufacturers:

- Energy costs increased by 18% in 2024

- Labor expenses rose 12% year-over-year

- Transportation costs jumped 25% due to fuel prices

- Environmental compliance expenses grew by 15%

The combination of these factors has led to a 20% decrease in innovation investment across the industry. Major players like Corning report a 25% reduction in new product development initiatives, while Japanese manufacturers struggle to maintain their technological edge against emerging competitors.

Chinese manufacturers capitalize on these challenges by leveraging their cost advantages and government subsidies, enabling them to invest in capacity expansion despite market pressures.

Geopolitical Factors Affecting Display Glass Market Growth

The display glass industry is facing major disruptions due to rising geopolitical tensions between key manufacturing countries. Trade restrictions between the U.S. and China have created significant obstacles for companies like Corning, making it difficult for them to maintain their market presence in Asia.

Key Trade Policy Impacts:

- 25% tariffs on Chinese display glass imports to the U.S.

- Export controls limiting technology transfer

- Increased scrutiny of cross-border investments

- Restricted access to critical raw materials

In response, Chinese manufacturers are developing domestic supply chains and reducing their reliance on foreign technology. This shift has accelerated the growth of companies like Irico and Tunghsu, who now have a larger share of Asian markets.

Supply Chain Vulnerabilities:

- Raw material sourcing disruptions

- Transportation route restrictions

- Intellectual property protection challenges

- Currency exchange rate fluctuations

The ongoing semiconductor shortage has worsened these challenges, causing delays in display glass production. Manufacturers in the U.S. are under increasing pressure to move their production facilities closer to home markets while still being able to compete with Asian producers on pricing.

Regional trade agreements are now crucial in determining market access. The RCEP (Regional Comprehensive Economic Partnership) has strengthened Asian manufacturing networks, while USMCA regulations influence North American production strategies.

Market Segmentation: Types and Applications of Display Glass

Display glass manufacturing operates on a generation-based system that defines the size and capabilities of glass substrates. Each generation serves specific market needs:

Generation Size Categories:

- Gen 6/6.5: 1500mm x 1850mm

- Optimal for smartphones and tablets

- Enables efficient small-device panel production

- Gen 8/8+: 2200mm x 2500mm

- Suited for large-screen TVs and monitors

- Higher yield rates for 65″ and 75″ displays

The display glass market splits into distinct application segments based on end-use requirements:

Consumer Electronics Applications:

- TVs: High-clarity panels for 4K/8K resolution

- Laptops: Thin, durable screens with touch capabilities

- Monitors: Professional-grade displays for gaming and workstations

- Smartphones: Impact-resistant glass with advanced touch sensitivity

Each application demands specific glass properties:

Technical Requirements:

- Thickness variations: 0.3mm – 2.0mm

- Surface quality: Ra < 0.5nm

- Optical transmission: >99%

- Chemical strengthening: Variable depths

The market segmentation reflects evolving consumer needs and technological capabilities. Chinese manufacturers focus on Gen 8/8+ production to meet growing TV panel demand, while Japanese and U.S. producers maintain strength in specialized Gen 6/6.5 applications for high-end mobile devices.

Display Glass Applications in Consumer Electronics and Automotive Industries

Display glass technology has transformed user experiences in both the consumer electronics and automotive industries. Its applications are diverse, catering to the specific needs of each sector.

Consumer Electronics Integration

- High-resolution TV screens utilize advanced display glass technology, enabling 4K and 8K resolution with enhanced color accuracy

- Smartphone displays incorporate strengthened glass materials for impact resistance while maintaining touch sensitivity

- Gaming monitors feature specialized display glass that reduces motion blur and supports high refresh rates

- Tablet devices benefit from anti-reflective coatings and optimized light transmission properties

Automotive Display Solutions

- Digital instrument clusters replace traditional analog gauges with customizable glass displays

- Head-up displays (HUD) project critical information onto windshields using specialized glass technology

- Center console infotainment systems integrate touch-sensitive display glass with anti-glare properties

- Rear-seat entertainment screens utilize impact-resistant display glass designed for passenger safety

The automotive industry has adopted display glass innovations to enhance driver experiences. Modern vehicles now come equipped with multiple display panels, ranging from dashboard interfaces to passenger entertainment systems. These automotive applications necessitate specific glass treatments to ensure:

- Temperature resistance (-40°C to 85°C)

- Anti-glare properties

- Impact protection

- EMI shielding

- Optical clarity

Additionally, the integration of curved display glass surfaces has opened up new design possibilities for both consumer electronics and automotive applications. Manufacturers are now capable of producing flexible display glass that can be molded into various shapes without compromising its structural integrity or visual performance.

Global Market Performance Metrics for Display Glass

The display glass market is experiencing strong growth in major global regions. Recent data shows a projected 14% increase in revenue year-over-year until 2025, driven by recovering demand and rising prices.

