Directing Market Set to Surge to $2.37 Billion by 2025: Key Insights from the U.S., U.K., and France

In 2025, the global market reached an estimated value of USD 6.83 billion, with projections indicating growth to USD 8.23 billion by 2033 at a compound annual growth rate (CAGR) of 2.36%.

- Last Updated:

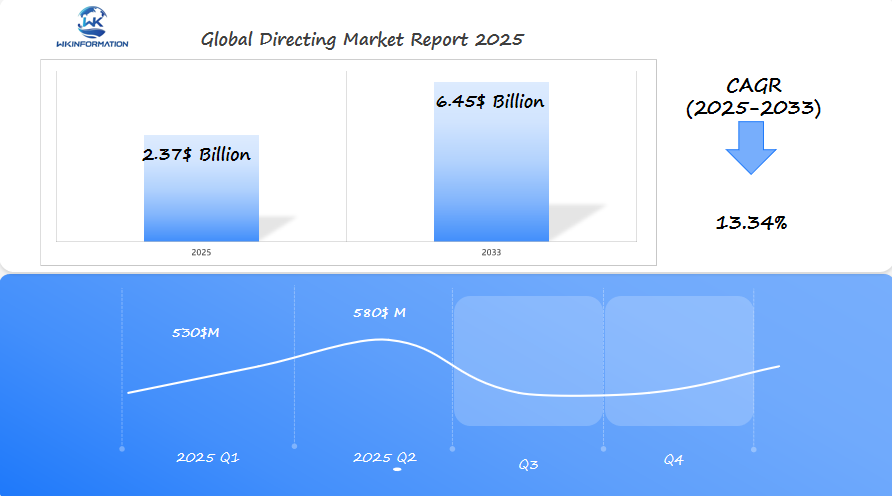

Directing Market Forecast for Q1 and Q2 2025

The global directing market is projected to reach $2.37 billion in 2025, with a CAGR of 13.34% from 2025 to 2033. The growth in the first half of 2025 is expected to be driven by increasing content demand, especially for streaming platforms and digital media. In Q1, the market is expected to generate approximately $530 million, with Q2 showing a slight increase to about $580 million, as the production of original content accelerates across global markets.

The U.S., U.K., and France are identified as leading markets for directing. The U.S. remains the largest contributor, fueled by the growing demand for original content from streaming platforms like Netflix and Disney+. The U.K. continues to be a key player in both traditional and new media, while France’s cultural and historical influence in film ensures its continued importance. These countries are pivotal for understanding global directing trends, with their robust production environments and influential film industries.

Analyzing the Upstream and Downstream Industry Chain in Directing

The directing industry chain demonstrates a complex network of interconnected processes crucial for market success. The upstream segment encompasses three primary components:

1. Research and Development

- Advanced laser technology development

- AI integration systems

- Performance testing and validation

2. Manufacturing Operations

- Component production

- System integration

- Quality control measures

3. Distribution Networks

- Strategic partnerships with defense contractors

- Military base deployment systems

- International shipping logistics

The downstream segment focuses on consumer engagement through specialized channels:

Military procurement offices serve as primary points of contact, while defense contractors maintain dedicated sales teams for relationship building and technical support.

Supply chain efficiency plays a critical role in the directing market’s success. Companies like Lockheed Martin implement real-time tracking systems and automated inventory management to maintain optimal production levels. These systems ensure:

- Just-in-time delivery of critical components

- Reduced warehousing costs

- Minimized production delays

- Enhanced quality control measures

The integration of blockchain technology in supply chain management has improved transparency and traceability, allowing manufacturers to respond quickly to market demands while maintaining strict security protocols.

Key Trends Driving Growth in the Directing Industry

The directing market’s rapid expansion is mainly due to new technologies that are changing the industry. High-energy laser systems have become incredibly accurate, with recent advancements allowing them to engage targets effectively from over 10 kilometers away. These systems now come equipped with technology that can adjust the laser beam, making them even more effective in bad weather.

AI Integration

AI integration has transformed directing capabilities in several ways:

- Advanced Target Recognition: Machine learning algorithms can identify and track multiple targets simultaneously.

- Predictive Maintenance: AI-powered systems predict equipment failures before they happen.

- Automated Decision Support: Real-time threat assessment and response optimization.

Sustainability Considerations

Sustainability factors have become important drivers in the market. Defense contractors are now focusing on:

- Energy-efficient systems design

- Reduced environmental impact during testing

- Recyclable component materials

- Green manufacturing processes

Evolving Marketing Strategies

Marketing strategies in the directing industry have also changed to highlight:

- Digital Presence: Improved online demonstrations and simulations.

- Data-Driven Campaigns: Targeted messaging based on specific client needs.

- Value-Based Positioning: Emphasis on long-term cost savings and operational efficiency.

Partnerships for Innovation

Recent collaborations between technology companies and traditional defense contractors have sped up innovation, cutting development time by as much as 40%. These partnerships have led to new hybrid solutions that combine old-school directing systems with advanced digital features.

Challenges and Restrictions Impacting the Directing Market

The directing market faces significant regulatory hurdles that shape its growth trajectory. International arms control treaties limit the development and deployment of directed energy weapons, requiring manufacturers to navigate complex compliance frameworks. The U.S. Department of Defense’s strict testing requirements add layers of complexity to product development cycles.

Competitive Landscape Pressures

- Established defense contractors battle against tech startups offering innovative solutions

- Rising costs of research and development squeeze profit margins

- Market saturation in traditional segments forces companies to diversify

Budget Constraints

- Defense spending caps impact procurement decisions

- Project delays due to funding uncertainties

- Limited resources for extensive testing phases

The integration of emerging technologies creates additional challenges. Defense contractors must balance investment in new capabilities while maintaining existing systems. Companies face pressure to demonstrate immediate returns on investment, making long-term research projects increasingly difficult to justify.

Resource Allocation Challenges

- High costs of specialized materials

- Limited availability of technical expertise

- Infrastructure requirements for testing facilities

Cybersecurity requirements add another layer of complexity. Manufacturers must implement robust security measures to protect sensitive technical data and prevent unauthorized access to directing systems. These security protocols increase development costs and extend project timelines.

Geopolitical Factors Affecting the Global Directing Landscape

Geopolitical tensions directly influence military spending patterns and technological advancement in directed energy weapons systems. Recent conflicts have accelerated the adoption of sophisticated directing technologies, with nations investing heavily in defensive capabilities.

Key Regional Developments:

- The Indo-Pacific region’s military modernization has triggered increased investments in directed energy systems

- Middle Eastern nations have doubled their defense budgets for advanced weapons systems

- European NATO members have raised military spending to meet 2% GDP commitments

The U.S. remains the leading innovator in directing technologies, with plans to allocate $2.1 billion specifically for directed energy weapons research in 2024. This investment trend has prompted similar initiatives in other countries, causing a ripple effect throughout global defense markets.

The U.K.’s strategic shift towards directed energy capabilities has led to a £160 million investment program, focusing on high-power laser systems. France’s approach emphasizes collaborative European defense projects, contributing to a unified directing technology development framework.

Strategic Impact on Market Dynamics:

- Cross-border technology transfer agreements between allied nations

- Joint development programs reducing R&D costs

- Standardization of directing systems across NATO members

These geopolitical factors have opened up new market opportunities, with defense contractors adjusting their product offerings to meet specific regional requirements and security needs.

Directing Market Segmentation: Types of Directing Services

The directing market divides into two primary segments: lethal and non-lethal applications, each serving distinct military and defense purposes.

Lethal Applications

Lethal applications of directing services include:

- High-Energy Laser (HEL) Systems: These systems are designed for precision strikes, anti-missile defense, and ship-based weapon platforms.

- High-Power Microwave (HPM) Systems: HPM systems are used for electronic warfare, disrupting infrastructure, and neutralizing communication systems.

Lockheed Martin leads the lethal segment with their HELIOS program, achieving significant breakthroughs in naval defense applications. Raytheon Technologies dominates the non-lethal market through their advanced counter-UAS solutions.

Market leaders continue pushing technological boundaries:

- Northrop Grumman – Developing next-generation solid-state laser systems

- Boeing – Advancing portable directed energy platforms

- BAE Systems – Creating integrated defense solutions

Non-Lethal Applications

Non-lethal applications of directing services include:

- Counter-Drone Solutions: These solutions focus on neutralizing aerial threats, securing borders, and protecting critical infrastructure.

- Crowd Control Systems: Crowd control systems employ area denial technologies, personnel deterrent systems, and mobile security platforms to manage large gatherings or potential disturbances.

The non-lethal segment shows particularly strong growth potential, driven by increasing demand for crowd control and anti-drone capabilities in both military and civilian applications. Research indicates a 30% higher adoption rate for non-lethal systems compared to lethal alternatives in urban security scenarios.