Regional Revenue Distribution:

- Asia-Pacific: Generates 65% of global revenue

- North America: Accounts for 18% of market share

- Europe: Represents 12% of total revenue

- Rest of World: Contributes 5% to global sales

Q4 2024 showed significant market momentum with:

- 7% increase in display glass shipments

- 16% growth in revenue generation

- Price stabilization across major markets

Market Value Projections:

- Current market value: $6.4 billion

- 2025 projected value: $7.5 billion

- Expected CAGR: 1.4% through 2033

- Anticipated 2033 value: $7.36 billion

The revenue distribution indicates changing manufacturing capabilities and regional demand patterns. North American markets are showing steady growth through high-value display applications, while European revenues come from premium automotive and industrial uses. Asia-Pacific’s leading position is supported by a strong manufacturing infrastructure and increasing demand for consumer electronics.

Raw material costs and improvements in production efficiency have had a positive effect on profit margins in all regions. Price differences between markets are minimal due to standardized manufacturing processes and integration of global supply chains.

China's Dominance in the Display Glass Market: Manufacturing Capacity & Market Share Analysis

China’s grip on the display glass market has reached unprecedented levels, commanding a 75% share of global demand in late 2024. This dominance stems from strategic investments in manufacturing infrastructure and aggressive capacity expansion initiatives.

Key Market Share Statistics:

- 75% current global demand share (Q4 2024)

- Projected increase to 77% by Q2 2025

- Double-digit growth in production capacity since 2020

Chinese manufacturers like Irico and Tunghsu have revolutionized the market landscape through:

- Advanced production facilities

- Cost-effective manufacturing processes

- Strategic partnerships with domestic electronics manufacturers

The rise of these manufacturers has directly challenged Corning’s historical market leadership. Chinese companies have achieved this through:

- Substantial government support and subsidies

- Integration of cutting-edge automation technologies

- Streamlined supply chain operations

- Lower production costs

Manufacturing Capacity Expansion:

- New facilities in major industrial zones

- Upgraded production lines for higher generation display glass

- Enhanced yield rates through technological improvements

- Increased focus on value-added products

This rapid expansion has transformed China from a major consumer to the primary producer of display glass, reshaping global supply chains and market dynamics. Local manufacturers now possess the capability to produce high-quality display glass for premium applications, competing directly with established international brands.

U.S. Demand Factors & Competitive Landscape for Display Glass Products

The U.S. display glass market has its own unique consumer preferences shaped by quality expectations and brand reputation. American consumers prioritize:

- High-Resolution Displays: Strong demand for 4K and 8K display technologies

- Durability: Preference for scratch-resistant and impact-resistant glass

- Brand Trust: Established reputation of manufacturers influences purchasing decisions

U.S.-based Corning maintains a competitive edge through:

- Advanced research facilities

- Strategic partnerships with major device manufacturers

- Patent portfolio protecting key innovations

The competitive landscape reveals distinct market segments:

- Premium Segment

- Dominated by Corning’s Gorilla Glass

- Focus on high-end smartphones and tablets

- Enhanced optical clarity and touch sensitivity

- Mid-Range Market

- Mix of domestic and international suppliers

- Price-competitive alternatives from Asian manufacturers

- Growing demand for automotive displays

Local manufacturers face pressure from international competitors offering:

- Lower production costs

- Rapid innovation cycles

- Flexible supply chain capabilities

The U.S. market sees increased competition in specialized applications:

- Medical display systems

- Military-grade screens

- Advanced gaming monitors

Recent supply chain disruptions have prompted U.S. manufacturers to explore domestic production expansion, supported by government initiatives to strengthen local manufacturing capabilities.

Japan's Influence on Display Glass Technology Advancements & Innovations History

Japan has played a significant role in shaping the display glass industry through its technological expertise and innovative breakthroughs. Japanese companies have been at the forefront of several key developments that have revolutionized the manufacturing process and improved display performance.

Key Historical Breakthroughs:

- Introduction of thin-film transistor (TFT) technology in the 1980s

- Development of advanced glass polishing techniques for superior optical clarity

- Creation of ultra-thin glass substrates for flexible displays

- Implementation of proprietary coating technologies for enhanced durability

These innovations have set new standards for quality and performance in the industry, with Japanese manufacturers known for their precision engineering and strict quality control measures.

Research Focus Areas for Market Leadership:

In order to maintain their competitive edge, Japanese companies are actively investing in research and development across various areas:

- Next-generation OLED display technologies

- Quantum dot integration for improved color accuracy

- Advanced glass strengthening processes

- Micro-LED display development

These focus areas align with global trends and demands in the display market, positioning Japan as a potential leader in these emerging technologies.

Pursuit of Flexible Display Innovations

Japanese research institutions are also making significant strides in flexible display technology, which is becoming increasingly important in consumer electronics and other industries. One notable area of progress is the development of bendable glass substrates that can be used in curved or foldable displays.

This advancement has the potential to open up new design possibilities and applications for displays, further solidifying Japan’s position as a key player in this field.

Exploration of Sustainable Display Solutions

In addition to flexible displays, there is a growing emphasis on sustainability within the display industry. Japanese researchers are actively exploring eco-friendly materials and manufacturing processes that minimize environmental impact.