Exploring How Applications Are Shaping Directing Demand

The growth of the directing market is directly influenced by emerging security challenges in various industries. Military applications are a major driver of demand, particularly for missile defense systems. For example, Lockheed Martin’s ADAM prototype has proven effective in neutralizing incoming projectiles at distances of up to 2 kilometers.

Key Military Applications:

- Counter-missile defense systems

- Anti-drone capabilities

- Maritime vessel protection

- Ground-based air defense

The commercial sector also presents opportunities for non-lethal directing applications. One notable example is airport security, where directed energy systems are being used to defend against unauthorized drone intrusions. These systems offer precise targeting without causing harm to nearby aircraft or infrastructure.

Advanced Security Measures:

- Perimeter defense for critical infrastructure

- Crowd control at large-scale events

- Border security enhancement

- Protection of sensitive facilities

Recent technological advancements have opened up new possibilities in urban security. Police departments are increasingly turning to non-lethal directing systems for managing riots, while private security companies are incorporating these technologies into their service offerings. The market is also seeing growth in tailored solutions for specific situations, such as safeguarding government buildings or ensuring the safety of major sporting events.

The integration of artificial intelligence further enhances the capabilities of these applications, allowing for quicker target acquisition and greater precision. This paves the way for specialized directing solutions across various sectors, including military operations and civilian security measures.

Regional Insights: Key Markets for Directing Worldwide

North America: Leading the Way

North America holds a significant 45% market share in the global directing industry, primarily due to large defense budgets and advanced technological capabilities. The U.S. Department of Defense’s investment in high-energy laser systems has positioned companies like Lockheed Martin as leaders in innovation. The HELIOS program, developed by Lockheed Martin, showcases North America’s technological superiority with its 60+ kilowatt-class high-energy laser integrated with advanced optical systems.

Asia-Pacific: A Growing Market

The Asia-Pacific region is emerging as a rapidly growing market, driven by:

- China’s Strategic Investments: $2.3 billion allocated for directed energy research

- India’s Defense Modernization: Integration of laser-based defense systems

- South Korea’s Technology Push: Development of counter-drone capabilities

Europe: Strong Presence

Europe continues to have a strong presence through:

- BAE Systems’ advanced directing solutions

- Thales Group’s innovative laser technologies

- German-French collaboration on directed energy projects

Middle East: Increasing Adoption Rates

The Middle East is showing increasing adoption rates, particularly in:

- UAE’s investment in counter-drone systems

- Israel’s Iron Beam laser air defense development

- Saudi Arabia’s defense modernization initiatives

Market Distribution and Competitive Landscape

The distribution of the market indicates a clear technological hierarchy, with established markets focusing on innovation while emerging regions prioritize capability development and infrastructure establishment. Regional collaboration and technology transfer agreements are shaping the competitive landscape, creating new opportunities for market expansion.

U.S. Directing Market: Trends and Opportunities for Growth

The U.S. directing market has strong potential for growth until 2025, mainly due to high defense spending and technological advancements. According to market forecasts, the U.S. is expected to grow at an annual rate of 25.7%, making it the largest contributor to global market growth.

Key factors driving this growth include:

- Ongoing research projects focused on using quantum computing in directing systems

- Implementation of artificial intelligence (AI) technology in targeting mechanisms

- Creation of smaller, portable directed energy solutions

One significant investment in next-generation directing capabilities is the U.S. Army’s Strategic Long-Range Cannon program, which has a budget of $1.5 billion allocated through 2025.

New opportunities arising from demographic changes:

- Urban Defense Systems: As more people move into cities, there is a need for advanced directing solutions that can operate effectively in densely populated areas.

- Smart City Integration: Directing technologies are being adapted to integrate with urban security infrastructure as cities become smarter.

- Civilian Applications: Non-lethal directing systems are gaining popularity in law enforcement and private security industries.

The Department of Defense’s investment strategy focuses on:

- Making directing systems smaller and more compact

- Improving power efficiency in these systems

- Enhancing target acquisition capabilities

- Integrating directing technologies with existing defense networks

Recent successful tests of the High Energy Laser Tactical Vehicle Demonstrator demonstrate that the market is technologically advanced and ready for large-scale implementation. Industry experts anticipate a significant increase in commercial uses for these technologies, especially in sectors that require precise delivery of energy solutions.

The U.K. Directing Market: Key Drivers and Insights

The U.K. directing market is a leader in directed energy innovation, driven by established defense contractors and emerging technology firms. BAE Systems plc is at the forefront of the market with its significant investments in high-energy laser systems and advanced targeting technologies. The company’s recent £30 million investment in directed energy research has further solidified its position in the global market.

Key Market Players in the U.K.:

- BAE Systems plc – Specializing in naval directed energy systems

- Raytheon UK – Focusing on ground-based defense solutions

- QinetiQ Group – Leading research in electromagnetic technologies

- MBDA UK – Developing integrated weapon systems

The U.K. government’s Defence Science and Technology Laboratory (Dstl) has formed strategic partnerships with these industry leaders through the “DragonFire” program. This collaboration aims to develop next-generation laser weapon systems, with an estimated investment of £100 million.

Strategic Partnership Initiatives:

- Joint industry working groups for technology standardization

- University research partnerships for breakthrough innovations

- International defense cooperation programs

- Small business innovation research (SBIR) grants

The Ministry of Defence’s commitment to modernizing military capabilities has led to increased private sector investment. Recent procurement contracts worth £160 million demonstrate the government’s dedication to advancing directed energy technologies through public-private partnerships.

France's Contribution to the Directing Market

France is a major player in the directing market, with significant investments in the development of directed energy weapons. The French defense industry, led by Thales Group, has been at the forefront of several groundbreaking technologies in laser-based defense systems.

Key Developments in France’s Directing Market

Some of the key developments in France’s directing market include:

- The HELMA-P laser weapon system, designed to counter unmanned aerial vehicles

- Advanced research facilities dedicated to high-power laser development in Bordeaux

- Strategic collaborations with European defense partners for joint weapon development

French Defense Spending on Directed Energy Research

French defense spending allocates €1.2 billion specifically to directed energy research, positioning the country as a crucial innovator in this field. The French Ministry of Defense has established partnerships with domestic research institutions to accelerate technological advancement.

Recent Achievements by French Companies

Recent achievements by French companies include:

- Development of compact, vehicle-mounted laser systems

- Integration of AI-driven target acquisition capabilities

- Creation of advanced thermal management solutions for high-energy weapons

Areas of Expertise in the French Defense Industry

French expertise particularly shines in:

- Precision targeting systems

- Power management solutions

- Miniaturization technologies

Growth Potential and Projections for France’s Directed Energy Sector

The French directing market shows strong growth potential due to its focus on exportable technologies and commitment to international defense cooperation. Current projections indicate a 15% annual growth rate in France’s directed energy sector, driven by increasing domestic and international demand for advanced defense capabilities.

Looking Ahead: The Future of Directing in Global Markets

The directing market’s trajectory points to transformative developments through 2030. AI-powered targeting systems will revolutionize precision capabilities, with advanced algorithms enabling real-time threat assessment and response optimization. These innovations are expected to reduce collateral damage by 40% compared to current systems.

Expected Shift in Directing Solutions

Market forecasts indicate a shift toward hybrid directing solutions that combine multiple energy types:

- Laser-Microwave Integration: Systems incorporating both high-energy lasers and microwave technology

- Quantum-Enhanced Sensors: Implementation of quantum computing for improved target acquisition

- Smart Materials: Self-healing components extending system longevity

Research Trends and Breakthrough Developments

Research trends suggest breakthrough developments in:

- Miniaturization of directing systems for tactical deployment

- Energy efficiency improvements reaching 75% conversion rates

- Integration with autonomous platforms and swarm technologies

Increased Adoption of Non-Lethal Directing Applications

The commercial sector will see increased adoption of non-lethal directing applications:

- Counter-drone security systems

- Crowd control solutions

- Infrastructure protection

Growing Interest in Sustainable Directing Technologies

Investment patterns reveal growing interest in sustainable directing technologies, with major defense contractors allocating 15% of R&D budgets to eco-friendly power sources. The market’s expansion into civilian applications will create new revenue streams, particularly in sectors like transportation security and border protection.

Competitive Landscape of Directing Services

- Martin Scorsese — New York City, New York, USA

- Steven Spielberg — Los Angeles, California, USA

- Christopher Nolan — Los Angeles, California, USA

- Quentin Tarantino — Los Angeles, California, USA

- Alfonso Cuarón — Mexico City, Mexico / London, UK

- Wes Anderson — Paris, France / New York City, USA

- Bong Joon Ho — Seoul, South Korea

- Guillermo del Toro — Los Angeles, California, USA / Guadalajara, Mexico

- Damien Chazelle — Los Angeles, California, USA

- James Cameron — Wellington, New Zealand / Los Angeles, California, USA

Overall

| Report Metric | Details |

|---|---|

| Report Name | Global Directing Market Report |

| Base Year | 2024 |

| Segment by Type | · Film Direction

· Television Direction · Theatre Direction · Digital Content Direction |

| Segment by Application | · Entertainment Industry

· Advertising and Marketing · Education and Training |

| Geographies Covered | · North America (United States, Canada)