This includes initiatives such as using bio-compatible display materials or energy-efficient production methods. By prioritizing sustainability, Japan aims to meet both regulatory requirements and consumer expectations while maintaining its reputation for high-quality products.

Continued Importance of Quality Engineering

Despite advancements in technology, certain sectors still prioritize traditional engineering principles when it comes to display manufacturing. Industries such as automotive or medical devices require stringent standards for reliability and durability.

Japanese manufacturers’ commitment to quality craftsmanship remains essential in meeting these specific needs. Their expertise in specialized glass formulations allows them to create tailored solutions that differentiate their offerings from competitors.

Overall, Japan’s influence on display glass technology advancements cannot be overstated. Through continuous innovation, rigorous research efforts, and unwavering dedication to quality, the country has established itself as a leader in this dynamic industry.

Future Opportunities & Challenges Ahead for The Overall Industry

The display glass industry is currently undergoing a significant transformation, driven by new technologies and changing market demands. Several key developments are expected to reshape the industry:

Emerging Technologies

- Quantum dot displays integration with traditional glass

- Self-healing glass materials for enhanced durability

- Smart glass with embedded sensors and interactive capabilities

- Ultra-thin flexible glass for foldable devices

Sustainability Innovations

- Recycled glass content incorporation in manufacturing

- Energy-efficient production methods

- Reduced carbon footprint through improved processes

- Bio-based materials for partial glass replacement

Market Challenges

- Raw material cost fluctuations

- Supply chain disruptions

- MicroLED technology competition

- Manufacturing complexity increases

The rise of alternative display technologies presents both opportunities and threats. MicroLED displays offer superior brightness and energy efficiency, pushing traditional glass manufacturers to innovate. Economic uncertainties in key markets could impact consumer spending on premium display products.

Research and development efforts focus on:

- Reducing production costs through automation

- Developing scratch-resistant coatings

- Creating thinner, lighter glass substrates

- Improving optical clarity and resolution capabilities

The integration of artificial intelligence in manufacturing processes promises enhanced quality control and reduced waste. Smart factory implementations could optimize production efficiency and reduce operational costs, though requiring significant initial investments.

Competitive Landscape in the Display Glass Market

- Corning Incorporated – Corning, New York, USA

- AGC Inc. – Tokyo, Japan

- Nippon Electric Glass (NEG) – Ōtsu, Shiga, Japan

- SCHOTT AG – Mainz, Germany

- AvanStrate Incorporated – Tokyo, Japan

Overall

| Report Metric | Details |

| Report Name | Global Display Glass Market Report |

| Base Year | 2024 |

| Segment by Type |

·Gen. 8/8+ |

| Segment by Application |

·Televisions |

|

Geographies Covered |

· North America (United States, Canada) · Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

The display glass market is set to experience substantial growth, driven by advancements in technology and the increasing demand for innovative applications. Companies must prioritize sustainability and eco-friendly practices to align with global environmental goals. Continuous innovation, strategic partnerships, and a focus on quality will remain essential for maintaining competitiveness. Stakeholders should closely monitor market trends and adapt to evolving consumer preferences. By addressing challenges such as production costs and emerging technologies, businesses can unlock significant opportunities and secure a strong position in this dynamic industry.

Global Display Glass Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Display Glass Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- Display GlassMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Display Glassplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Display Glass Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Display Glass Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Display Glass Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofDisplay Glass Market Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the key components of the display glass supply chain?

The display glass supply chain consists of upstream suppliers providing raw materials and downstream consumers, primarily manufacturers, who utilize these materials to produce display glass products. The production process involves transforming raw materials into finished products, followed by logistics and distribution that play a critical role in market dynamics.

How are technological advancements influencing the display glass market?

Technological advancements are significantly shaping the display glass market by enhancing product quality and performance. Innovations in manufacturing processes and materials have led to higher demand for high-quality displays, particularly in consumer electronics, driving market growth and influencing pricing trends.

What challenges do manufacturers face in the display glass industry?

Manufacturers in the display glass industry face several challenges, including production disruptions from factory closures in regions like Japan, intense competition from smaller manufacturers offering lower prices, and rising costs that impact production efficiency and profit margins.

How do geopolitical factors affect the display glass market?

Geopolitical tensions can greatly influence the display glass market by affecting supply chains and market access for manufacturers. Trade policies impacting major players such as Corning and Chinese manufacturers can alter competitive dynamics and availability of resources necessary for production.

What are the primary applications of display glass in various industries?

Display glass is widely used across multiple applications including televisions, laptops, monitors, smartphones, and automotive sectors. In automotive applications, it enhances infotainment systems and instrument clusters, showcasing its versatility in improving visual quality and durability.

What future opportunities and challenges exist for the display glass industry?

The future of the display glass industry presents opportunities for new technologies such as eco-friendly materials and innovative designs. However, challenges remain due to ongoing competition from alternative solutions like microLEDs and economic uncertainties that could affect global demand levels.