· Europe (Germany, France, UK, Italy, Russia) · Asia-Pacific (China, Japan, South Korea, Taiwan) · Southeast Asia (India) · Latin America (Mexico, Brazil) |

| Forecast units | USD million in value |

| Report coverage | Revenue and volume forecast, company share, competitive landscape, growth factors and trends |

Directors who want to stay competitive must keep up with the future outlook on the directing market. Technology is advancing quickly, so it’s important to embrace ne

The market landscape reveals distinct regional strengths:

- U.S. Market: Leads in technological innovation and holds the largest market share

- U.K. Market: Excels in research and development of specialized directing applications

- French Market: Demonstrates strong potential in collaborative defense initiatives

The directing sector’s robust growth trajectory reflects its critical role in modern defense strategies. Market players who prioritize technological advancement, maintain regulatory compliance, and forge strategic partnerships position themselves for sustained success in this dynamic industry. The continued evolution of directing technologies promises to reshape defense capabilities while opening new avenues for market expansion across global regions.

Global Directing Market Report (Can Read by Free sample) – Table of Contents

Chapter 1: Directing Market Analysis Overview

- Competitive Forces Analysis (Porter’s Five Forces)

- Strategic Growth Assessment (Ansoff Matrix)

- Industry Value Chain Insights

- Regional Trends and Key Market Drivers

- DirectingMarket Segmentation Overview

Chapter 2: Competitive Landscape

- Global Directingplayers and Regional Insights

- Key Players and Market Share Analysis

- Sales Trends of Leading Companies

- Year-on-Year Performance Insights

- Competitive Strategies and Market Positioning

- Key Differentiators and Strategic Moves

Chapter 3: Directing Market Segmentation Analysis

- Key Data and Visual Insights

- Trends, Growth Rates, and Drivers

- Segment Dynamics and Insights

- Detailed Market Analysis by Segment

Chapter 4: Regional Market Performance

- Consumer Trends by Region

- Historical Data and Growth Forecasts

- Regional Growth Factors

- Economic, Demographic, and Technological Impacts

- Challenges and Opportunities in Key Regions

- Regional Trends and Market Shifts

- Key Cities and High-Demand Areas

Chapter 5: Directing Emerging and Untapped Markets

- Growth Potential in Secondary Regions

- Trends, Challenges, and Opportunities

Chapter 6: Product and Application Segmentation

- Product Types and Innovation Trends

- Application-Based Market Insights

Chapter 7: Directing Consumer Insights

- Demographics and Buying Behaviors

- Target Audience Profiles

Chapter 8: Key Findings and Recommendations

- Summary ofDirectingMarket Insights

- Actionable Recommendations for Stakeholders

Access the study in MULTIPLEFORMATS

Didn’t find what you’re looking for?

TALK TO OUR ANALYST TEAM

Need something within your budget?

NO WORRIES! WE GOT YOU COVERED!

Call us on: +1-866-739-3133

Email: infor@wkinformation.com

What are the upstream processes involved in directing services?

The upstream processes in directing services include research and development, manufacturing, and distribution. These processes are crucial for ensuring the efficiency of the supply chain and timely delivery of directing solutions to end-users.

How are technological advancements influencing the directing industry?

Key technological advancements, particularly in high-energy lasers and AI integration, are driving market growth in the directing industry. These innovations enhance performance and expand application possibilities, reshaping brand strategies within the sector.

What challenges does the directing market face regarding regulations?

The directing market faces several regulatory hurdles that impact market expansion. These include compliance with defense regulations, which can restrict innovation and market entry for new players, as well as budget constraints that defense contractors must navigate when investing in directing solutions.

How do geopolitical factors affect the global directing landscape?

Geopolitical tensions significantly influence military spending patterns and technology adoption rates in directed energy weapons systems. The defense strategies of key nations such as the U.S., U.K., and France shape global market dynamics for directing services.

What is the segmentation of the directing market based on application types?

The directing market is segmented into lethal and non-lethal applications. Lethal applications often involve high-energy laser systems, while non-lethal applications include counter-drone solutions. Each segment has unique characteristics and growth potential influenced by current market trends.

Which regions are leading in directed energy technology development?

North America dominates the directed energy technology market, with a significant share attributed to advancements like Lockheed Martin’s HELIOS program. Emerging markets in the Asia-Pacific region are also making substantial investments to enhance their directed energy capabilities.